Awesome Tips About Expenses In An Income Statement

How much money a business spent during a reporting period.

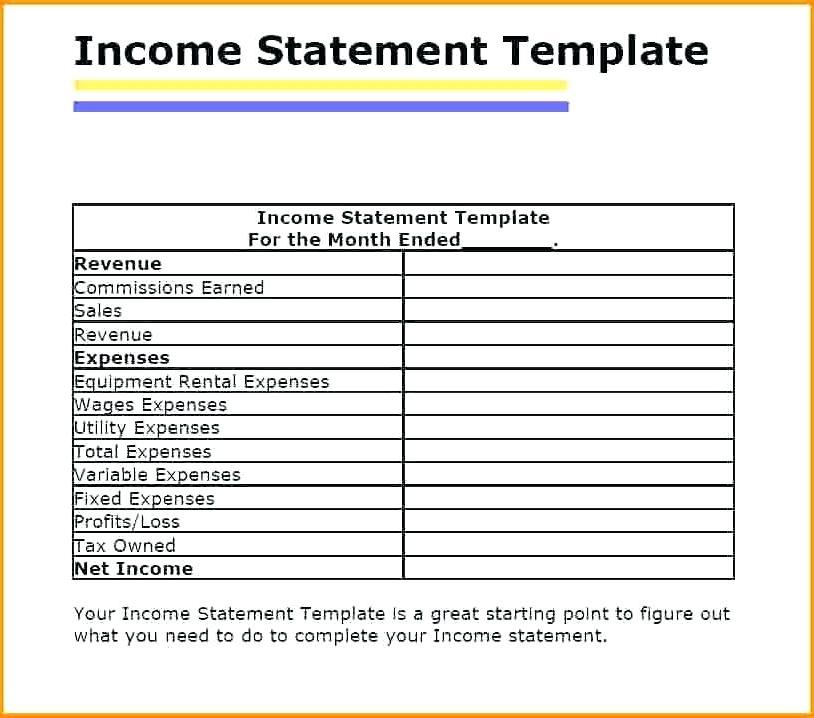

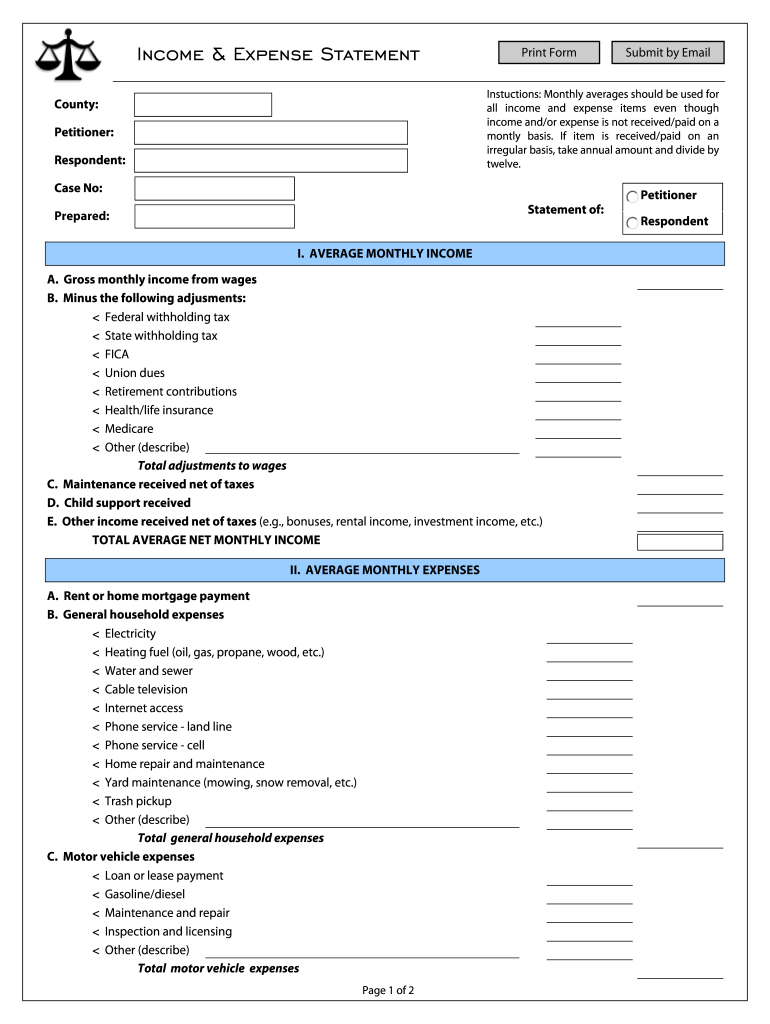

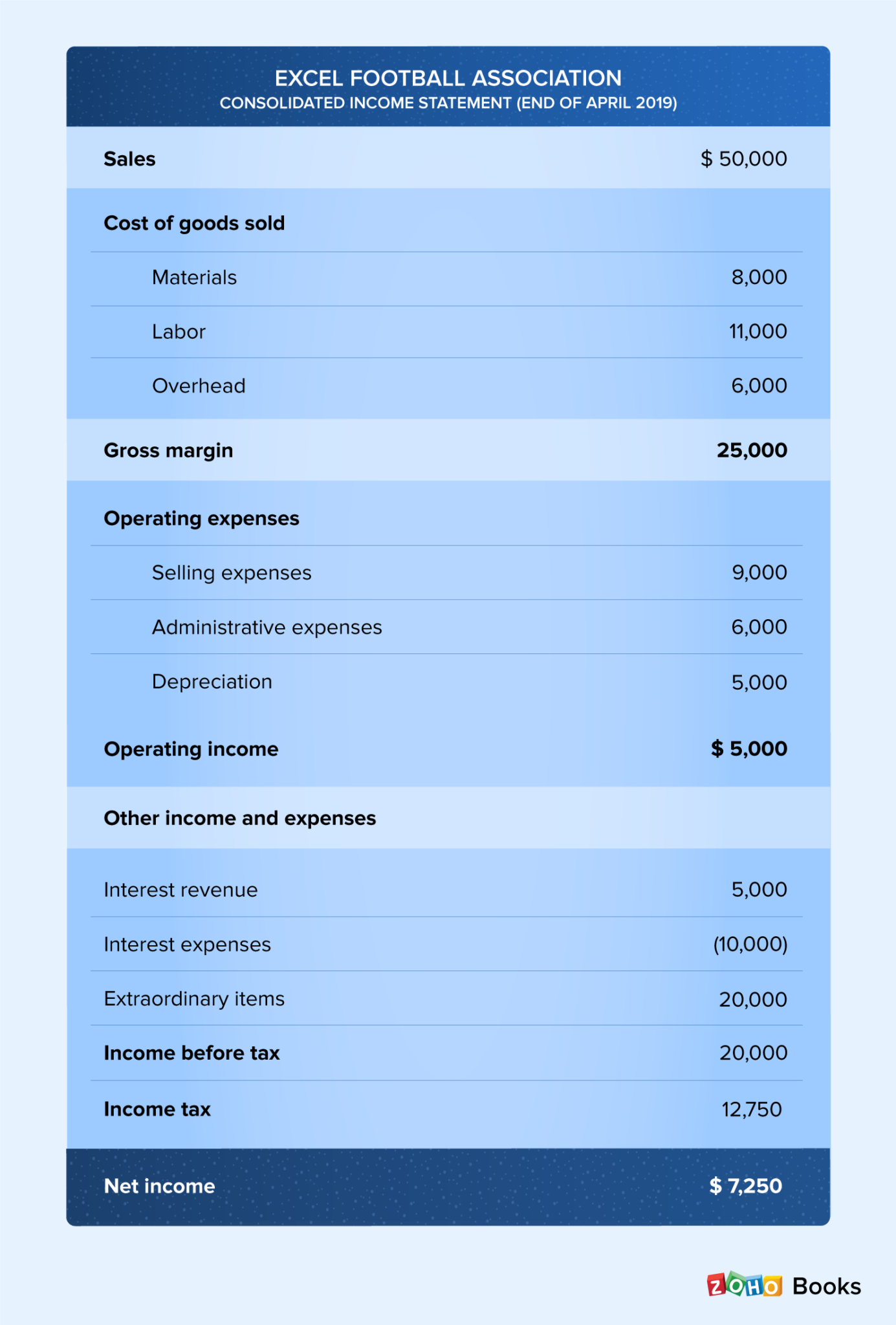

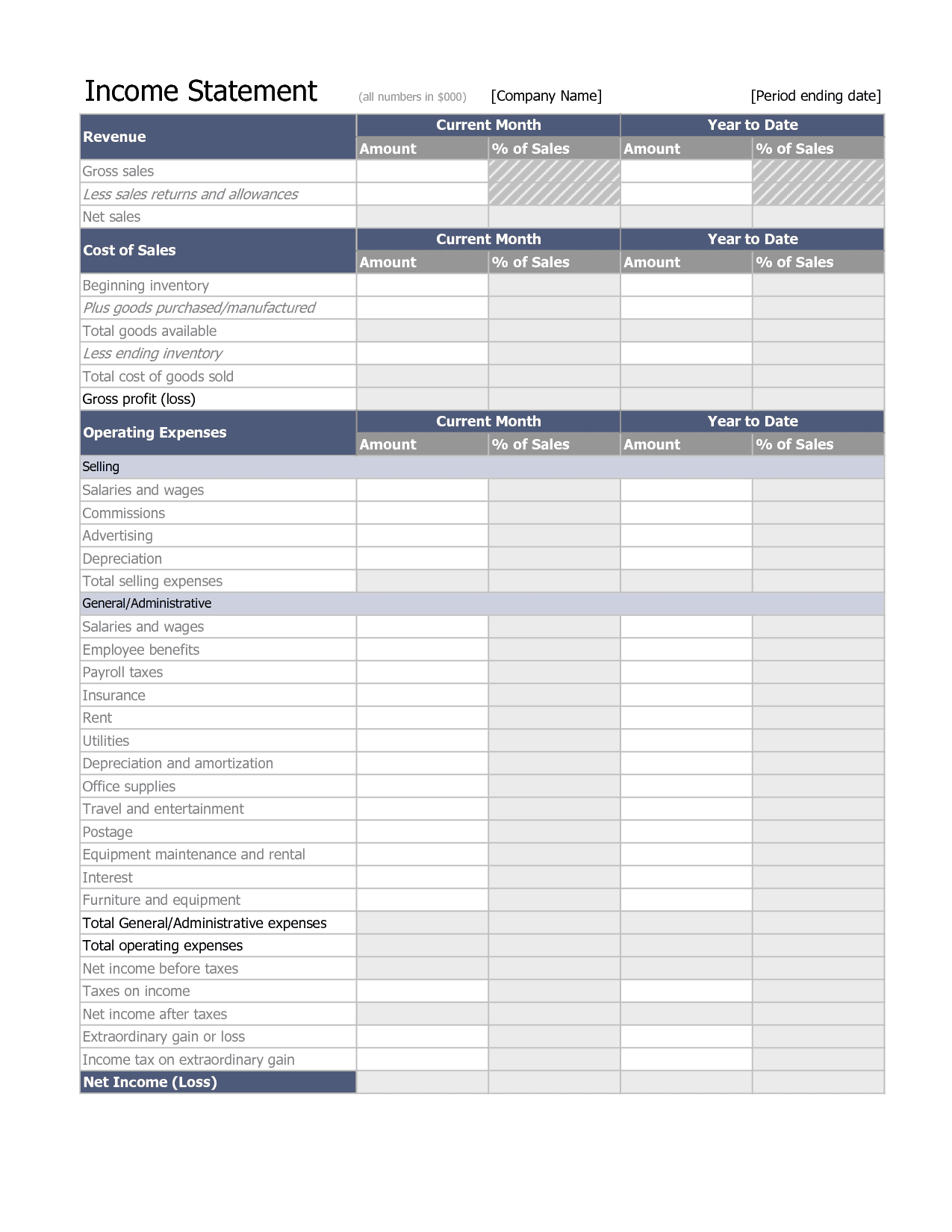

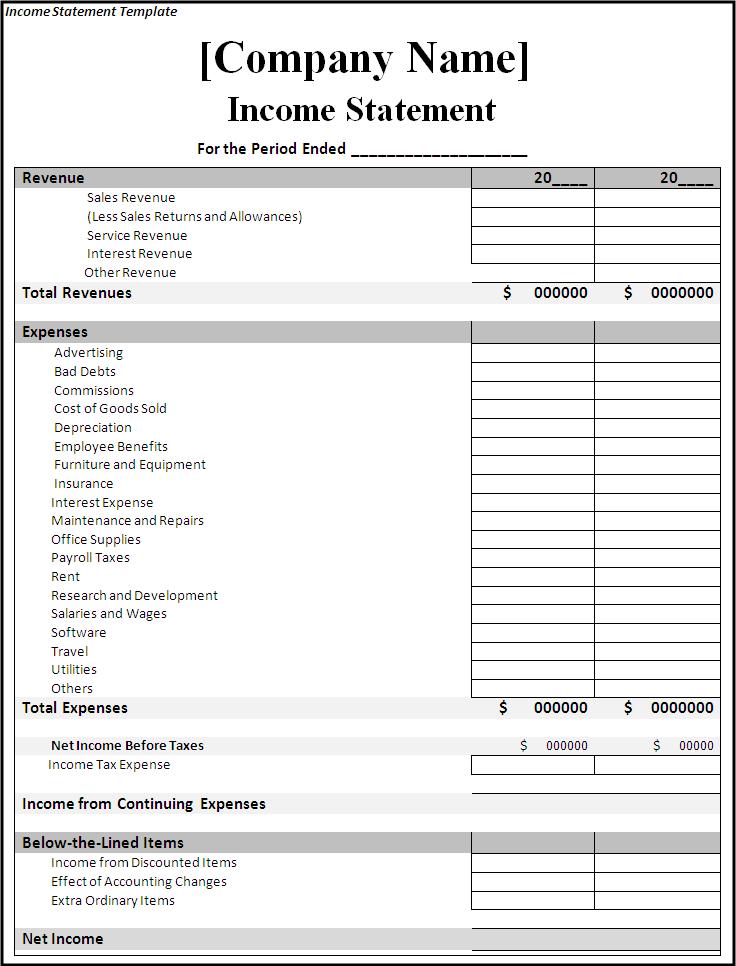

Expenses in an income statement. Expenses are the second element of income statement which consists of two main categories which are the cost of goods sold and operating expenses. So, the income statement shows total revenue and. Year ended december 31, 2022.

Income statements or profit and loss accounts are financial statements used to calculate the financial health of the company. Some of the common expenses recorded in the income statement include equipment depreciation, employee wages, and supplier payments. It shows your revenue, minus your expenses and losses.

The income statement is also referred to as the statement of earnings or profit and loss (p&l) statement. Many key fundamental ratios use information from the income statement. An income statement lists a company’s income, expenses, and resulting profits over a specific time frame, usually a quarter or fiscal year.

It shows the company’s revenues and expenses during a particular period, which can be selected according to the company’s needs. The typical income statement contains: The income statement is a useful way to see how a company makes money and how it spends it.

While an income statement and balance sheet are both key financial statements for companies, they are very different. These costs include wages, depreciation, and interest expense among others. Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss transactions.

An income statement is a financial document that details the revenue and expenses of a company. How to read and understand income statements as a small business It records revenues, gains, expenses, and losses to evaluate net income.

An expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. Expenses are outlays of resources for goods or services. The income statement reports revenues, expenses, gains, losses, and the resulting net income which occurred during the accounting period shown in its heading.

It’s one of the 3 major financial statements that small businesses prepare to report on their financial performance, along with the balance sheet and the cash flow statement. Gross profit represents the income or profit remaining after production costs have been subtracted from revenue. Income statement vs.

An income statement compares revenue to expenses to determine profit or loss. An income statement is a financial statement that shows you how profitable your business was over a given reporting period. If you work the whole year, this would be 52 weeks.

The income statement, also known as a profit and loss statement, shows a business’s financial performance during a specific accounting period. The income statement, along with balance sheet and cash flow statement, helps you understand the financial health of your business. We can define expenses as the outflow of economic resources that occurs in the normal course of business activities.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)