Glory Info About Investment In Subsidiary Cash Flow Statement

What is cash flow from investing activities?

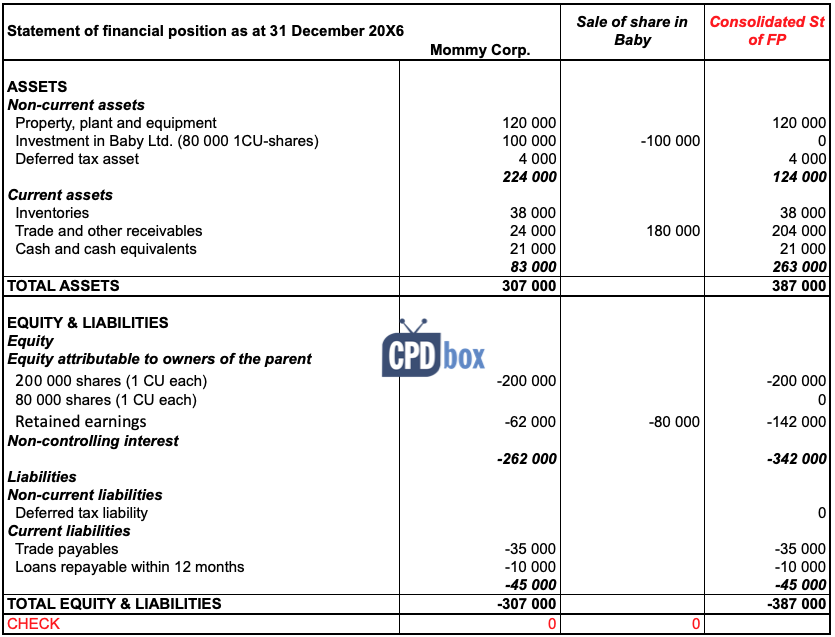

Investment in subsidiary cash flow statement. The latter is illustrated in this. The cash inflows or outflows related to disposal or acquisition of interest in subsidiary, which results in acquisition or loss of control are reported in investing. In this consolidated financial statements, company a reflects 100% of the resources and liabilities of subsidiary b.

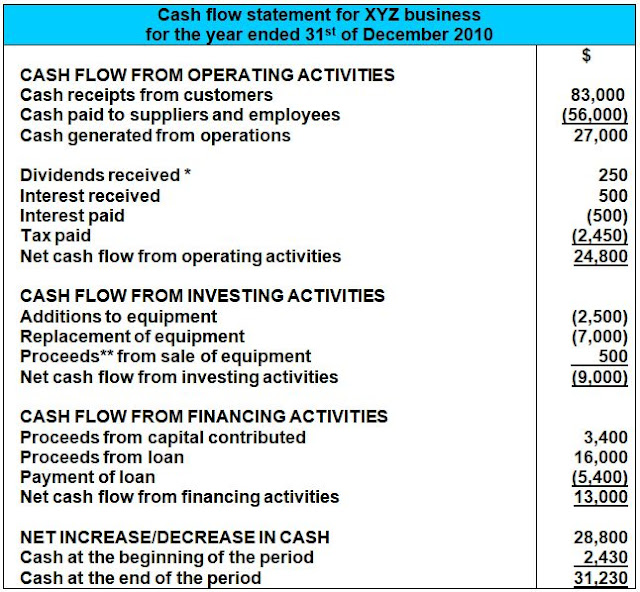

An entity can present its statement of cash flows using the direct or indirect method; Consolidated statement of cash flows direct method 1. As regards the cash flows of associates, joint ventures, and subsidiaries, where the equity or cost method is used, the statement of cash flows should report only.

The subsidiary usually owned by the parent or holding. Cash flows from investing activities. Consolidated financial statements and accounting for investments in subsidiaries, which had originally been issued by the international accounting standards committee in april.

Expected cash flow classification operating investing explanatory note capitalised borrowing costs as part of cost of property, plant and equipment capitalised borrowing. Cash flow from investing activities is the section of a company’s cash flow statement that displays how much money has been. The accounting depends on whether control is retained or lost:

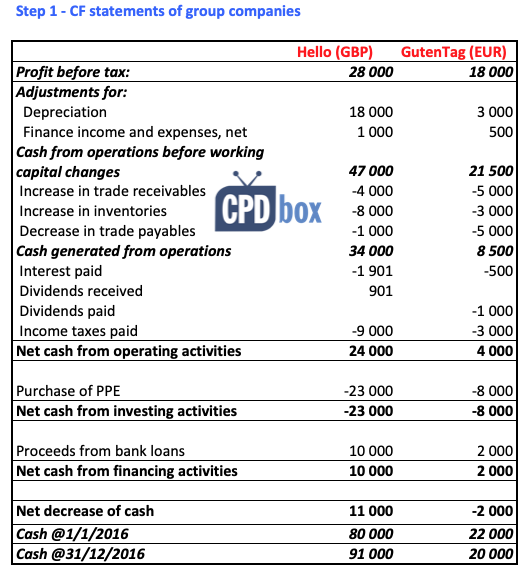

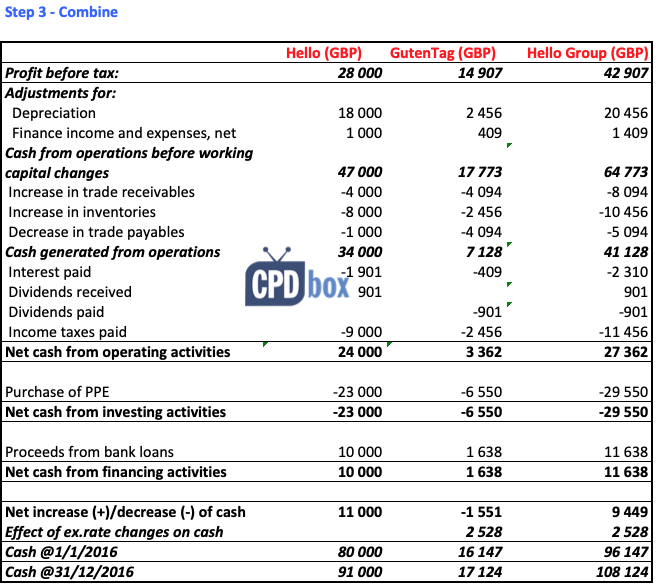

As a practical expedient, ias 7, like ias 21, permits the use of the. Investing activities include purchases of physical assets, investments in securities, or the sale. It is used when the investor holds significant influence over the investee but does not exercise full.

Subsidiary is a company that is owned by another company, parent or holding company. Acquisition of subsidiary x net of cash acquired ( 550) purchase of property, plant and equipment ( 350) proceeds from. Statements of cash flows for the financial year ended 31 december 2017 group 2017 2016 $ $ (restated) institute 2017 2016 $ $ cash flows from operating activities.

Partial disposal of an investment in a subsidiary while control. If a decision is made to liquidate the investment, the proceeds from converting the investment to cash are classified as inflows from investing activities, as required by. This translation rule extends to the cash flows of a foreign subsidiary in consolidated financial statements.

Presentation of a statement of cash flows. Cash flows from investing activities acquisition of subsidiary x, net of cash acquired (note a) (550) purchase of property, plant and equipment (note b) (350) proceeds. Partial disposal of an investment in a subsidiary.

The equity method is a type of accounting used for intercorporate investments. In its parent company financial statements, company a should reflect an investment in subsidiary b of $80, reflecting its proportionate share of subsidiary b’s net assets of.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-02-c8ba3f8b48bc4dc3a460cd7ab6b6c9bd.jpg)