Awesome Info About Example For Prepaid Expenses

Accounting, examples, journal entries, and more explained by leasequery | aug 9, 2023 | articles, expense accounting this article, .

Example for prepaid expenses. Paying for a subscription for a year upfront because they were offering a large discount. Prepaid expenses guide: When he paid this premium, he.

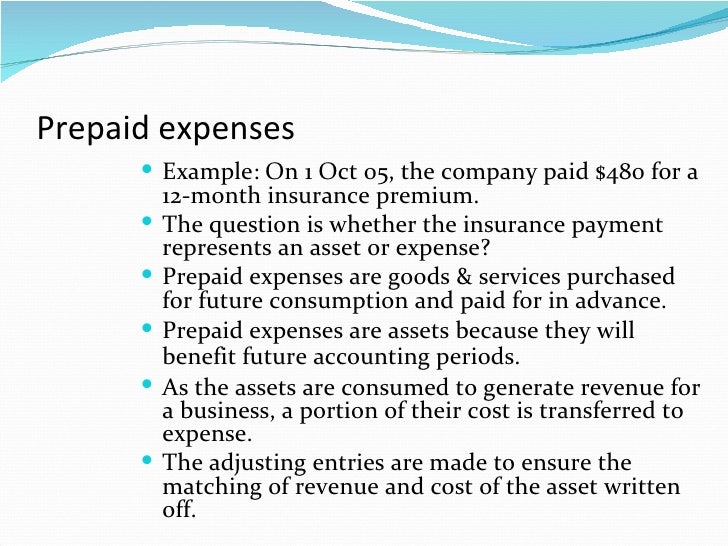

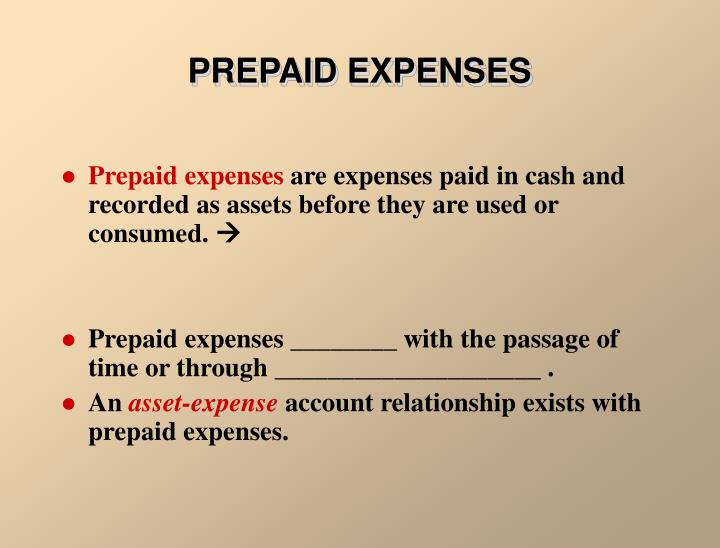

You accrue a prepaid expense when you pay for something that you will receive in the near future. Prepaid expenses are expenses that are paid in advance before the actual costs are incurred. Example of a prepaid expense.

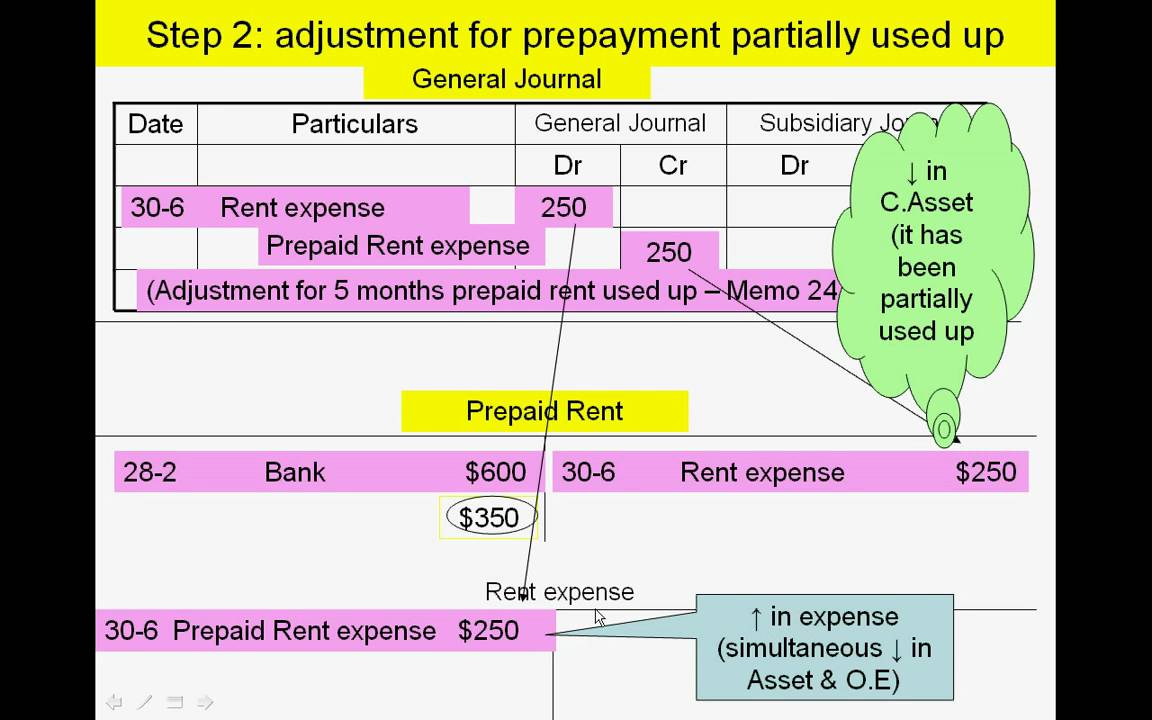

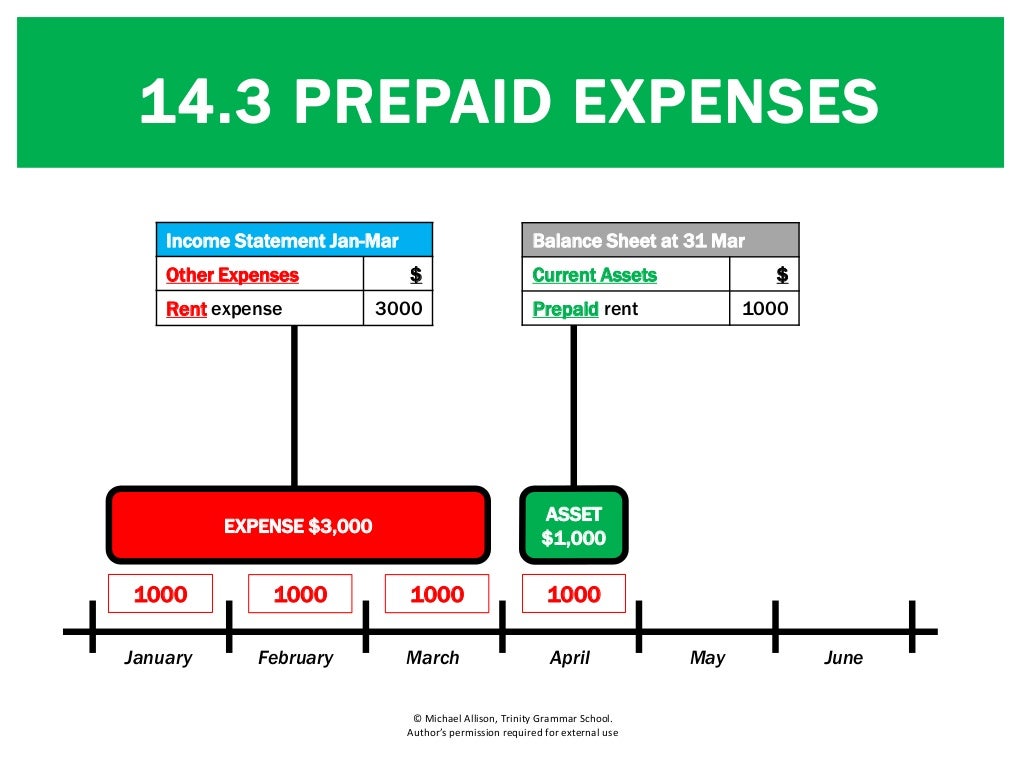

To explain the journal entries, let’s take a common example of prepaid expense: Rent paid in advance when the rent is prepaid in advance, the following. We will look at two examples of prepaid expenses:

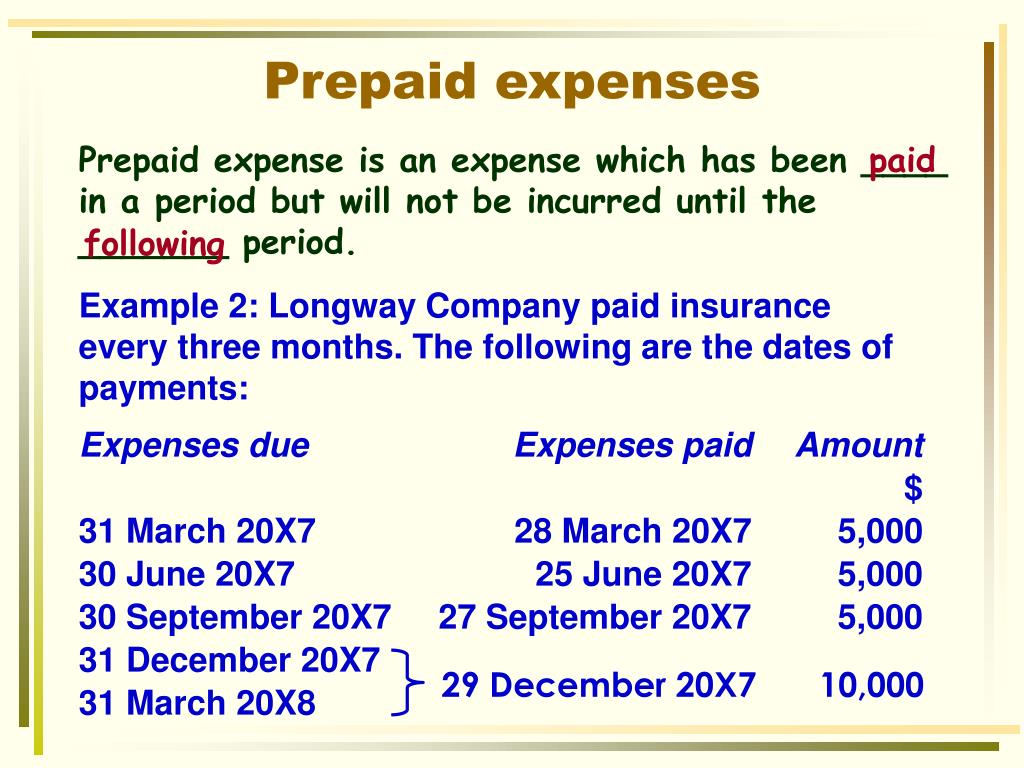

Typically, organizations record expenses as prepaid expenses when they make advance payments for items such as rent,. Examples of prepaid expenses include insurance, rent, leases, interest, and taxes. An example of a prepaid expense is insurance, which is frequently paid in advance for multiple future periods;

Prepaid expenses are expenses paid for in advance. Expenses like insurance, quarterly estimated taxes and rent are prepaid. John bought a motor car and got it insured for one year, paying $4,800 as a premium.

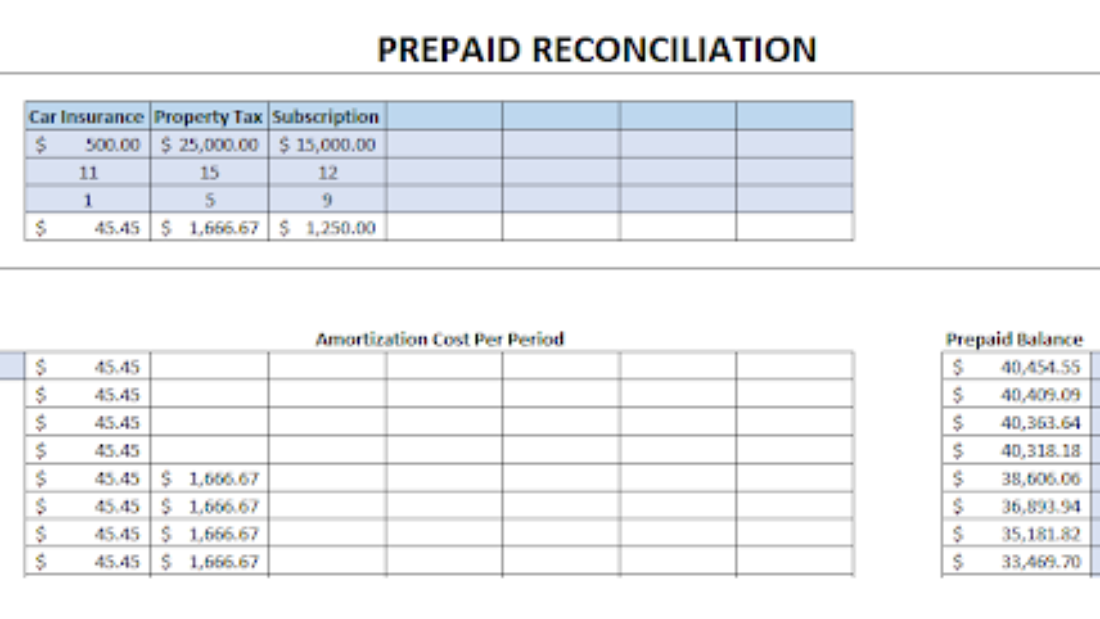

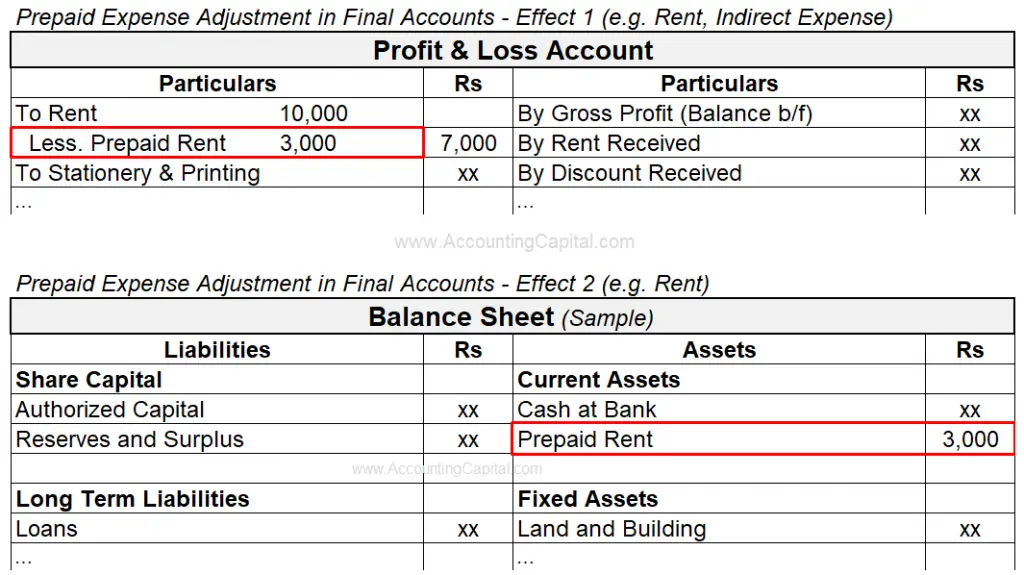

Amount x is the cash credit. For example, let’s say a journal entry is recorded as amount x paid for abc prepaid expense; Prepaid expenses aren’t included in the income statement per generally.

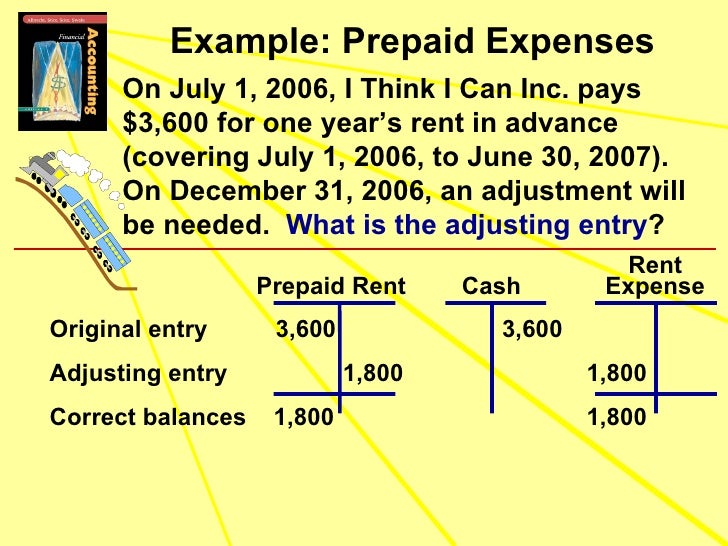

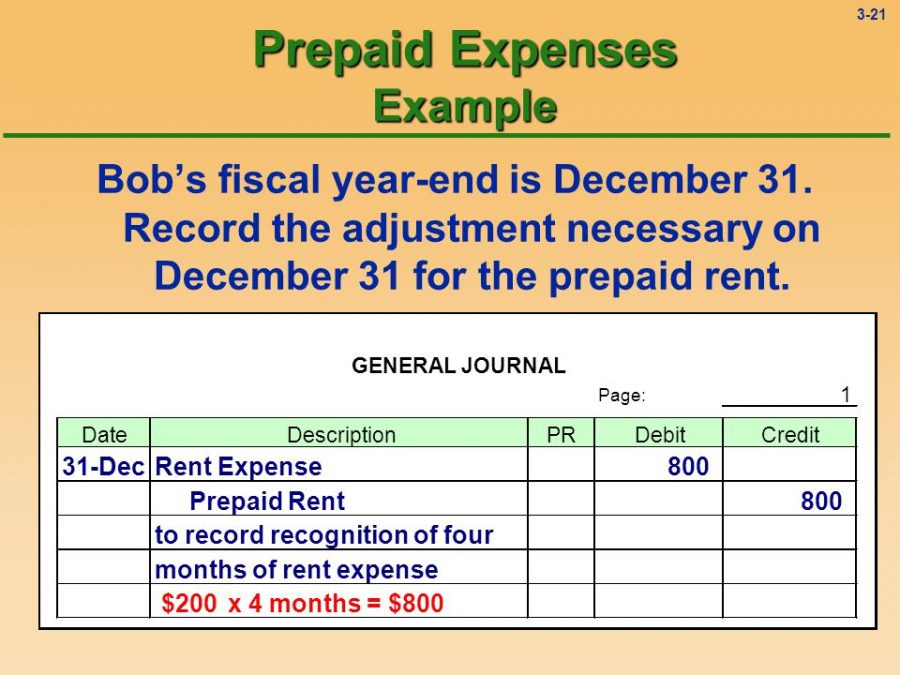

The initial journal entryfor company a would be as follows: Simplifying prepaid expenses adjustment entry with an example. The landlord requires that company a pays the annual amount ($120,000) upfront at the beginning of the year.

Initial upfront payment = $24,000 monthly expense on income statement = $2,000 Within a financial year, each time a. Example on 1 september 2019, mr.

Why are prepaid expenses considered an asset? Common examples of prepaid expenses are rent, insurance, and specialized products. Prepaid expenses are a common occurrence for small businesses.

In this article, we discuss what a prepaid expense is, who benefits from them and how to record them for a business, then offer some examples. Examples of prepaid expenses #1. Prepaid expenses example.

:max_bytes(150000):strip_icc()/prepaid-expense-4191042-recirc-blue-1d8d154bf0c94ba6858fe12907d2b694.jpg)