Wonderful Tips About Income Statement For Nonprofit Organization

Once categorized and reconciled, it will produce all the above reports.

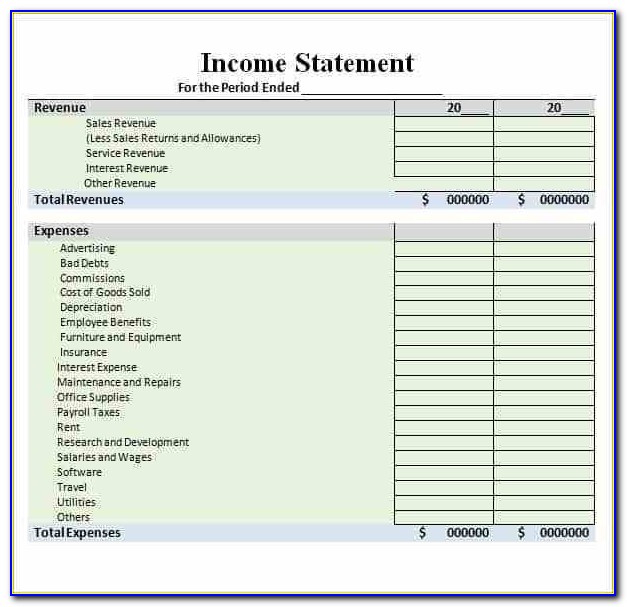

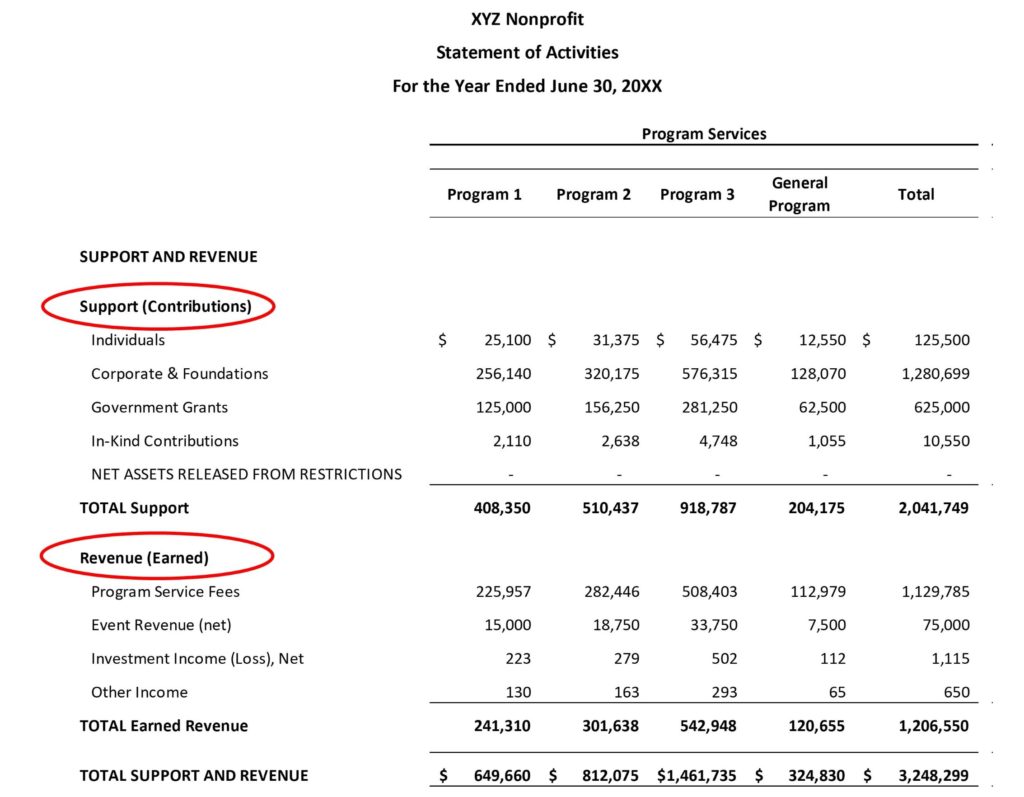

Income statement for nonprofit organization. Revenue is money earned from a nonprofit’s normal business operations. Trump was penalized $355 million plus interest and banned for three years from serving in any top roles at a new york. Typically, this includes gifts, grants, membership fees, and/or income from fundraising events or investments.

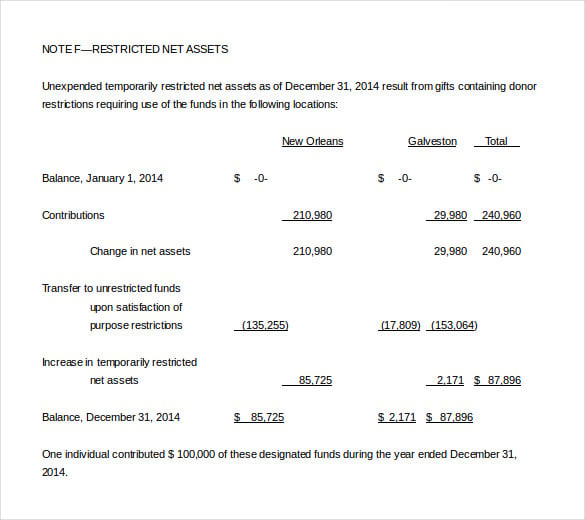

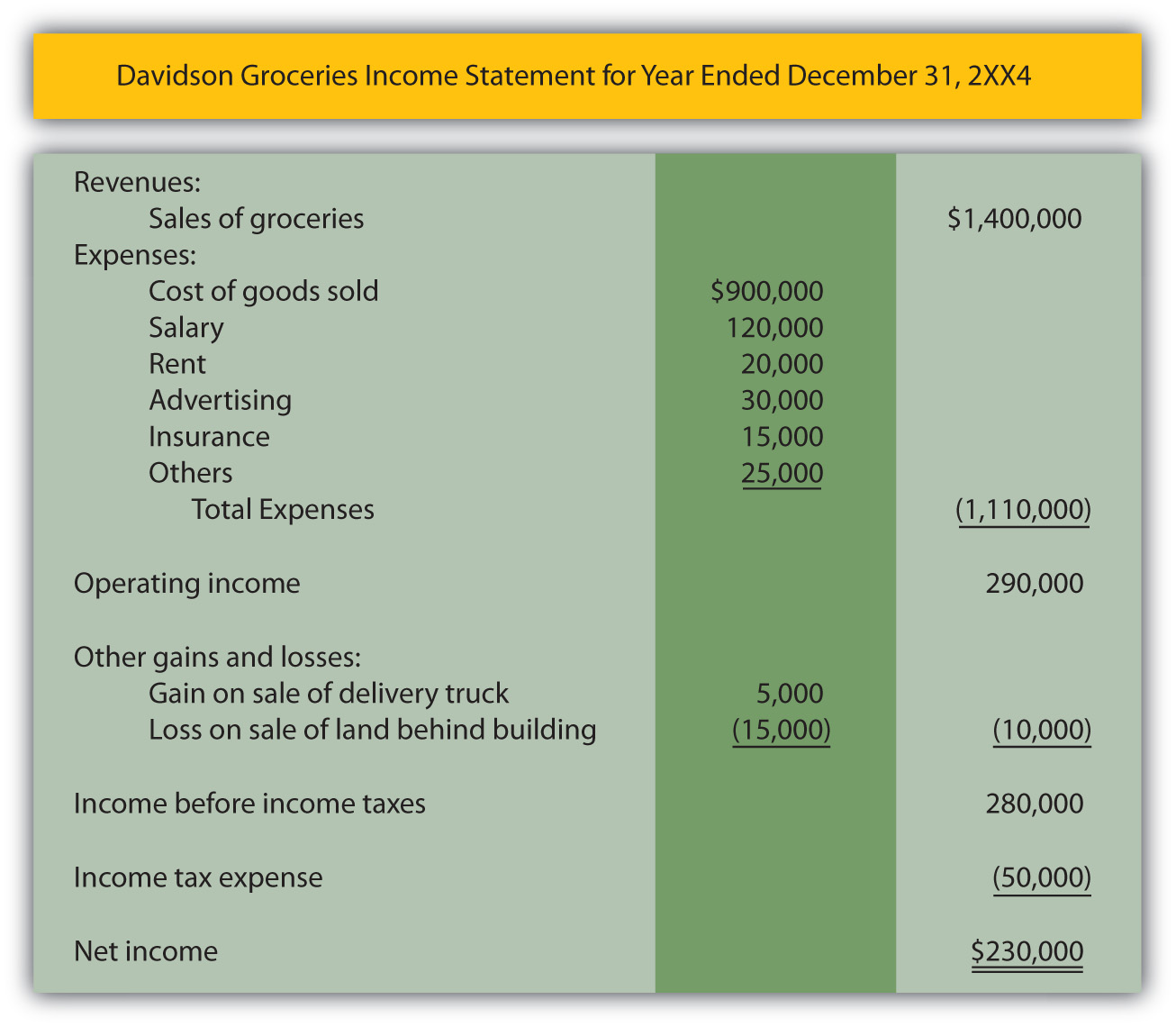

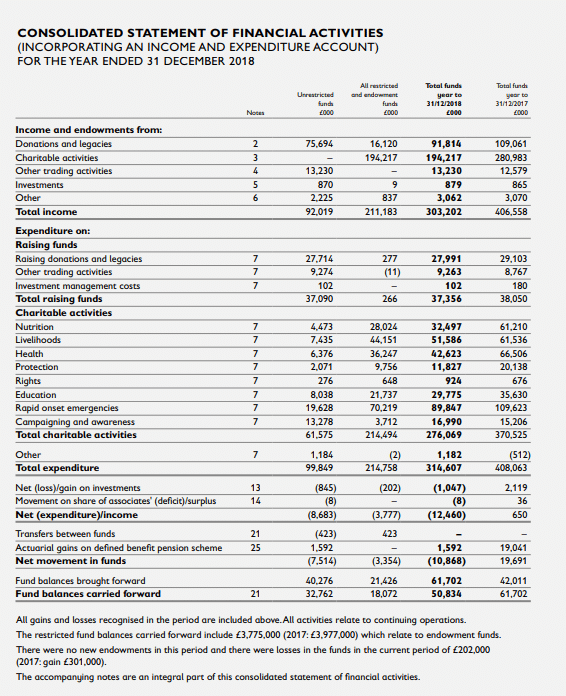

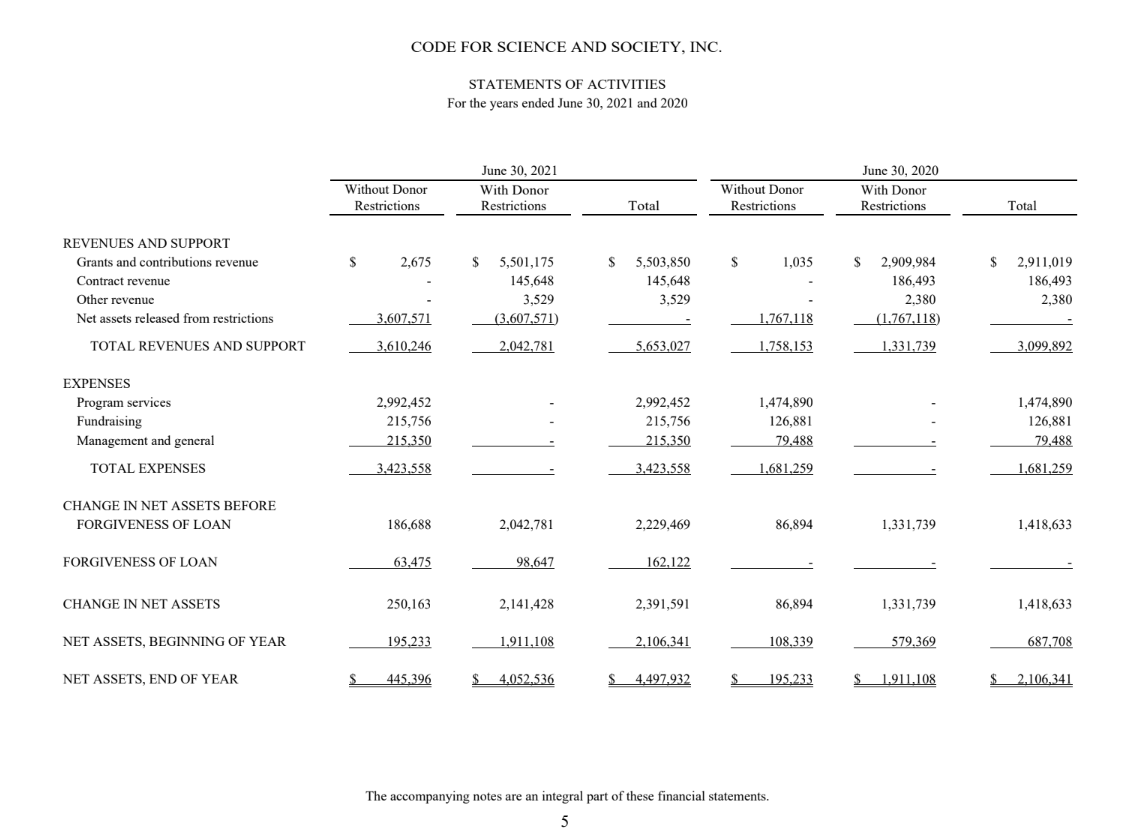

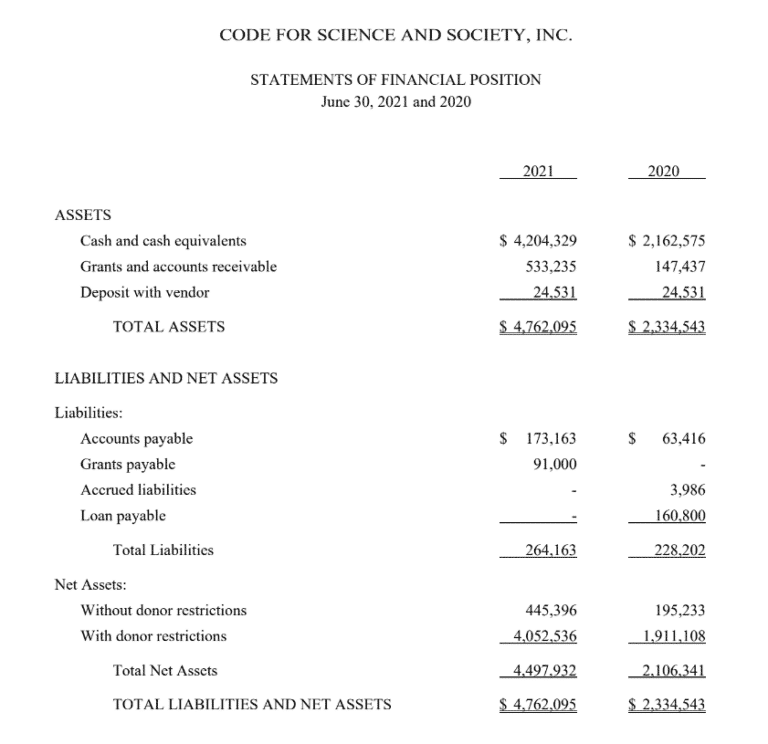

The expenses on the statement of. The nonprofit statement of activities shows the funds coming into the organization less the costs of operating the organization. The statement of financial position is like.

The statement of activities shows the financial statements nonprofits revenues, expenses, and changes in net assets over a specific. Best for large, growing organizations: As we mentioned earlier, many nonprofits use these financial statements in their annual reports to show transparency and build trust in their organization.

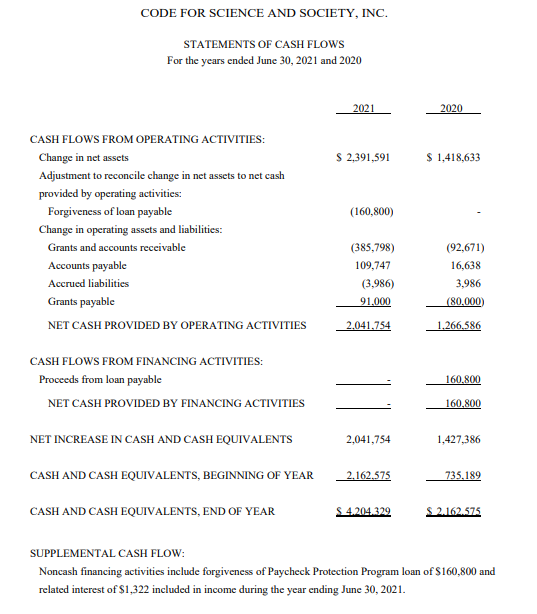

Your financial statement should include: Statement of financial position the statement of financial position is a snapshot of what your organization owns and what it owes to others at a specific point in time. Statement of financial position, statement of activities, statement of cash flows, and statement of functional expenses.

Includes all sources of income for the organization, such as donations, grants, and program fees. This statement shows the inflow and outflow of cash within the organization. The report reflects the changes to an organization’s net assets resulting from financial activities.

It’s also used to categorize your nonprofit’s revenue and expenses. Best overall nonprofit accounting software: Download anafp's guide to understanding nonprofit financial statements to learn more.

Nonprofits can use this report to file form 990 with the irs and provide donors with transparency and trust in the organization. Its purpose is to provide detailed information about your organization’s transactions, showing how your expense allocation and revenue generation further your mission. An understanding of financial statements is a prerequisite for effective oversight of the financial affairs of the organization.

It’s one of the core financial statements that all nonprofits need. Diversity in the types and sources of income among nonprofit organizations; It’s easy to set up and easy to enter and import your data.

In nonprofit accounting, there are four required financial statements that organizations must produce, and we will touch on each of these in this guide. As shown in the sample statement below, the cash flow starts with the. Known as the statement of activities for nonprofits, it shows the following formula:

In this guide we explore the do's, don'ts and requirements of financial statements for your nonprofit organization. What is a nonprofit statement of activities? The statement of activities is the income statement of a nonprofit organization.

![Free Printable Nonprofit Financial Statement Templates [Excel]](https://www.typecalendar.com/wp-content/uploads/2023/08/Nonprofit-Financial-Statement-Word-Format.jpg?gid=902)