Neat Tips About Bank Balance Sheet

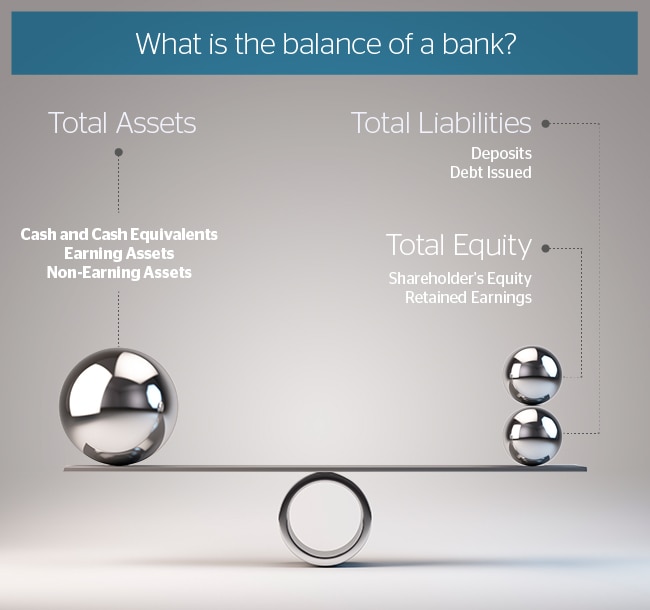

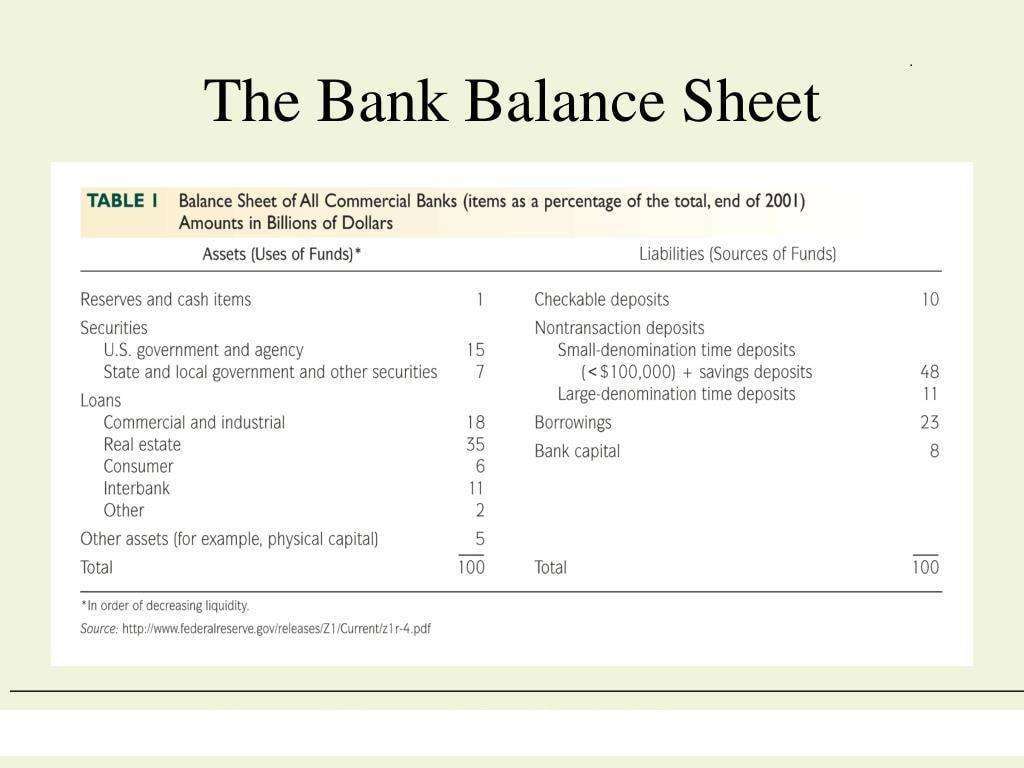

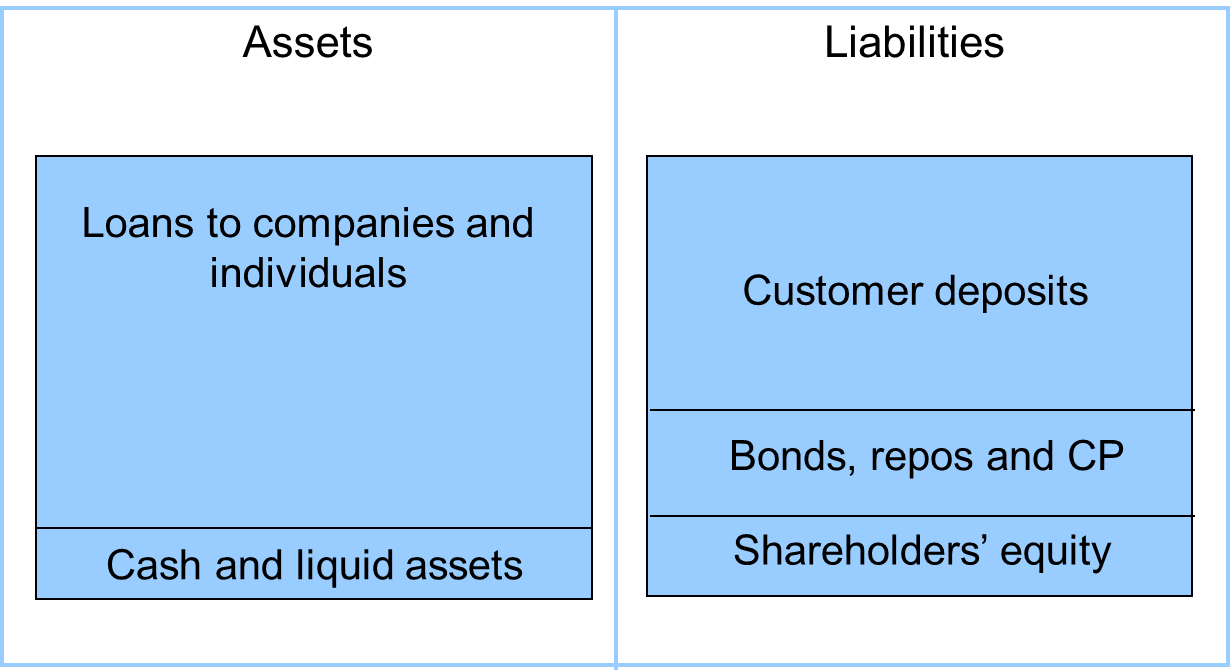

Assets = liabilities + capital the assets are items that the bank owns.

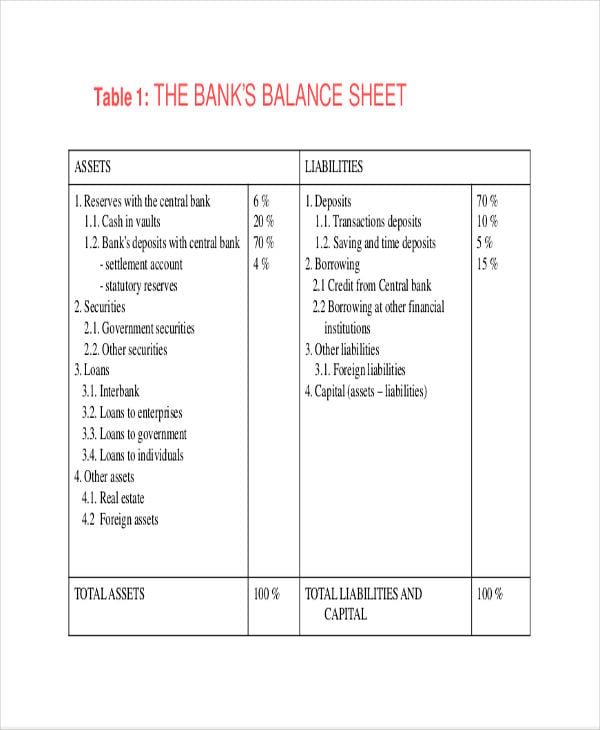

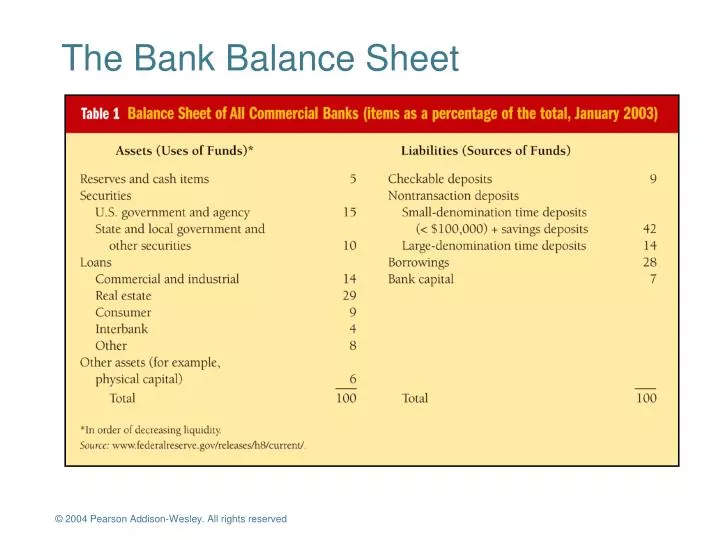

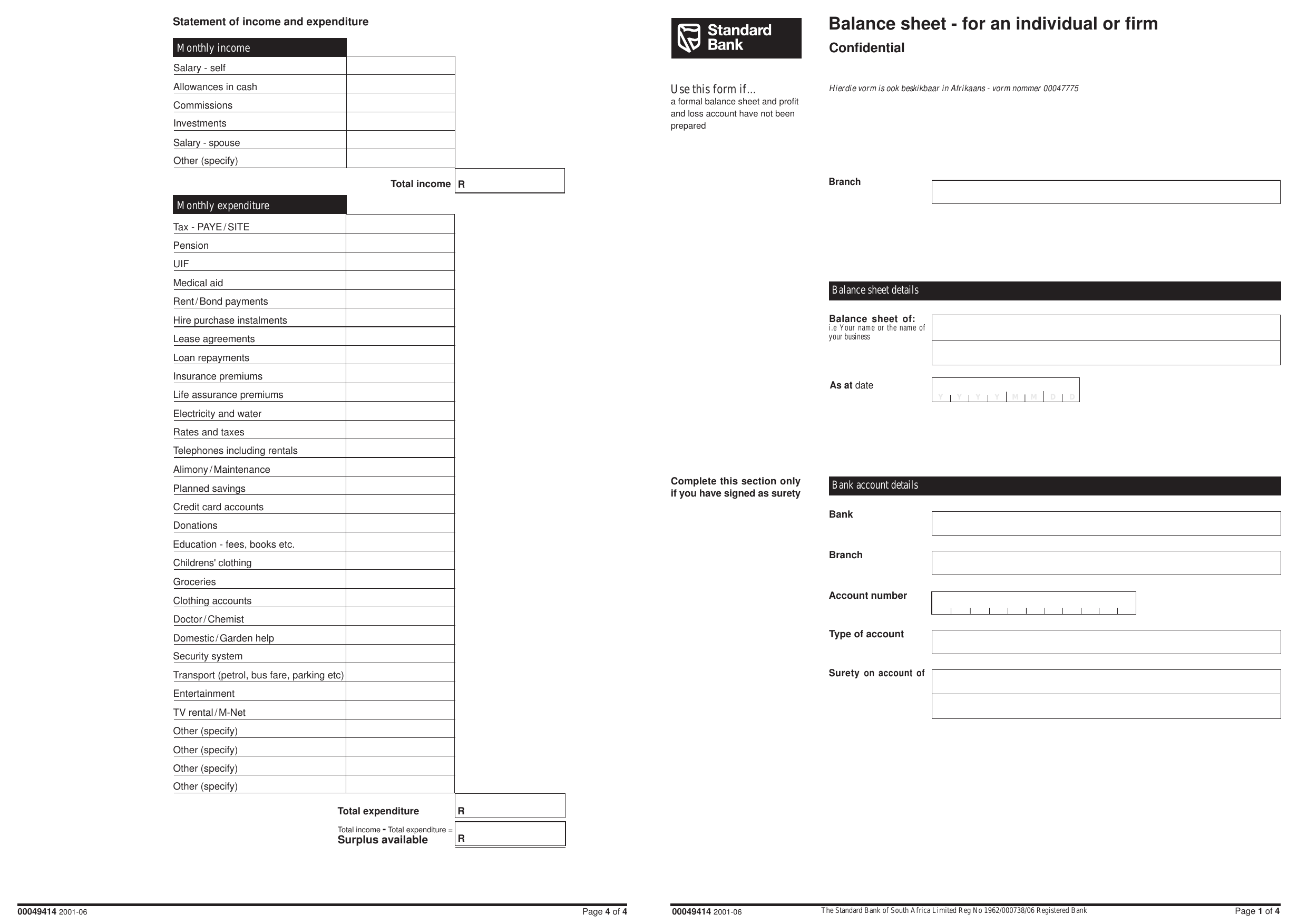

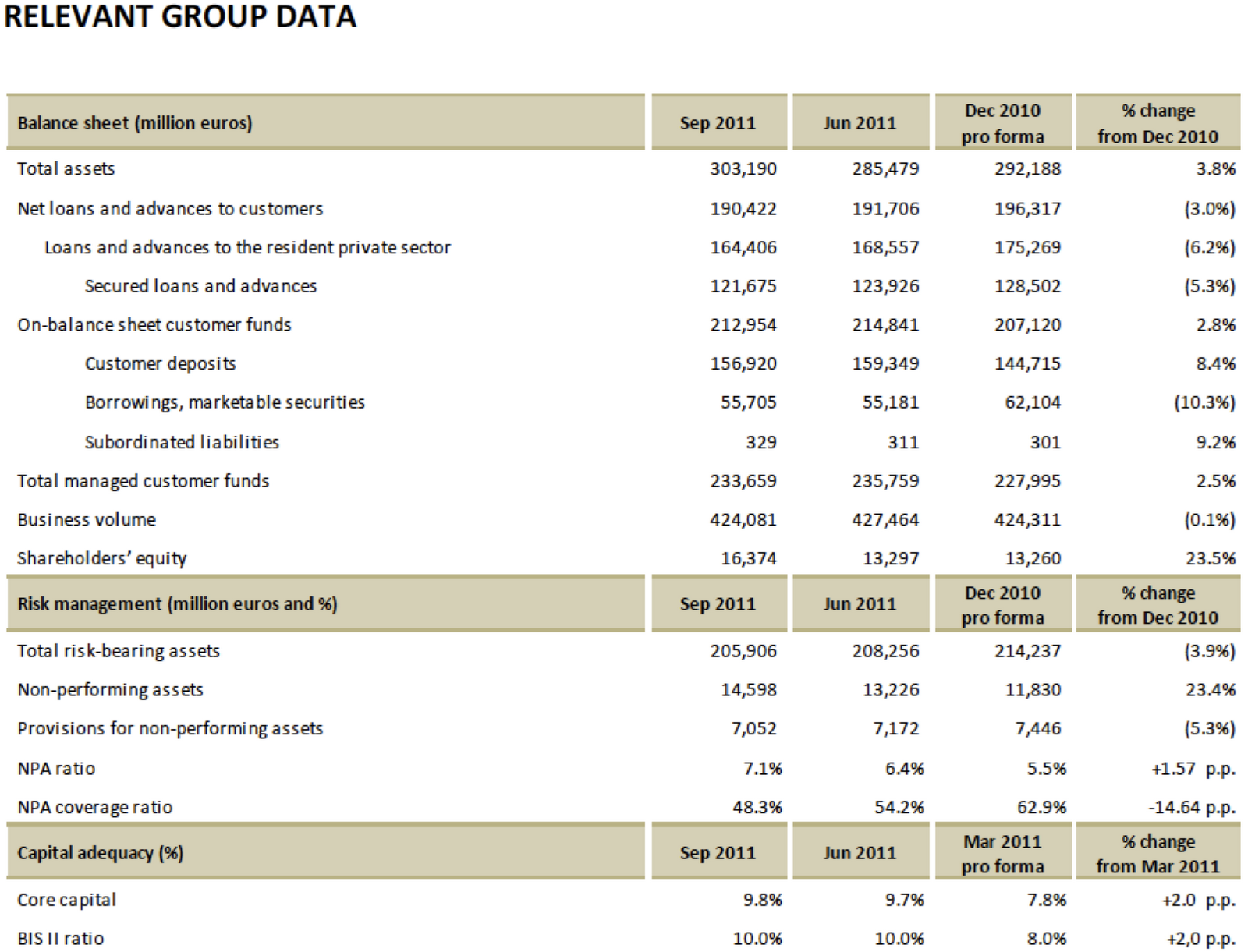

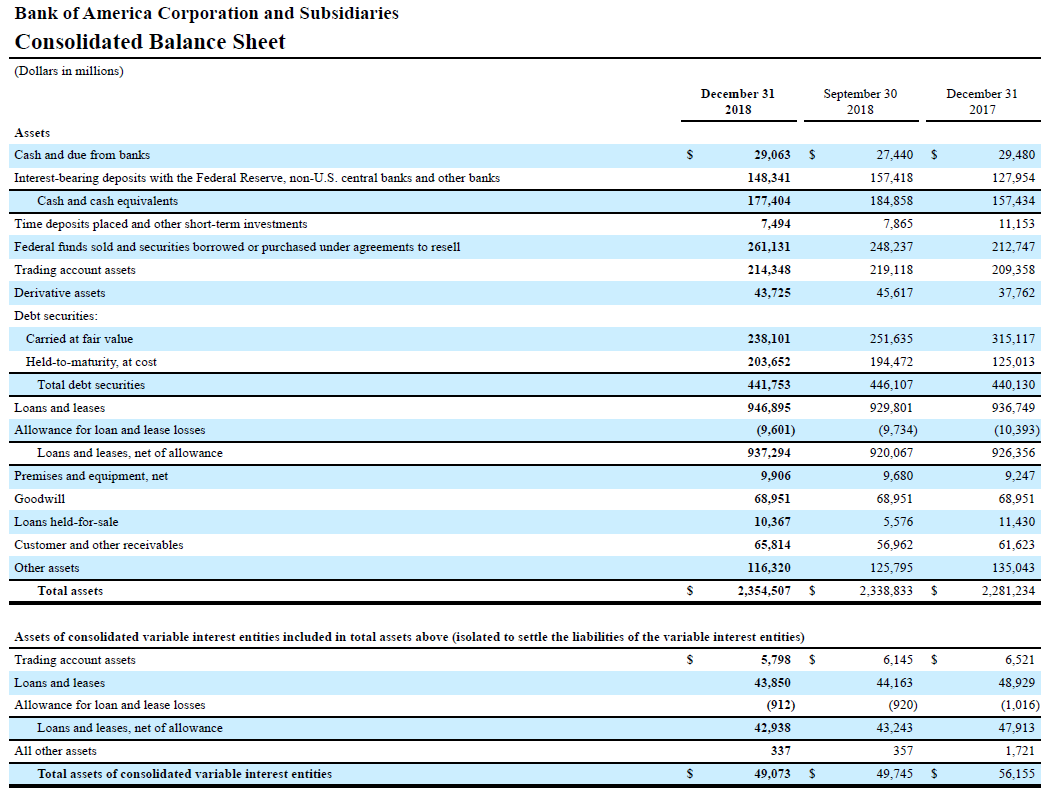

Bank balance sheet. A company's balance sheet is a snapshot of assets and liabilities at a single point in time. A bank balance sheet is a key way to draw conclusions regarding a bank’s business and the resources used to be able to finance lending. Its main activity consists of using money from savers to lend to those requesting credit.

Bank balance sheets report the assets, liabilities, and bank capital for an individual bank. Assets = liabilities + shareholders’ equity the equation above includes three broad buckets, or categories, of value which must be accounted for: A bank’s mandate reflects the relationship between the profit made by the bank, its risk levels, and its financial health.

The main elements if this balance sheer are assets, liabilities, and the bank capital. Provisioning, asset valuation, securitisation etc.) on the financial statements. It is allowing up to $95 billion in treasury and mortgage bonds to.

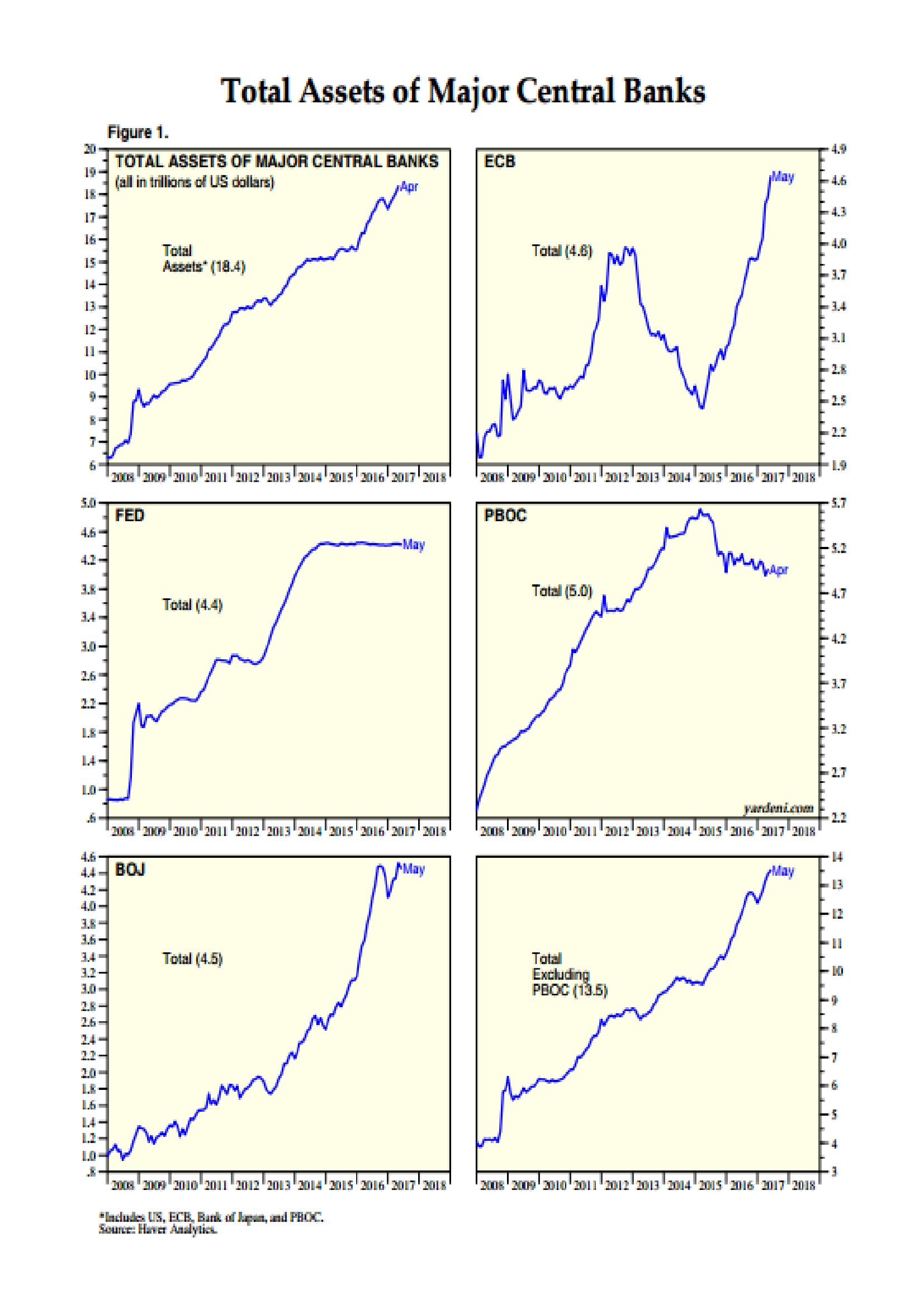

Balance sheets examine risk. The current size of the fed's balance sheet is $7.7 trillion. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time.

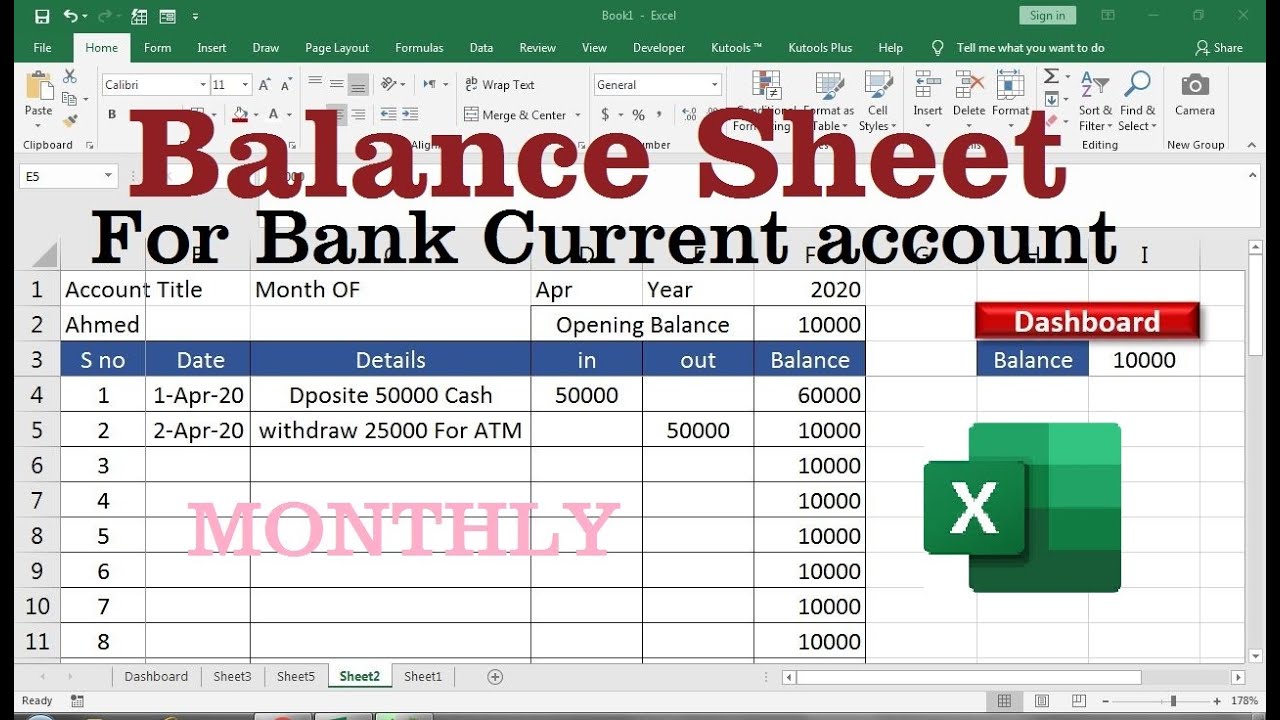

Determine a reporting date for the balance sheet. The qt process complements fed rate hikes aimed at cooling high levels of inflation. With this information, a company can quickly assess whether it has borrowed a large amount of money, whether the assets are not liquid enough, or whether it has enough current cash to fulfill current demands.

It was a new kind of accommodative monetary policy, but the result was that central banks wound up holding billions worth of assets on their balance sheets. Thomson reuters the evolution of the fed's balance sheet. The balance sheet, together with the income.

This means that a bank’s balance sheet is somewhat different from a. The balance sheet is based on the fundamental equation: The fed has been reducing the size of its holdings since 2022.

The volume of business of a bank is included in its balance sheet for both assets (lending) and liabilities (customer deposits or other financial instruments). It had miscalculated the proportion of risky loans on its balance sheet, meaning metro breached bank of england rules that required banks to hold enough capital to cover potential losses. The btfp has allowed banks to get cash from the fed window without declaring a loss in their balance sheet.

A bank is not like any other company. The balance sheet items are average balances for each line item rather than the balance at the end of the period. Fundamental analysts focus on the balance sheet when considering an investment opportunity or.

Graph and download economic data for balance sheet: With price pressures heading back to the 2% target fed officials are openly weighing when they can lower the federal funds target rate from its current 5.25% to 5.5% level. A banks balance sheet refers to the financial statement prepared by the banks based on which the current status and performance of the entity in the banking industry can be assessed and analyzed.