Painstaking Lessons Of Info About Loan Payable On Balance Sheet

(any interest that has accrued since the last payment should be reported as.

Loan payable on balance sheet. Its liabilities (specifically, the long. Presentation of a loan payable. When you make that loan payment, you pay interest up to december 28.

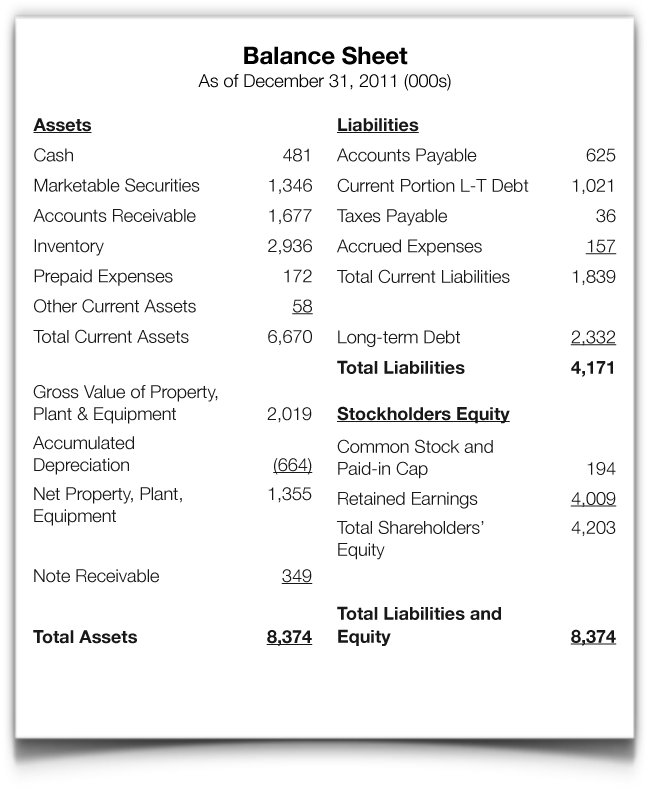

Here are four steps to record loan and loan repayment in your. The account mortgage loan payable contains the principal amount owed on a mortgage loan. A balance sheet provides a snapshot of a company’s financial performance at a given point in time.

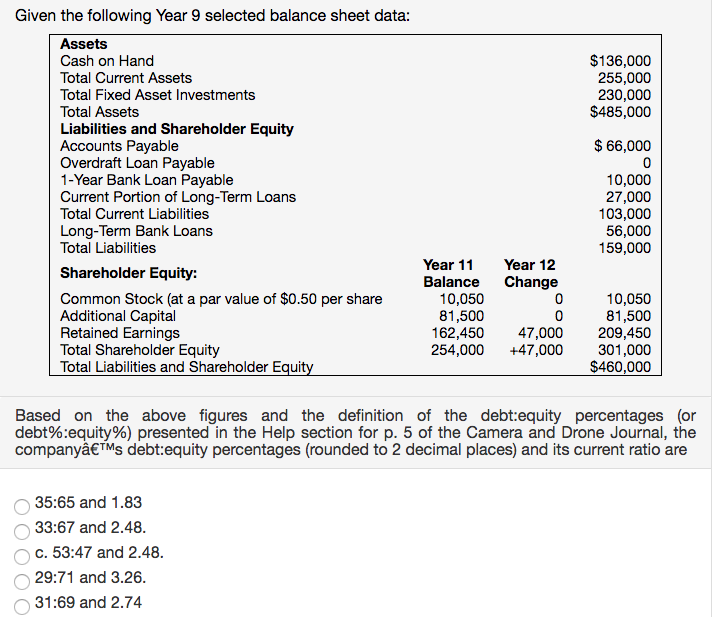

Loan payables obviously are recognized under liabilities on the balance sheet, there’s no doubt about it. Accounts payable is a liability since it is money owed to creditors and is listed under current. When a reporting entity holds an originated or purchased loan for which it has the intent and ability to hold for the foreseeable future or to maturity or payoff, the loan should be.

Which means, the company paid. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. This financial statement is used.

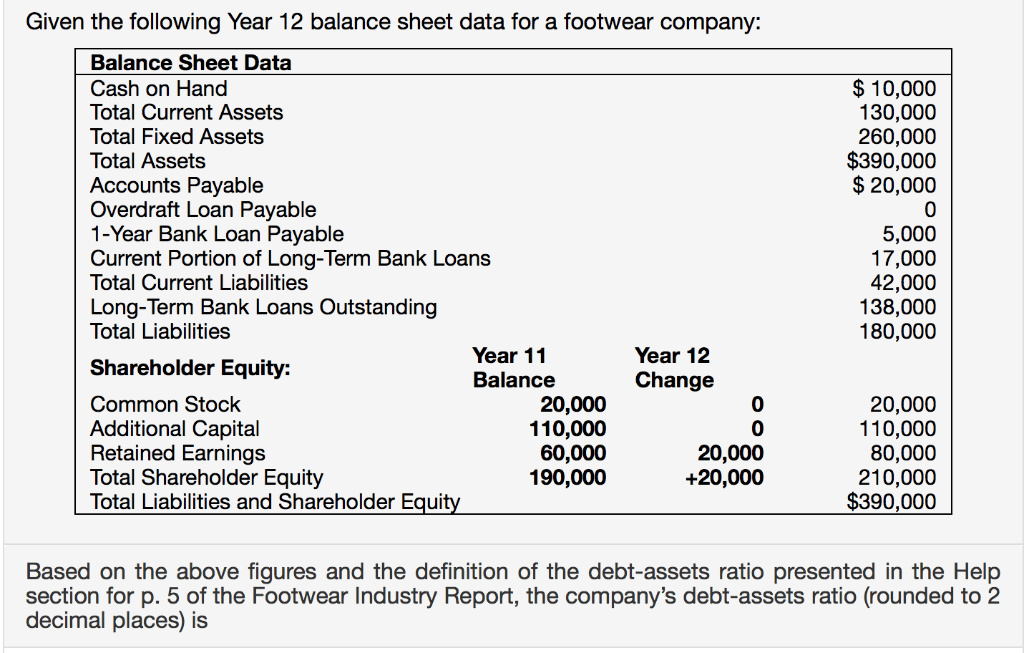

As fixed assets age, they begin to lose their value. Loan payables to be recognized in the balance sheets as at 30 june. If the principal on a loan is payable within the next year, it is classified on the balance sheet as a current.

Additionally, they are classified as current liabilities when the amounts are due. Michael signed a note payable promising to make payments to bob on the first date of every month consisting of $500 toward the principal amount and $50 toward. The balance sheet.

Generally, asc 310 permits loans and receivables to be presented on the balance sheet as aggregate amounts. Notes payable appear as liabilities on a balance sheet. For example, assume you have a loan due on december 28.

Accountants realize that if a company has a balance in. Presentation of mortgage loan payable. This may be the case when.

Correctly recording the loan and loan payments will allow the balance sheet to properly display the remaining loan balance and the income statement to record the. Cancelling student loan debt for more than 930,000 borrowers who have been in repayment for over 20 years but never got the relief they earned because of. Accounts payable is listed on a company's balance sheet.

When you see a negative number for a loan, this indicates that there is a credit balance. The mortgage loan payable that is to be paid within the next 12 months is reported as a current liability on the balance. Interest payable is a liability account that reports the amount of interest the company owes as of the balance sheet date.