Neat Tips About Cost Of Goods Sold In Profit And Loss Statement

Then, subtract the value of the inventory yet to be sold.

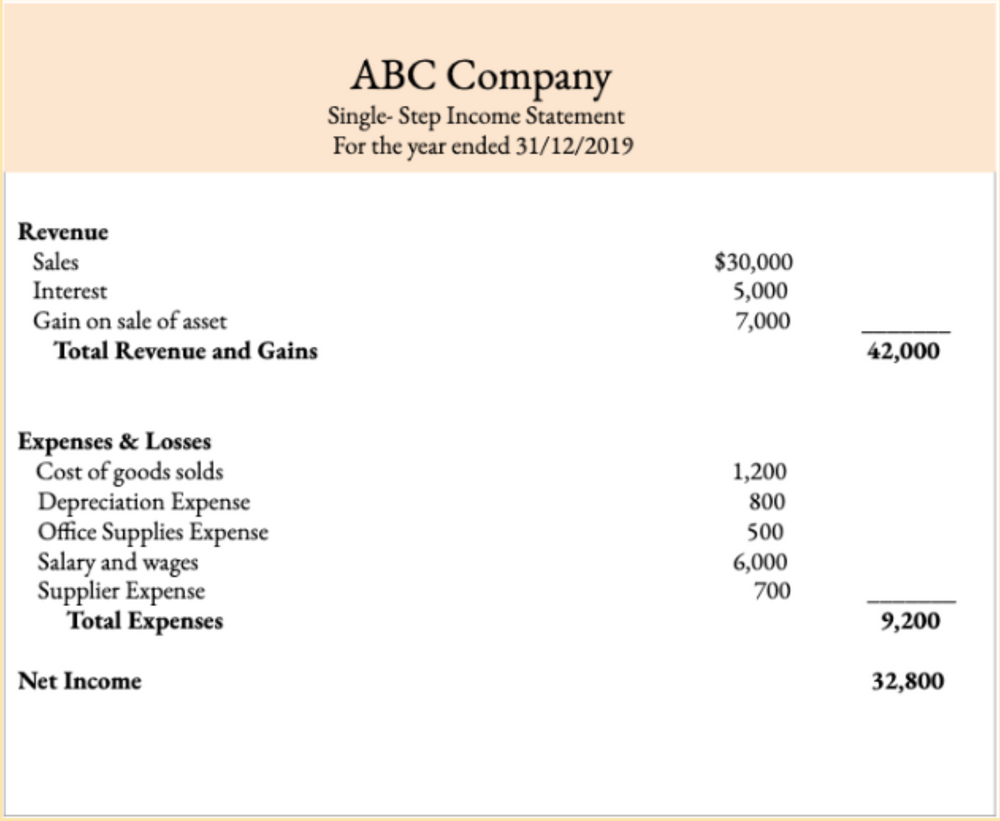

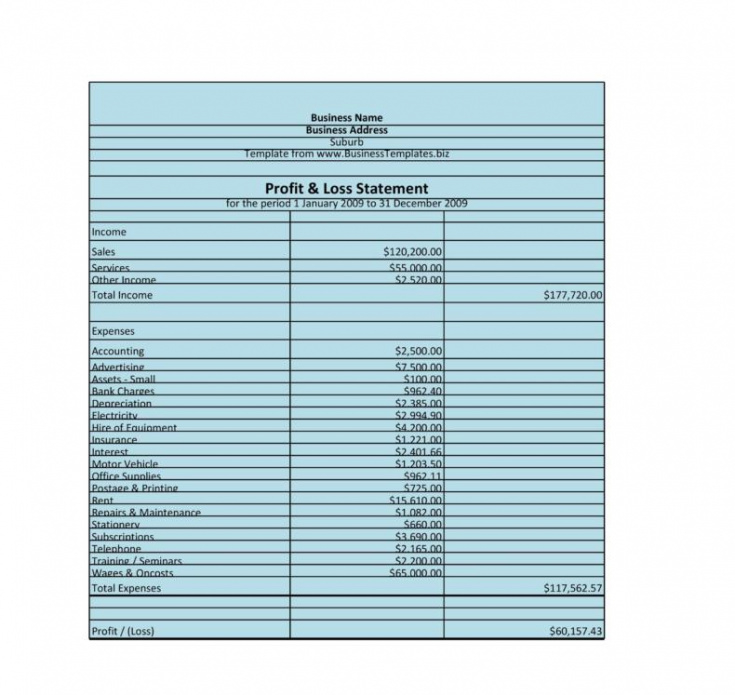

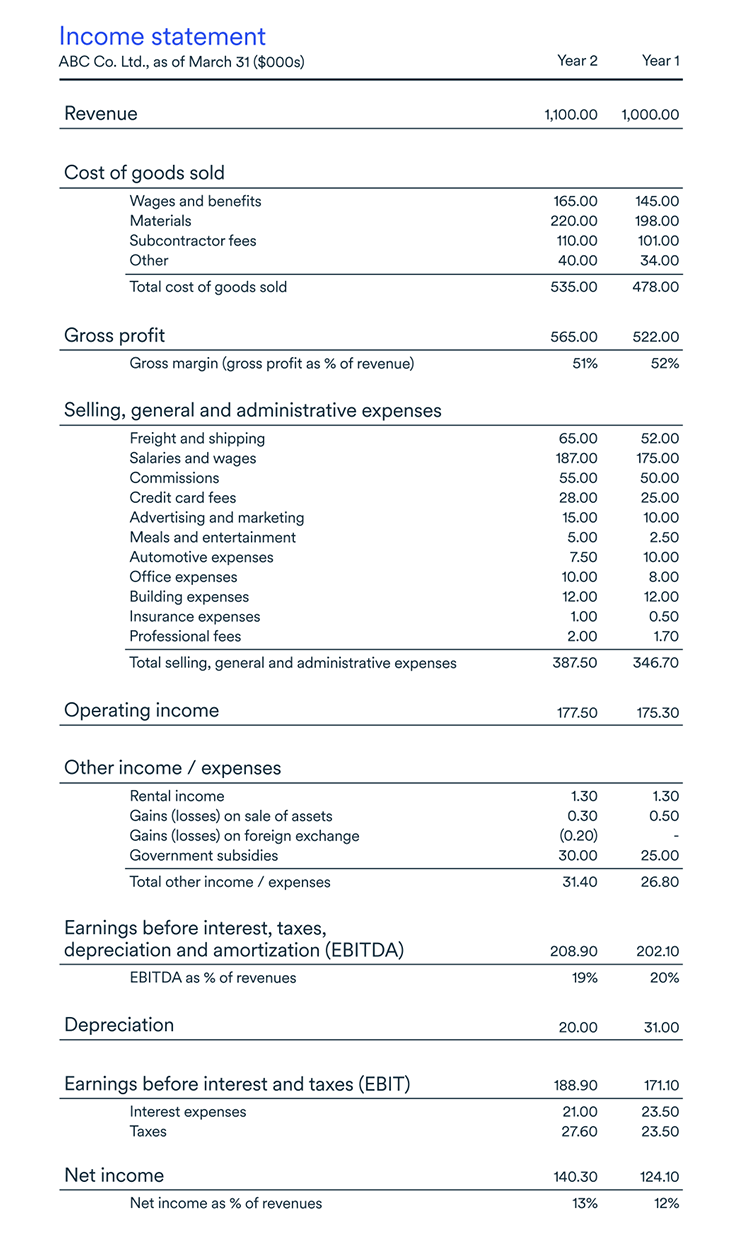

Cost of goods sold in profit and loss statement. How to prepare the profit and loss statement (p&l) the profit and loss statement (p&l) can be prepared by an accountant under two. Cogs counts as a business expense and affects how much profit a company makes on its products. Businesses need to track all direct costs of processing goods for sale, including labor and material expenses.

These costs are known as cost of goods sold (cogs), a calculation that usually appears in a business’s profit. Cogs show up on a business’s income statement or profit and loss statement. Calculating cost of goods sold.

This amount includes the cost of the materials and labor directly used to create the good. Cogs refers to the direct costs of goods manufactured or purchased by a business and sold to consumers or other businesses. Cogs is deducted from your gross receipts to figure the gross profit for your business each year.

It includes the costs of the materials, storage and manufacturing labour, but not indirect costs such as distribution, marketing and management salaries. The cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company while attempting to generate revenue. The main categories that can be found on the p&l include:

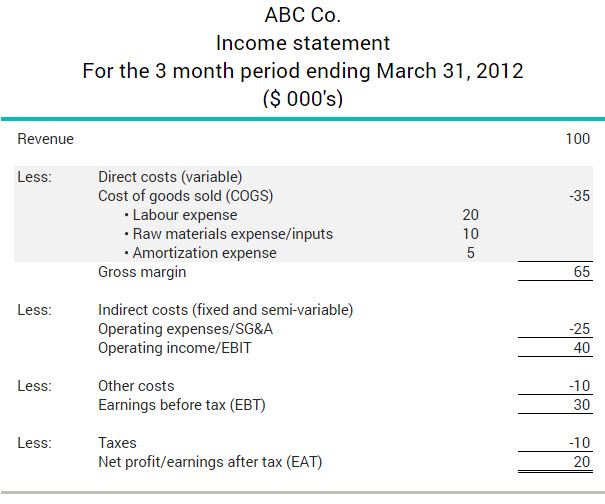

The weighted average cost method. Here's the main one: Revenue (or sales) cost of goods sold (or cost of sales) selling, general & administrative (sg&a) expenses.

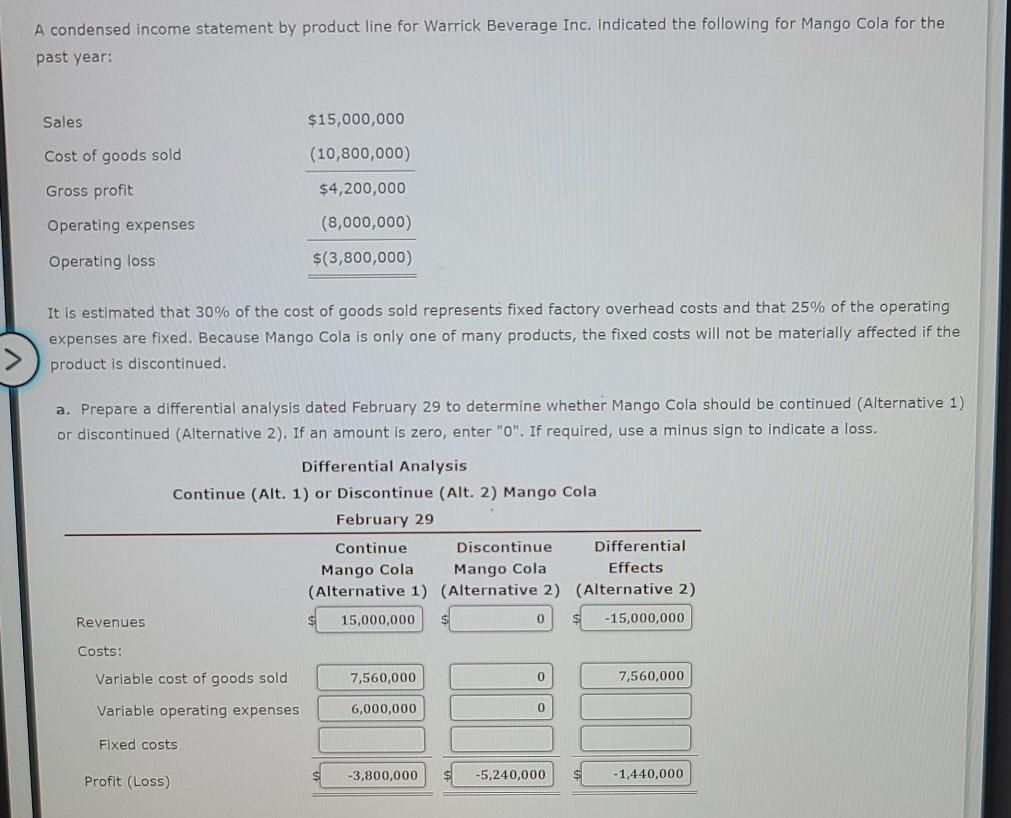

Costs can only be expensed and shown in the p&l after the goods have been sold and their revenues reported in the p&l. This is the amount the business paid to buy the goods they are selling. To calculate her cost of goods sold for the month, her formula would be:

This information is also required for tax return filing as the cost of goods sold (cogs) contributes to the taxable income. Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year. For example, if your business creates a product for nine dollars, incurring one dollar in direct overhead.

To calculate cogs, take the cost of initial inventory and add additional direct costs during the period you are measuring. How to calculate cost of goods sold. Cost of goods sold (cogs) and operating costs (sg&a, r&d) earn profits → e.g.

Gross margin, operating margin, ebitda margin, net profit margin; How to calculate cost of goods sold (cogs)? This is calculated as follows:

(500 x $1.20) + (200 x $1.00) = $800. If the cogs formula is confusing, think of it this way. Cost of goods sold (cogs) is significant for every business, as this number appears in the company’s profit and loss statement (p&l) aka i ncome statement and plays a vital role in calculating net income for a business.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF] Profit And](https://i.pinimg.com/originals/c2/2b/92/c22b92d6bb3d5a06982417eaf4bcacee.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)