Here’s A Quick Way To Solve A Info About Journal Entry For Goods Sold On Profit

With the information in the example, we can calculate the cost of.

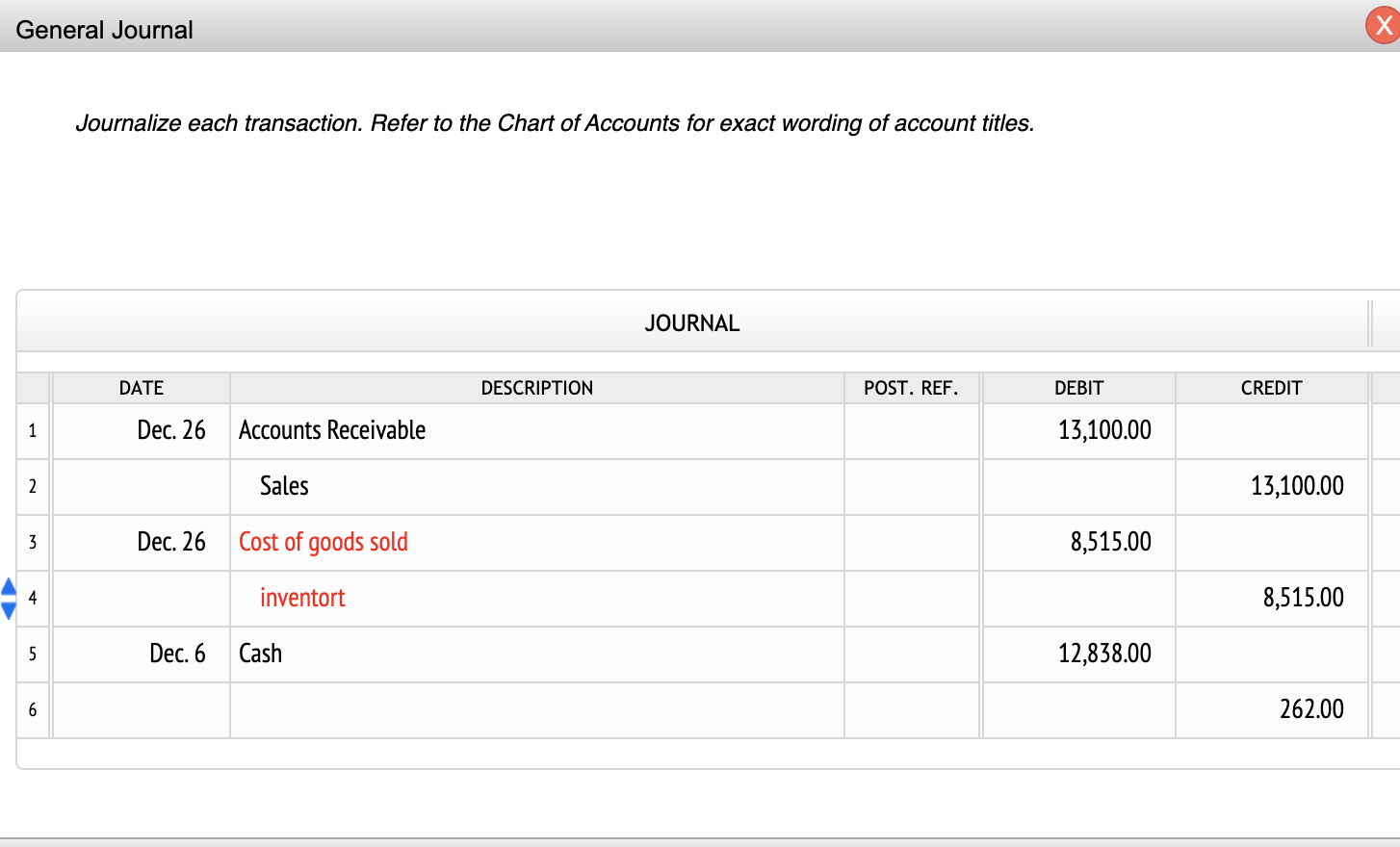

Journal entry for goods sold on profit. Sold machinery (fixed assets) book value rs 100000 for rs 90,000. In this video, brittany brown, our chief guru, shows how to create a product cost catalog and keep track of inventory and cogs in quickbooks online. 10.2 calculate the cost of goods sold and ending inventory using the periodic method;

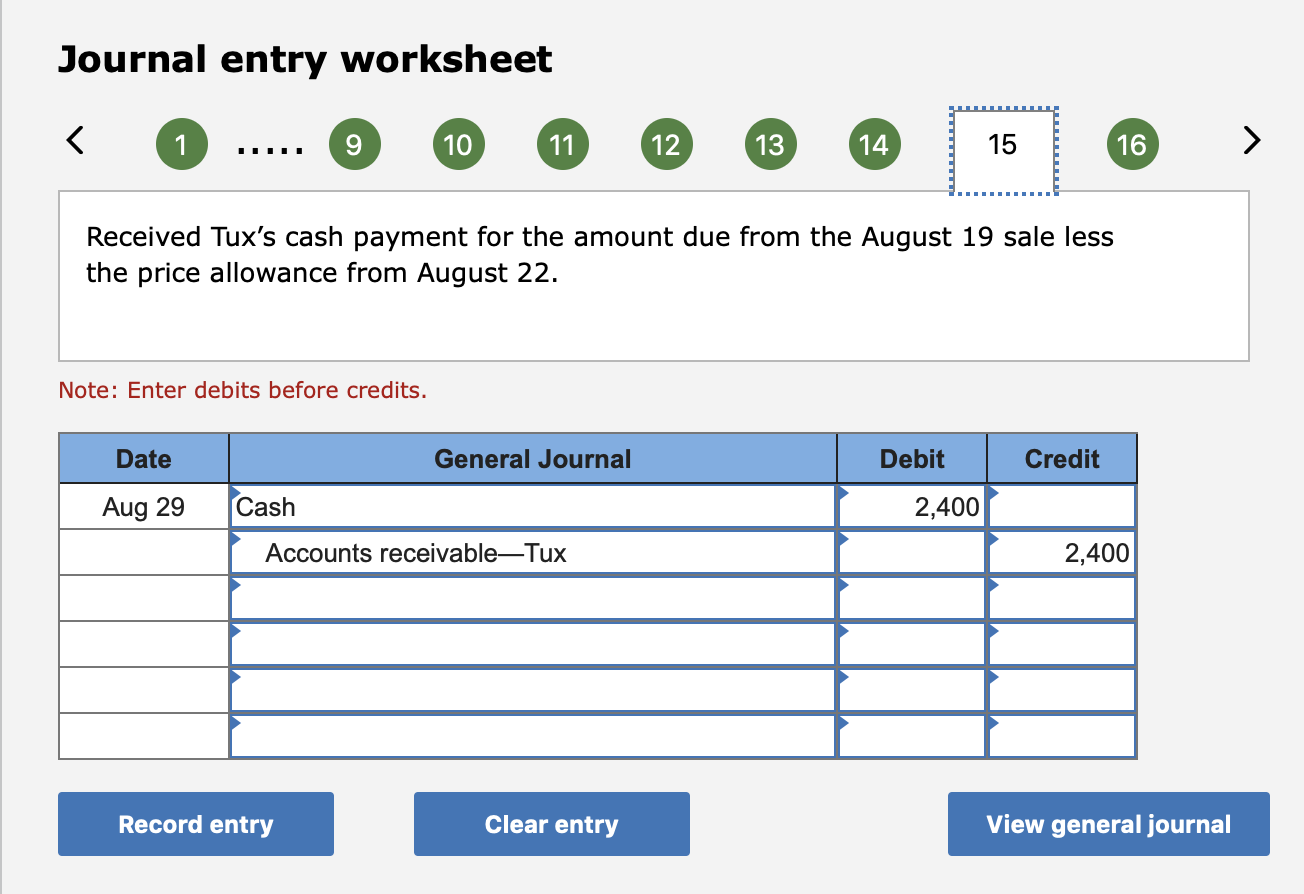

Goods purchased in cash ₹25,000. Journal entry examples gross profit march 1, 2018 accta q13. Later, on july 20, when we receive the $5,000 cash payment for the goods sold on credit that we have made on june 30, we can make the journal entry as below:

The firm gets rs.4000 as. The journal entry in the books of xyz ltd. Journal entry for profit on sale of fixed assets.

The common journal entries that a consignee makes in his books are given below: How to record a journal entry for cost of goods sold. Goods worth ₹1,000 taken away for personal use by proprietor.

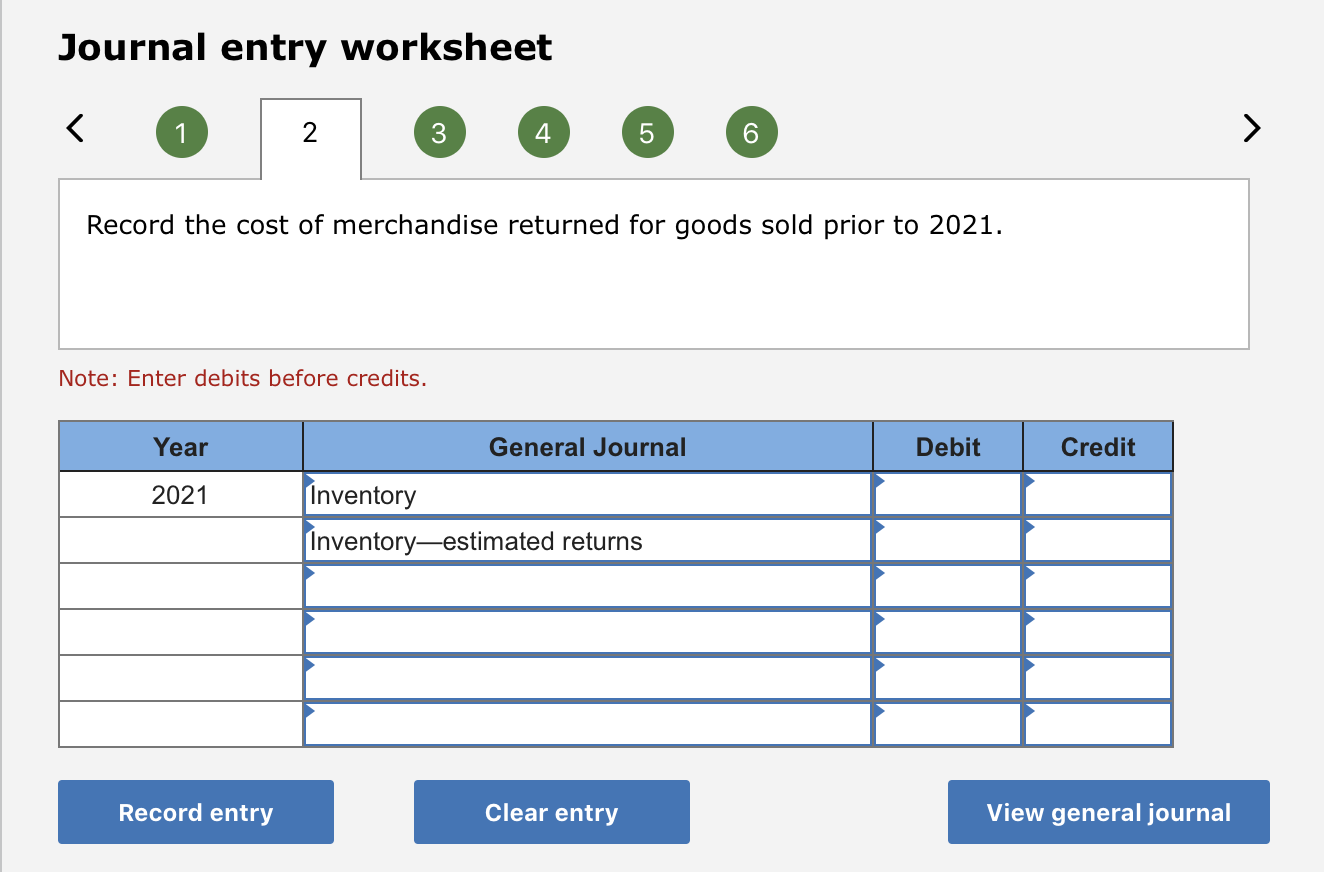

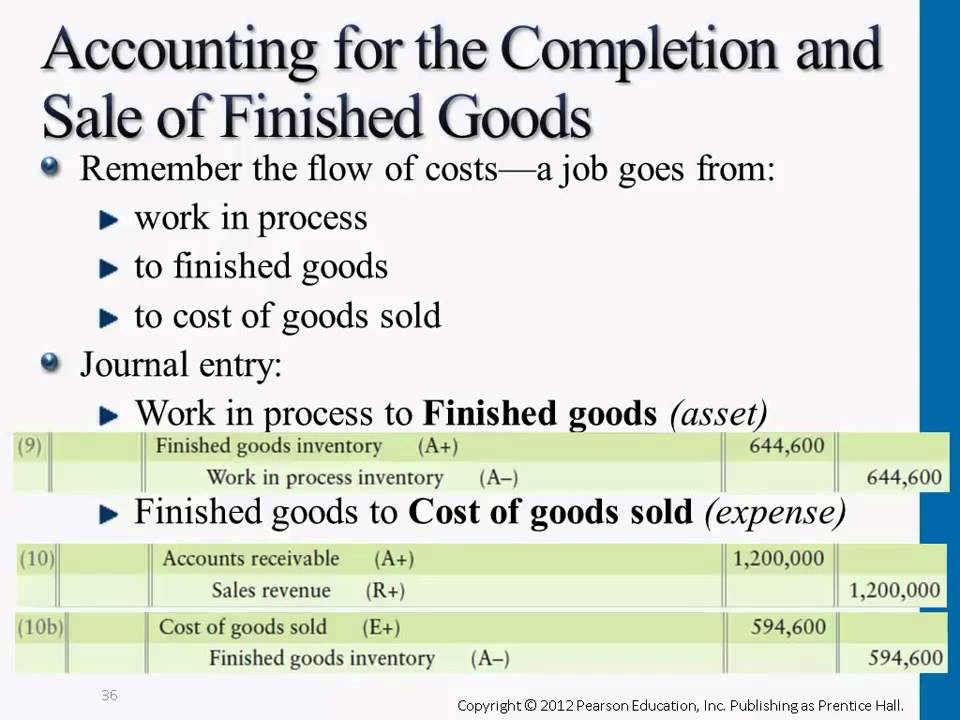

To record the cost of goods sold, we need to find its value before we process a journal entry. This entry matches the ending balance in the inventory account to the costed actual ending inventory, while eliminating. Note here the asset which we have.

Journal entry for loss on sale of asset. The purpose of this account is to determine the gross profit/ (loss) of a business from its trading activities. To understand it more clearly, let us take an example.

Journal entry in the book of sk book supplier journal entry for american style journal entry for european style problem: Trading activities are generally the buying. Gross profit entity a sold 200 units of merchandise in cash at a selling price of $50 per unit.

Sold goods amounting to 50,000 to mr a on credit. As the goods are sold for a 20% higher cost, which is rs.4000 the p&l account must be credited as incomes should be credited. The cost of goods sold journal entry is:

What is the journal entry to record the cost of goods sold at the end of the accounting period? The transaction, goods sold for cash, has an effect on both sides of the accounting equation. Goods worth ₹5,000 were given as a donation.

Entry at the time of receiving goods: (being goods sold on credit) 500+ accounting. Lets under stand its with example.