Formidable Info About Pro Forma Balance

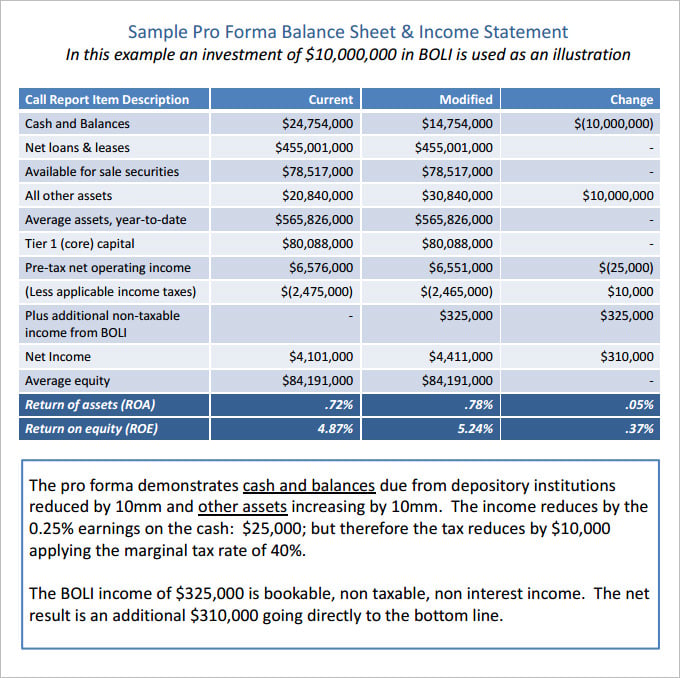

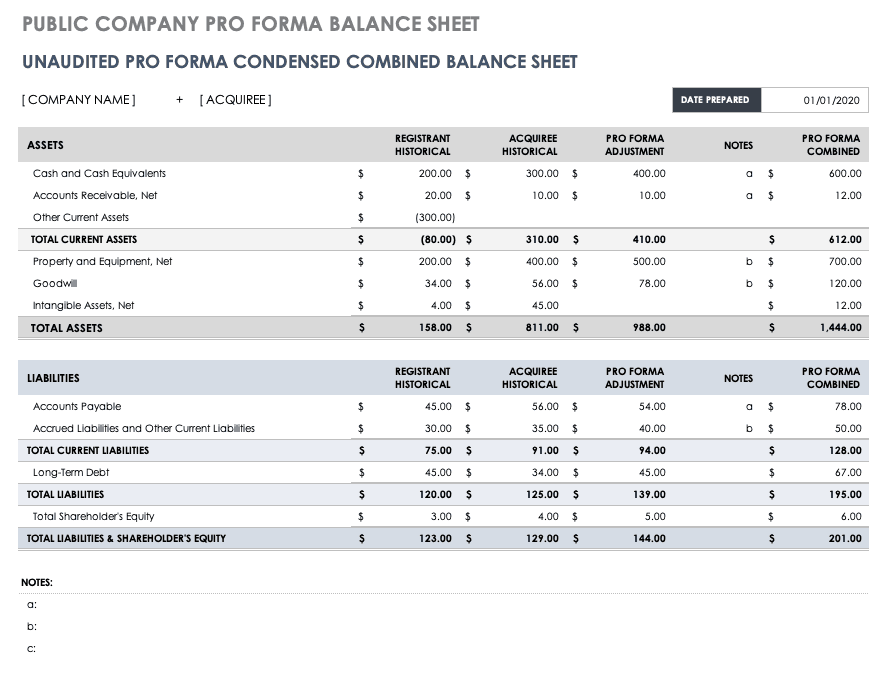

A pro forma balance sheet is a financial statement showing a company’s expected assets, liabilities, and equity after a significant event, such as an acquisition or a new financing round.

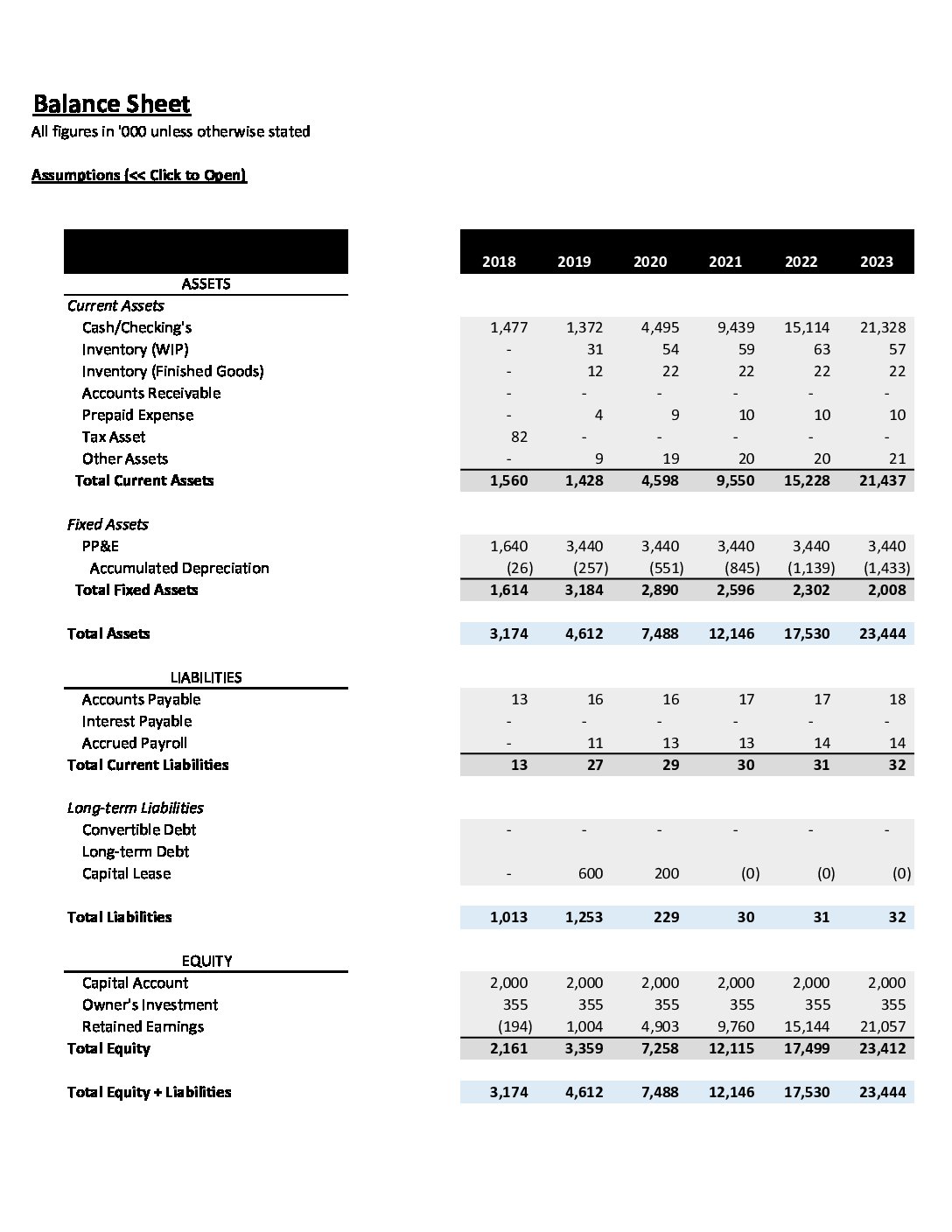

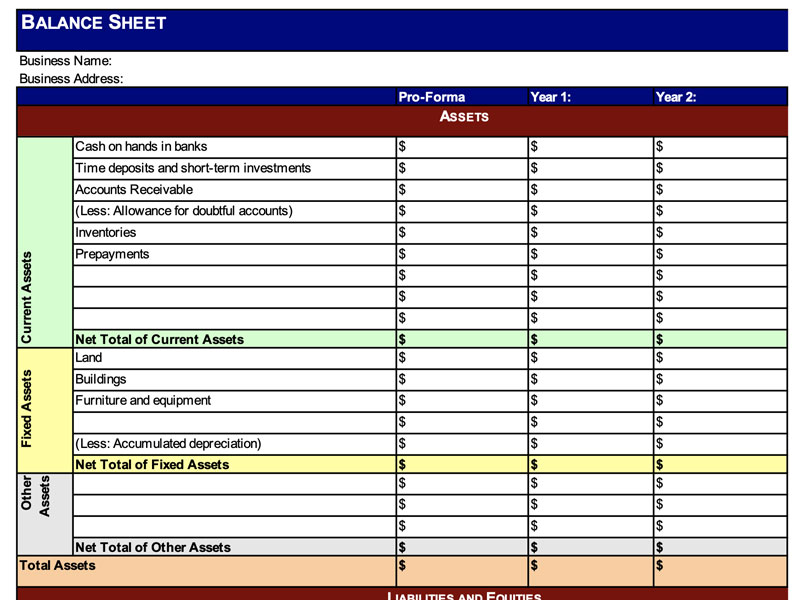

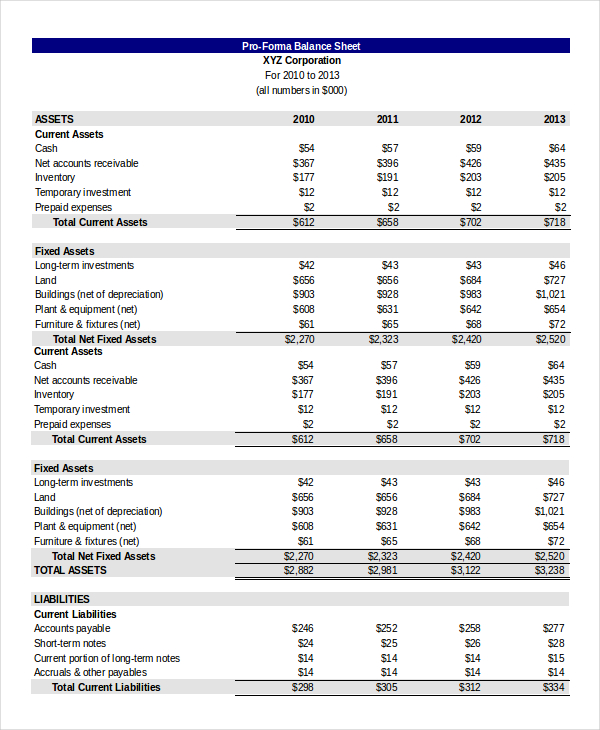

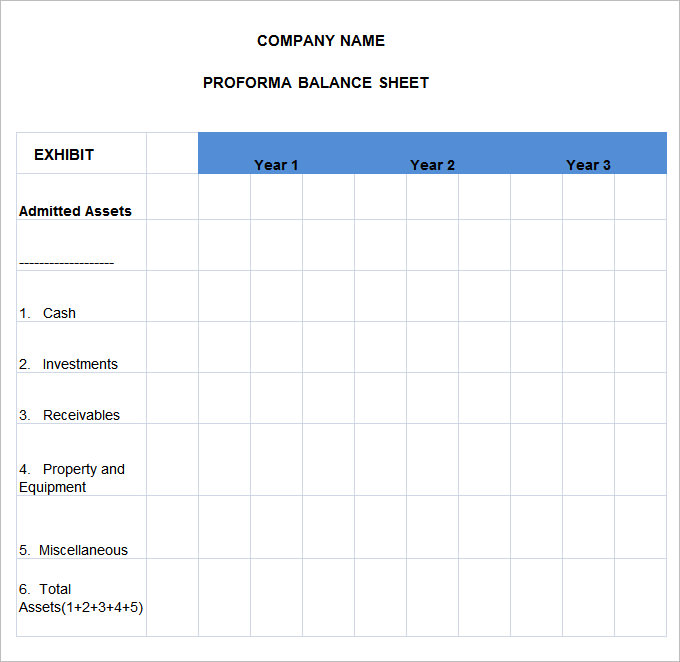

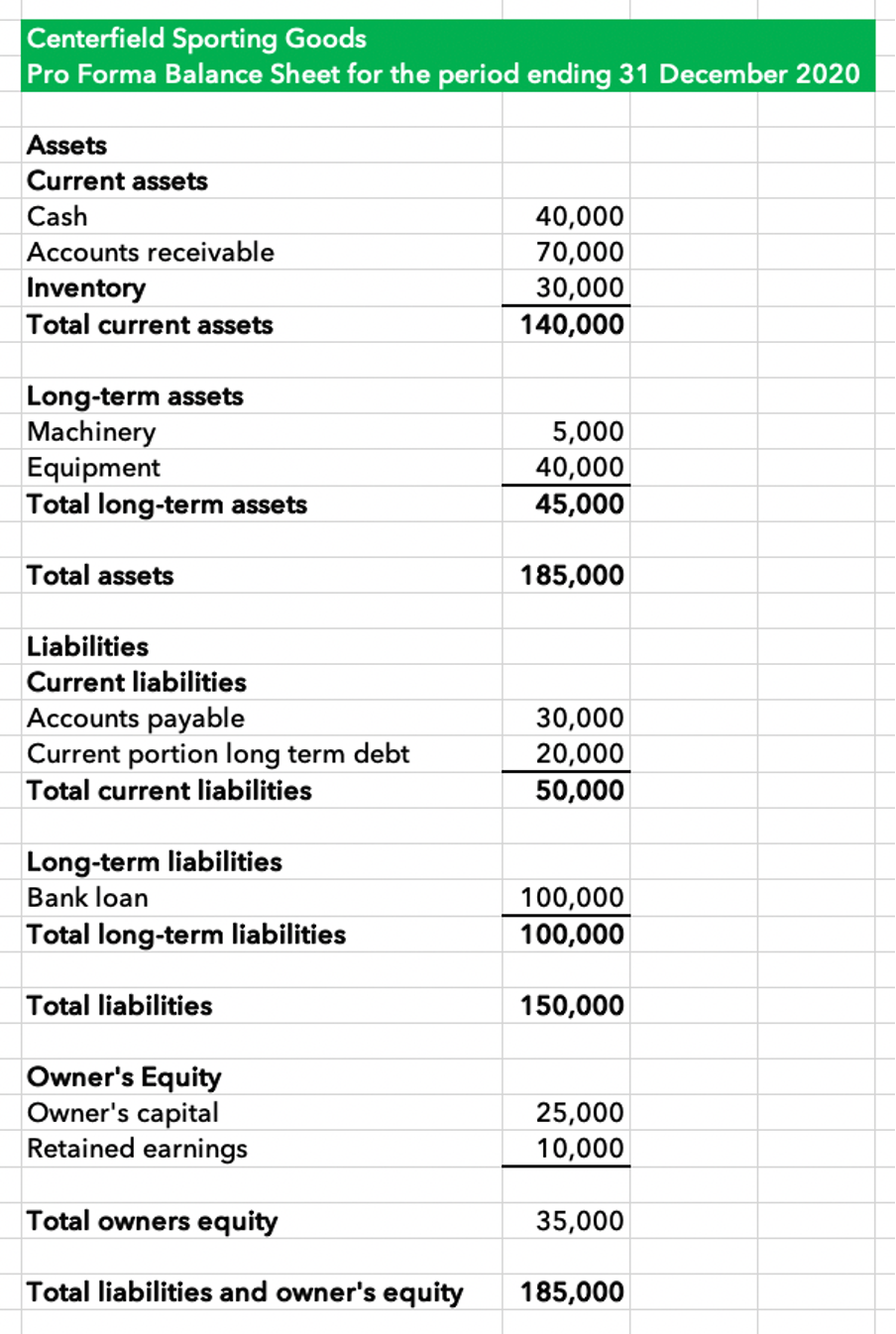

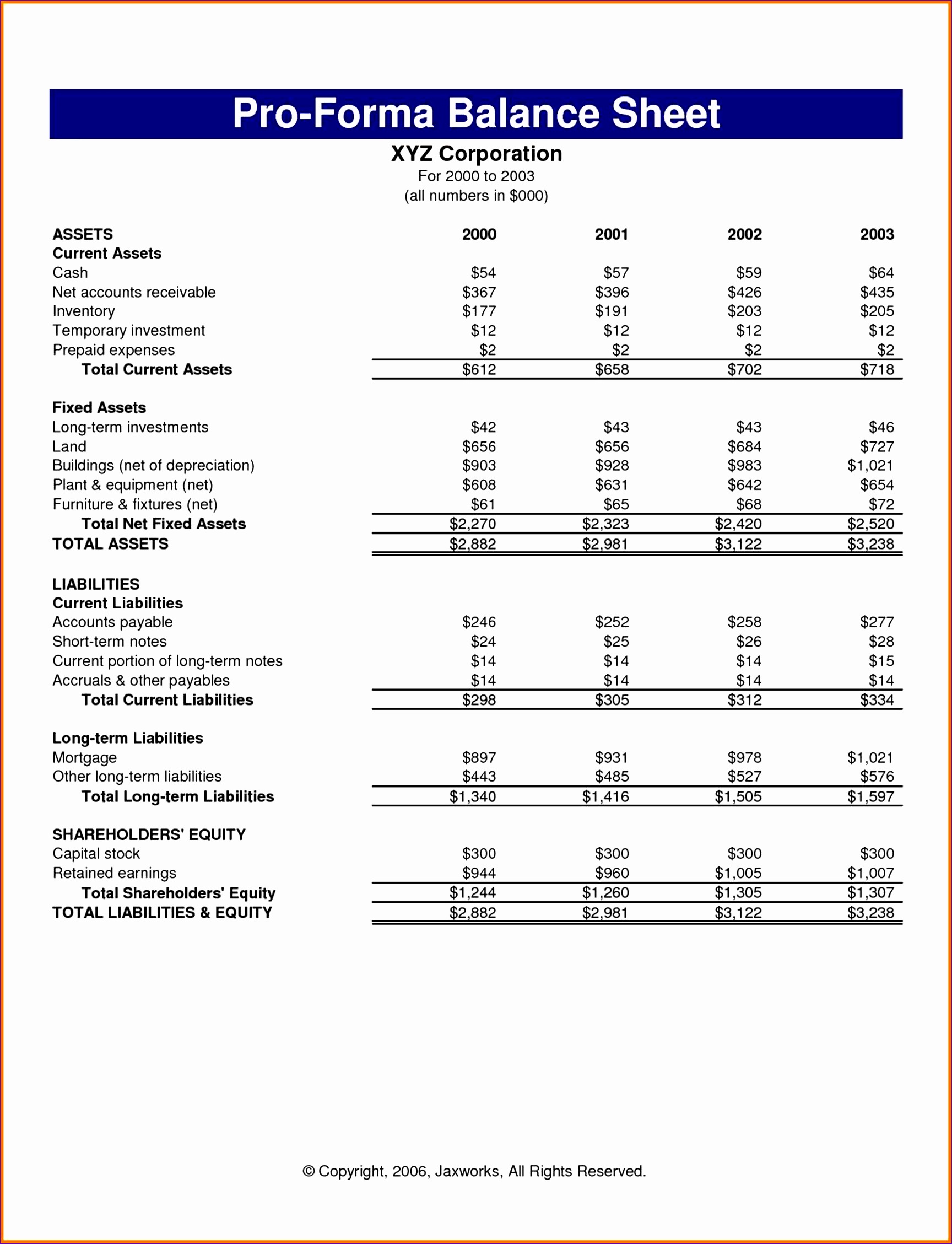

Pro forma balance. We are pleased to present this publication, pro forma financial information: Discover an insightful workflow for creating a pro forma balance sheet, complete with financial projections, adjustments, and comprehensive analysis. It lists out your future assets, liabilities, and stockholders’ equity in the same format as your historical balance sheet.

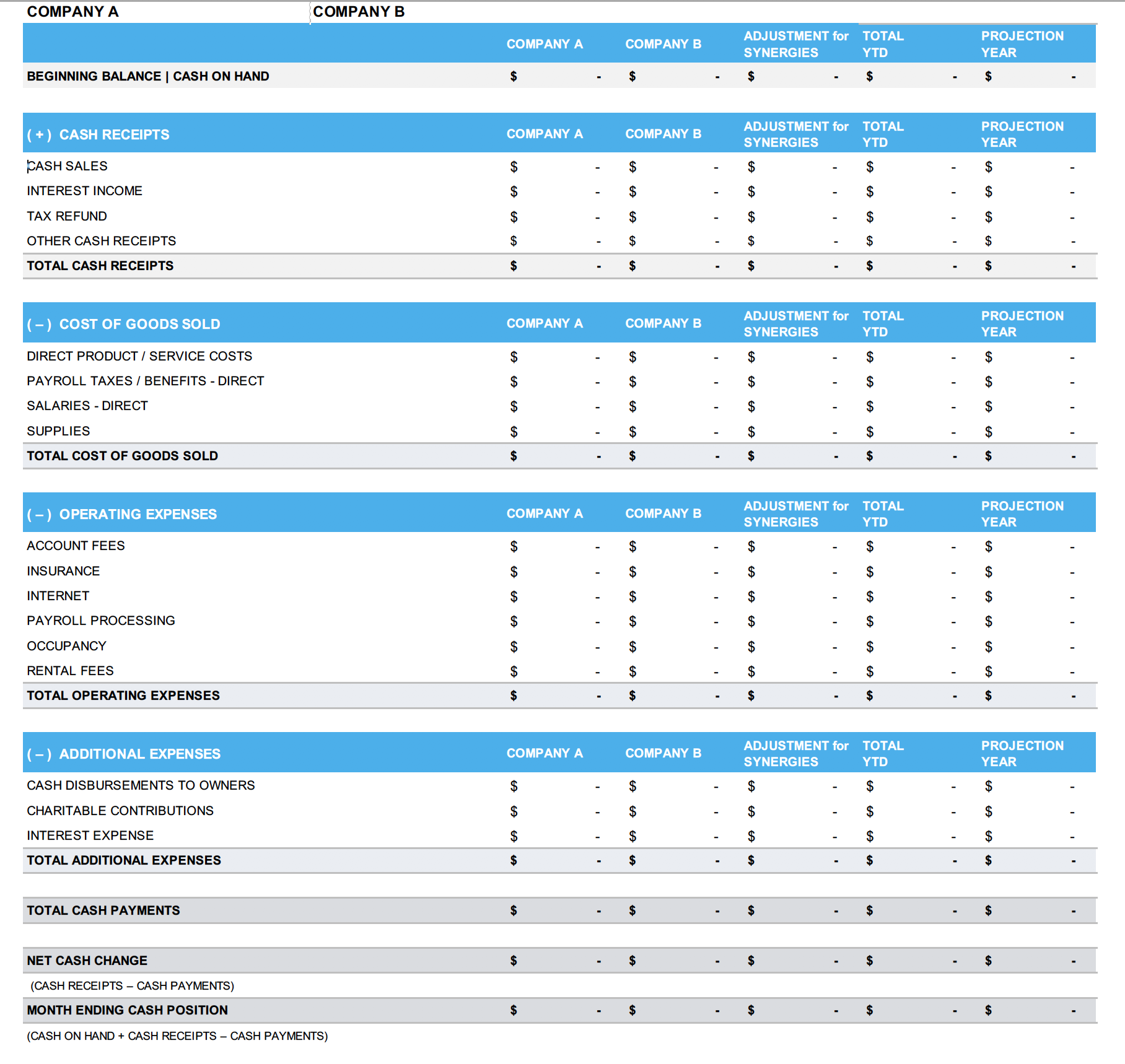

Create pro forma income statements, pro forma balance sheets, and pro forma cash flow statements. A pro forma balance sheet is a financial document that discloses a business’s assets, liabilities, and equity at a specific point in time. Then, make pro forma adjustments based.

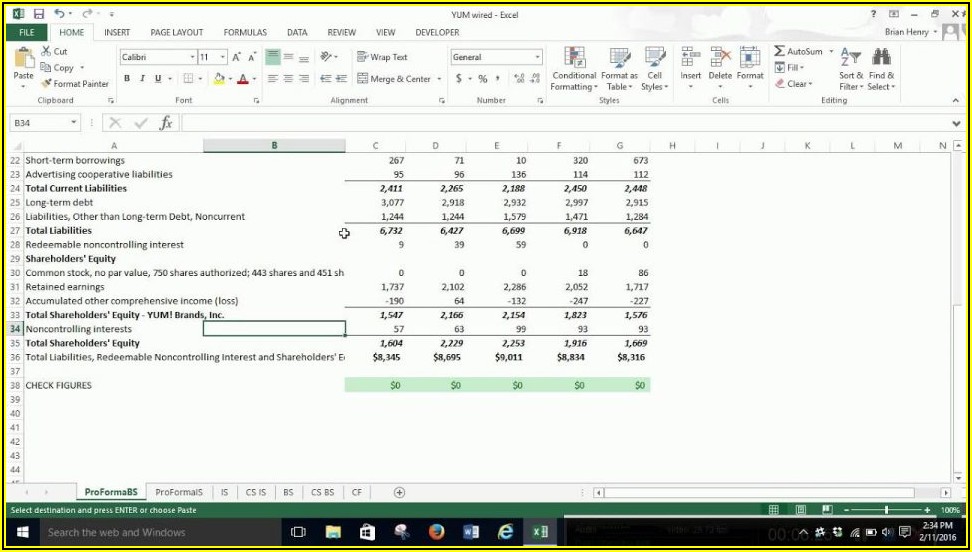

Remember, in its simplest form, the equation is assets = liabilities + owner's equity. The balance sheet, for example, considers assets and liabilities like accounts receivables, payables, and inventories. Pro forma balance sheet.

Pro forma’s contain running balances for the assets, liabilities, and equity we wish to have in the future. There are two items on the balance to take into account when considering the creation of a pro forma balance sheet. So, if you wanted to see how refinancing debt—a liability—would affect your future financial position, you'd use a pro forma balance sheet.

Key takeaways pro forma financial statements illustrate how a company’s financial position might change in the future. June 14, 2022 | chelsie kugler | bookkeeping | strategy. Easily change the data to make new predictions.

What does pro forma mean? Documents in pro forma financial statements. Learn how to create one here.

A pro forma balance sheet is a balance with forecasted future values. A pro forma balance sheet can quickly show the projected relative amount of money tied up in receivables, inventory, and more. Pro forma, latin for “as a matter of form” or “for the sake of form”, is a method of calculating financial results using certain projections or presumptions.

A pro forma balance sheet is a projected financial statement detailing a company's estimated assets, liabilities and equity at a specific point in the future. The image below shows the fundamental line items comprising a balance sheet. Sally uses her sales estimate to estimate the dollar amount of inventory at the end of 2021.

Por seis anos, leandro teve canal sobre a terra plana e acumulou cerca de 150 mil seguidores. Agora, ele quer mostrar para as pessoas que estava errado. Compile information on current liabilities.

Pro forma is latin for “as a matter of” or “for the sake of form.” it is used primarily in reference to the presentation of information in a formal way, assuming or forecasting pieces of information that may be unavailable. Pro forma financials may not be. Pro forma balance sheets are also used to analyze the risk.