Neat Info About Unearned Revenue Balance

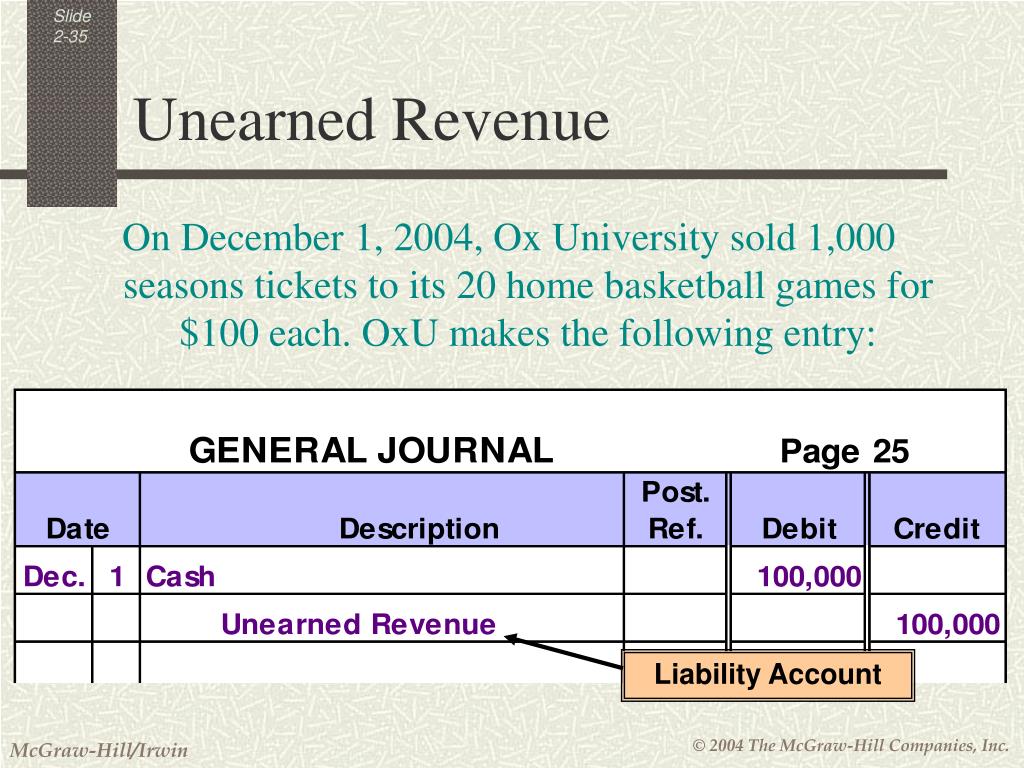

Remember that adding debits and credits.

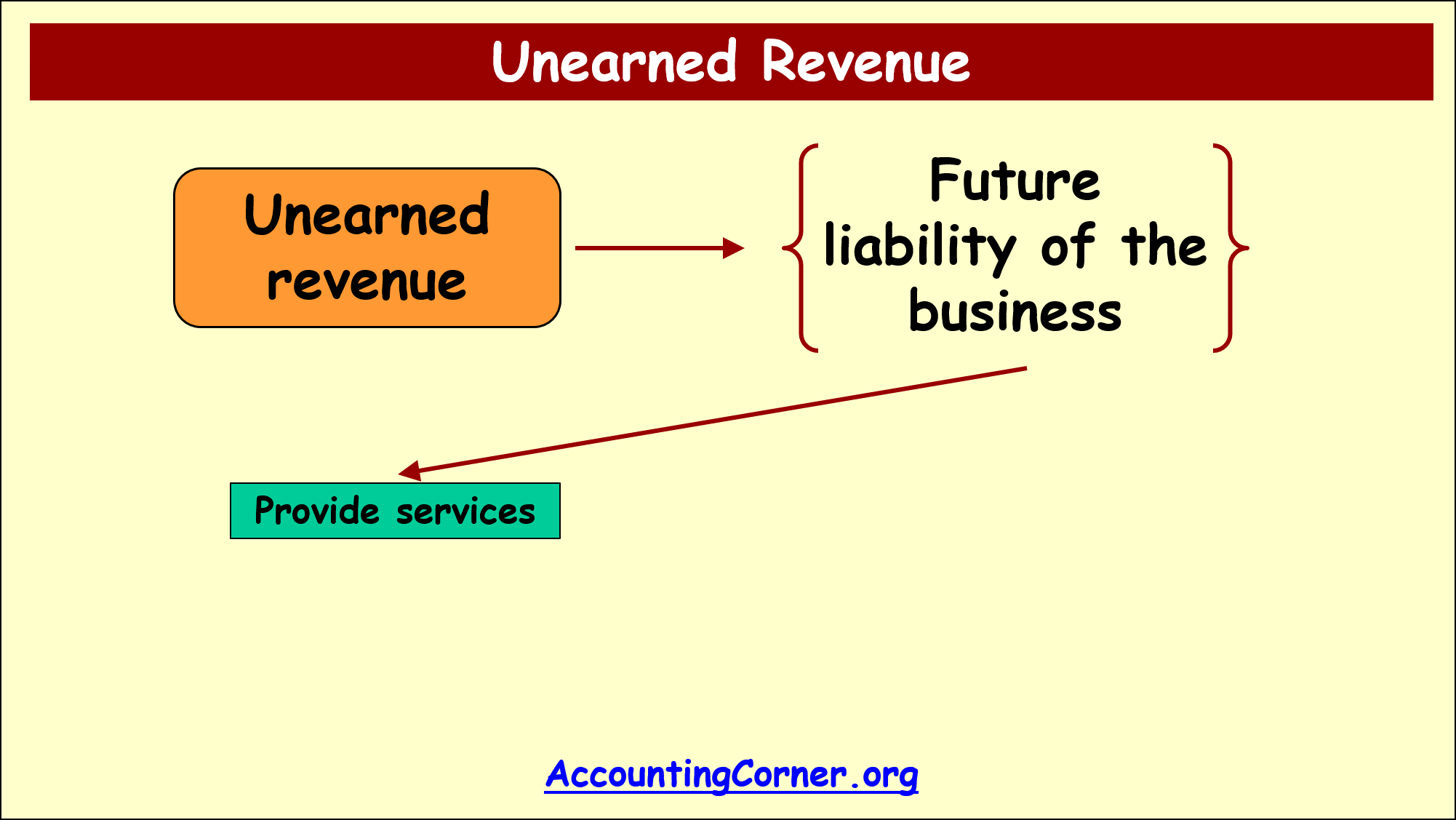

Unearned revenue balance. Another way to look at it is prepaid revenue. Unearned revenue is money that is received by a business before goods or services are provided. Unearned revenue can also be.

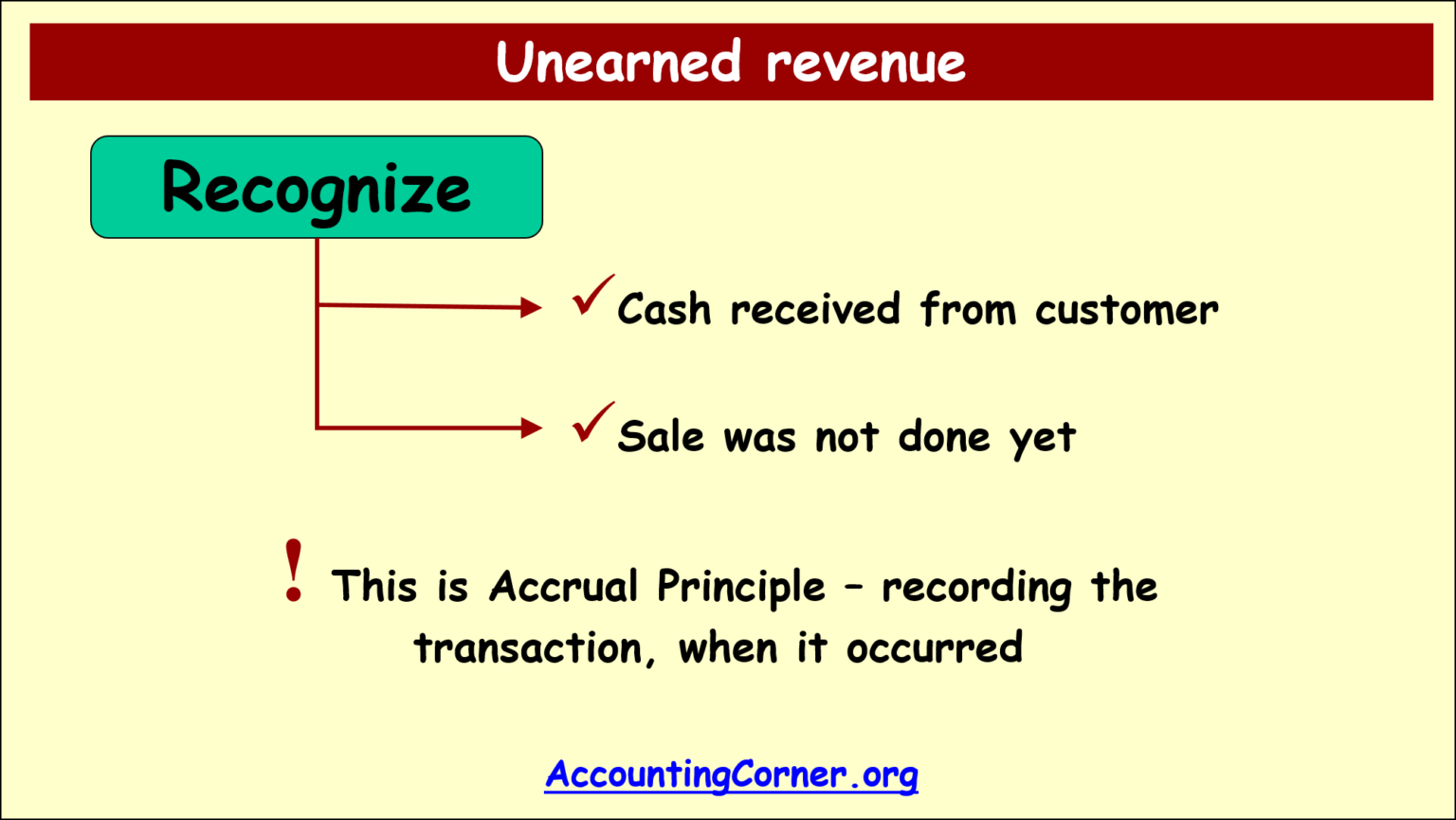

Unearned revenue is amount of money that is received by the business for goods and services that is yet to be delivered or rendered. Unearned revenue is recorded on a company’s balance sheet as a liability. Because it is a liability account.

A liability account that reports amounts received in advance of providing goods or services. Unearned revenue is placed on a balance sheet as a liability to be solved, whereas unrecorded revenue is delayed in this process. The short answer to the question is the unearned revenue’s normal balance is a credit;

Unearned revenue, sometimes called deferred revenue, is when you receive payment now for services that you will provide at some point in the future. Unlike earned revenue (which shows up as an asset), unearned income shows up as a liability on your balance sheet. The amount of unearned revenue in this journal entry represents the obligation that the.

Unearned revenue refers to the money small businesses collect from customers for their products or services that have not yet been provided. It is treated as a liability because the revenue has still not been earned and represents products or services owed to a customer. By treating it as a liability for accounting purposes, you can.

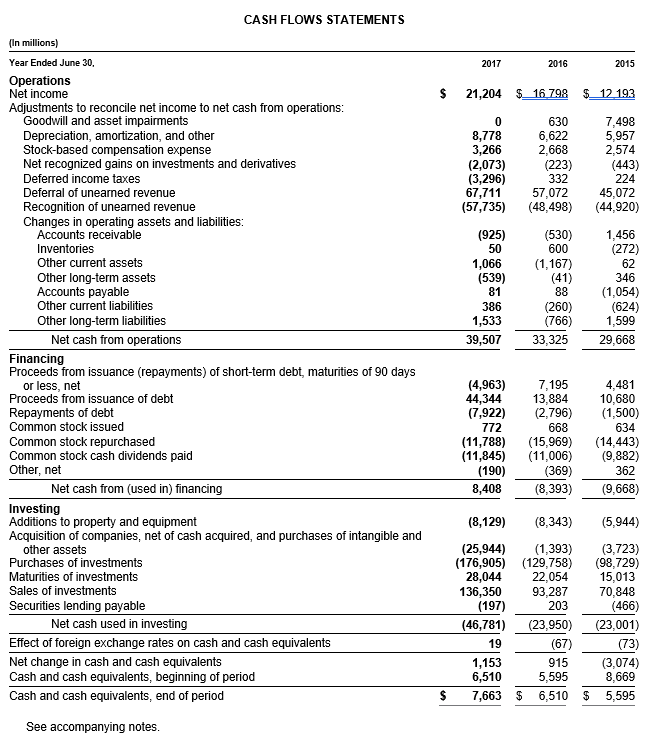

In accounting, unearned revenue has its own account, which can be found on the business’s balance. The balance of unearned revenue is now at $24,000. So, what type of account is unearned revenue, exactly?

This article will go into more detail about what unearned. When the goods or services are provided, this. Unearned revenue (s) definition.

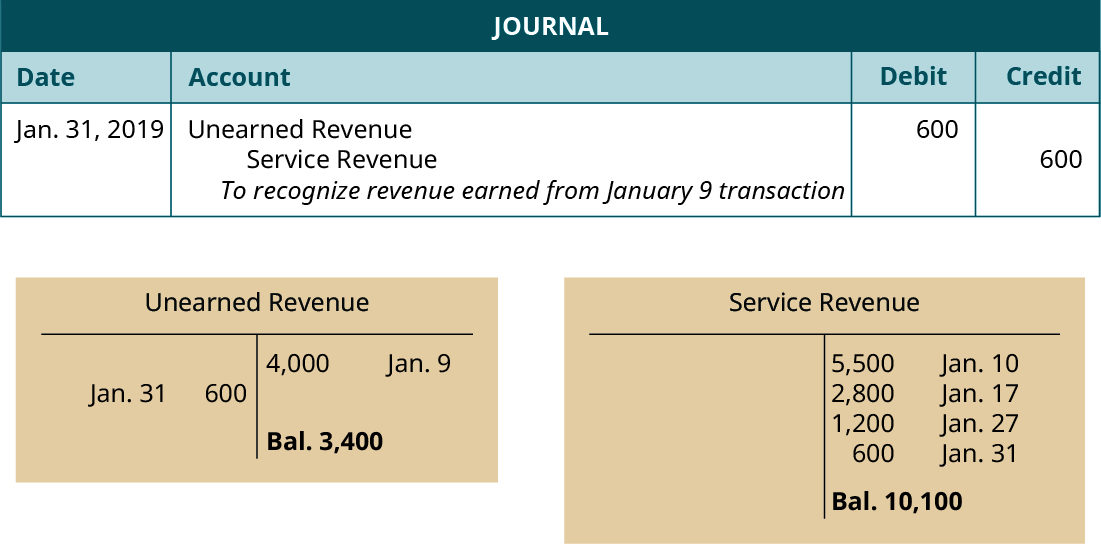

Unearned revenue had a credit balance of $4,000 in the trial balance column, and a debit adjustment of $600 in the adjustment column. What you need to know ☰ how cube works sync data, gain insights, and analyze business performance right in excel, google sheets, or the cube. As the prepaid service or product is gradually delivered over time, it is recognized as revenue on.

Income method under the income method, the accountant records the entire collection under an income account. If you would like a fuller explanation, please read on. Unearned revenue is a liability account which its normal balance is on the credit side.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)