Marvelous Info About Pro Forma Cash Budget Example

Forma cash flow budget.

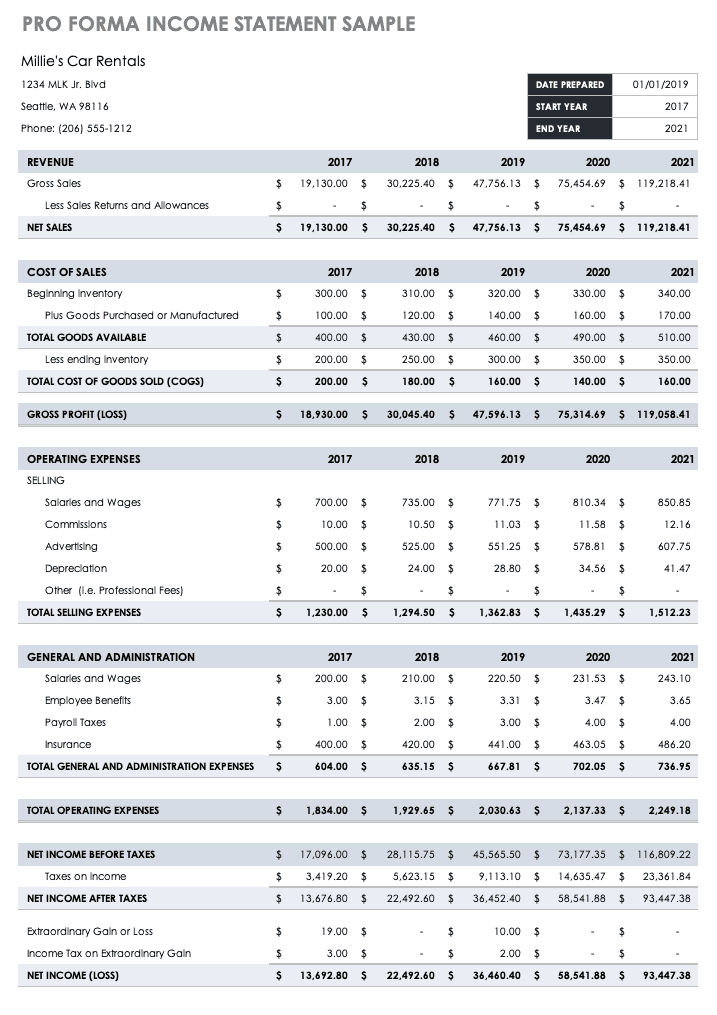

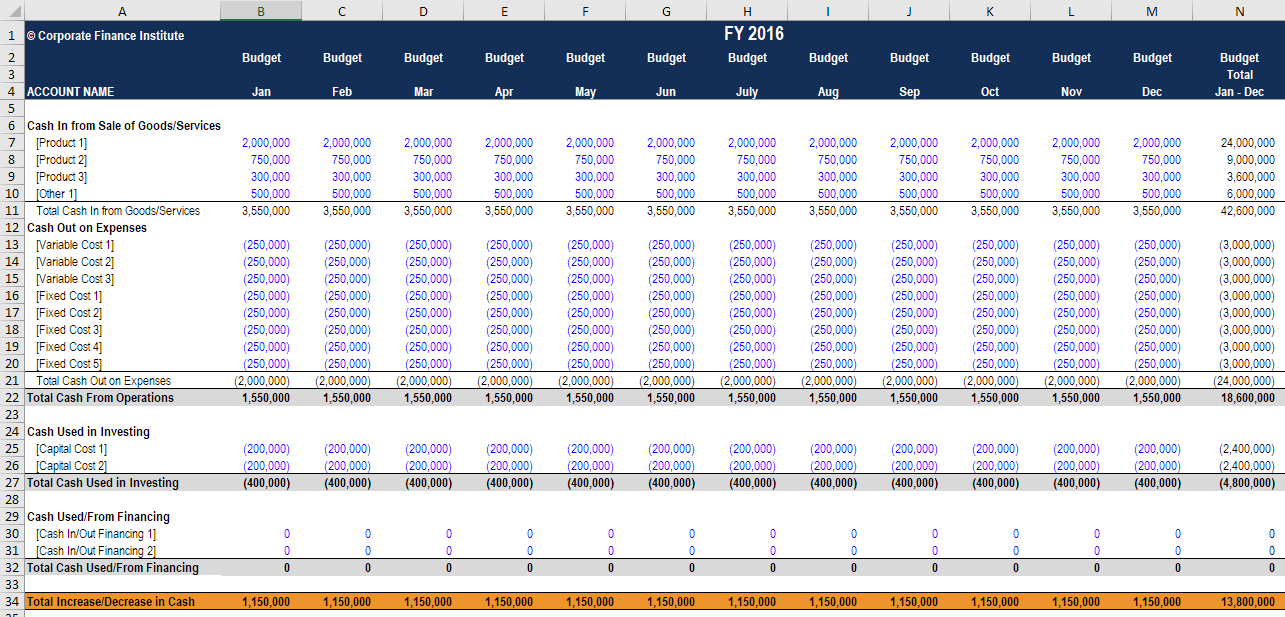

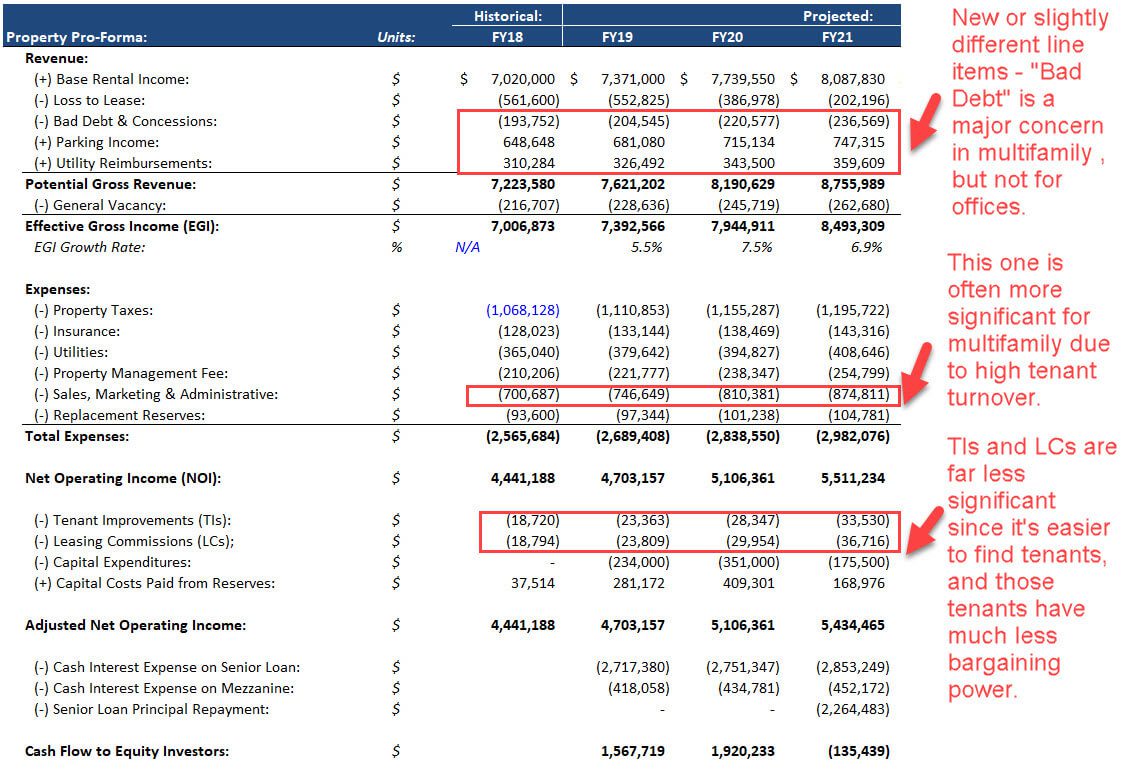

Pro forma cash budget example. Pro forma cash flow statements help companies project their cash inflows and outflows over specified. Pro forma budgets are prepared by almost all business organizations and companies to guess the incomes and expenditures for a coming particular period of time. For example, if a company usually collects 80 percent of its invoices within 30 days and economic conditions are worsening, it should use a lower collection ratio for its cash flow.

How to read financial statements (with types and guides) discover what a pro forma cash flow is and the methods of forecasting cash flows, identify the types of. Based on your pro forma annual income statement, next year’s income will be. A pro forma budget is a projected budget based on “what if” scenarios.

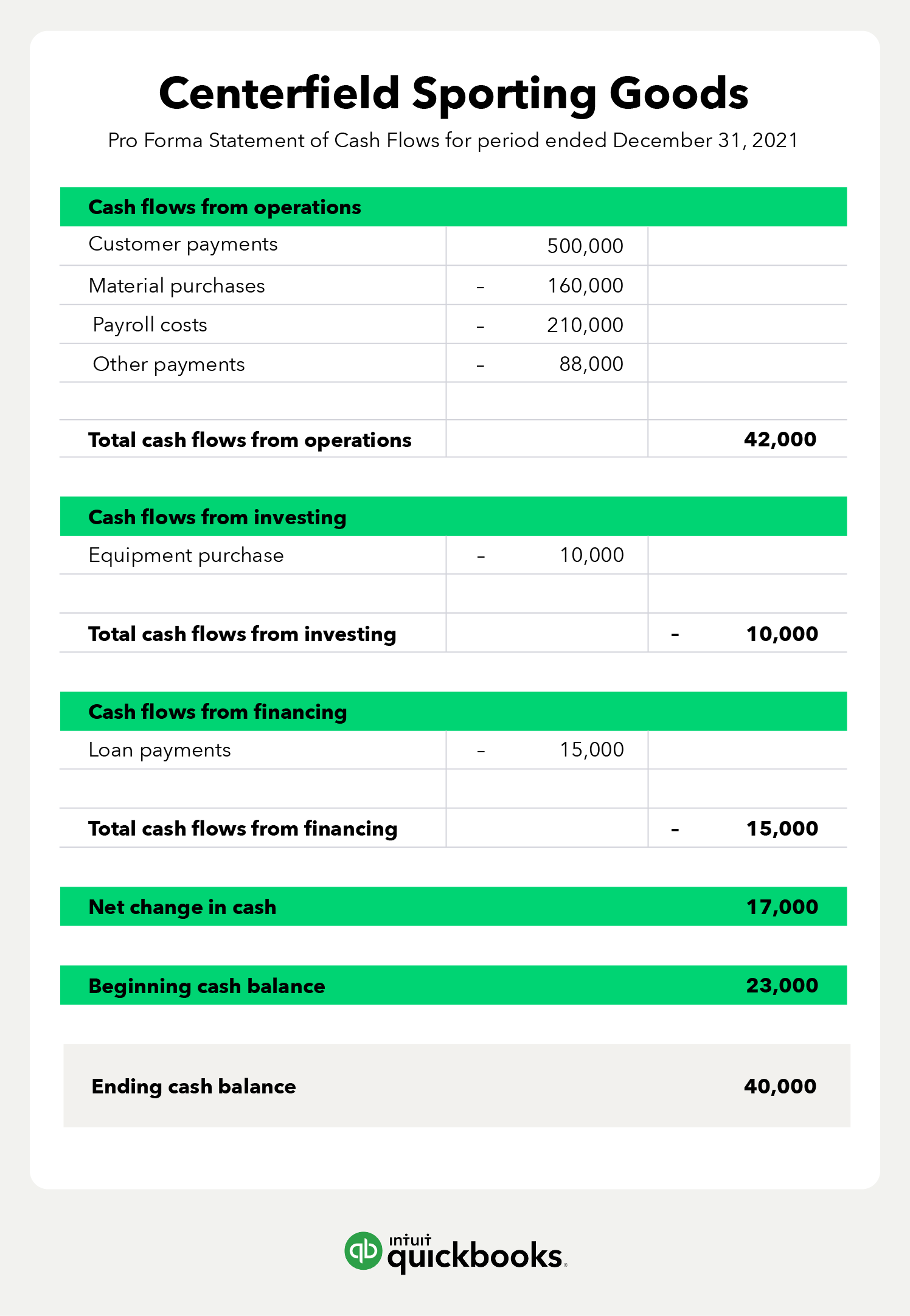

A cash budget is an estimation of the cash inflows and outflows for a business over a specific period of time, and this budget is used to assess. Pro forma cash flow is the estimated amount of cash inflows and outflows expected in one or more future periods. This information may be developed as part of the.

For example, let’s say your business has an income this year of $100,000. Companies use pro forma financial statements to provide forecasts and financial projections, and they can be an integral part of business planning for budgets. Cash budget explained purpose how to prepare?

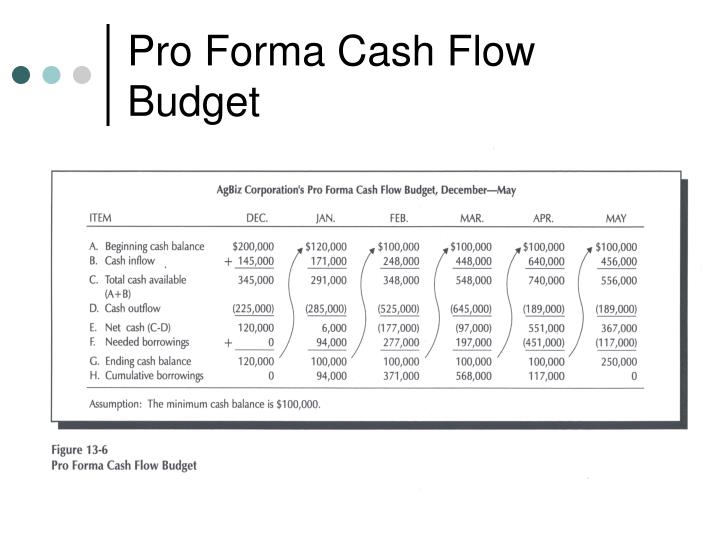

Your budget may be based on the financial information of your pro forma statements—after all, it makes sense to make plans based on your predictions. It includes only cash expenses and provides an indication of when. Company a maintains a minimum cash balance of $5,000.

Your income this year is $37,000. Suzanne kvilhaug what is pro forma? Maybe your company is considering changes to its operating structure.

Pro forma means “for the sake of form” or “as a matter of form. when it appears in financial statements, it indicates that a. Indeed editorial team. Accounting pro forma is actually a latin term meaning for form (or today we might say for the.

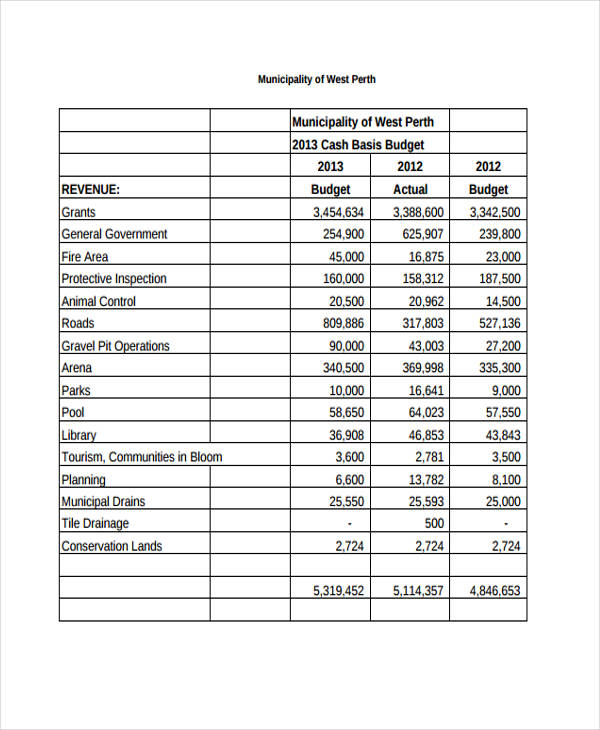

What may happen if a business receives a $150,000 loan? A cash flow budget shows cash receipts and cash expenses by month (table 4). By adding the net change figure to the starting cash figure, you will have the starting cash figure for the next month or time period for which you are calculating a cash flow.

Examples format importance recommended articles cash budget explained. Table of contents what is cash budget? According to your pro forma annual income statement, your financial.

In case of a deficiency, loan is obtained at.