Simple Tips About Investing Activities Accounting

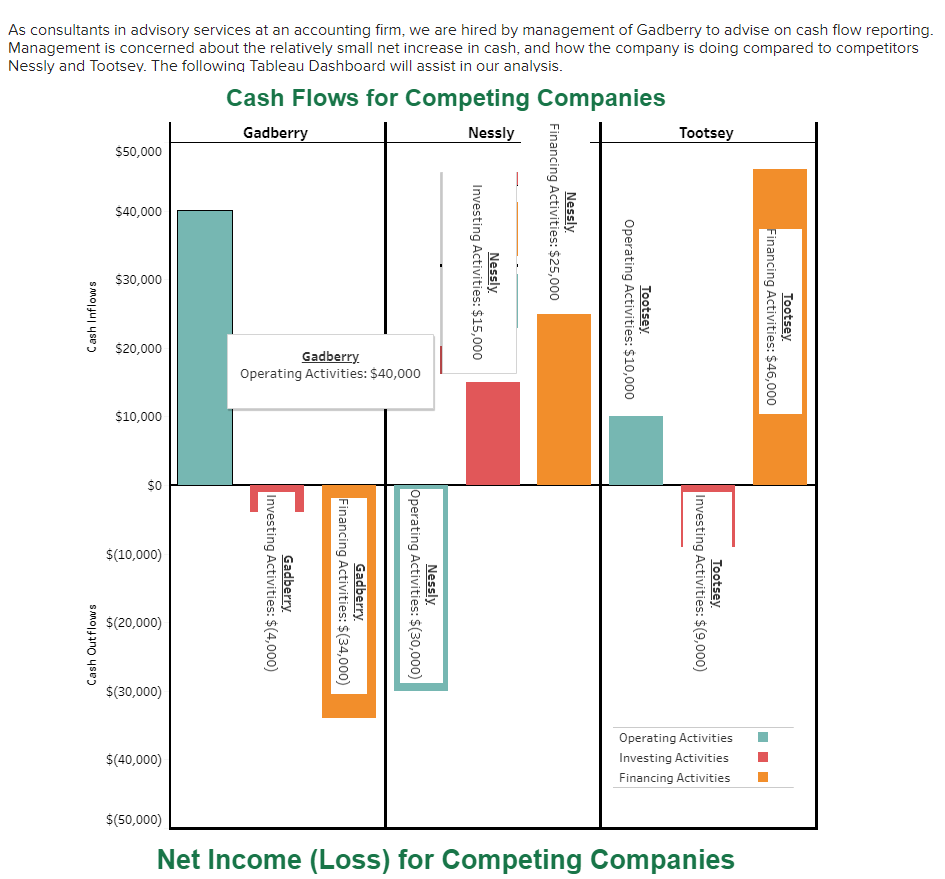

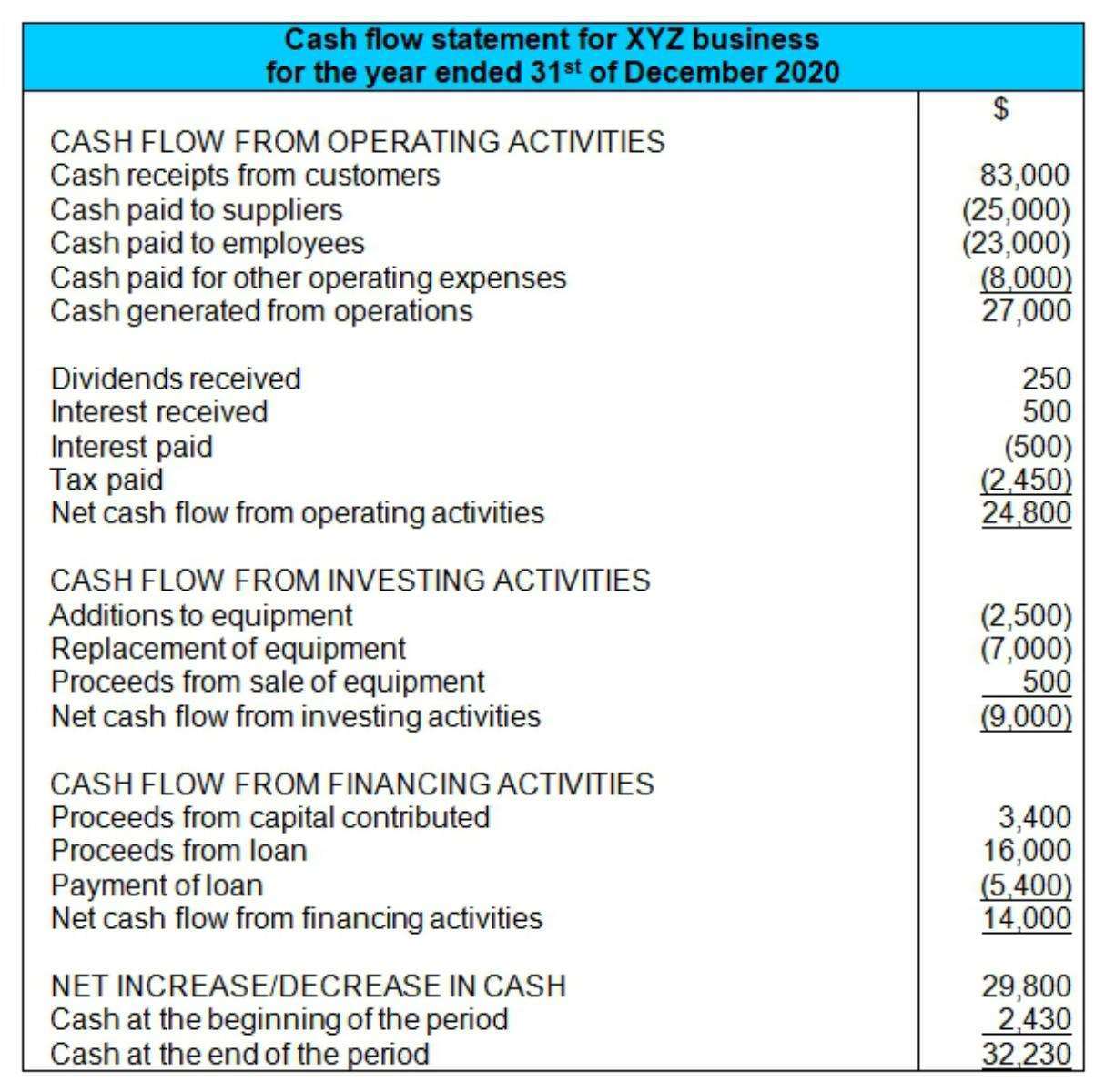

Investing activities show some of the common accounting transactions in the statement of cash flow of the business;

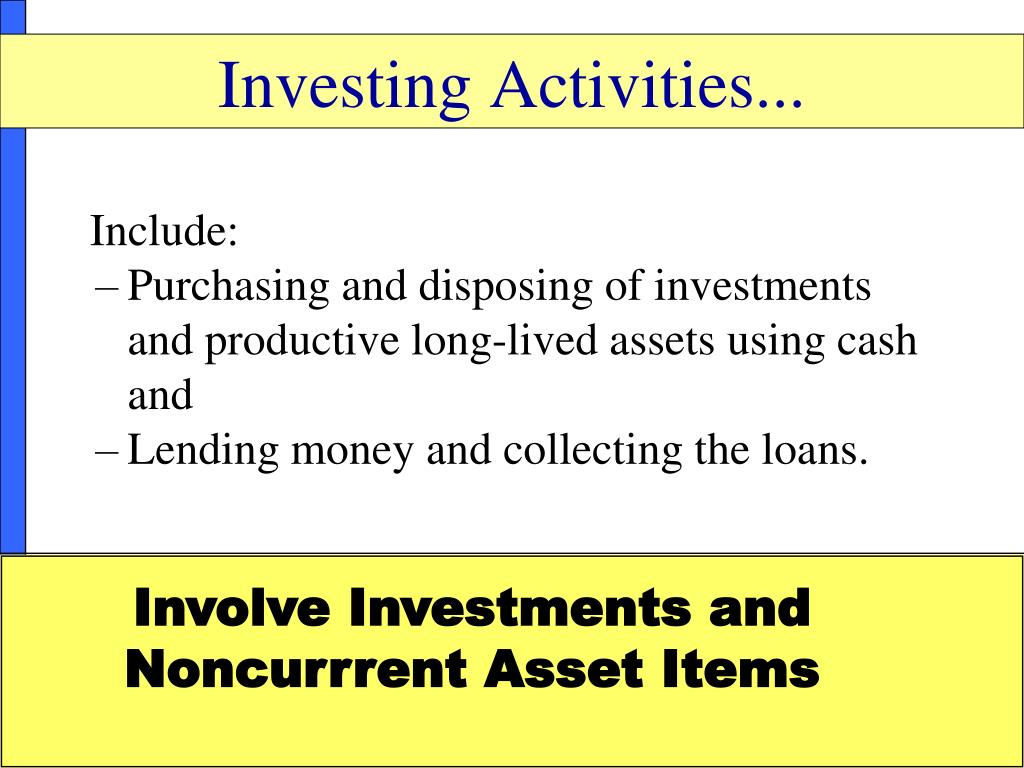

Investing activities accounting. The second section of the cash flow statement involves investing activities. Investing activities in accounting. Investing activities and financing activities are two key categories in a company’s cash flow statement, representing distinct aspects of its financial operations.

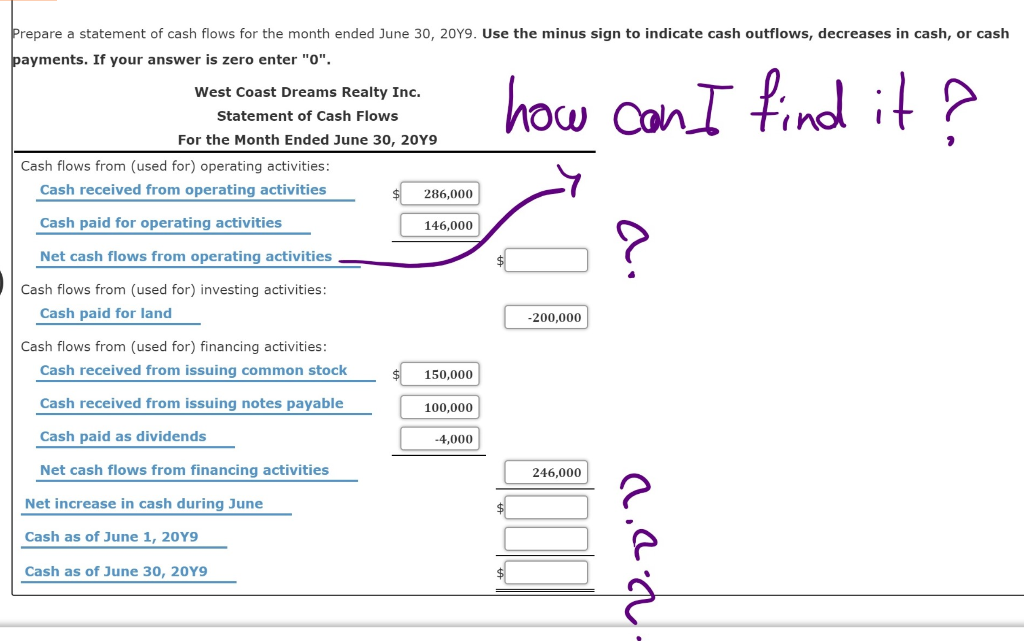

1.2 identify users of accounting information and how they. 1.1 explain the importance of accounting and distinguish between financial and managerial accounting; The formula for calculating the cash from investing section is as.

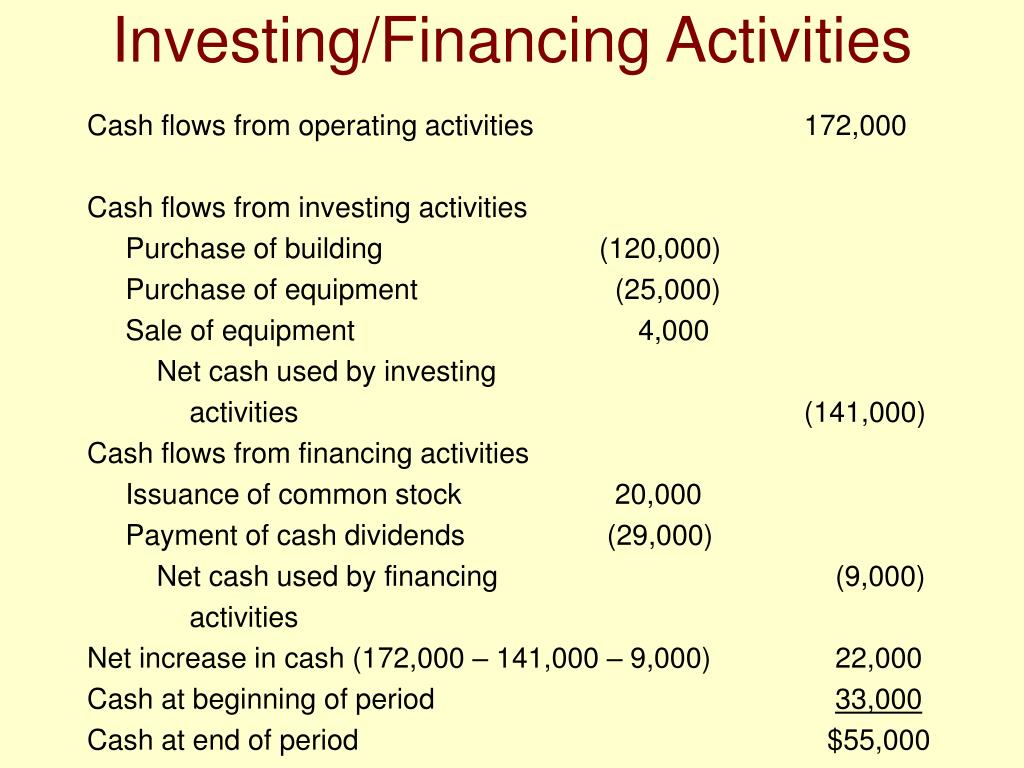

The cash flow statement reports the amount. Cash flows from investing activities is a line item in the statement of cash flows, which is one of the documents comprising a company's financial statements. Accordingly, you will see an investing activities section in the cash flow financial.

Capital expenditures such as property, plant and equipment. Definition investing activity is an investment of funds in the production of products (performance of work, provision of services) or their other use to generate profit. So far, we’ve outlined the common line items in the cash from investing activities section.

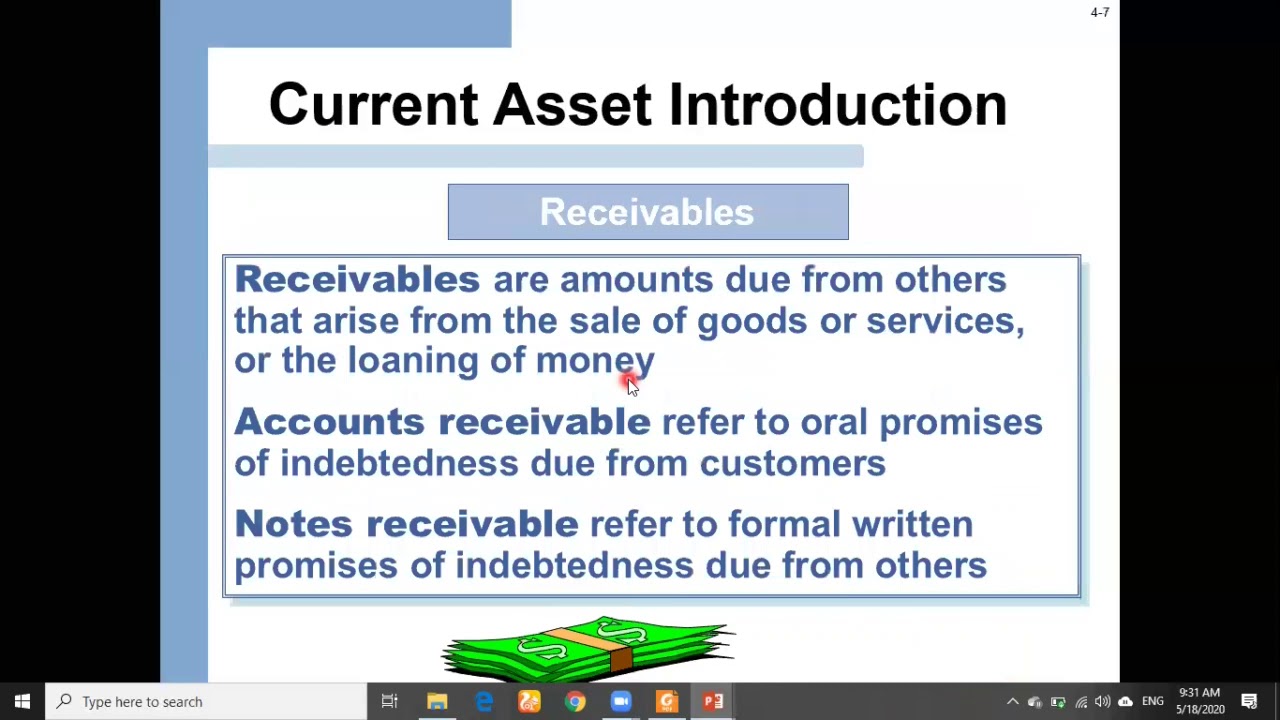

In this section of the cash flow statement, there can be a wide range of items listed and included, so it’s important to know how investing activities are handled in accounting. This strategic financial practice enables individuals and organizations to deploy. Investing activities refer to two major kinds of net cash activities that appear in a company's investing section on its balance sheet:

Purchase of property plant, and. The three net cash amounts from the operating, investing, and financing activities are combined into the amount often described as net increase (or decrease) in cash during. Identify cash flows that result from investing activities.

To determine cash flows from investing activities, the accountant must analyze the changes that have taken place in each nonoperational asset such as buildings and. Investing activities involve the allocation of funds to generate returns over time.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/terms_c_cash-flow-from-operating-activities_FINAL-e4025a9df8de40059fc1b585394c4b8b.jpg)