Lessons I Learned From Info About Direct Cash Flow And Indirect

Instead, the direct method is more clear in how it’s calculated and can give you a better idea of your current cash standing.

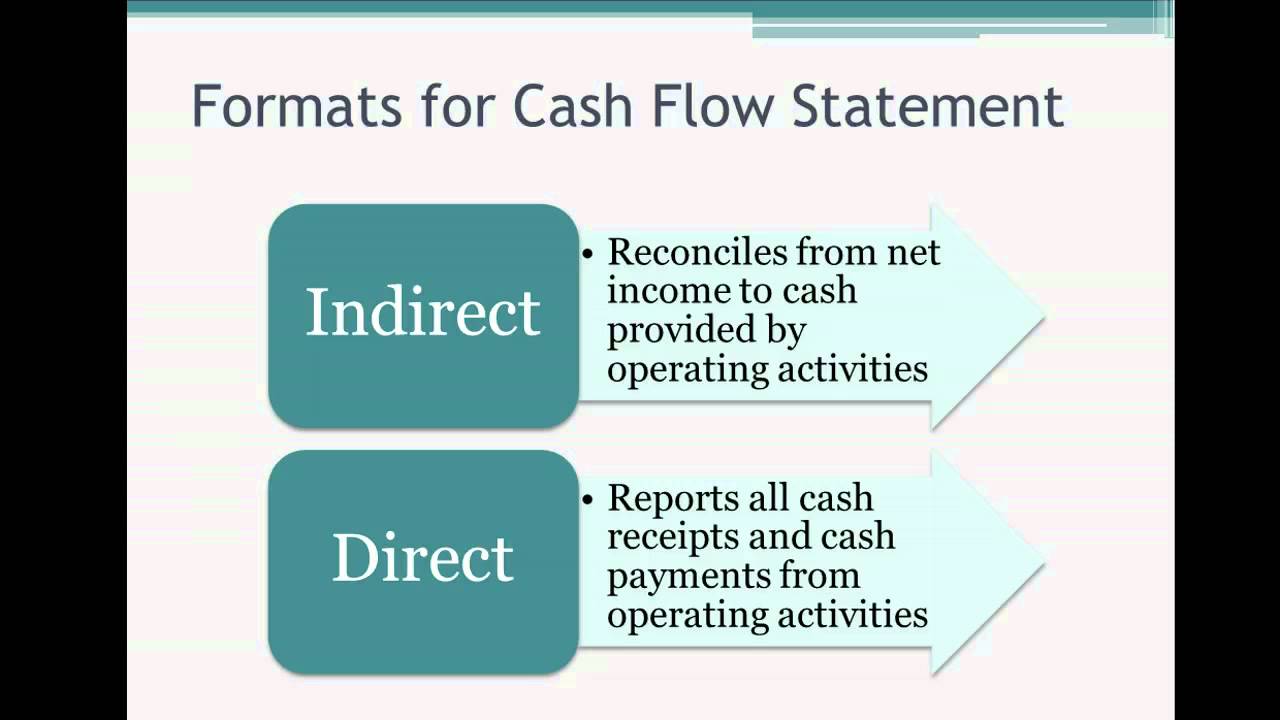

Direct cash flow and indirect cash flow. The difference between these methods lies in the presentation of information within the cash flows from operating activities section of the statement. The direct method and the indirect method are alternative ways to present information in an organization’s statement of cash flows. When it comes to cash flows from operations, the standards allow us to choose between two distinct approaches.

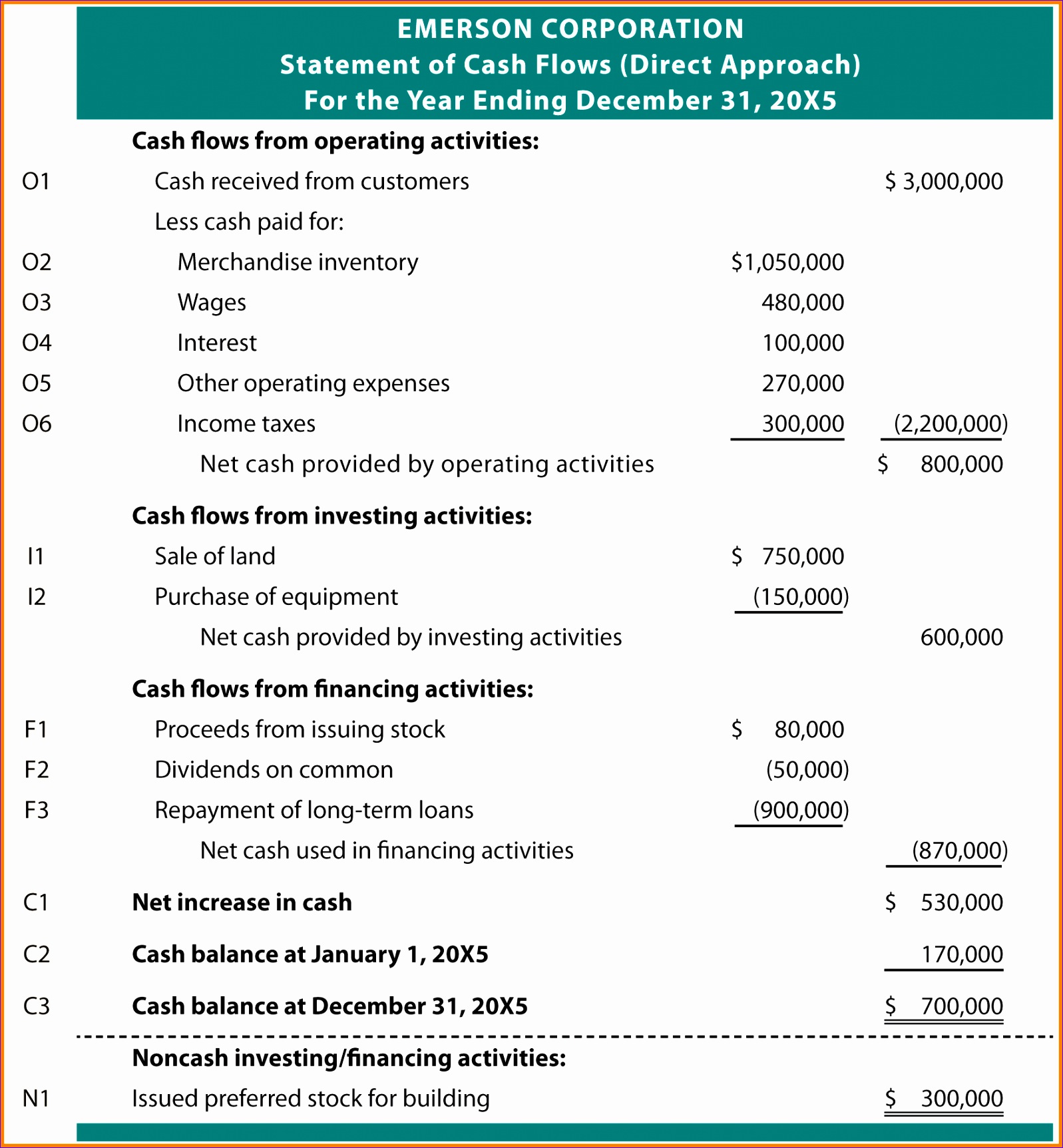

When using the direct method to calculate cash flow from operating, investing and financing activities, your statement may look something like this: Indirect cash flow method is the type of transactions used to produce a cash flow statement. Comparing the direct and indirect cash flow methods.

What is indirect cash flow? What is direct cash flow? For instance, assume that sales are stated at $100,000 on an accrual basis.

The main difference between the direct method and the indirect method of presenting the statement of cash flows (scf) involves the cash flows from operating activities. For example, if a retailer sells an item on credit, the indirect method will. Cash flows arise from the operating, investing, and financing activities of a company.

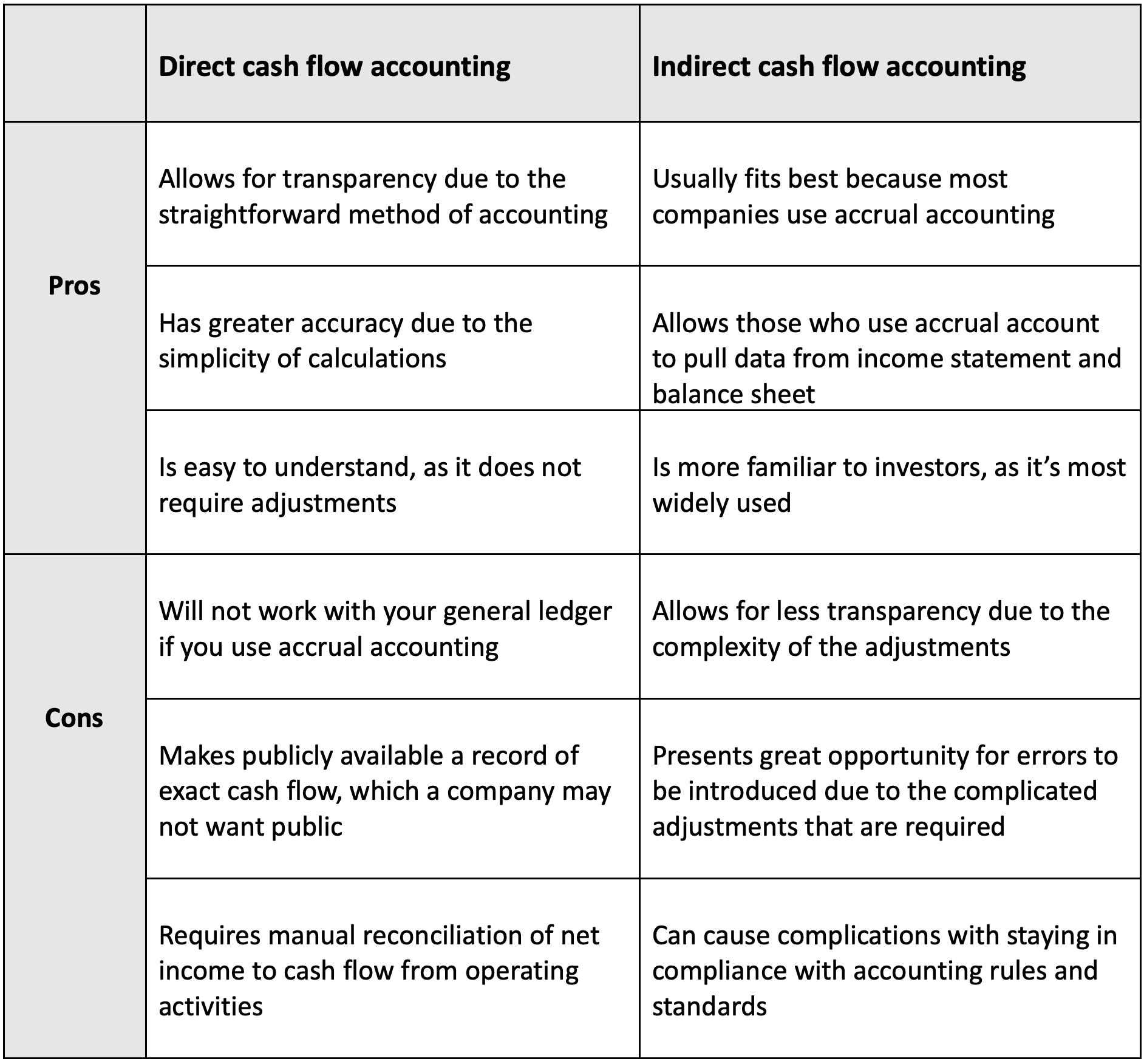

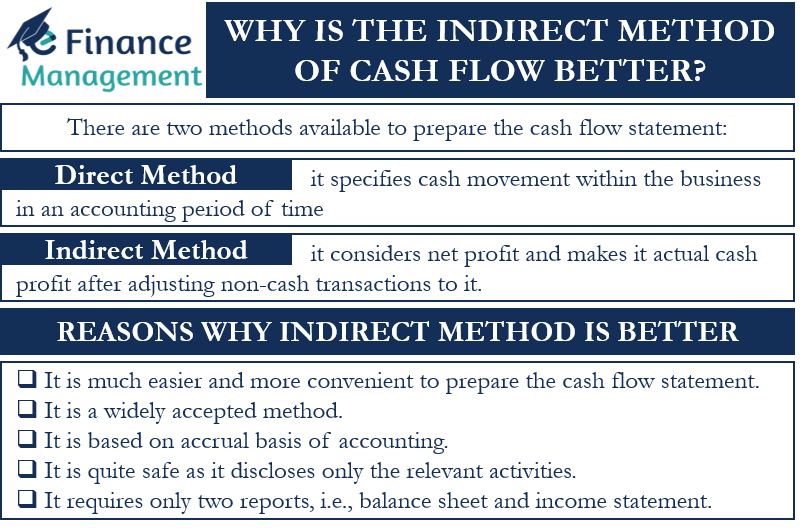

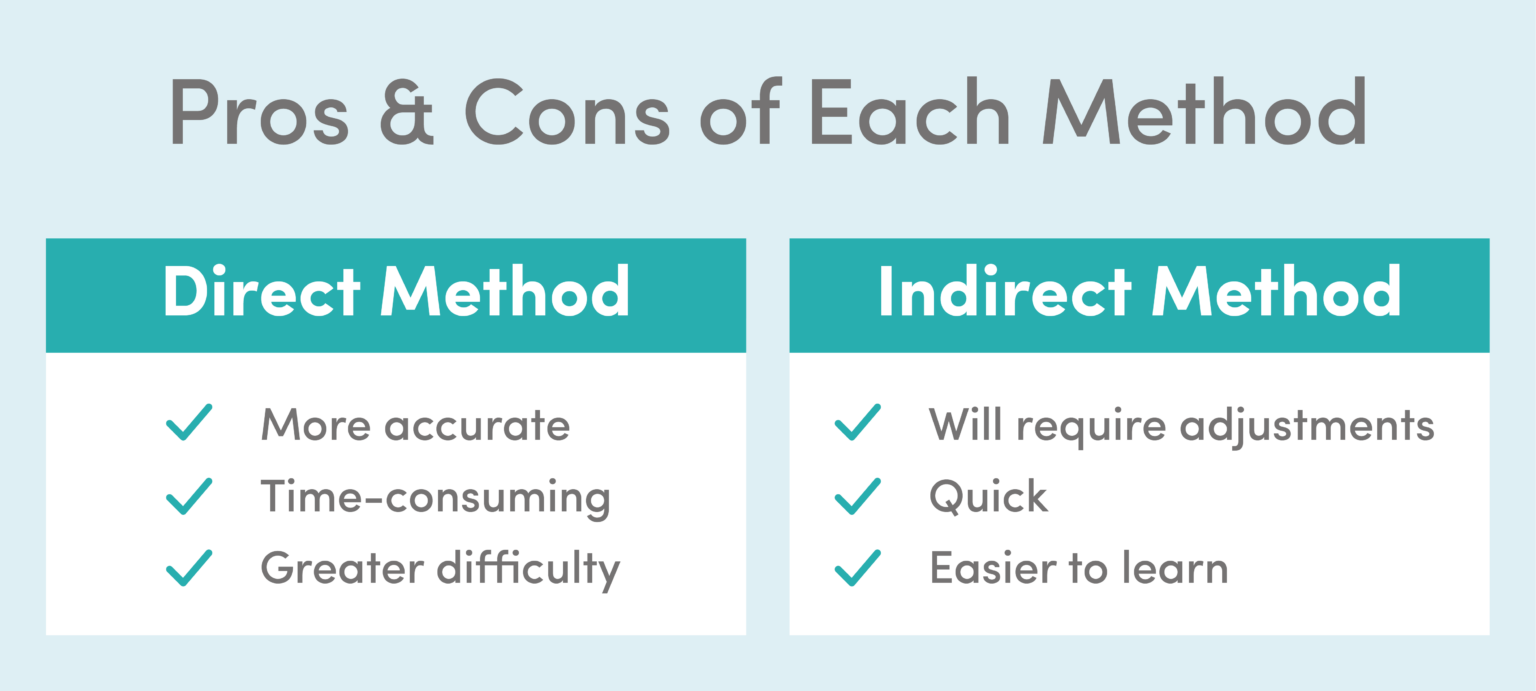

The statement of cash flows direct method uses actual cash inflows and outflows from the. Components of the indirect cash flow method pros and cons of the indirect method 4. The indirect method focuses on net income and may include cash that is not yet in the business.

Relevance of indirect and direct methods to different business stakeholders 5. One of the key differences between direct cash flow vs. The indirect method uses net income as the base and converts the income into the cash flow through adjustments.

The american institute of certified public accountants reports that approximately 98% of all companies choose the indirect method of cash flows. The direct method is one of two accounting treatments used to generate a cash flow statement. They are commonly known as direct and indirect methods.

Direct method cash flow components pros and cons of the direct method 3.