Best Tips About Net Income Before Extraordinary Items

Gain on sale of subsidiary over book value:.

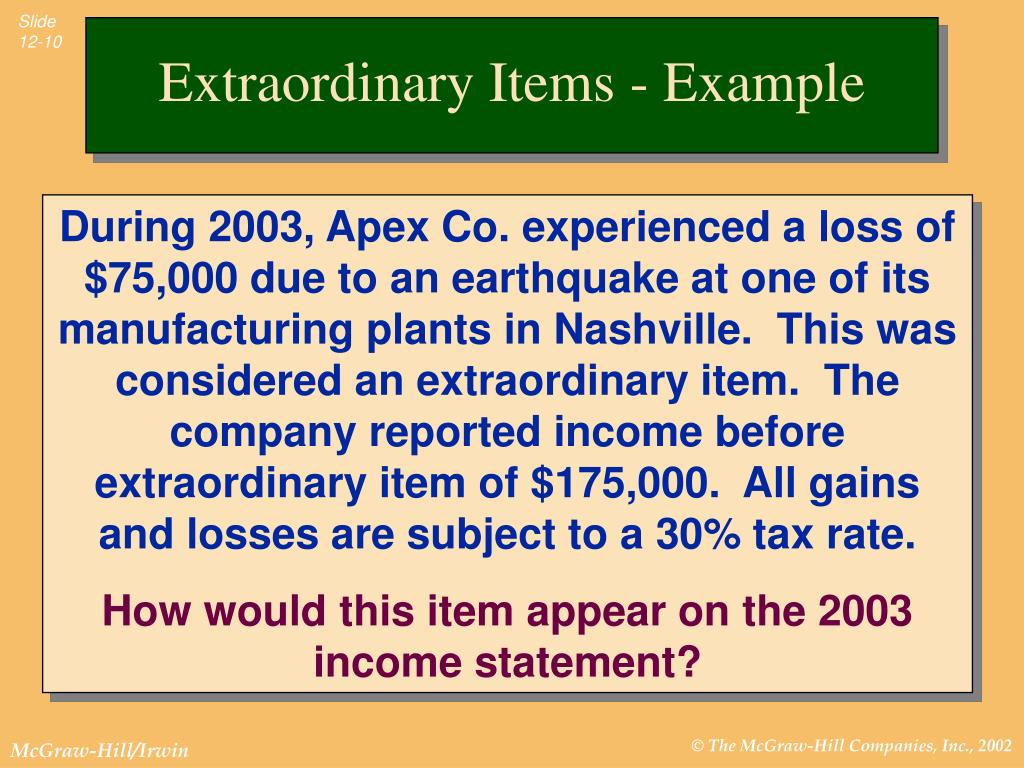

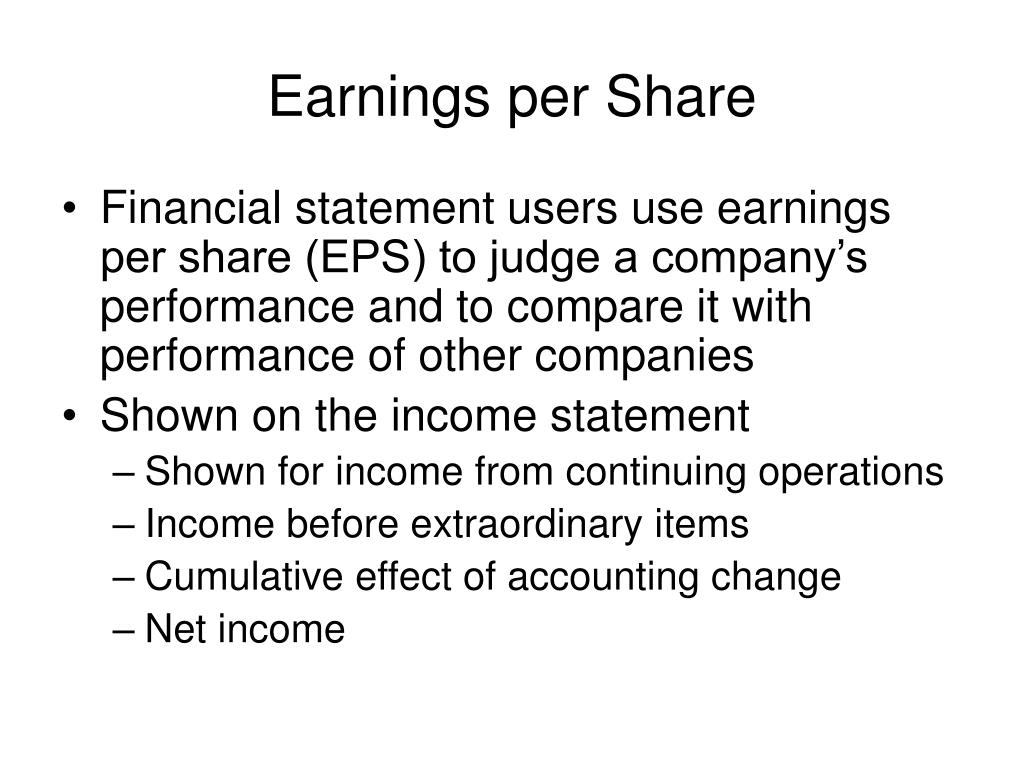

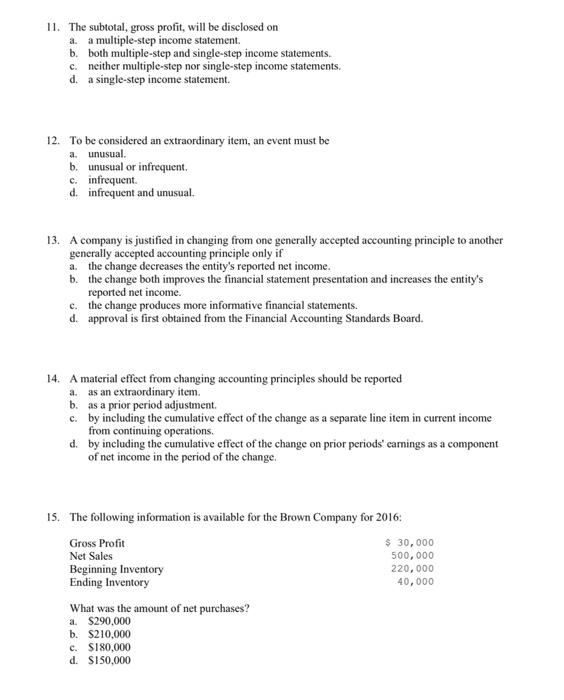

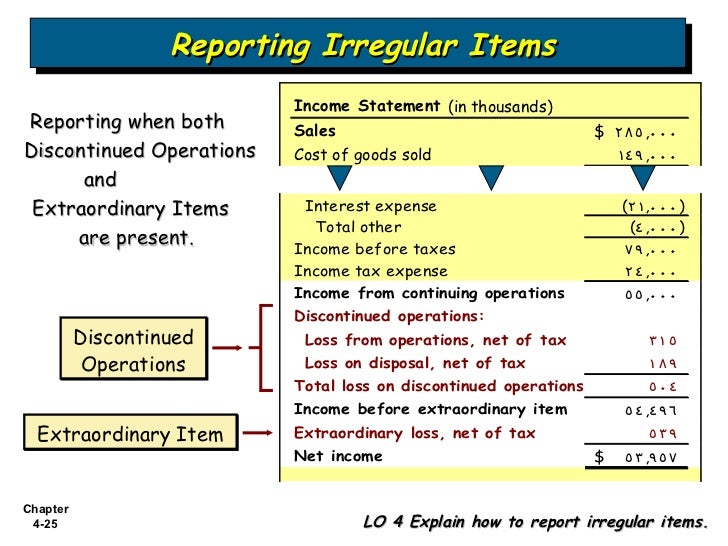

Net income before extraordinary items. Identified, should extraordinary gains and losses be reported as a component of net income in the income statement or directly in stockholders' equity in the balance sheet,. Table 2 panel a provides summary statistics for the five variables. An extraordinary item is an accounting term that refers to an abnormal gain or loss that is not generated from the ordinary business operations of a company, is infrequent in.

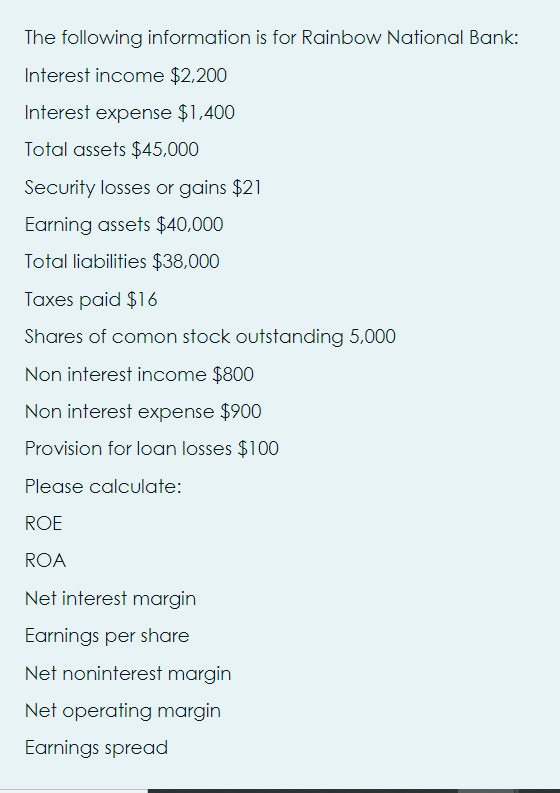

Net profit before extraordinaries. For instance, nonrecurring items are recorded under operating expenses in the net income statement. It provides a snapshot of a firm’s.

Confirm powered by learn about the income before extraordinary items and discontinued operations with the definition and formula explained in detail. Extraordinary items were usually explained further in the notes to the financial statements. Examples of net income before extraordinary items in a sentence notwithstanding the foregoing, the quarterly payments shall be made only out of, and not to exceed ten.

Net profit before extraordinaries is the residual income of a firm after taking total revenue and subtracting all ordinary expenses for the. Extraordinary items consisted of gains or losses from events that were unusual and infrequent in nature that were separately classified, presented and disclosed on companies' financial statements. The objective of the paper is to identify income smoothing by the four income concepts:

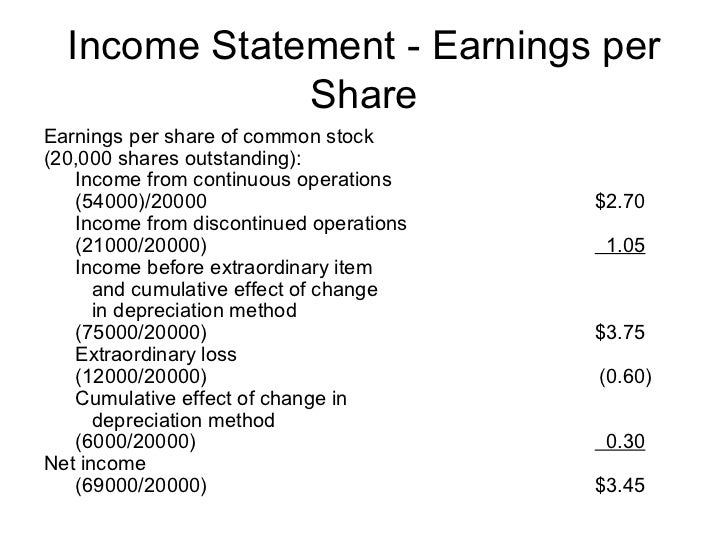

Income before extraordinary item and the cumulative effect of a change in accounting principle: Extraordinary items definition january 13, 2024 what are extraordinary items? Table a1, panel a provides alternate definitions of earnings, cash flows, and accruals computed using the following compustat variables:

The third is income before extraordinary items, which is equal to ordinary revenues less ordinary expenses. Operating income, income from operations, income before extraordinary. Calculate the income tax expense for the company using the company's current federal and state tax bracket.

Hasil penelitian menunjukkan bahwa 58 (38,41%) perusahaan diidentifikasi sebagai pelaku perata laba dengan operating income dan 69 (45,70%) perusahaan diidentifikasi. Net income before extraordinary items net income before extraordinary items represents net income before being adjusted by extraordinary items, such as:. So, if income before taxes is $120,000 and the tax.

Net income before tax refers to a company’s total earnings or profit before tax deductions and other obligations are subtracted. An extraordinary item in accounting is an event or transaction that is considered. Net income excluding extraordinary items (mil) (fy) net income before extraordinary items represents net income before being adjusted by extraordinary items, such as.

By contrast, extraordinary items are most commonly listed.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)