Ideal Tips About Interest Receivable Balance Sheet

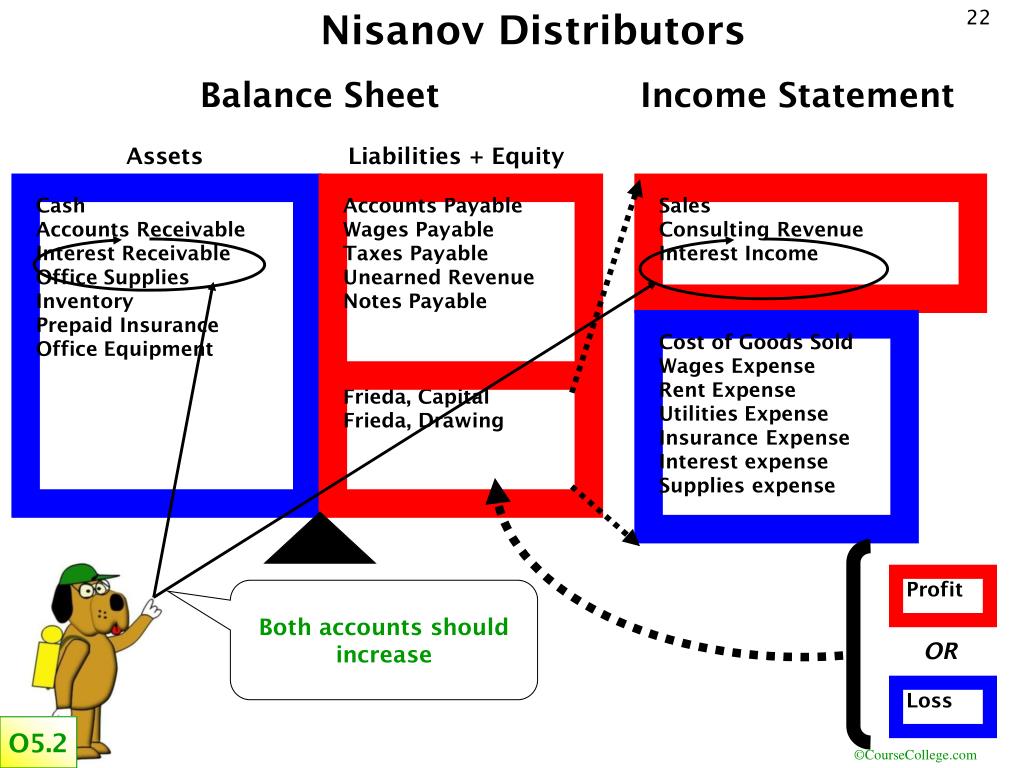

Interest receivable definition the current asset that represents the amount of interest revenue that was reported as earned, but has not yet been received.

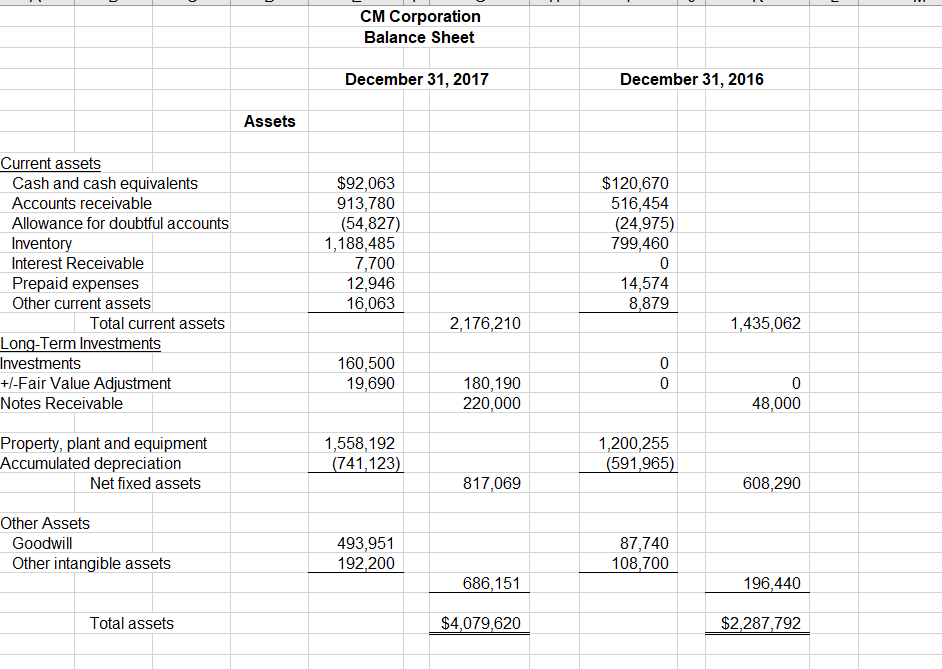

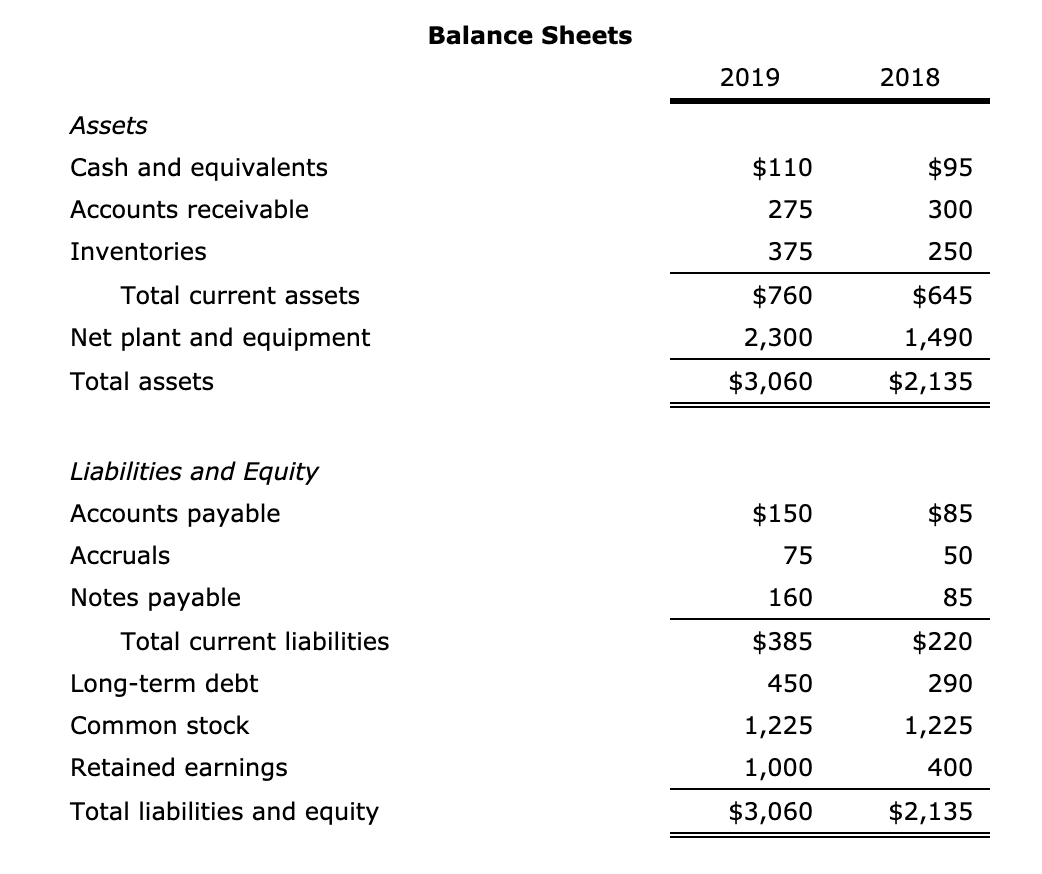

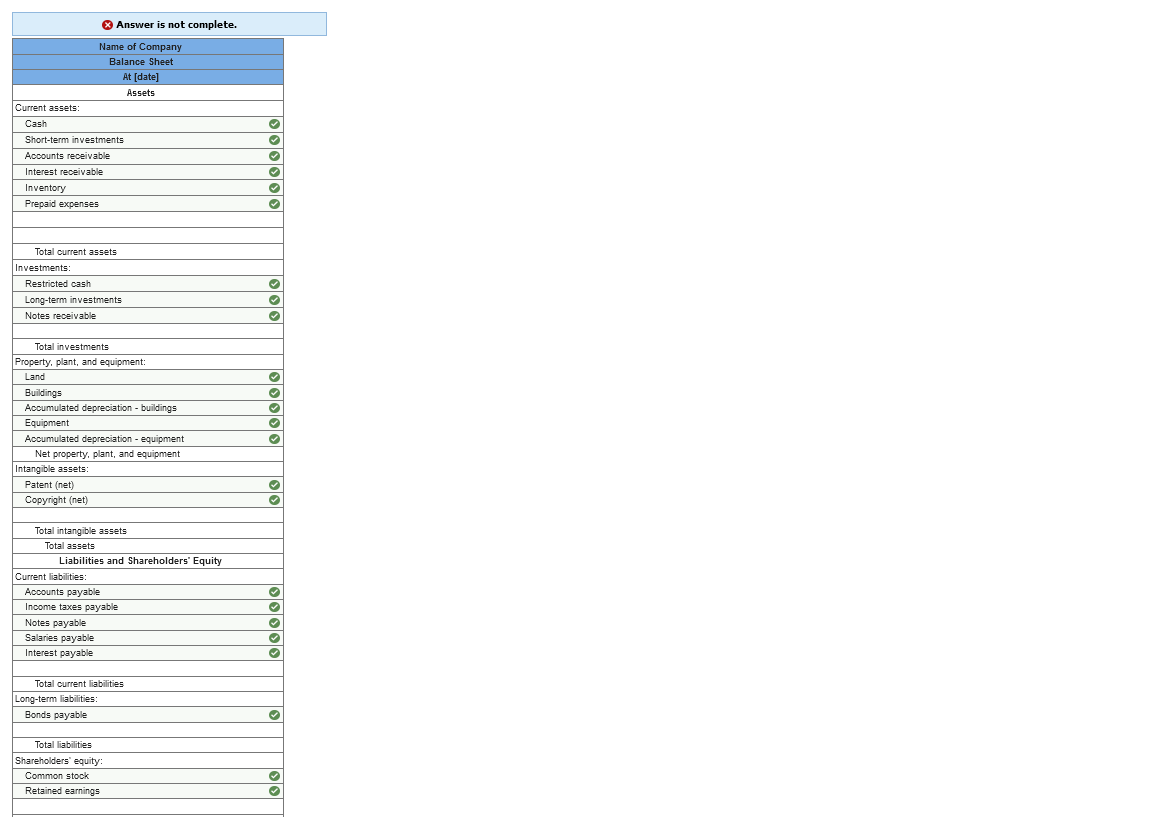

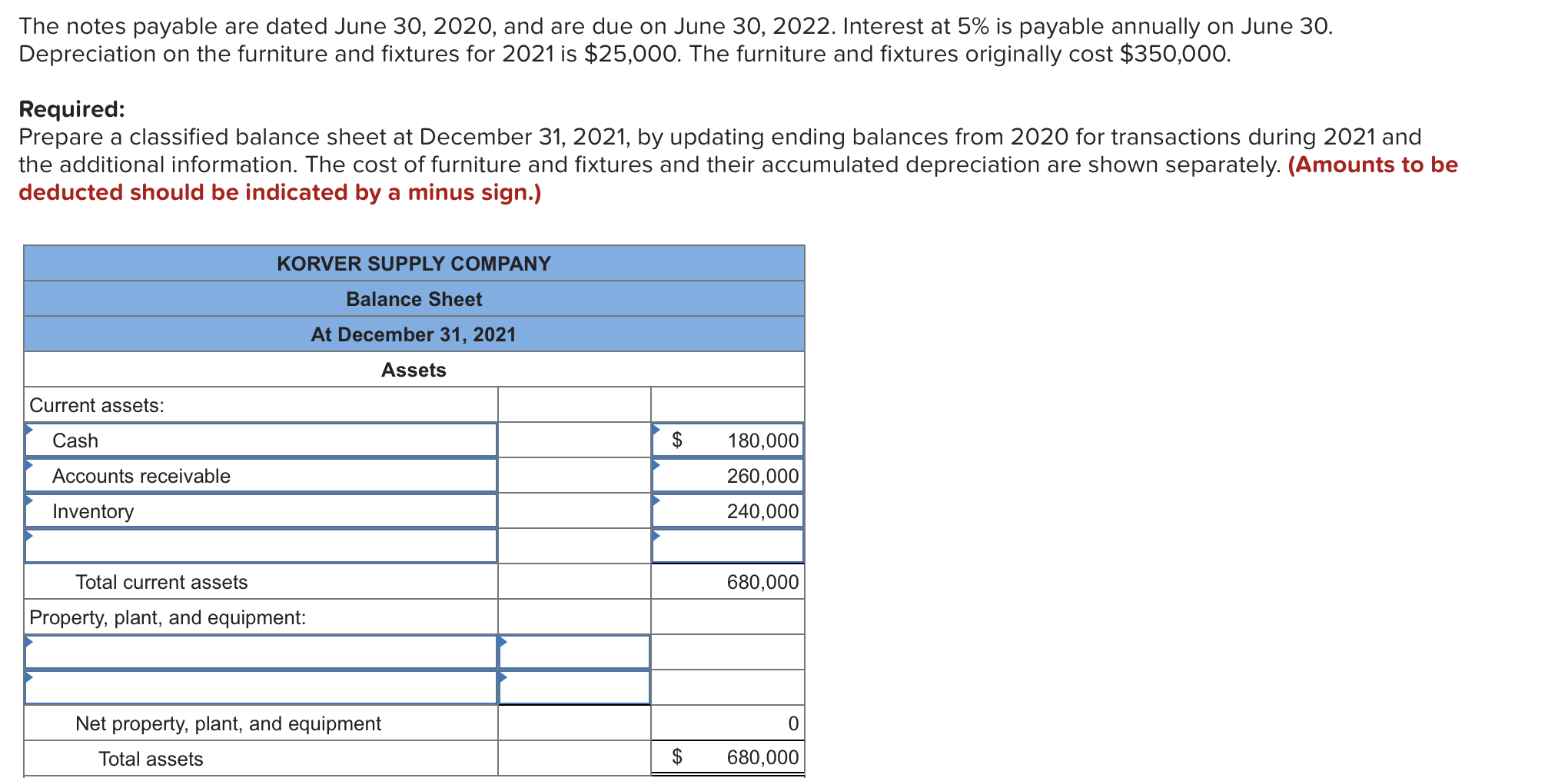

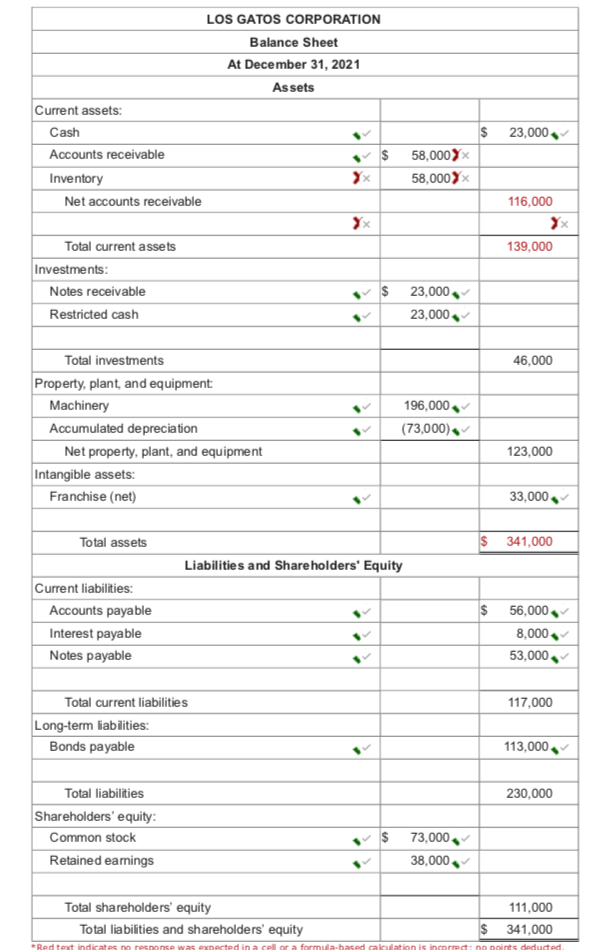

Interest receivable balance sheet. As long as it can be reasonably expected to be paid within a year, interest receivable is generally recorded as a current asset on the balance sheet. Accrued interest income that is to be reported on the income statement; As fixed assets age, they begin to lose their value.

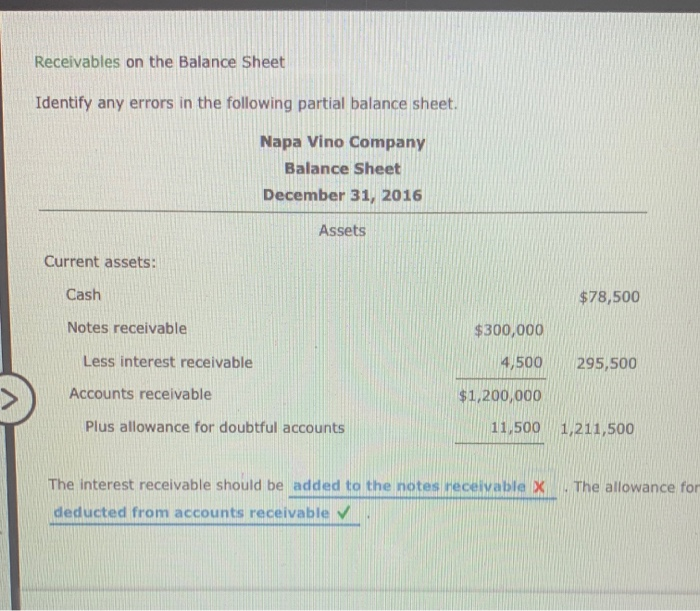

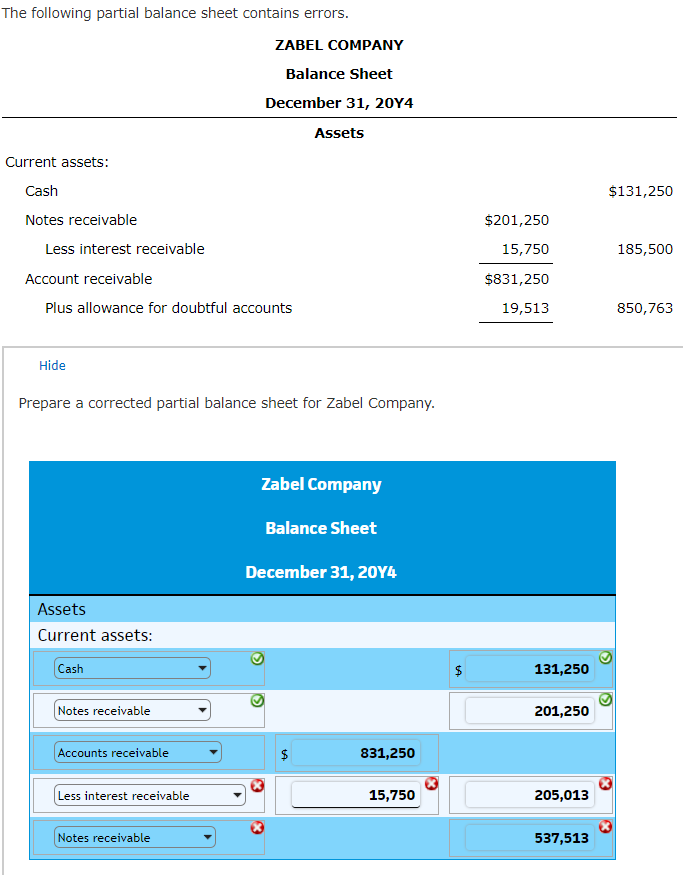

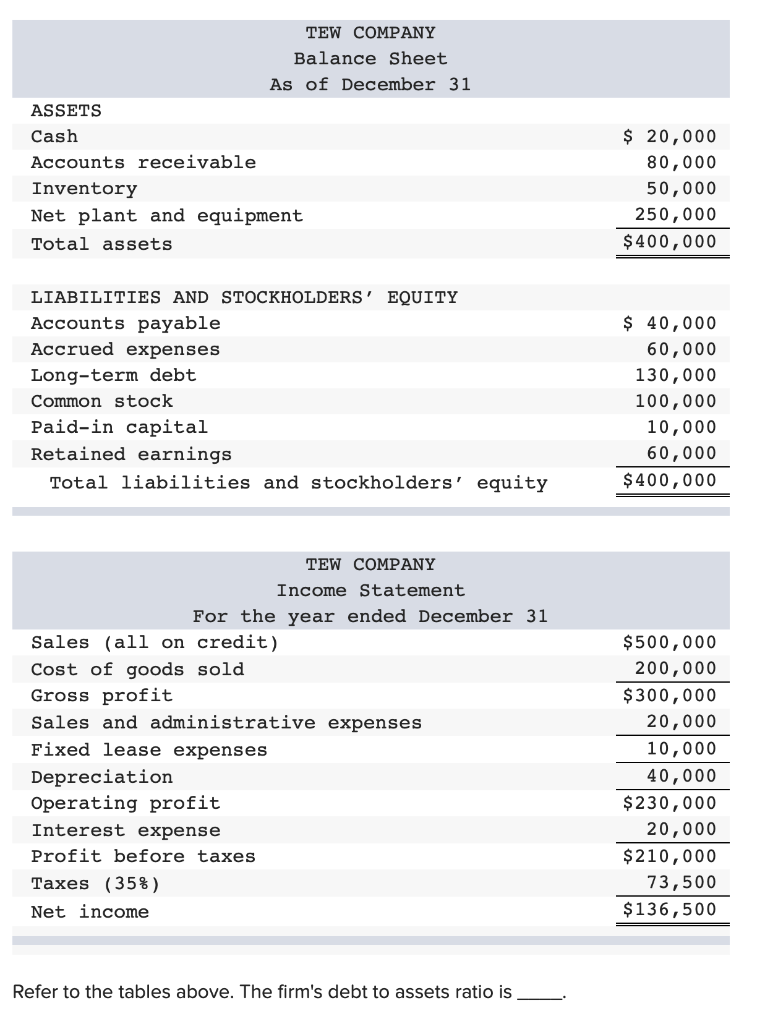

Interest receivable is a balance sheet account that reflects the interest income a business has earned but for which a customer or debtor has yet to pay, reports. It provides a snapshot of a company's finances (what it. Principal x interest x time =.

The interest receivable account is usually classified as a current asset on the balance sheet, unless there is no expectation to receive payment from the borrower within one year. Entities accumulate interest earned but not yet collected on financial assets as an accrued interest receivable. Interest receivable = principal amount * interest rate * number of months passed / 12 = 100,000 * 0.04 * 3/12

Receivables are listed as assets on the company's balance sheet and carry a debit balance on the general ledger. Record the amount of interest receivable in the “current assets” section of your balance sheet if the note receivable is an amount due within one year's time. Since the payment of accrued.

December 07, 2023 notes receivable definition a note receivable is a written promise to receive a specific amount of cash from another party on one or more future dates. In addition, the interest receivable is computed as follows: As long as it can be reasonably expected to be paid within a year, interest receivable is generally recorded as a current asset on the balance sheet.

The interest receivable account balance will be reported on the company's balance sheet as a current asset such as accrued interest receivable or interest receivable. A company (the asset originator) with receivables (e.g., auto loans, credit card debt), identifies the receivables (assets) it wants to sell and remove from its balance. What is the interest receivable on this note?

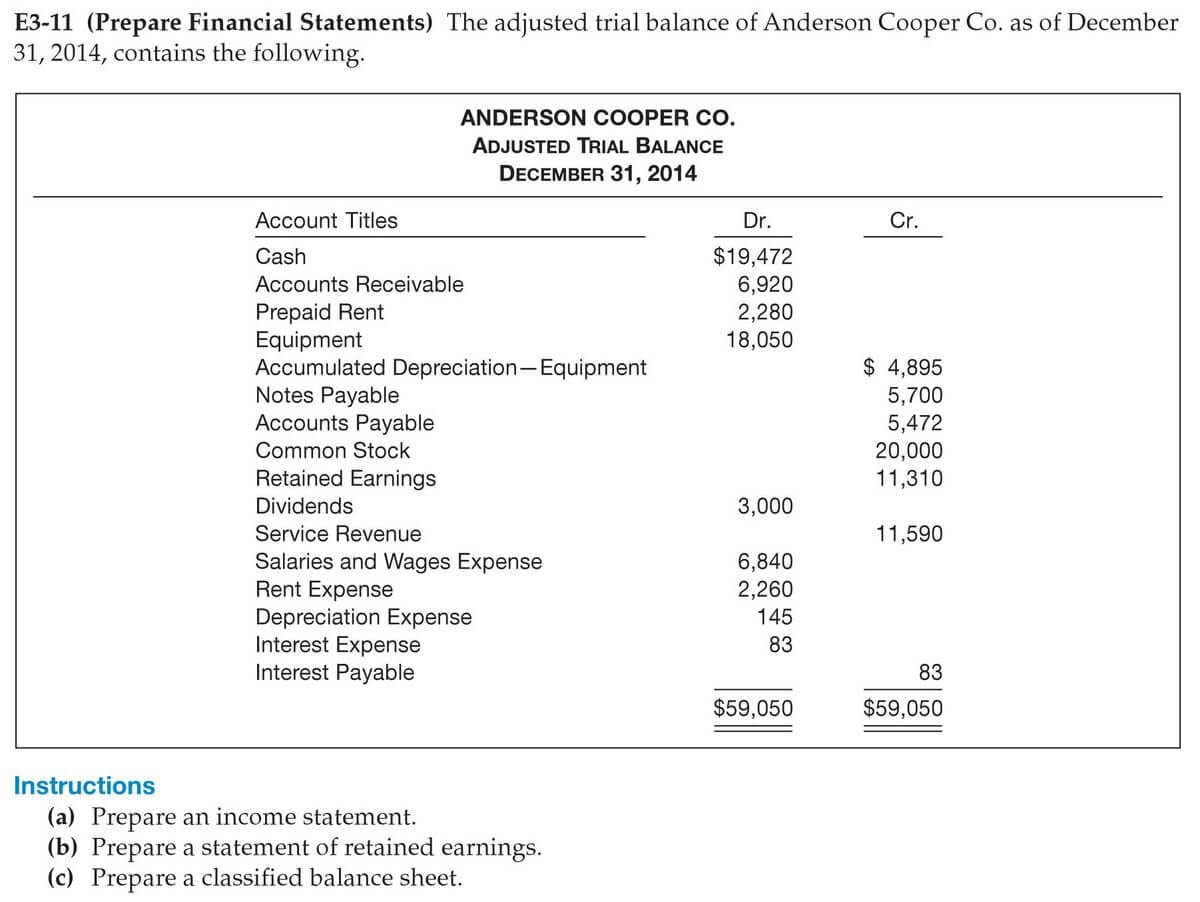

Between the interest payment dates, the company will have: To calculate the interest receivable on this note, the math would be as follows: The balance sheet is one of the three core financial statements that are used to evaluate a business.

So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. Accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. The interest receivable is an asset account on the balance sheet while the interest revenue is an income.

If a company has delivered products or. The entry consists of interest income or interest expense on the income statement, and a receivable or payable account on the balance sheet.