Exemplary Info About Profit On Income Statement

The income statement and profit and loss statement serve.

Profit on income statement. Nvda) today reported revenue for the fourth quarter ended january 28, 2024, of $22.1 billion, up 22% from the previous quarter and up 265% from a year ago. This contrasts with the balance sheet, which represents a single moment in time. An income statement represents a period of time (as does the cash flow statement ).

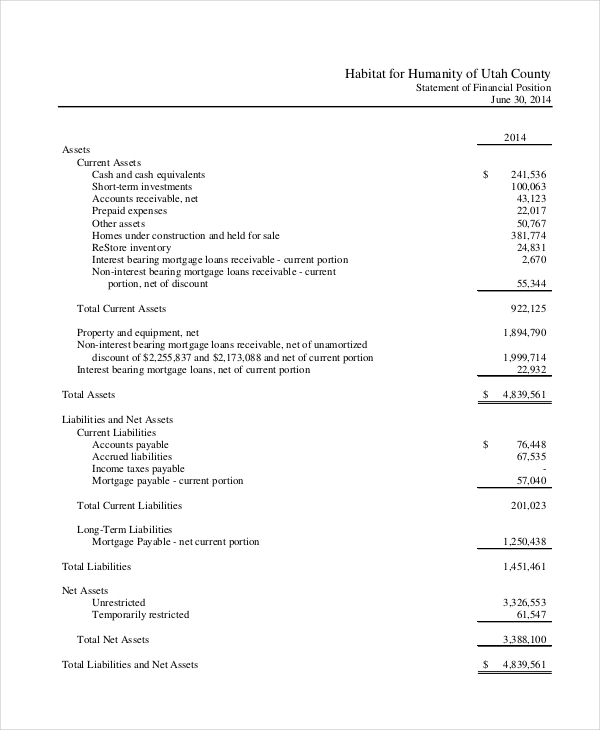

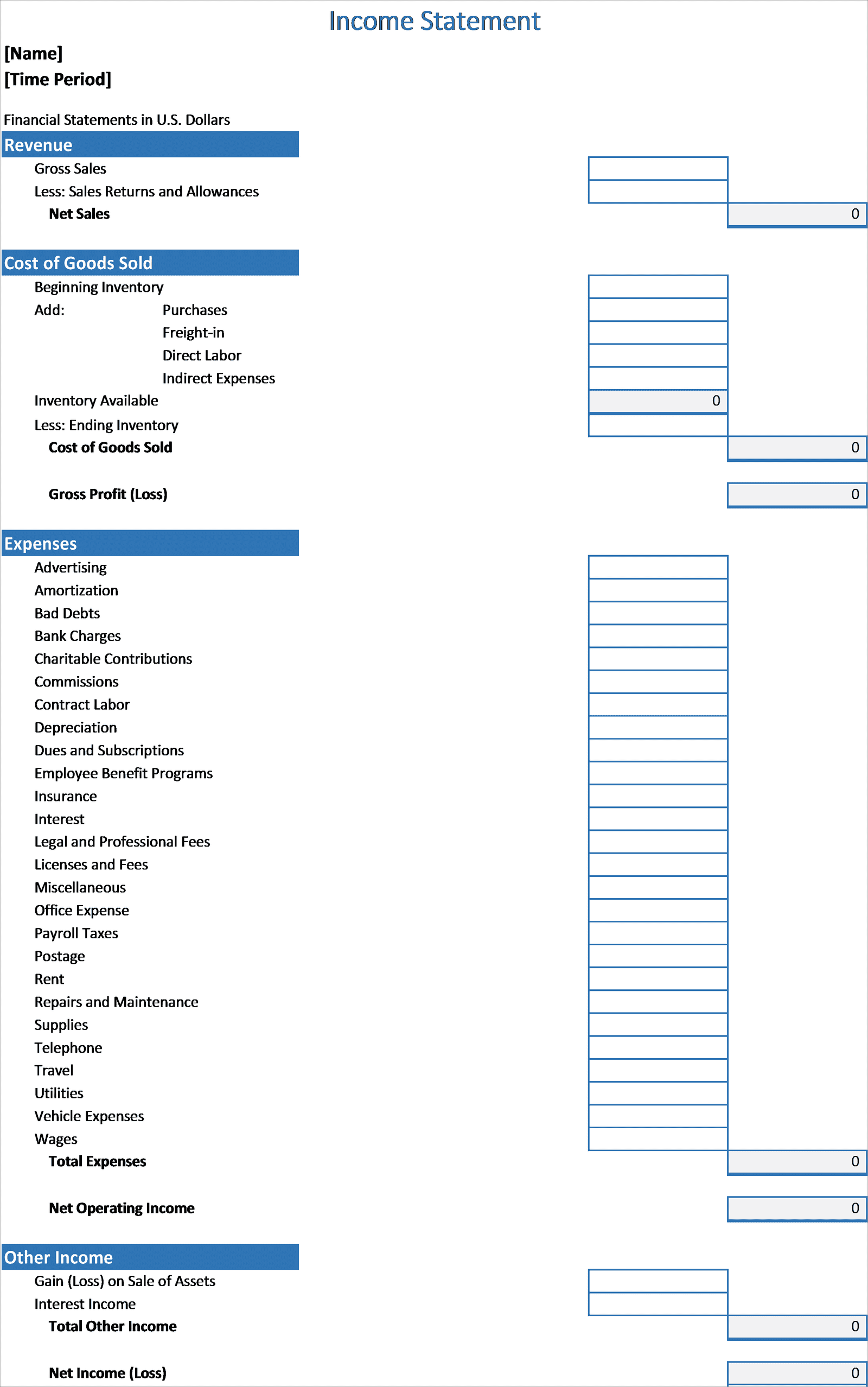

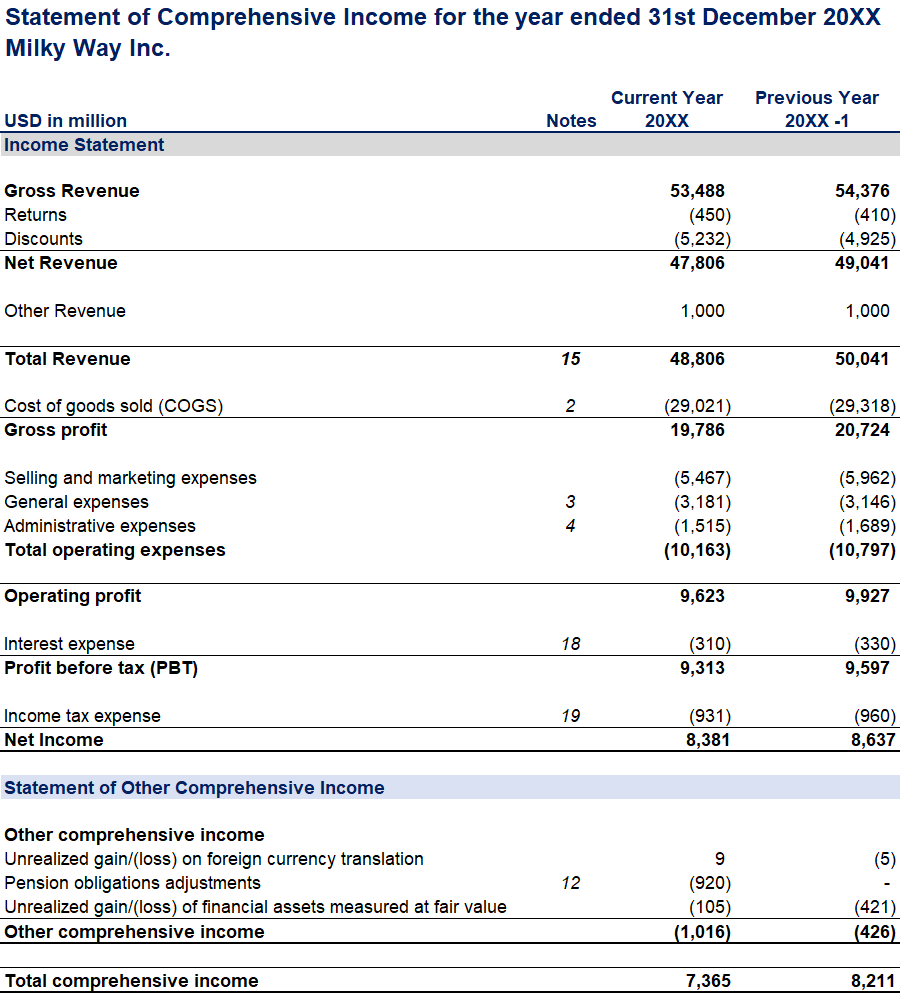

Unlike a balance sheet, which records assets, liabilities and. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. The net profit or net income is recorded as the last item on the business’s income.

Many key fundamental ratios use information from the income statement. It’s one of the most important financial statements for small business owners, so it’s key to understand what an income statement is, what its purpose is, and how to read one. You may also hear it referred to as a profit and loss statement or income and expense report.

An income statement is a financial document that shows your company’s income and expenses. But, the profit and loss statement summarizes the profit or loss for a given period. The purpose of the income statement is to show managers and investors whether the company made money (profit) or lost money (loss) during the period being reported.

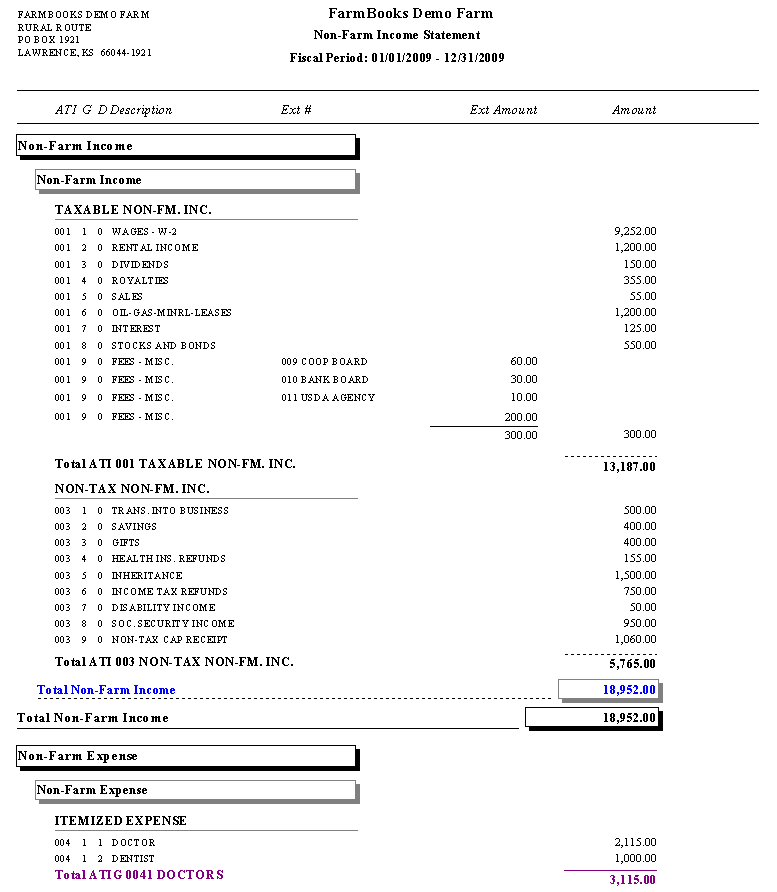

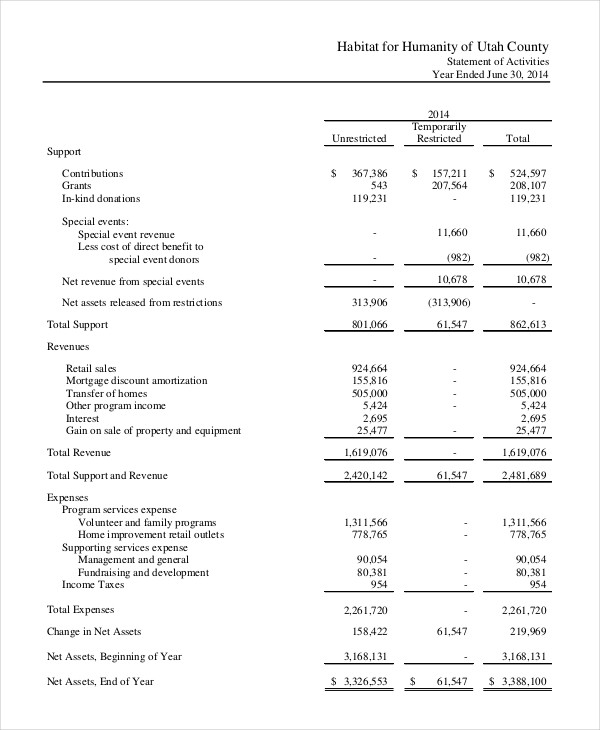

Income from operations of $652 million; Income statement with calculator and pen. What is a nonprofit statement of activities?

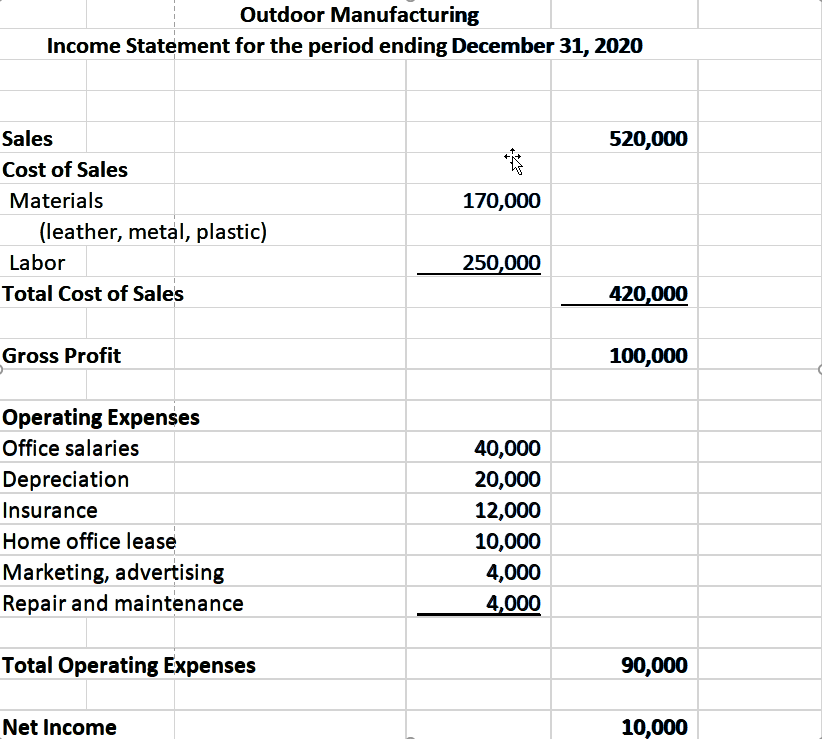

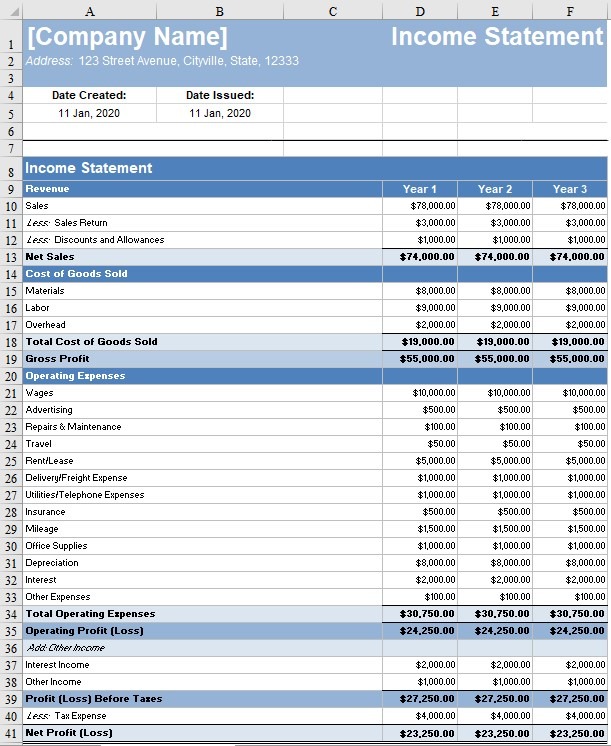

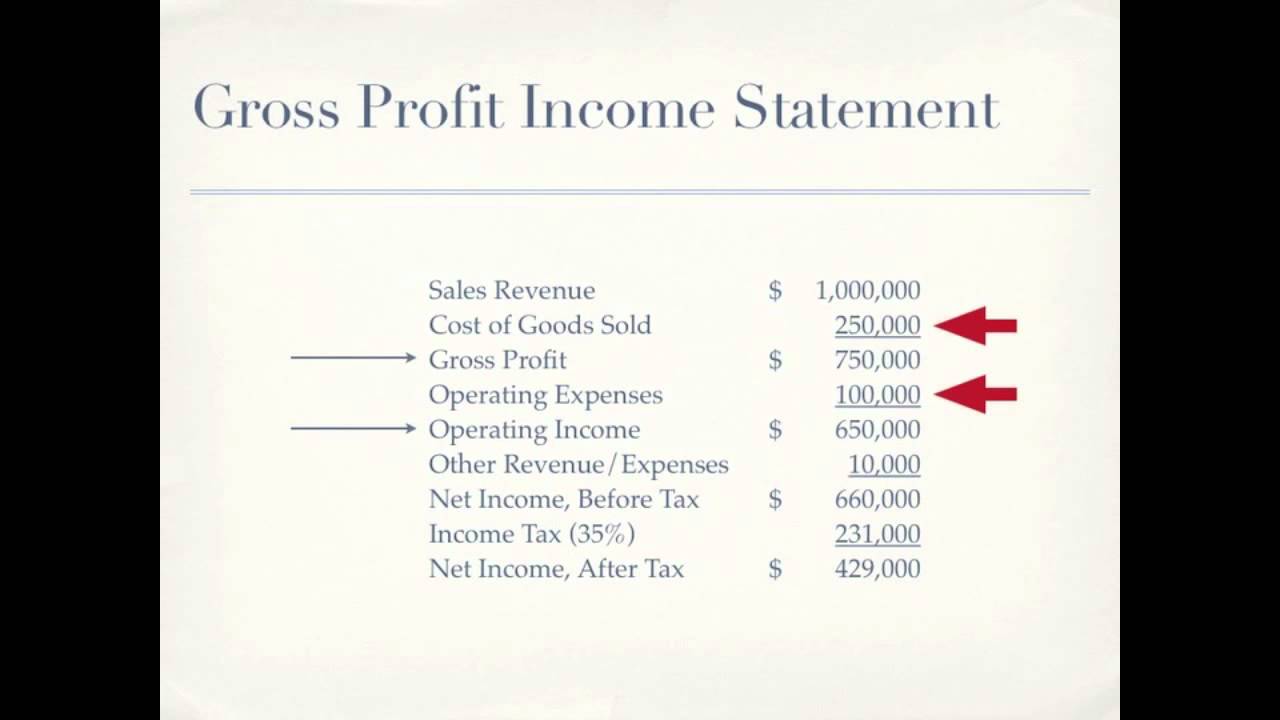

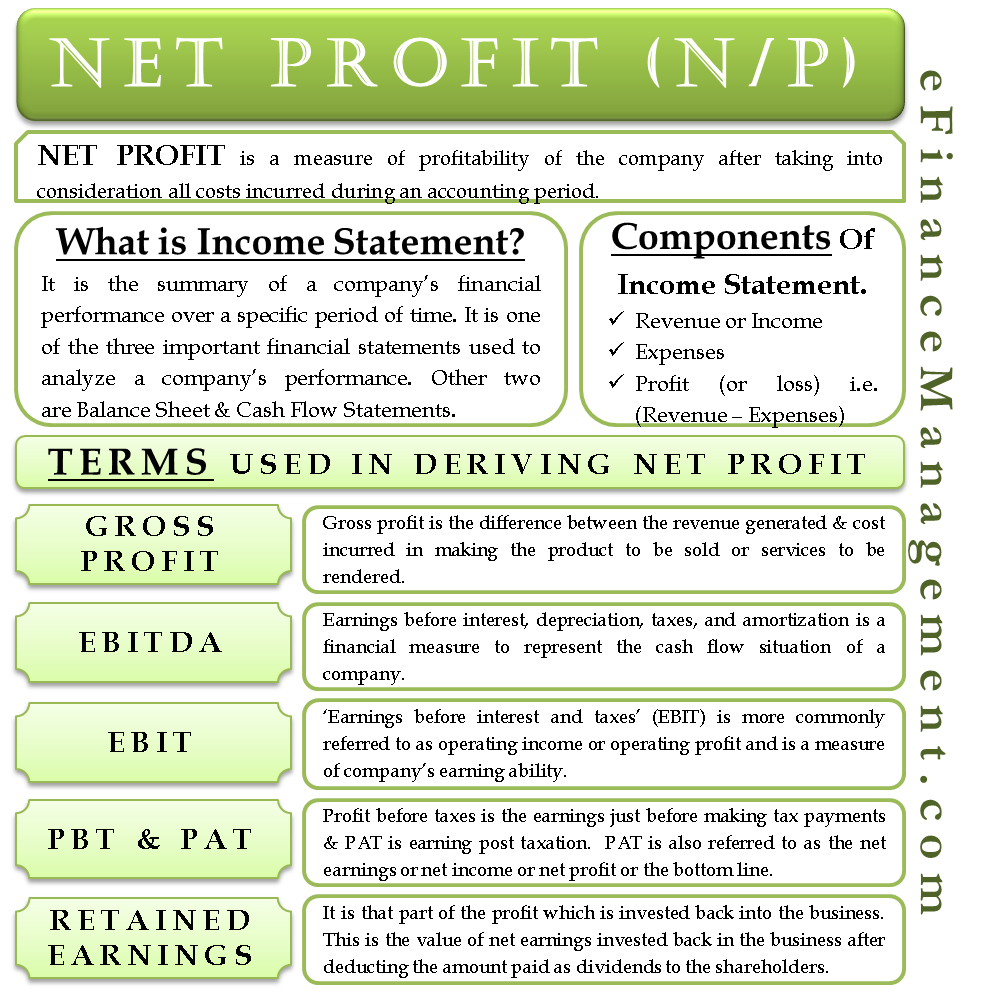

Then, it subtracts the costs of making those goods or providing those services, like. More advanced profit and loss statements also include operating profit and earnings before interest, taxes, depreciation, and amortization (ebitda). Income statements are often shared as quarterly and annual reports, showing financial trends and comparisons over time.

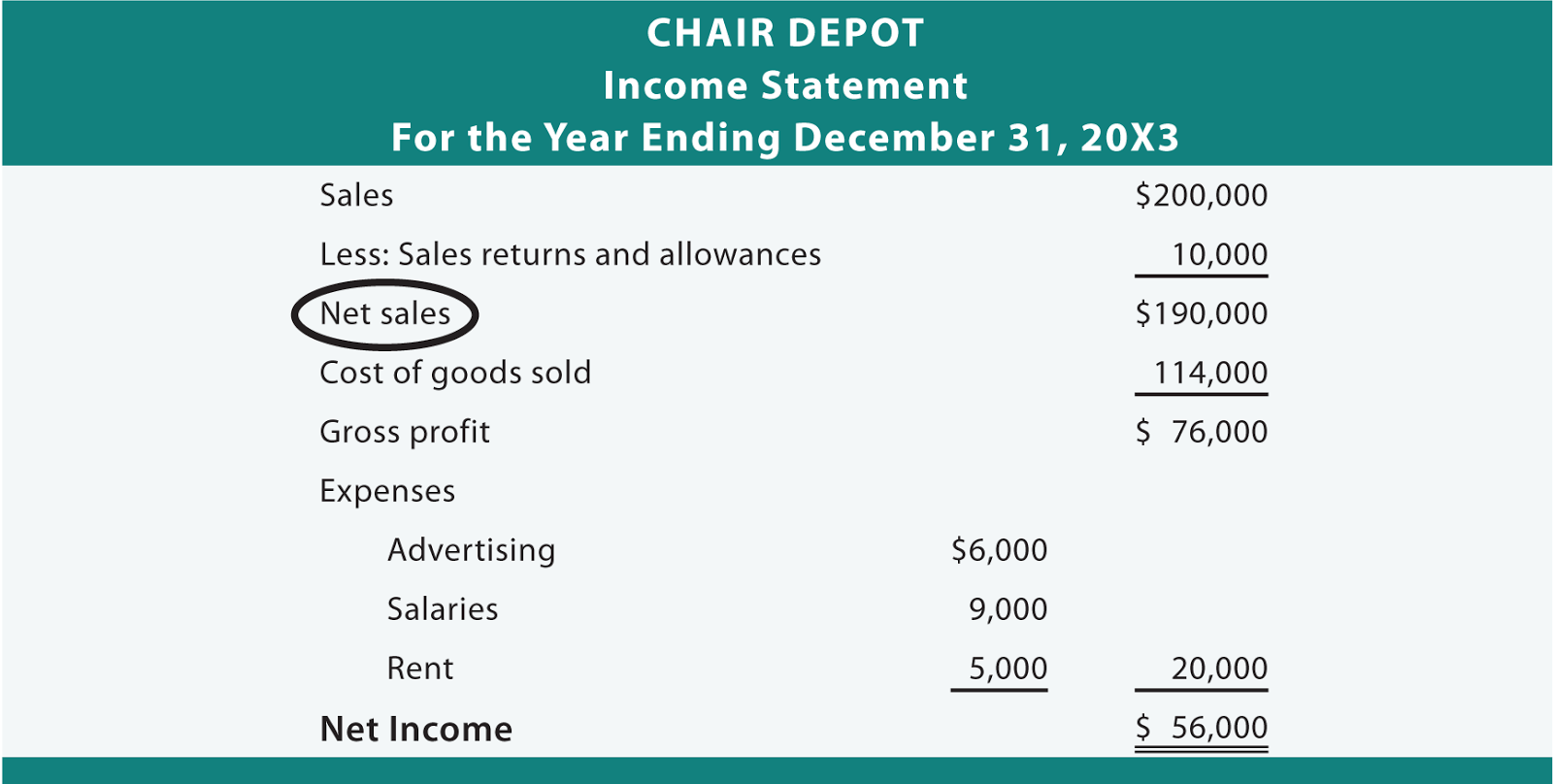

An income statement is a financial report detailing a company’s income and expenses over a reporting period. For the quarter, gaap earnings per diluted share was $4.93, up 33% from the previous quarter. Gross profit is the difference between the revenue generated and the cost incurred in making the product to be sold or services to be rendered.

Importance of an income statement. The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services. $6,016.34 / $57,050.68 = 0.11, or 11%.

Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year. The income statement calculates the company’s net income or net profit by taking into account its earnings, gains, expenses, and losses over a period. Santa clara, calif., feb.

Revenue, expenses, and net income. Together with the balance sheet and the cash flow statement, it provides a detailed insight into the financial health of your business, including whether you’re making a profit or a loss. An income statement, also known interchangeably as a profit and loss account, provides a summary of a company’s revenues, expenses, and profits over a specific period.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)