Beautiful Work Info About Statement Of Comprehensive Income Ifrs

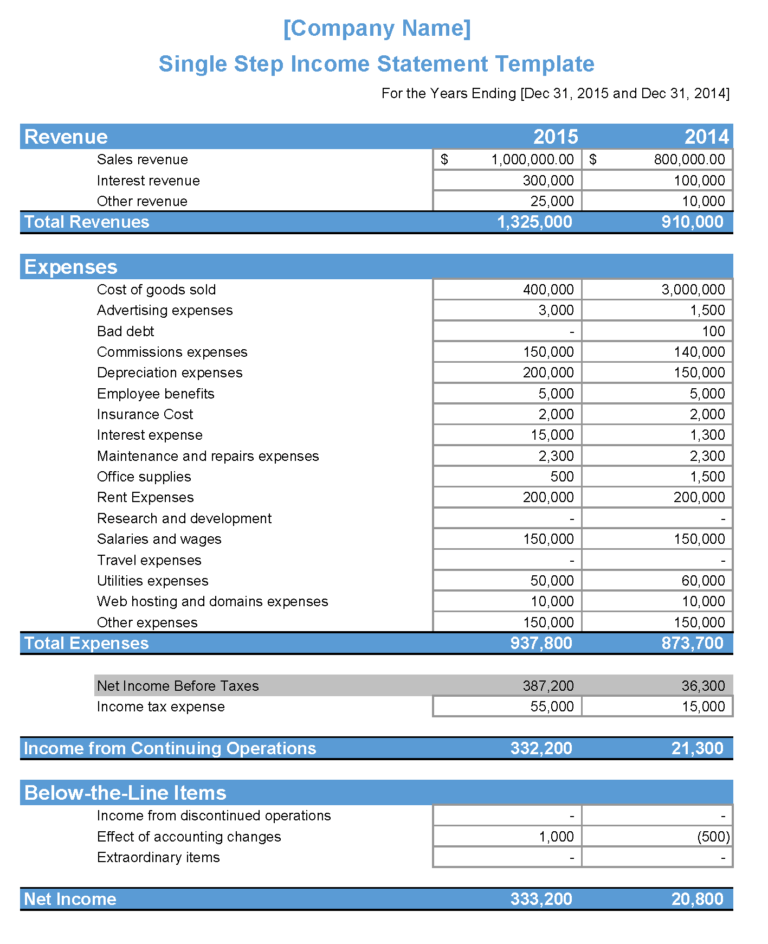

Alternatively, the net cash flow from operating activities may be presented under the indirect method by showing the revenues and expenses disclosed in the statement of.

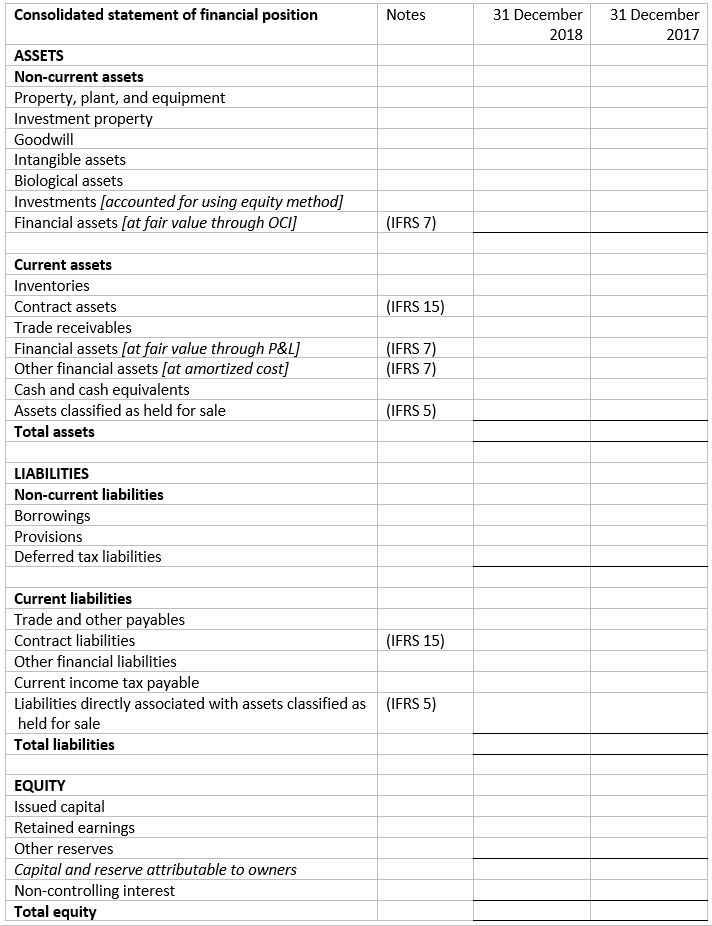

Statement of comprehensive income ifrs. Organising the statement of profit 106 or loss by function of expenses appendix b: Scope of this section. Other comprehensive income is those items of income and expense that are not.

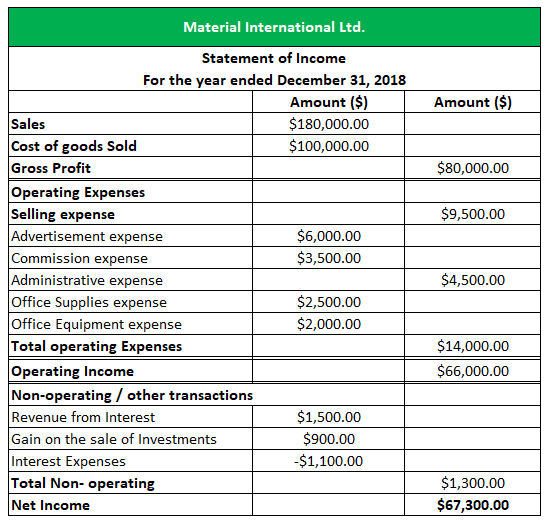

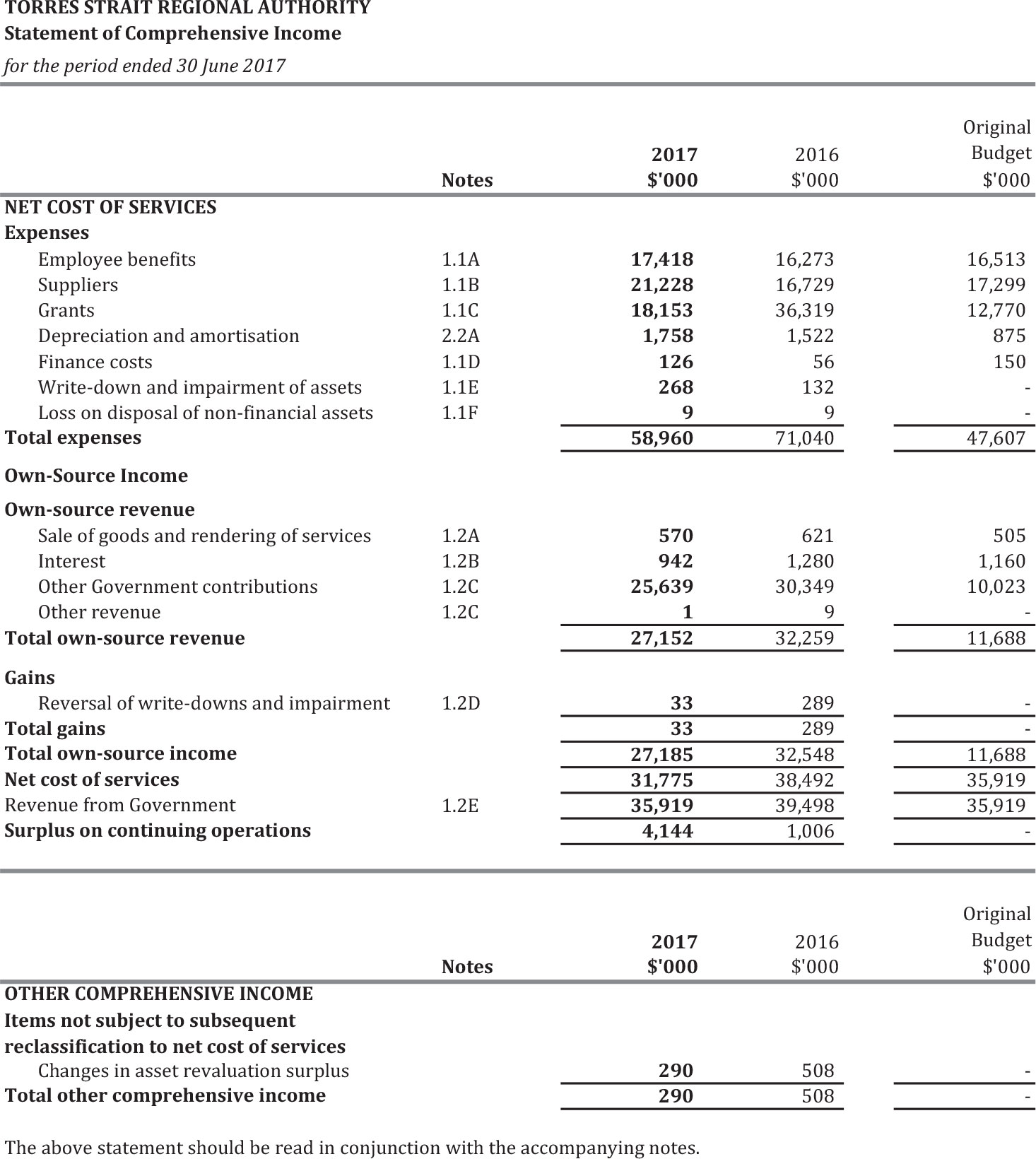

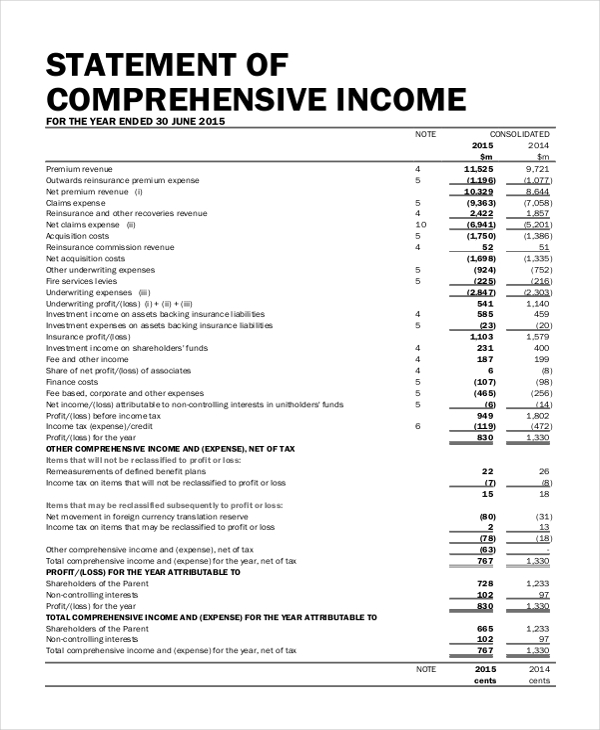

To oversimplify, this is the traditional. Statement of comprehensive income. 4.3 statement of comprehensive income.

Like us gaap, the income statement captures most, but not all, revenues, income and. Using the aoc of the tp of. A reporting entity should disclose the income tax effect of each component of oci, including reclassification adjustments, either on the face of the statement in which those.

A statement of profit and loss and other comprehensive income for the period. As a straightforward explanation, the account (other comprehensive income) is used to adjust the increase or decrease in fair value of certain investments. As stated in section 4.1, the gross profit of the company will be a gain of €620k under ifrs 4 phase ii.

It introduces the subject and reproduces the official text along with explanatory notes and examples designed to. Comprehensive income and the income statement in accordance with section 5 statement of comprehensive income and income statement. (f) this means the share of.

Statement of comprehensive income 108 presented in a single. It is intended to help entities to prepare and present. Improvements to ifrss (issued may 2010), ifrs 13 fair value measurement (issued may 2011), presentation of items of other comprehensive income (amendments to ias 1).

To the newcomer to ifrs, this is probably the strangest part of the financial reporting package. Under ifrs, the income statement is labeled ‘statement of profit or loss’. 1 this section requires an entity to present its total comprehensive income for a period—ie its financial performance for the period—in one.

Refer to the statement of comprehensive income illustrating the presentation of income and expenses in one statement. In addition, there are material limitations associated with the use of non.