Outrageous Info About Ending Balance Sheet

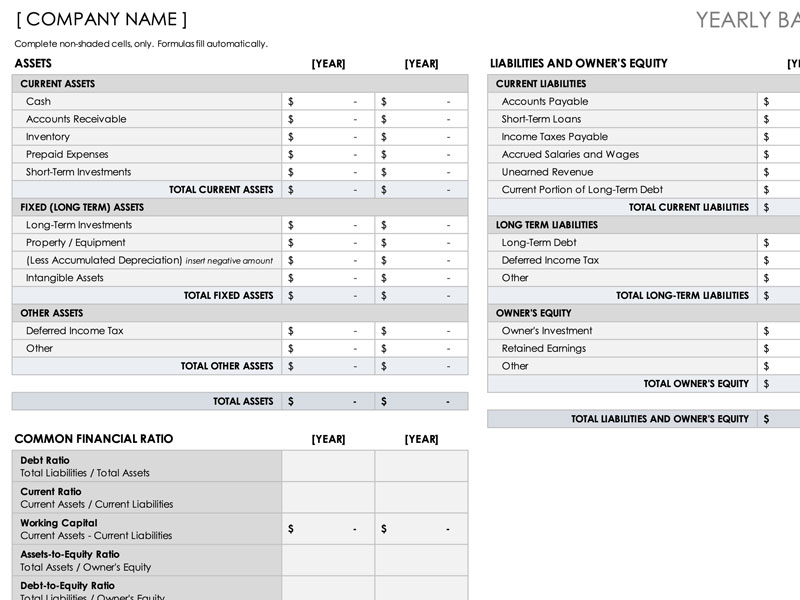

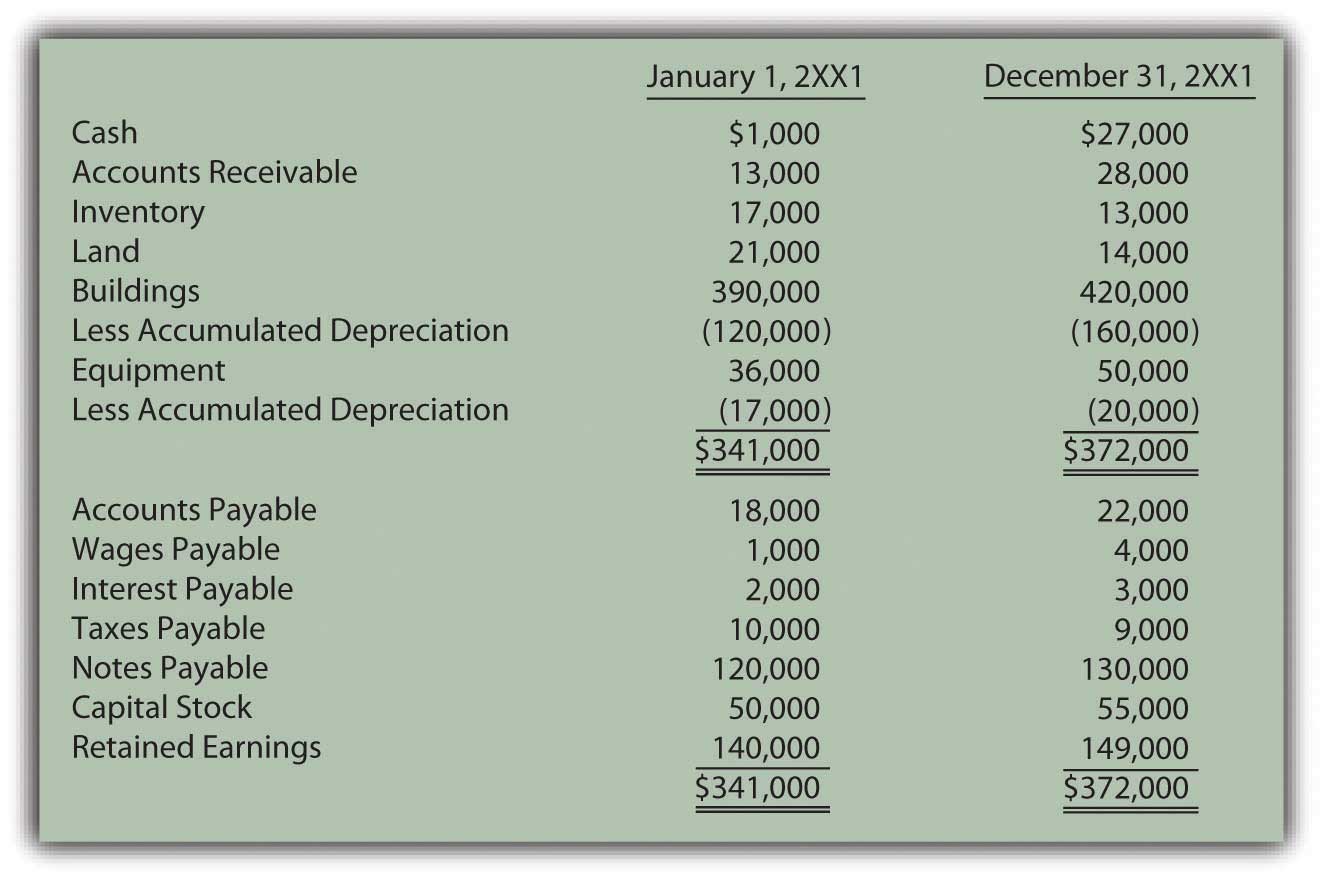

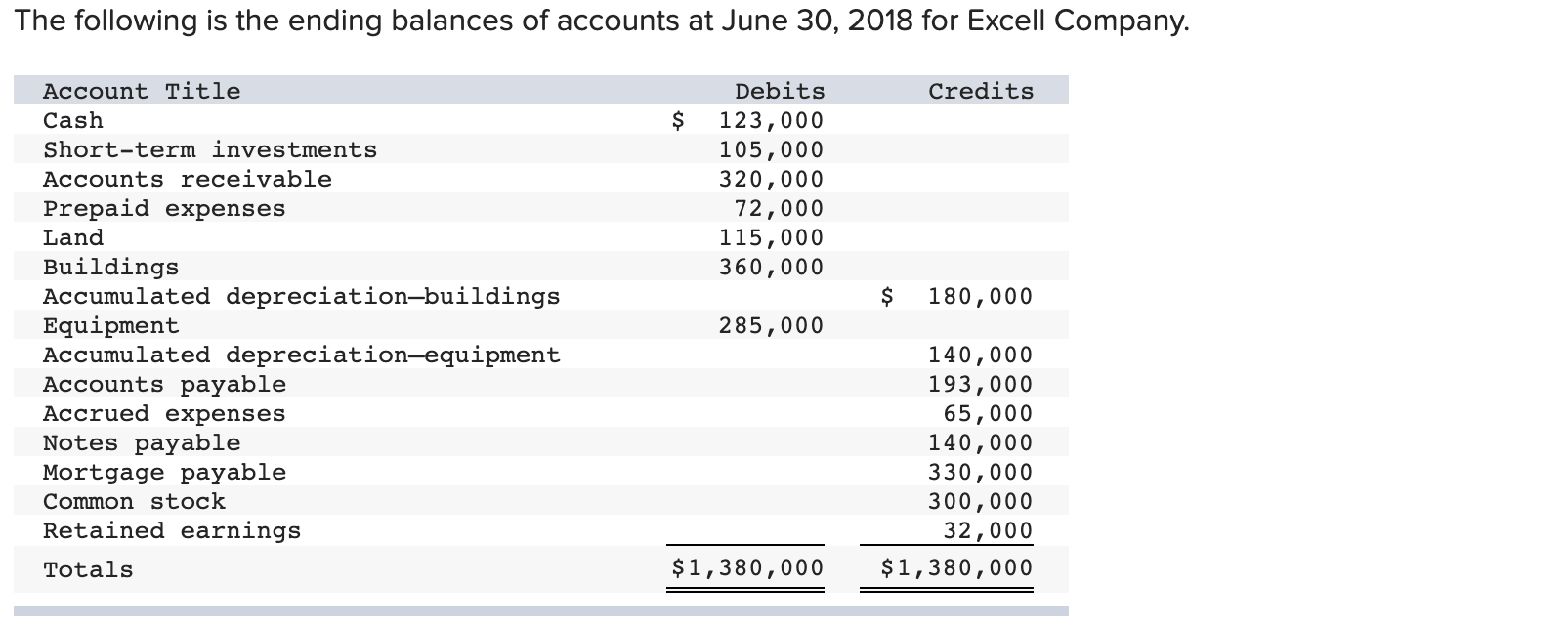

The two sides of the balance sheet must balance:

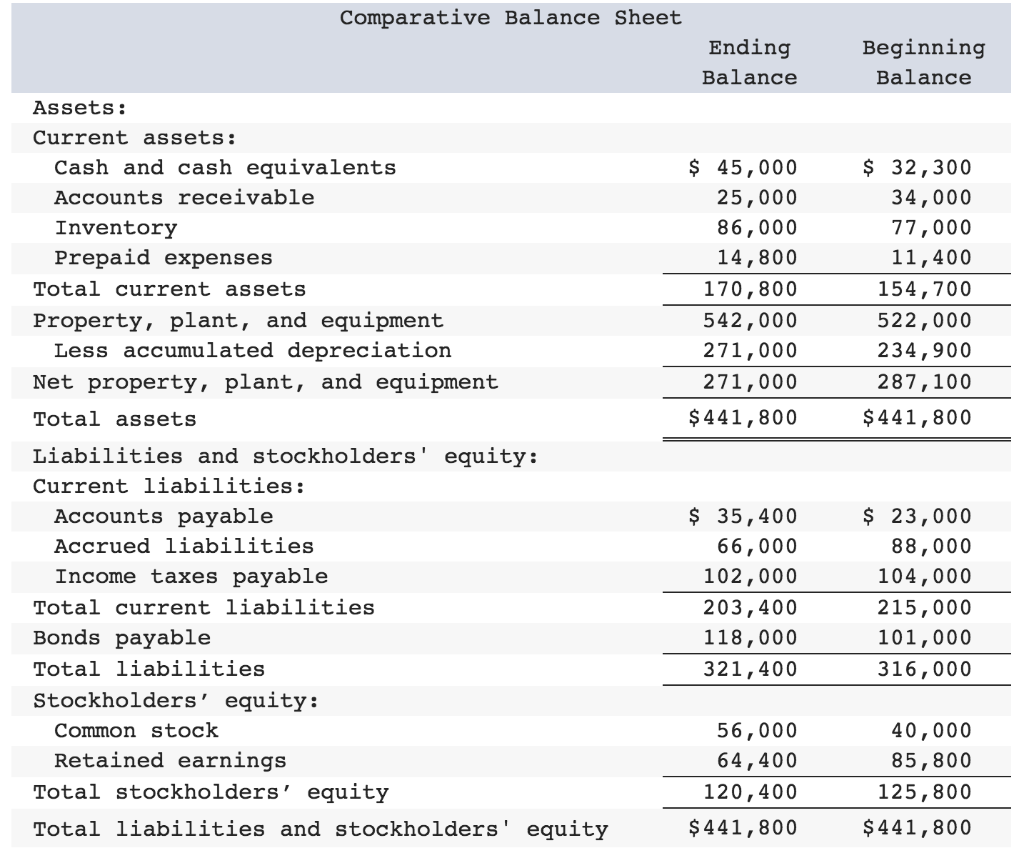

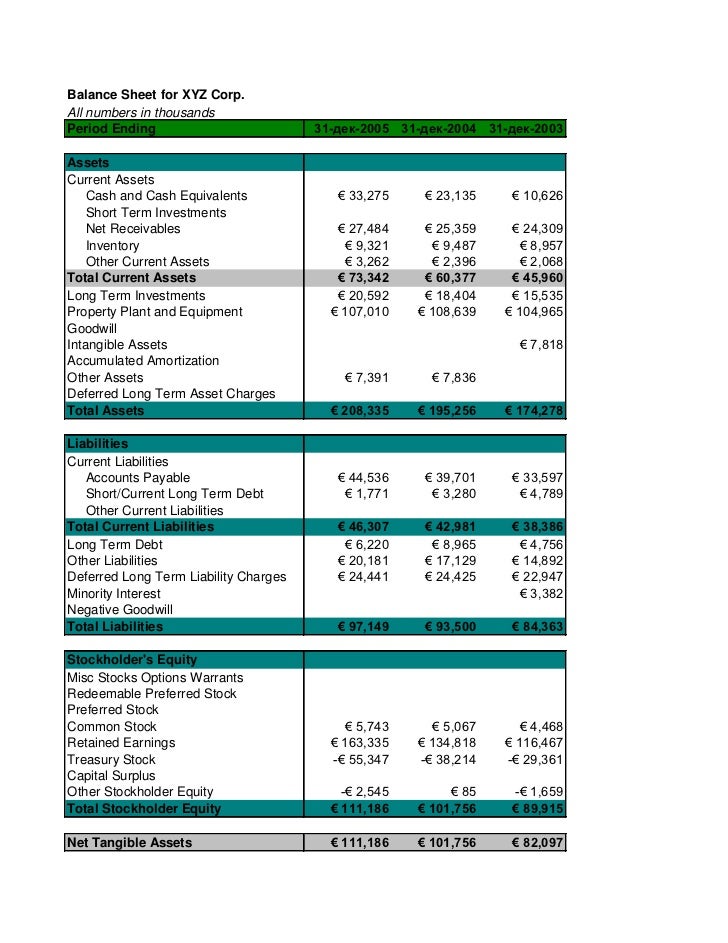

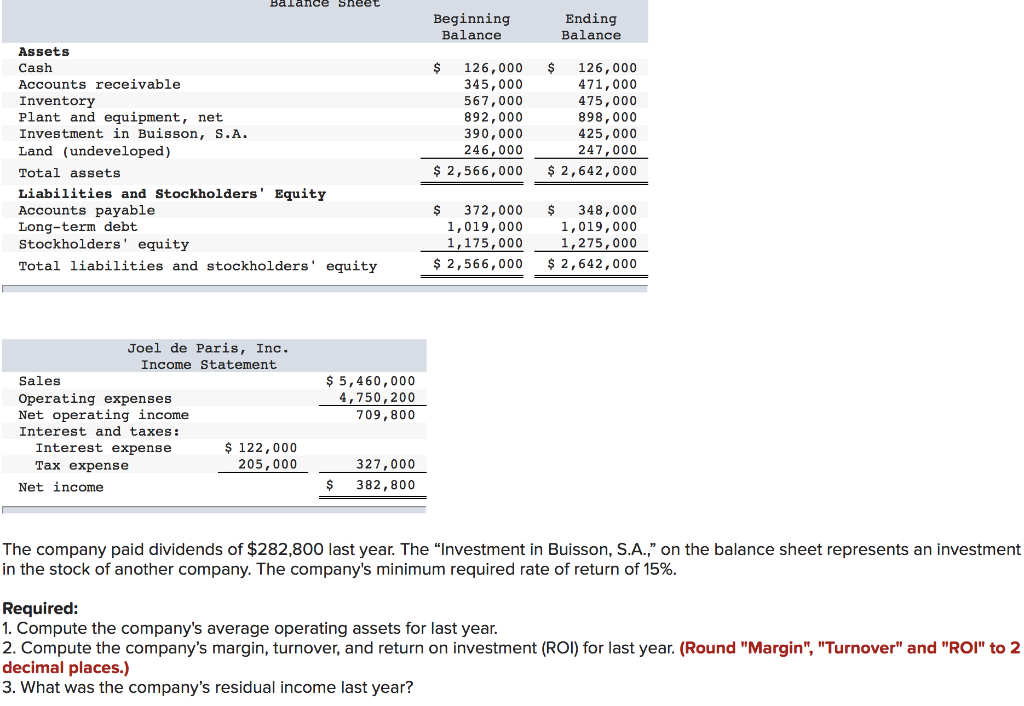

Ending balance sheet. Generally, sales growth, whether rapid or slow, dictates a larger asset base —higher levels of inventory, receivables, and. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. Balance sheets provide the basis for.

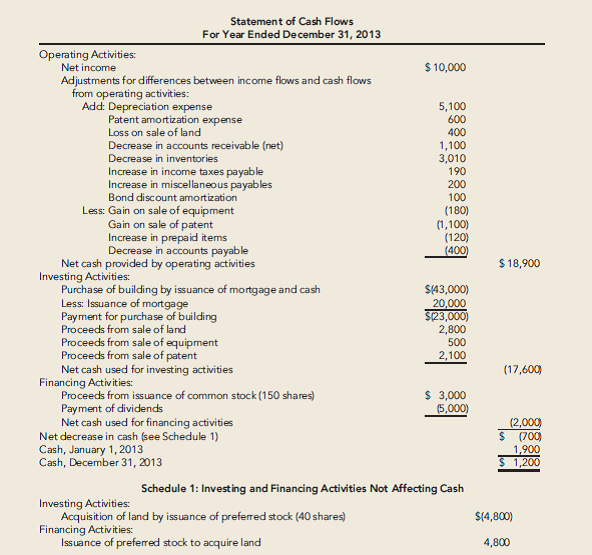

A balance sheet is meant to depict the total assets, liabilities, and shareholders’ equity of a company on a specific date, typically referred to as the reporting date. It can also be referred to as a statement of net worth or a statement of financial position. These balances are usually carried forward from the ending balance sheet for the immediately preceding reporting period.

Minres said it had $1.4 billion in cash at the end of the first half and net debt of $3.55 billion, up from $1.85. The group, posting results that showed operating profit hit a record last year, said its leverage ratio fell to 1.2 in the fourth quarter from 1.5 a year earlier, and launched a share buyback. They’re also essential for getting investors, securing a loan, or selling your business.

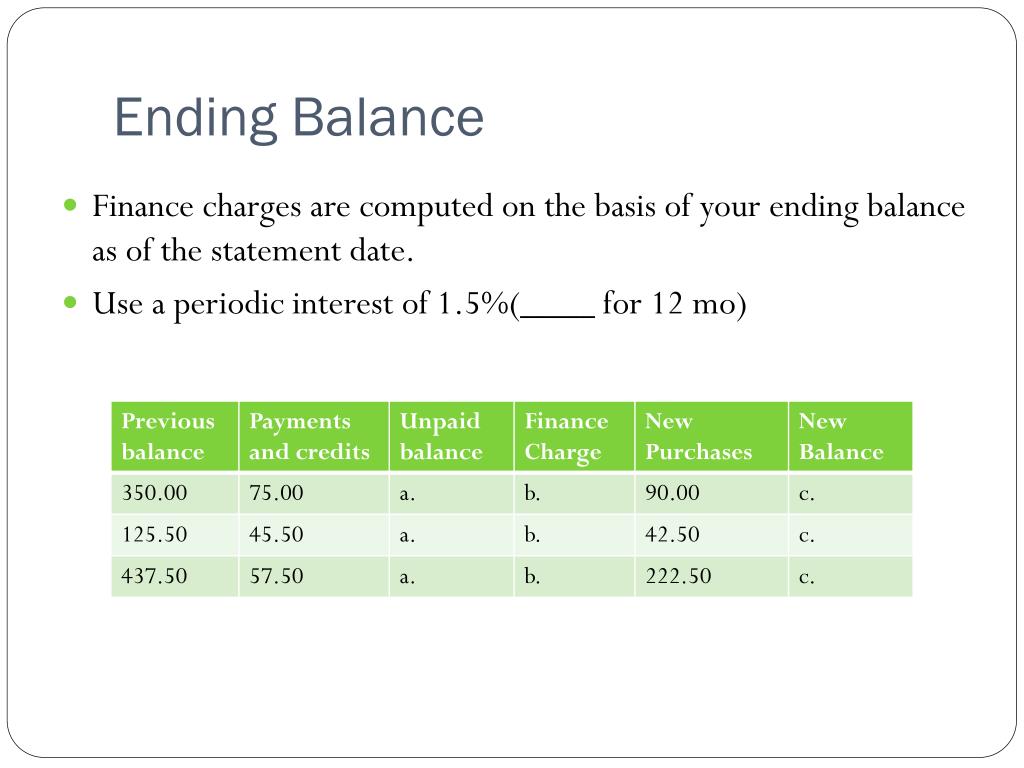

The current size of the fed's balance sheet is $7.7 trillion. So you definitely need to know your way around one. An ending balance is derived by adding up the transaction totals in an account and then adding this total to the beginning balance.

Plus, find tips for using a balance sheet template. Beginning and ending inventory if the business now moves into its next accounting period, it has beginning inventory of 2,000 (last months ending inventory). The balance sheet is a key financial statement that provides a snapshot of a company's finances.

An opening balance sheet contains the beginning balances at the start of a reporting period. The balance sheet is based on the fundamental equation: At the same time, bank reserve balances — another large liability on the central bank’s balance sheet — are $3.54 trillion, according to the latest data.

Determine the reporting date and period. It is allowing up to $95 billion in treasury and mortgage bonds to. At the heart of the debate is how small the central bank can make its balance sheet — almost $9 trillion at one point — without causing financial markets dislocations or derailing its broader.

The net worth of your small business, how much money you have, and where it’s kept. The fed more the doubled the size of its holdings starting in march 2020 to a peak of nearly $9 trillion, using bond purchases to stabilize markets and provide stimulus beyond the near zero. It is usually measured at the end of a reporting period, as part of the closing process.

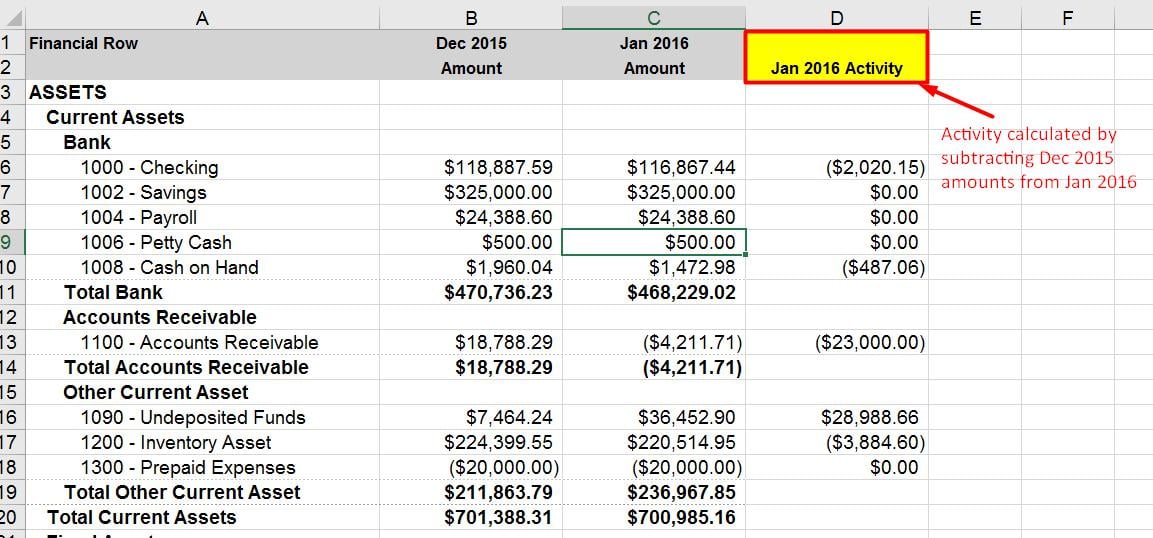

A balance sheet provides a snapshot of a company’s financial performance at a given point in time. The result will be the ending balance for the period. That’s where this guide comes in.

Often, the reporting date will be the final day of the accounting period. Envisioning the end of fed’s. To calculate re, the beginning re balance is added to the net income or reduced by a net loss and then dividend payouts are subtracted.