Who Else Wants Tips About Summary Trial Balance

For example, utility expenses during a period include the payments of four different bills amounting to $ 1,000, $ 3,000, $ 2,500, and $ 1,500, so in the trial balance, single utility expenses account will be shown.

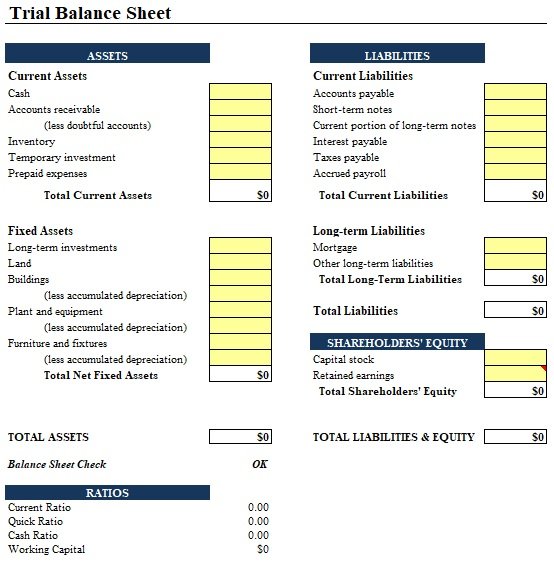

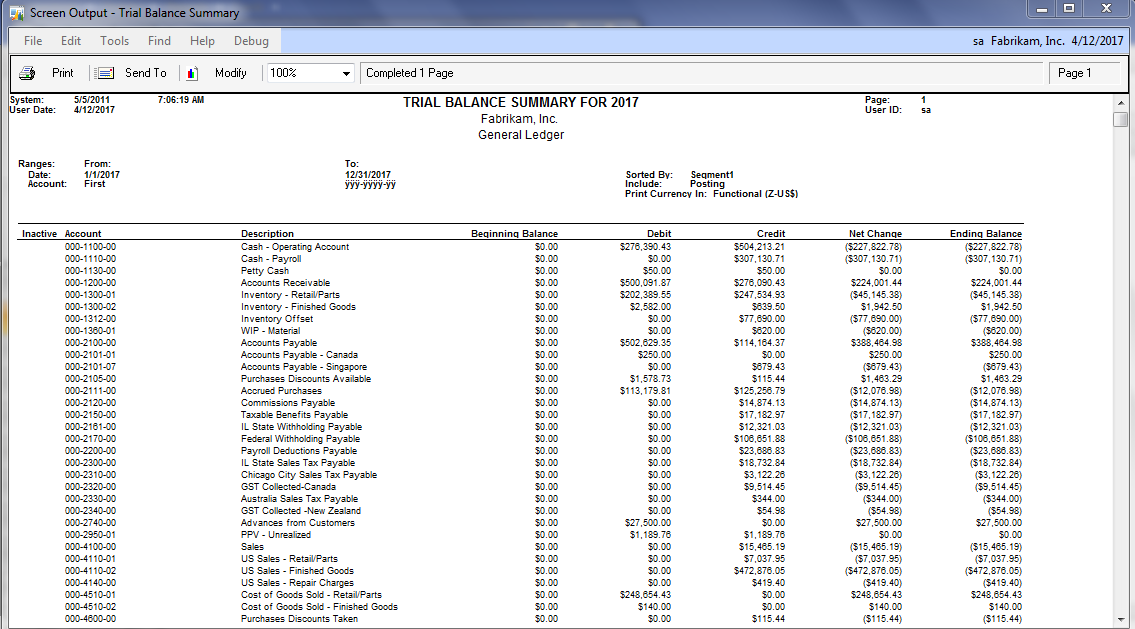

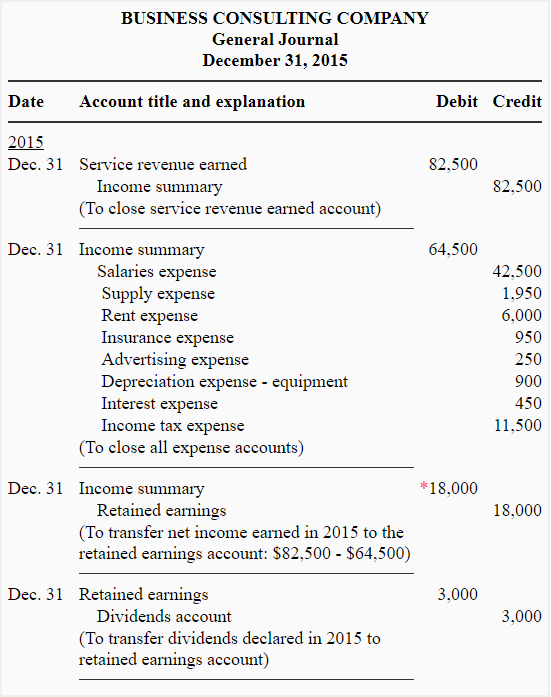

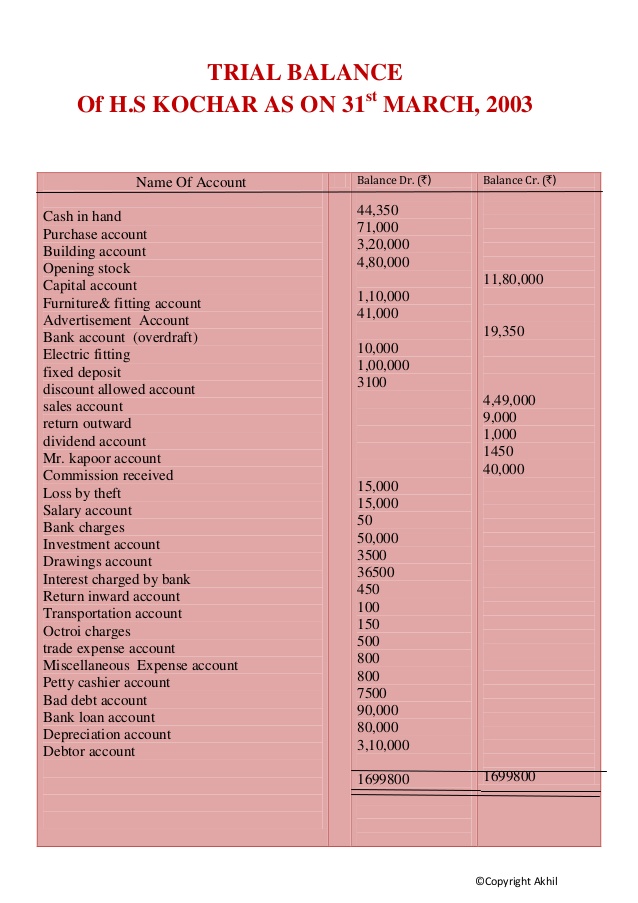

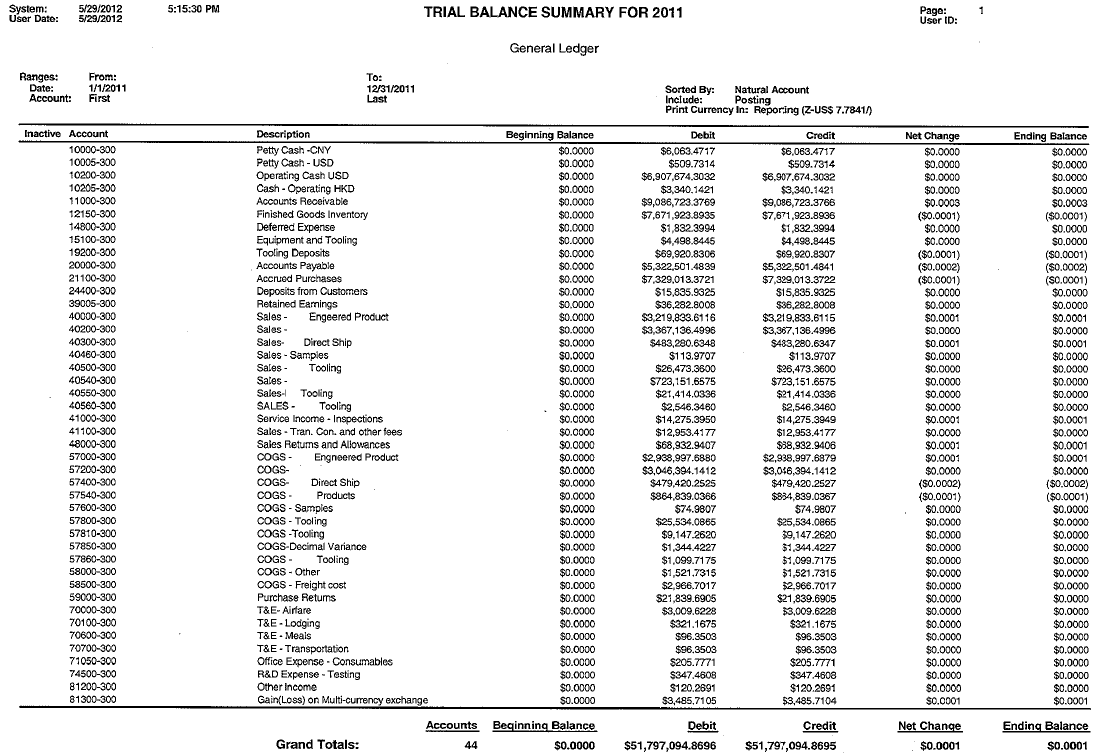

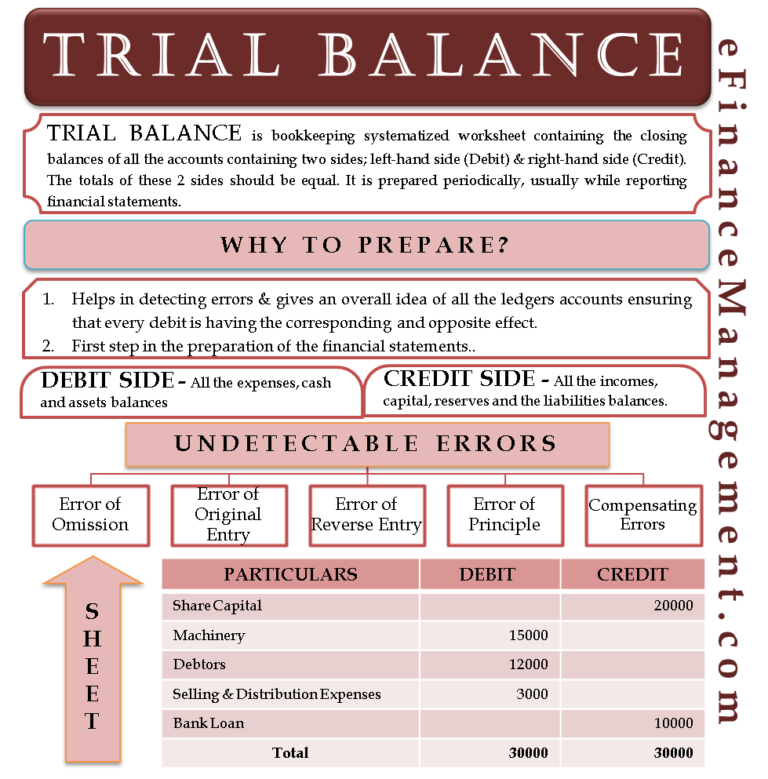

Summary trial balance. The primary purpose of a trial balance is to identify errors and ensure the equality of debits and credits. Example of a trial balance document The trial balance is an accounting report that lists the ending balance in each general ledger account.

The learner needs to understand that a trial balance is prepared for twofold reasons. It is prepared at the end of a particular period to indicate the correct nature of the balances of various accounts. The balances of the ledgers are added to the debit and credit columns.

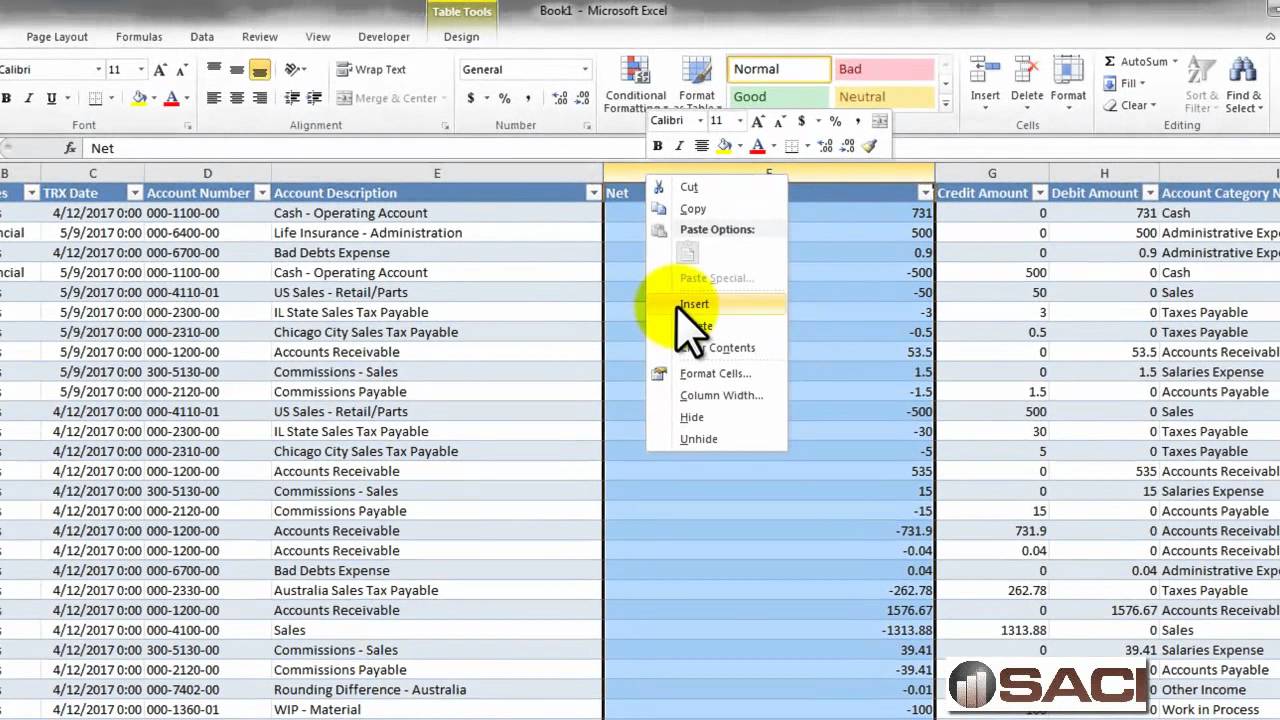

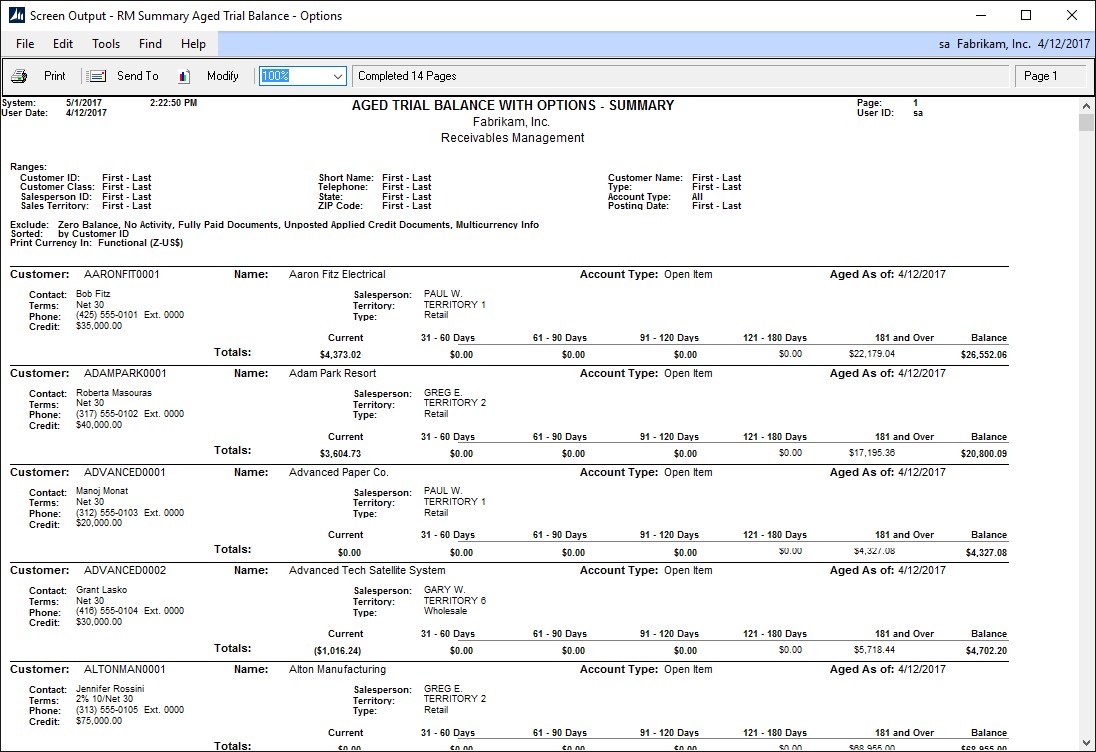

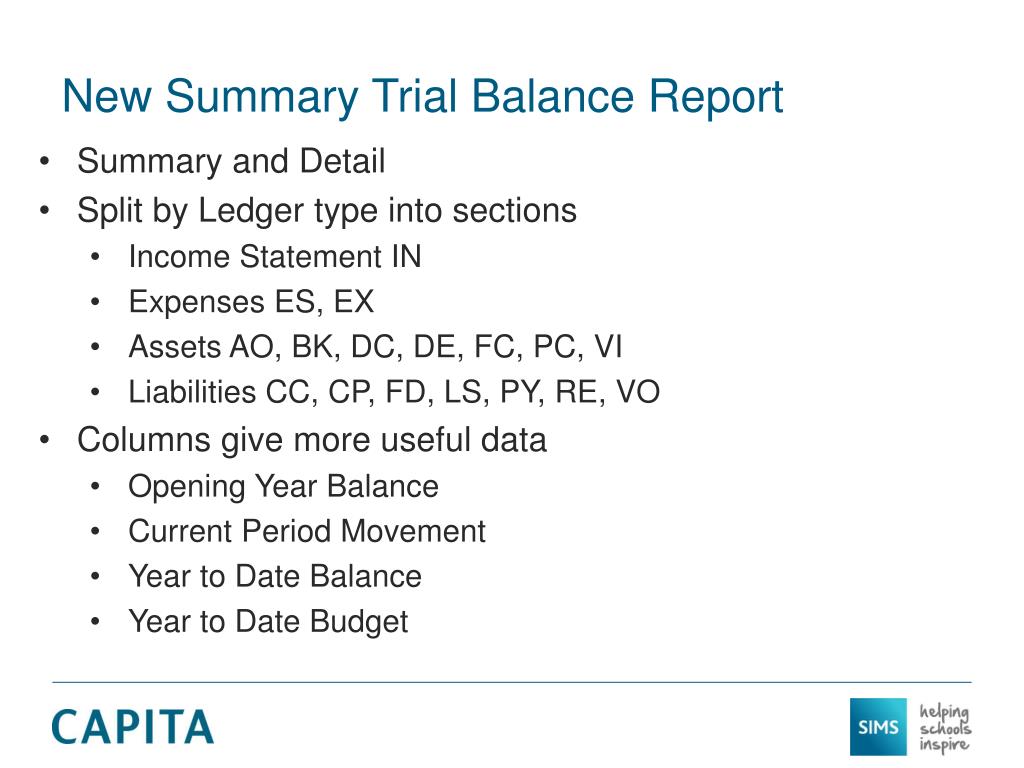

Therefore, if the debit and the credit sides of the trial balance are the same, it is assumed that. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. The trial balance report lists all balance sheet and income statement summary accounts with account numbers and descriptions.

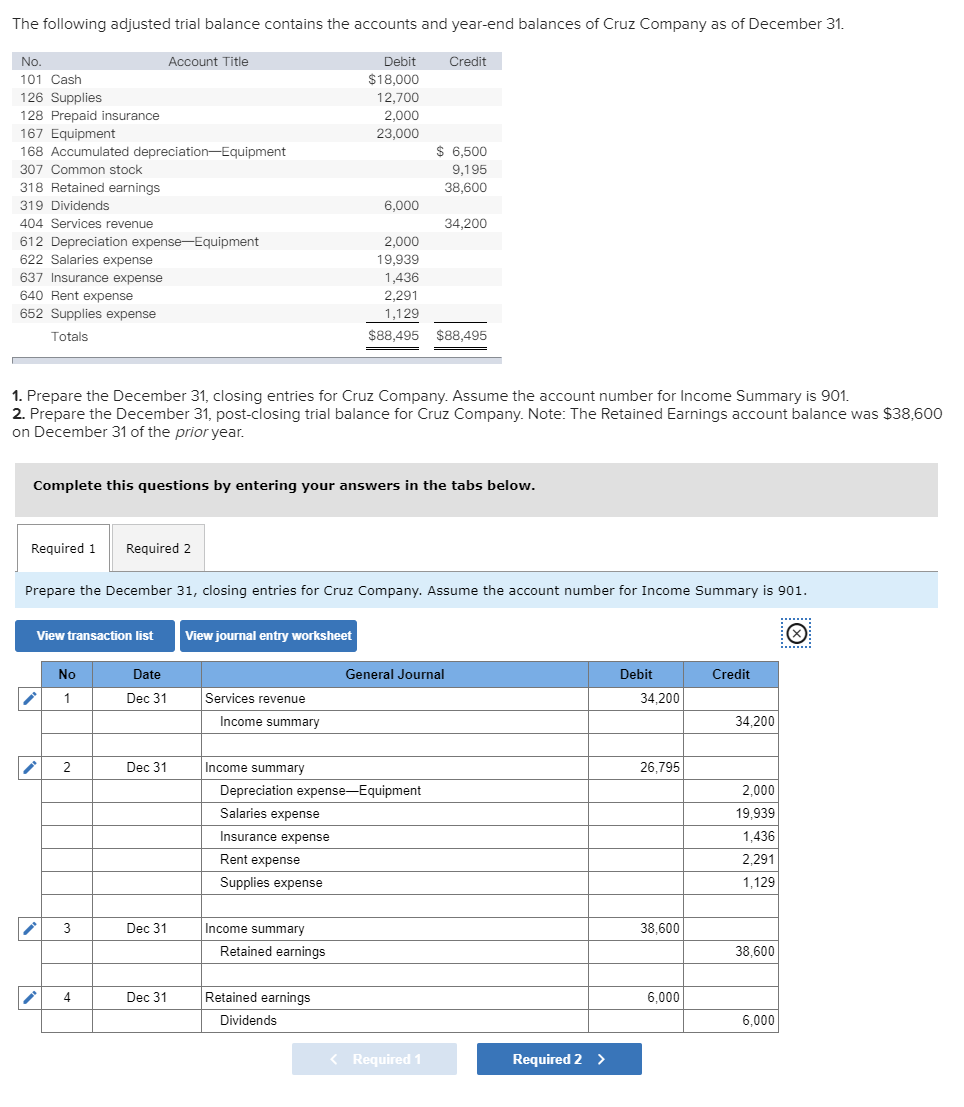

Before you start off with the trial balance, you need to make sure that every ledger account is balanced. The trial balance report is an accounting report that lists the closing balances of the general ledger accounts. Your turn magnificent adjusted trial balance go over the adjusted trial balance for magnificent landscaping service.

In trial balance, all the ledger balances are posted either. A trial balance is a summary statement and comprises all the ending balances from each general ledger account. A trial balance is the summary of all the balances in the ledger account.

Note that for this step, we are considering our trial balance to be unadjusted. Trial balance and balance sheet. The total of these two columns should match.

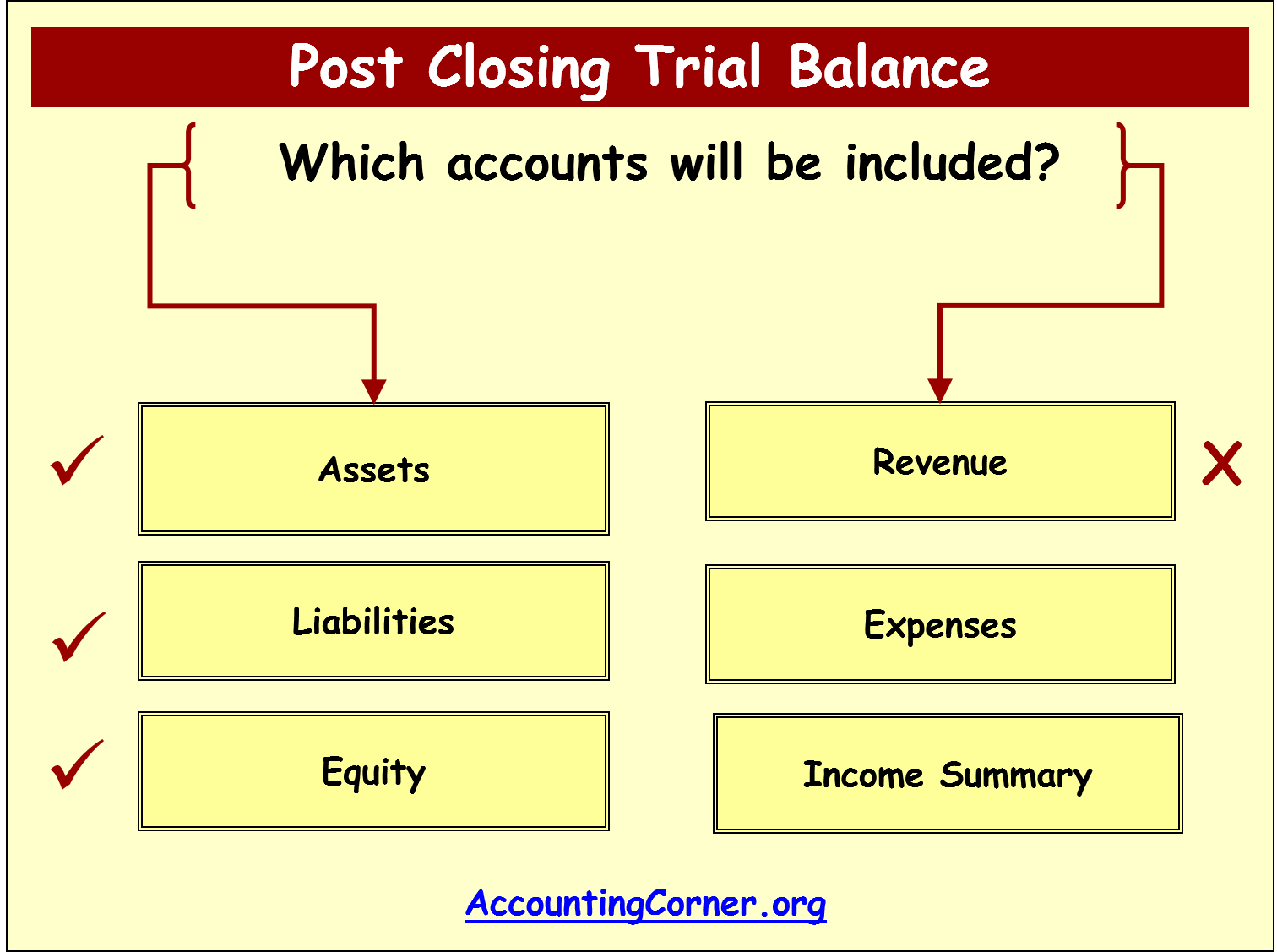

This means that it states the total for each asset, liability, equity, revenue, expense, gain, and loss account. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle. By preparing a trial balance, accountants can identify errors before finalizing financial.

A trial balance is a summarization of all journal entries made, aggregated by account. This information is then used to prepare financial statements. Trial balance is a statement that lists the balances of all general ledger accounts to ensure the equality of debits and credits.

Trump was penalized $355 million, plus millions more in interest, and banned for three years from serving in any top roles at a new. The balance sheet is going to include assets, contra assets, liabilities, and stockholder equity accounts, including ending retained earnings and common stock. The trial balance is prepared after posting all financial transactions to the journals and summarizing them on the ledger statements.

Engoron attends the trump organization civil fraud trial in new york in november 2023. The trial balance is made to ensure that the debits equal the credits in the chart of accounts. The accounts reflected on a trial balance are related to all major accounting items, including assets , liabilities, equity, revenues, expenses , gains, and.