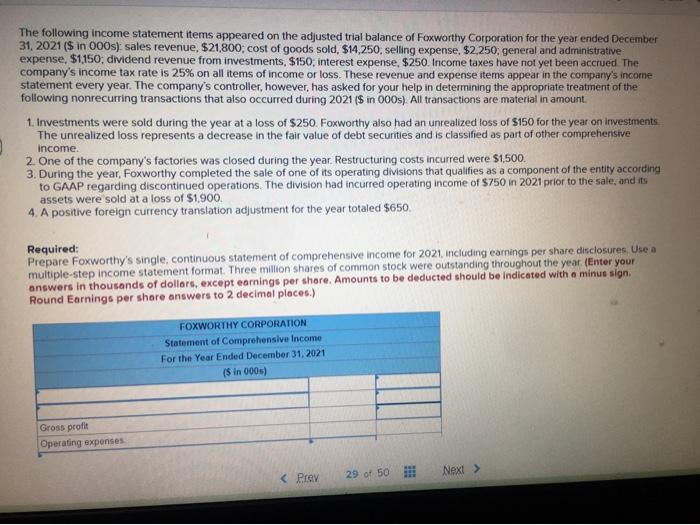

Fun Info About Restructuring Costs On Income Statement

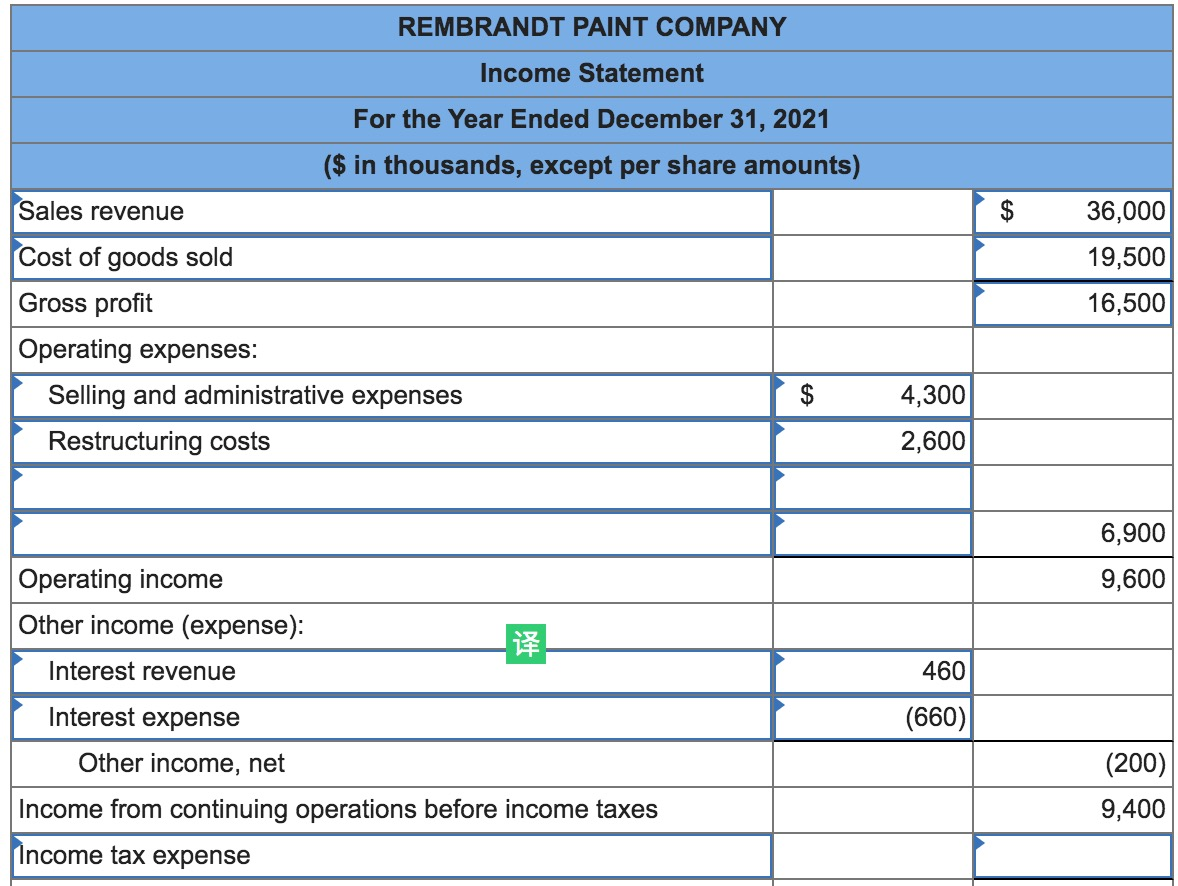

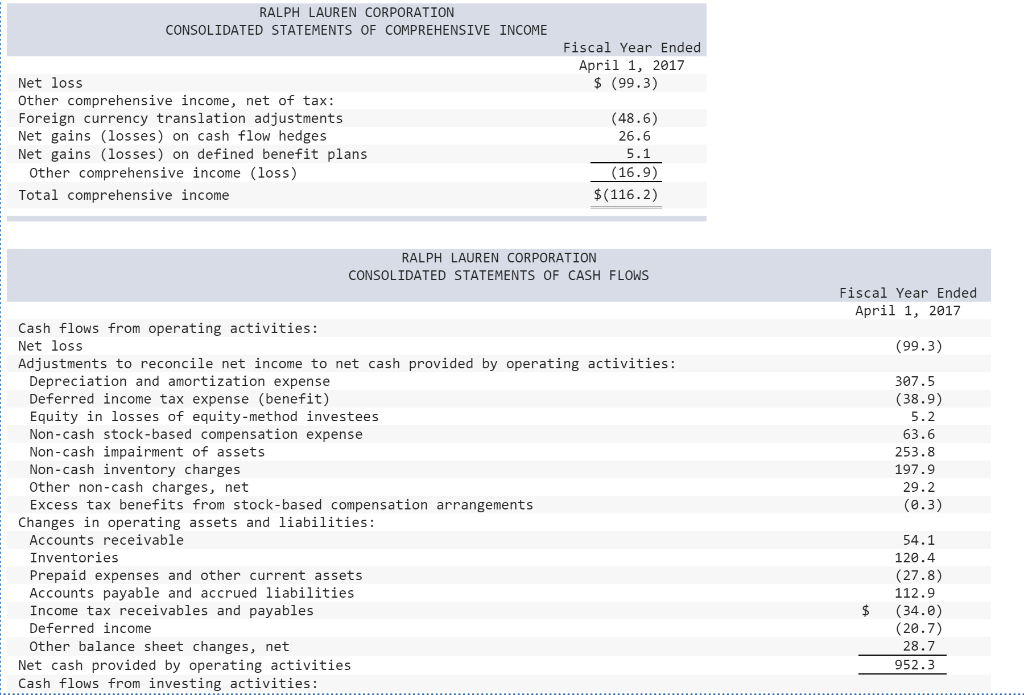

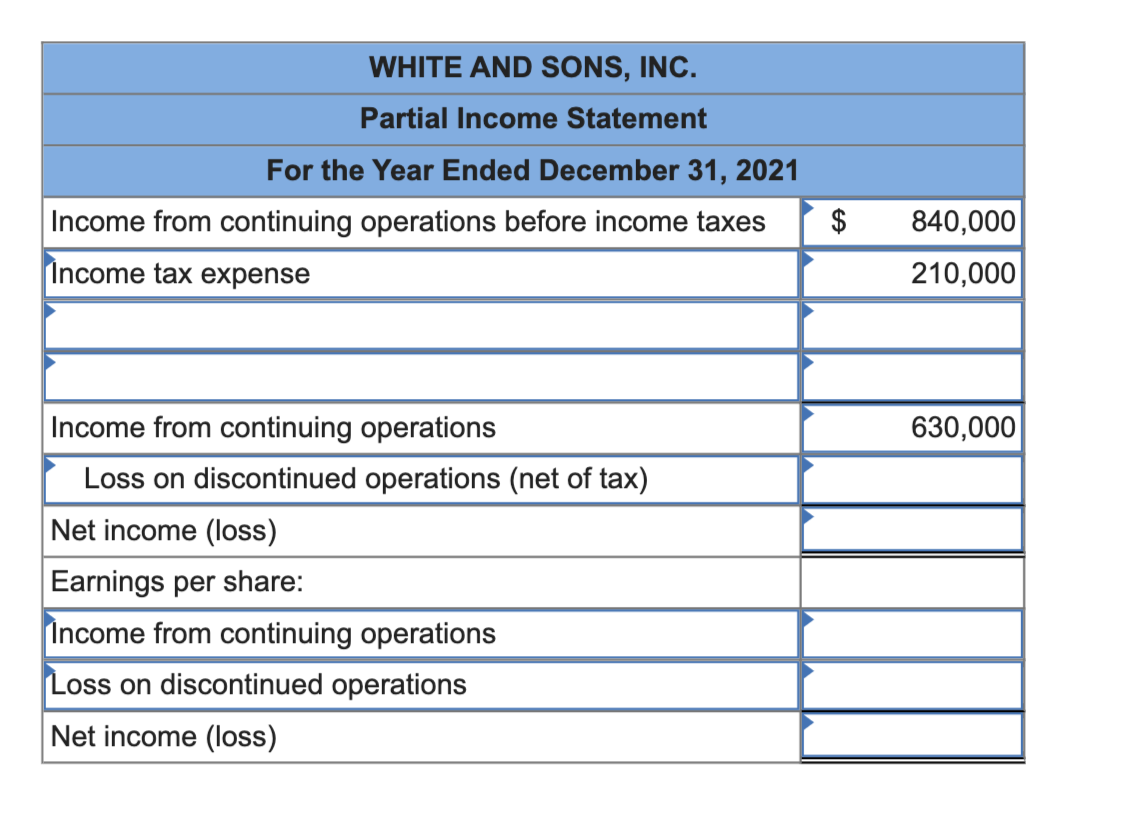

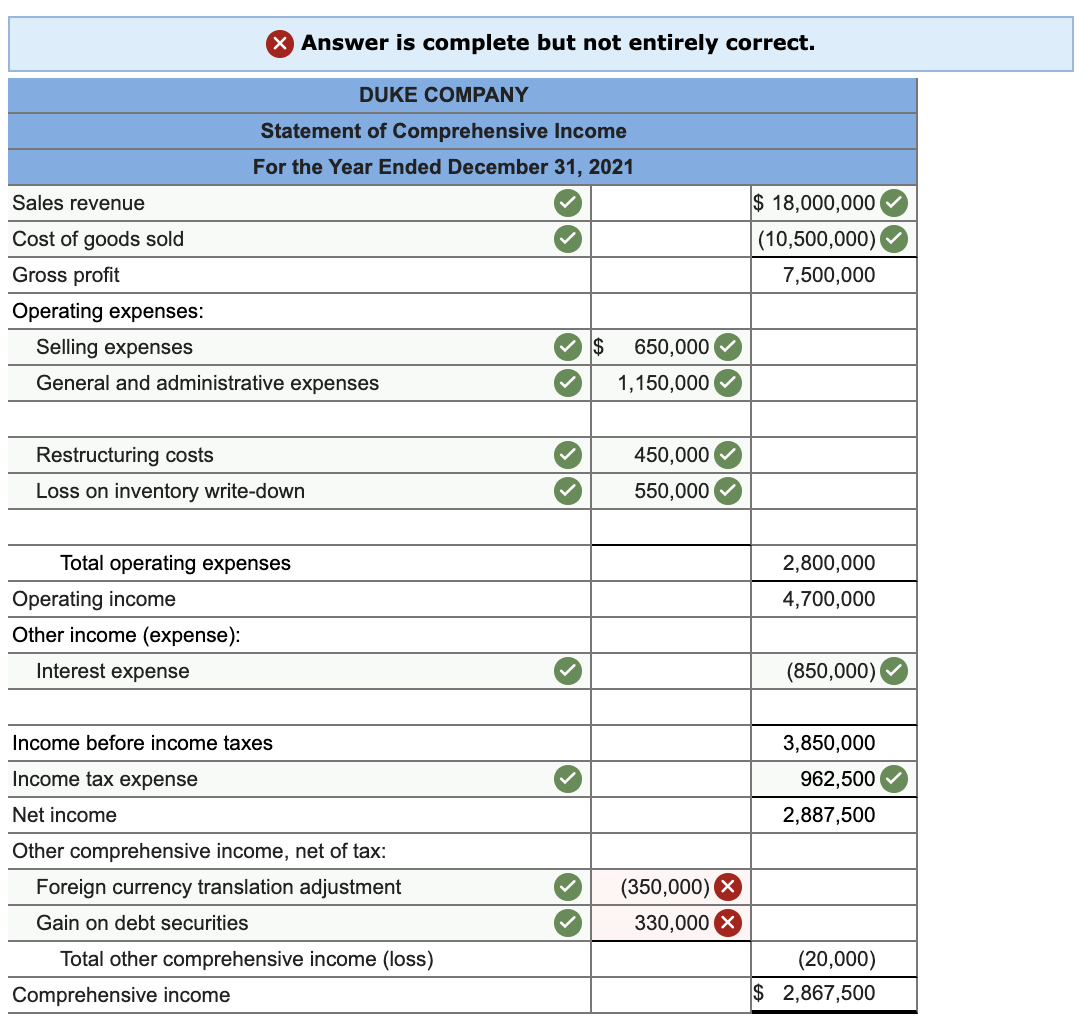

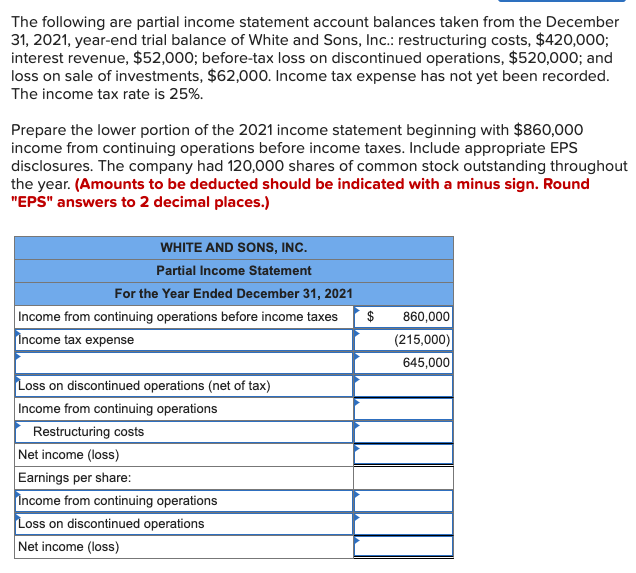

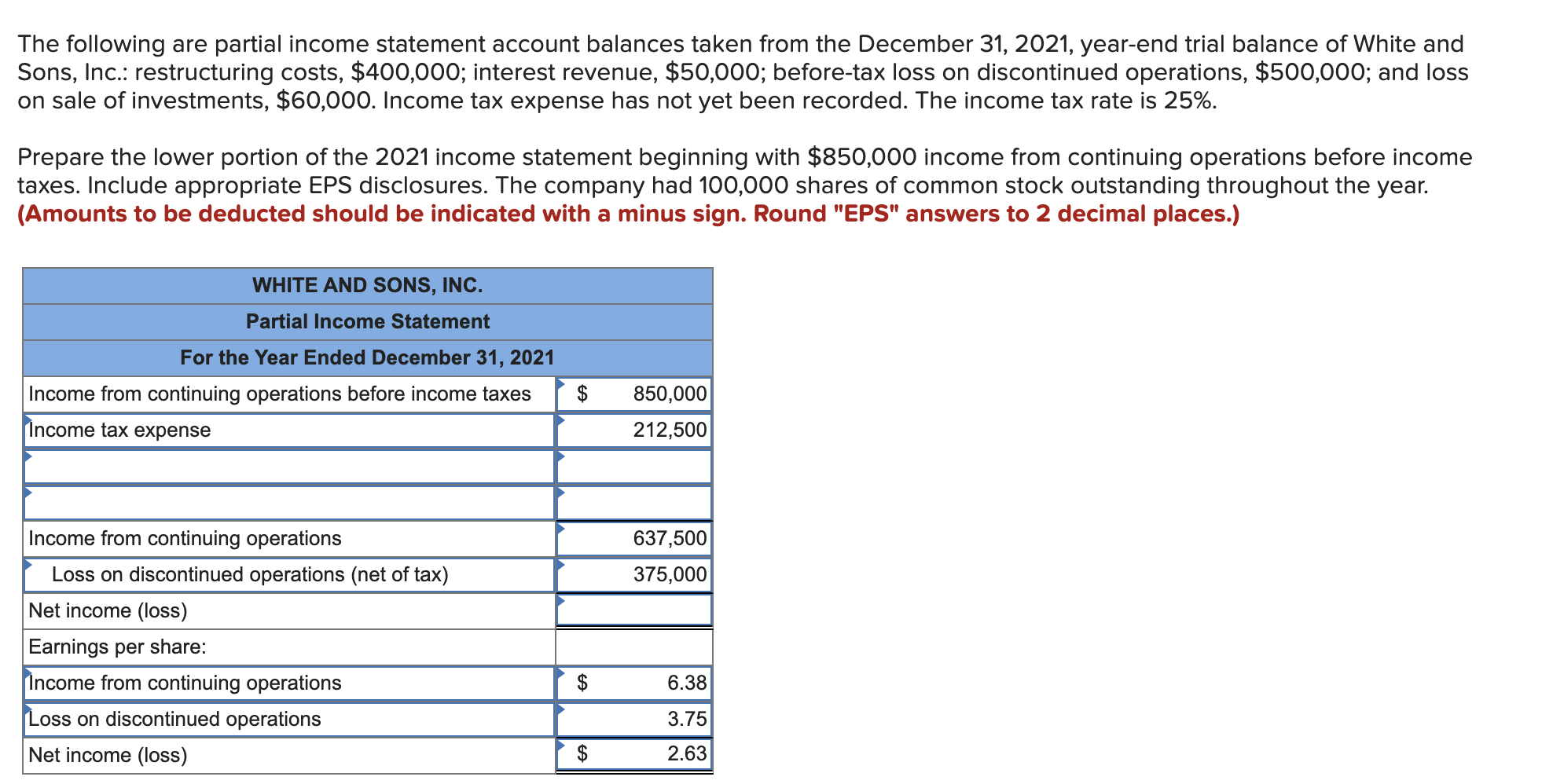

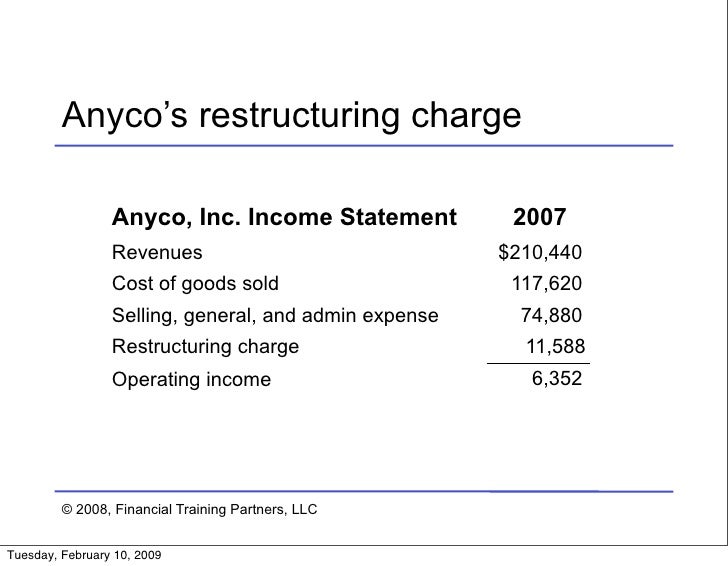

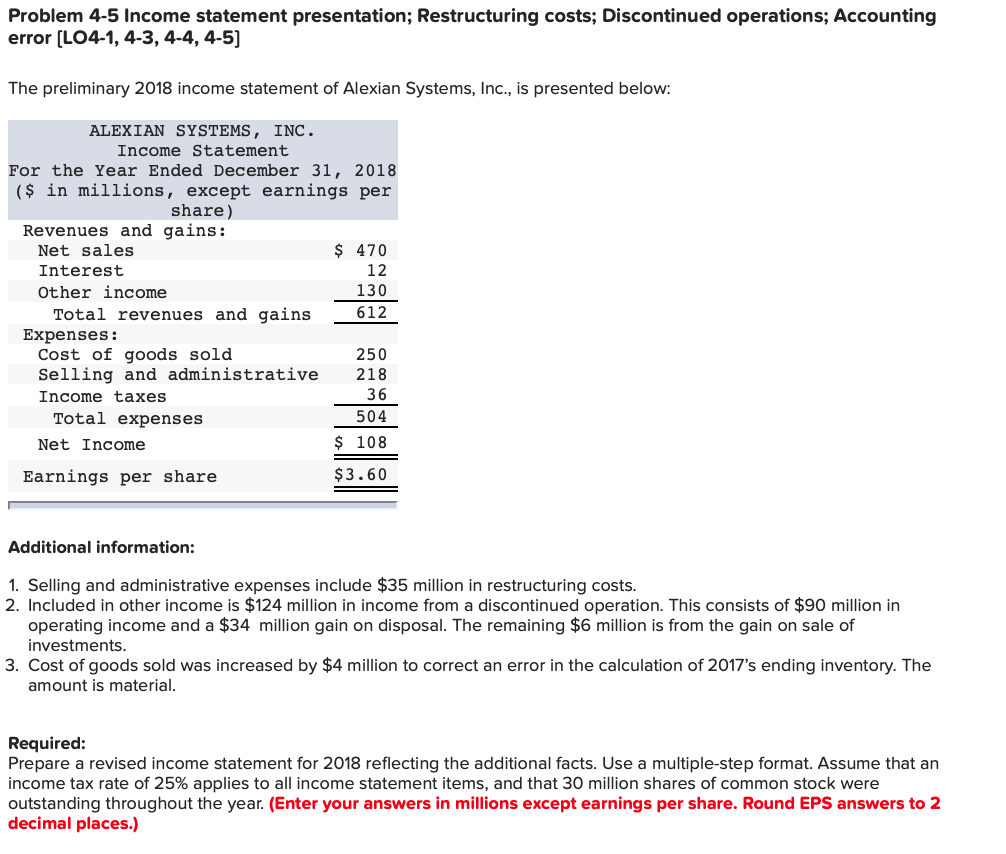

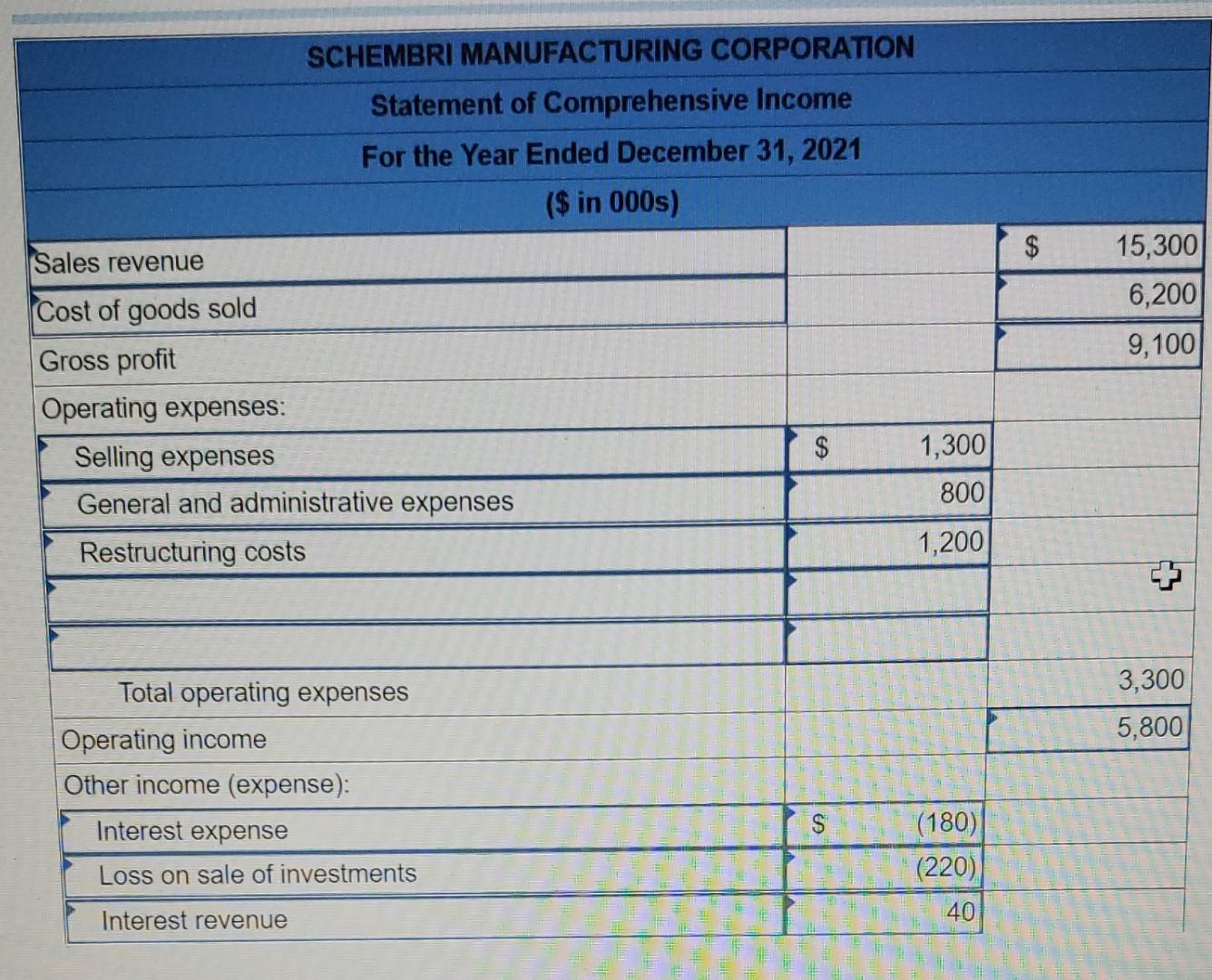

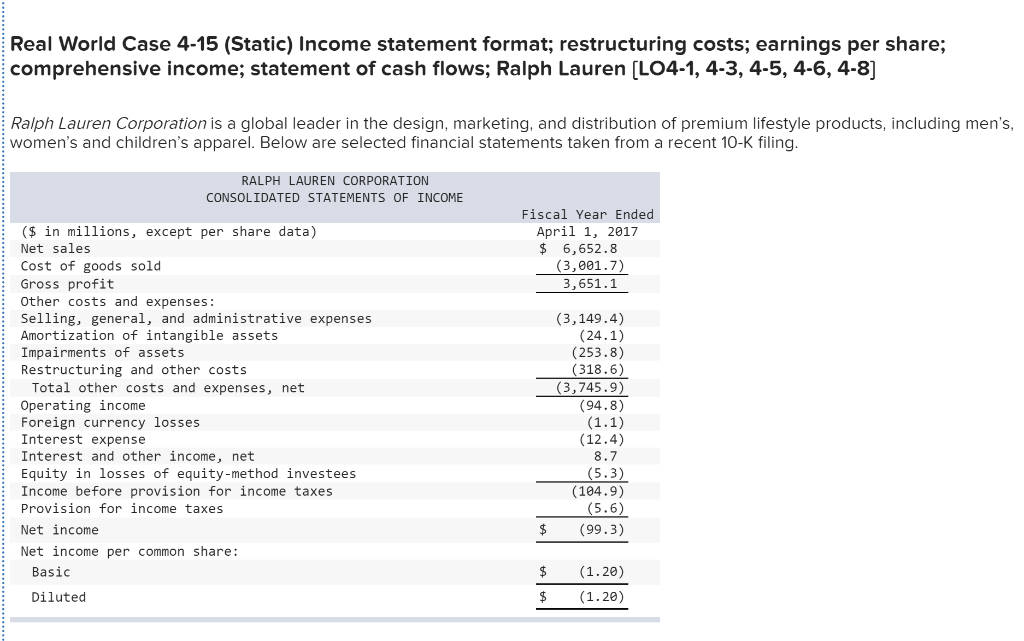

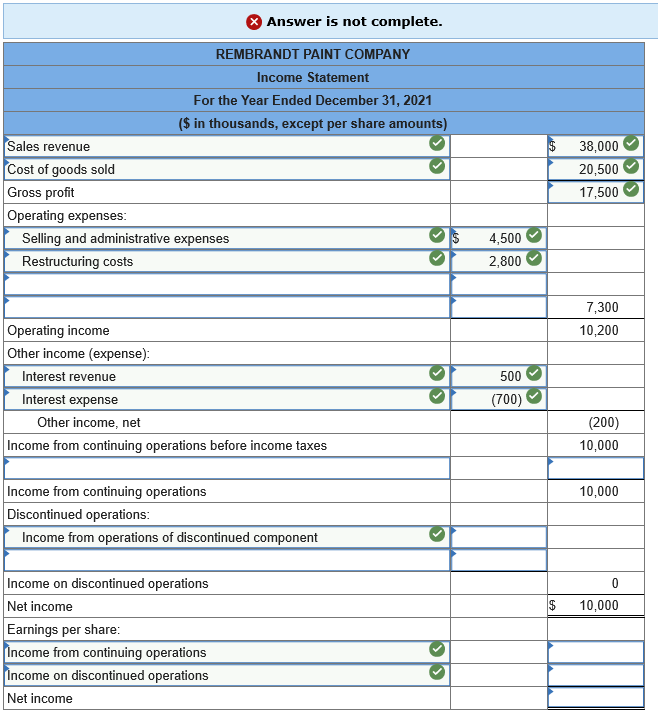

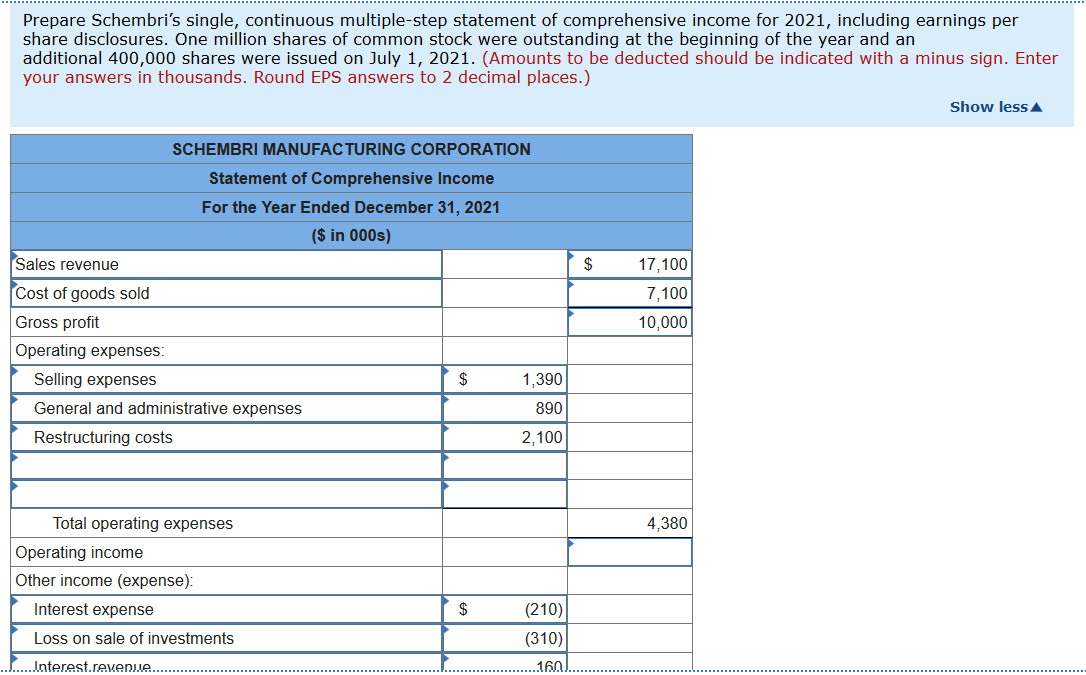

There are accounts such as revenue, cost of goods sold, operating expenses, interest expense, interest income and others on this statement.

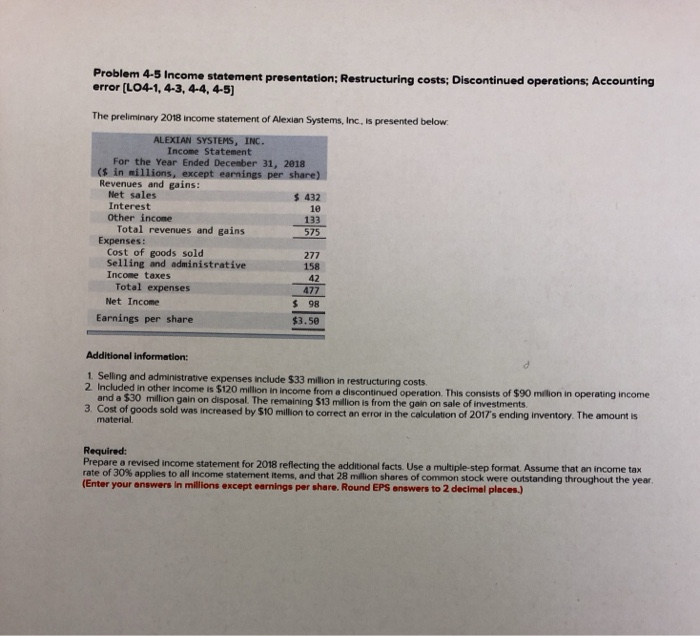

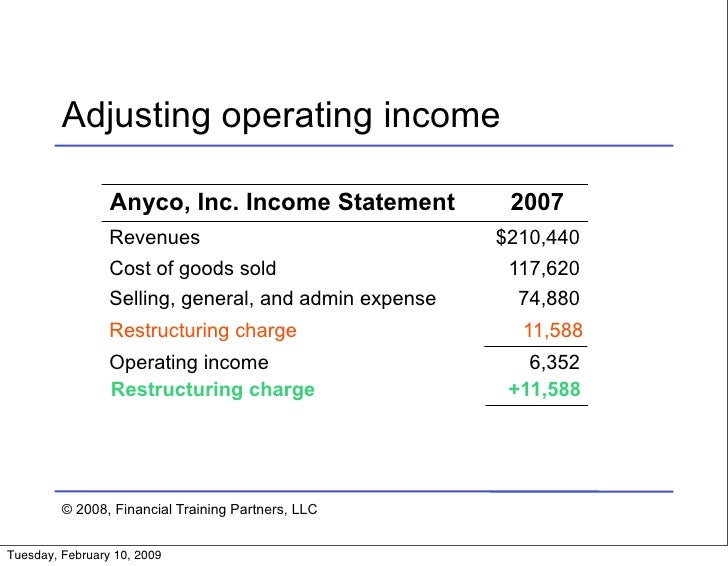

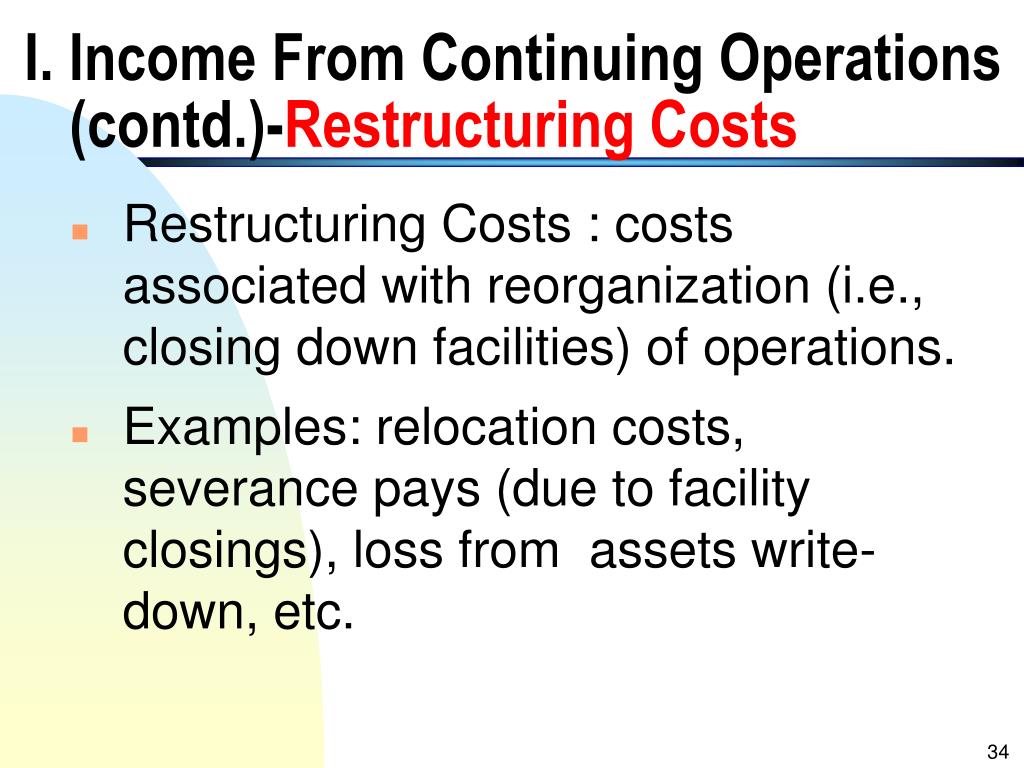

Restructuring costs on income statement. Classification of costs in the income statement. Registrants should refer to eitf issue no. Business changes by eileen rojas if your business has incurred a restructuring gain, accounting standards require a reporting of the gain on the period’s income statement.

The guidance to determine whether a restructuring of a debt investment represents an extinguishment or a modification varies between the two frameworks. (1) involuntary employee termination benefits pursuant.

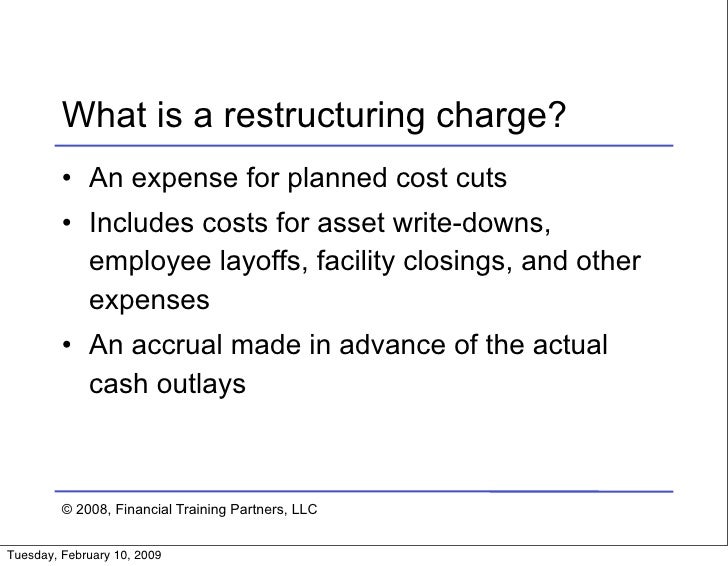

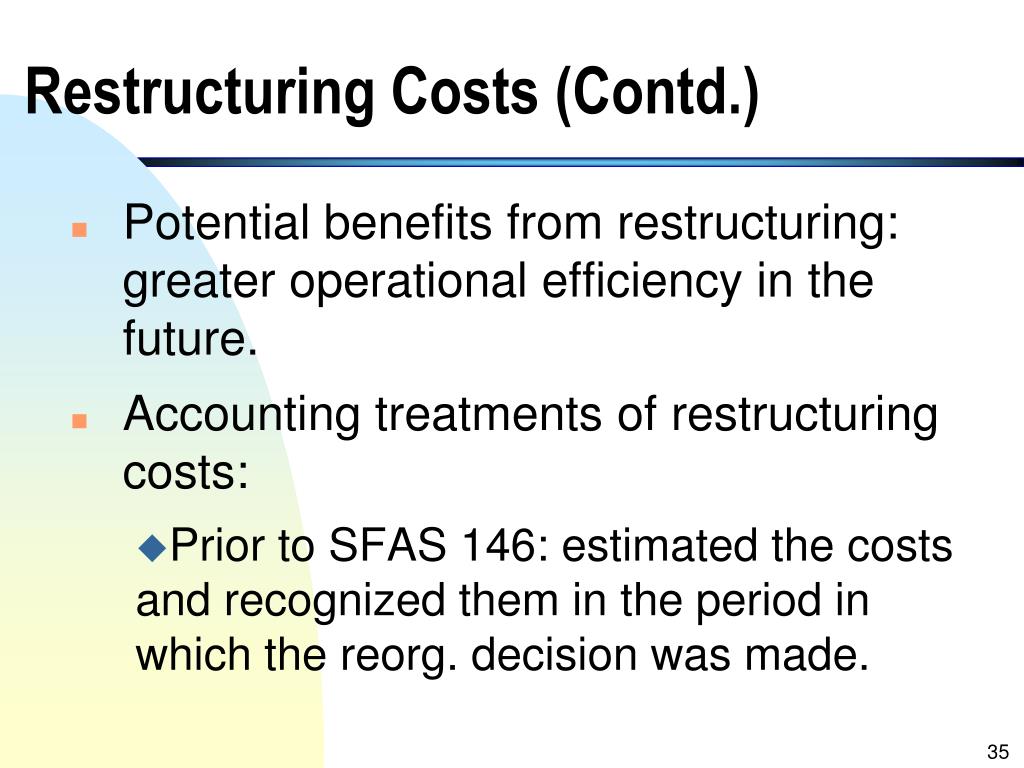

In the following year, it reduced its estimate of restructuring costs “due to the efficient. Restructuring expense is defined as the cost a company incurs during corporate restructuring. 4.1.10 restructuring costs publication date:

They are considered nonrecurring operating expenses and, if a. Management’s plans alone do not necessarily result in a restructuring provision in the financial statements. Chf 50 million) is reported in the.

Cisco reported second quarter revenue of $12.8 billion, net income on a generally accepted accounting principles (gaap) basis of $2.6 billion or $0.65 per share,. Restructuring expense is defined as the cost a company incurs during corporate restructuring. Both ifrs and us gaap require certain restructuring costs to be recognized in the financial statements before the restructuring actually occurs.

They are considered nonrecurring operating expenses and, if a company is undergoing restructuring, they show up as a line item on the income statement. Number of employees to be terminated.

A restructuring provision is recognised only when. 19 may 2023 gx financial reporting in the oil and gas industry major restructuring programmes often follow business combinations. Asc 205, presentation of financial statements, and asc 225, income statement, provide the baseline authoritative guidance for presentation of the income statement for all us.