Perfect Info About Pro Forma Financial Projections

Here are 5 tips to accurately build a pro forma statement for your small business.

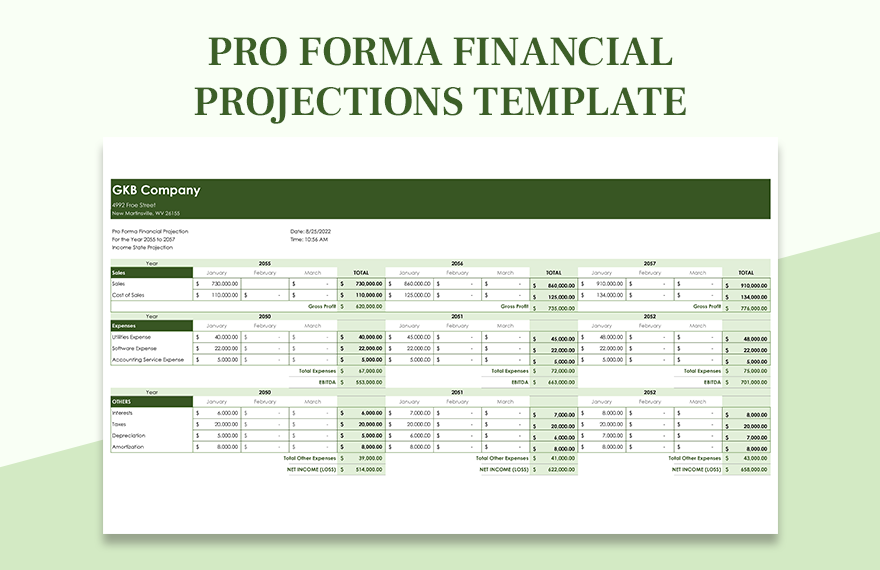

Pro forma financial projections. Sales and revenue projections based on market research. In fact, some would say they are synonymous. This involves guesswork and assumptions, as many unforeseen.

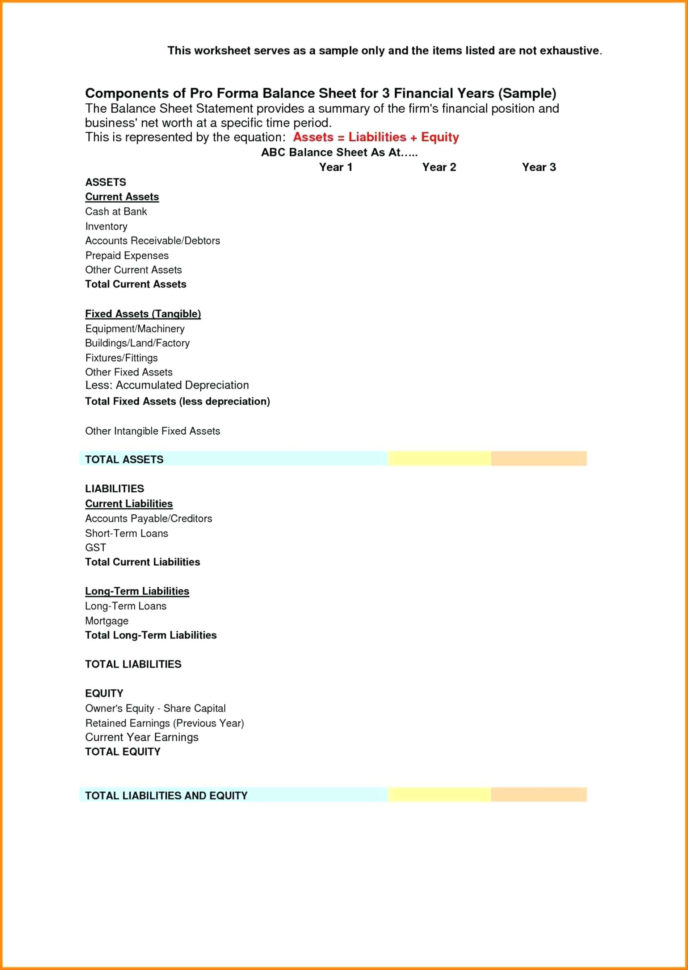

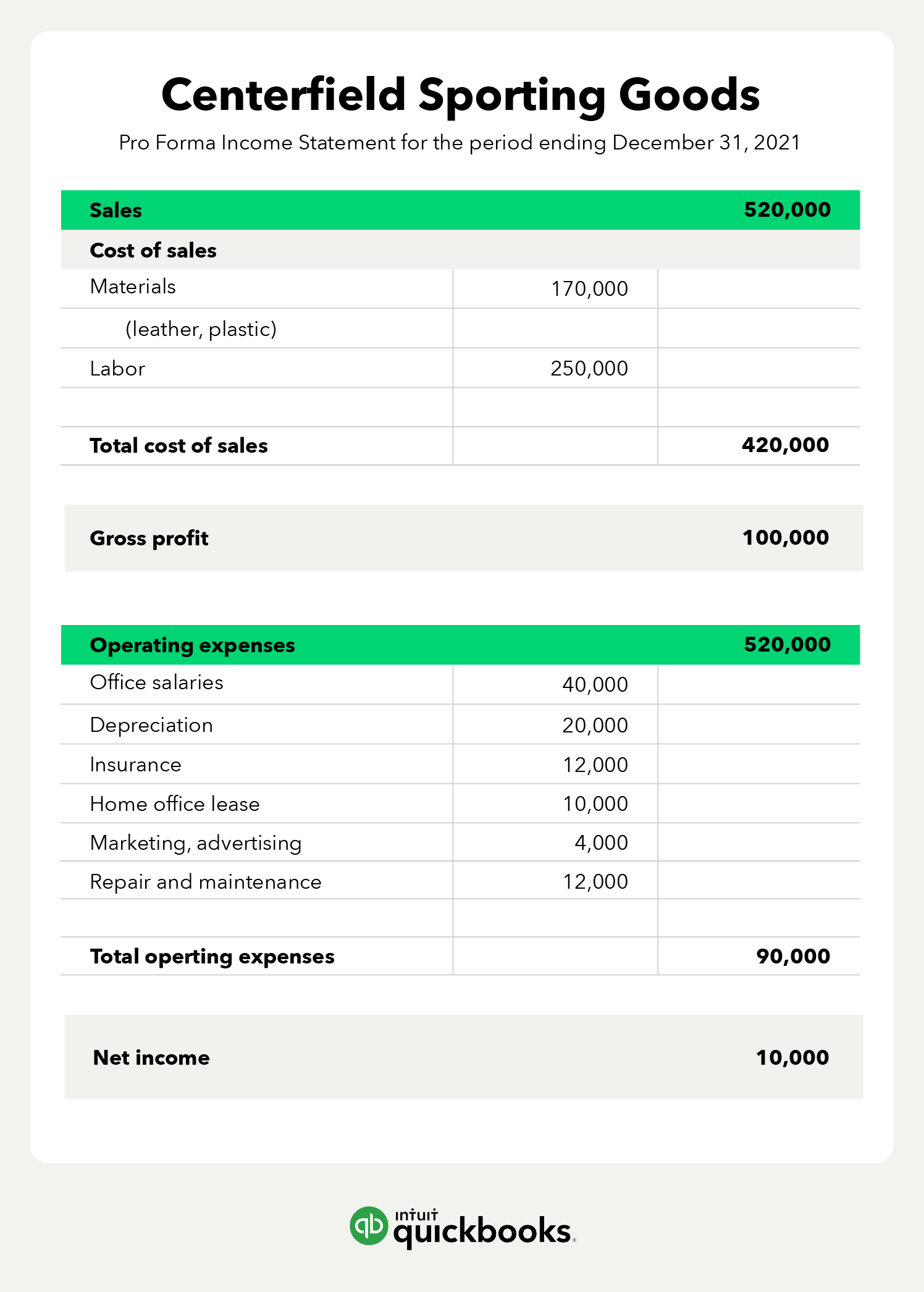

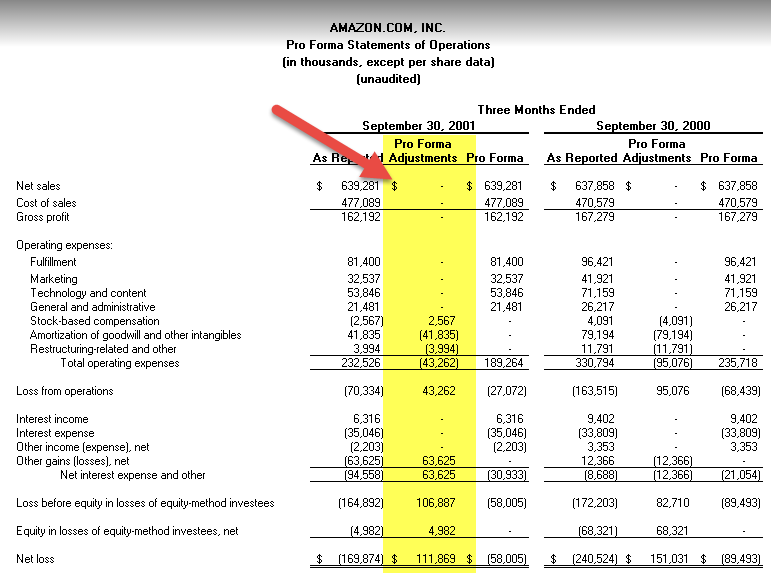

Key takeaways pro forma financial statements illustrate how a company’s financial position might change in. There are four main types of pro forma statements. Pro forma financial statements are an essential part of any company's strategic plan.

3 types of pro forma statements. October 5th, 2022 | by: Pro forma financial statements are a common type of forecast that can be useful in these situations.

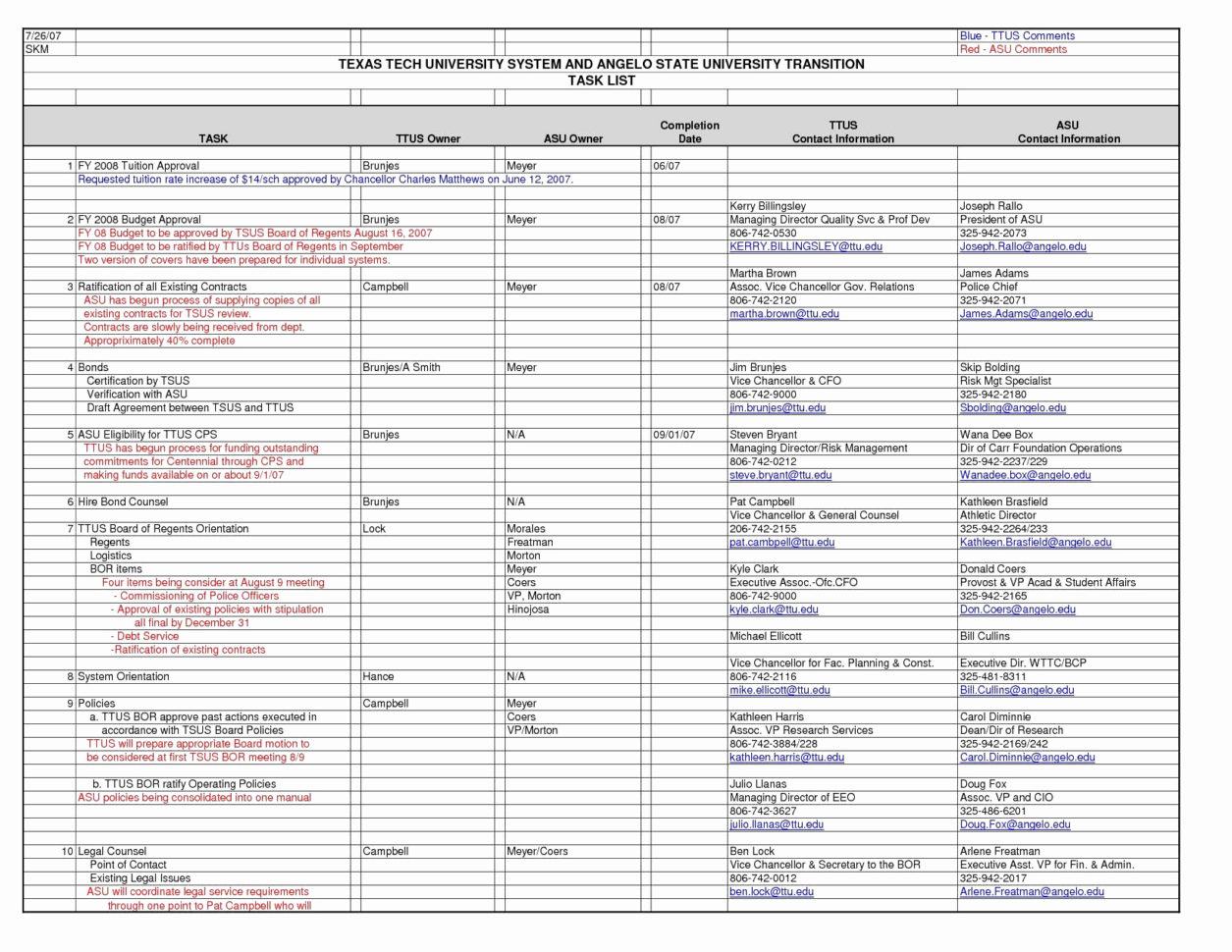

Every business needs to plan for the future. Pro forma financial statements are based on various assumptions and scenarios that a company believes might occur in the future or are contingent upon a certain event taking place. These statements are then presented to the management of the company and the investors and creditors.

In my opinion the key difference between the two is as follows: These projections aid entrepreneurs in making informed decisions and strategizing for. There are four main types of pro forma statements that you can use to manage your cash flows and the financial health of your business.

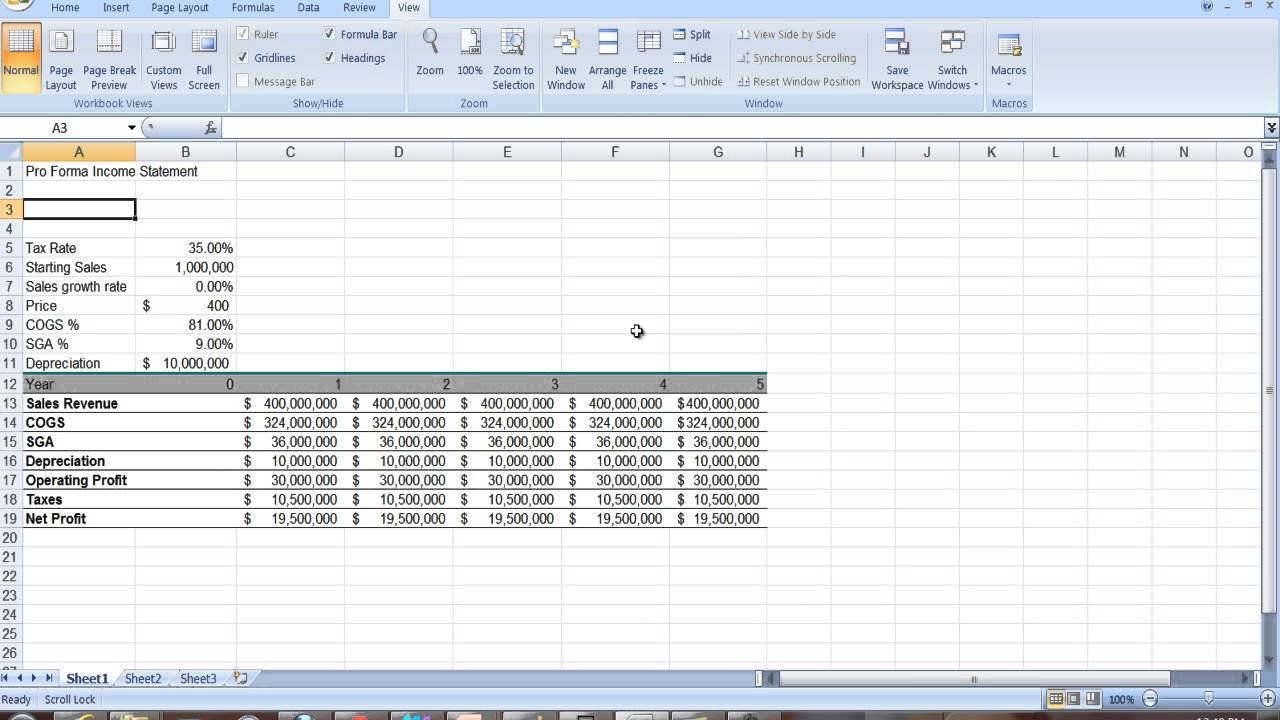

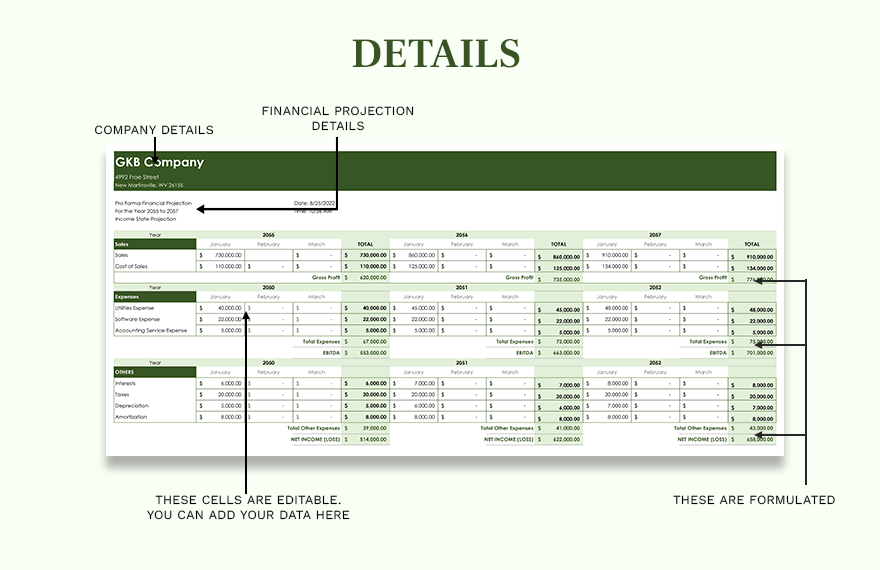

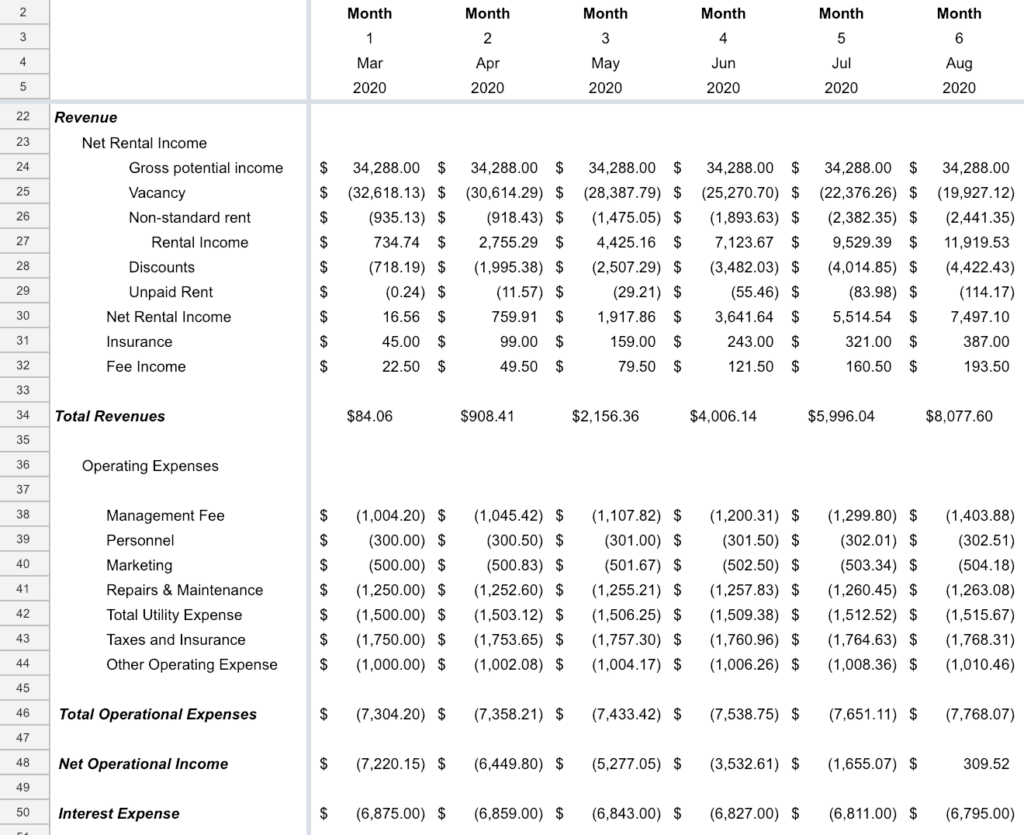

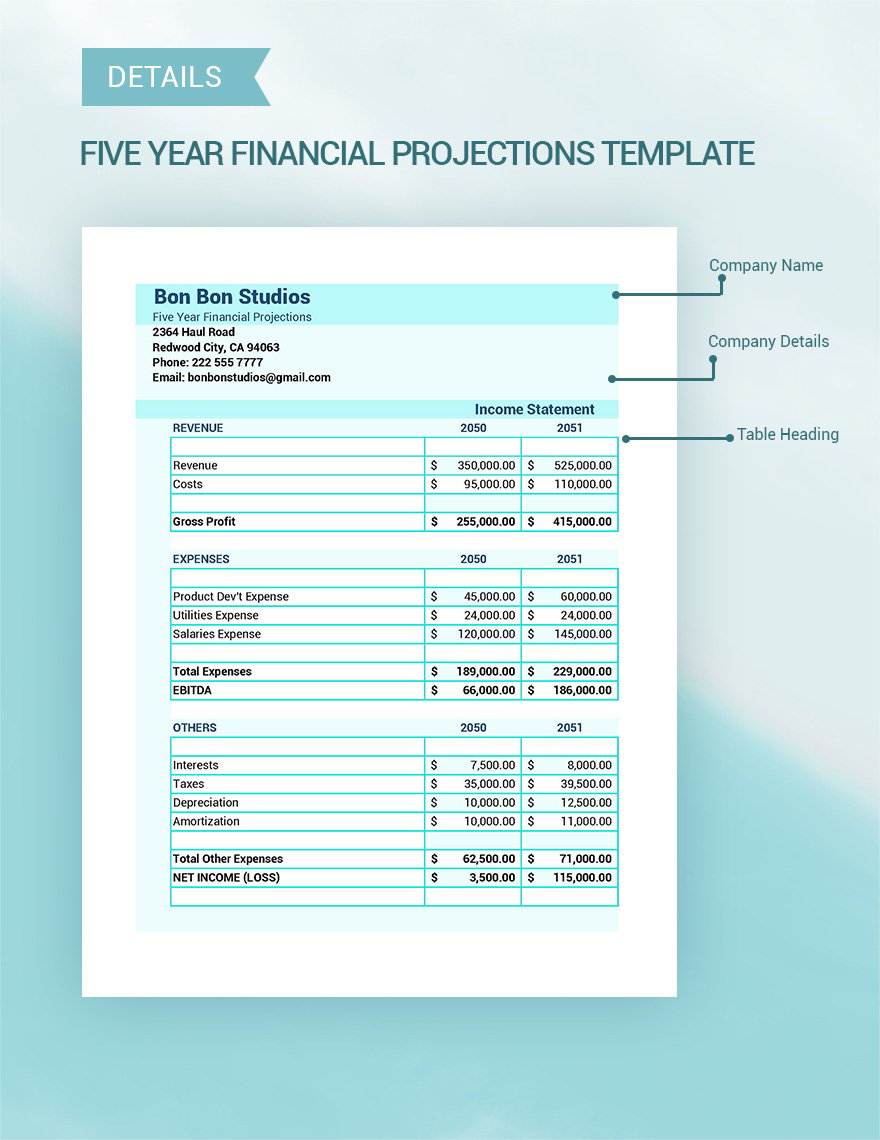

Generate financial projections for your startup's first year. While they all fall into the same categories—income statement, balance sheet, and cash flow statement—they differ based on the purpose of the financial forecast. Pro forma template for startups.

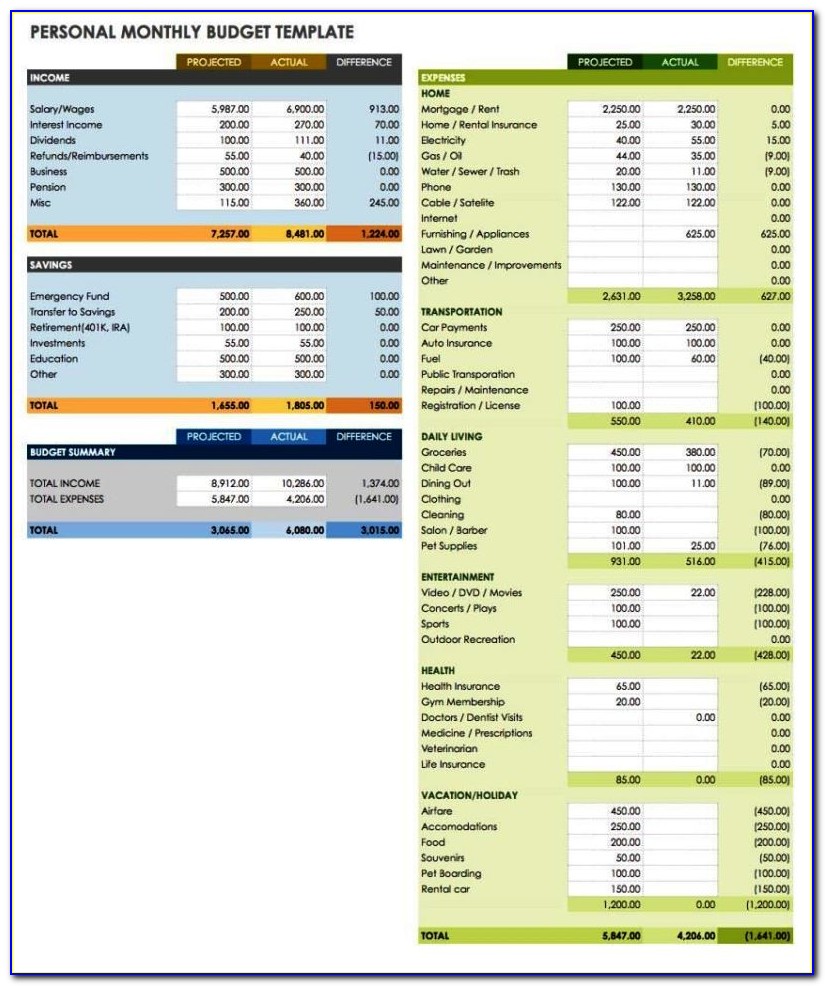

What does pro forma mean? Pro forma financial assumptions enable. Small business owners can use pro forma statements to draft forecasted financial statements, budgets, and quotes.

4 main types of pro forma statements. Last modified october 14th, 2022 by michael brown. Pro forma financial statements and financial projections are very similar.

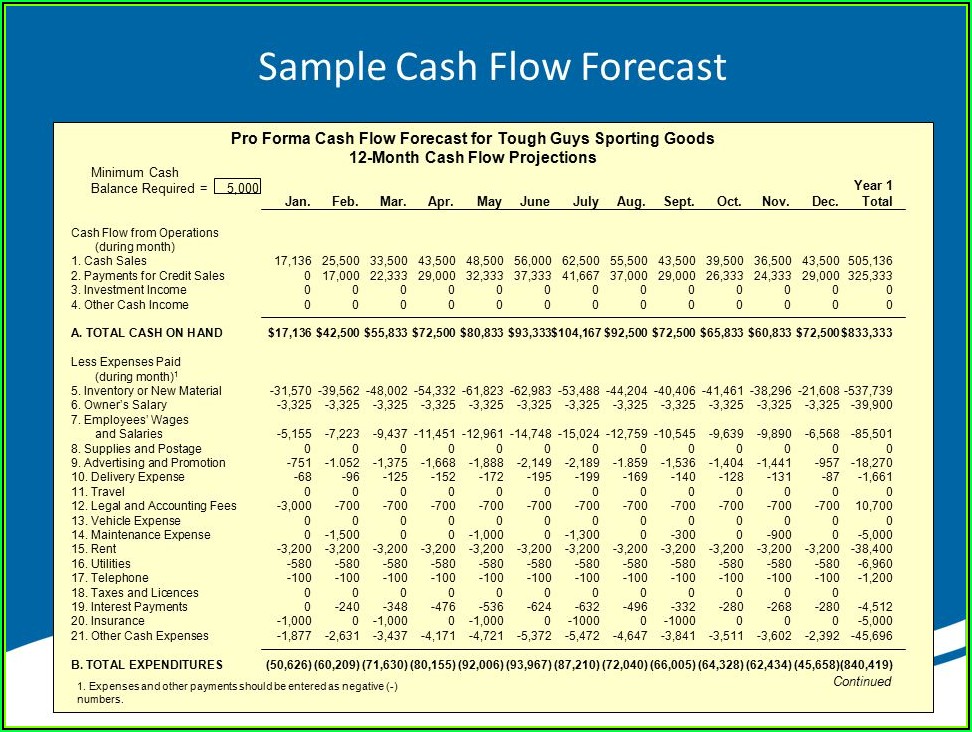

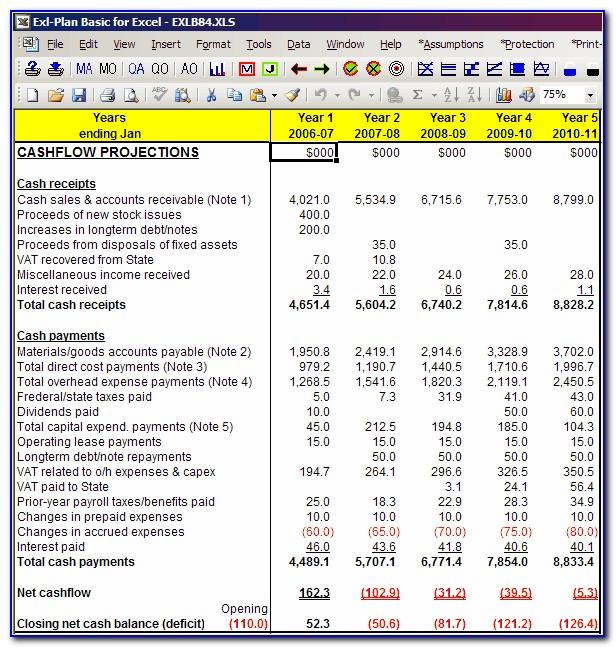

Learn about the components of pro forma statements like balance sheets, income statments and cash flow for a better. Compile all the financial and operational information into a development pro forma for the real estate project. Forecast revenue, expenses, and employee costs while automatically generating an income statement, balance sheet, and cash flow pro forma.

In this article, we hope to guide you through the process to make it less daunting to figure out on your own. They encompass market trends, pricing strategies, production costs, and growth rates. Pro forma is latin for “as a matter of” or “for the sake of form.” it is used primarily in reference to the presentation of information in a formal way, assuming or forecasting pieces of information that may be unavailable.