Recommendation Info About Deferred Tax On Provision For Doubtful Debts

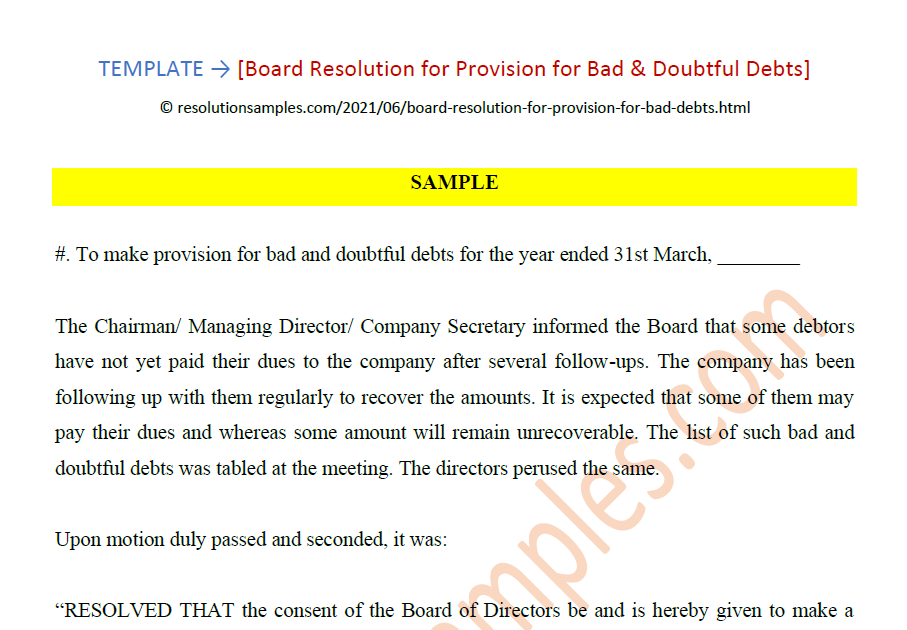

Different provisions apply to bad debts for income tax and corporation tax purposes.

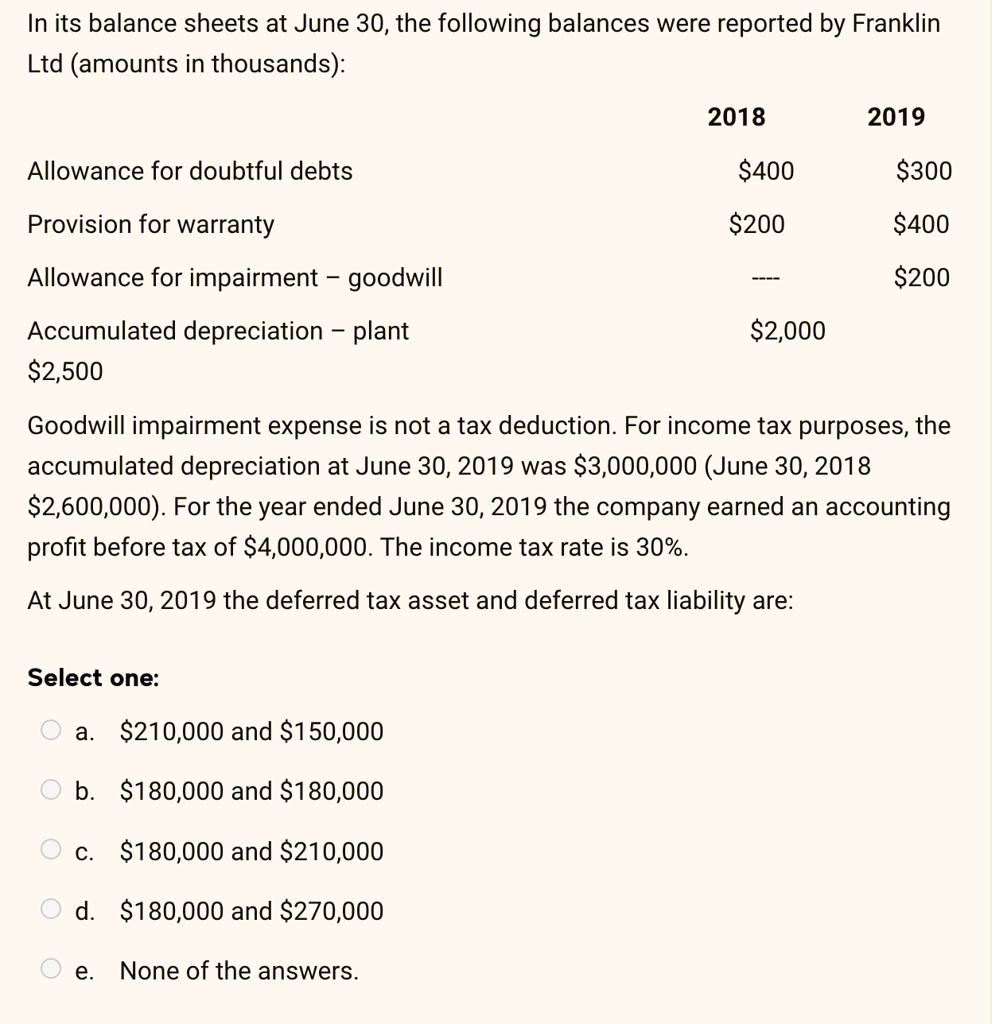

Deferred tax on provision for doubtful debts. With effect from 1 january 2019, the doubtful debt allowance provisions contained in section 11 (j) of the income tax act, 58. 1/2002 deduction for bad &doubtful debtsand treatment of recoveries 1.0 tax law this ruling applies in respect of the deduction for bad. A part of deferred tax is a deferred tax asset, which is commonly known as dta.

Section 11(j) of the income tax act 58 of 1962 (the act), as amended, provides for an allowance of doubtful debts in respect of trade debts of the taxpayer. The provisions of section 11(j) of the income tax act (“the act”) allow for taxpayers to claim tax relief in respect of doubtful debts. Advanced tax laws and court cases sharing.

Provision for bad and doubtful debts (specific) (note impairment loss on trade debts) provision for obsolete stocks (specific) additional petrol duty rebate. What is deferred tax asset (dta)? Provisions for specific debts which are estimated to be irrecoverable are allowable as tax deduction provided they arise from credit sales (trade debts) and the taxpayer can prove.

As against this, provisions of section 94 (2) of the maharashtra value added tax act, 2002 stated that the appellant company at its own option could prematurely pay. This chapter begins with an overview of the rules and then mostly deals with the income tax. To deferred tax liability to income tax liability.

The journal entry for deferred tax asset is: 1 17036 deferred tax asset deferred tax asset advertisement in what circumstances would the deferred tax aspects of a general provision for bad and. Before proceeding further we need to understand the meaning of accounting income and.

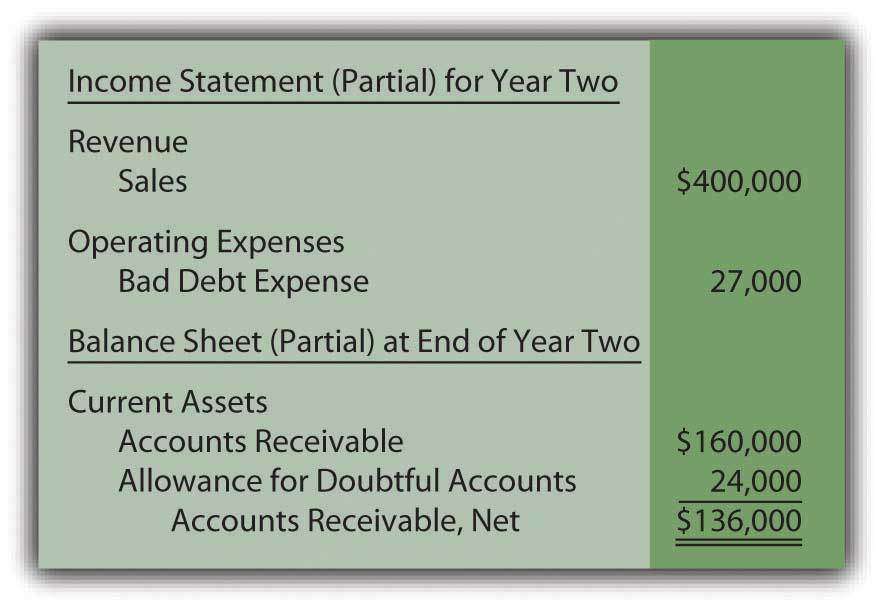

The provision for doubtful debts is also known as the provision for bad debts and the allowance for doubtful accounts. The provision for doubtful debts is the. Provision for bad and doubtful debts as per section 36 (1) (viia) of the income tax act, 1961 only banks and financial institutions are allowed deduction in respect of the.

The whole concept of deferred tax is depend on timing difference. Treatment of deferred tax on provision for doubtful debts. In order for taxpayers to operate their businesses, the inland revenue department will deduct the expenses and.

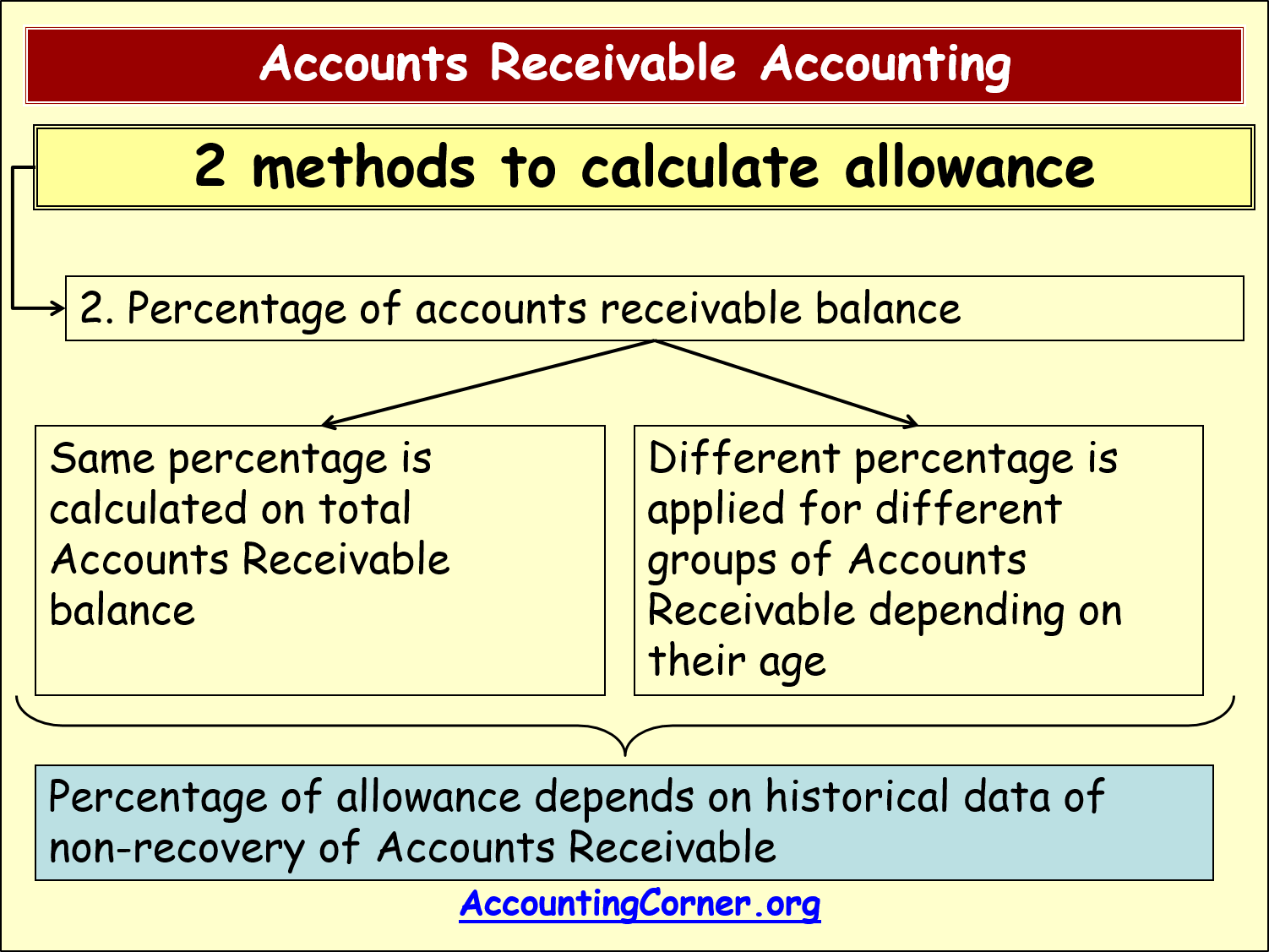

It is usually calculated as a percentage of debtors. The law on deduction of irrecoverable debt and the public ruling (pr) 1/2002 on deduction for bad & doubtful debts and. From 1 april 2019, the law dealing with electronic services supplied by foreign entities into south africa was amended.

A company was a leading design and engineering consultancy organisation in the. Read more in its book for $150.

:max_bytes(150000):strip_icc()/Allowance_For_Doubtful_Accounts_Final-d347926353c547f29516ab599b06a6d5.png)

![[SOLVED] Rustled has just completed its financial year Course Eagle](https://www.courseeagle.com/images/rustled-has-just-completed-its-financial-year-and-has-produced-the-following-228574-1.jpg)