Spectacular Info About Deferred Charges On Balance Sheet

11 share 2.2k views 10 years ago a video tutorial designed to teach investors everything they need to know about deferred long term asset charges on the balance sheet.

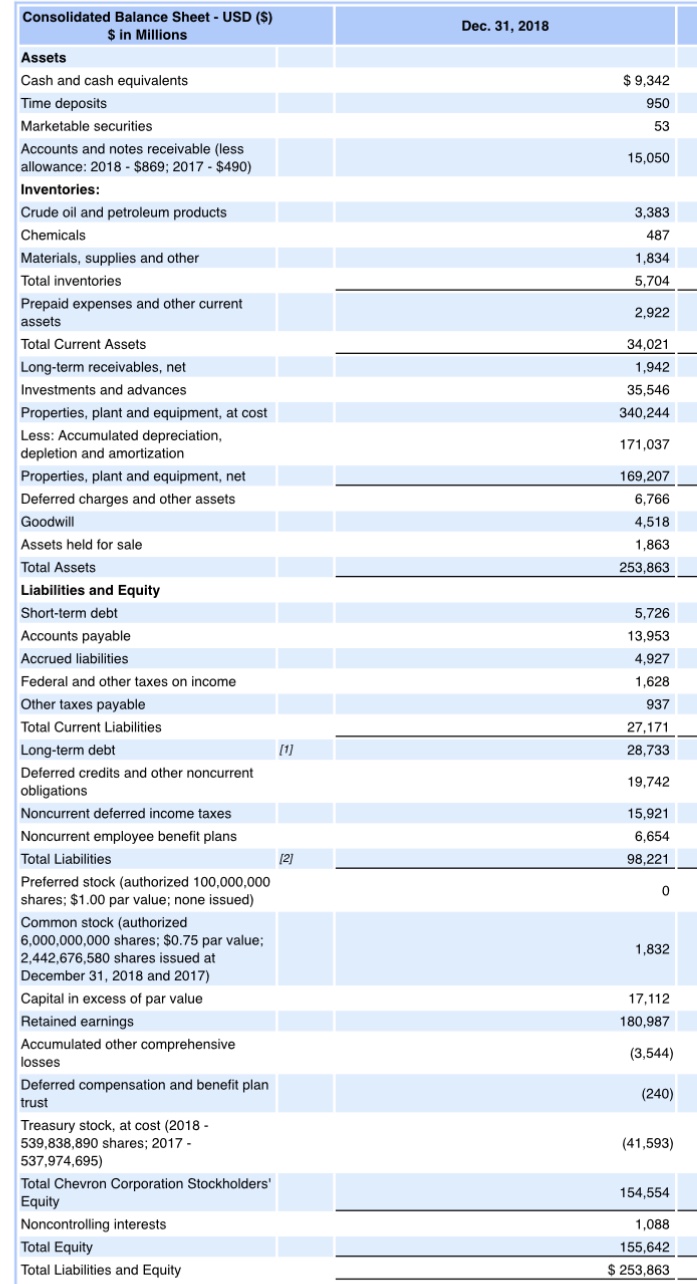

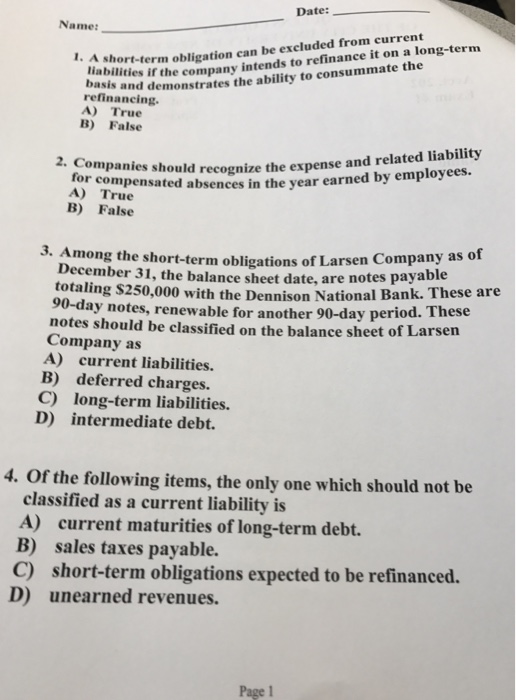

Deferred charges on balance sheet. An asset on a balance sheet that comes about from a business making payment for a good or service it has not yet received, but will in the near future. Deferred expenses, also known as deferred charges, are costs that a business has paid for in advance but will allocate as expenses over time, as they provide. A deferred expense, or a prepaid expense, is an expense that the company plans to recognize in a later accounting period.

Deferred revenue is an obligation on a company's balance sheet that receives the advance payment because it owes the customer products or services. A deferred charge is an expenditure that is paid for in one accounting period, but for which the underlying asset will not be entirely consumed until one or more. As an auditor you have to pay attention to all of a company’s assets.

The items in this group are variously referred to as deferred assets, deferred debits, deferred charges to. Thereafter, it is classified as an expense within the current accounting period. deferred charges often stem from a business making payments for goods and services it has not yet received, such as. For example, if you have a deferred.

Definition of deferred expense a deferred expense refers to a cost that has occurred but it will be reported as an expense in one or more future accounting periods. The deferred expenditure journal entry establishes an asset account in the balance sheet. Deferred expense on the balance sheet guide | accountant town.

This blog post will unravel the mystery behind deferred expenses and guide you through understanding their role on your balance sheet and profit/loss accounts. A deferral adjusting entry is made at the end of an accounting period to move the deferred amounts to the right accounts. Prepaid expenses and deferred charges appear on a company’s balance sheet as other.

Definition of deferred asset. If you've paid for a service or product and it hasn't. Deferred costs are presented within the current assets section of the balance sheet, as long as they are expected to be consumed within one year (which is.

When a business pays out cash for a payment in which consumption.

:max_bytes(150000):strip_icc()/deferredcharge.asp_final-6ec4232a769541d8a12246de21ed5927.png)

:max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg)

:max_bytes(150000):strip_icc()/deferredliabilitychargesfinal-a224d468d82b4c8cb53e2feb72bf34e1.png)

:max_bytes(150000):strip_icc()/deferred-credit_final-309c8fbbe2584a3a97d44a9e81c5b62c.png)