Casual Tips About Business Plan And Financial Projections

The boe expects output will grow by just 0.25% in 2024 and 0.75% in 2025, much weaker than.

Business plan and financial projections. This aligns with godongwana’s medium term budget policy statement (mtbps) that was tabled in november 2023. Avoiding the typical mistakes small businesses make with financial planning so, you’ve decided to write a business plan? Creating an accurate, adaptive financial projection for your business offers many benefits, including:

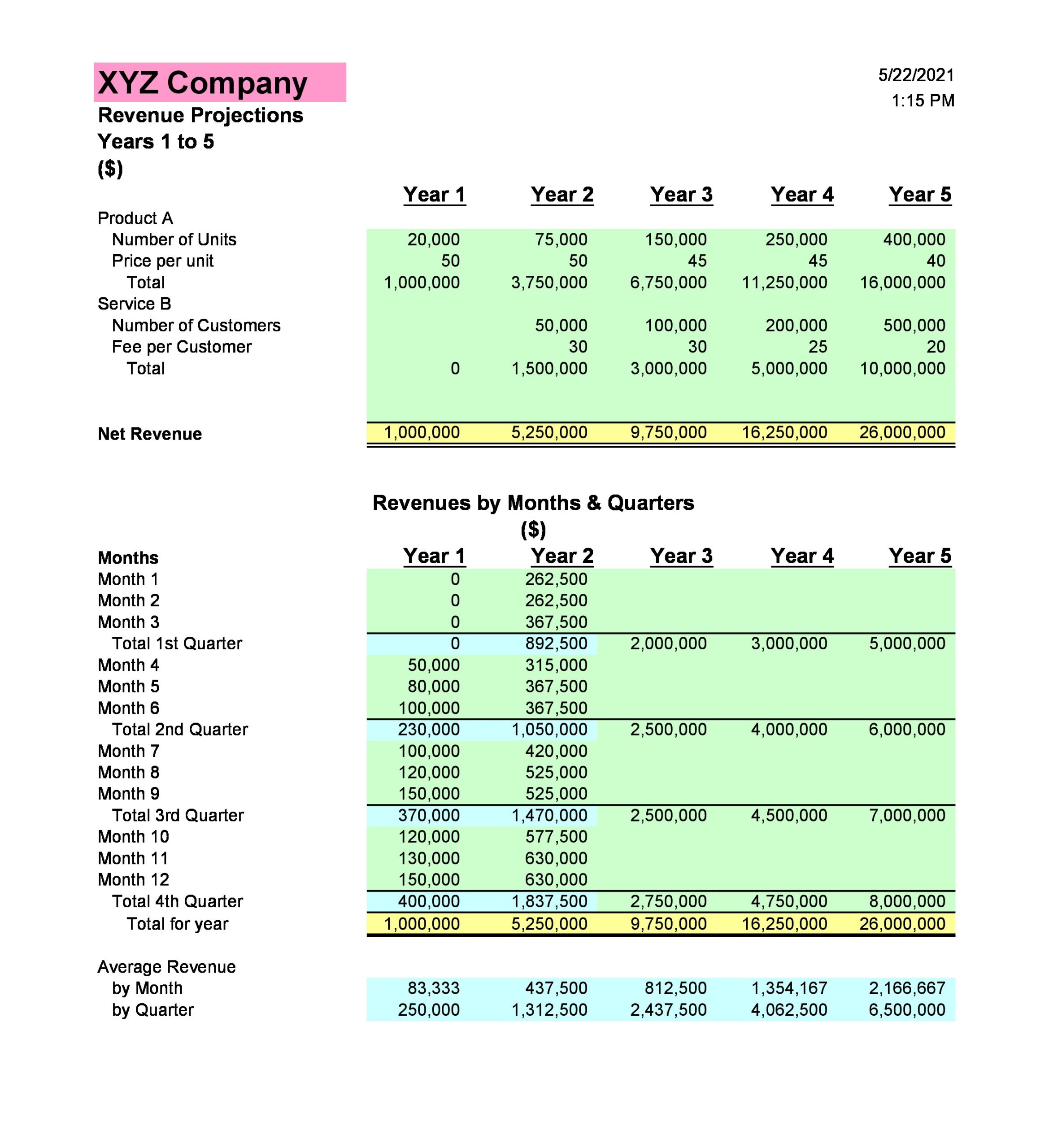

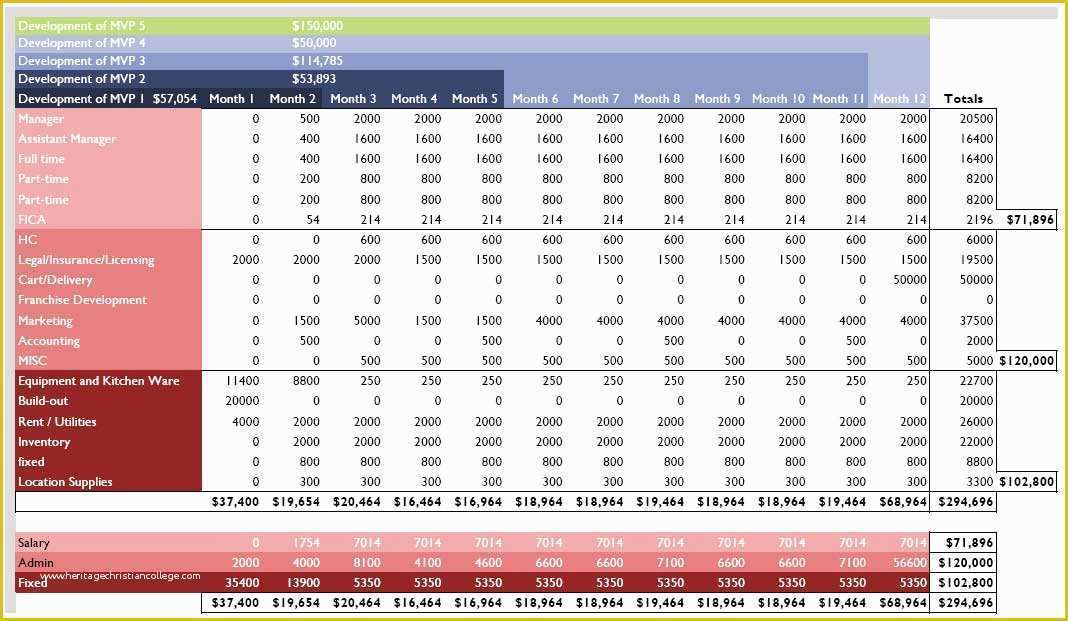

He highlighted a relatively new economic model that has proven to be more timely than the. Create a system to grow consistently. It's a good practice to provide quarterly or monthly projections for the first year and annual projections for the four years after that.

How to succeed in an era of volatility. Download our ultimate business plan template here The projections give investors and lenders an idea of how well your business is likely to do in the future.

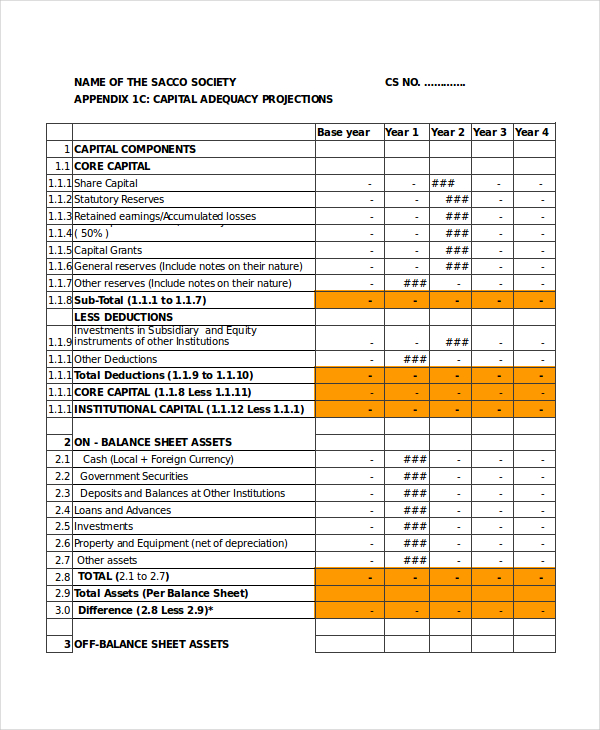

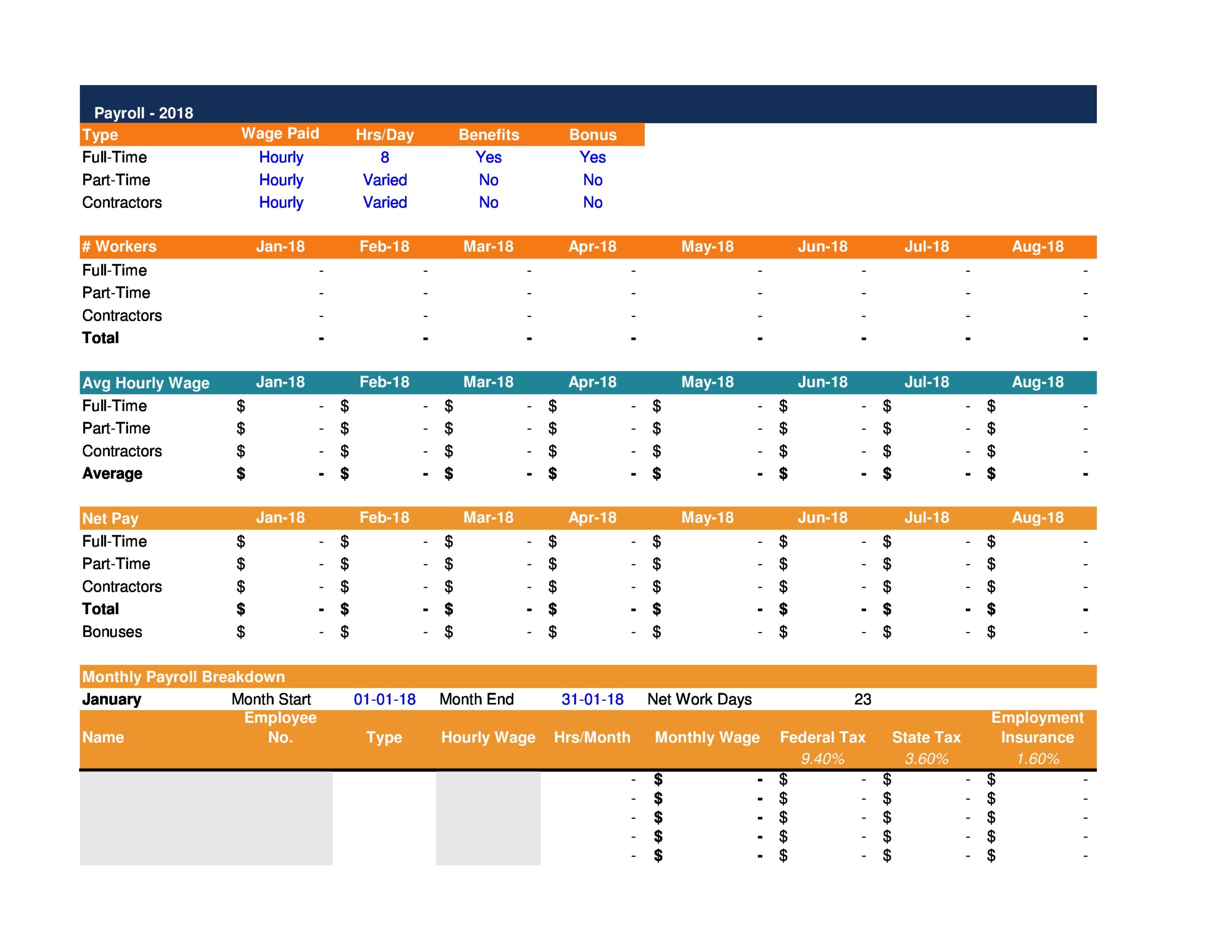

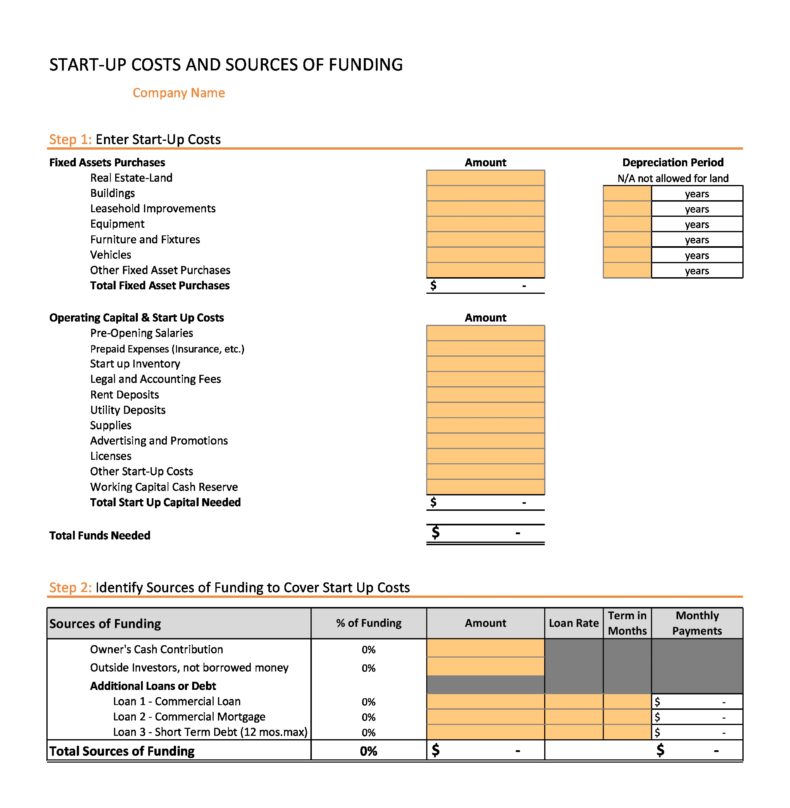

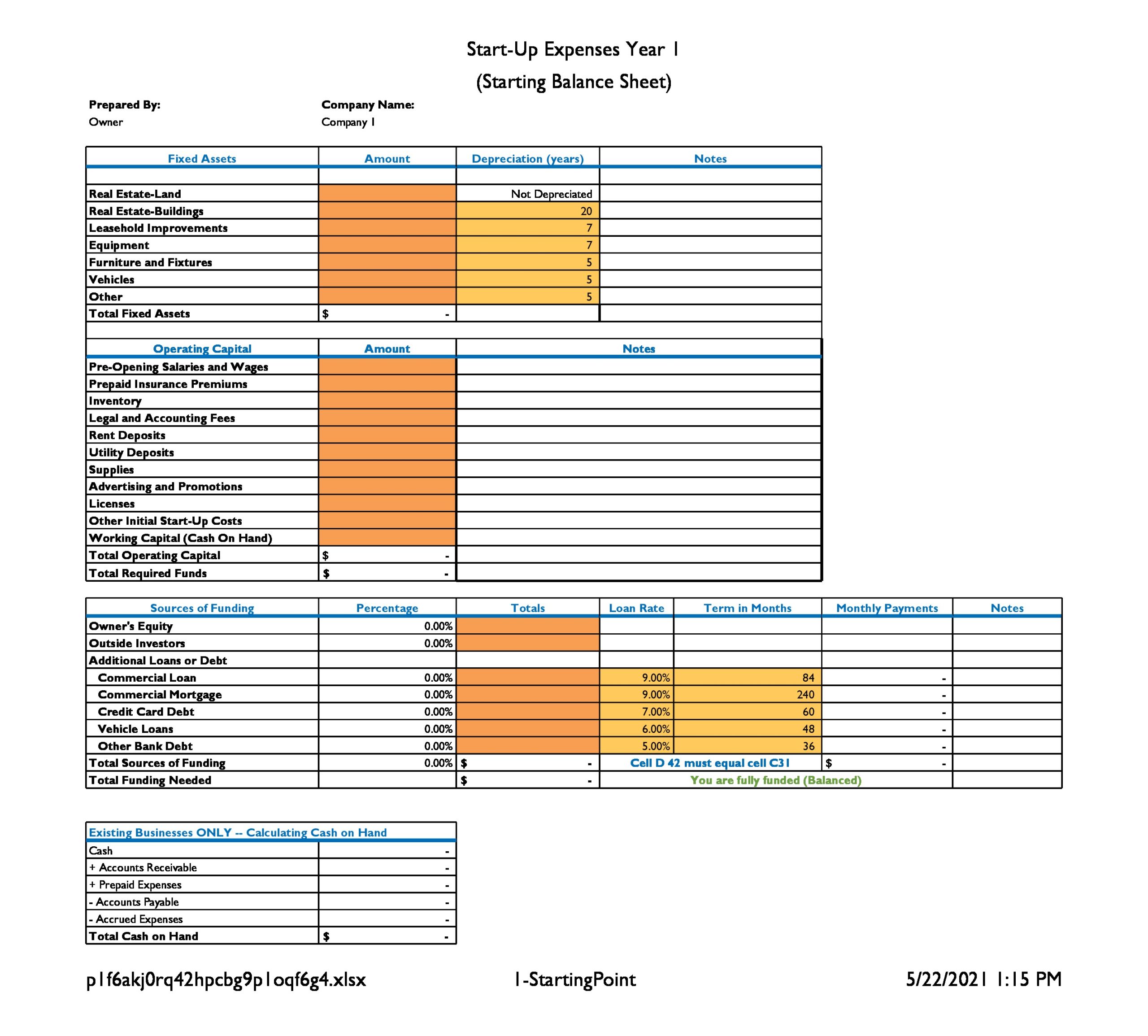

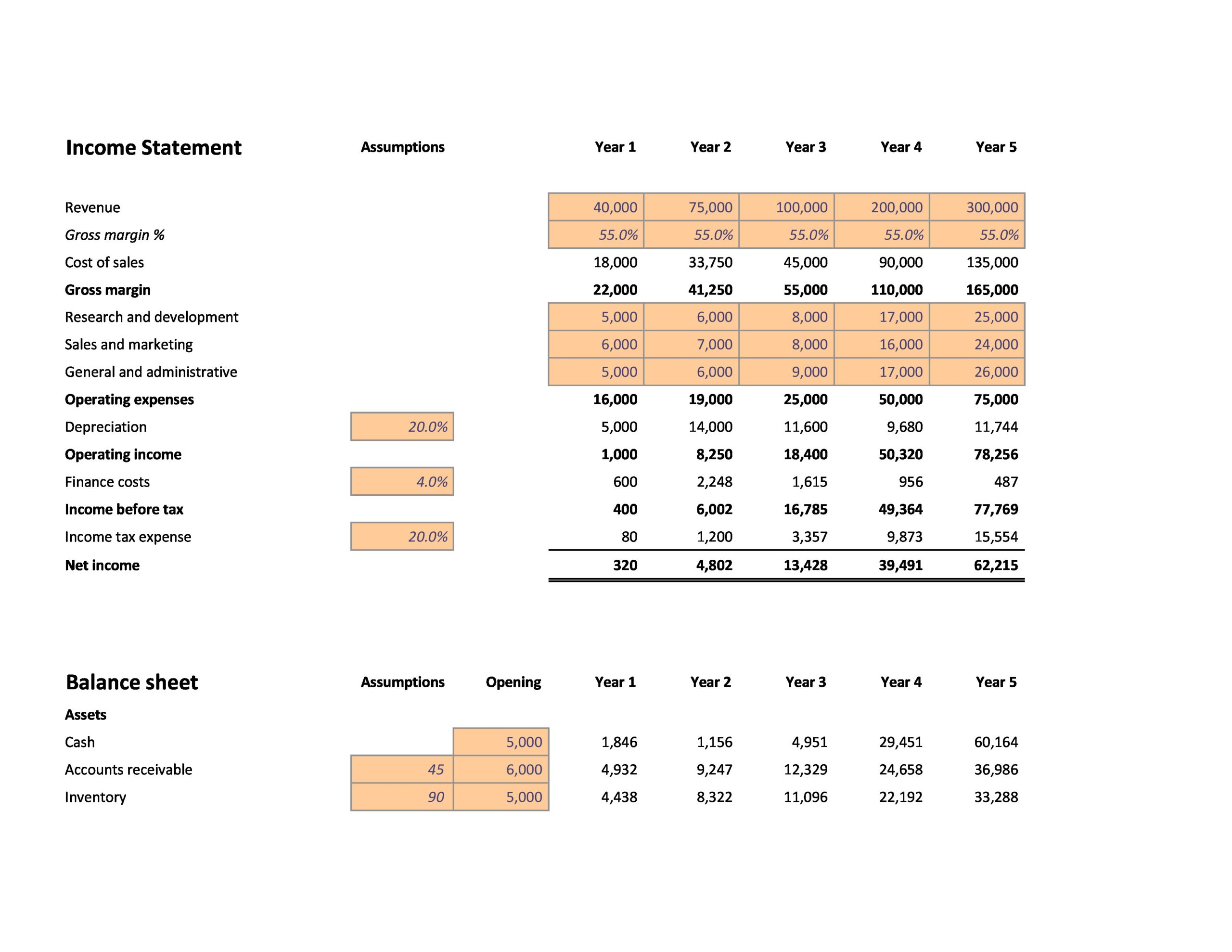

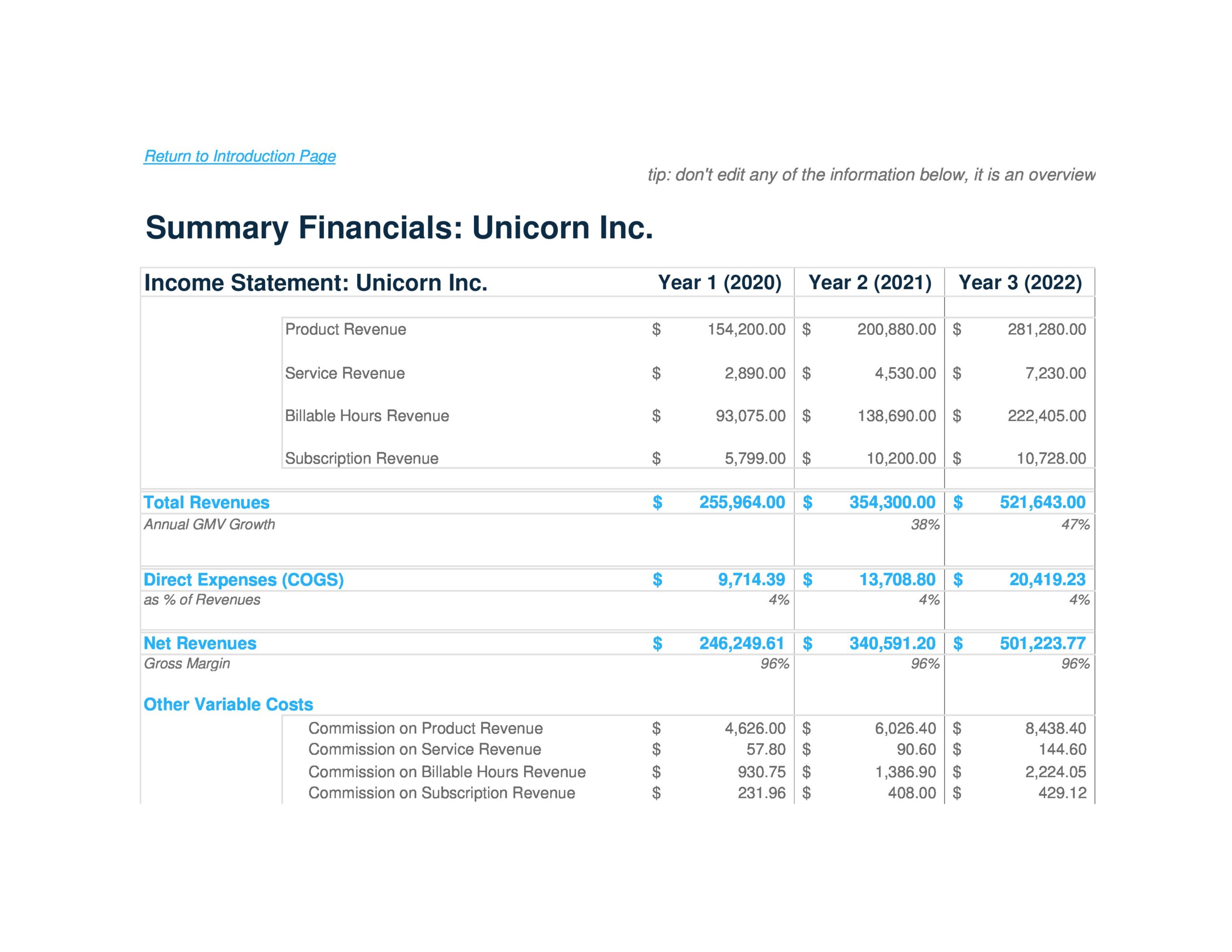

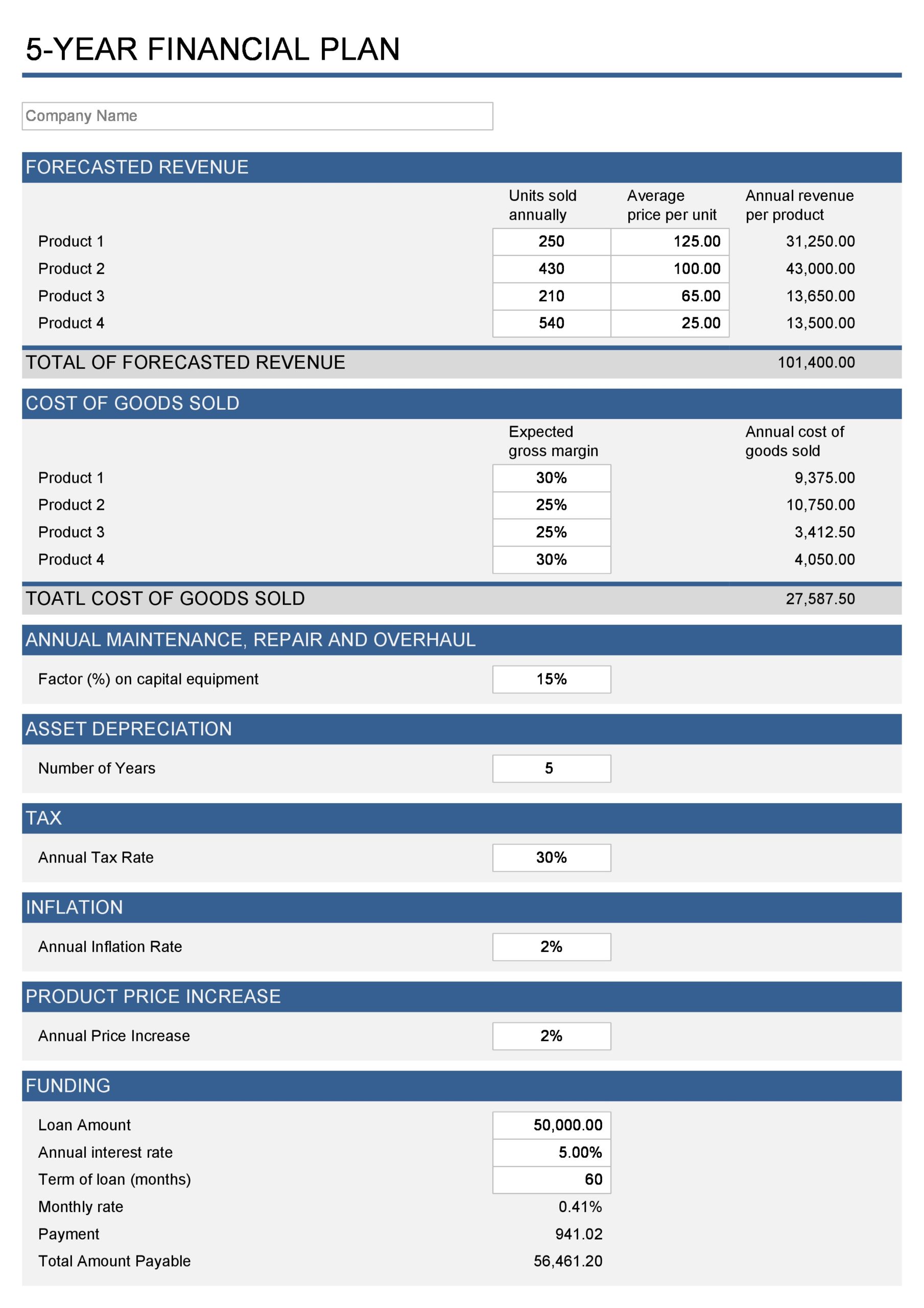

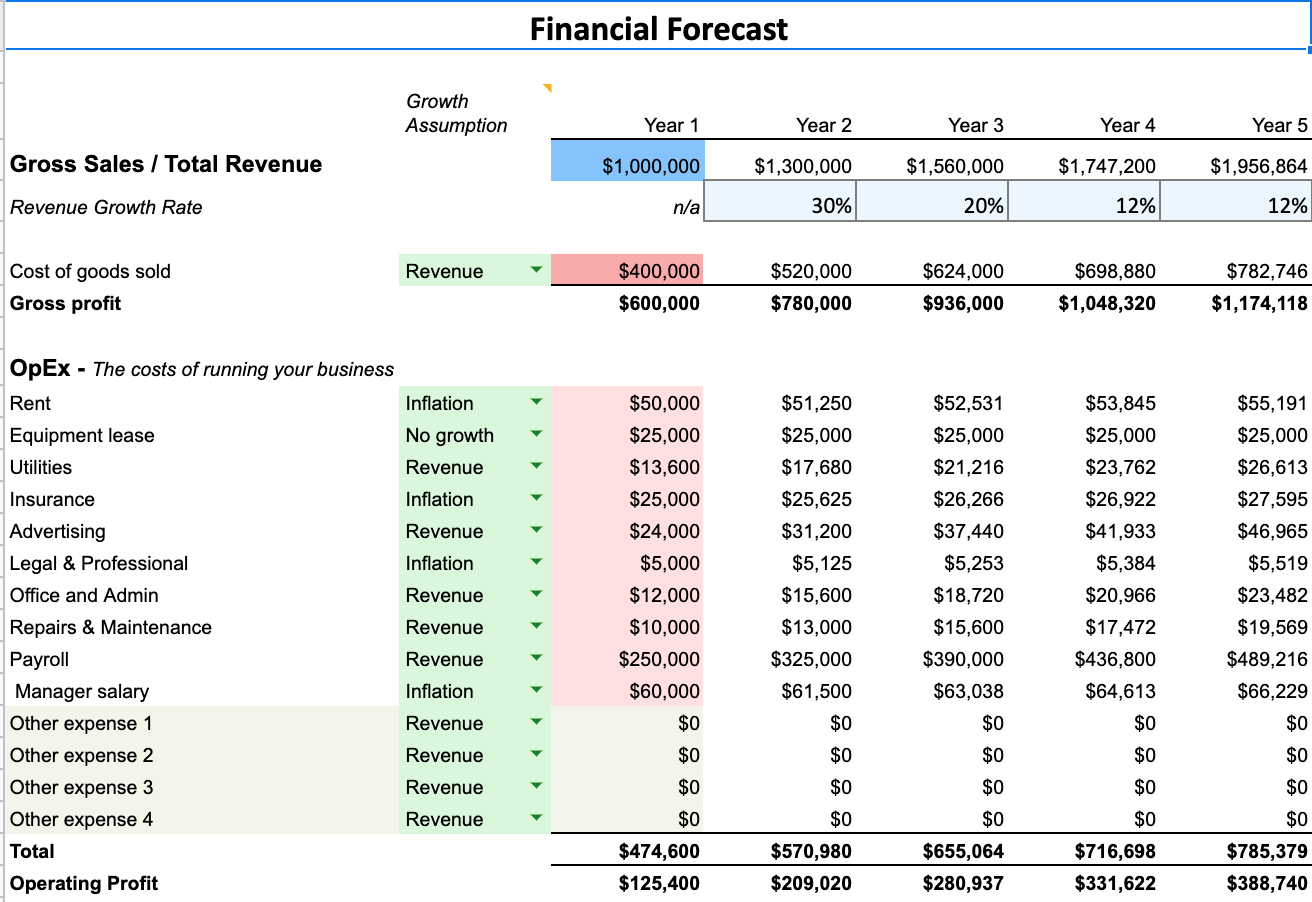

This financial plan projections template comes as a set of pro forma templates designed to help startups. Sales projections, expense projections, balance sheet projections, income statement projections, and cash flow projections It’s an important document that will help you outline your business goals, strategies, and tactics.

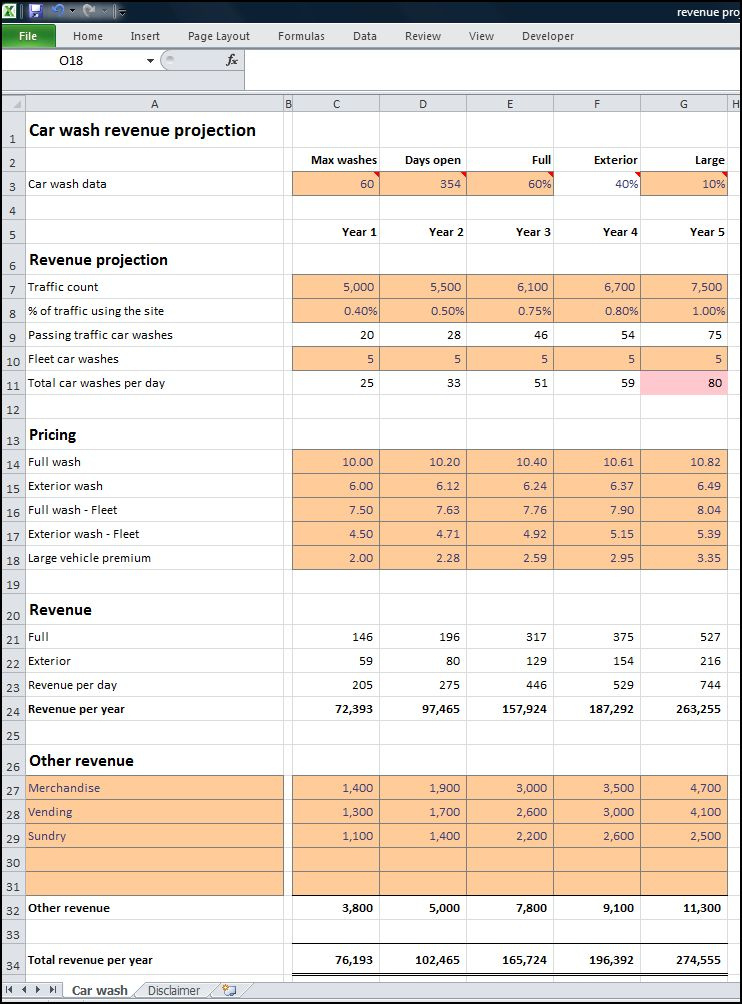

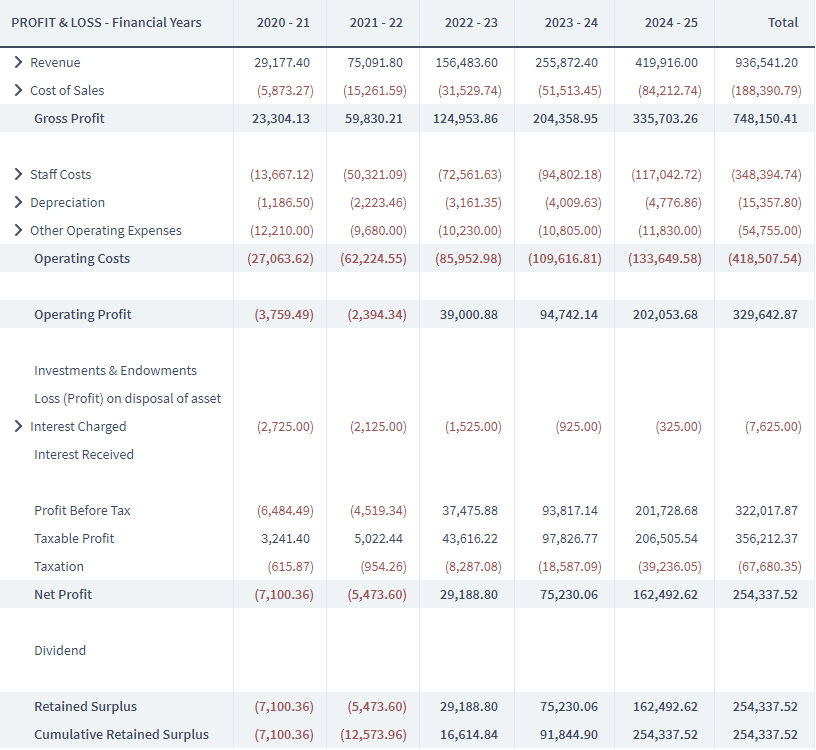

This article will show you how to make financial projections for a startup business plan or an existing business. Business plan financial projections are a company’s estimates, or forecasts, of its financial performance at some point in the future. The critical elements of a financial projection are the income statements, cash flow and balance sheet.

Financial projections include both income statements and balance sheets. The financial section of your business plan should include a sales forecast , expenses budget , cash flow statement , balance sheet , and a profit and loss statement. Growth—in revenues and profits—is the yardstick by.

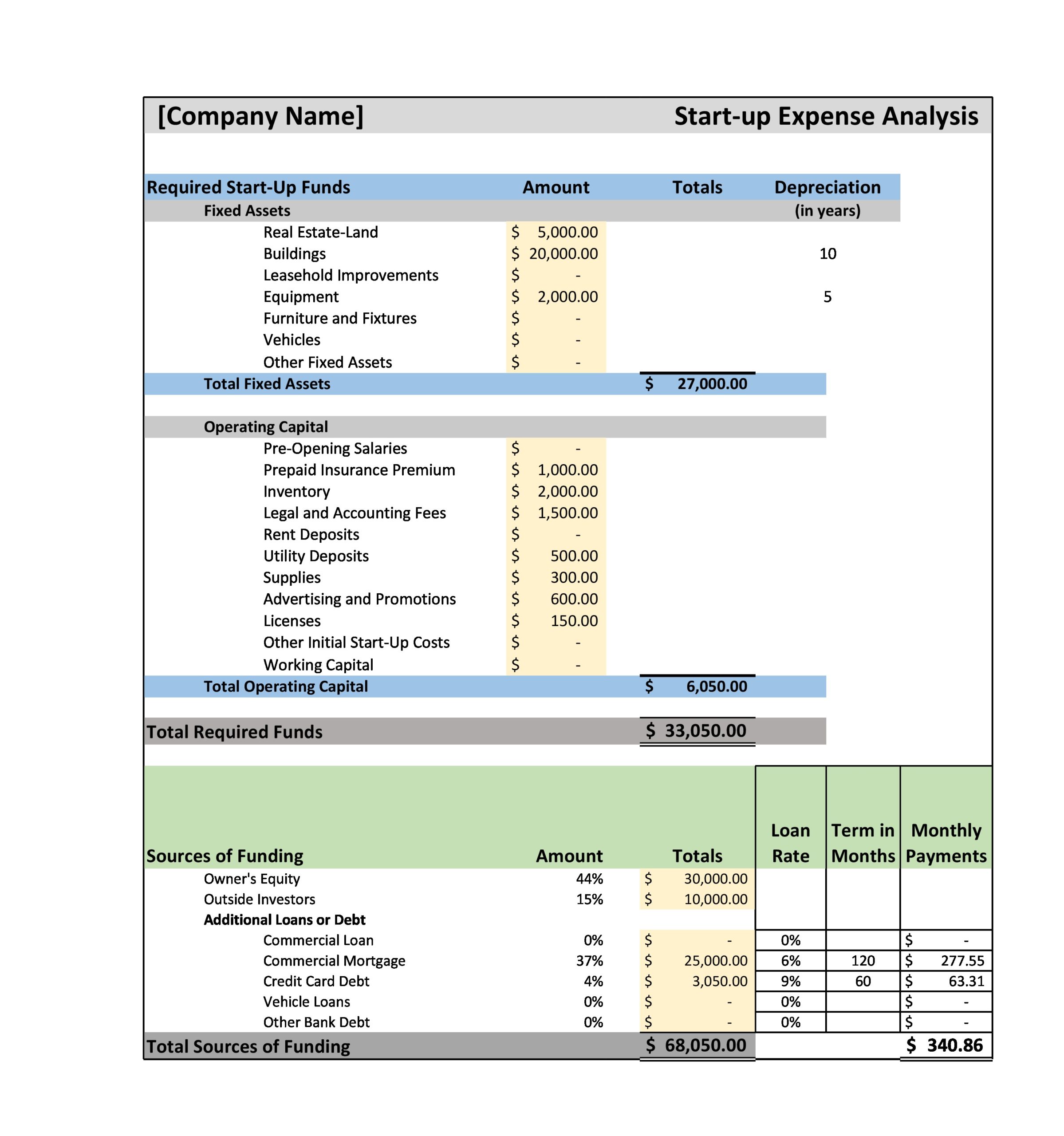

Frequently used as a way to attract future investors, financial projections are also an important component when preparing a business plan for a new business or creating a strategic. If you’re applying for a business loan with a bank or other financial institution, they’ll likely want to see financial projections in your business plan. If you’re starting a business, financial projections help you plan your startup budget, assess when you expect the business to become profitable, and set benchmarks for achieving financial goals.

Identify financial requirements and objectives. A financial projection is an estimate of future revenue, expenses and profits for a business. The plan projections template is free, easy to set up and customize, and loaded with great features.

In fact, financial projections are also equally as important to existing businesses in order to set new and recurring goals, monitor progress and act as a warning system when things fall off track. For existing businesses, draw on historical data to detail how your company expects metrics like revenue, expenses, profit, and cash flow to change over time. Everything you need to create perfect business financial projections for startups.

Creating financial projections can break down into 5 simple steps: You will learn what to include in your financial projections, why they are essential, and how you can create them effectively. Financial projections are a valuable tool for entrepreneurs as they offer insight into a business's ability to generate profit, increase cash flow, and repay debts.