Fun Info About Cash Paid For Interest Flow Statement

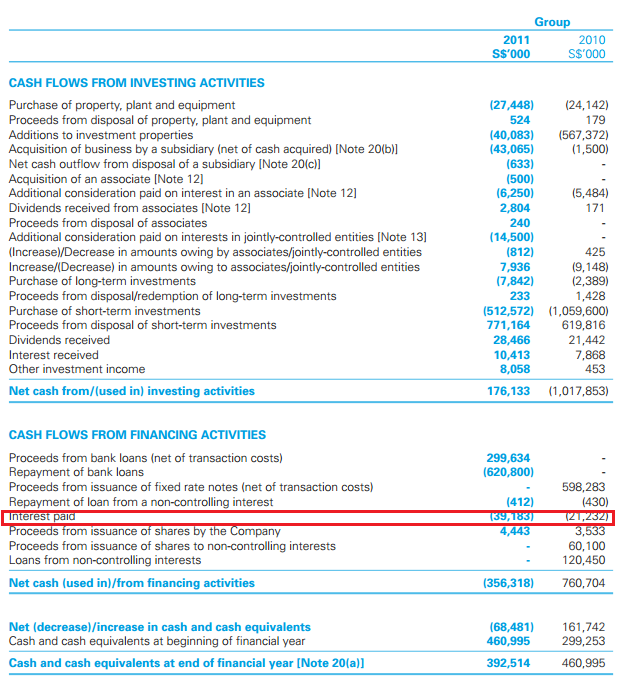

Others treat interest received as investing cash flow and interest paid as a financing cash flow.

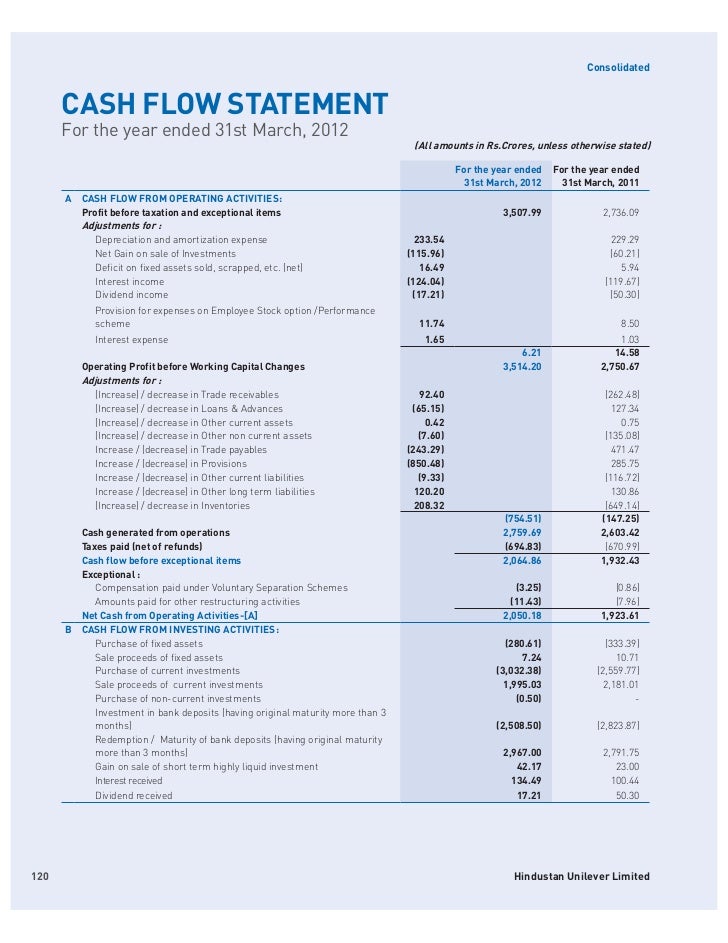

Cash paid for interest cash flow statement. The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of cash flows, which classifies cash flows during the period according to operating, investing, and financing activities. The interest expense reported on your company’s income statement reduces the amount of cash recorded on the related cash flow statement. The interest is payable on the bonds, convertible bonds, bank loans, and lines of credit.

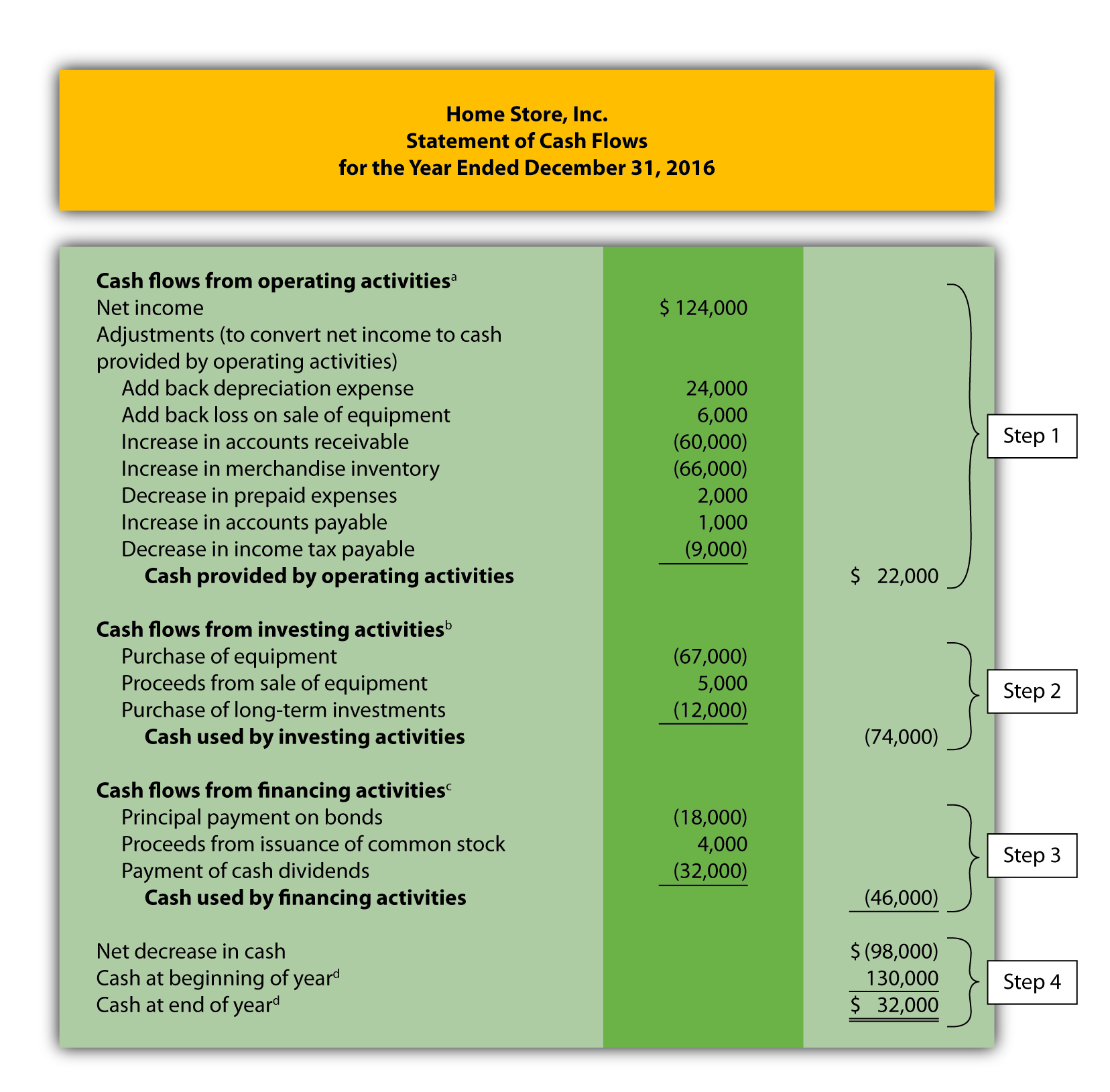

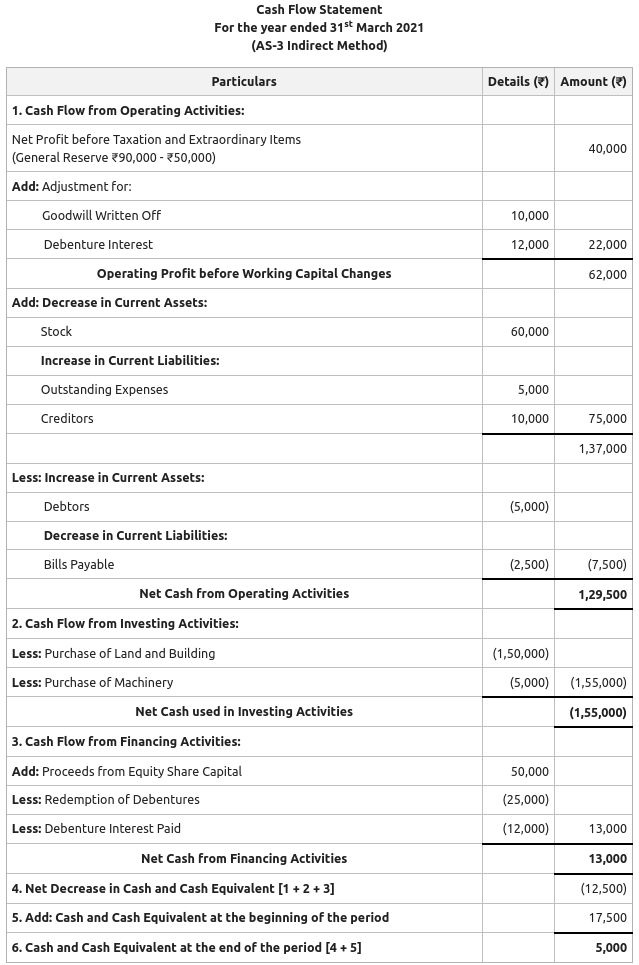

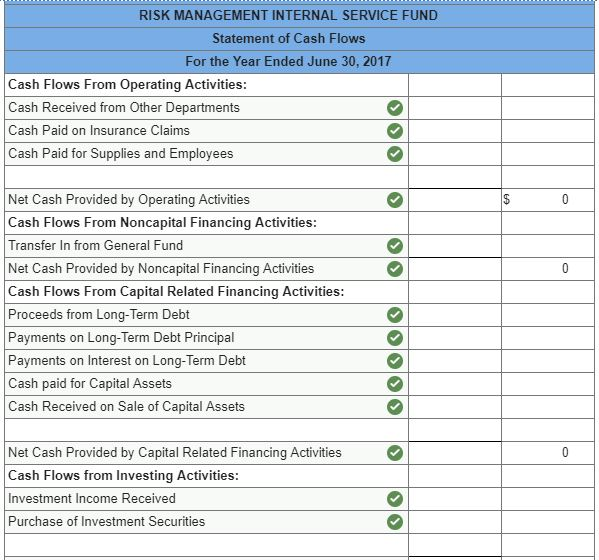

Remember in this cashflow analysis, it is extremely important that we keep track of our signs. The method used is the choice of the company. The statement of cash flows reports cash inflows and/or cash outflows in each of three sections:

Differences exist between the two frameworks for the presentation of the statement of cash flows that could result in differences in the actual amount shown as cash and cash equivalents in the statement of cash flows (including the presentation of restricted cash) as well as changes to each of the operating, investing, and financing activity sec. Often used interchangeably with the term, “statement of cash flows,” the cash flow statement tracks the real inflows and outflows of cash from operating, investing and financing activities. If a company's business operations can generate positive cash flow, negative overall cash flow.

A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company. But don’t expect him to dig into his pocket anytime soon. Cash paid on interest will be present under.

Under ifrs, there are two allowable ways of presenting interest expense or income in the cash flow statement. The cash flow statement provides important information about a company’s cash receipts and cash payments during an accounting period as well as information about a company’s operating, investing, and financing activities. Presented below is the balance sheet and income statement for watson ltd.

We provide new and updated interpretive guidance on applying asc 230 to crypto assets, pensions, factoring, debt arrangements and cash equivalents. For the interest expenses your business paid during a. The cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or scf.

The total interest expense of the company is. The cfs highlights a company's cash management, including how well it generates. The final section of the statement reconciles the net change in cash flows of the three activities, with the opening and closing cash and cash equivalents balances taken from the balance sheet.

Free cash flow is the remaining cash a company has after accounting for operating expenses and capital expenditures. The interest paid on a note payable is reported in the section of the cash flow statement entitled cash flows from operating activities. This value can be found on the income statement of the same accounting period.

7.2.2 cash inflows and outflows. Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. Cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities.

The statement of cash flows analyses changes in cash and cash equivalents during a period. Trump claimed under oath last year that he was sitting on more than $400 million in cash, but between justice engoron’s $355 million punishment, the interest mr. Since most corporations report the cash flows from operating activities by using the indirect method, the interest expense will be included in the company's net income or net earnings.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)