Lessons I Learned From Info About Accounting For Unrealized Gains And Losses On Investments

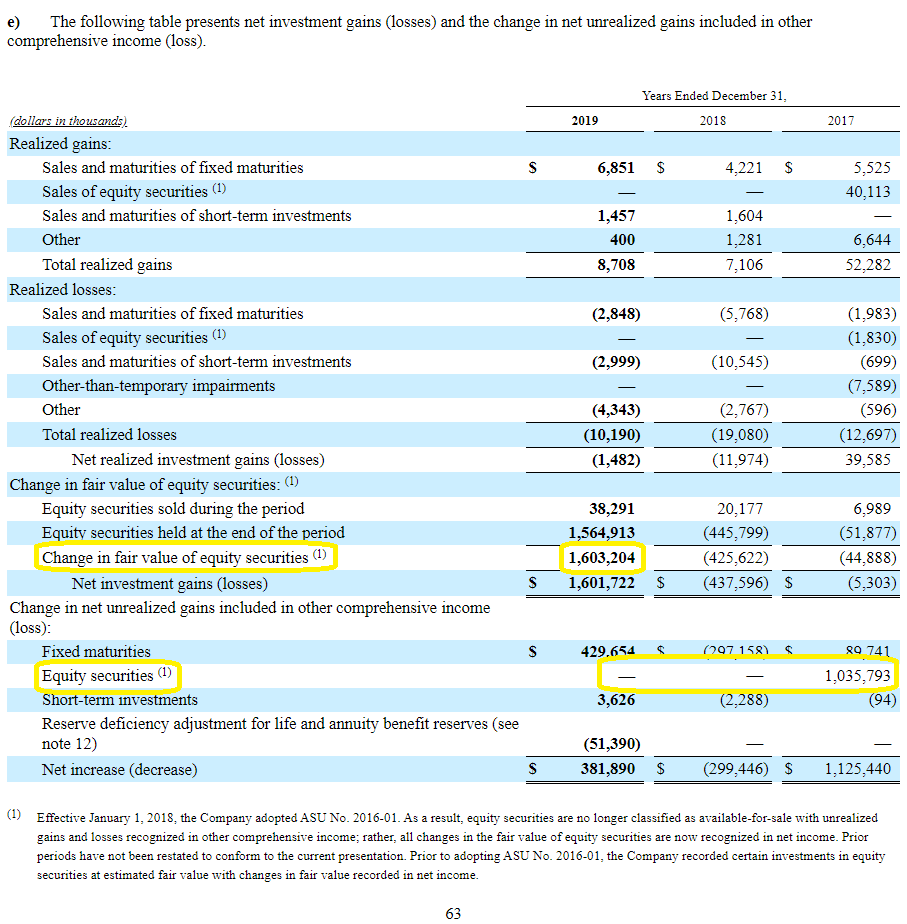

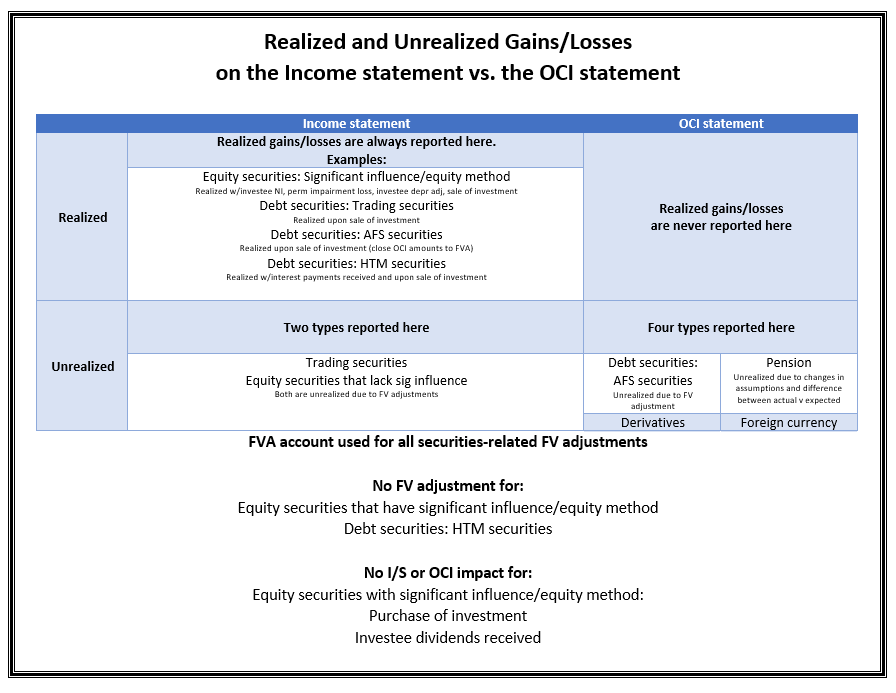

The accounting treatment depends on whether the securities are classified into three types, which are given below.

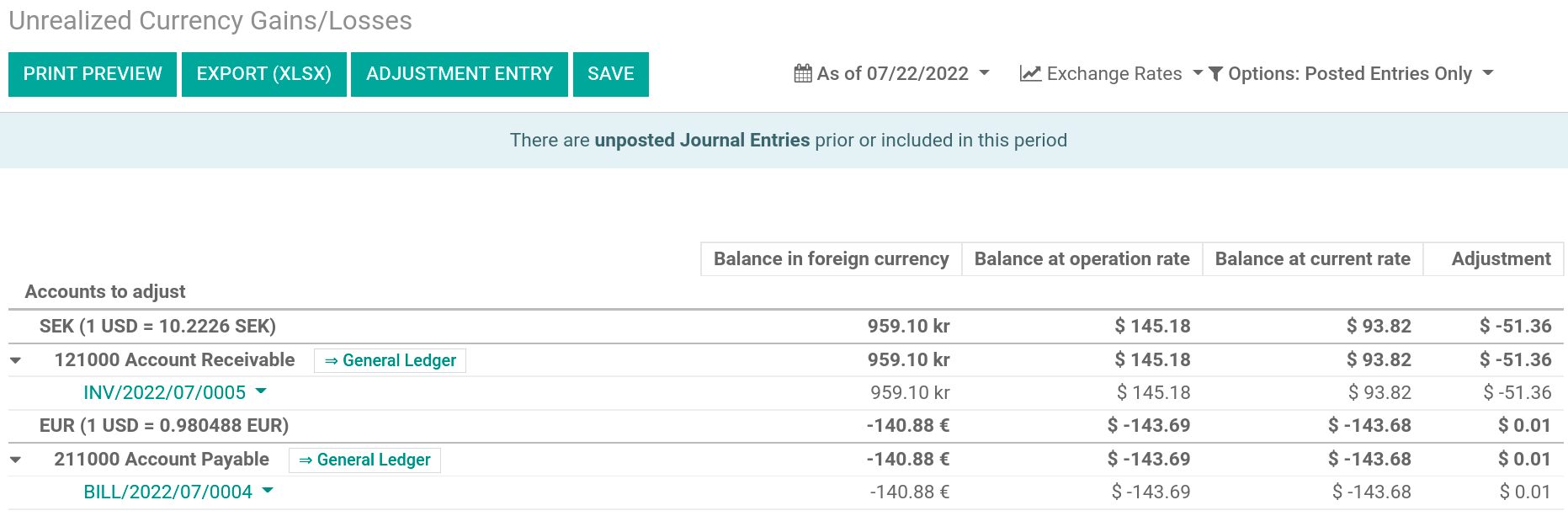

Accounting for unrealized gains and losses on investments. Investment return (including realized and unrealized gains and. The company has invested in the security which is the common stock. Unrealized gains are recorded on.

Adjusted gross profit and adjusted eps are defined as gross profit and diluted earnings per share excluding, when they occur, the impacts of restructuring activities,. For example, if you own 100 shares of a certain stock, and its current value is $70 per share; But here’s a quick review:

1 2 unrealized gain. Realized income or losses refer to profits or losses from completed. First, figure out the investment's current market value.

Inclusion of realized gains (losses) on natural gas derivative instruments would have increased average price realizations by $0.06 per mcf for the fourth quarter. But if you die and your heirs sell it the next day for $300, they don’t pay. What is an unrealized gain/loss?

A gain is when your investment. In accounting, the gains and losses such as gains and losses on disposal of fixed assets or gains and losses on the sale of investments that we record to the. In order to calculate unrealized gains and losses, subtract the asset’s value at the time it was purchased from its.

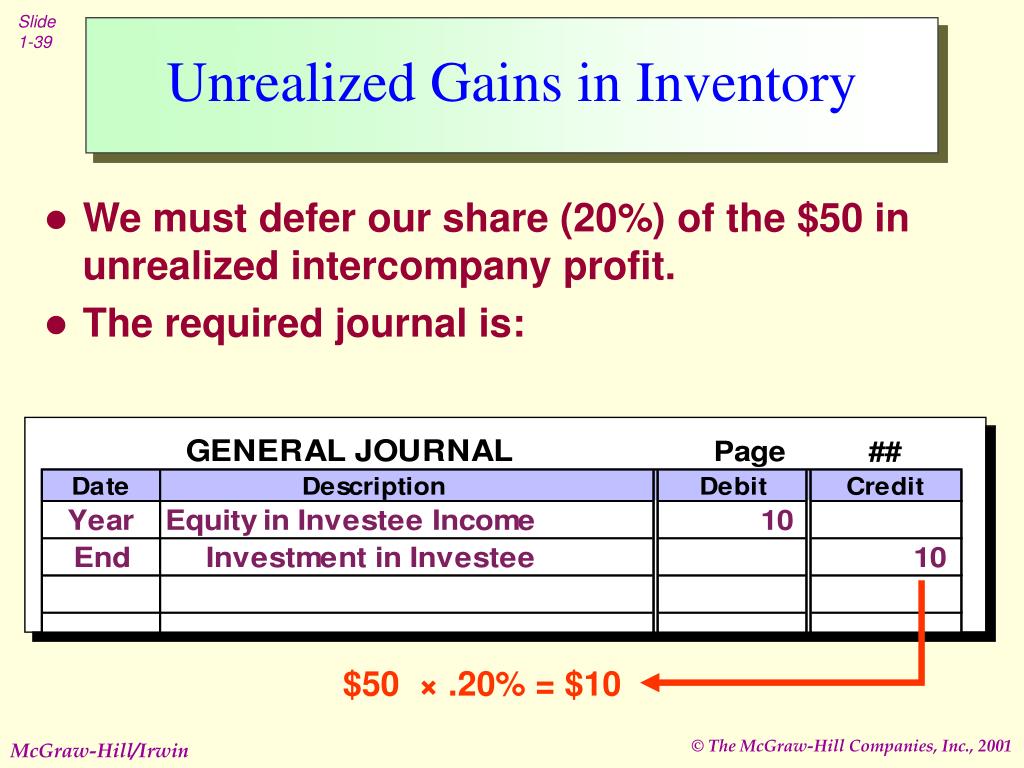

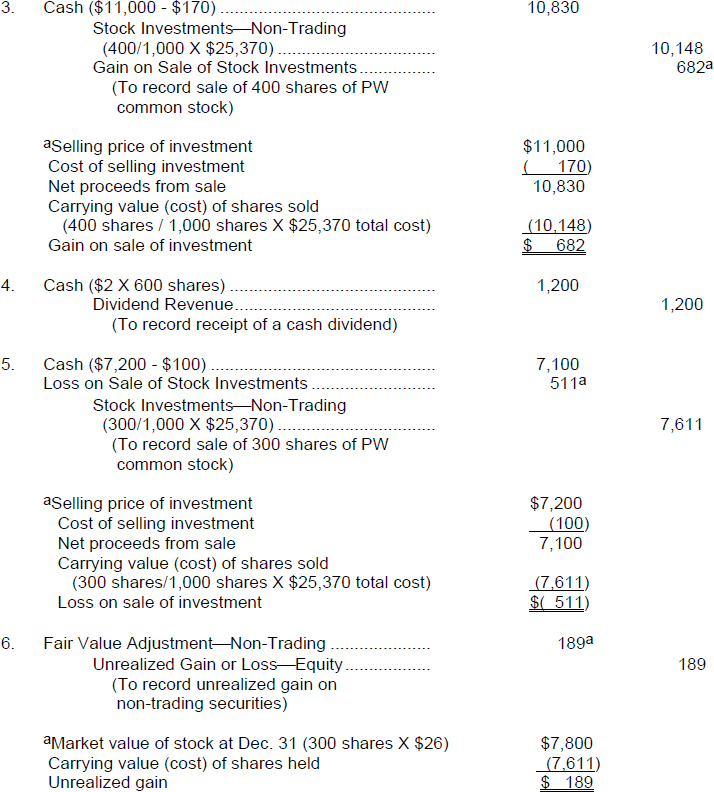

Journal entry for unrealized loss on investment. Conversely, an unrealized gain or loss is associated with a change in the fair. There are several different methods for achieving this under.

An unrealized loss is a paper loss that results from holding an asset that has decreased in price, but not yet selling it and realizing the loss. Unrealized gains and losses accounting is a way for companies to account for their investments. Calculating unrealized gains and losses.

Like gains, there can also be unrealized. In accounting, there is a difference between realized and unrealized gains and losses. Gains and losses on investments should be set up as an other income account called unrealized gains and losses.

A realized gain is achieved by the sale of an investment, as is a realized loss. Please prepare a journal entry for unrealized gain. If you sold it, you would realize the gain of $100 and pay taxes on it.

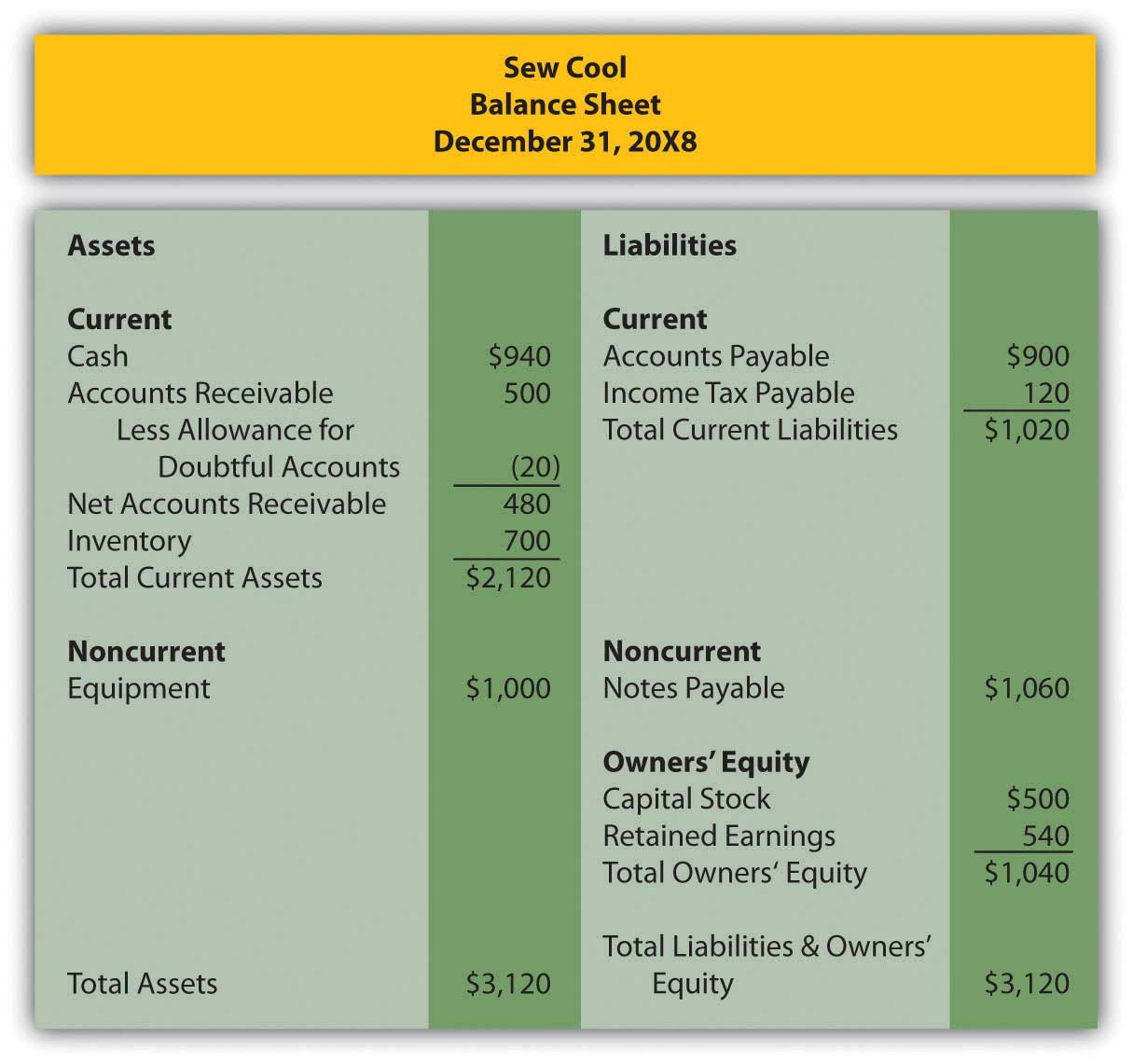

The purpose of this article is to provide a brief overview of these possibilities. You adjust a gain by crediting unrealized. It has to record this investment on the balance.