Fun Info About Companies House Profit And Loss

Filing deadlines will not be shortened at the moment, but legislation will be introduced to facilitate future changes.

Companies house profit and loss. The economic crime and corporate transparency act received royal assent on 26 october as part of new measures to improve transparency. An accountant typically prepares the reports. Uk house prices have risen.

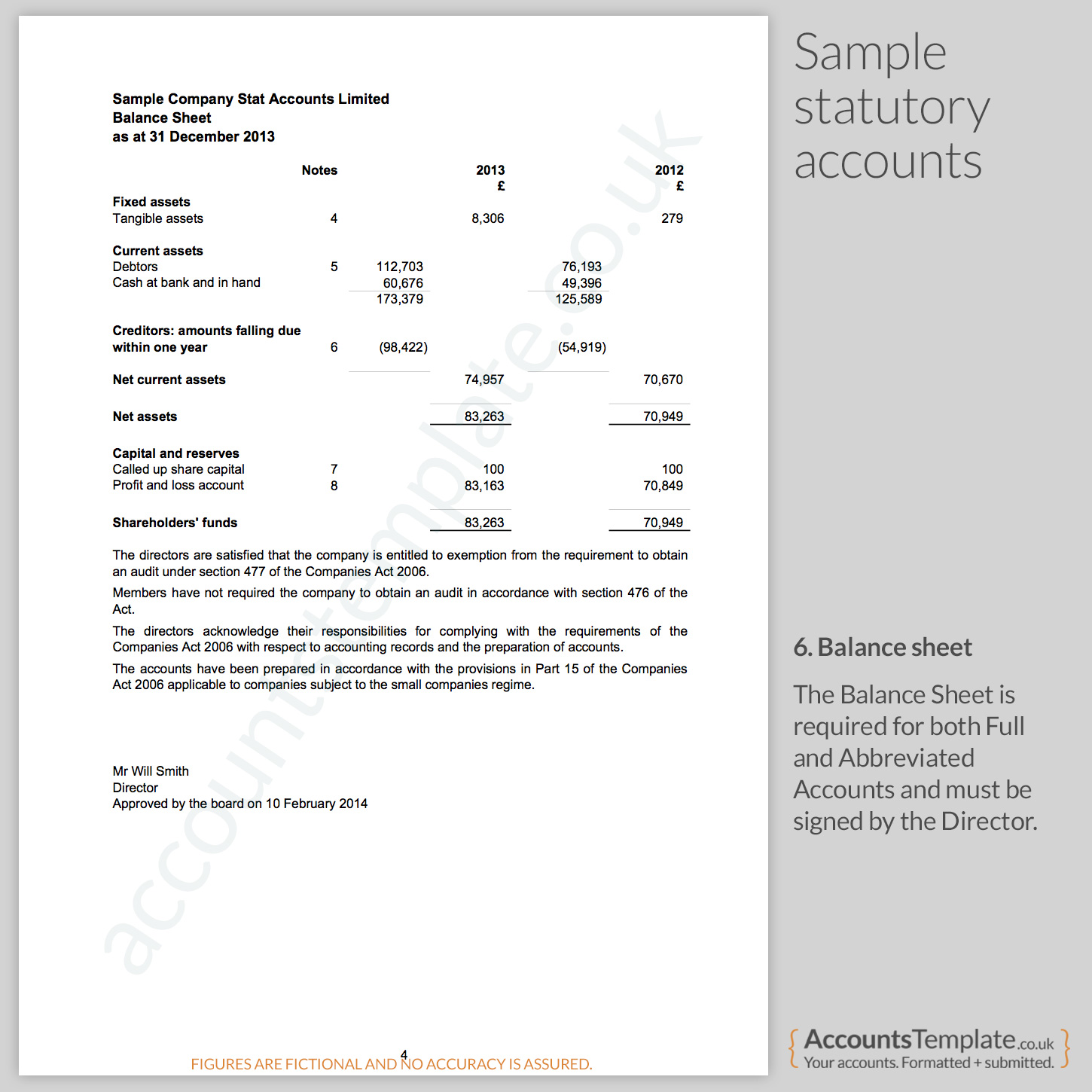

United parcel service inc. The balance sheet shows the value of everything the company. It should go on your p&l and the best place to categorise it is either legal & professional or sundries.

Yes you can include it in your p&l. To be classed as a small company a ltd must have at least two of the following: Pz cussons made a loss of £94.2m in the.

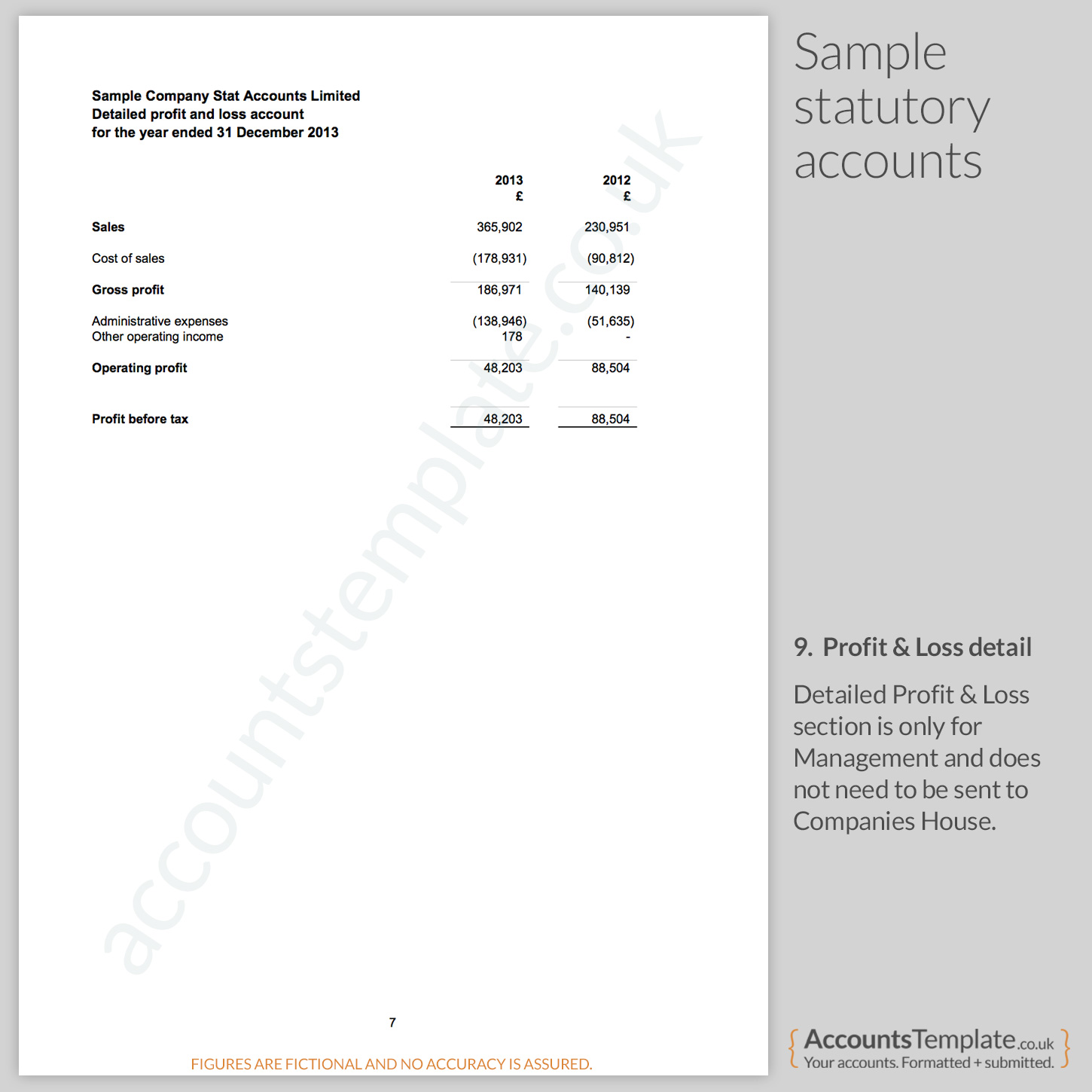

Since february 2022, the uk government has made clear its intention to expand the role and powers of companies house to combat the misuse of uk corporate entities and maximise the accuracy of filed information. Former president donald trump on saturday launched a sneaker line, a day after he and his companies were ordered by a judge to pay nearly $355 million in his new york civil fraud trial. The profit and loss account shows the company’s sales, running costs and the profit or loss it has made over the last year.

Several phone service providers, including at&t, were down for many users across the united states early thursday, according to downdetector.com, which tracks. Uber posts first operating profit as public company. Here’s what you need to know.

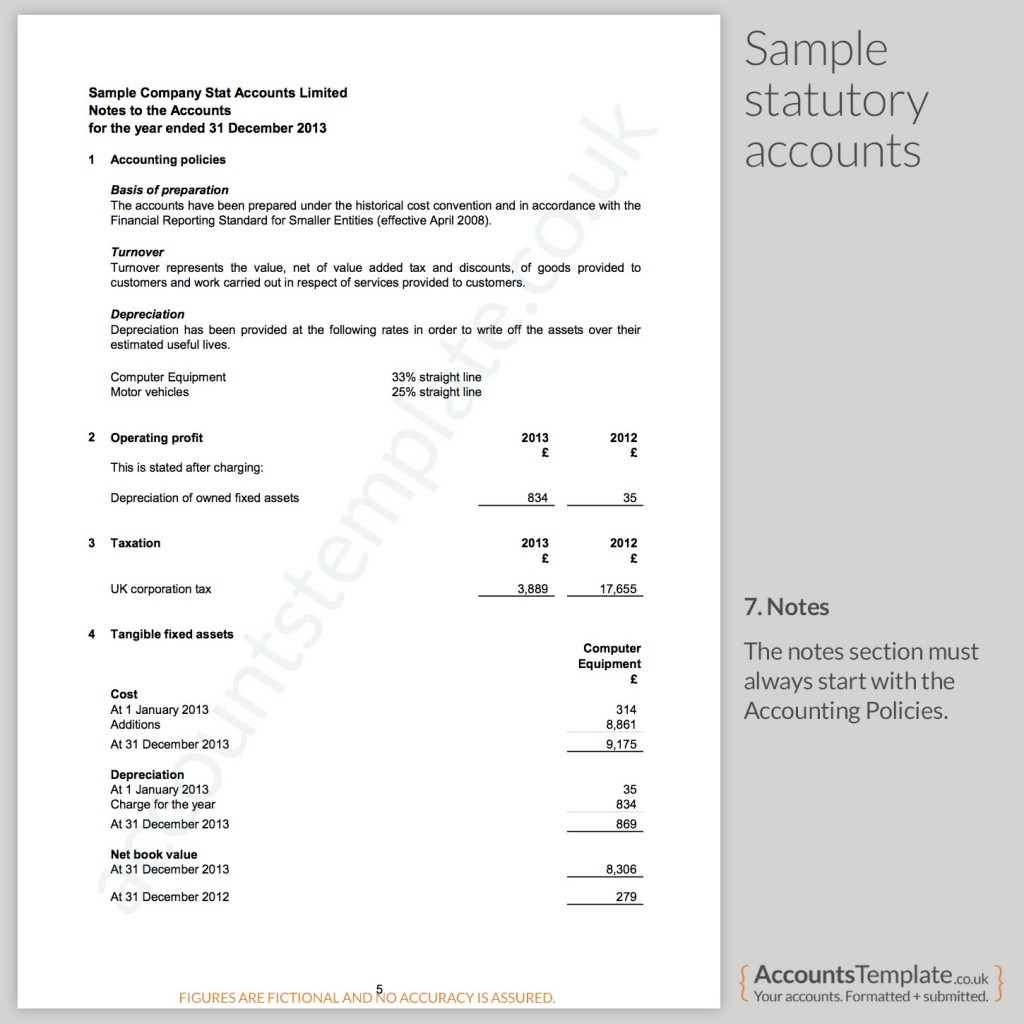

It shows both turnover and profitability for. The recent approval of the economic crime and corporate transparency act has paved the way for tighter regulations concerning how companies report information to companies house in the uk. You don't need to include a directors' report or profit and loss account you don't need to change the date the accounts are made up to your balance sheet doesn’t have 'revaluation reserve', or.

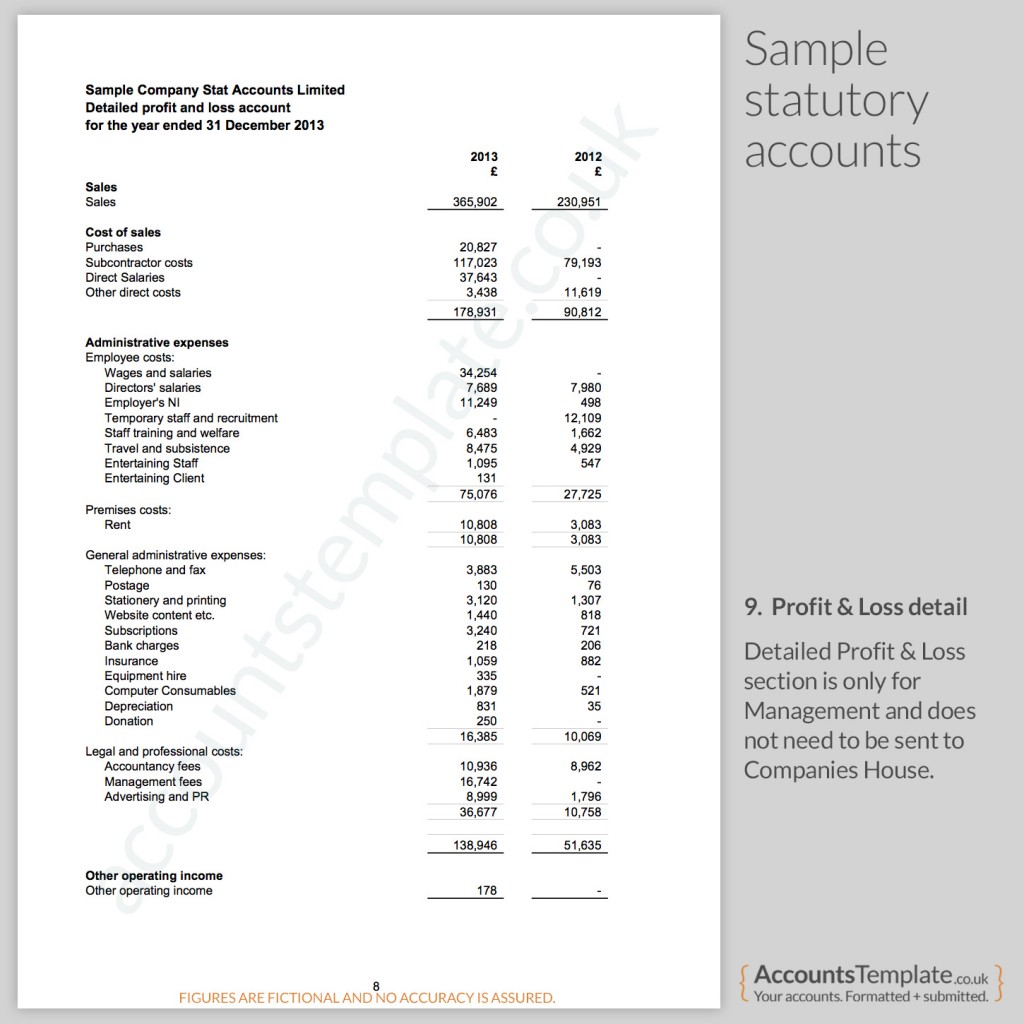

Under the new plans, even small and micro businesses will need to submit a profit and loss (p&l) report to companies house. If registered at companies house, annual accounts are submitted. A profit and loss account (or income and expenditure account if the company is not trading for profit) a balance sheet signed by a director on behalf of the board and the printed name of.

Companies that don’t opt to file their director’s report and profit and loss are said to be filing “filleted” accounts (in every case the company must file at least the balance sheet & any. Small ltd companies are not required to file profit and loss accounts at companies house. The trump condo sold for over $4,600 per square foot;

These companies must also provide a. A ‘profit and loss account’, which shows the company’s sales, running costs and the profit or loss it has made over the financial year notes about the accounts a director’s report (unless. The company posted a loss of $26 million.

All companies require an accounting profit and loss statement (p&l) or income statement for their accounts. There are several reasons why you need the financial report, including: