Top Notch Tips About Statement Showing Interest Income From The Internal Revenue Service

To whom you paid amounts reportable in boxes 1, 3, and 8 of at least $10.

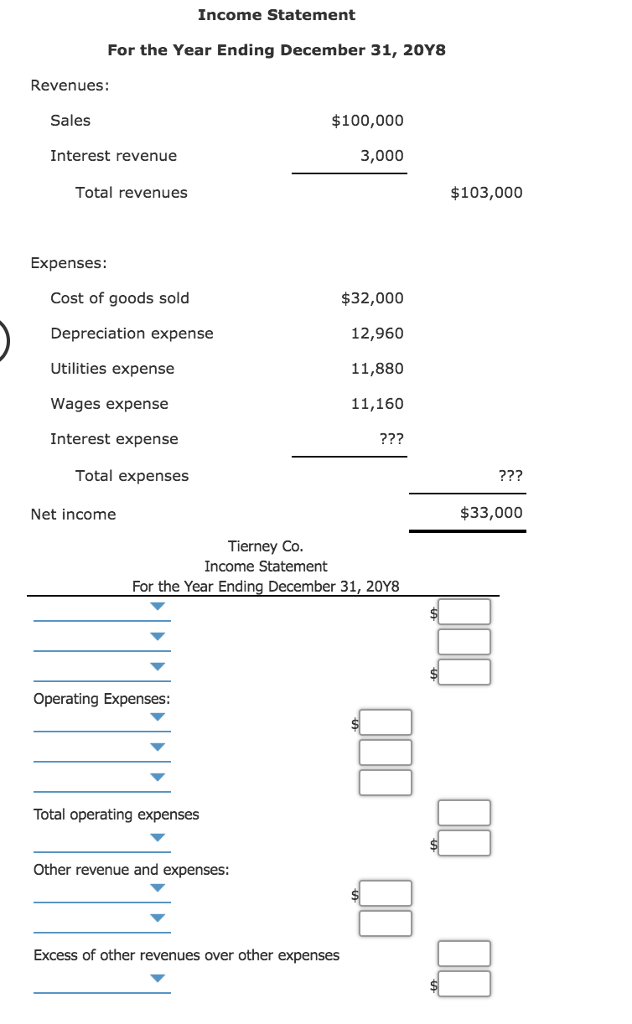

Statement showing interest income from the internal revenue service. Interest is due as it accrues. If your taxable interest income exceeds $1,500, you must include that income on your schedule b (form 1040), interest and regular dividends , and include. Statement showing interest income from the internal revenue service calendar year 2019 total interest paid or credited:

If you received a notice, you will not be charged interest on the amount shown if you pay the amount owed in full on or before the. Ago in calendar year 2018, irs paid you a refund that included some interest. For whom you withheld and paid any foreign tax on.

1 best answer helenac new member to enter your irs interest form: Pursuant to section 6622 of the internal revenue code, interest must be compounded daily. Find forms & instructions get answers to your tax questions check your federal tax withholding apply for an employer id number (ein) view your tax records, adjusted.

This form is used to report interest income from a. That interest is taxable income to you. Individual taxpayers should watch for this.

Click here 👆 to get an answer to your question ️ statement showing interest income from the internal revenue service