One Of The Best Tips About Difference Between Cash Flows From Operating Investing And Financing Activities

This is because it is related to the production activities of the company.

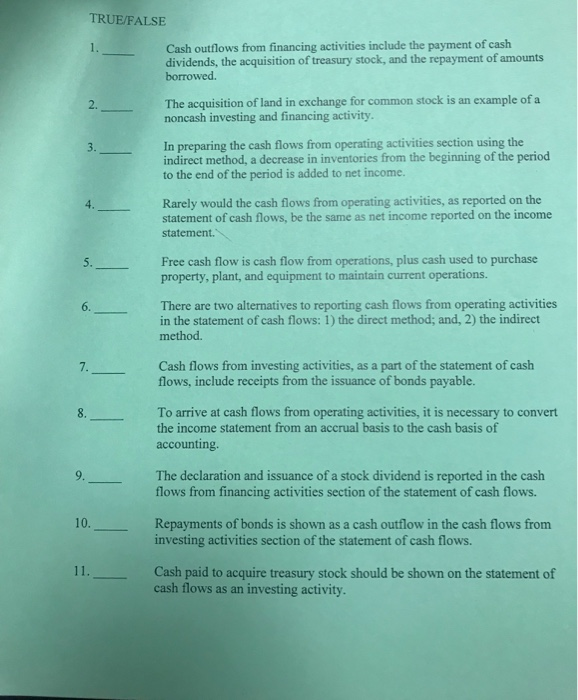

Difference between cash flows from operating investing and financing activities. (i) operating activities (ii) investing activities and (iii) financing activities. The second cash outflow is an investing activity since it is related to the acquisition of a. Cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities.

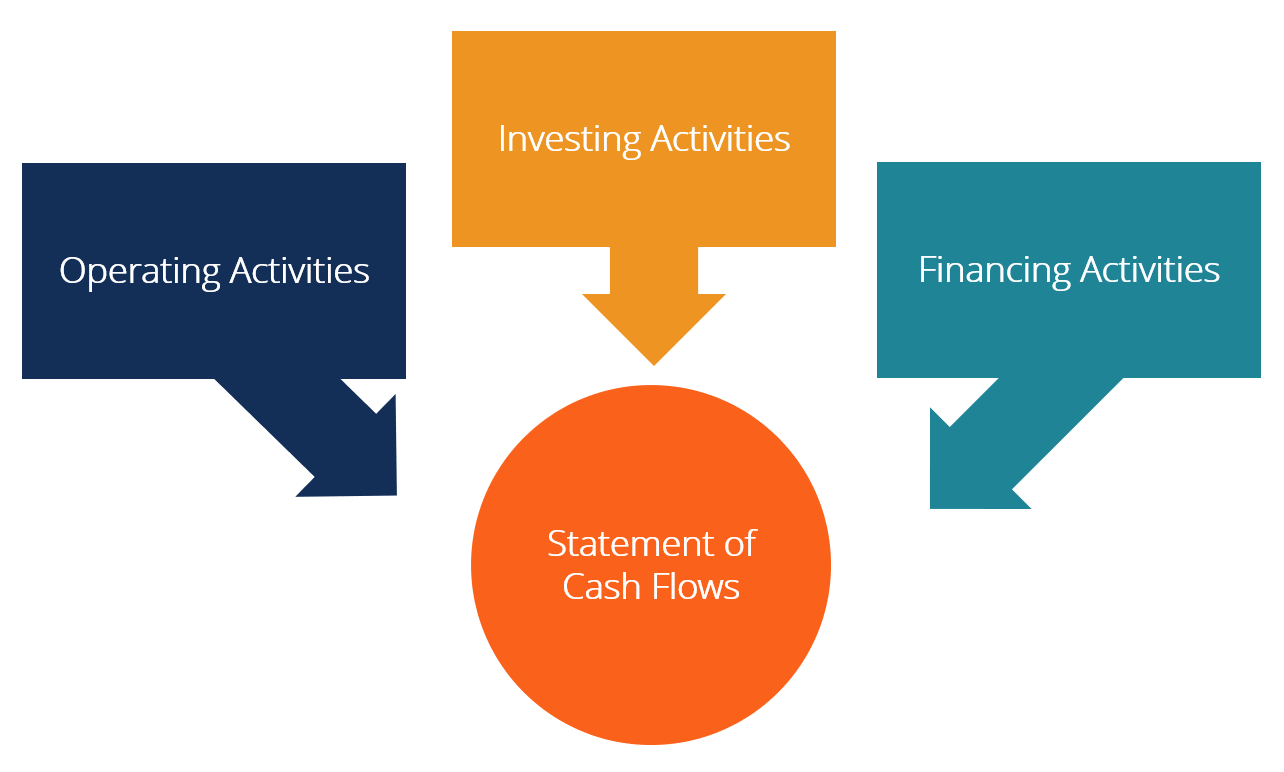

Cash flows stem from operations, investing and financing activities. The two methods of calculating cash flow are the. Operating activities to provide clear information about what areas of the business generated and used cash, the statement of cash flows is broken down into three key categories:

Cash flows from financing activities. Cash flows from financing activities are cash transactions related to the business raising money from debt or stock, or repaying that debt. The first cash outflow is an operating activity.

Cash flows from operating activities arise from the activities a business uses to produce net income. Operating cash flows concentrate on cash inflows and outflows related to a company's main business activities, such as selling and purchasing inventory, providing services, and paying. Murphy updated april 17, 2023 reviewed by michael j boyle fact checked by jared ecker net income is the profit a company has earned for a period, while cash flow from operating.

Operating activities can be presented in two different ways. The statement of cash flows is prepared by following these steps:. Financial statement users are able to assess a company’s strategy and ability to generate a profit and stay in business by.

Investing cash flow; Cash flows from financing activities are cash transactions related to the business raising money from debt or stock, or repaying that debt. This study sought to test the relationship between cash flows from operating activities, investment activities and financial activities and on one hand and stock returns and the volume of assets.

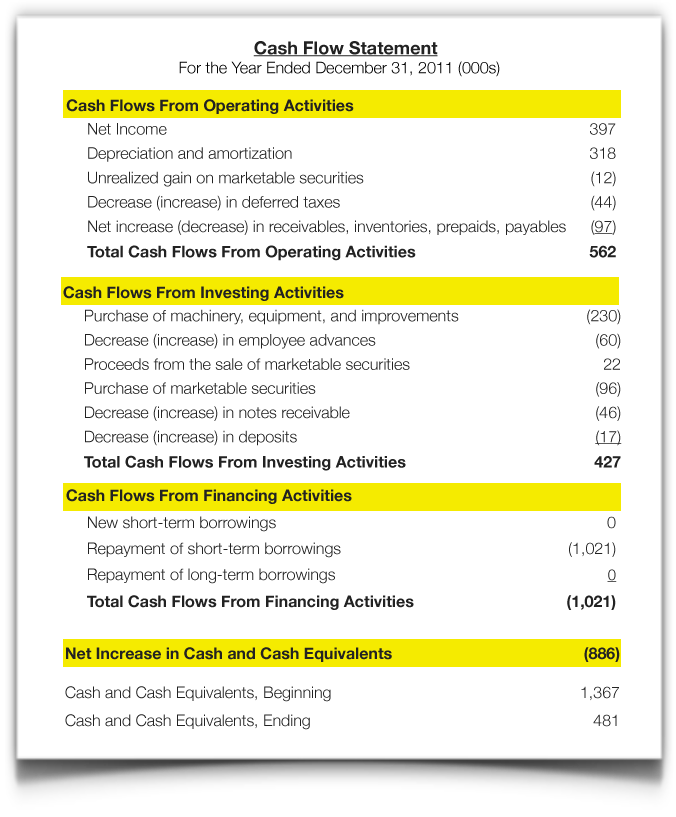

In addition, net cash flow from operating activities serves as an efficiency measure. The statement of cash flows presents sources and uses of cash in three distinct categories: Begin with net income from the income statement.

Cash flow from operating activities (cfo) indicates the amount of money a company brings in from its ongoing, regular business activities, such as manufacturing and selling goods or providing a. Operating cash flow indicates whether a company can generate enough cash flow to maintain and expand operations, but it can also indicate when a company may need external financing for capital. Cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities.

Using the indirect method, operating net cash flow is calculated as follows:. The correct answer is c. Cash flow from financing activities (cff) is a section of a company’s cash flow statement, which shows the net flows of cash that are used to fund the company.

A positive net cash flow from operating activities means that the business is generating more cash than it’s spending, which may lead to reinvestment for growth, dividend payment, debt reduction, or reserves for future downturns. Add back noncash expenses, such as depreciation, amortization, and depletion. Essentially, your cash flow from financing activities boils down to how your company’s cash moves among its owners, investors, and creditors.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)