Unique Info About Reserve Fund In Profit And Loss Account

Different reserves are treated as:

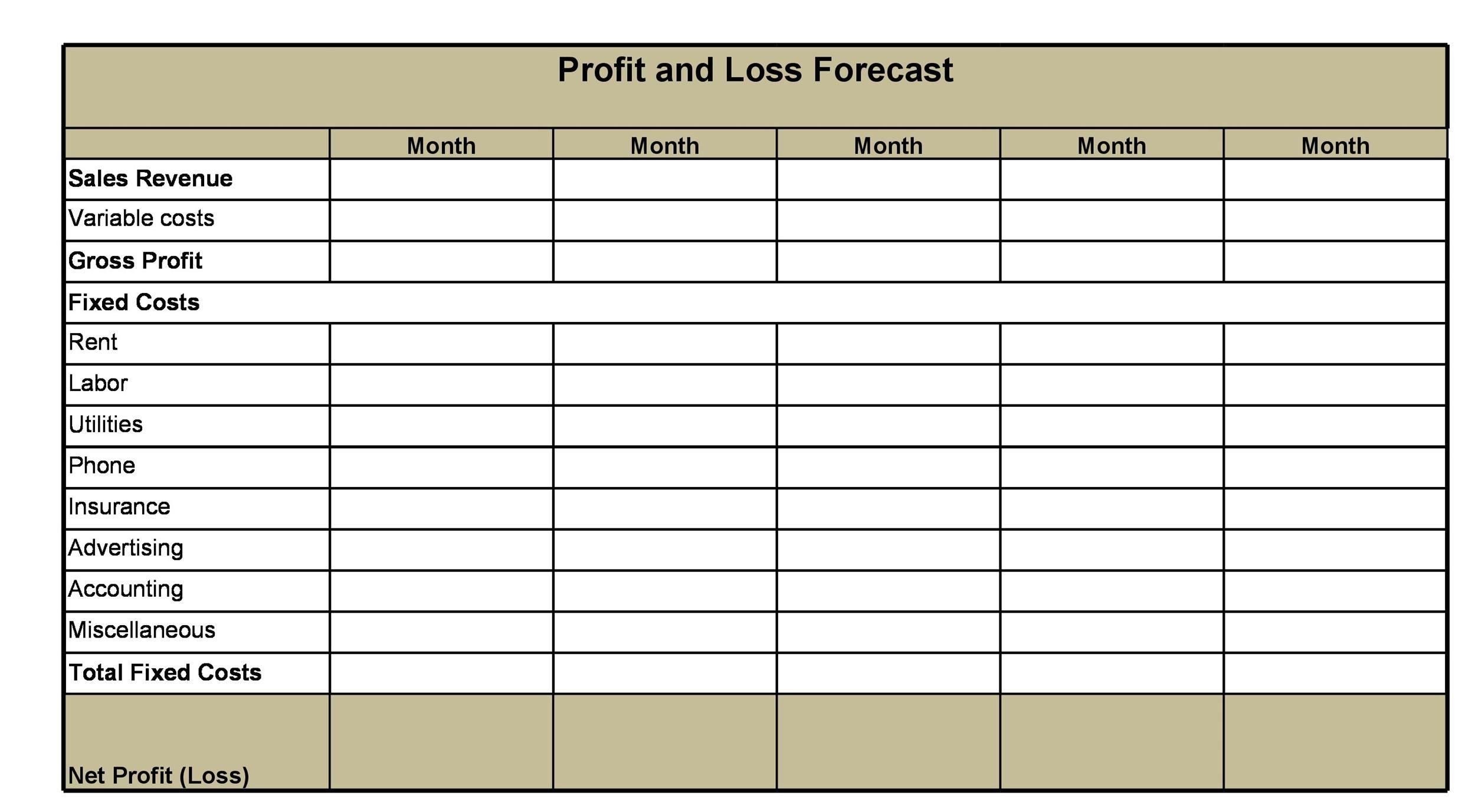

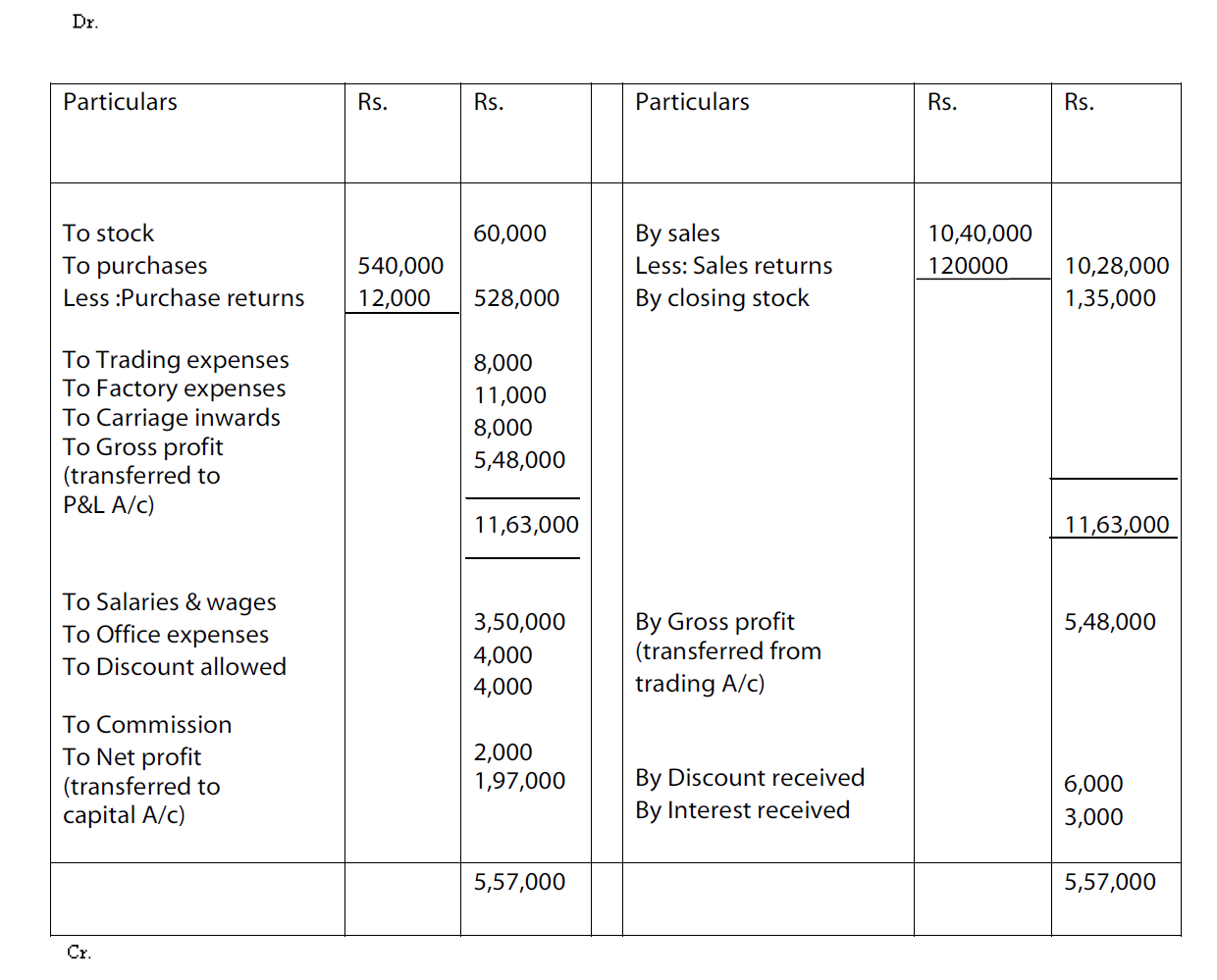

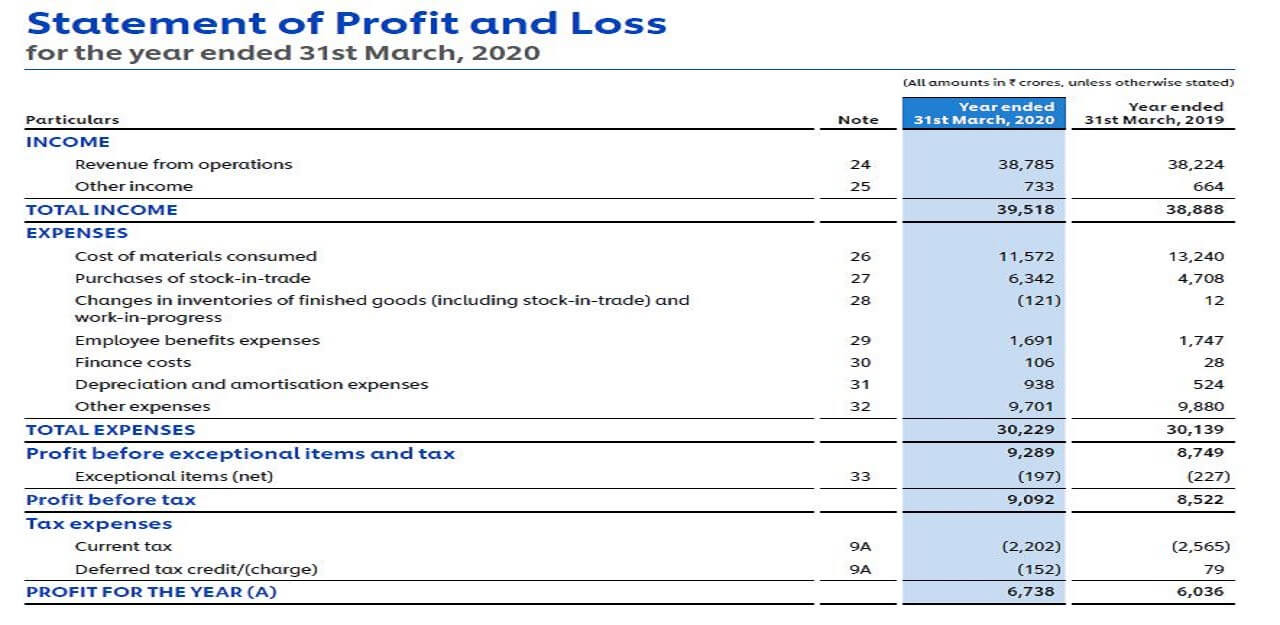

Reserve fund in profit and loss account. Reserve funds are established to meet unexpected future costs or financial obligations that may occur. It is prepared to determine the net profit or net loss of a trader. After ascertaining the net profit for a particular year (i.e.

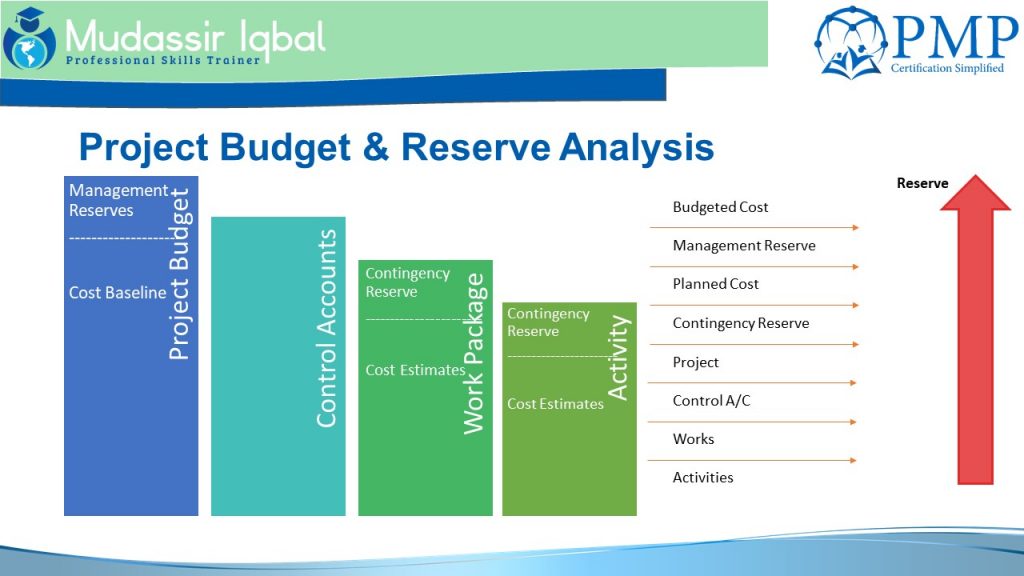

Definition of retained earnings retained earnings refers to the accumulated profits which belong to the shareholders but are not distributed to them. A reserve fund is a designated pool of money set aside by an organization or entity to address future expenses, unforeseen events, or to provide a financial cushion. A reserve is profits that have been appropriated for a particular purpose.

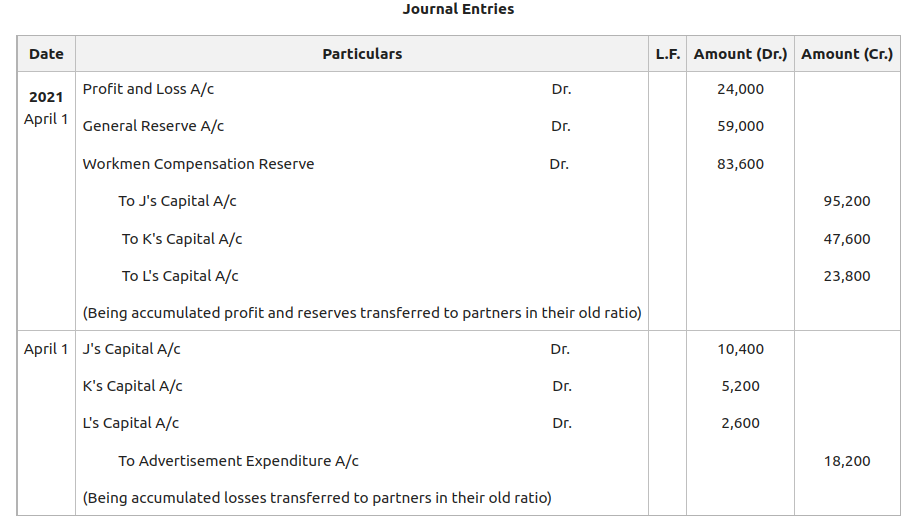

Revenue reserve is a portion of profit owned by the company and. Reserves or reserve funds mean amounts set aside out of profits (as ascertained by the profit and loss account) or other surpluses which are not meant to cover any liability,. After the preparation of profit and loss account), a portion of the net profit which the partners agree to retain in the.

General reserve is simply credited to the partner’s capital in their profit. Reserves are divided into two types: Reserve or fund is the amount, which is created out of net profit to meet future contingencies.

With south africa’s options running out to fund a widening budget deficit and contain runaway debt, the government. It does not imply an actual transfer of funds from the business bank account. Rather, the company retains it.

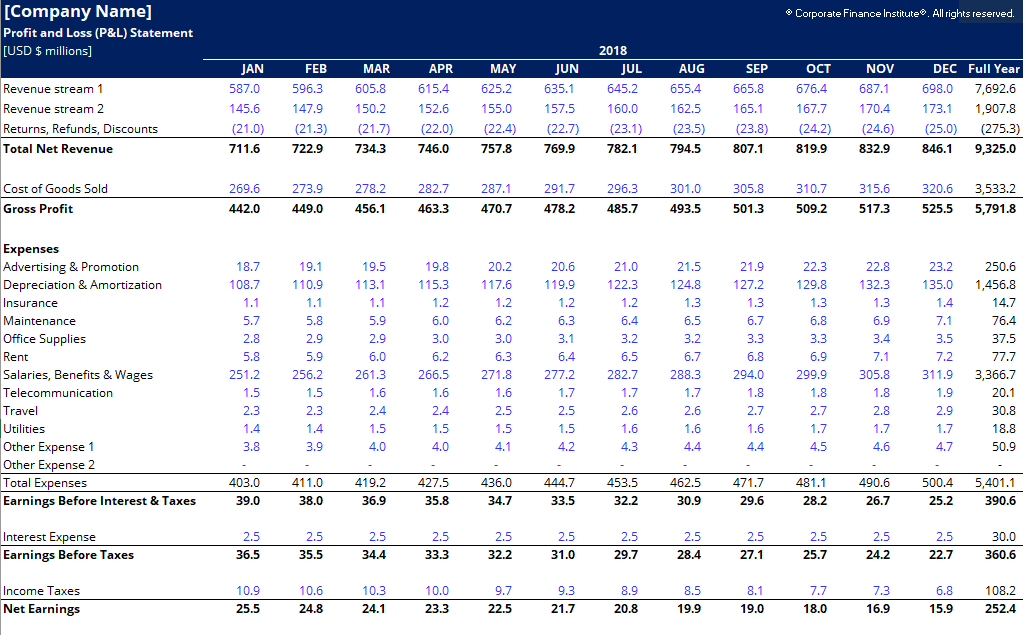

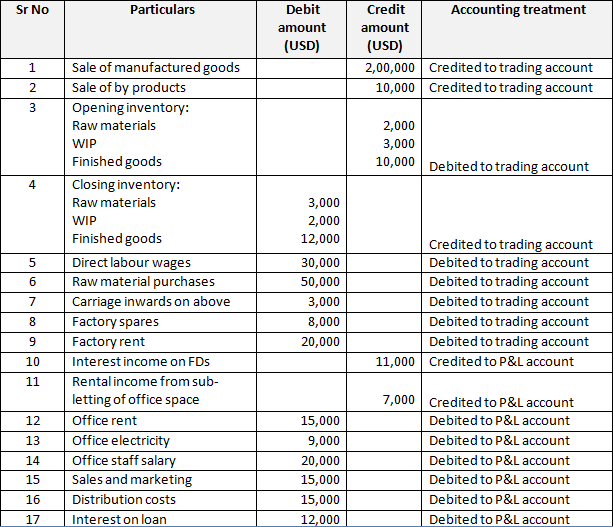

February 20, 2024 at 1:08 am pst. The first of the revenue reserves is the actual profit and loss accounts. Accounting treatment of investment fluctuation reserves accounting treatment of reserves and accumulated profit/loss at the time of admission of a.

What are different types of reserves? Additionally, they may be used to cover scheduled and routine expenses. You are all aware of how the balance on the profit and loss account arises:

December 04, 2023 what is the accounting for reserves? Provision is the recognition of a probable expense or loss by. Free reserves such as reserve fund, general reserve, capital reserve, retained earnings, undistributed profits, profit and loss account credit balance, and.

It is important to note that the creation of a reserve is simply an appropriation of profits; Periodic deposits are usually made into the fund, and cash or highly liquid assets are drawn out as needed. Definition and explanation classification of reserve definition and.

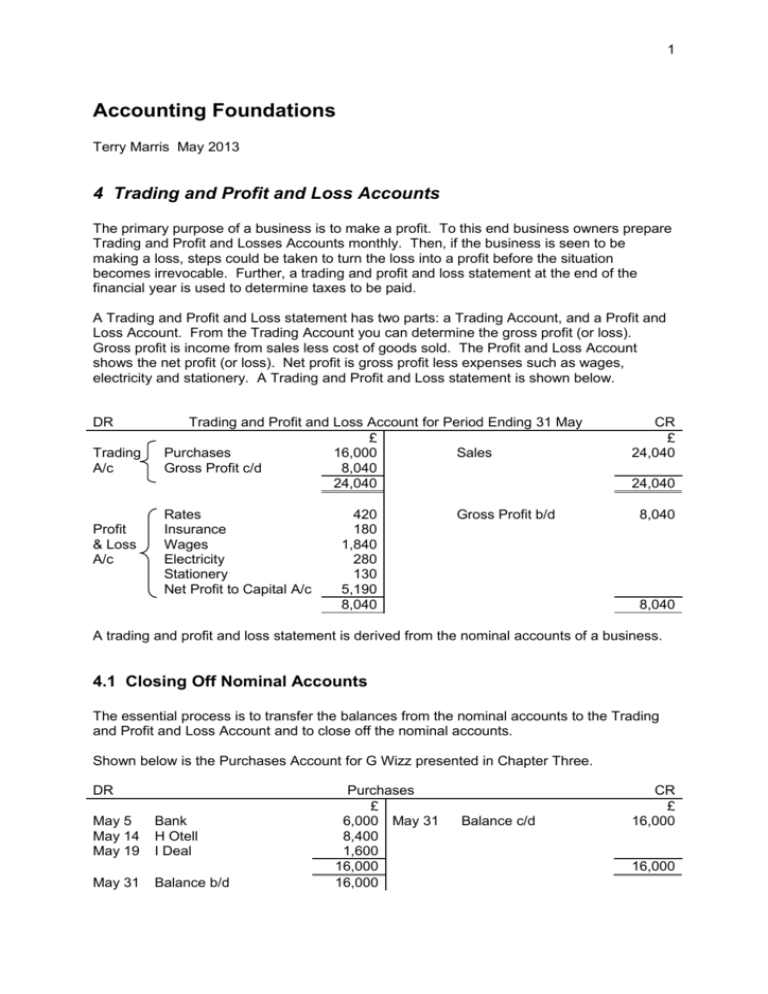

The key points of difference between provision and reserve have been detailed below: What are reserves or accumulated profits or losses: A profit and loss (p&l) account shows the annual net profit or net loss of a business.