Looking Good Tips About Type Of Income Statement

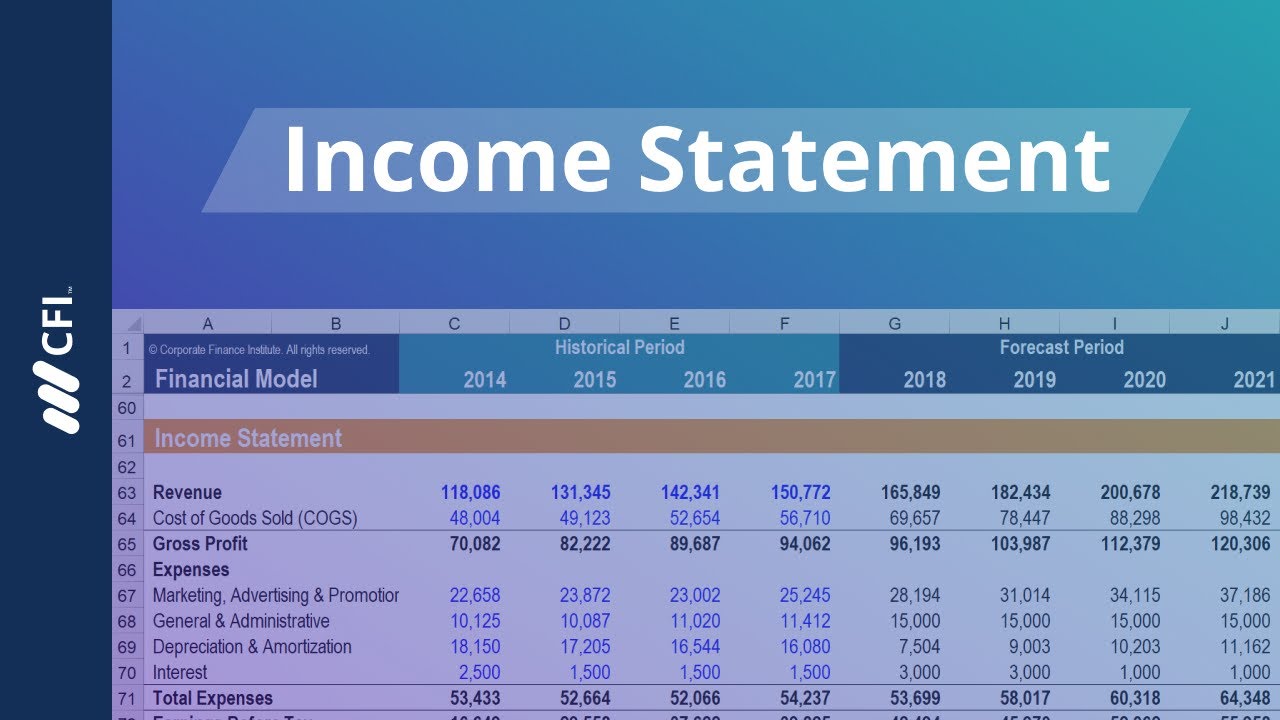

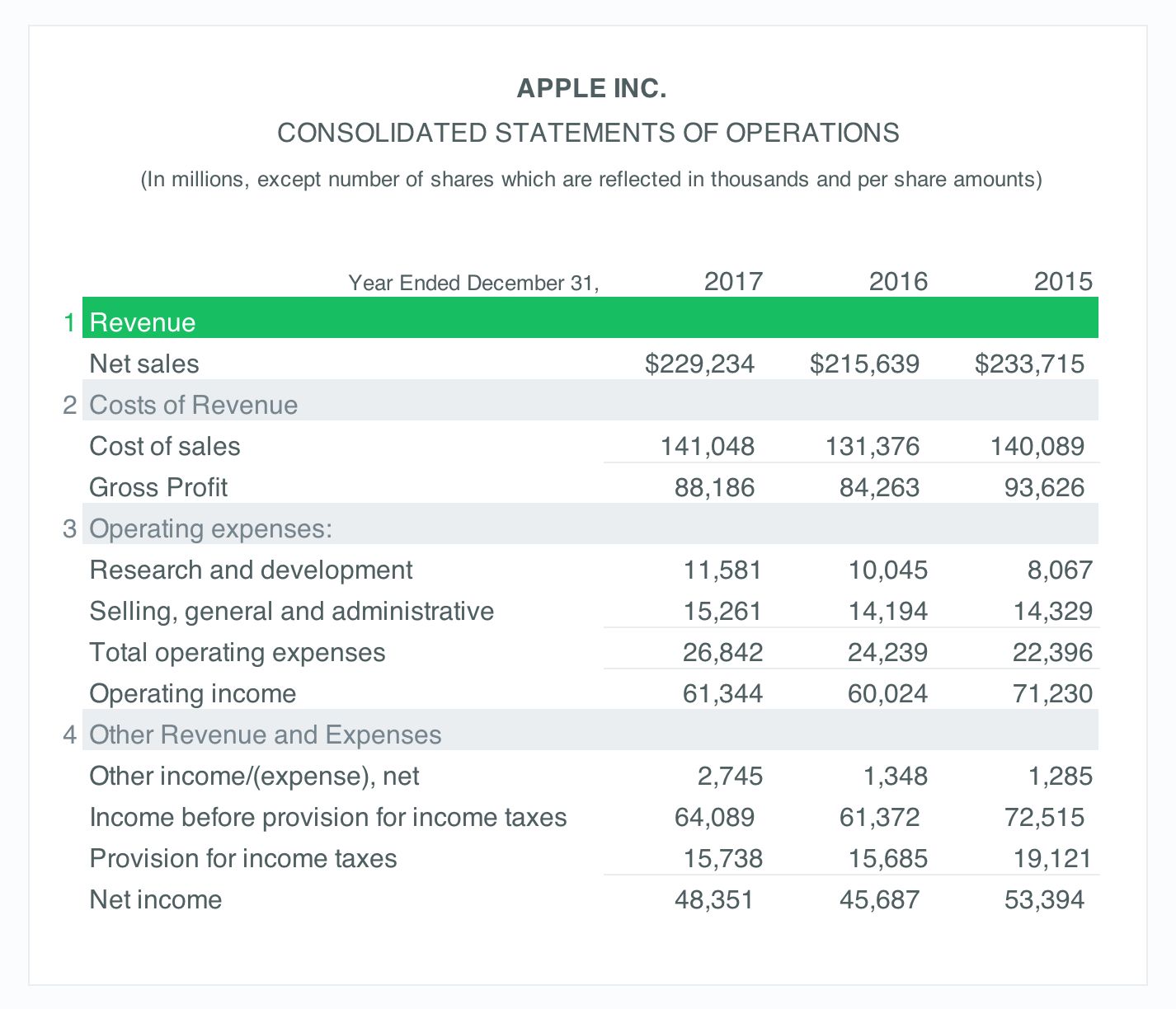

The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting.

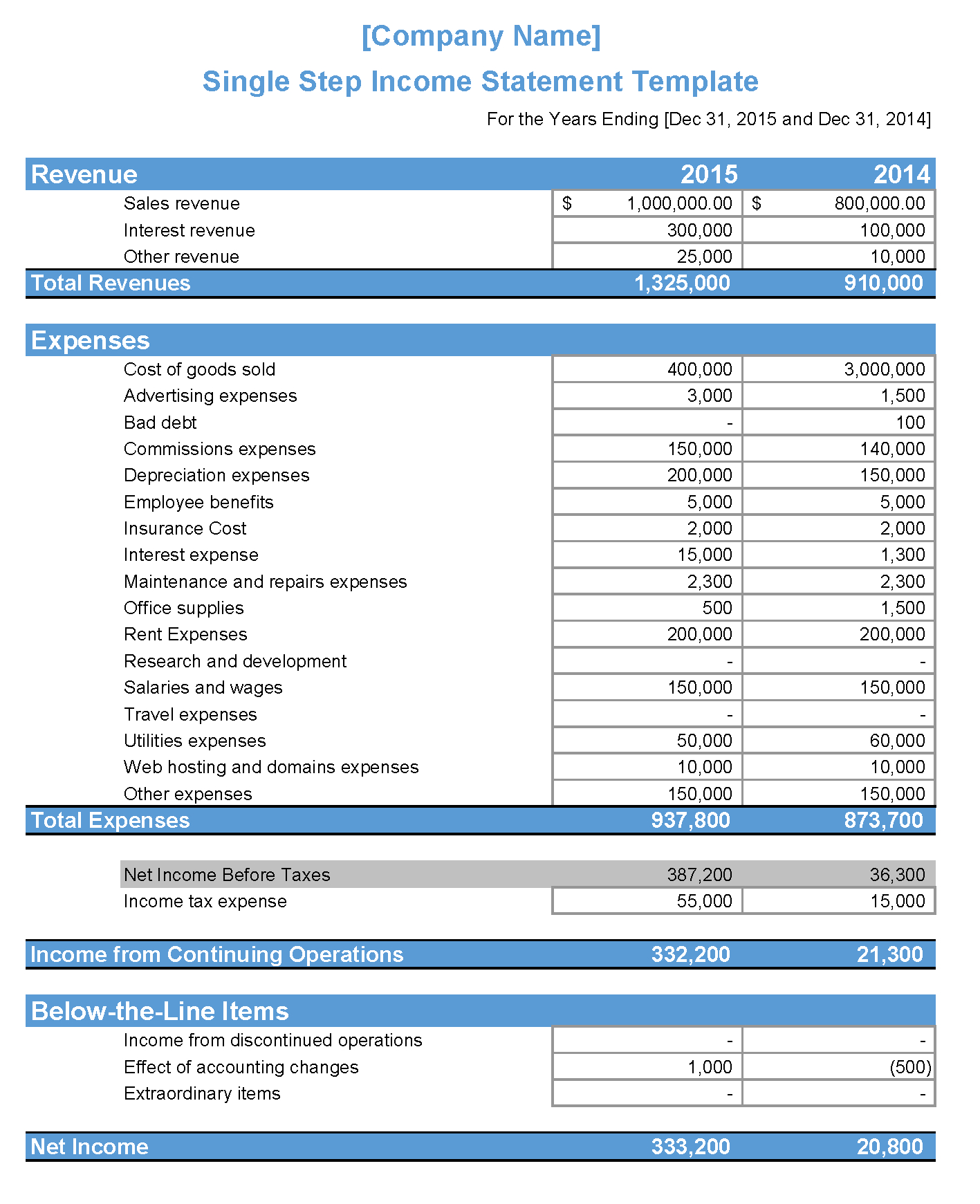

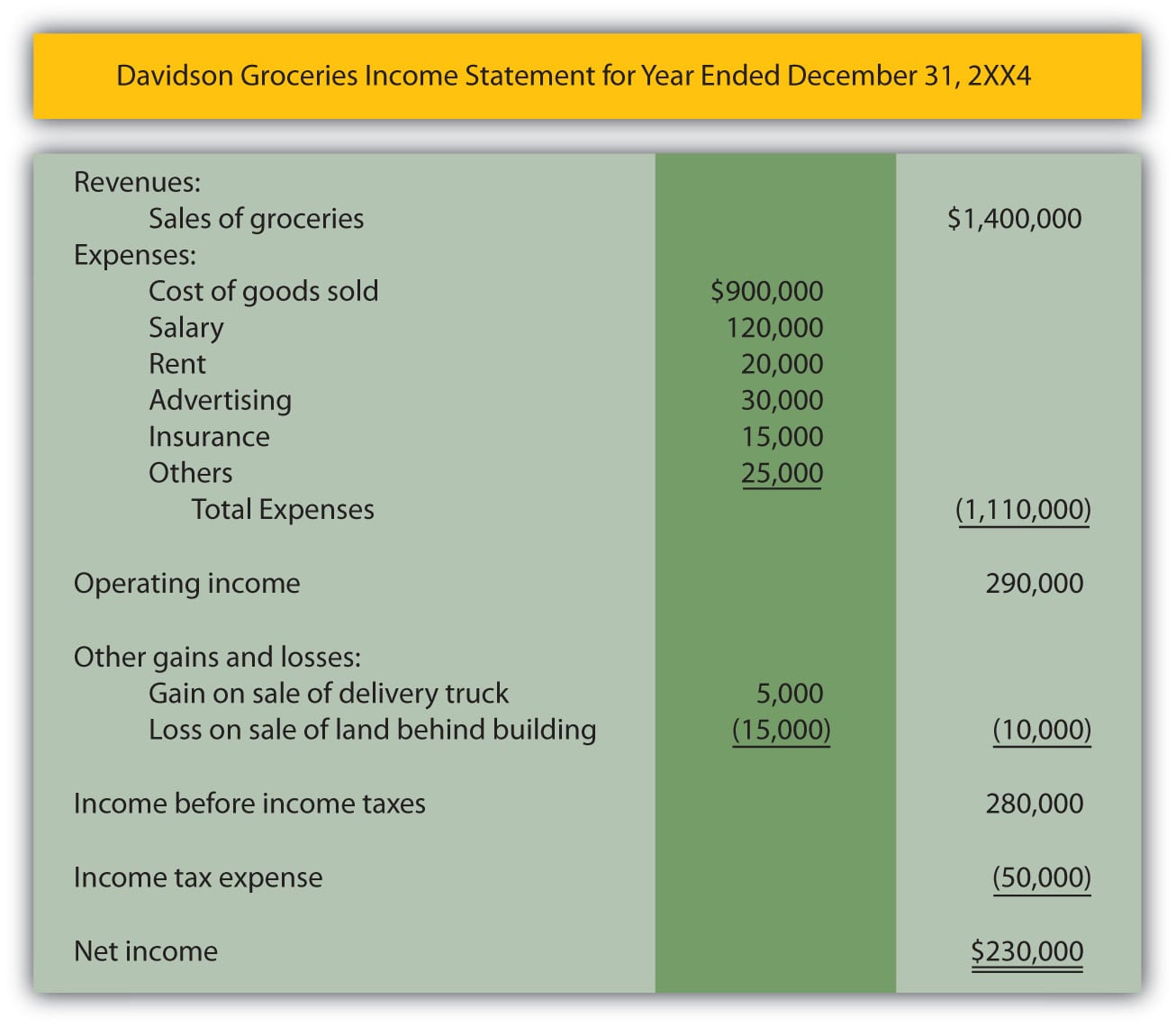

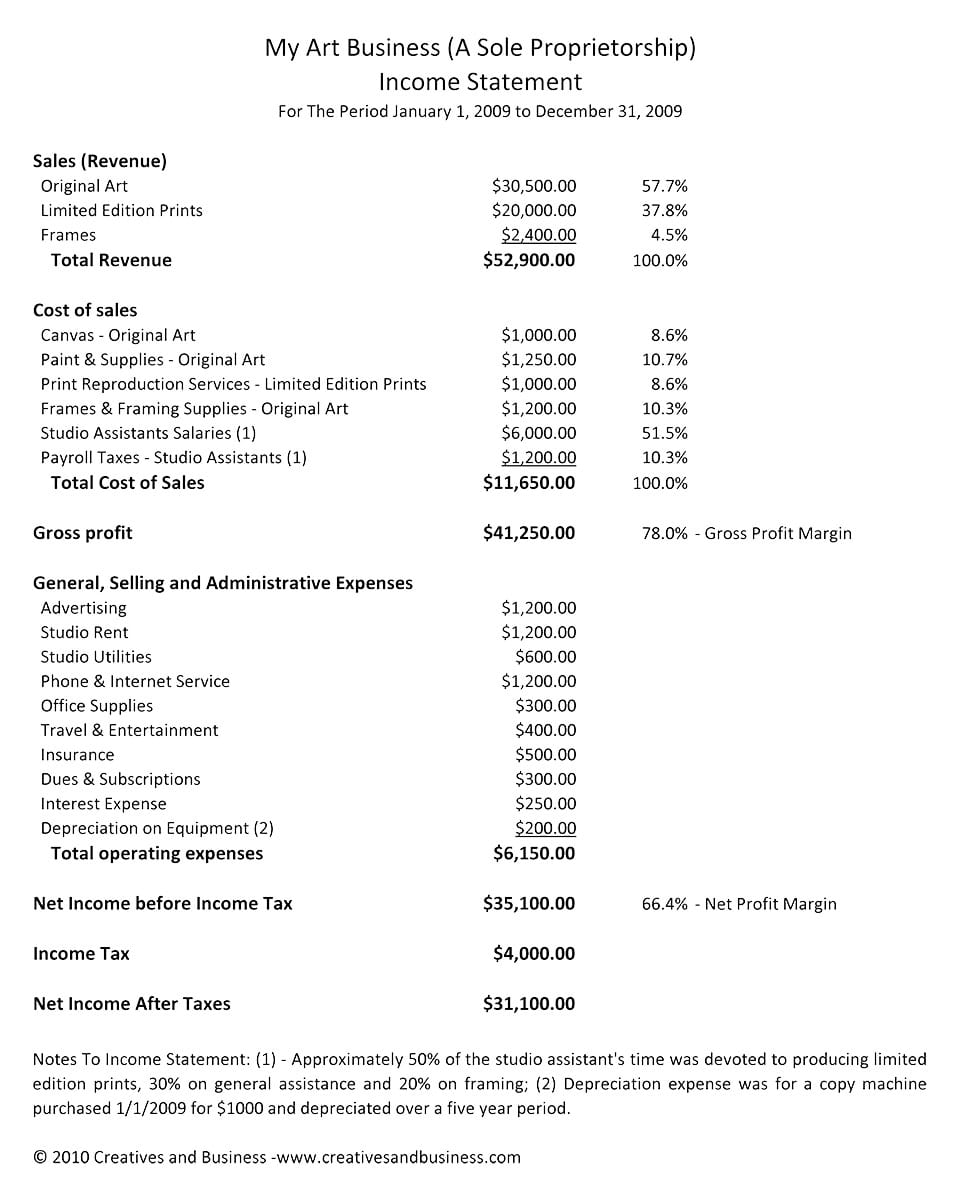

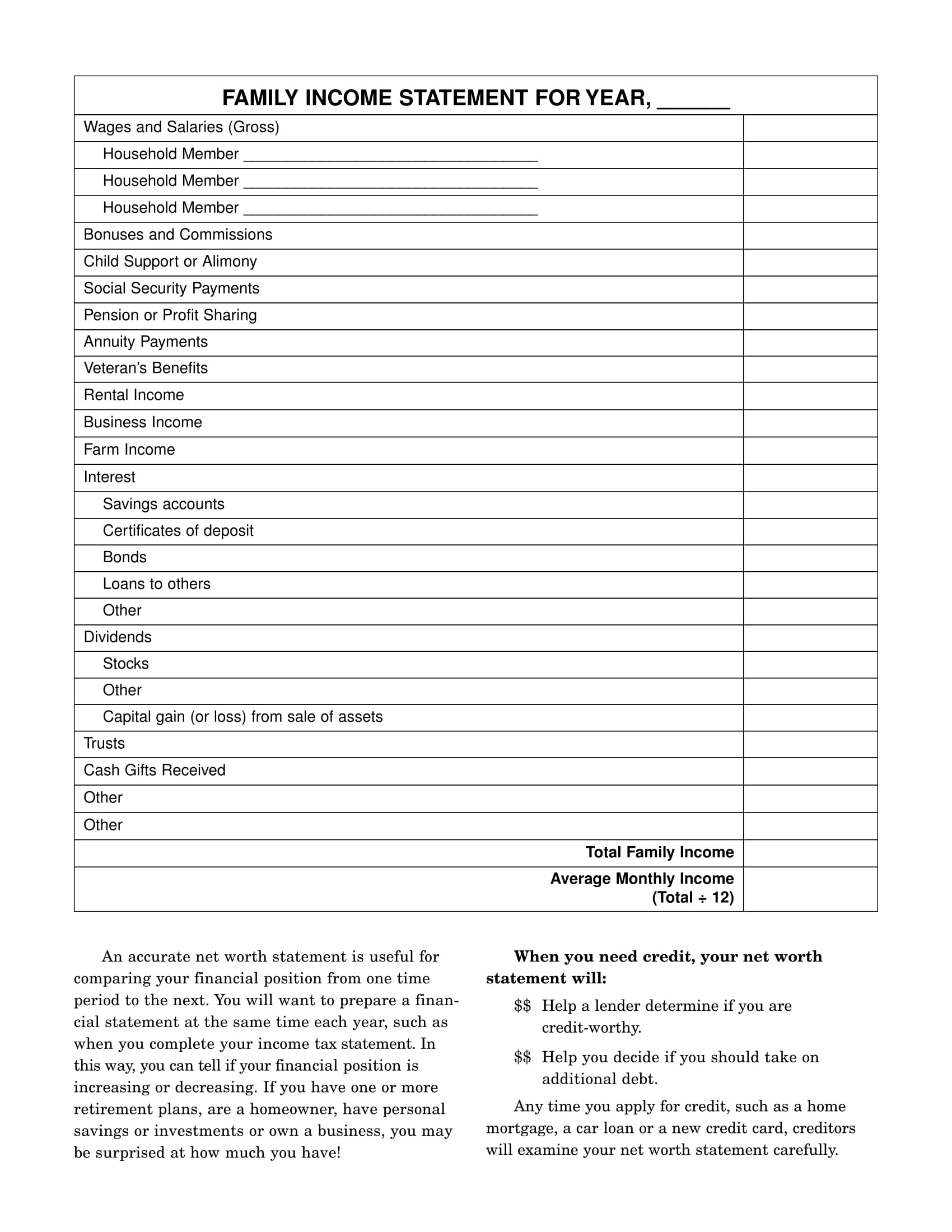

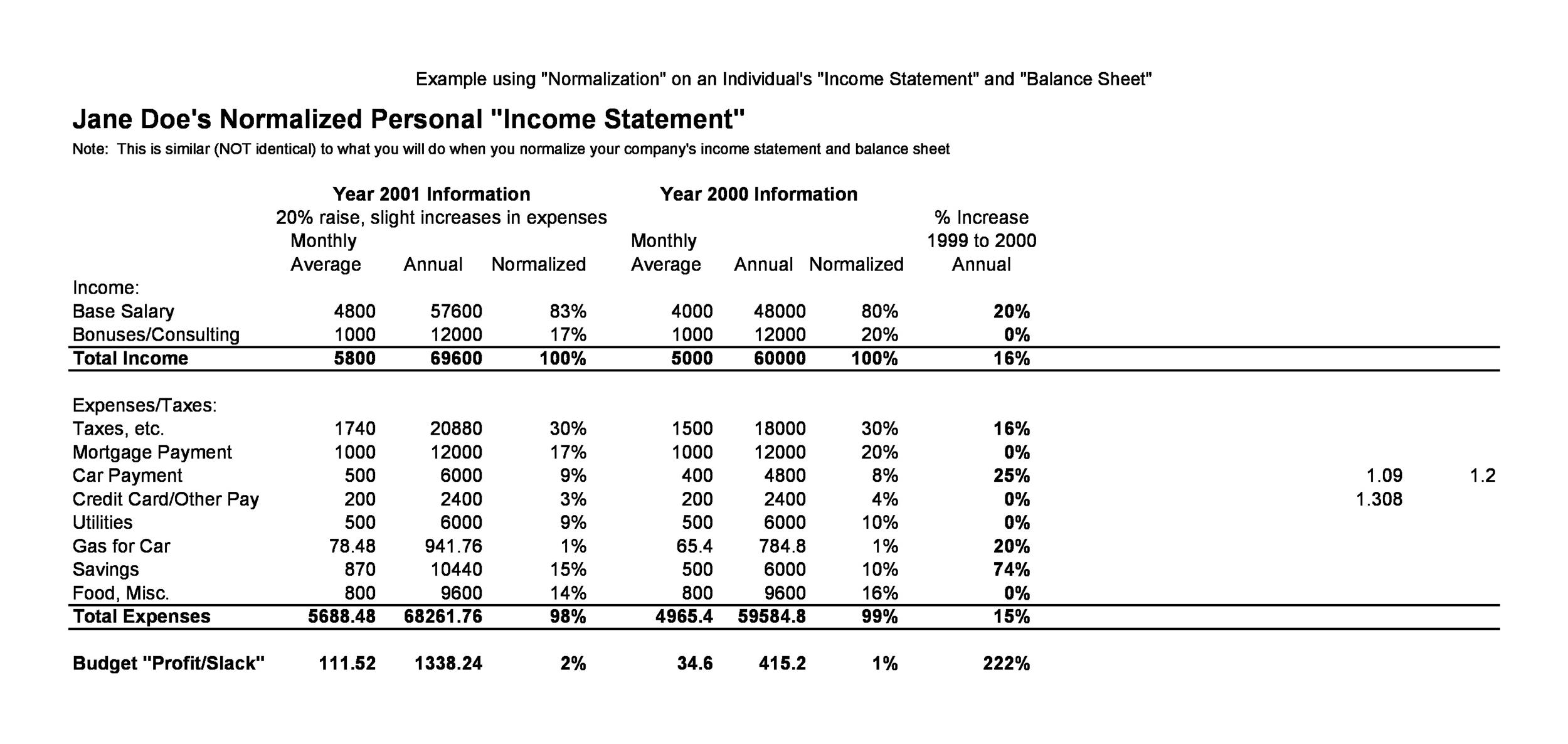

Type of income statement. Income statements are often shared as quarterly and annual reports, showing financial trends and comparisons over time. Depending on the business type and preferences, income statements may refer to revenue as: Income statements are also known as statements of earnings, statements of income, net income statements, profit and loss statements or simply “p&ls,” among other names.

The comparative income statement presents the results of multiple reporting periods in. Of all the financial statements income statement is very popular and important. In brief, the balance which stands after deduction of total expenses from total.

It can also be referred to as a profit and loss (p&l) statement and is typically prepared quarterly or annually. An income statement is generally and officially called the statement of comprehensive income. Types of income statements classified income statement.

The chapea mission 1 crew (from left: Here are seven different types of income statements: This annexure presents government’s latest estimates of the fiscal cost of tax expenditures, as well as the methodology used to produce these estimates.

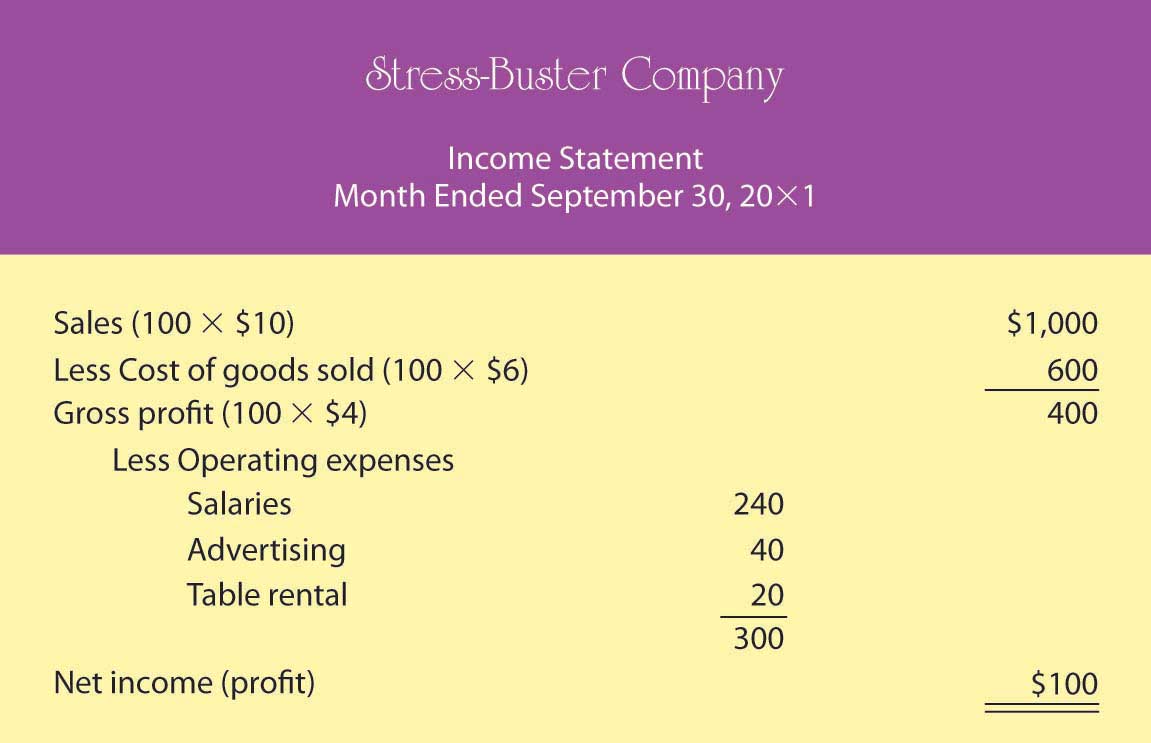

An income statement is a financial statement that reports the revenues and expenses of a company over a specific accounting period. Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss transactions. It also shows whether a company is making profit or loss for a given period.

There are two types of income statements: We can interpret the new name of this statement simply as it is provided. An income statement is a financial statement that shows you the company’s income and expenditures.

An income statement is a financial report detailing a company’s income and expenses over a reporting period. The income statement focuses on four key items: What are the different types of income statements and how are they calculated?

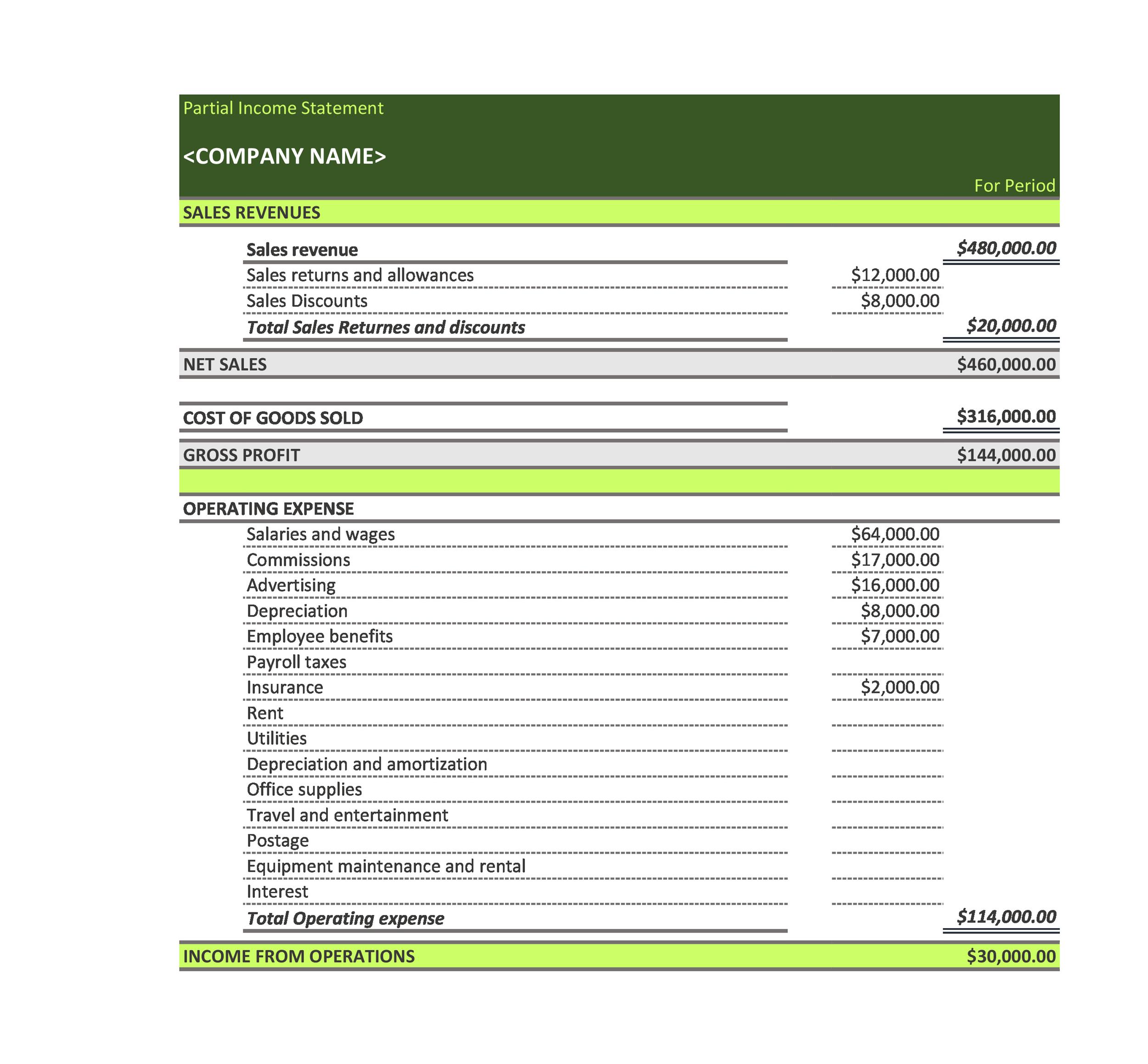

These types of income statements are the most basic and easiest to understand. A business uses a classified income statement when it has a large number of revenue and expense. There are four primary types of financial statements:

It is also known as the profit and loss (p&l) statement, where profit or loss is determined by subtracting all expenses from the. The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement. Statements and releases today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable.

The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner. The classified income statement uses subtotals for the gross margin, operating expenses,. There are several different types of income statements, each with its own purpose and information.