Simple Info About Contribution Margin Income

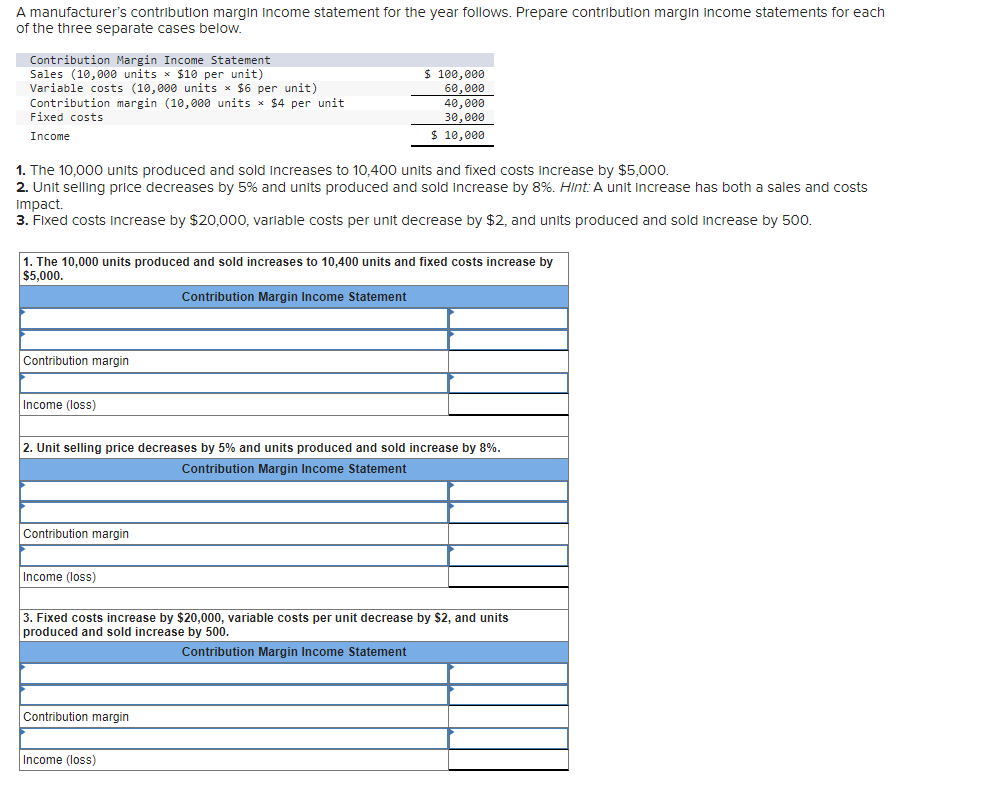

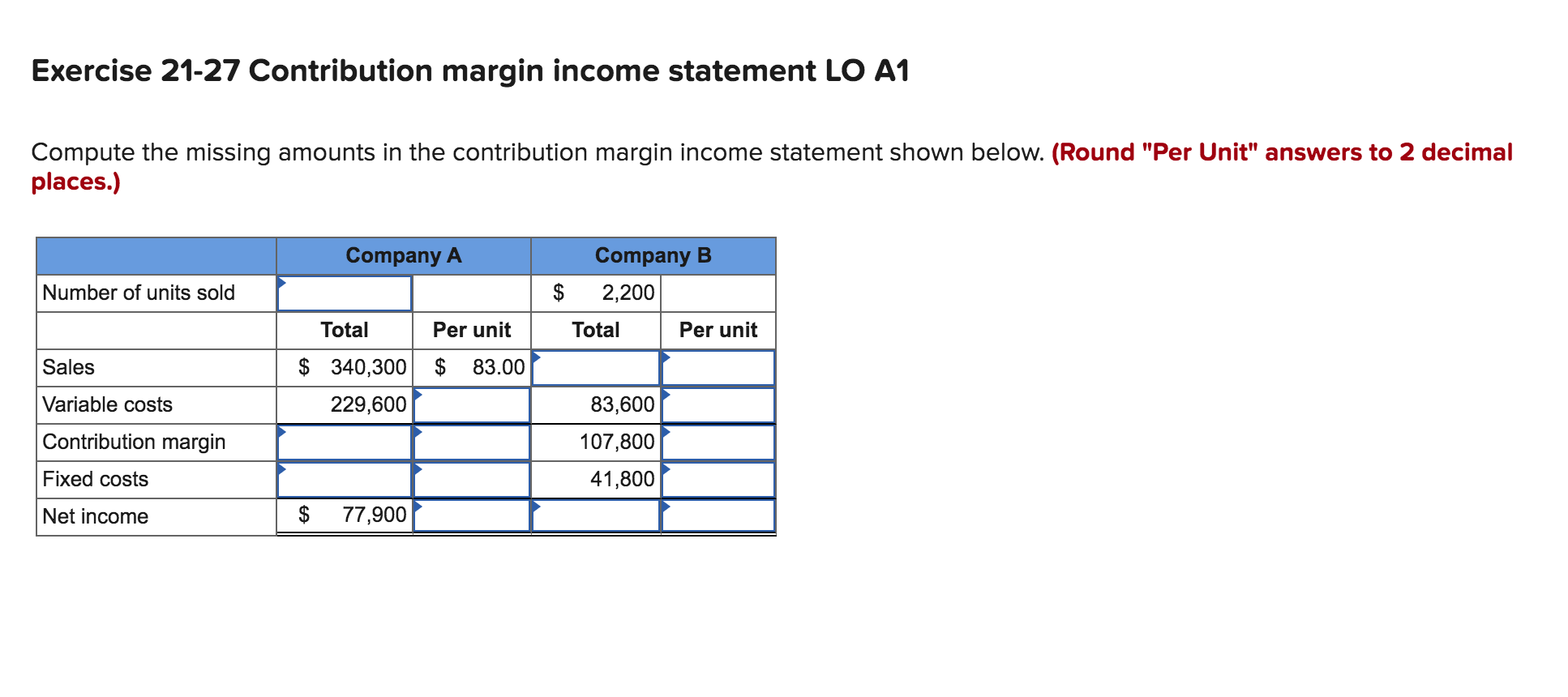

In accounting, contribution margin is the difference between the revenue and the variable costs of a product.

Contribution margin income. In terms of computing the amount: Operating income, excluding special items and u.s. For the quarter, gaap earnings per diluted share was $4.93, up 33% from the previous quarter.

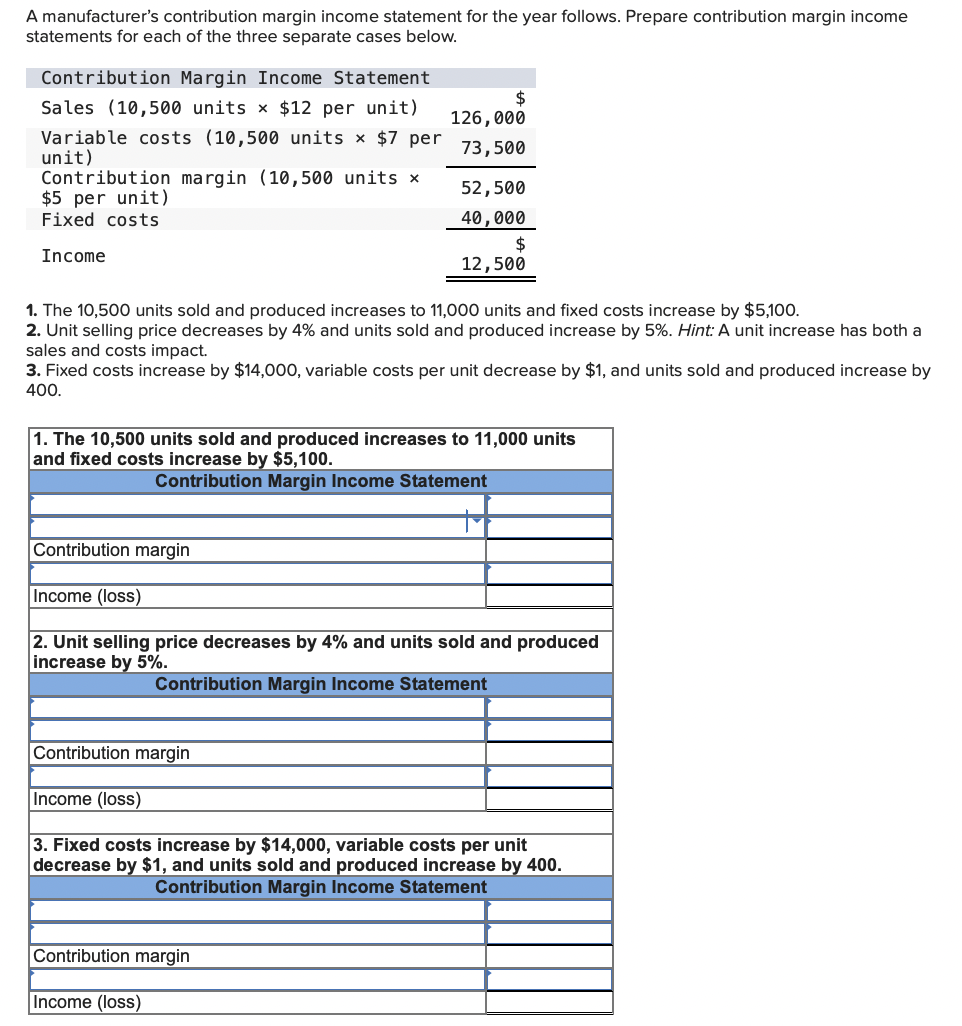

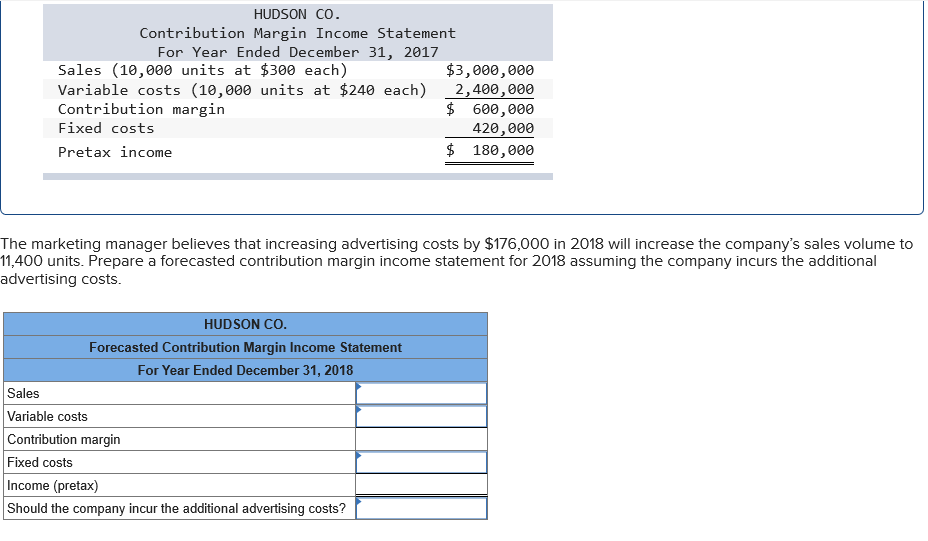

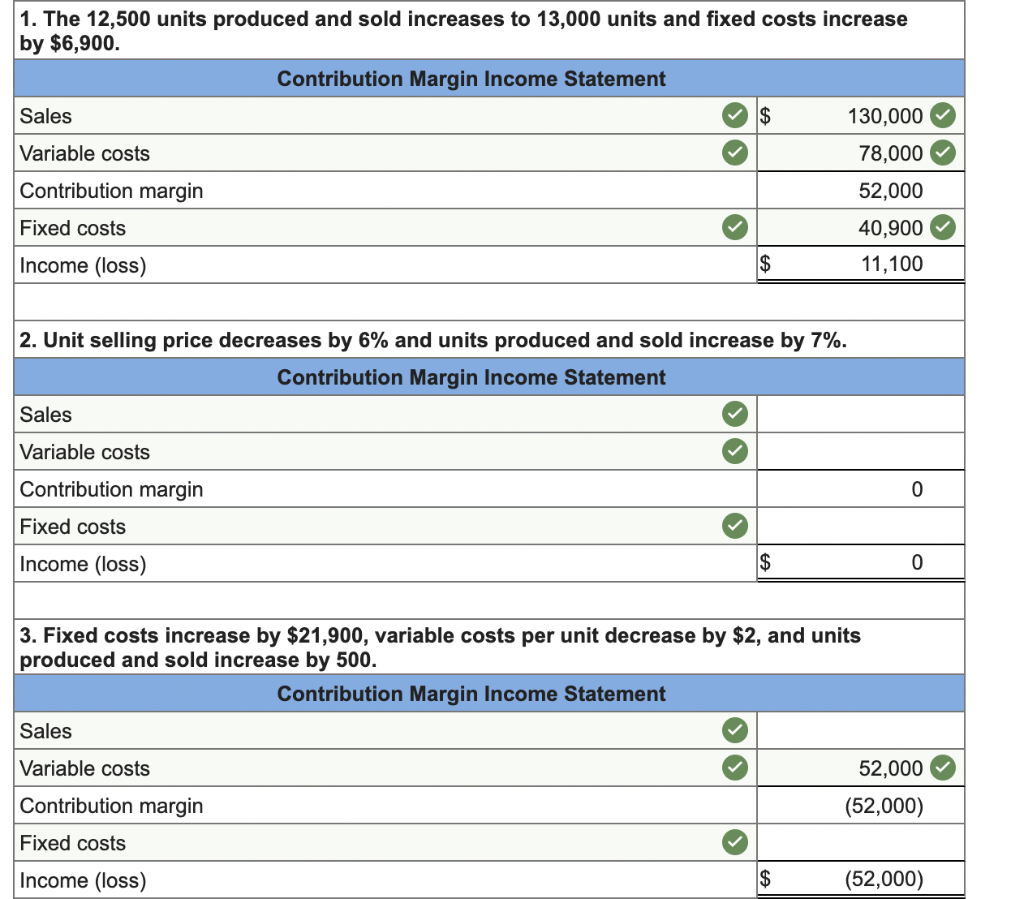

Contribution margin = fixed costs + net income The contribution margin ratio refers to the difference between your sales and variable expenses expressed as a percentage. If fixed costs were $100,000, for example, operating income would be $45,400.

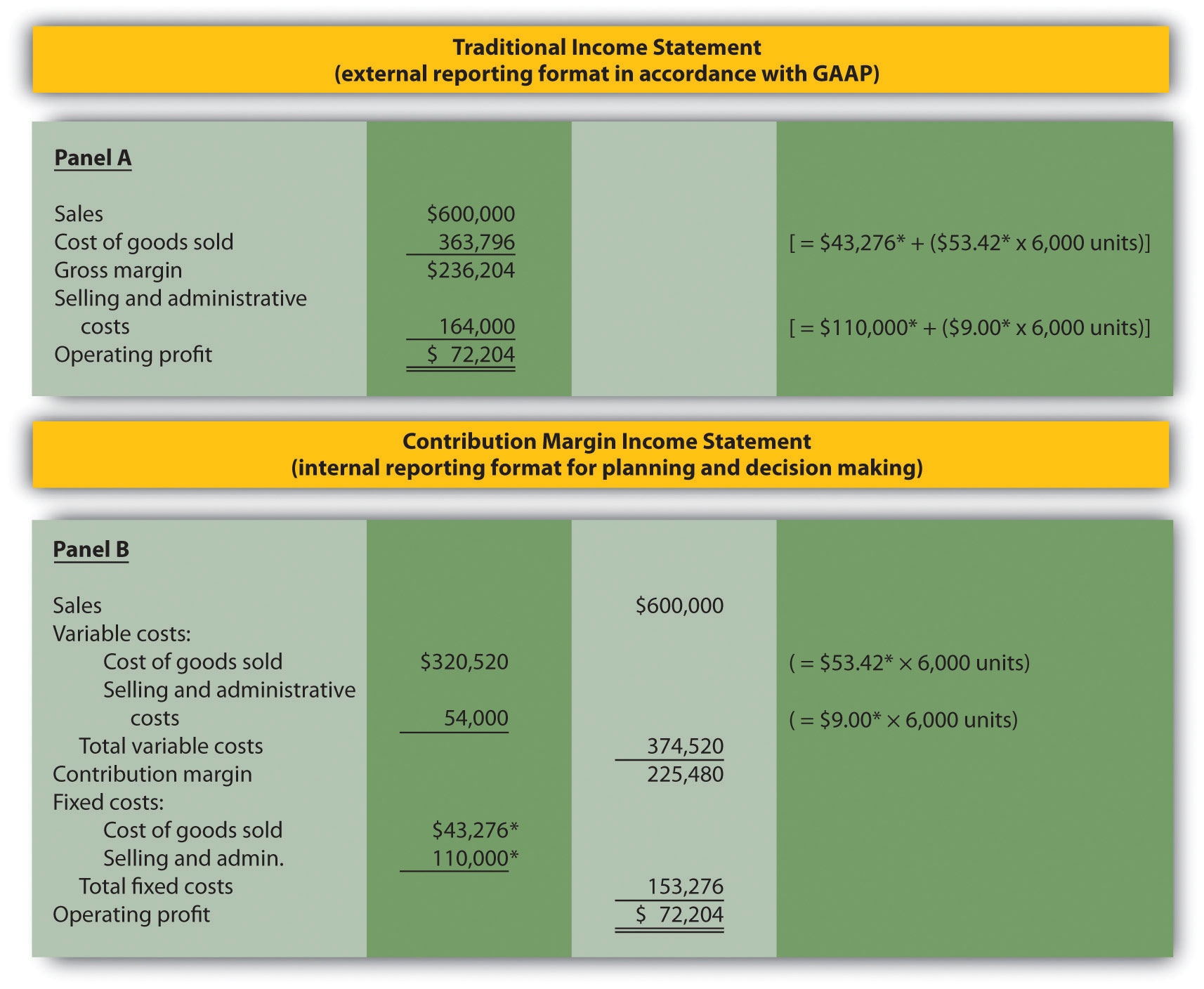

After variable costs of a product are covered by sales, contribution margin begins to cover fixed costs. The fixed costs are situated lower down in the income statement. It can be calculated using either the unit contribution margin or the total contribution margin.

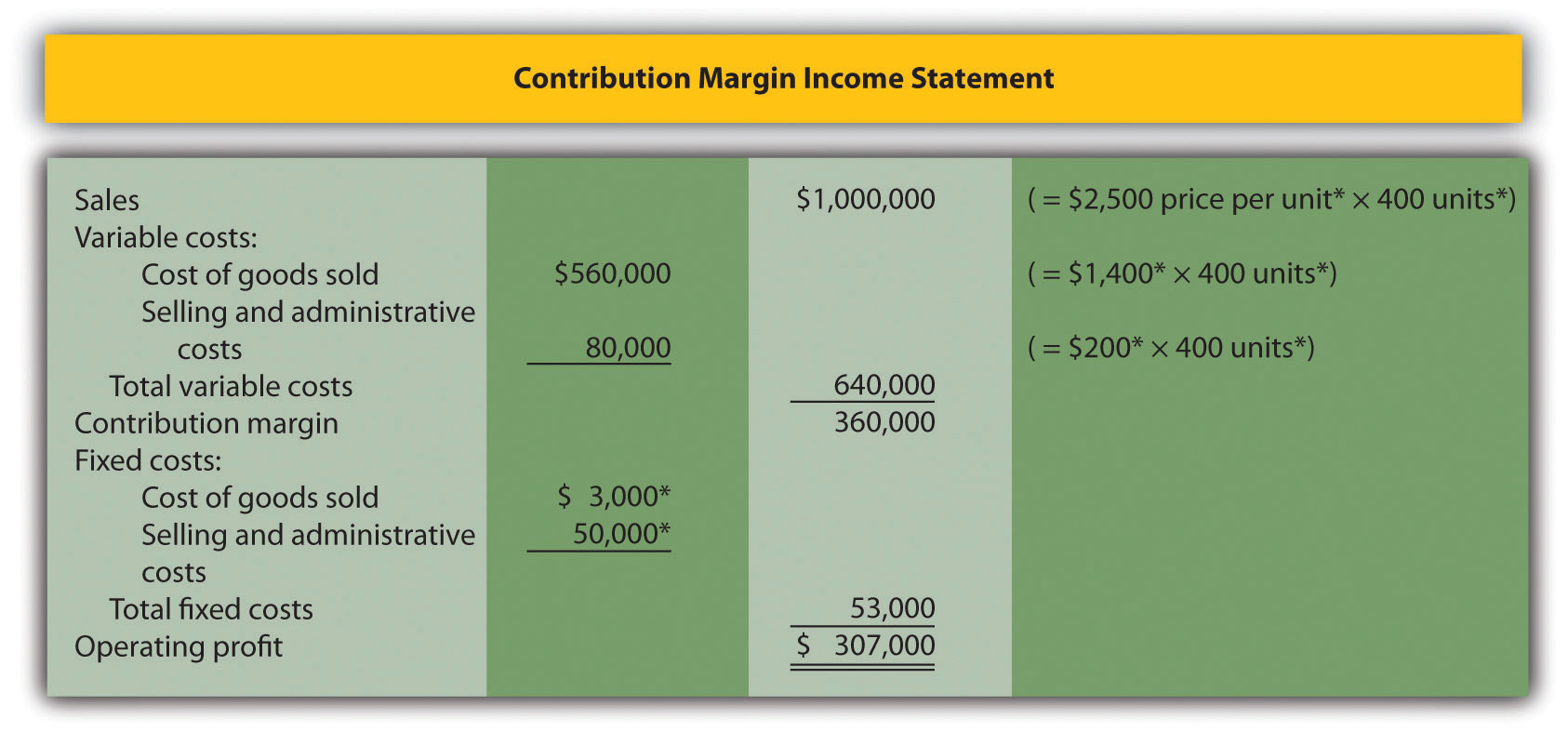

Example of contribution margin assume that a retailer had sales of $400,000 and its cost of goods sold was $250,000. Definition of contribution margin contribution margin is defined as revenues minus the variable costs and variable expenses. Contribution margin = fixed costs + net income.

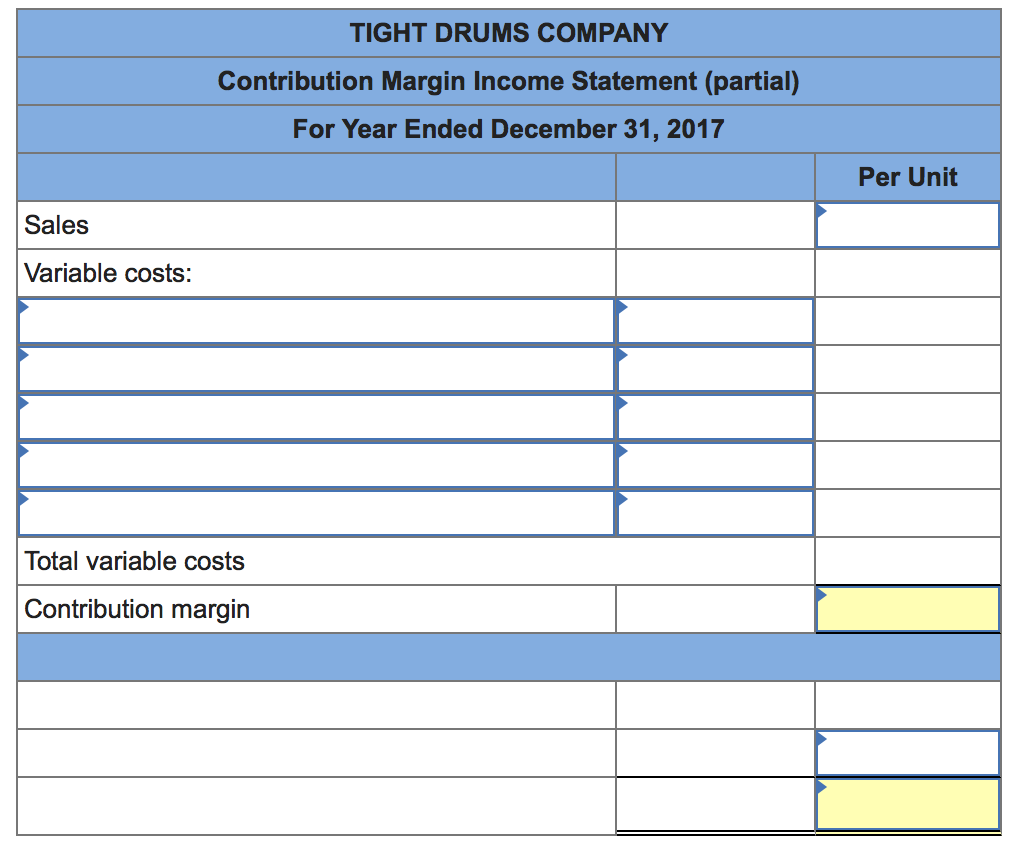

Calculate the contribution margin and the income of the company during the period using the contribution margin income statement. The resulting value is sometimes referred to as operating income or net income. What it is, how to calculate it, and why you need it by amy gallo october 13, 2017 ross m.

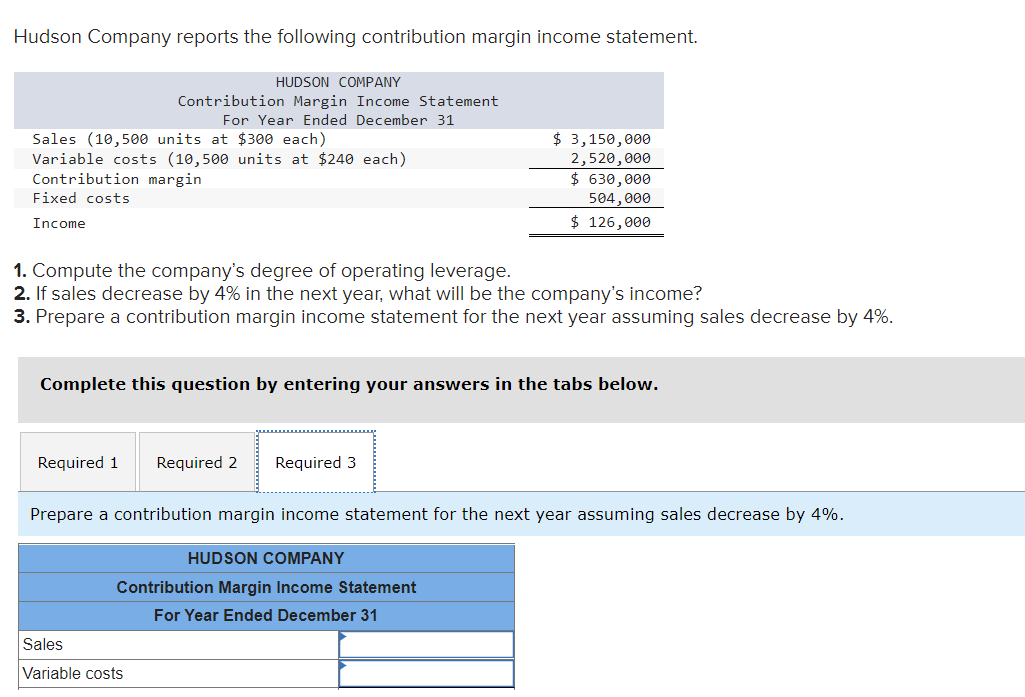

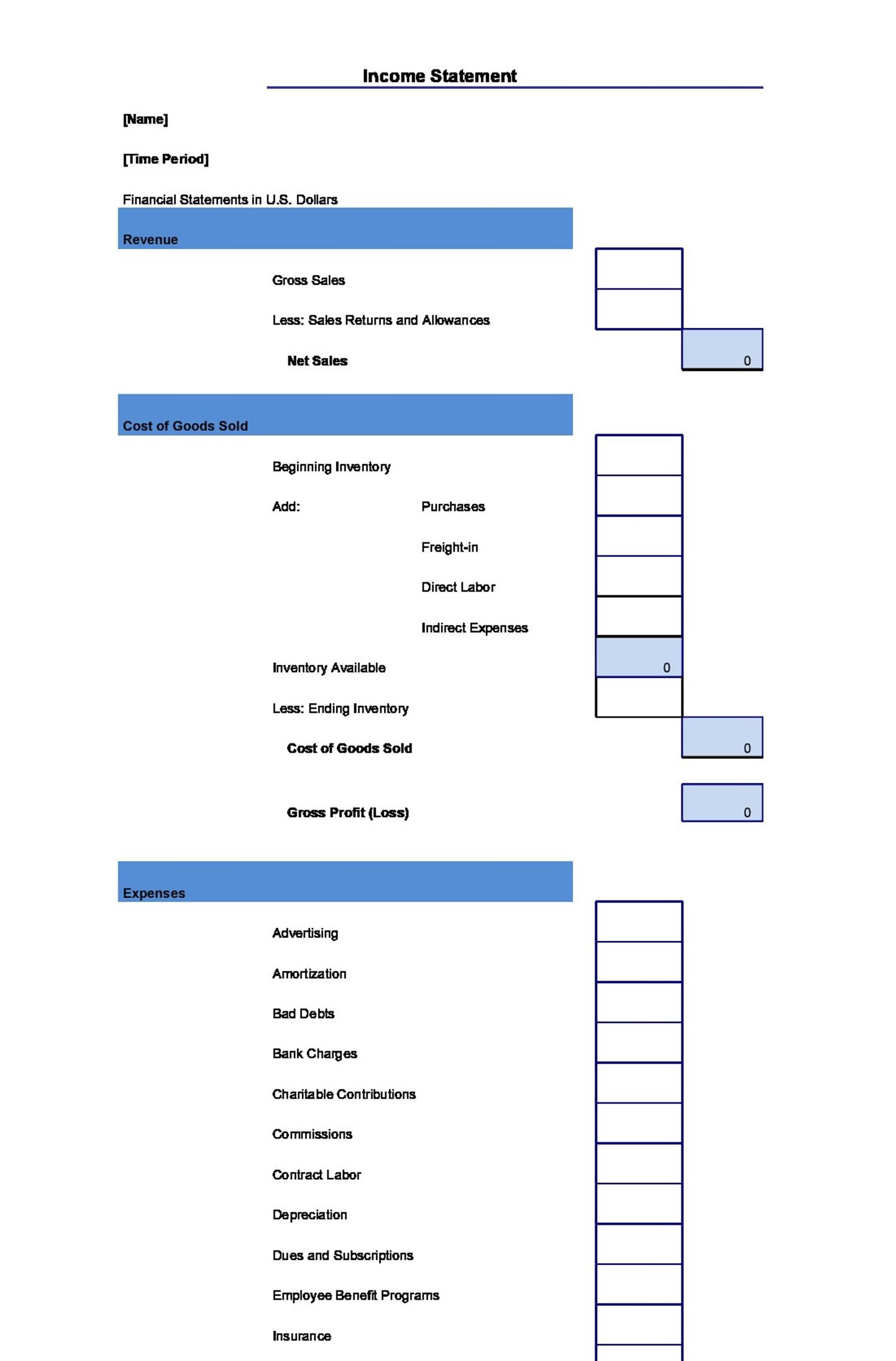

The net profit margin is net income divided by revenue. A contribution margin income statement is distinct from a regular income statement in the following ways: It is the amount remaining that will contribute to covering fixed costs and to operating profit.

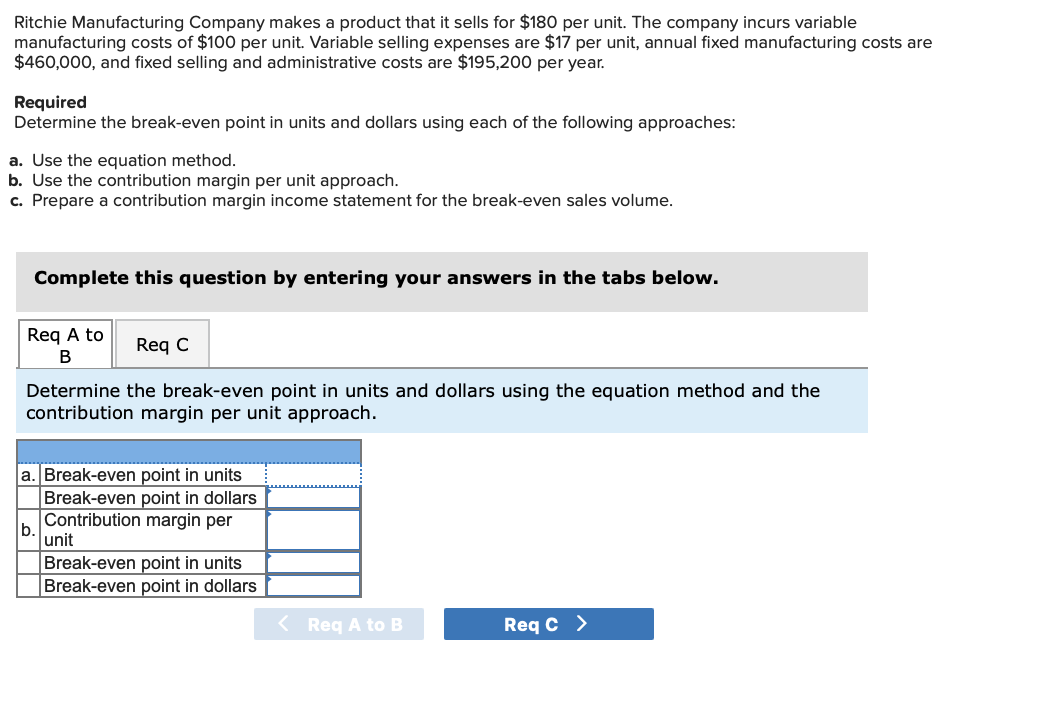

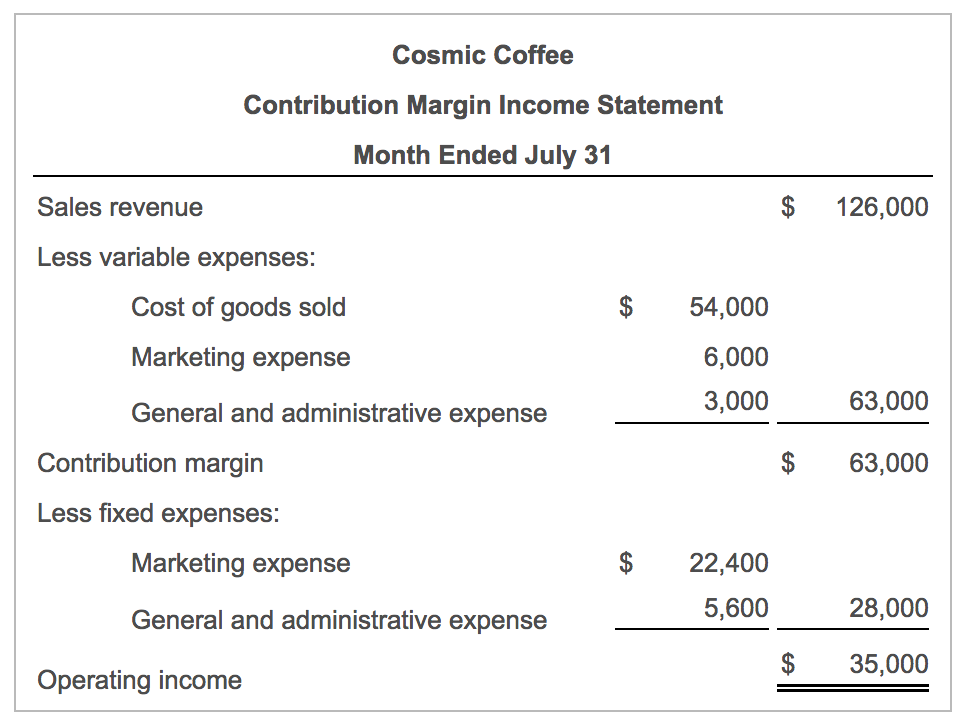

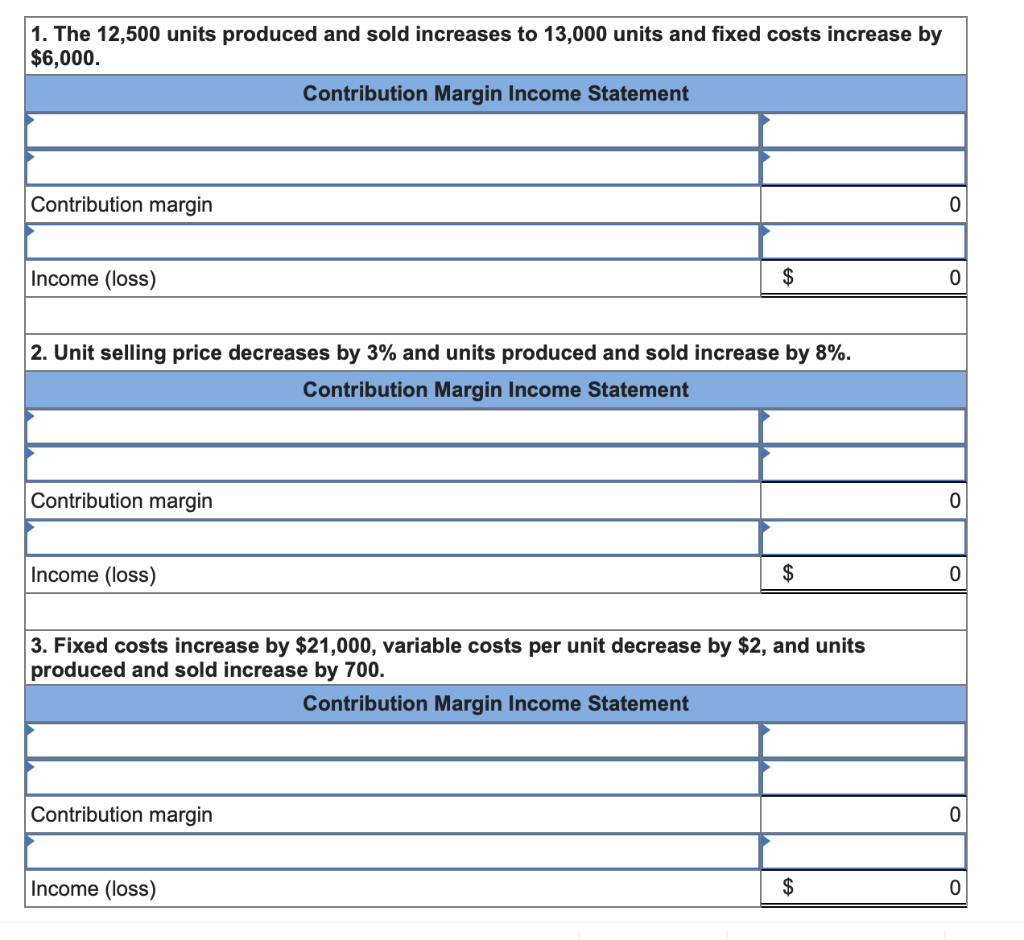

The 60% ratio means that the contribution margin for each dollar of revenue generated is $0.60. A contribution margin income statement is an income statement in which all variable expenses are deducted from sales to arrive at a contribution margin. Then, all fixed expenses are subtracted to arrive at the net profit or net loss for the period.

Recall that total fixed costs remain constant regardless of the level of activity. The contribution margin income statement helps leaders understand whether the company is profitable. This is expressed through the following formula:

To understand how profitable a business is, many. In the next step, the cm ratio can be calculated using the following formula: Then, further fixed expenses are deducted from the contribution to get the net profit/loss of the business entity.

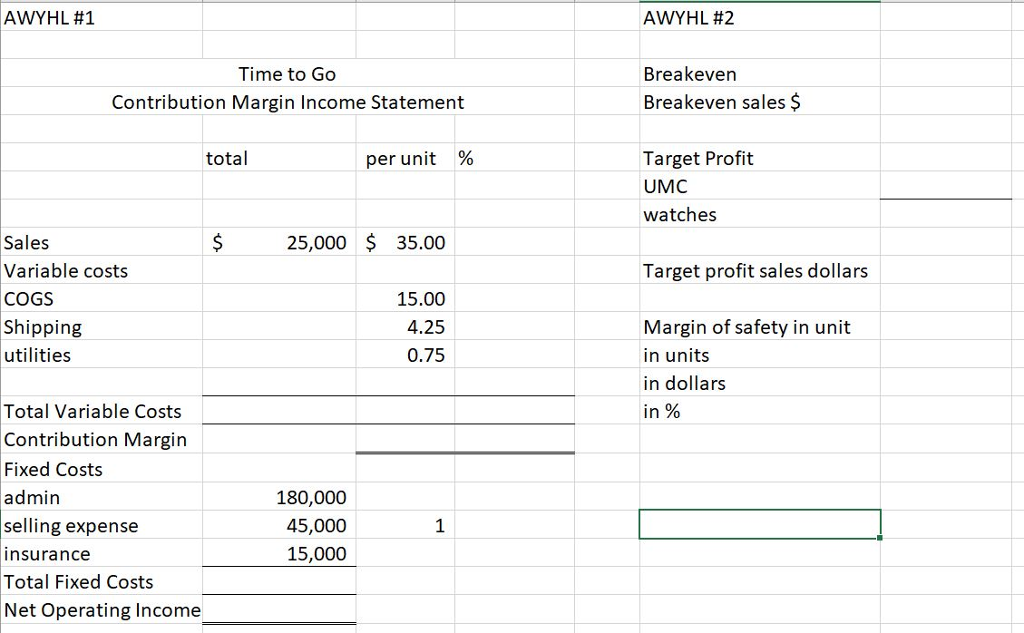

Cm ratio = $15.00 ÷ $25.00 = 0.60, or 60%; A contribution margin income statement is a document that tallies all of a company’s products and varying contribution margins together. That is, this ratio calculates the percentage of the contribution margin compared to your company’s net sales.