Outrageous Info About Balancing A Balance Sheet

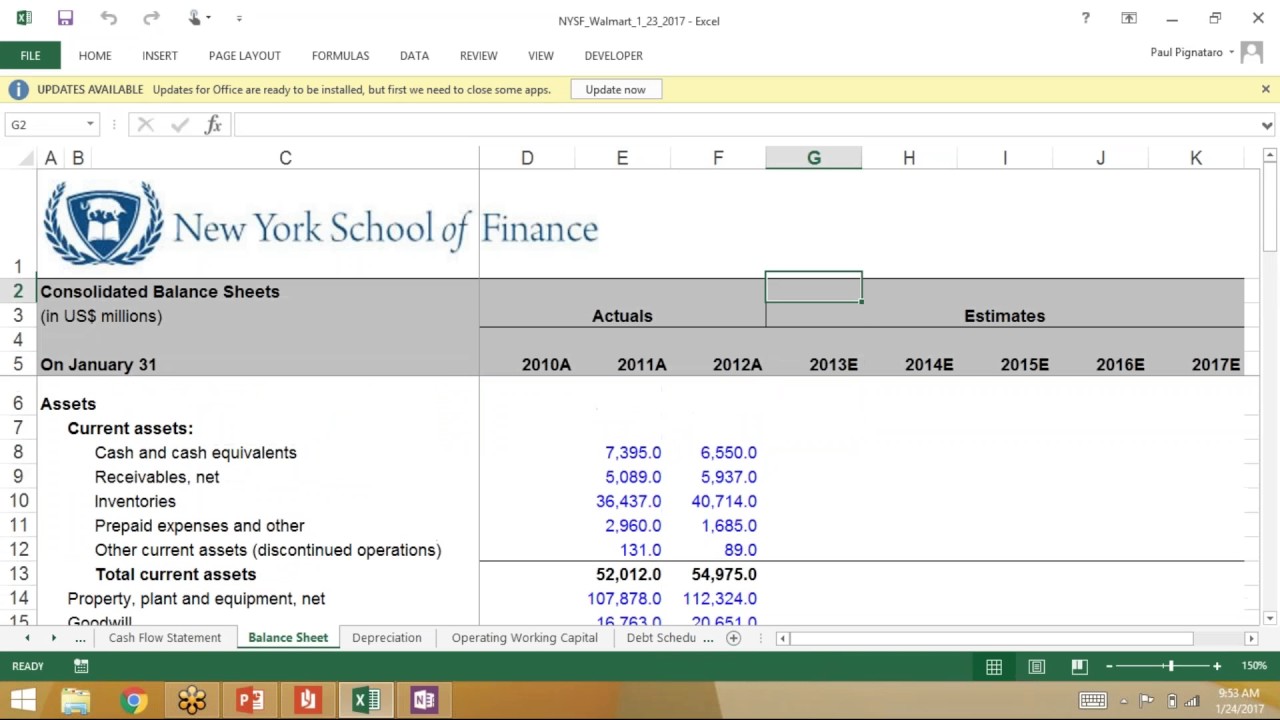

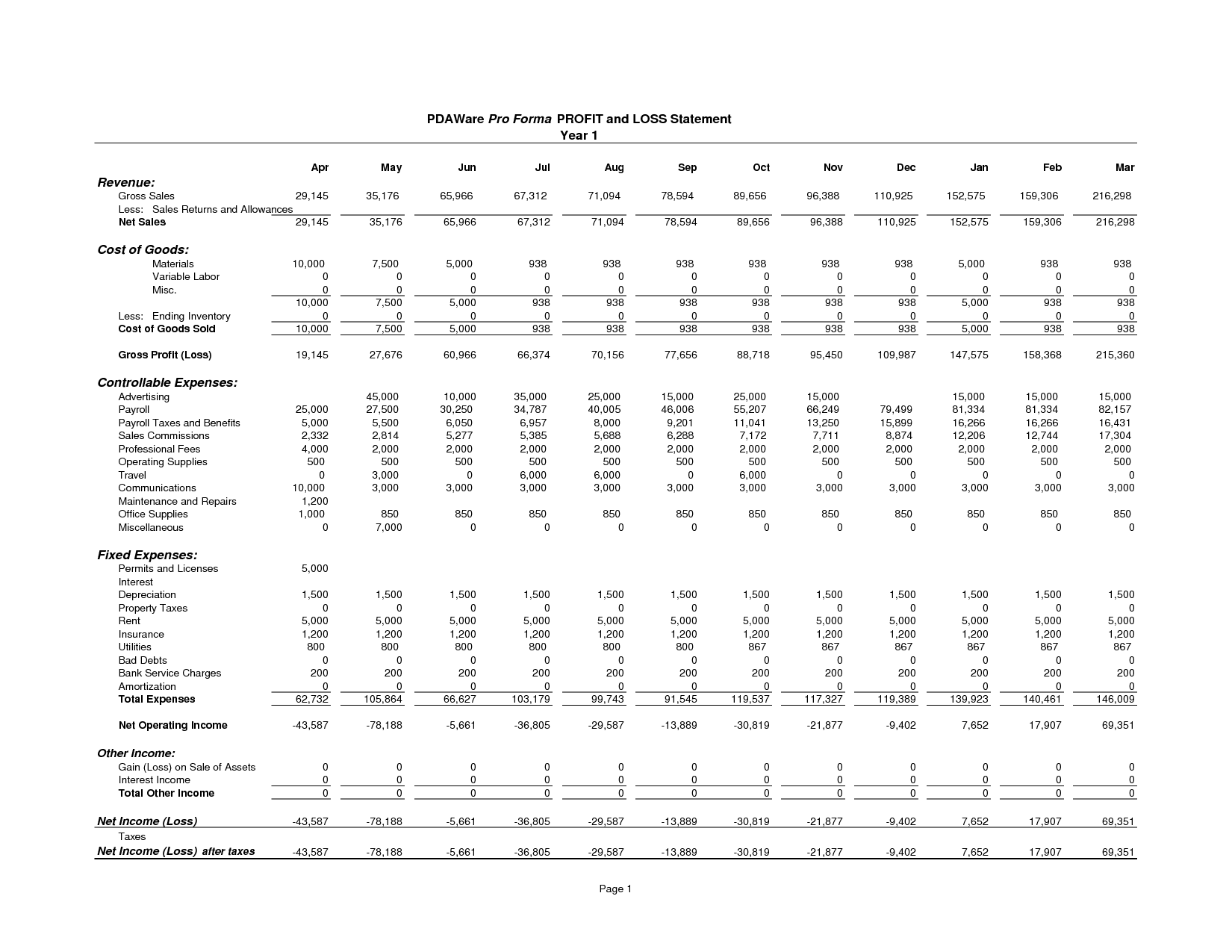

Typically, a balance sheet will be prepared and distributed on a quarterly or monthly basis, depending on the frequency of reporting as determined by law or company policy.

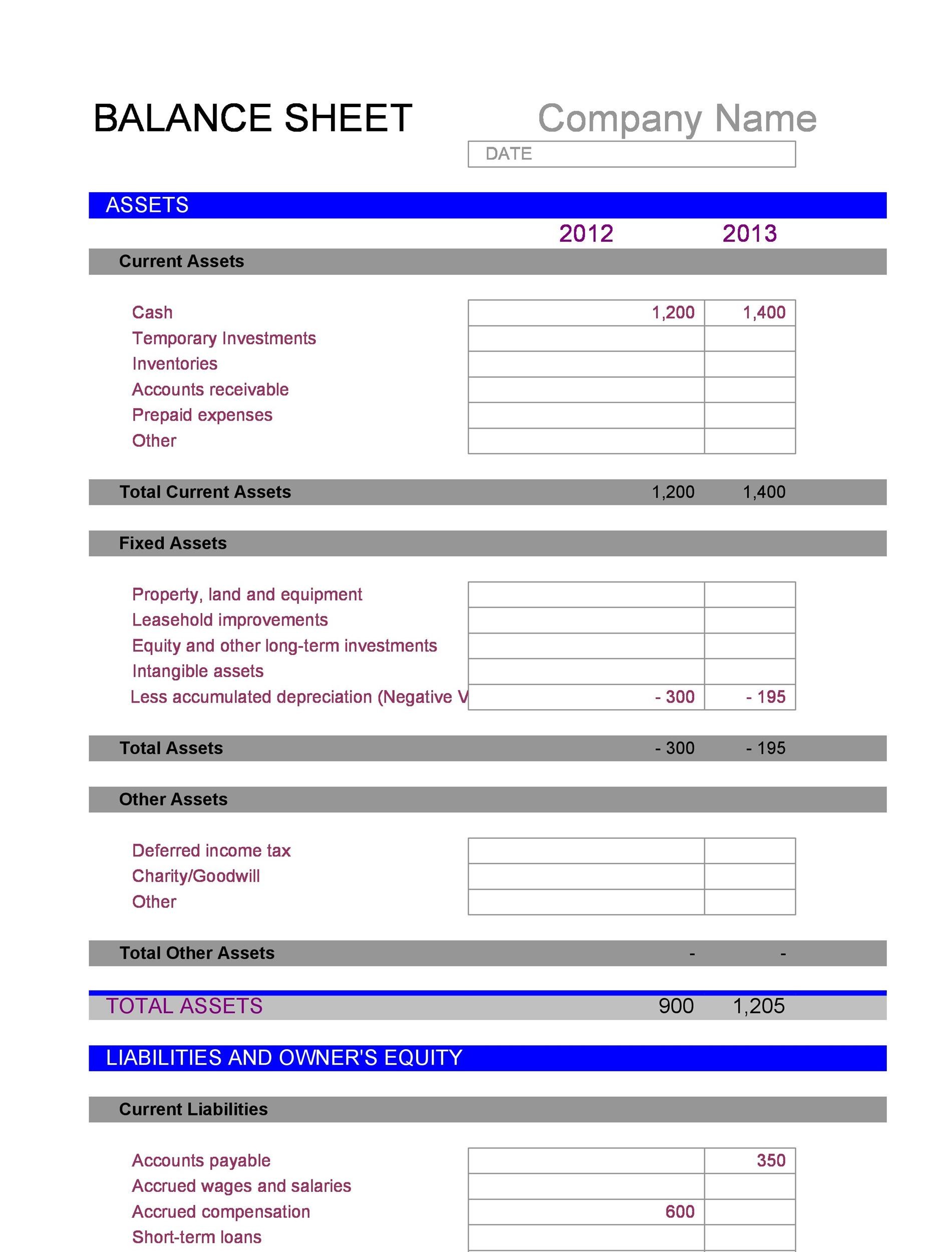

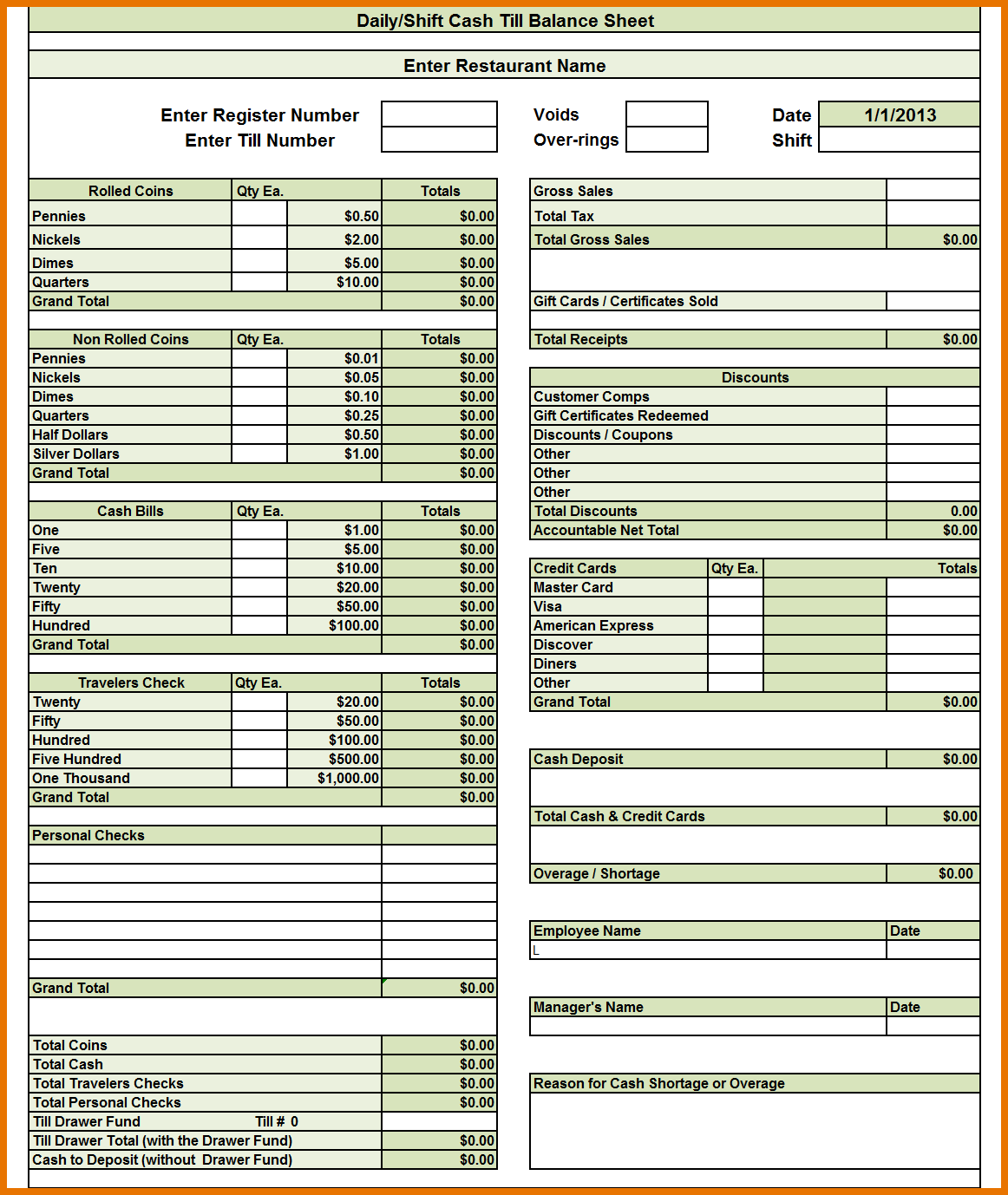

Balancing a balance sheet. Title the sum “total liabilities and owner's equity. the balance sheet has been correctly prepared if “total assets” and “total liabilities and owner's equity” are equal. Assets = liabilities + equity. Top 10 ways to fix an unbalanced balance sheet.

The balance sheet, one of the core financial statements, provides a snapshot of a company’s assets, liabilities and shareholders’ equity at a specific point in time. Enter hardcodes across one row of the balance sheet for each year that doesn’t balance). The balance sheet is based on the fundamental equation:

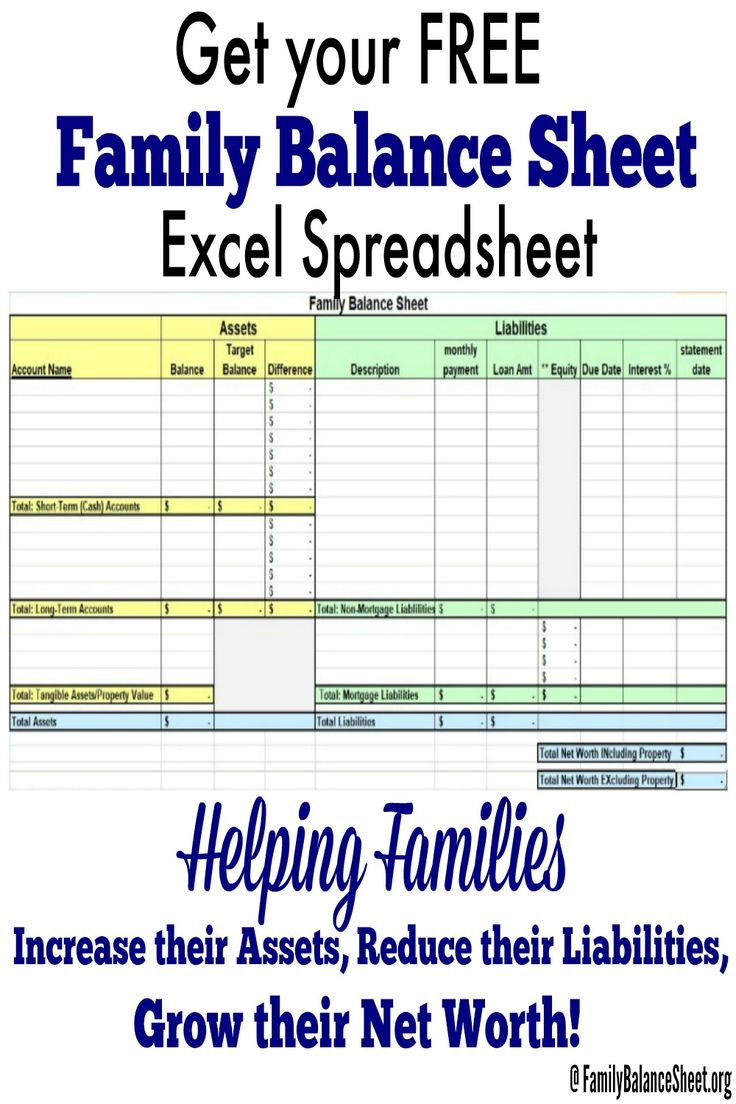

The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. A balance sheet provides a snapshot of a company’s financial performance at a given point in time. Wire the balance sheet so that it always balances by making retained earnings equal to total assets less total liabilities less all other equity accounts.

Most balance sheets are arranged according to this equation: We start the balance sheet forecast by forecasting working capital items. The report can be used by business owners, investors, creditors, and shareholders.

A balance sheet is guided by the accounting equation: This session will show you a simple trick to get your balance sheet to balance first time, every time using simple modelling techniques, a little accounting knowledge, gratuitous use of error checks and a very basic control account. A balance sheet is a statement of the assets, liabilities, and shareholders’ (or owners’) equity of a business at a particular point in time.

A balance sheet is one of the financial statements of a business that shows its financial position. Balance sheets provide the basis for. When we are setting up our financial statements, we must make sure we bring in both sides of the double entries to ensure our balance sheet balances.

The balance sheet has been described as a snapshot of a company's financial condition. What is a balance sheet? On the other hand, the income statement offers a dynamic view of a company’s profitability over a particular period, showcasing its revenue, expenses, and net income.

Key natural actives of our acne care facial wipes and sheet mask. (for a complete guide to working capital, read our “working capital 101” article.). The name balance sheet is based on the fact that assets will equal liabilities and shareholders' equity every time.

The “balance” in balance sheet indicates the 2 sides have to balance every time. Be in control of your modelling and account for your outputs efficiently and effectively. Both parts should be equal to each other or balance each other out.

A balance sheet should always balance. A balance sheet is a comprehensive financial statement that gives a snapshot of a company’s financial standing at a particular moment.

![49 Balancing Chemical Equations Worksheets [with Answers]](https://templatelab.com/wp-content/uploads/2017/01/balancing-equations-02.jpg)