Build A Info About Use Of Form 26as

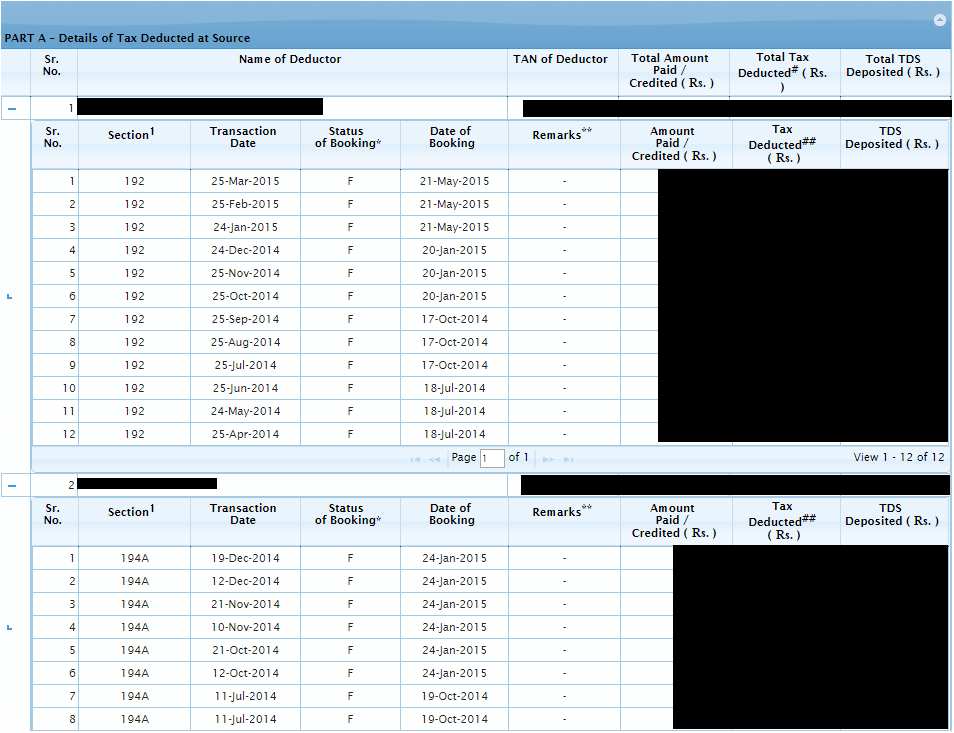

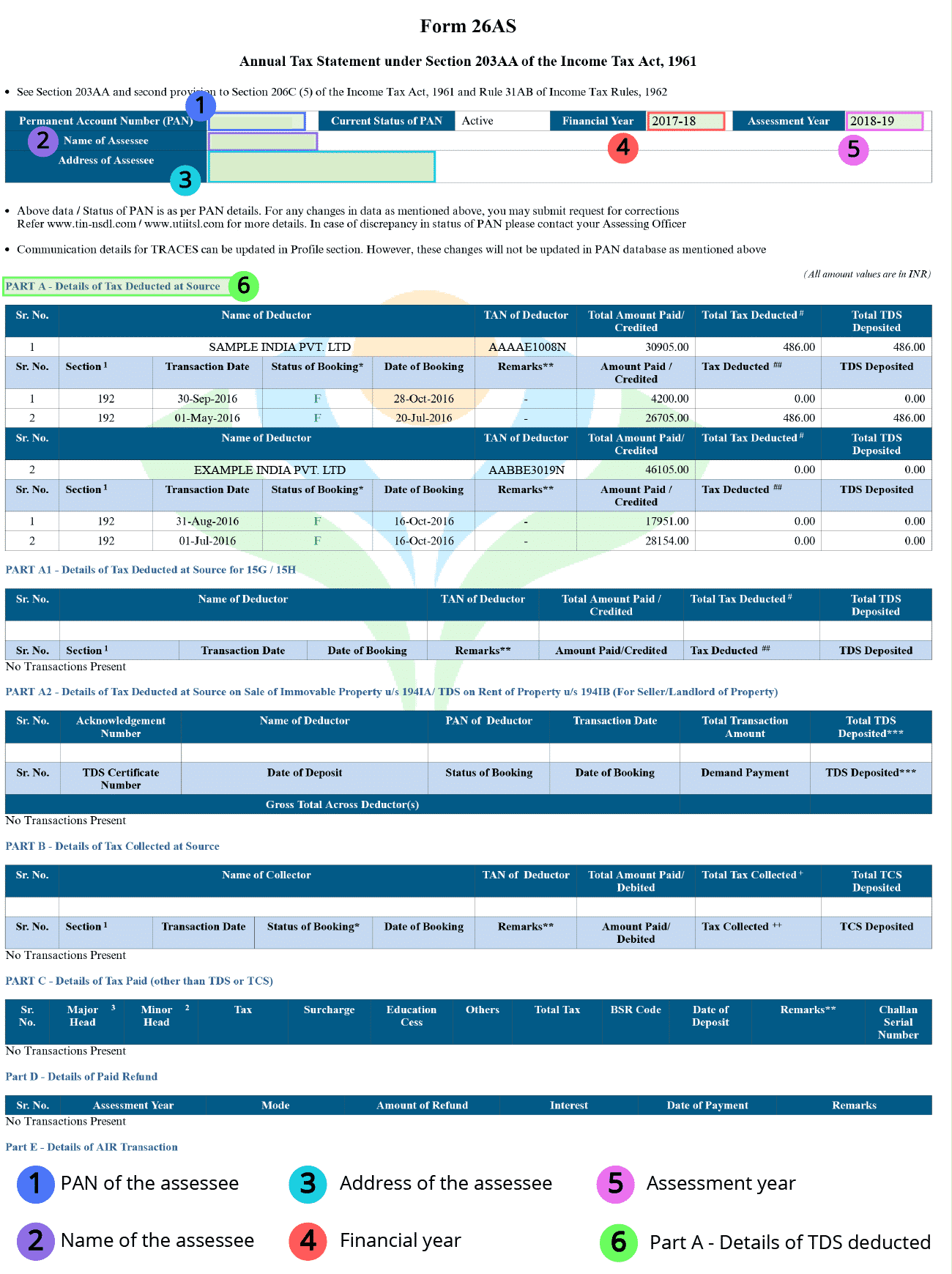

There should be no discrepancy between the tds data on your form 26as and your employer’s form 16.

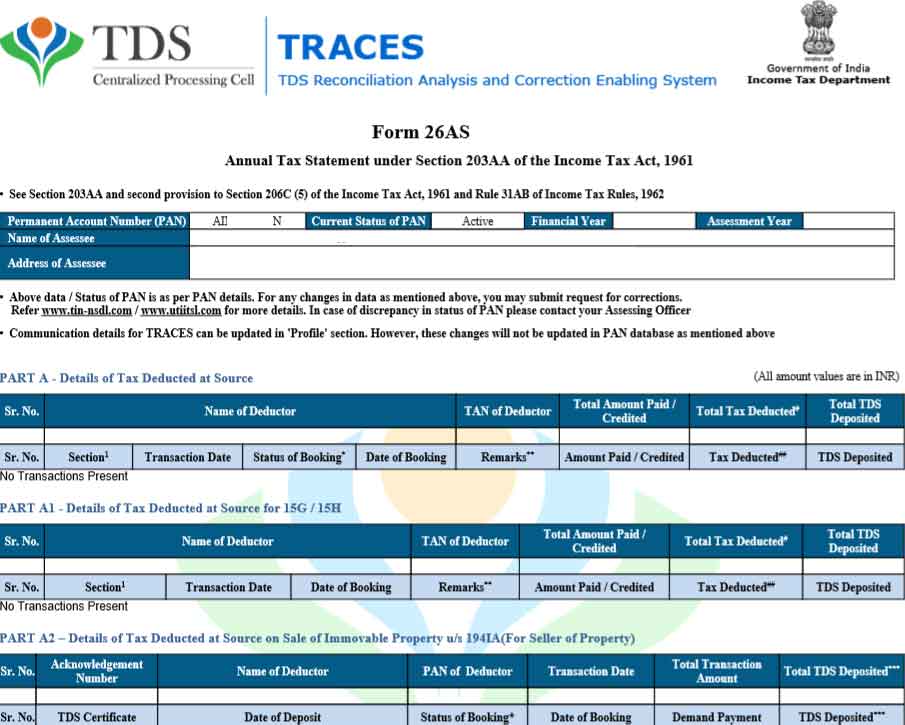

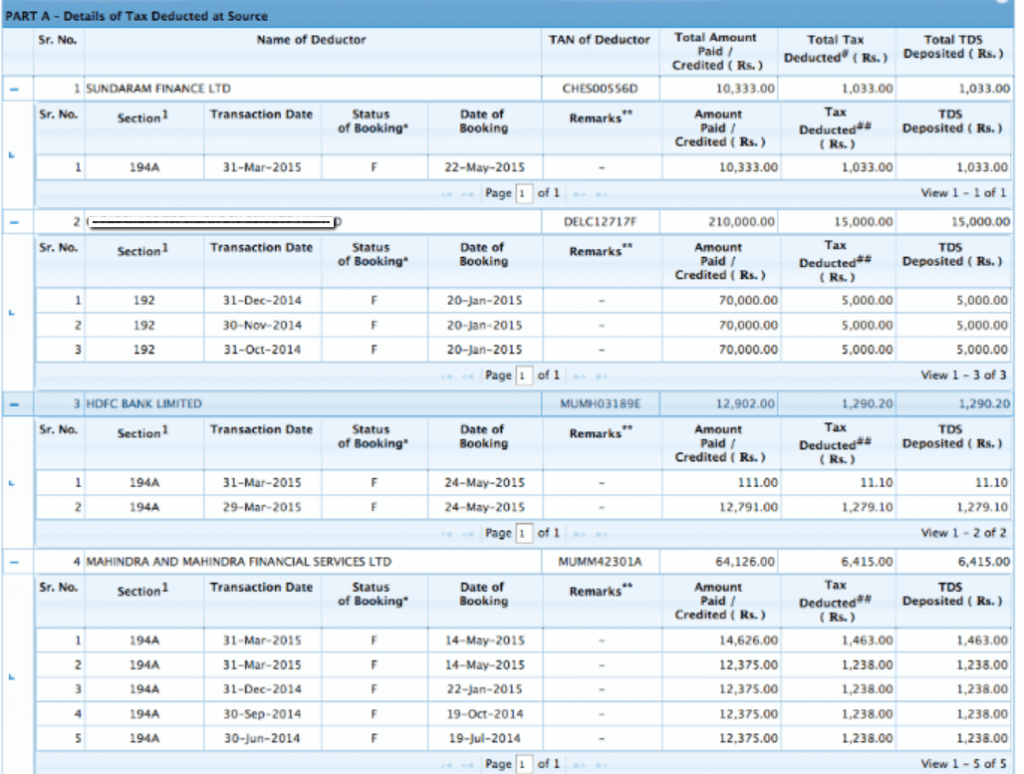

Use of form 26as. It is an important document needed at the time of filing itr,. The income tax department has said that form 26as will now reflect only tds and tcs. It is also known as tax credit statement or annual tax.

Form 26as, often known as the tax credit statement, is a crucial record for filing taxes. Form 26as is a consolidated tax statement issued to the pan holders. Form 26as provides the taxpayer with the relevant tax related information such as details of tds and tcs, details of taxes paid in the form of advance tax and self.

Click on the link view tax credit (form 26as) at the bottom of the. The days of manually filing it returns by downloading form 26as are long. The website provides access to the.

Form 26as proves to be helpful for verifying the tax credits and computation of income before filing income tax returns. How can you use form 26as for filing income tax returns? Form 26as is a tax credit statement that provides the complete record of the taxes paid by a taxpayer.

Form 26as is an annual consolidated tax statement that you can acquire on the it website with your permanent account number (pan). The requirement to manually file it returns required the download of form 26as. You are accessing traces from outside india and therefore, you will require a user id with password.

Form 26as provides a detailed overview of your financial activities for a specific year, going beyond just tds (tax deducted at source) and tcs (tax collected. How to use form 26as. The tax credit statement, also known as form 26as, is crucial documentation for file taxes.

Importance & uses of form 26as. However, with the deadline approaching fast, an individual can use other documents such as form 26as, and ais to file their itr and avoid penalty of up to rs.