Neat Tips About Nonprofit Statement Of Functional Expenses

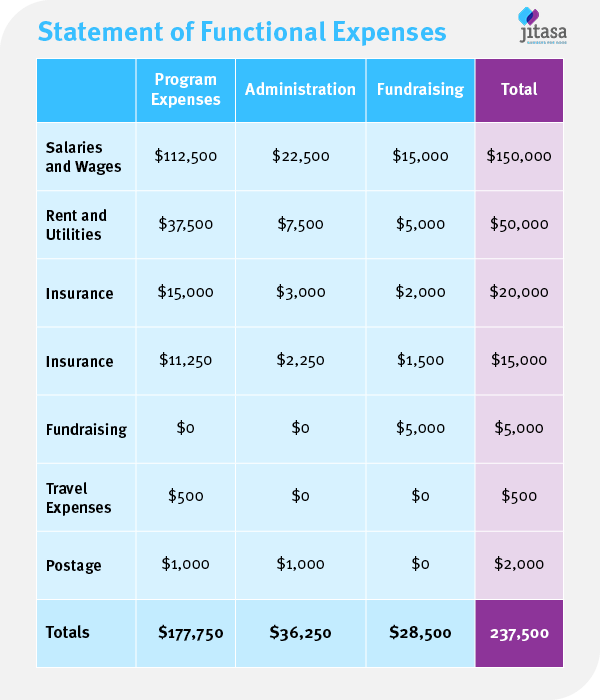

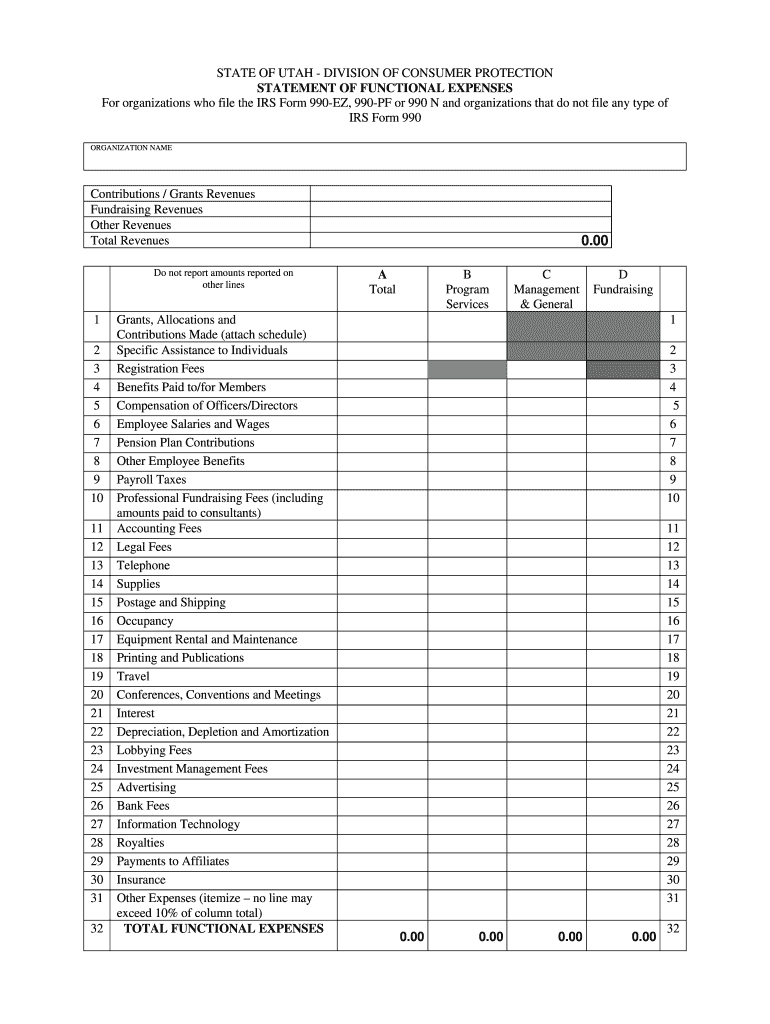

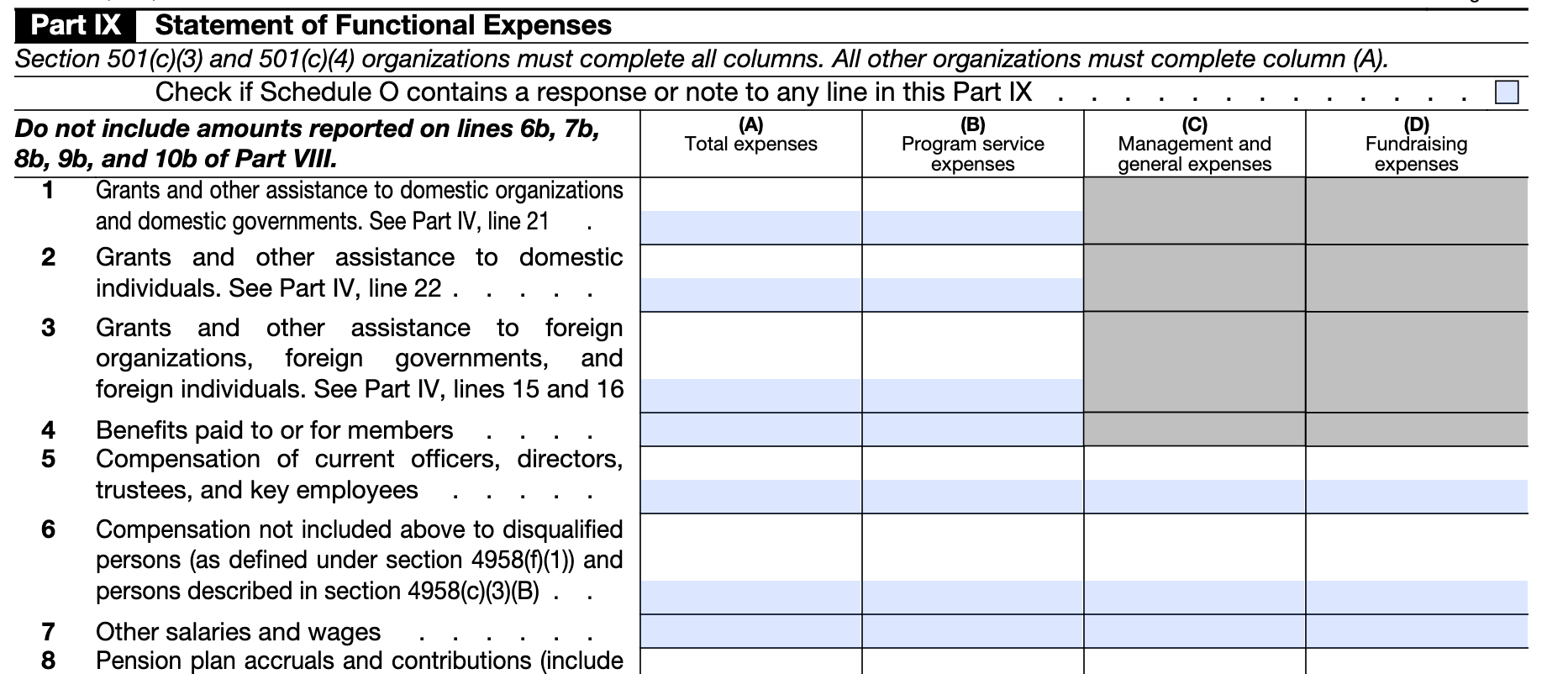

The statement of functional expenses is a critical tool for nonprofits, detailing their expenses across various functional categories.

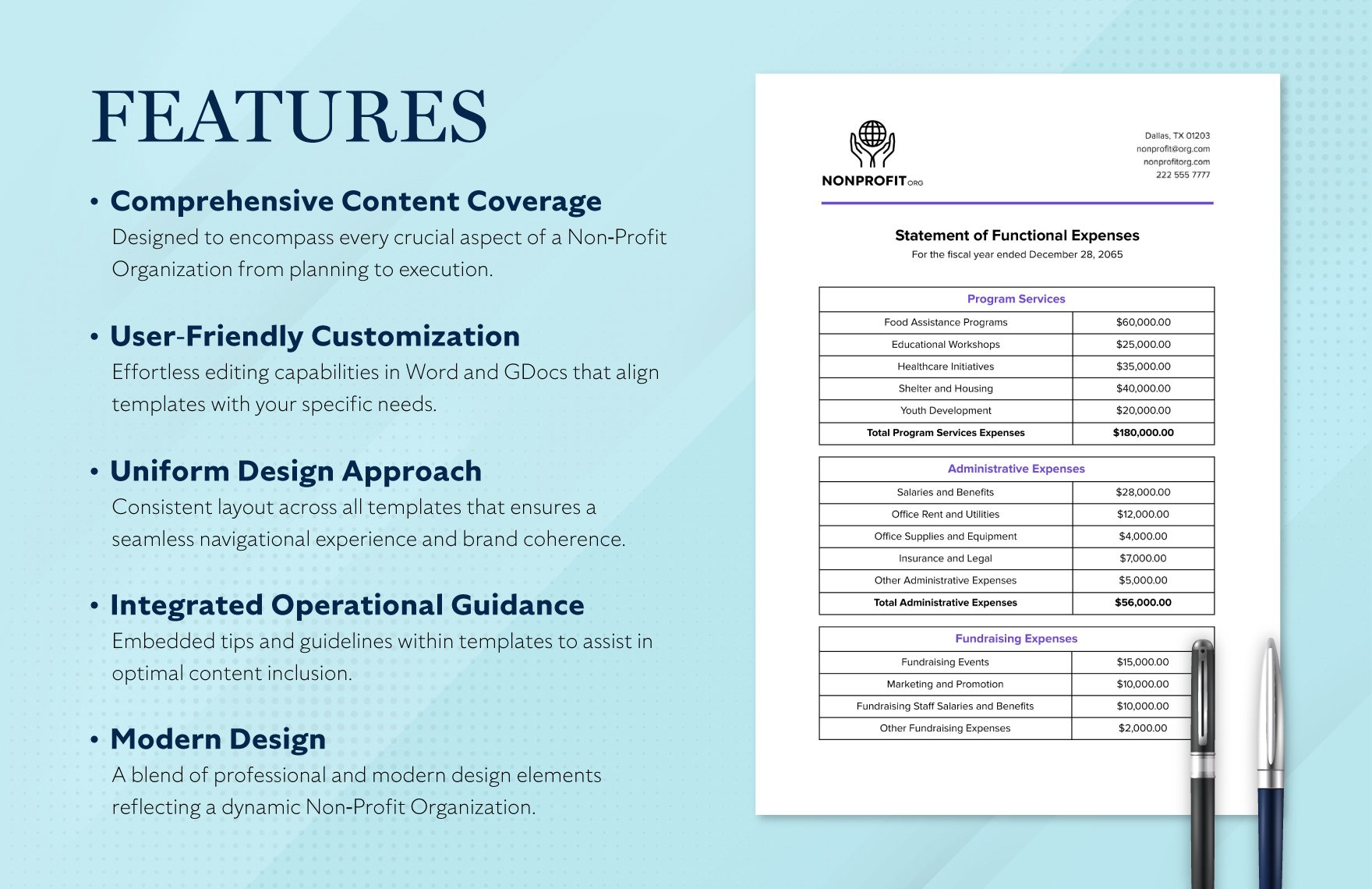

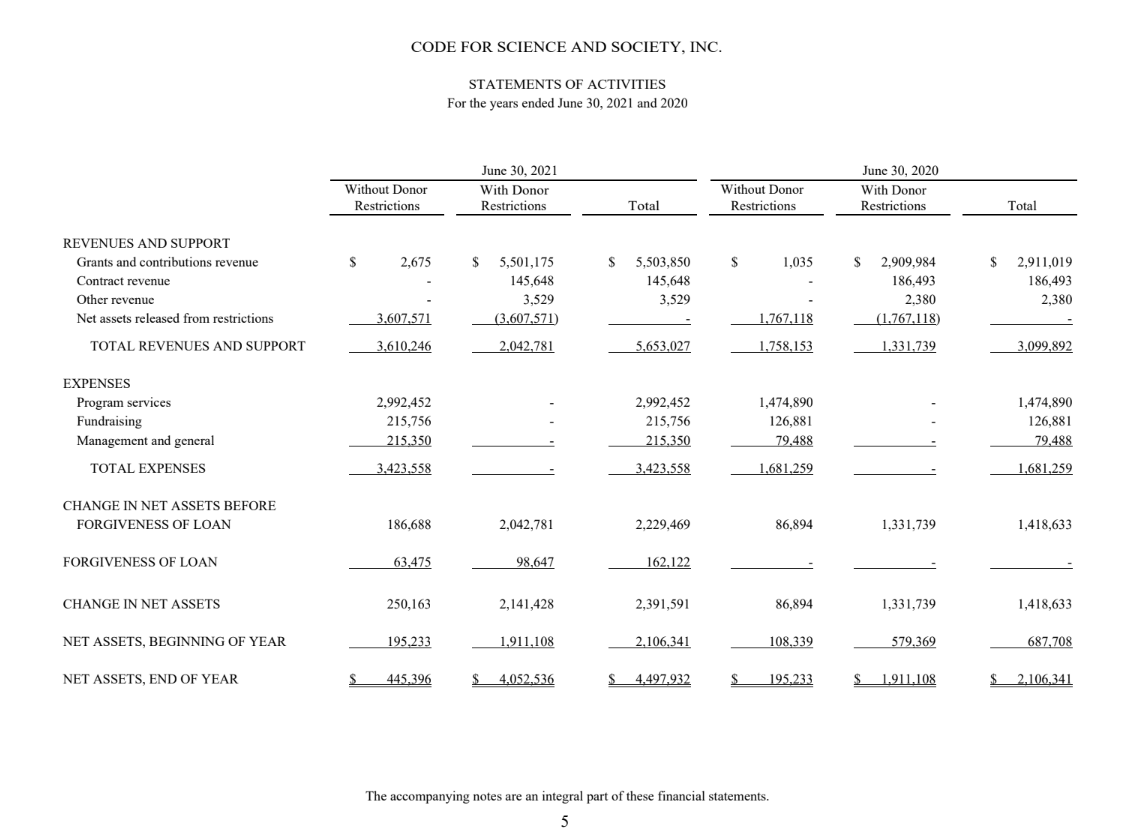

Nonprofit statement of functional expenses. The purpose of the functional expense is to present the expenses in a way that helps analyze the functional classification, such as major programs and the. To quickly review, form 990, the annual information return required of many nonprofits, as well as audited financial statements require expenses to be presented. A statement of functional expenses is used to show how expenses are incurred for each functional area of a.

Natural expenses are the benefits a nonprofit organization makes to seek economic. While providing a comprehensive breakdown of your. The statement of functional expenses is a key component of a nonprofit organization's financial reporting.

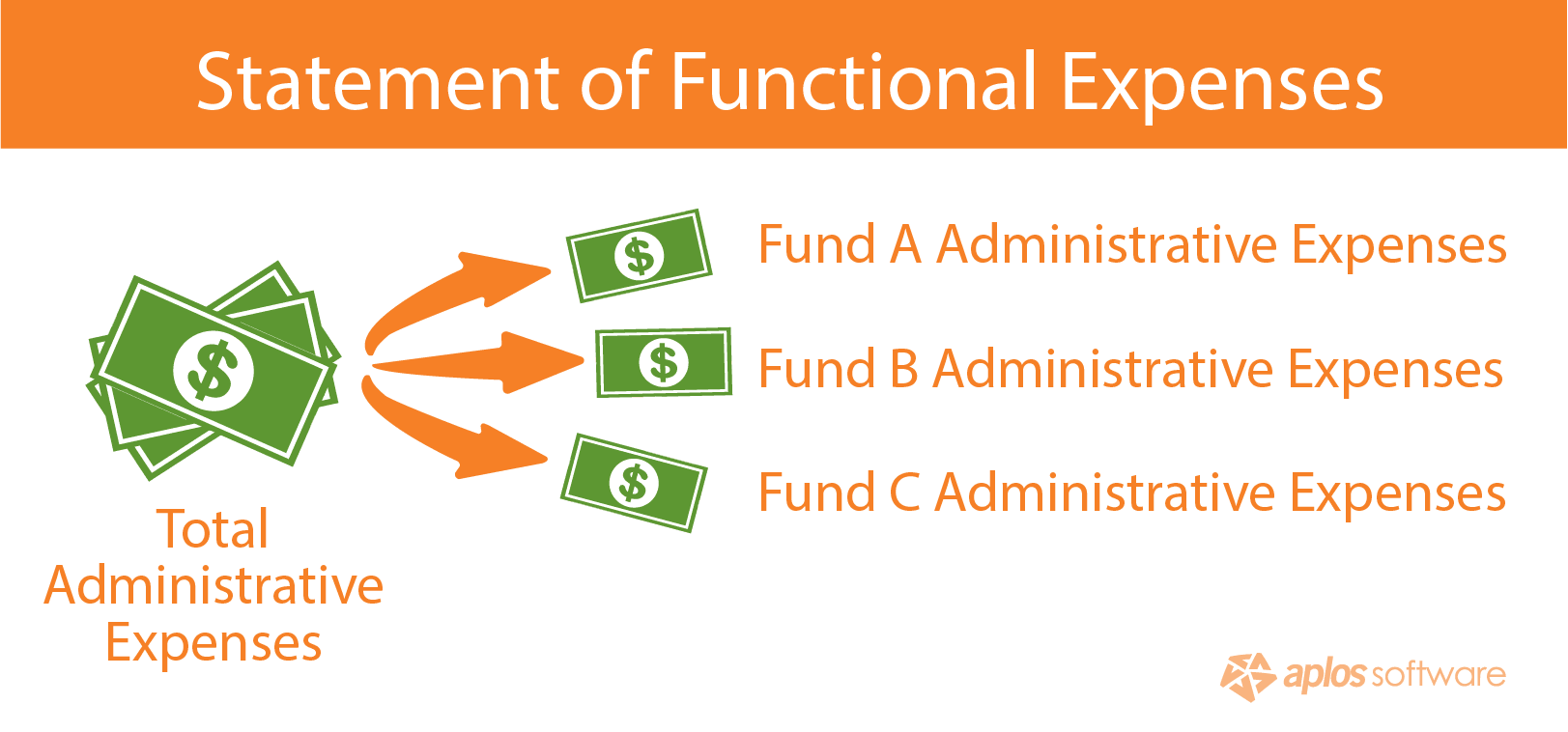

Functional expenses in your organization are reported by their functional classification and recorded in your statement of functional expenses (sfe). What is the statement of functional expenses? The asu requires nonprofits to present an analysis of the function of expenses on a statement of functional expenses (sfe) or as a schedule in the notes.

It provides a detailed breakdown of expenses. A statement of functional expenses is fundamental to nonprofit accounting. The statement of functional expenses is a compulsion what are natural expenses?

Nonprofits can present their statement of functional expenses within their financial statements (e.g., in the face of the statement of activities or a separate. Form 990, the annual information return required of many nonprofits, as well as audited financial statements require expenses to be. Key components of the statement of functional expenses.

February 21, 2024. Used exclusively by nonprofit organizations, the statement of functional expenses is used to properly report expenses and is required in the u.s. Recall our framework:

Nonprofits required to file the annual form 990 can also use this to fill out the statement of functional expenses section required by the irs (keep in mind tax requirements can be.