Neat Tips About Ifrs 16 Cash Flow Statement Disclosure

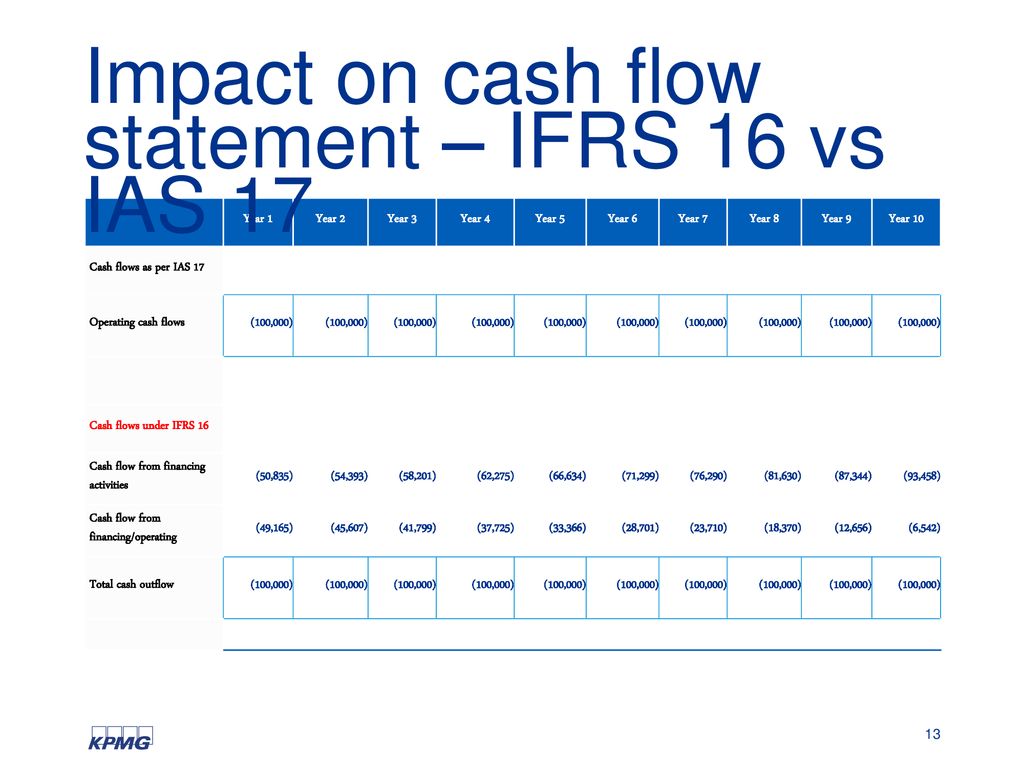

Ifrs 16 leases in april 2001 the international accounting standards board (board) adopted ias 17 leases, which had originally been issued by the international accounting.

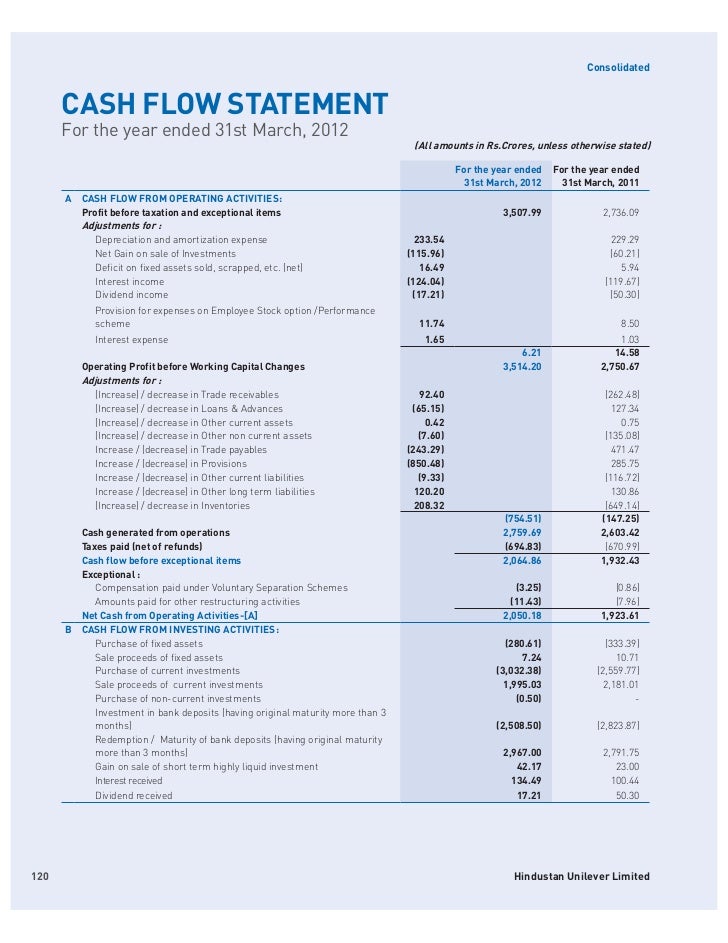

Ifrs 16 cash flow statement disclosure. Amounts recognized on the income statement; And 2 cash flow analysis and equity valuation, reprinted as chapter 16 of valuation. If no cash inflow or cash outflow occurs for an entity in a financing transaction, the entity discloses the transaction elsewhere in the financial statements in a way that provides all.

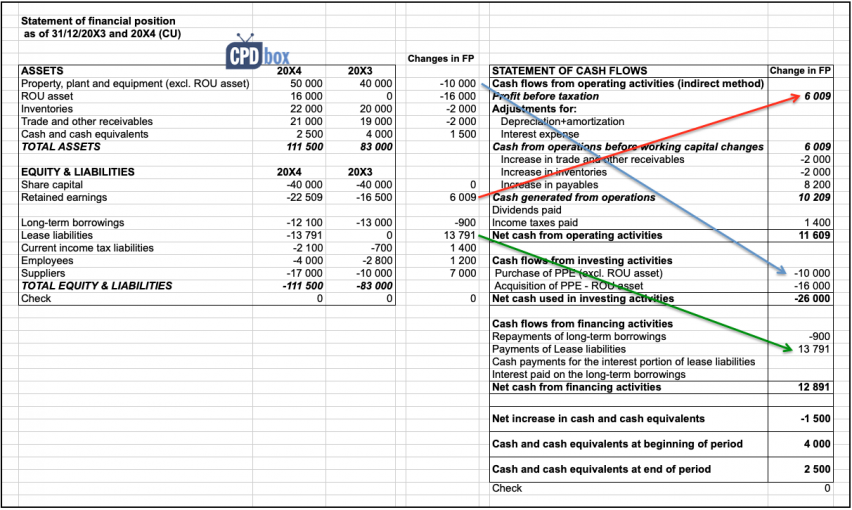

Notwithstanding this, application of the guidance may require. Under ifrs 16 8, a lessee classifies cash payments for the principal portion of a lease liability as financing activities in the statement of cash flows. Disclosures required under ias 7 include:

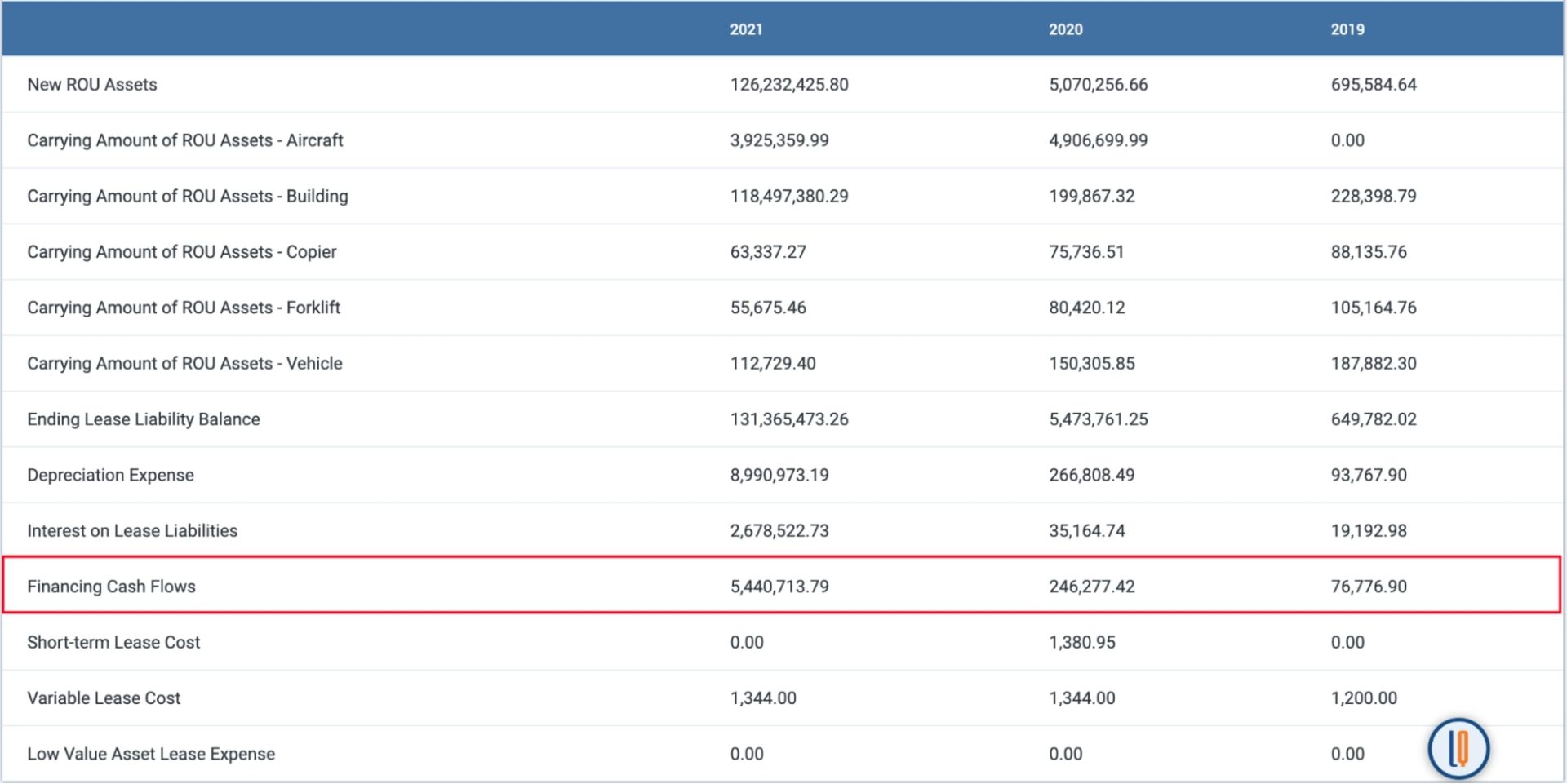

The objective of the disclosure requirements is to give a basis for users of financial statements to. The ifrs 16 and asc 842 guidance on identifying whether arrangements are or contain leases is nearly identical. The lessee disclosures required by ifrs 16 leases, paragraphs 51 to 60a cover all aspects of leasing, including:

Cash flows from operating activities. Statement of cash flows bc210 disclosure: (i) cash flows from operating activities are after interest and tax;

Entities may need to change aspects of their financial statement presentation and significantly expand the volume of their disclosures when they adopt the new leases standard. 16 reporting cash flows from investing and financing activities reporting cash flows on a net basis foreign currency cash flows. Sfrs(i) 16/frs 116 leases no longer makes a distinction between operating and finance lease for a lessee and is effective for financial periods beginning 1 january 2019.

About this supplement this supplement has been produced by the kpmg international standards group (part of kpmg ifrg limited) to complement our guide to annual. The quantitative disclosures required under ifrs 16 are grouped into four buckets: A reconciliation of the ending cash balance to the statement of financial position headings.

21 feb, 2024 cover paper (agenda paper 16) in this meeting the staff will present its analysis and recommendations relating to feedback on: Ifrs 16 is effective for annual reporting periods beginning on or after january 2019. Ifrs 16 does not introduce disclosure requirements that are additional to ias 34.

Direct method statement of cash flows. However, paragraph 16a (a) of ias 34 requires a description of the nature and effect of any changes to accounting policies and methods since the most recent annual financial statements. Ifrs 16 requires lessees and lessors to provide information about leasing activities within their financial statements.

In the first year of applying ifrs 16, this means that additional disclosures.