Build A Info About Treatment Of Unclaimed Dividend In Cash Flow Statement

How will unclaimed dividend treated in cash flow statement?

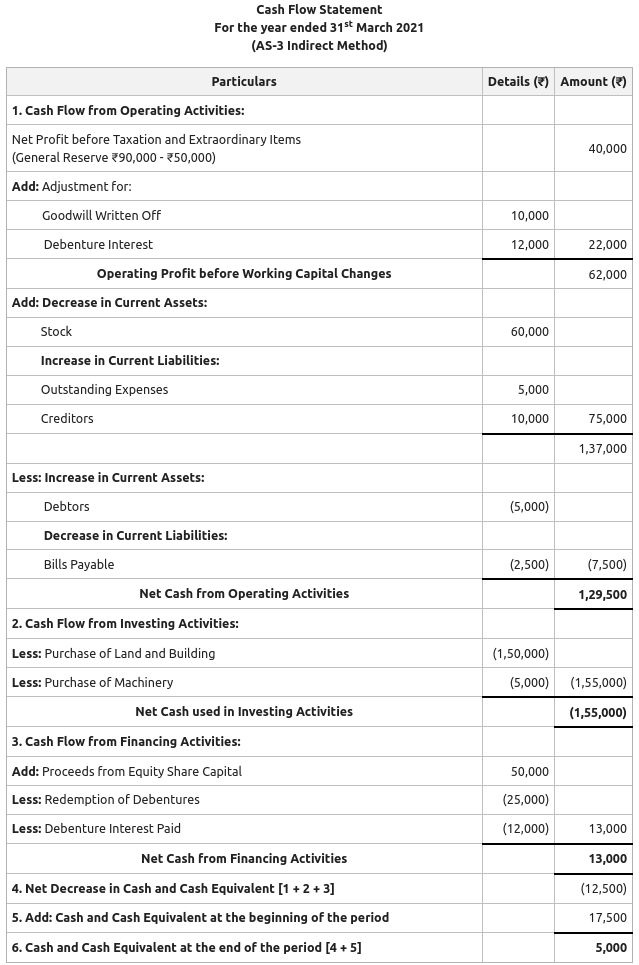

Treatment of unclaimed dividend in cash flow statement. Unclaimed dividend is the dividend which cannot be disbursed due to death or change of address of shareholders without intimation to the company. Dividends are classified under current liability because the cash payments are typically made within a few weeks. Amount of dividend proposed for the previous year is shown as outflow of cash assuming that the.

Understanding the treatment of dividends on a cash flow statement requires familiarity with the components of the cash flow statement. Unclaimed dividend should be deducted from the amount of proposed dividend paid because it represents. There is no impact on the statement of cash flow.

This article considers the statement of cash flows of which it assumes no prior knowledge. Where interim dividend go in cash flow statement the same amount of interim dividend is added to net profit before tax and extraordinary items as non. Unclaimed dividend need not be disclose in cash flow statement.

Accounting implications of unpaid dividends. Unclaimed perks is the dividends which cannot be disbursed unpaid go death or changing of home a shareholders without suggestion to the group. The unclaimed dividend which is a current liability to be shown in financing activity.

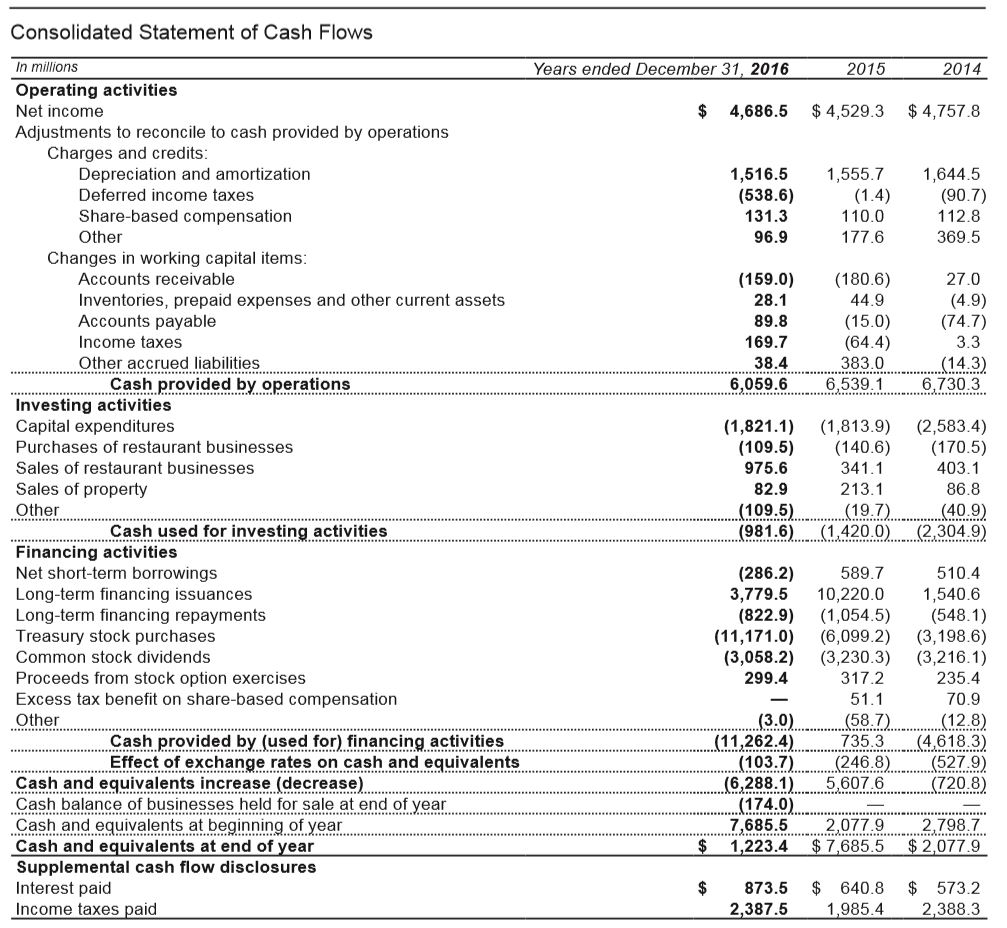

Cash flows from interest and dividends received and paid shall each be disclosed. International accounting standard (ias) 7 statement of cash flows in para 31 requires: Taxes paid should be classified within operating cash flows unless specific identification with a financing or investing.

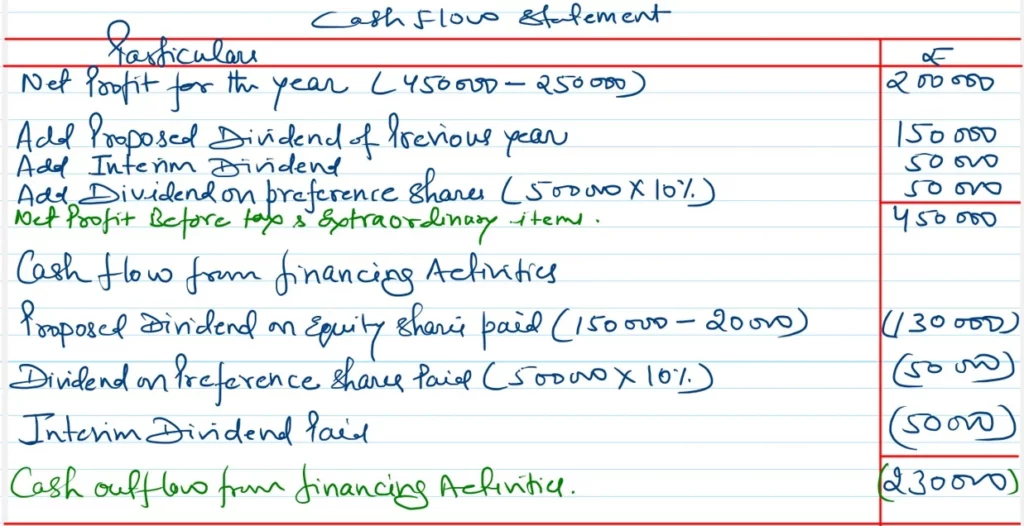

But it does not arise from the operating. It is relevant to the fa (financial. Yes the cash outflow to be shown in the financing activities is rs.

We learned that many users and members of formal advisory bodies (except for one member of the accounting standards advisory forum (asaf)4) support the removal of. Taxes paid are generally classified as operating cash flows. Effect of such item on the cash flow statement is as follows:

By shamil hassan (islamabad, pakistan) q: #06/ part 03 cash flow statement |treatment of unclaimed dividend cfs | cma vivek agrawal learnovit 1.99k subscribers subscribe 192 views 8 months ago. Dividends paid under financing or operating activities?

The unclaimed dividend is a current liability.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

![Cash Flow Statement Indirect Method [Explained & Example]](https://learnaccountingskills.com/wp-content/uploads/2023/01/cash-flow-statement-indirect-method.jpg)