What Everybody Ought To Know About Financial Accounting With Ifrs

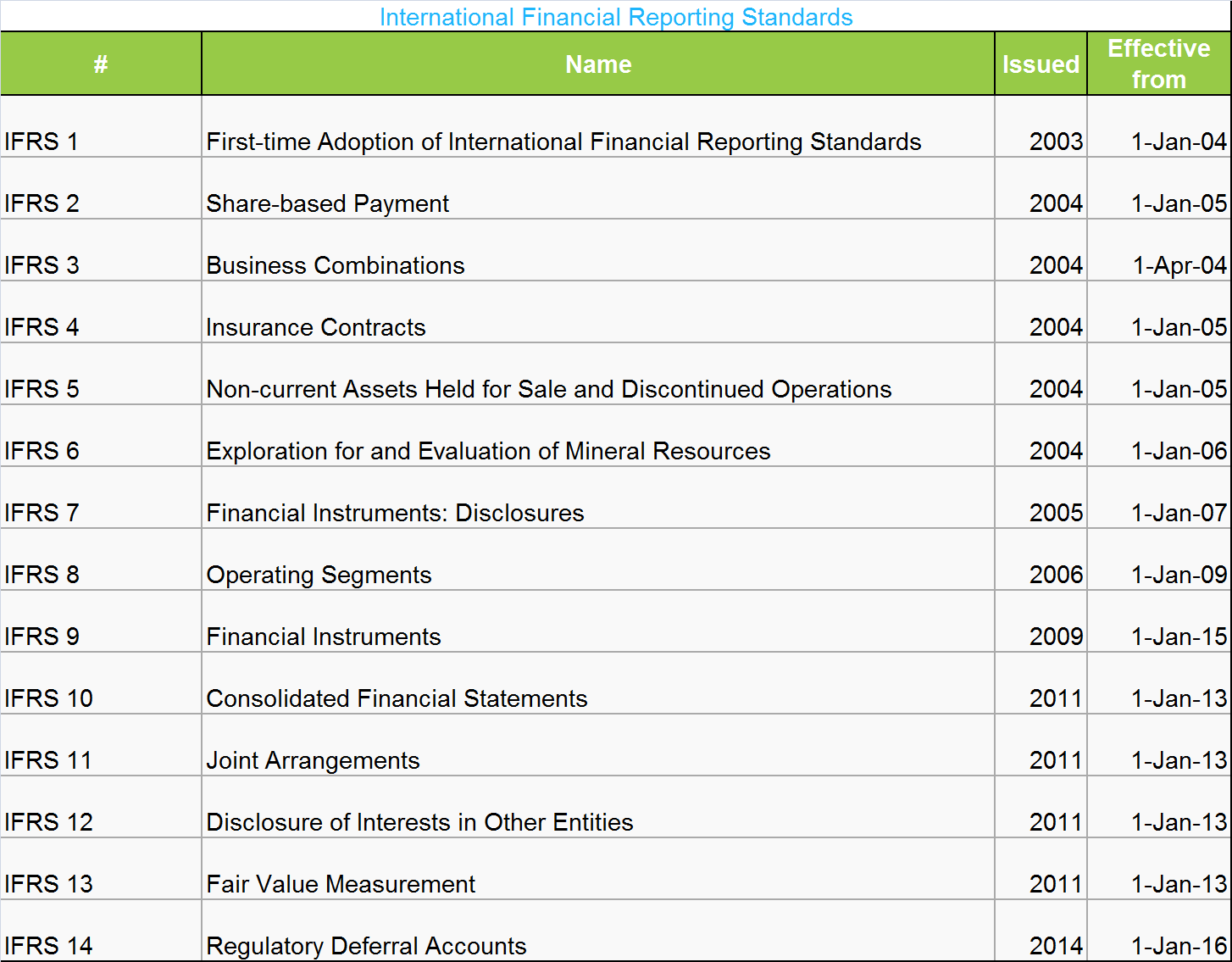

International financial reporting standards, commonly called ifrs, are accounting standards issued by the ifrs foundation and the international accounting standards board (iasb).

Financial accounting with ifrs. Toc, writing style, pedagogy, robust eoc) on which users of weygandt. An essential and intuitive treatment of financial accounting with an international perspective. Unfortunately, unlike when we travel to foreign lands, companies cannot use google translate to simplify financials across countries, and the ifrs helps set one uniform.

Ifrs highlights the integration of more us gaap rules, a desired feature as more foreign companies find the united states to be their largest market. Key ifrs standards compared to us gaap and other accounting standards over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more. Download it once and read it on your kindle device, pc, phones or tablets.

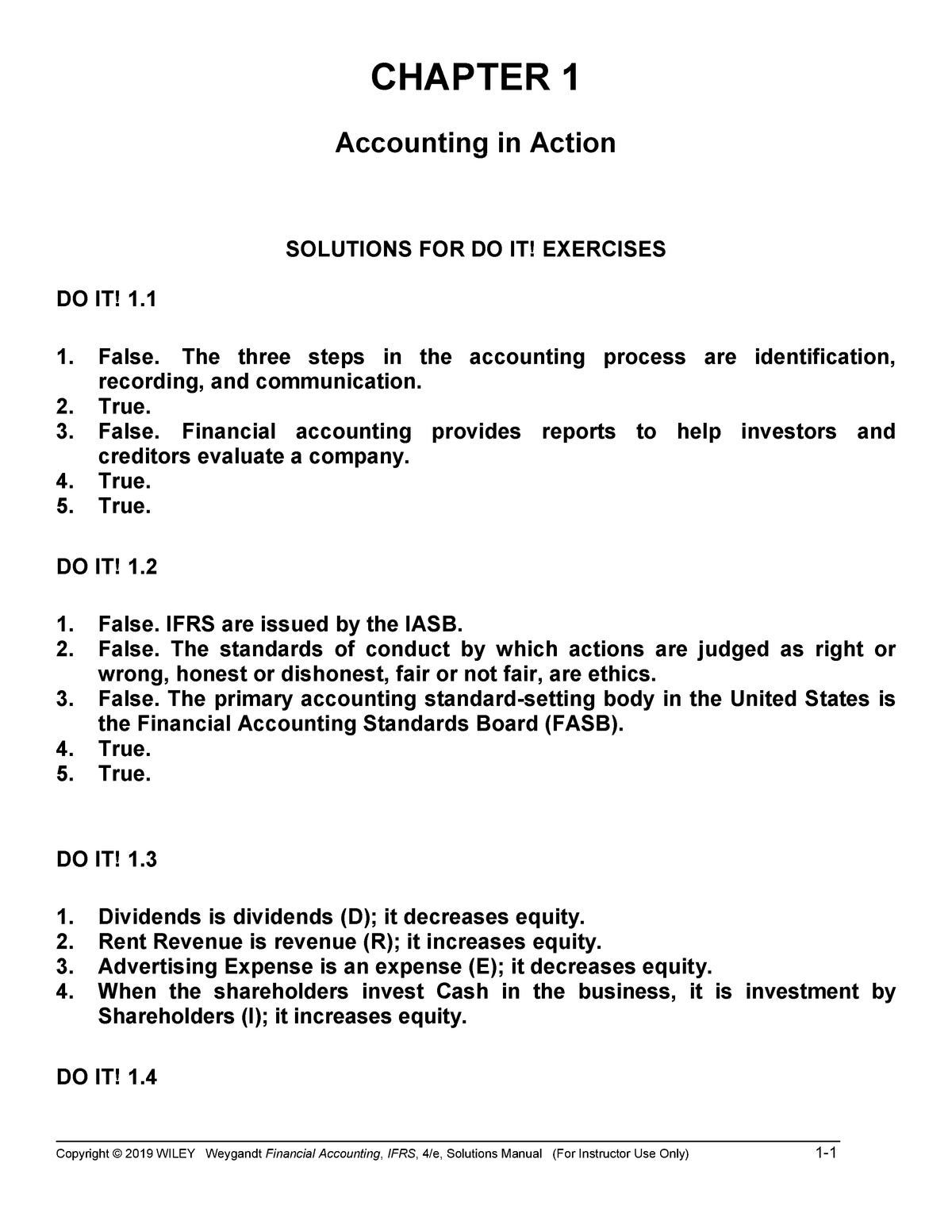

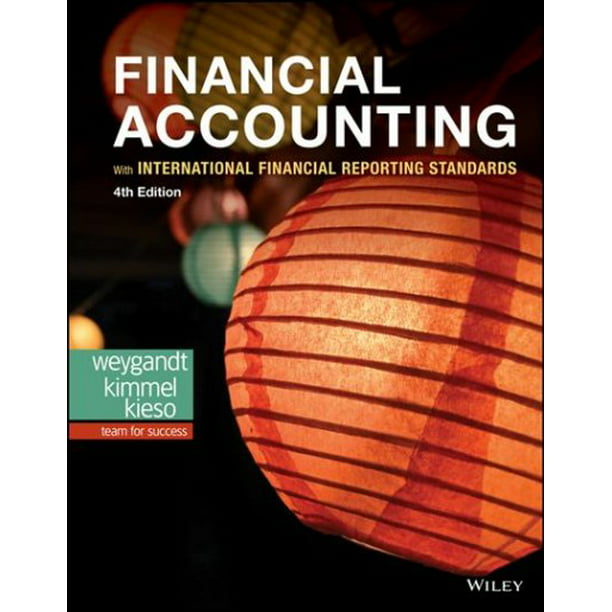

The ifrs grants limited exemptions from the general requirement to comply with each ifrs effective at the end of its first ifrs reporting period. Weygandts fourth edition of financial accounting: Its 10 chapters tackle all the elements required to draw up and disclose financial statements according to ifrs.it presents the standards, accounting systems and main financial statements,.

Ifrs highlights the integration of more us gaap rules, a desired feature as more foreign companies find the united states to be their largest market.the highly anticipated new edition retains each of the key features (e.g. Ifrs mandates that all companies follow it uses the same rules and standards to prepare their financial statements. Pdf | the fifth edition of financial accounting:

How to use this site. Welcome to the 2021 edition of ifrs in your pocket. 1606/2002 which required publicly traded european union (eu) incorporated companies to prepare, by 2005 at the latest, their consolidated financial statements under ifrs ‘adopted’ for application within the eu.

The use of ifrs helps to ensure the transparency and credibility of the accounting statements. Financial accounting is the process of recording, summarizing and reporting the myriad of transactions resulting from business operations over a period of time. The iasb is supported by.

Conceptual framework for financial reportingwas issued by the international accounting standards board in september 2010. The revised conceptual framework for financial reporting (conceptual framework) issued in march 2018 is effective immediately for the international accounting standards board (board) and the ifrs interpretations committee.for companies that use the conceptual framework to develop accounting policies when no ifrs standard applies. Ifrs accounting standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are required to use them when reporting on their financial health.

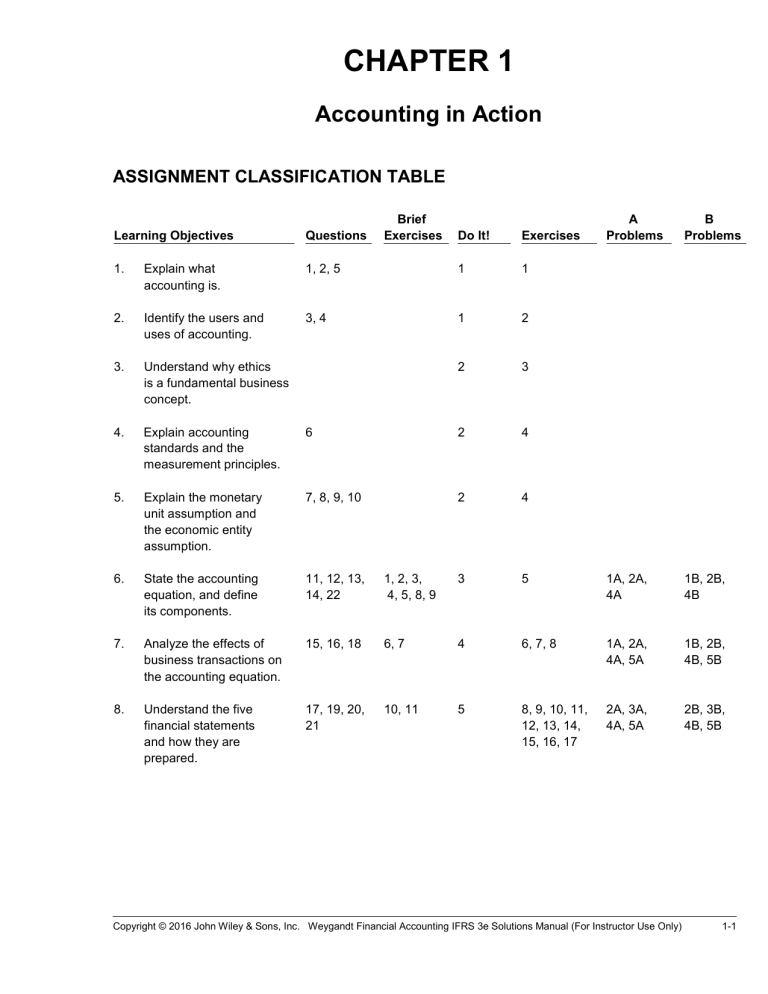

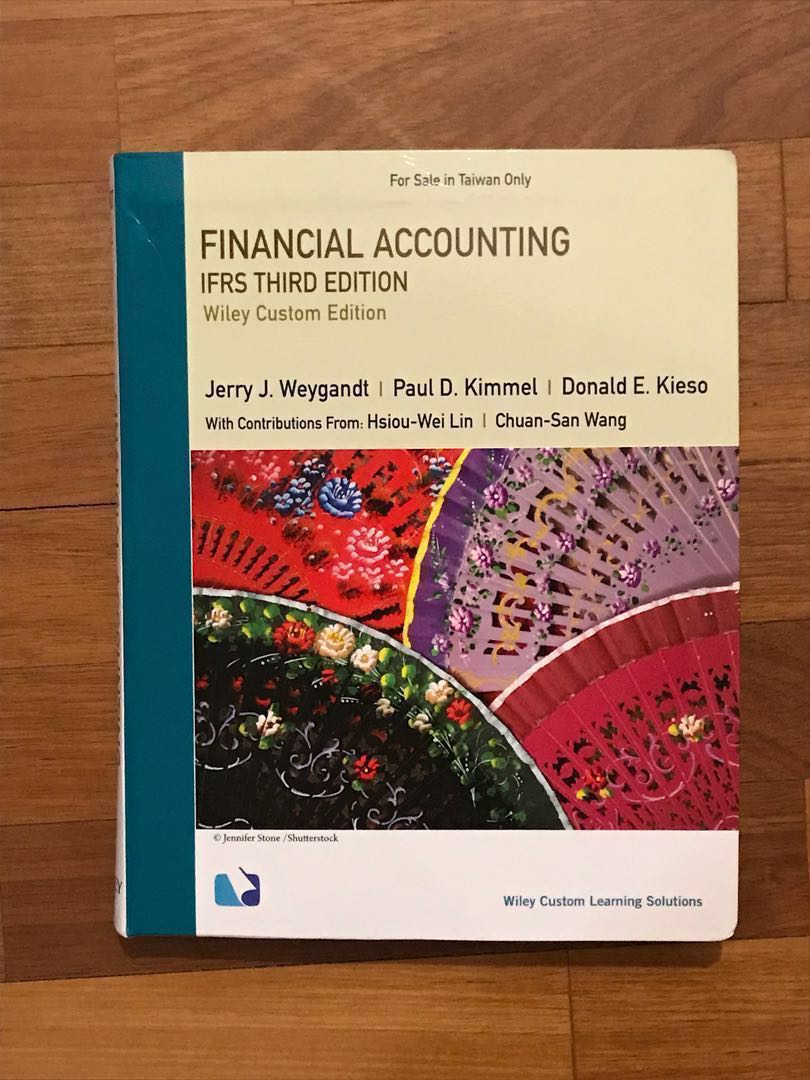

Weygandts third edition of financial accounting: The iasb is supported by technical staff and a range of advisory bodies. The use of international financial reporting standards is growing rapidly, both outside of the united states and within, especially.

The iasb (international accounting standards board) issued the ifrs, a set of accounting rules standardized across companies of 167 different jurisdictions. Conceptual framework © ifrs foundation a13 contents from paragraph status and purpose of the conceptual framework sp1.1 chapter 1—the objective of general. | find, read and cite all the research you.

Ifrs 1 sets out the procedures that an entity must follow when it adopts ifrss for the first time as the basis for preparing its general purpose financial statements. The european endorsement mechanism for ifrss. In preparation for the adoption of ind as 117, the equivalent to ifrs 17 'insurance contracts', the insurance regulatory and development authority of india (irdai) has announced the reconstitution of its expert committee dedicated to the implementation of indian accounting standards (ind as) and international financial reporting standards.