Who Else Wants Tips About Consolidated Cash Flow

Proceeds from issue of share capital.

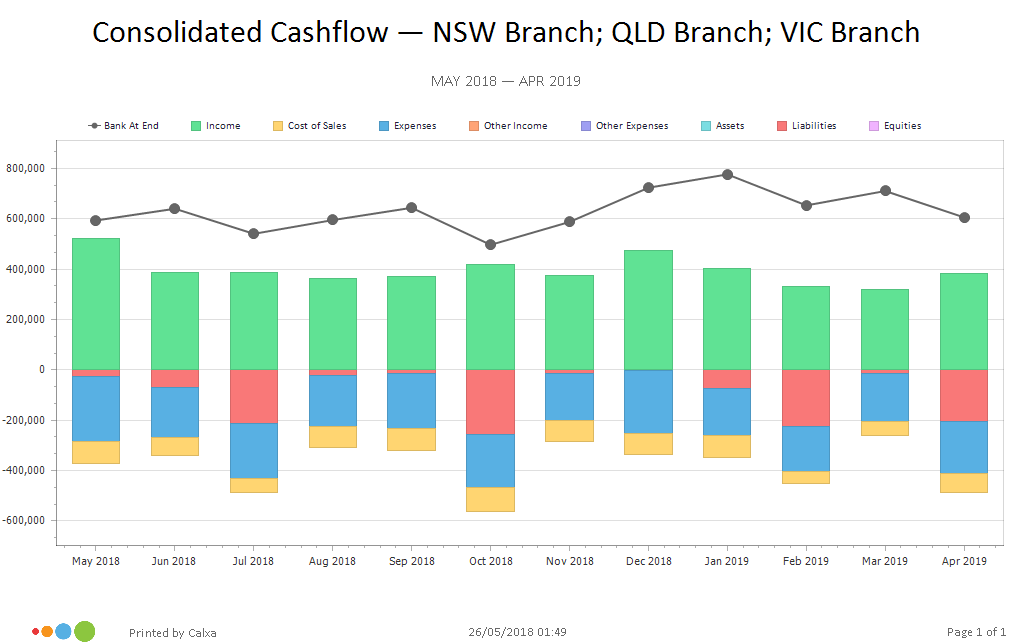

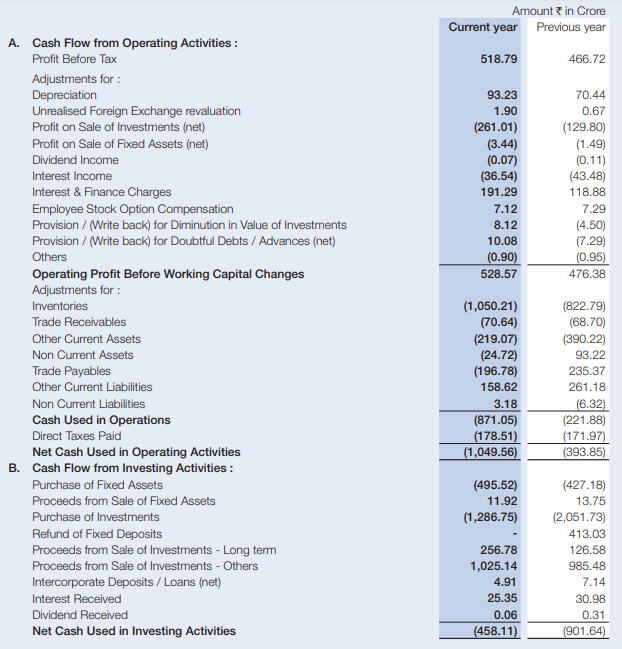

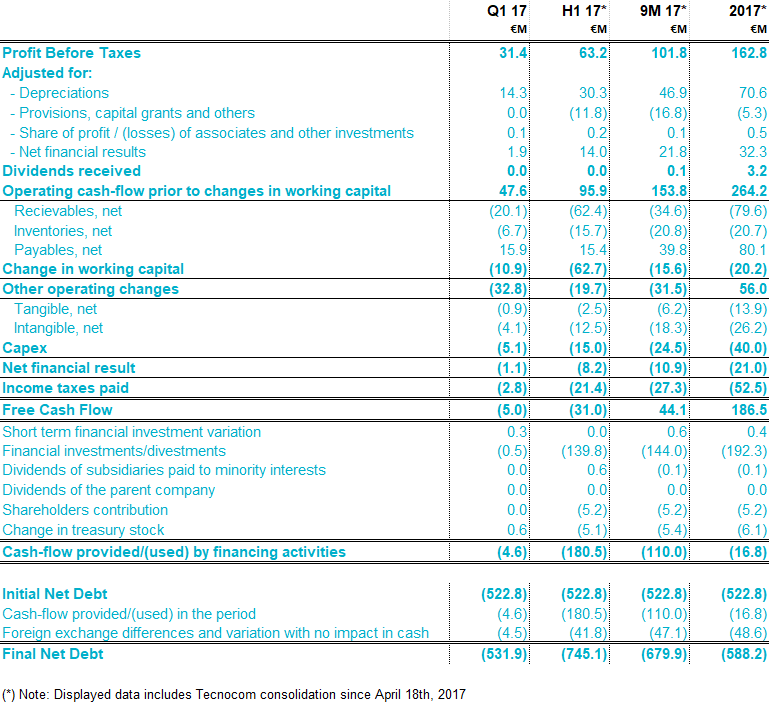

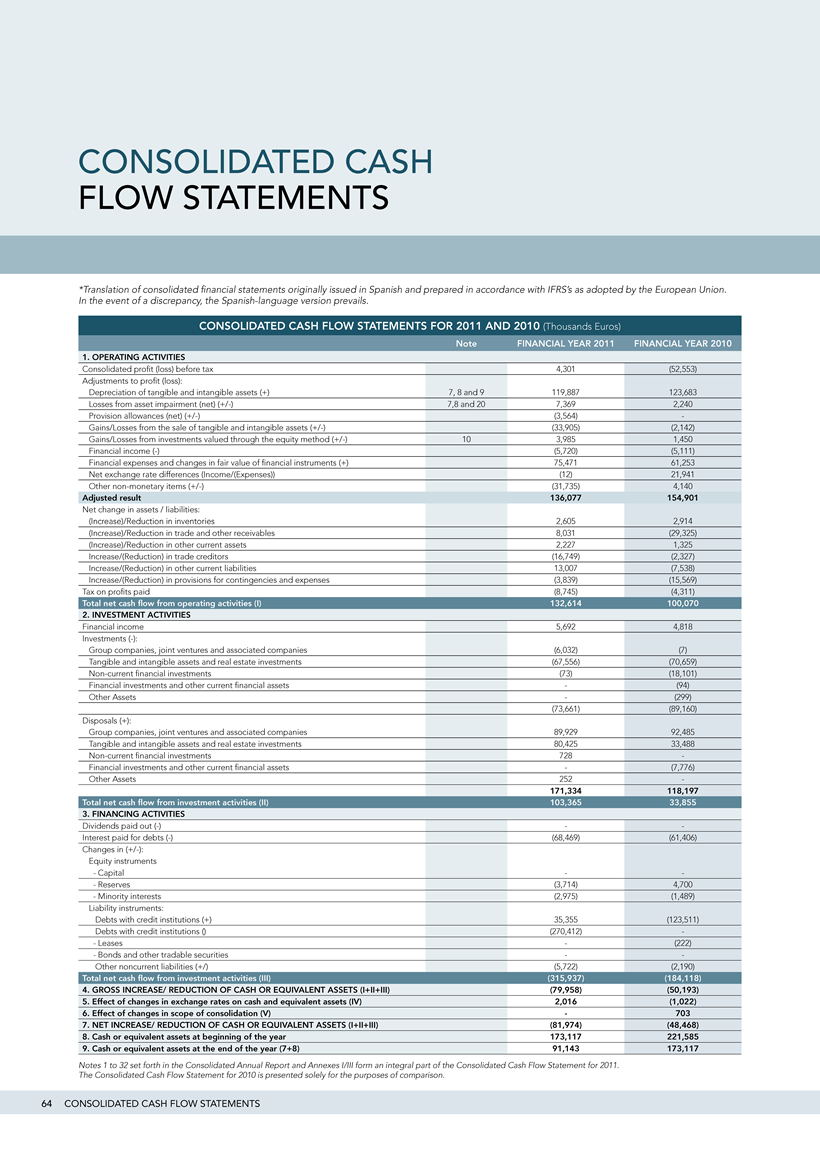

Consolidated cash flow. Payment of lease liabilities ( 90) dividends. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). Cash flows from financing activities.

Cash received represents inflows, while money spent represents outflows. The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. The consolidated statement of cash flows is not prepared from the individual cash flow statements of the separate companies.

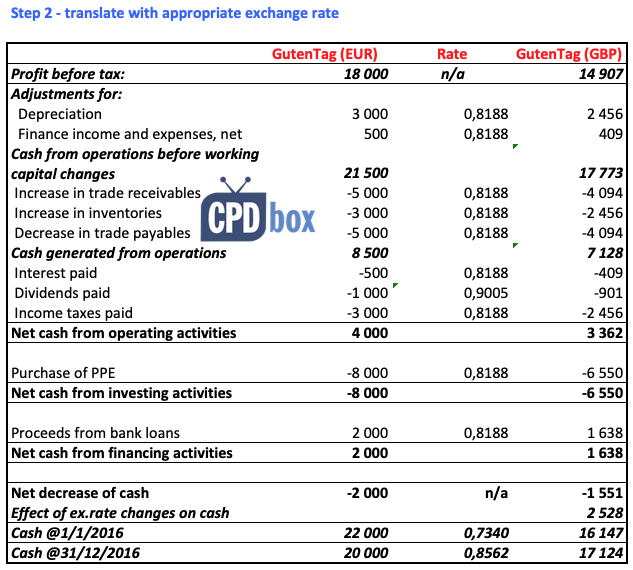

Ifrs 10 consolidated financial statements (issued may 2011), ifrs 11 joint arrangements (issued may 2011), investment entities (amendments to ifrs 10, ifrs 12 and ias 27) (issued october 2012), ifrs 16 leases (issued january 2016) and ifrs 17 insurance contracts (issued may 2017). The article will explain how to calculate cash flows and where those cash flows are presented in the statement of cash flows. The main components of the.

A company creates value for. Cash flow is the net cash and cash equivalents transferred in and out of a company. The diagram below shows an example of a typical group structure:

These statements are then comprehensively combined by the parent company to final consolidated reports of the balance sheet, income statement, and cash flow statement. This article considers the statement of cash flows of which it assumes no prior knowledge. Ias 27 defines consolidated financial statements as ‘the financial statements of a group in which the assets, liabilities, equity, income, expenses and cash flows of the parent and its subsidiaries are presented as those of a single economic entity.’.

The cash flows statement is then based on the resulting consolidated figures. This financial statement complements the balance sheet and the income statement. Instead, the income statements and balance sheets are first brought together on the worksheet.