Stunning Info About Cash Flow Position Meaning

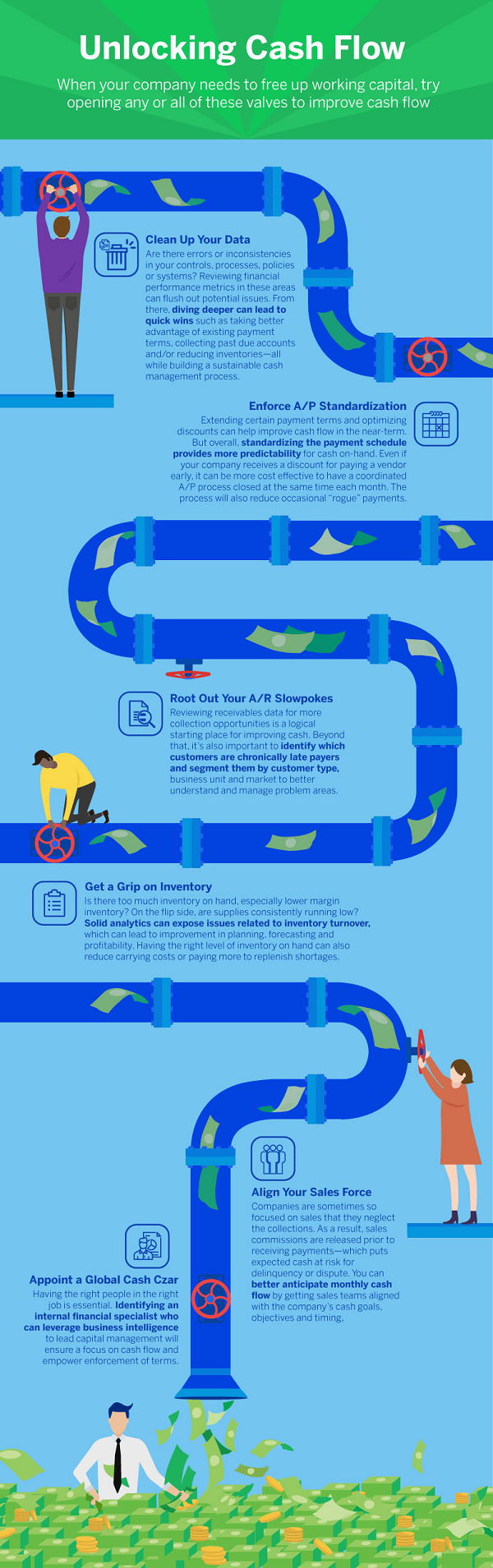

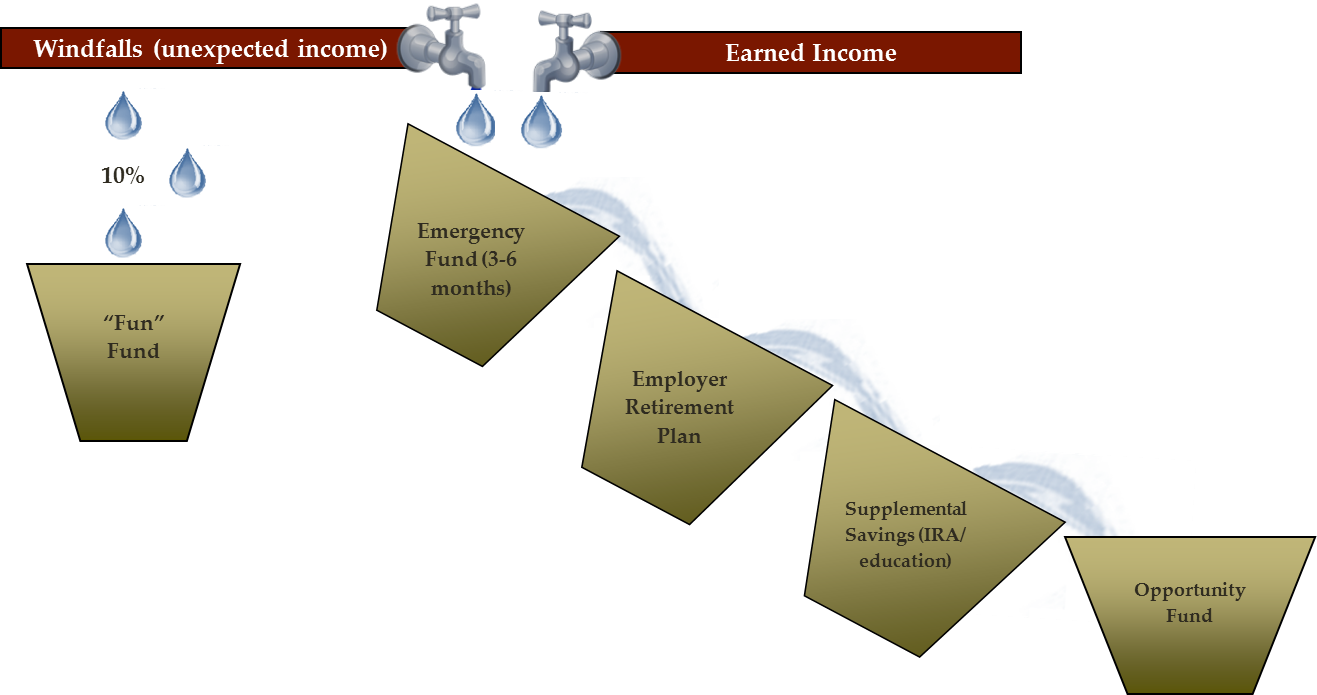

Cash flow planning in business involves matching funding sources with capital needs.

Cash flow position meaning. The most liquid assets such as. Cash flow is the amount of cash generated from multiple profit streams, including operations and lenders, during a certain time period. A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and.

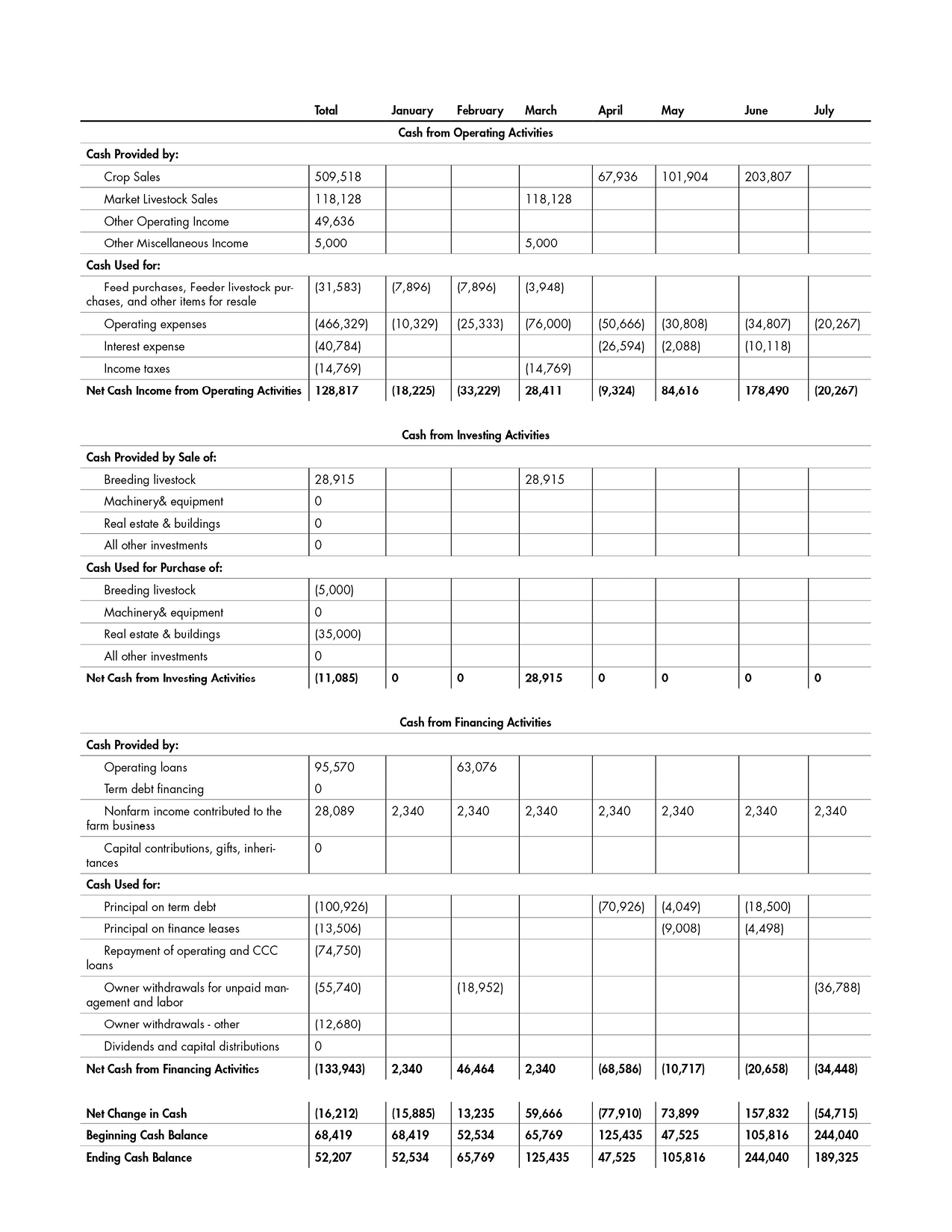

Cash flow from operating activities is cash earned or spent in the course of regular business activity—the main way your business makes money, by selling products. In a cash flow statement, the cash position at the end of the month represents the amount of cash that the company has on hand, at that moment in time. It is measured relative to expenses and liabilities, and it helps reveal a company’s liquidity.

The cash flow analysis refers to the examination or analysis of the different inflows of the cash to the company and the outflow of the cash from the company during the period. Cash position cash flow basics. Introduction cash flow projections represent the beating heart of a company’s financial rhythm.

Internal stakeholders look at cash position as frequently as daily, while external investors and analysts look at an organization's cash position on its quarterly cash flow statement. A stable cash position is one that. It’s a compass that guides the cfo’s.

Cash flow analysis is often used to analyse the liquidity position of the company. Cash position is the total amount of cash and cash equivalents it has available at a specific moment in time. The cash position is the amount of cash your business has at a given moment in time relative to your expenses and liabilities.

For example, a company has (in millions) an operating income of $8,500, depreciation of. Cash position is the amount of money a business has at any given time. Cash position is the amount of cash a company has at a specific moment in time.

Cash flow forecasts provide business leaders with important insight about likely changes in a company’s cash position and are a critical tool for charting a. Cash positioning is a process of determining a company’s cash position by analyzing actual cash flows from sources like bank statements and external. It’s not just a tool;

Cash flow analysis is the process of examining the amount of cash that flows into a company and the amount of cash that flows out to determine the net. It gives a snapshot of the amount of cash coming into the business, from where, and amount flowing out.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)