Marvelous Tips About Cash In Bank Balance Sheet

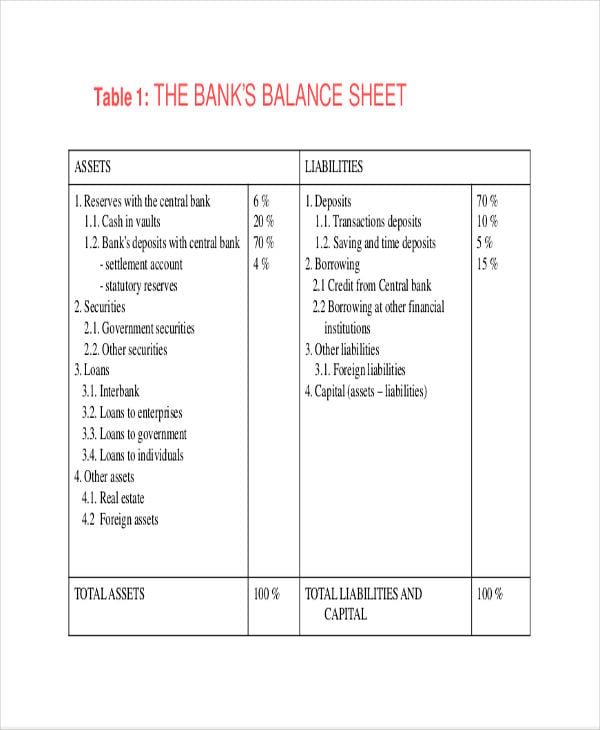

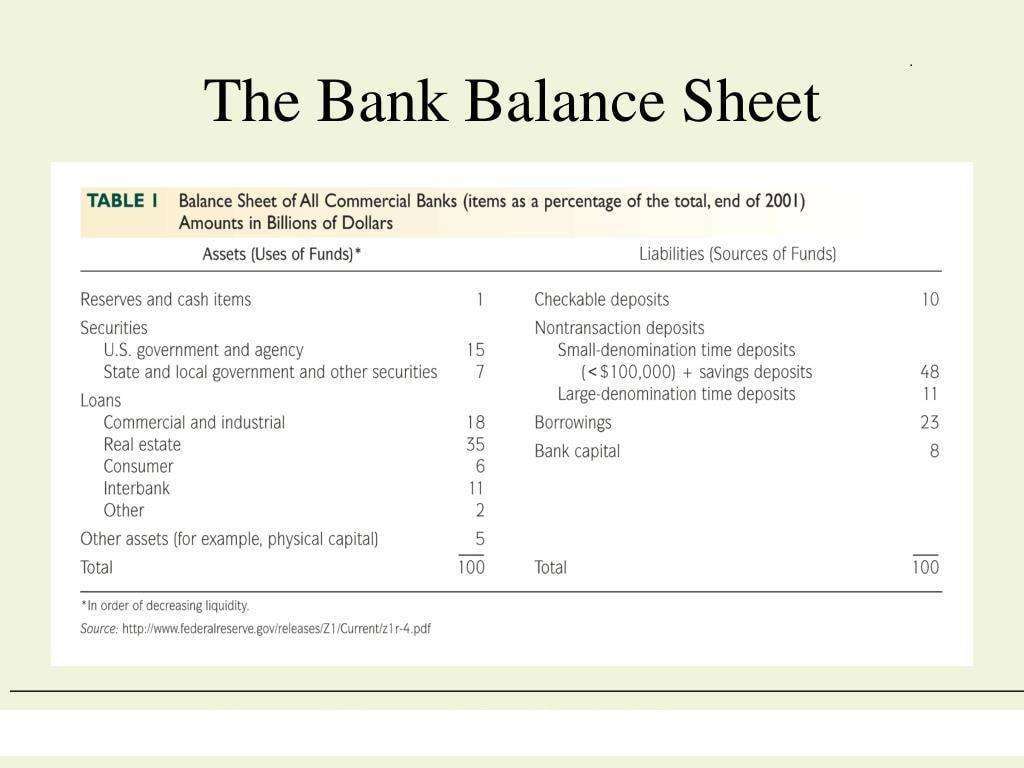

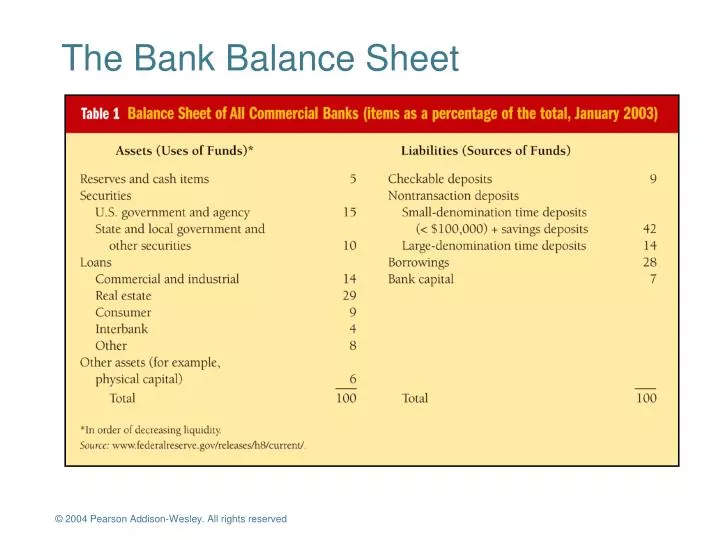

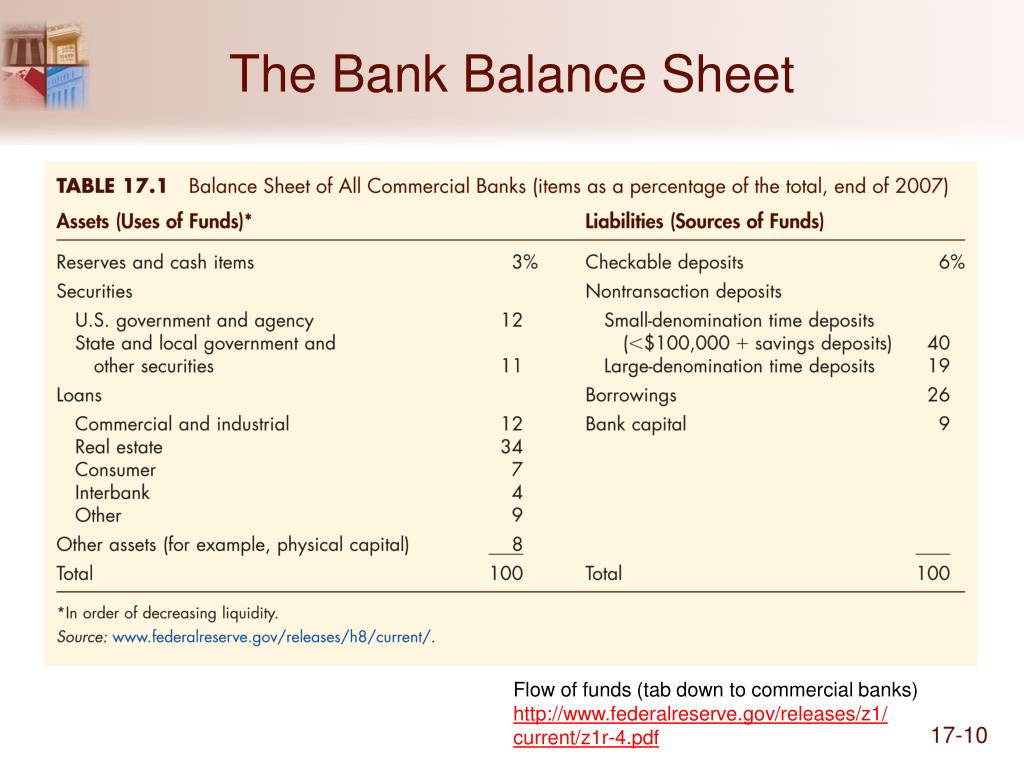

The assets in the financial statement for banks are the lending resources available with the banks, while the liabilities in these balance sheets indicate the deposits that customers make along with other financial instruments that it possesses.

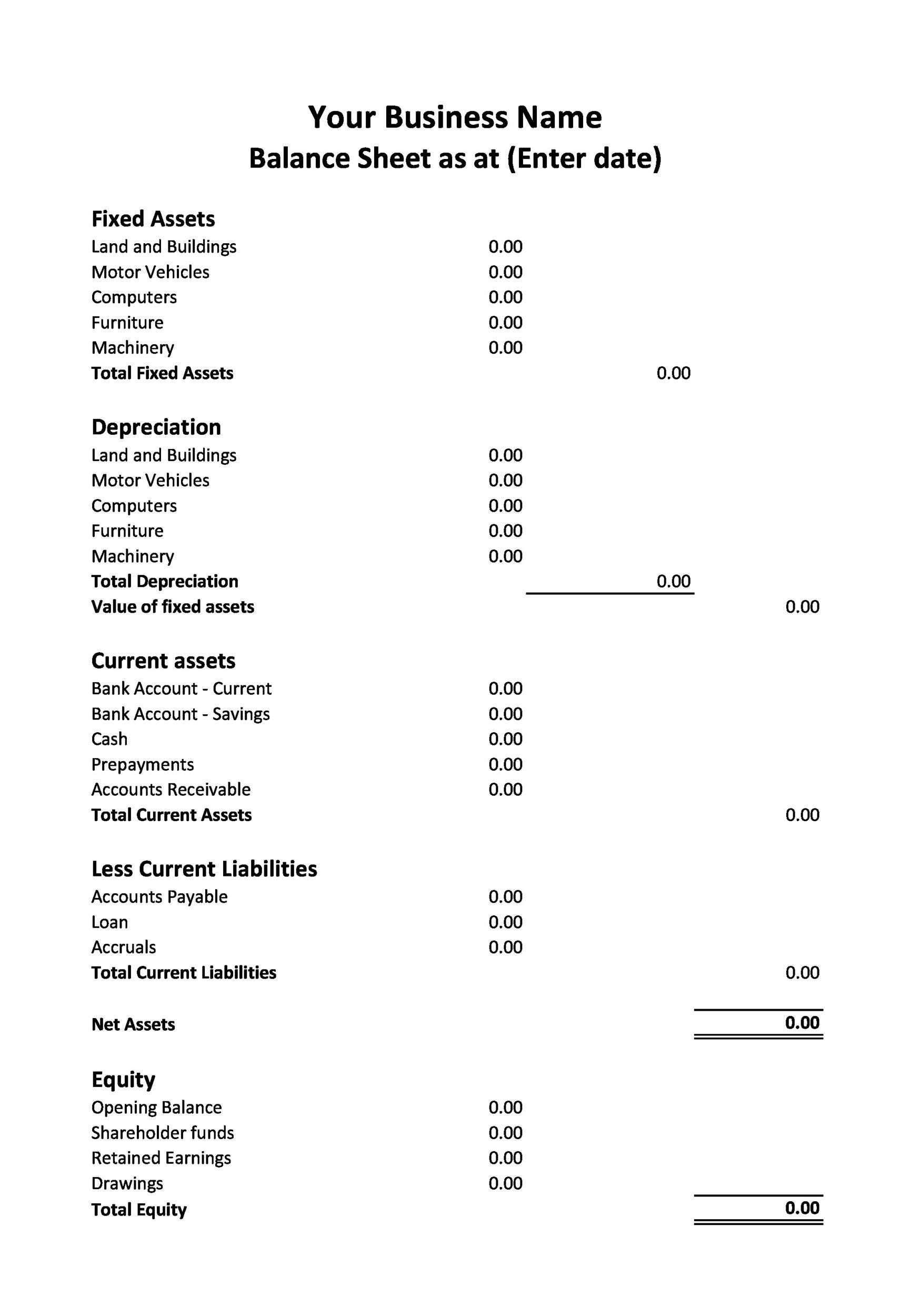

Cash in bank in balance sheet. This money is kept on hand to offset any unplanned cash outflows. Liability payments cash is reduced by the payment of amounts owed to a company's vendors, to banking institutions, or to the government for. It is included in the balance sheet under current assets.

Asc 210, balance sheet, indicates that a reporting entity's cash account at a bank is not considered an amount owed to the reporting entity for purposes of determining whether a right of offset exists.accordingly, the asc 210 offset model cannot be utilized to offset a bank account in a deposit position against another bank account with the same bank. The two sides must balance—hence the name “balance sheet.”. But for banks, it’s a different story.

Cash is an asset account on the balance sheet. It is necessary to keep some cash available in case of unforeseen expenses. A typical balance sheet consists of the core accounting equation, assets equal liabilities plus equity.

Assets = liabilities + owner’s equity. Balance sheets provide the basis for. Cash is reported in the current assets.

Cash in the process of collection; Parker conrad says it will invest hundreds of millions of dollars from the balance sheet in r&d. Learn about these key factors in evaluating a.

It tells you how much money is available to the business immediately. Cash on a balance sheet includes currency, bank accounts and undeposited checks. What are the contents of a cash basis balance sheet?

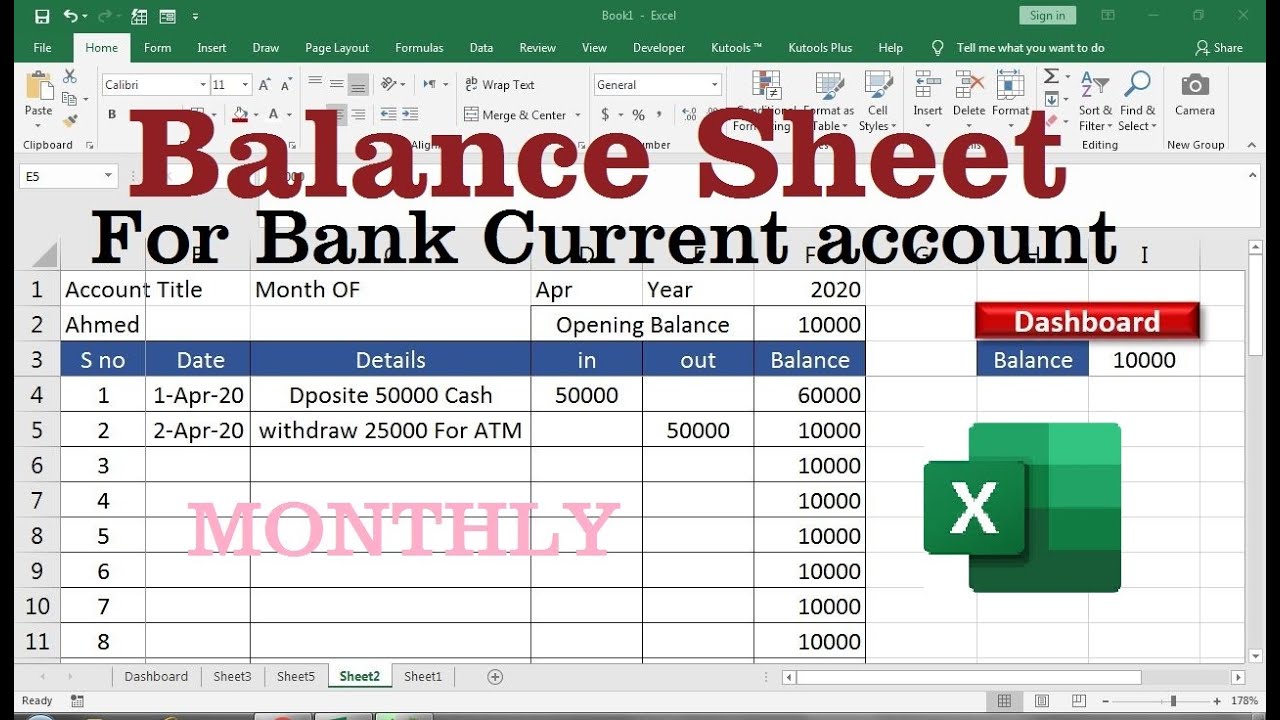

Balance sheets are typically prepared and distributed monthly or quarterly depending on the. When deciding whether to invest in a company, it’s important to consider its cash on hand and cash flow. Antonio luis san frutos velasco.

Cash is considered a source of income and is kept on deposit. On the bank’s balance sheet, your money is a liability because the bank has to give it to you. Cash and bank balances are typically recorded as current assets on a company’s balance sheet.

The first is cash at hand, which refers to physical currency, coins, and checks that a business has on its premises. If not for this safety buffer, businesses can find themselves unable to pay their bills. A judge has ordered former president donald trump and his companies to pay nearly $355 million in a ruling in the new york civil fraud case.

Cash and cash equivalents mainly refer to the line items on the balance sheet that represent the underlying value of the company’s assets that are in the form of cash or any other liquid form of cash. The cash flow statement shows the cash inflows and outflows for a company during a period. Rippling is sitting on a war chest of funding it raised during the crash of silicon valley bank.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

![[Economics] What is Understanding Balance sheet of a Commercial Bank](https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/d41d2102-4f84-4785-90c3-817a96d6ad2b/balance-sheet-of-a-company-vs-balance-sheet-of-bank---teachoo.jpg)