Painstaking Lessons Of Tips About Income Expense Ledger

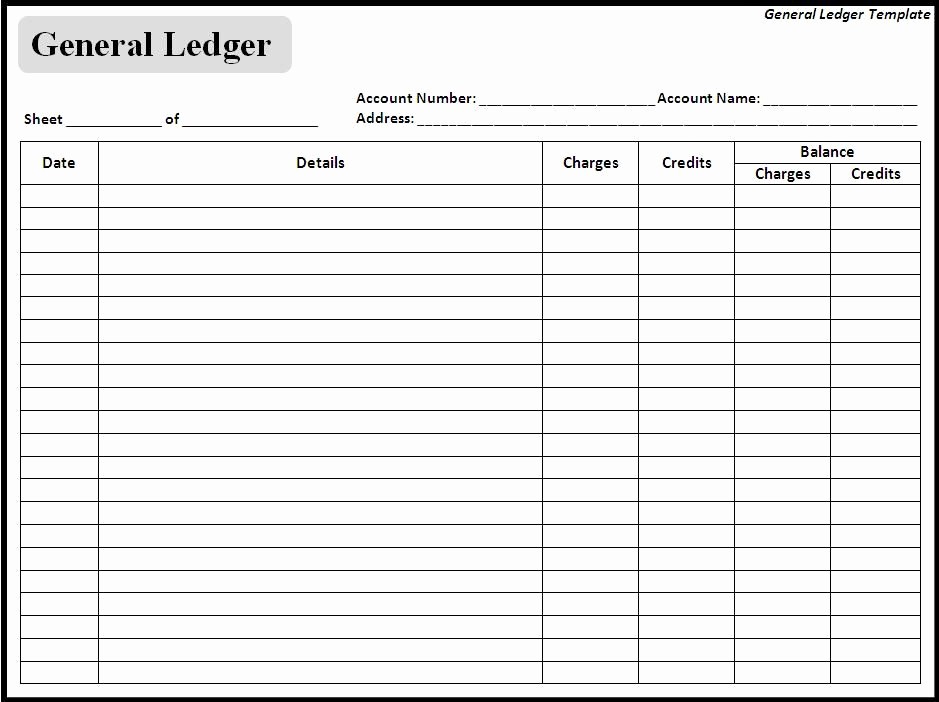

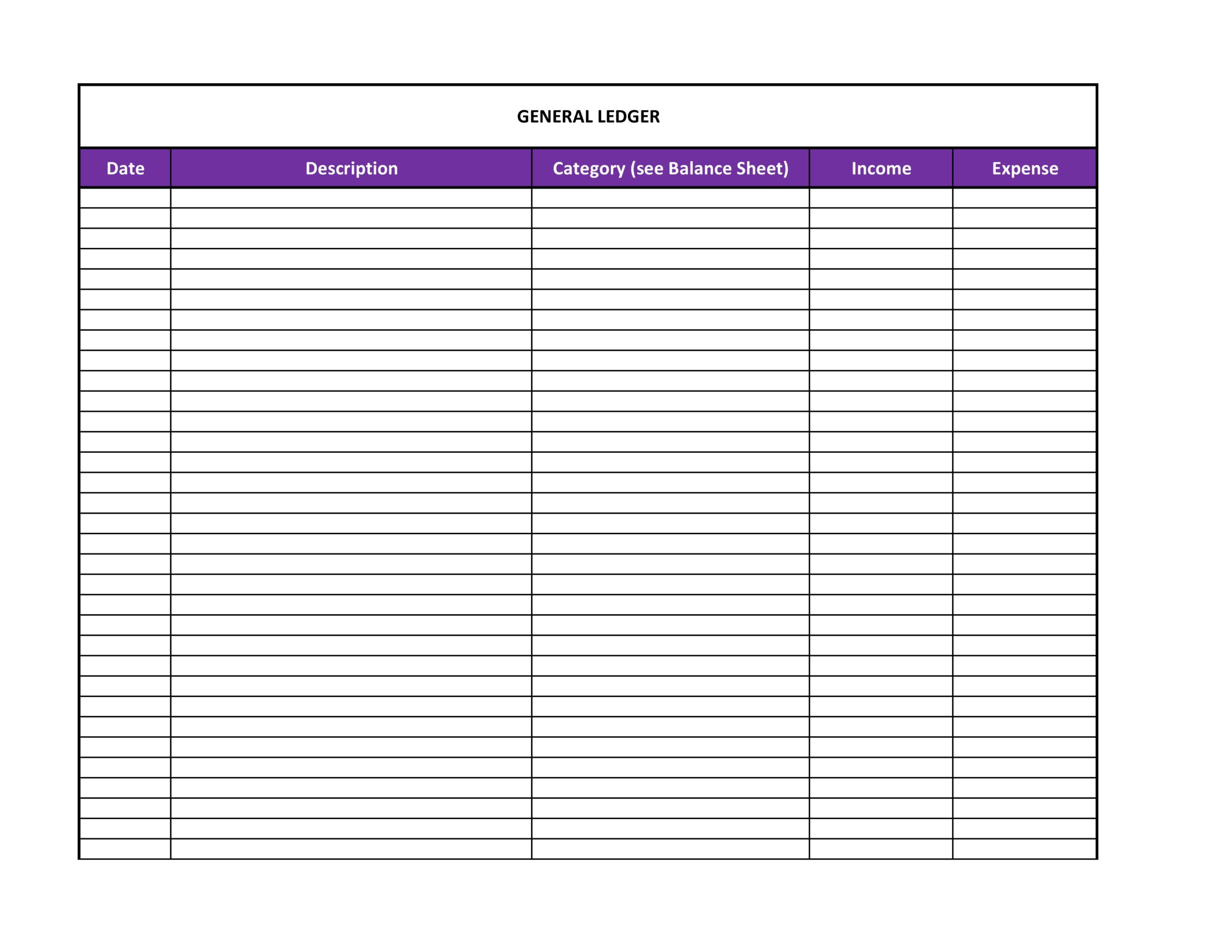

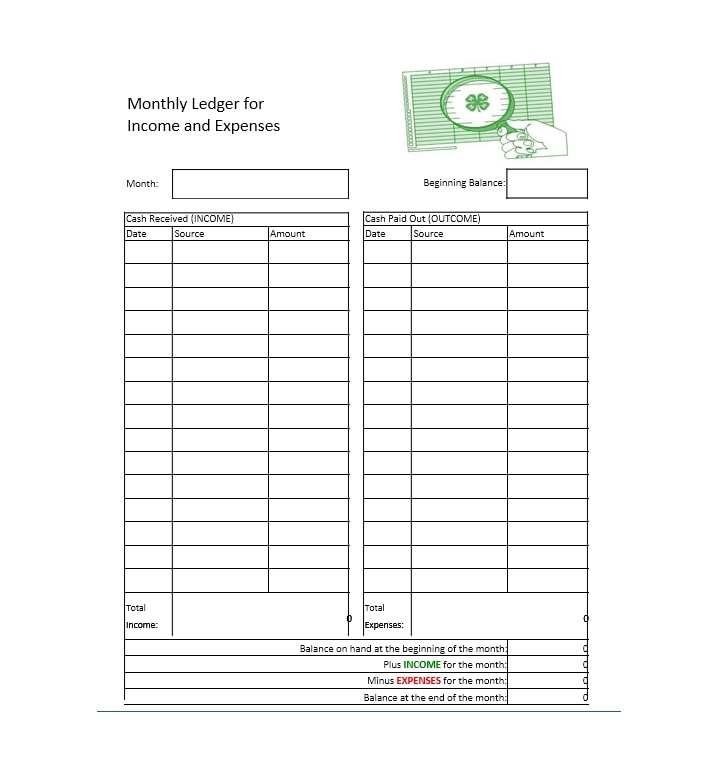

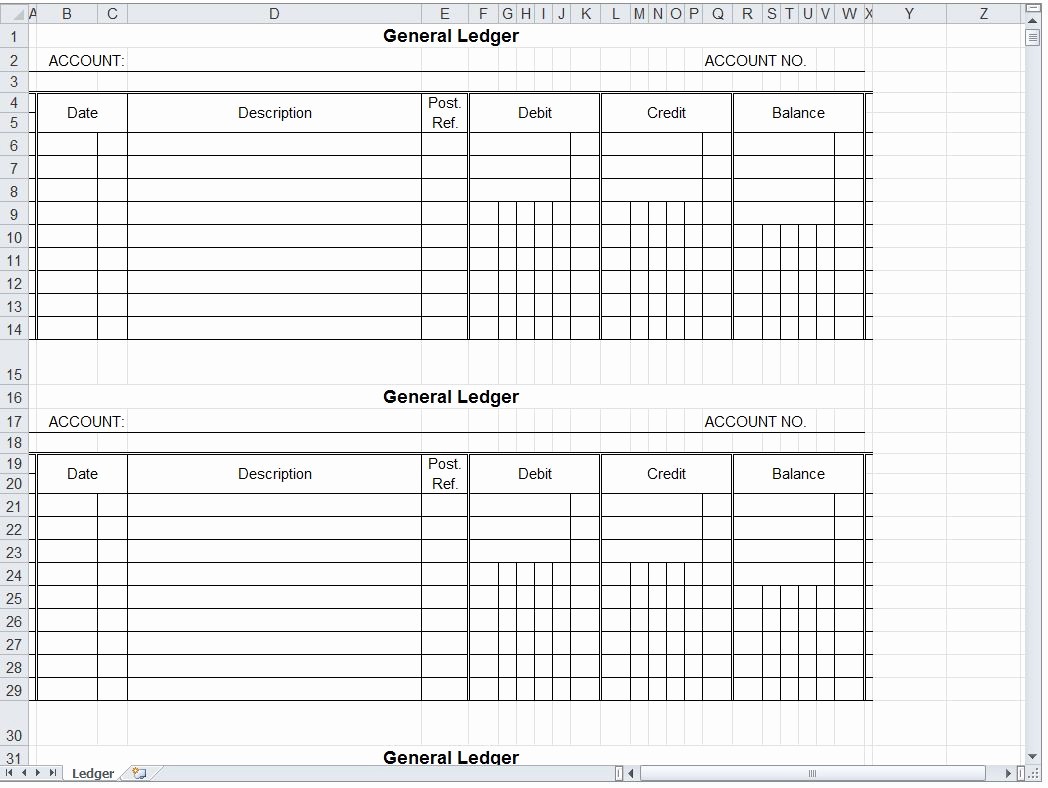

A general ledger template can help you record and monitor your financial data to ensure your debits and credits reflect your budget.

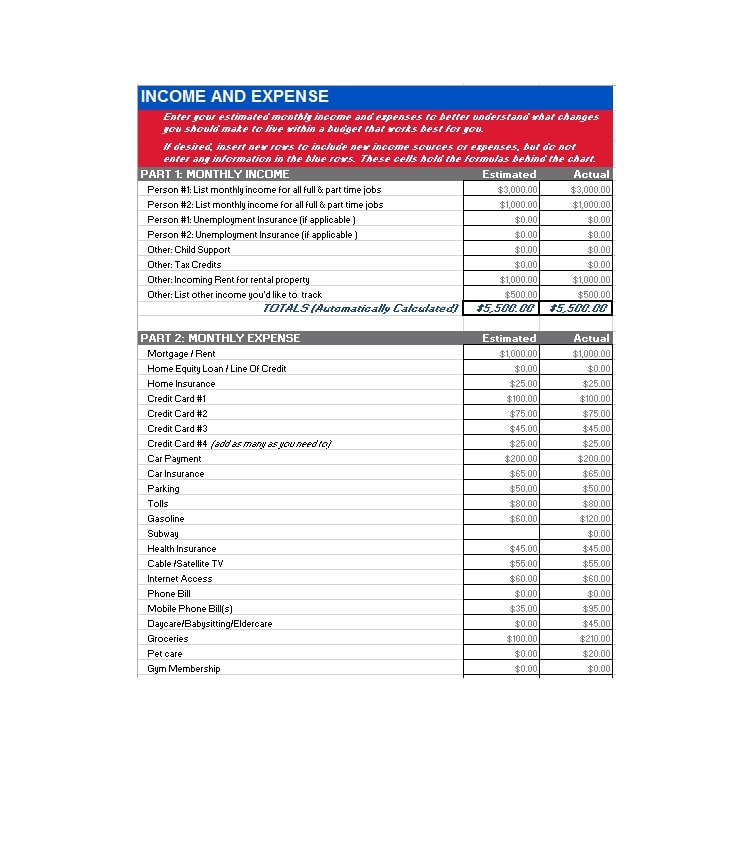

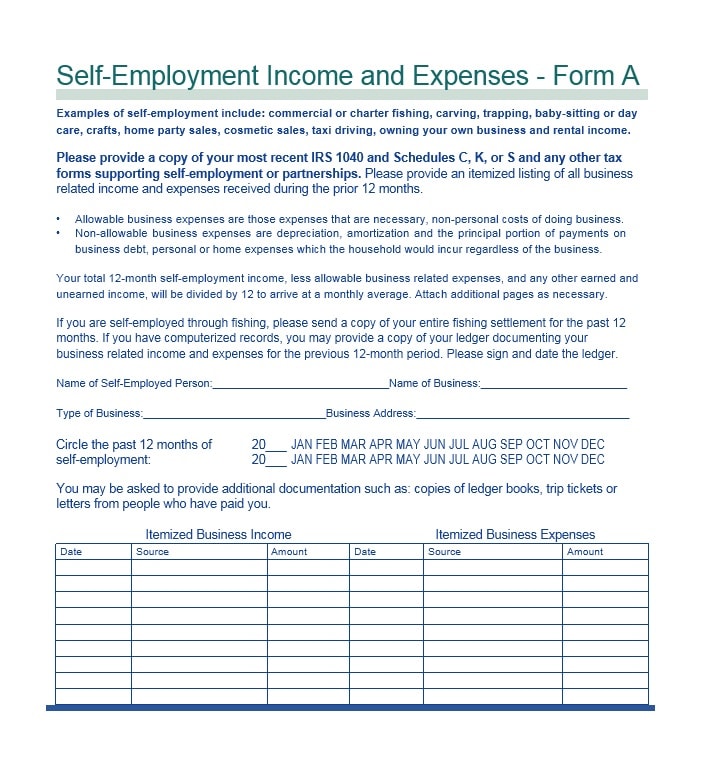

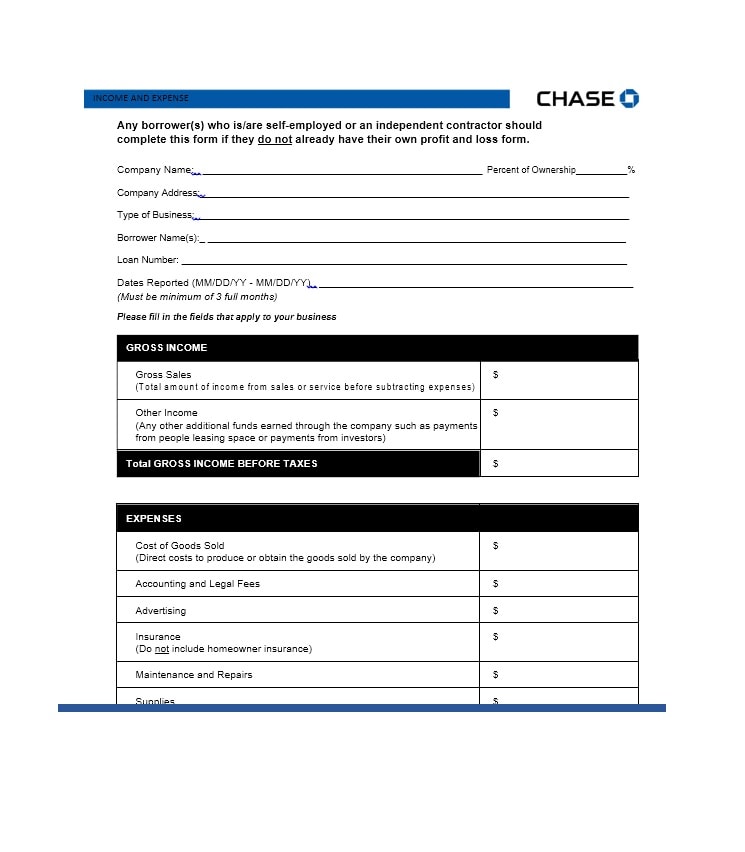

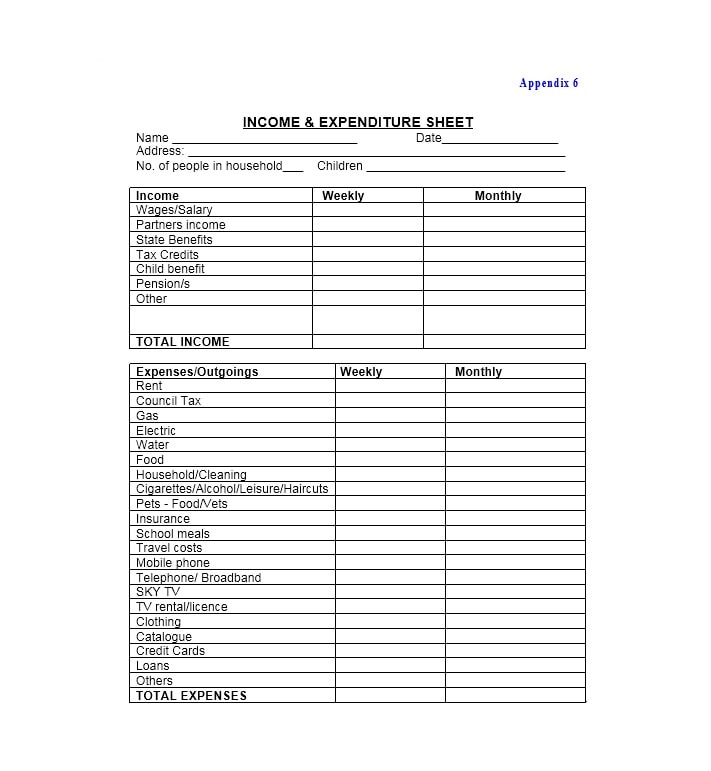

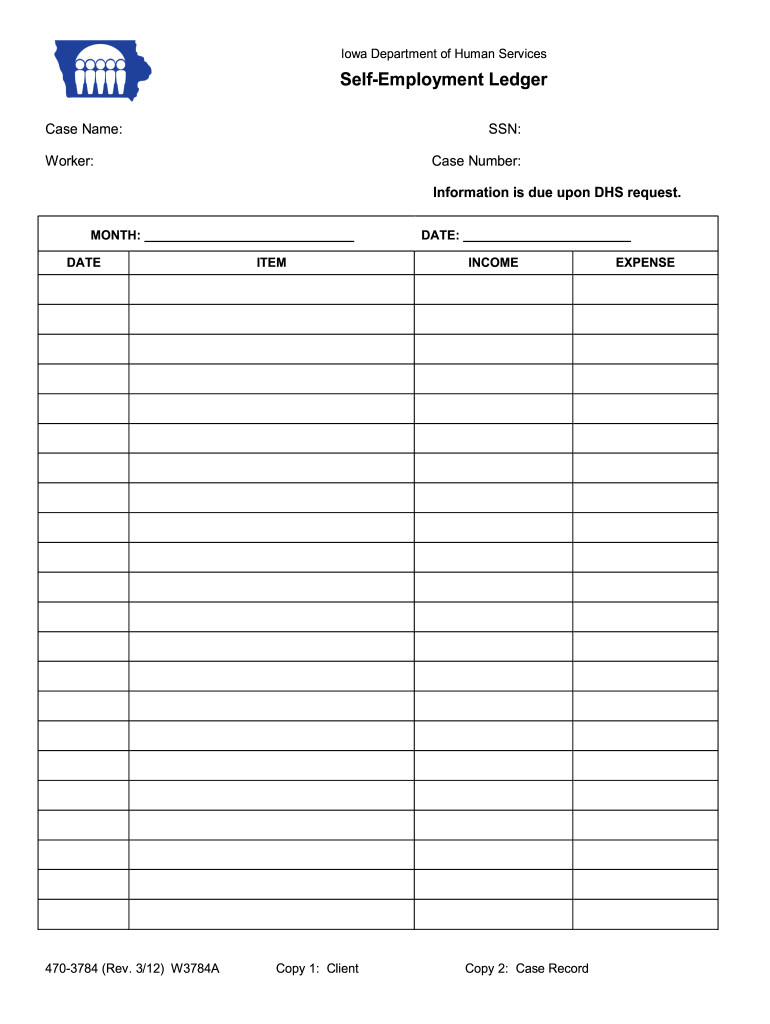

Income expense ledger. To create an expense ledger 1. In this example, the amount is $500. Creating an expense and income spreadsheet can help you.

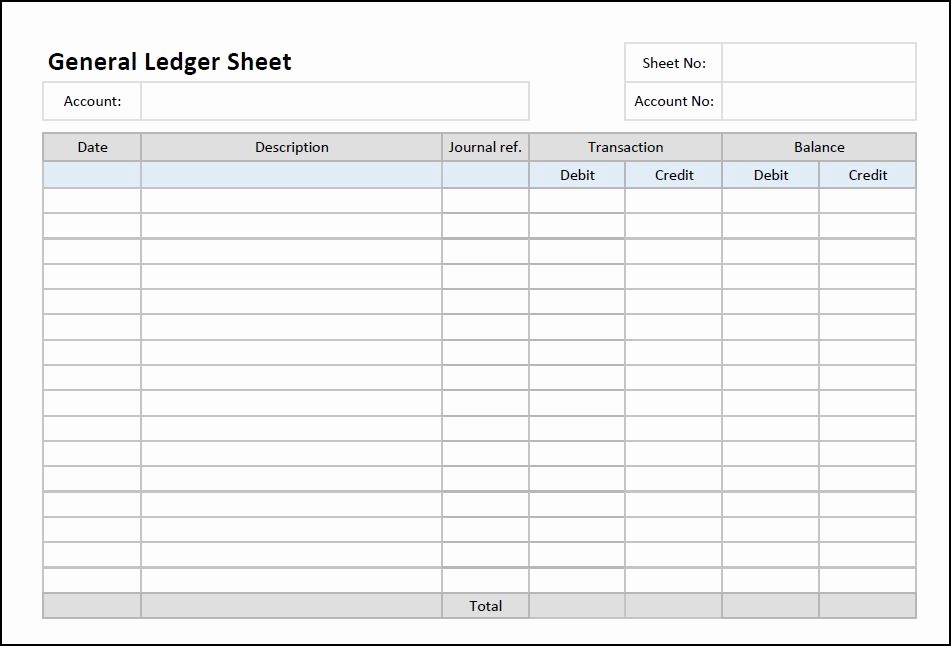

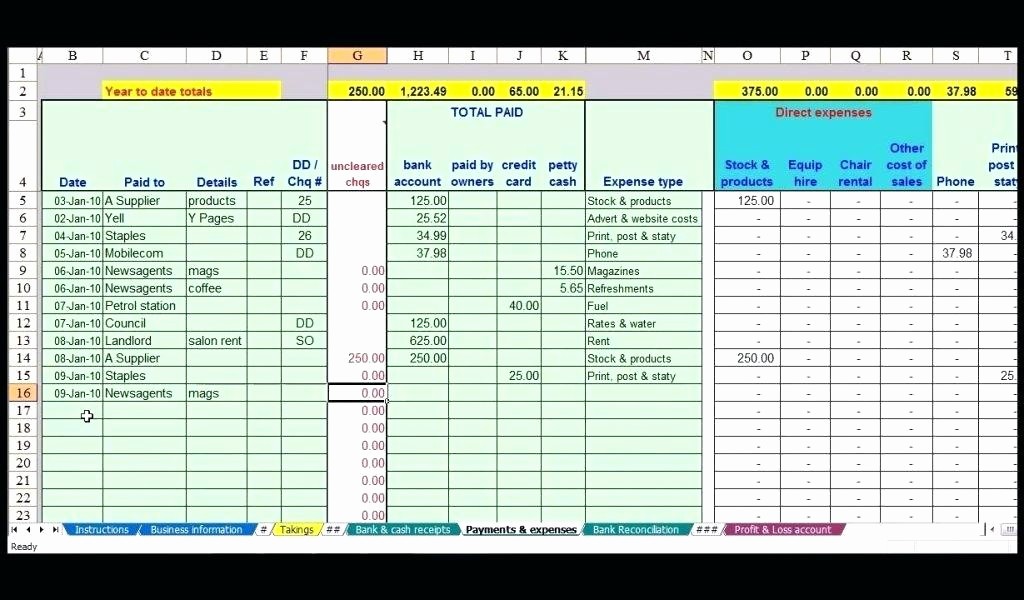

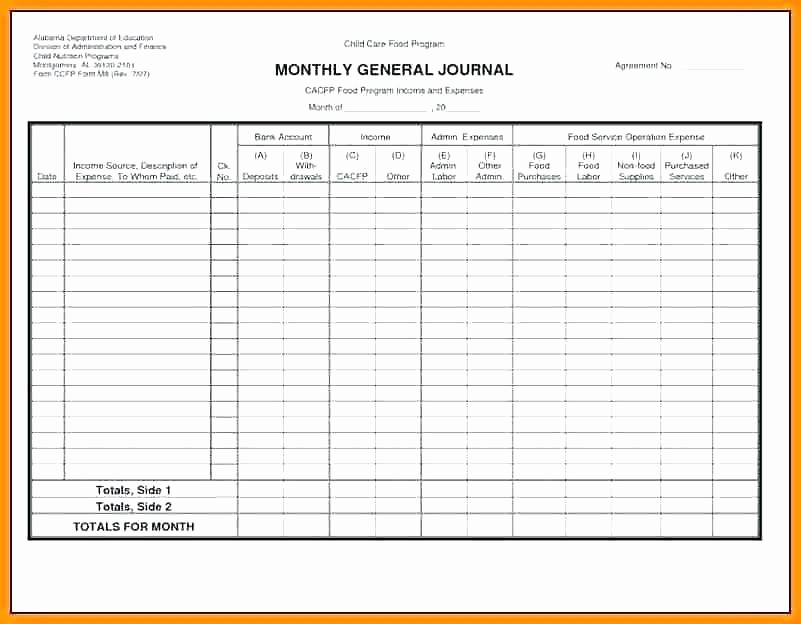

In the left column (which is used for recording debits), write the date of the transaction, and then write the amount. The closing balance amount of $5000. The corresponding credit entry has been made in the cash ledger.

Double entry bookkeeping to better understand the general. You can also use the general ledger in the budget preparation process. Categorize income and expenses:

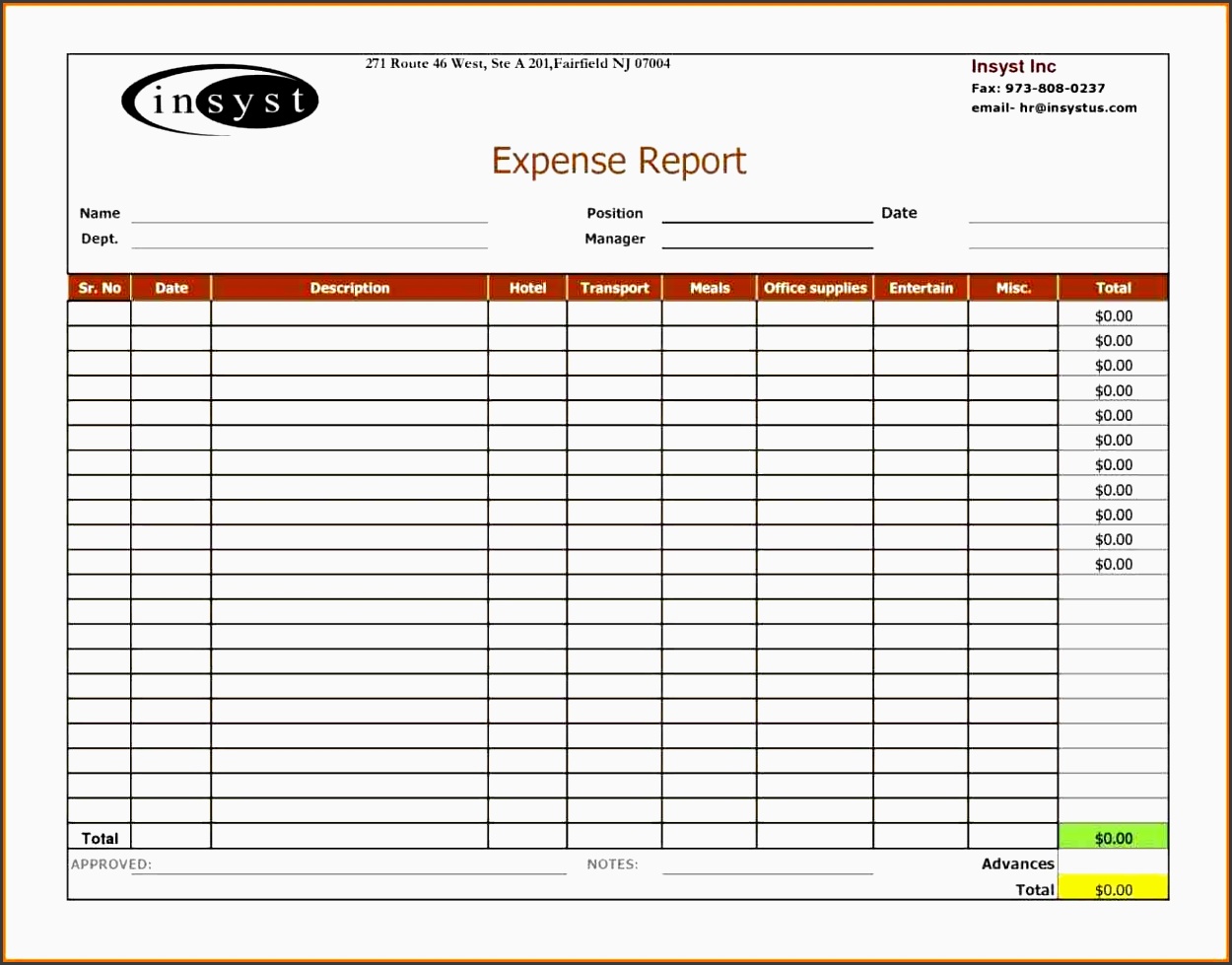

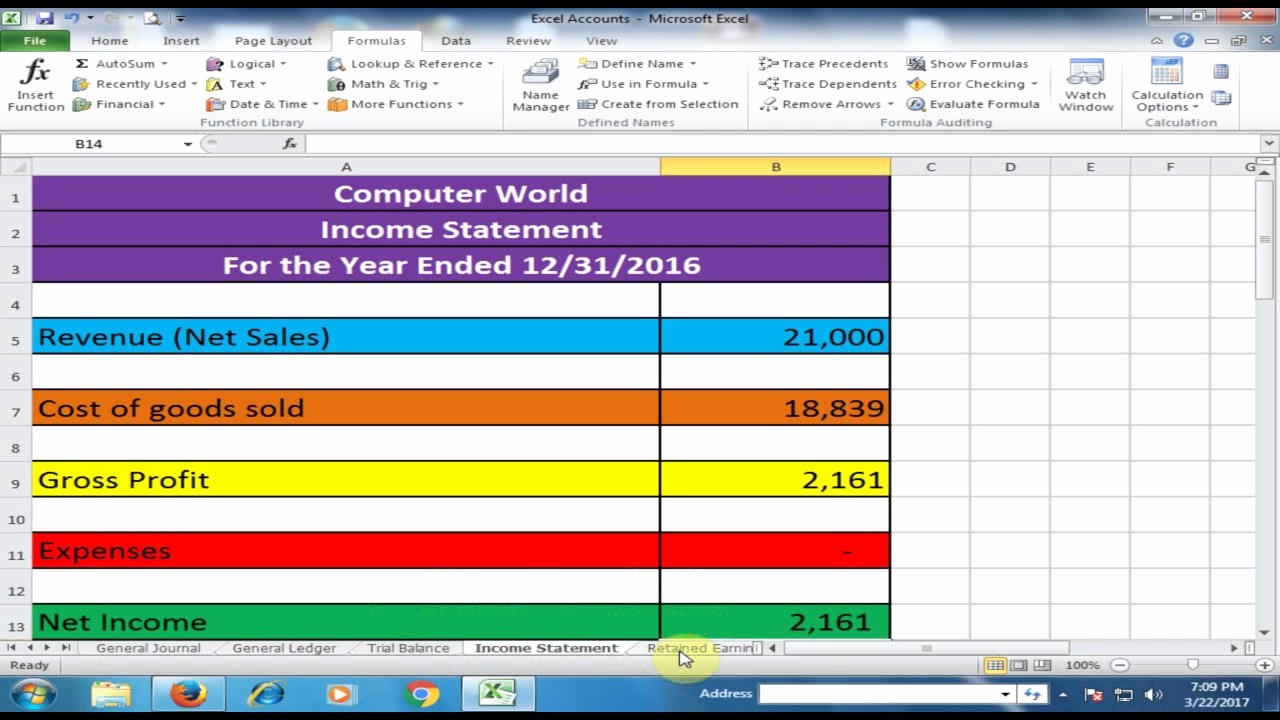

Categorize income sources and various types of expenses to ensure accurate tracking. The general ledger can be used to track a company’s income, expenses, assets, liabilities and equity. Go to gateway of tally > accounts info.

This includes debits (money leaving your business) and credits (money coming. Summarize the income and expenses by month. Update the income and expenses pivottables.

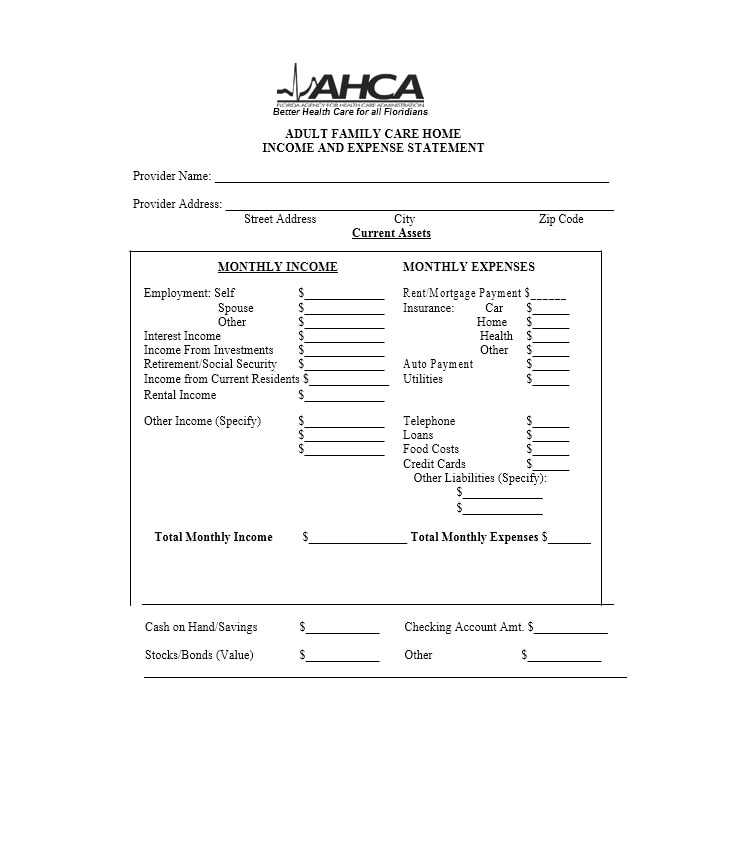

A general ledger is the foundation of a system employed by accountants to store and organize financial data used to create the firm’s financial statements. A general ledger template is a record of the income and expenses that affect your company’s bottom line. It includes accounts related to income, expenses, losses, and gains—rent, salary, interest on loans interest on loans the term “interest on loan”.

Make layout of ledger a ledger contains the debit and credit and the current balance after every transaction. What is a general ledger account? The ledger contains the business’s income and expenses, which can be used in the budget formulation.

The expense ledger is being debited to account for the increase in expense. A general ledger account, or gl account, is one of the basic elements of financial accounting. A general ledger is an accounting record of all financial transactions in your business.