Wonderful Tips About Direct Expenses In Profit And Loss Account

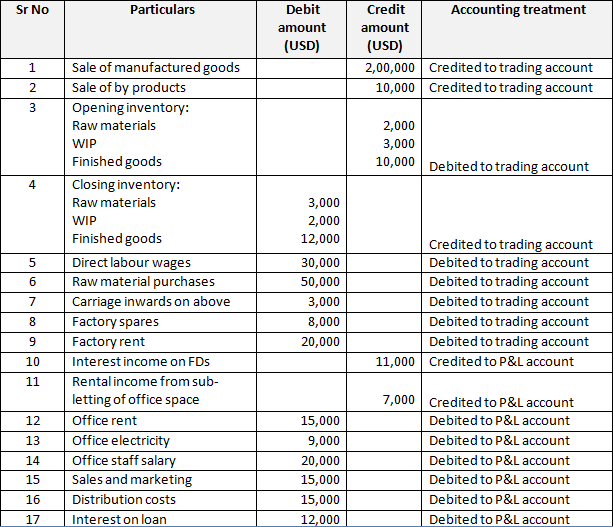

Rather, it is recorded in the profit and loss account.

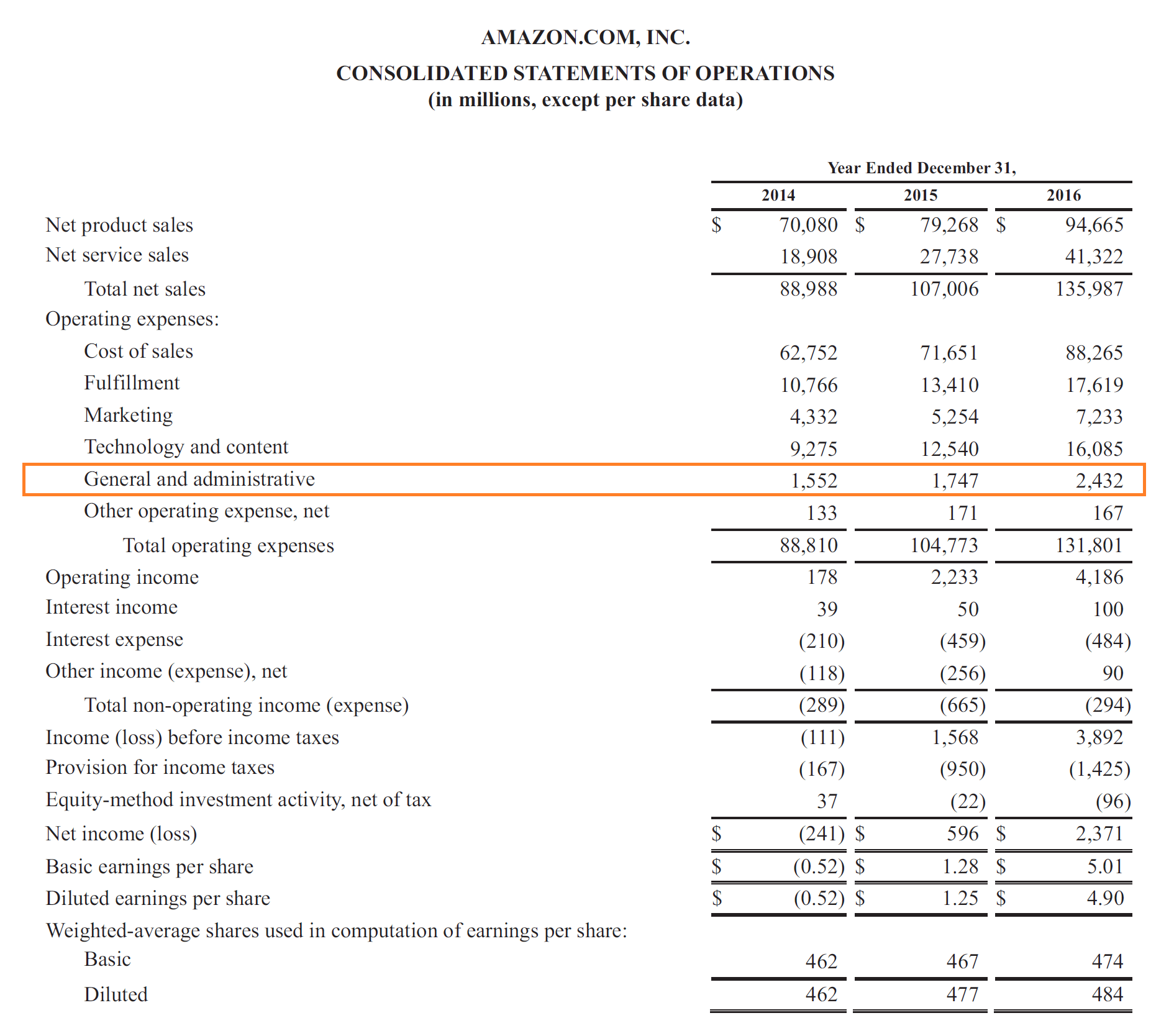

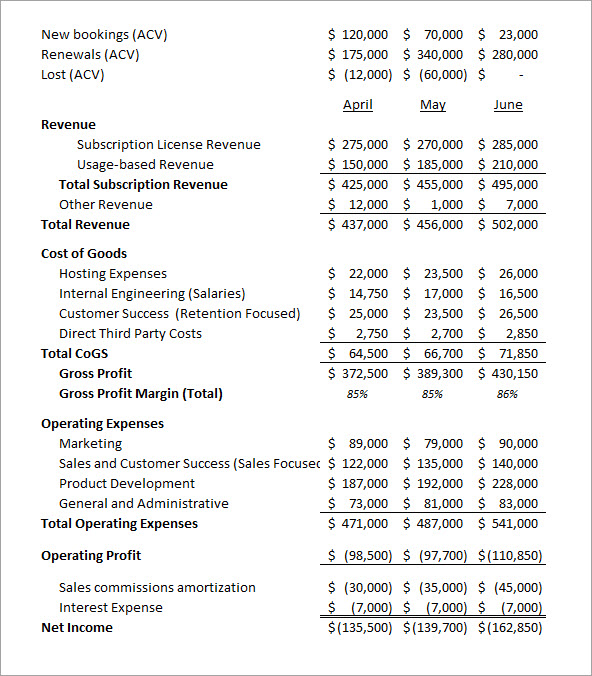

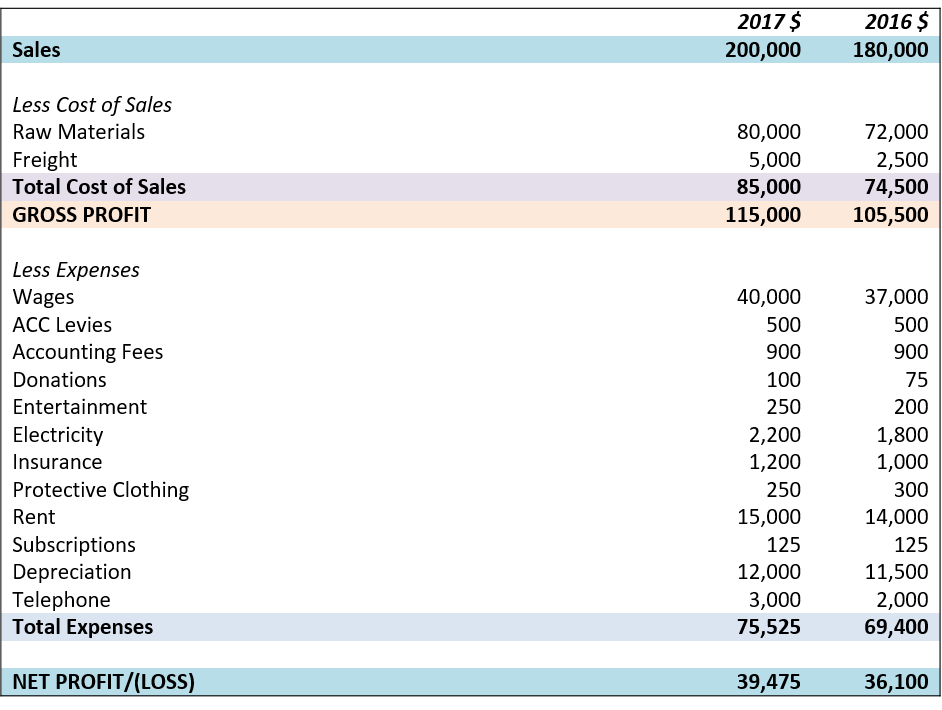

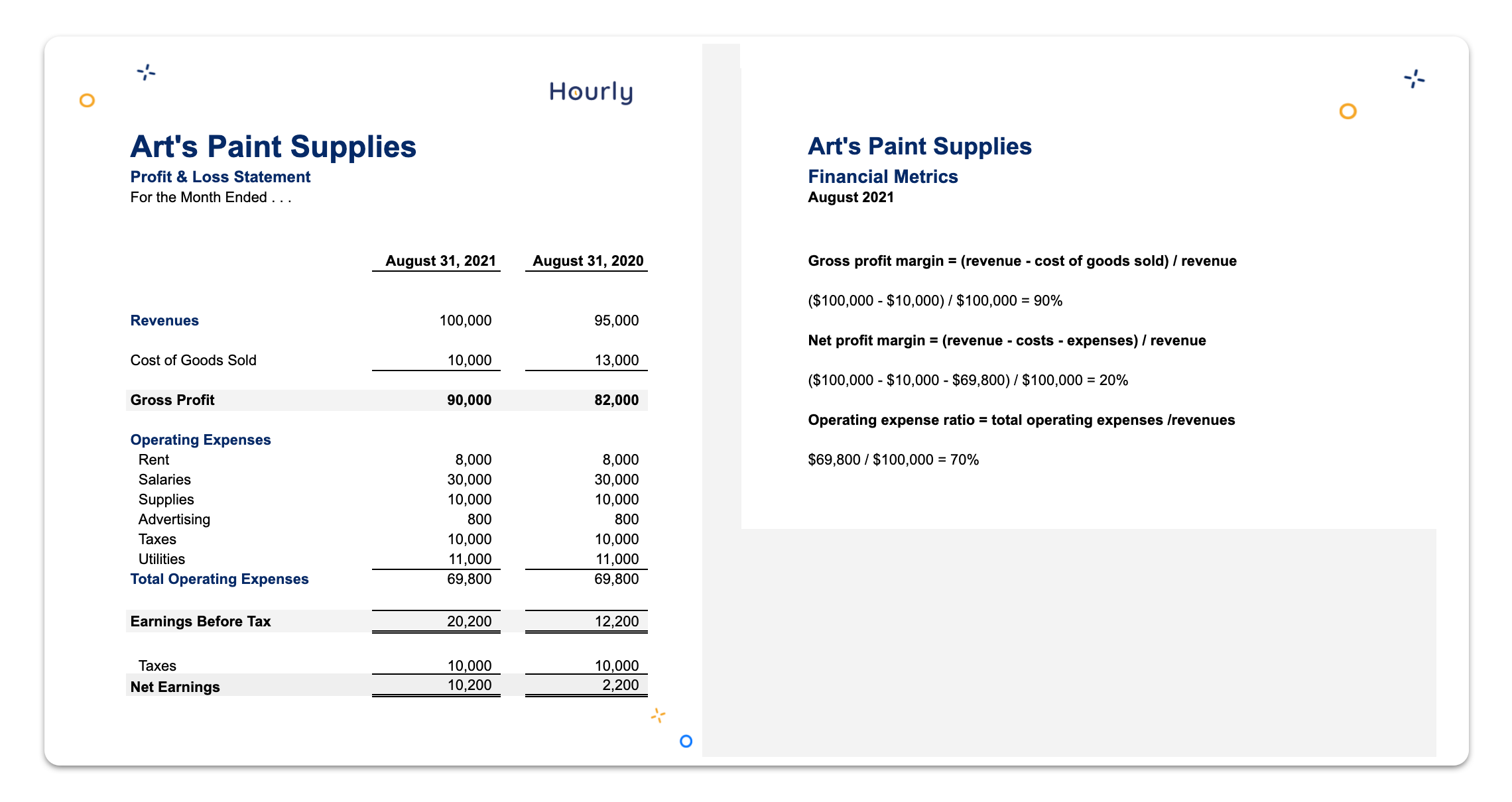

Direct expenses in profit and loss account. An income statement, also known interchangeably as a profit and loss account, provides a summary of a company’s revenues, expenses, and profits over a. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and. Direct expenses become part of the.

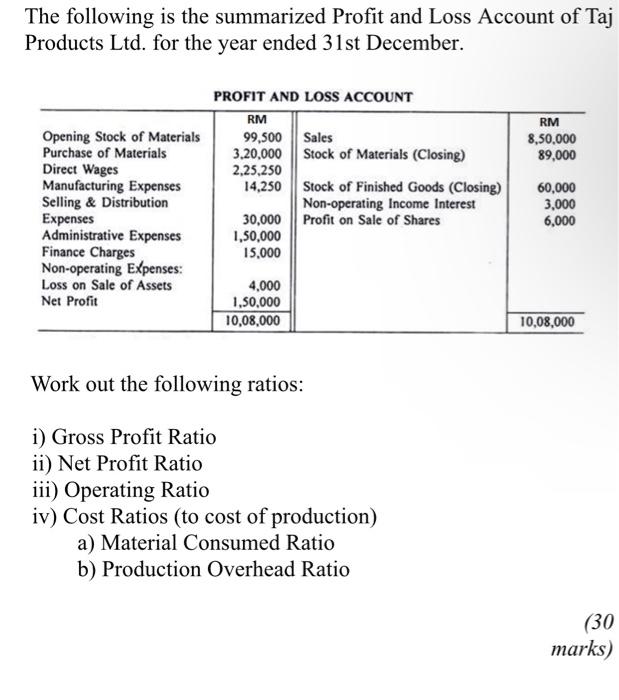

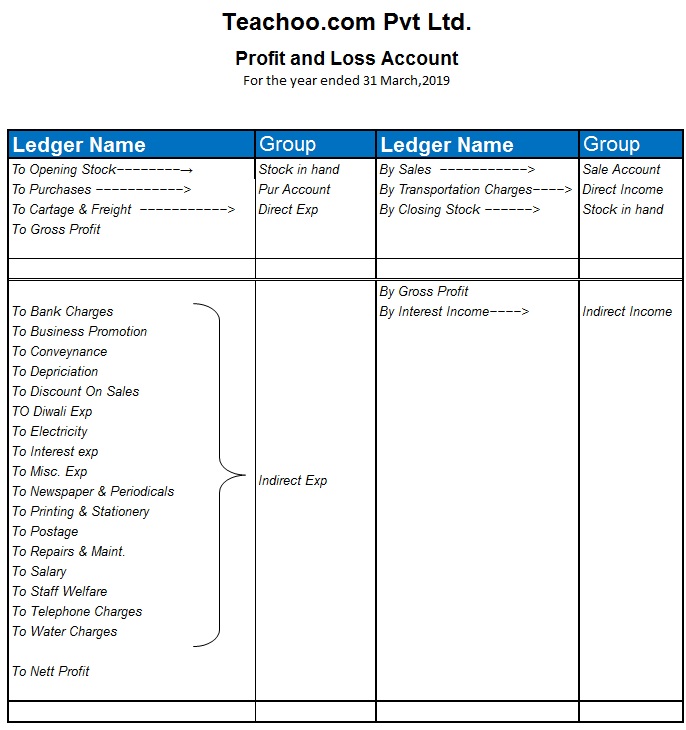

Direct expenses are any expenses incurred to manufacture or purchase goods and to bring them into saleable condition. They have already been accounted for in the trading account. Direct expenses in trading account are normally recorded on the trading account's debit side.

It could be for a week, a quarter or a financial year. As seen before with best buy, macy's gross profit of $2.14 billion dramatically differs from its net income of $43 million, due to sg&a costs, interest. As against, indirect expenses are incurred in connection to the.

Your net profit deducts all expenses (direct and indirect) from your total revenue. Direct expenses are costs directly related to the production or purchase of goods. We’re about to break down exactly what makes up your profit and loss account.

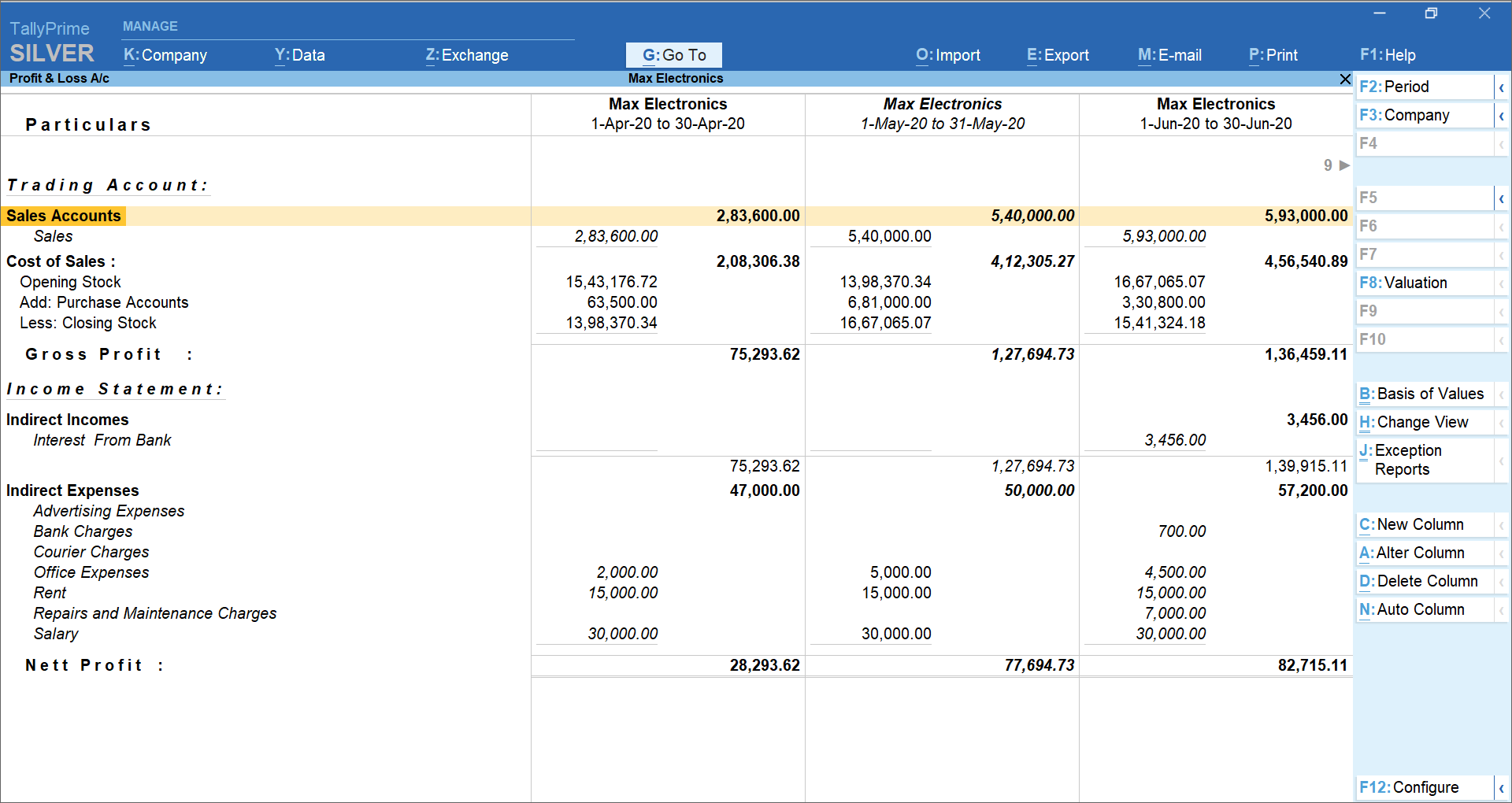

If you’re using automated accounting software, you may want. Under the indirect method, the. The first section of your profit and loss statement will be your sales or turnover minus your direct costs.

The examples of expenses that can be included in a profit and loss account are: You are required to calculate cfo using the direct method. It is not a direct expense and should not be recorded in trading account;

Direct expenses are shown on the debit side of a trading account because costs related to the production, procurement, buying and selling of goods/services should appear in this account. These two types of expenses. Direct expenses are a major component of a business or company's financial metric as it helps them to keep track of their spending.

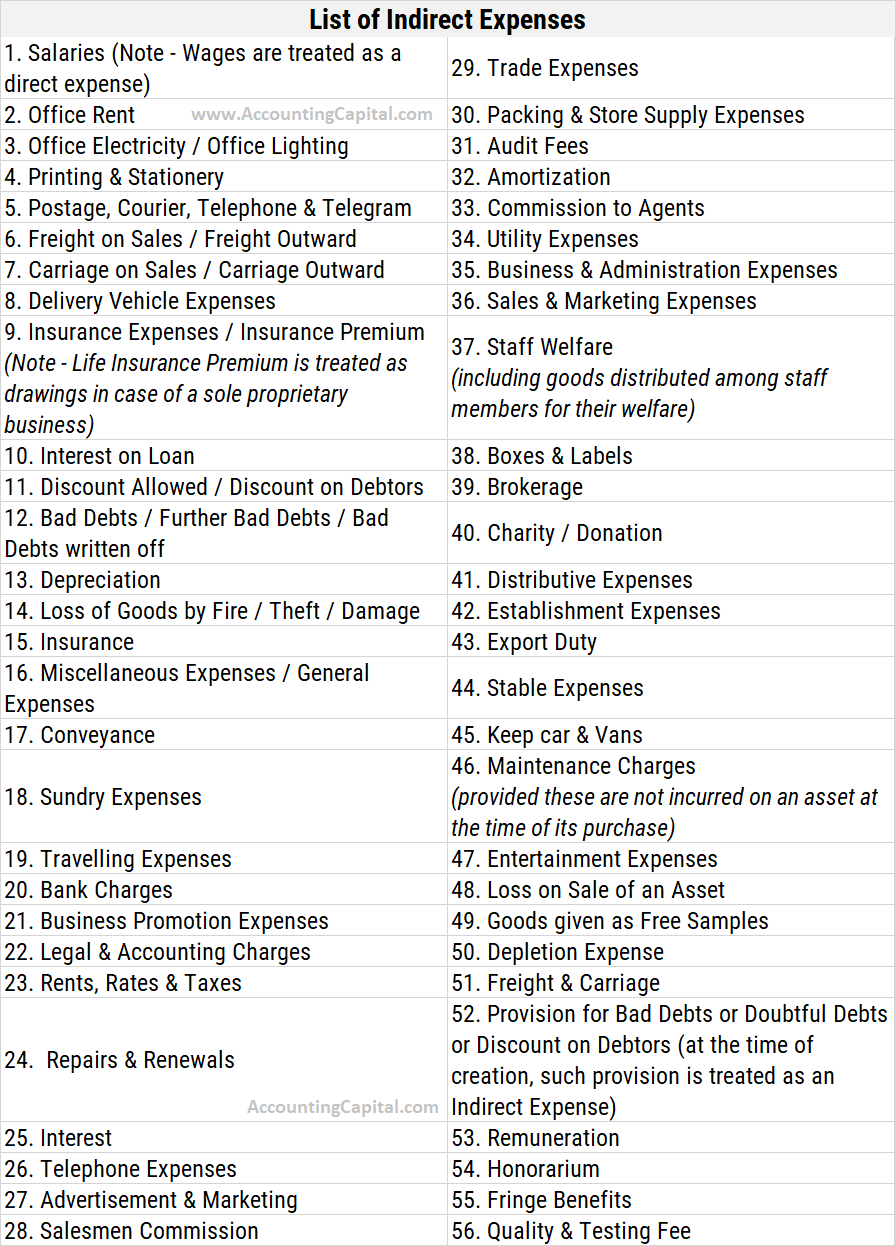

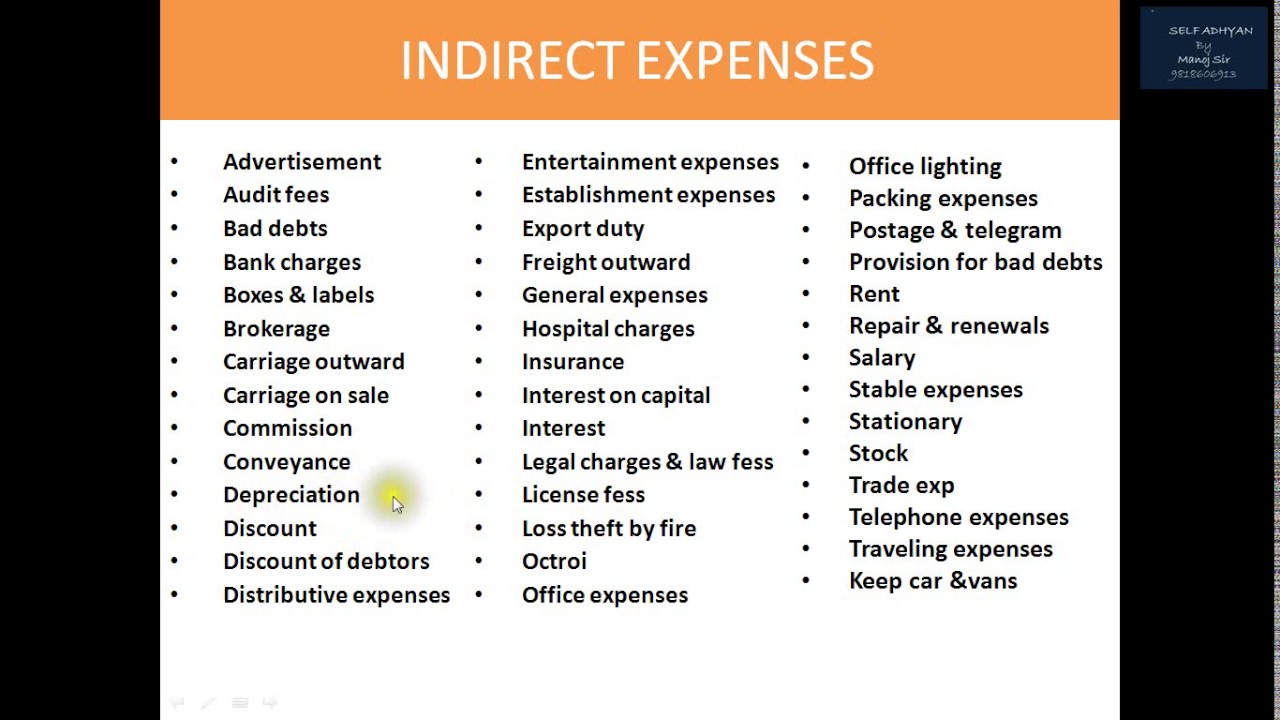

Indirect expenses in profit and loss account are recorded on the. Profit and loss accounting explained. Direct costs are the raw materials, salaries or equipment used to directly.

A typical departmental trading and profit and loss account format for a two department business (a and b) is shown below. The profit & loss account reports the incomes and expenses directly related to an organisation to measure the performance in terms of profit or loss. Cartage cartage is another term.

This reveals the total profit your company has made. This is where the initial gross profit or gross loss is determined. Expenses are mainly divided into two categories: