Supreme Info About Capital In Cash Flow Statement

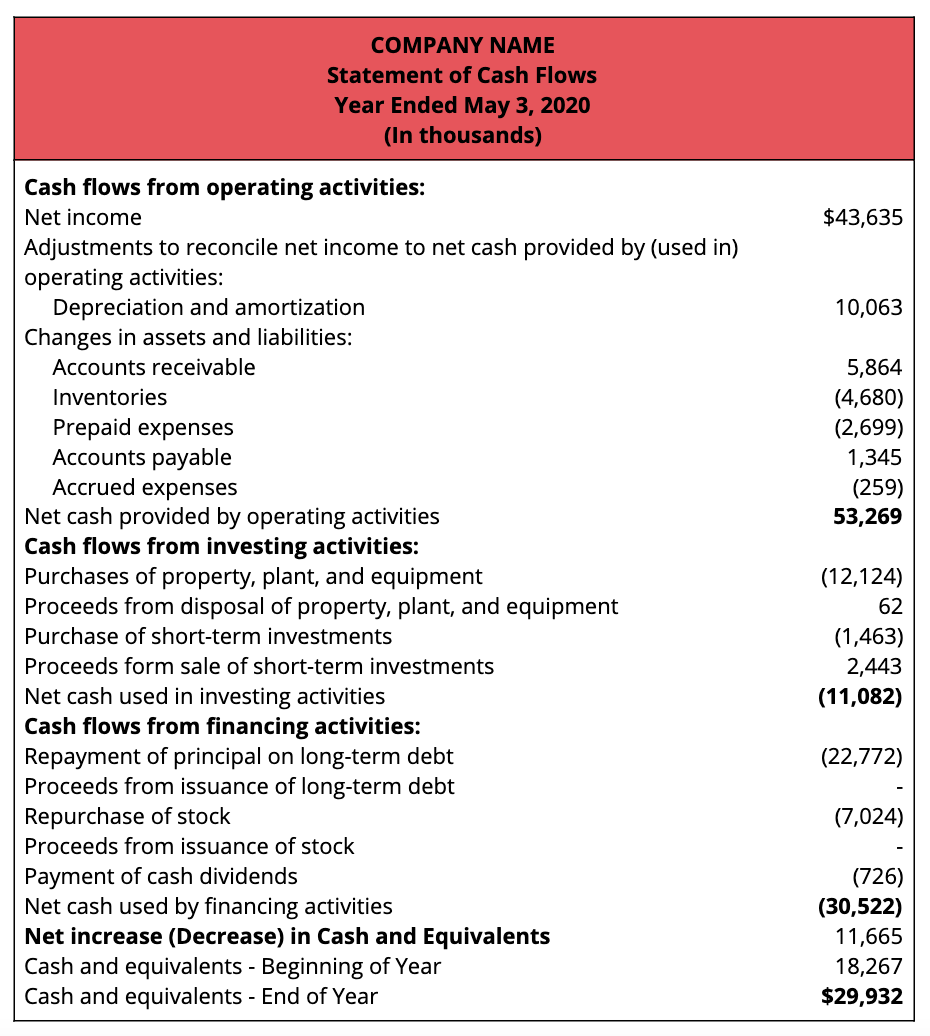

Free cash flow can be easily derived from the statement of cash flows by taking operating cash flow and deducting capital expenditures.

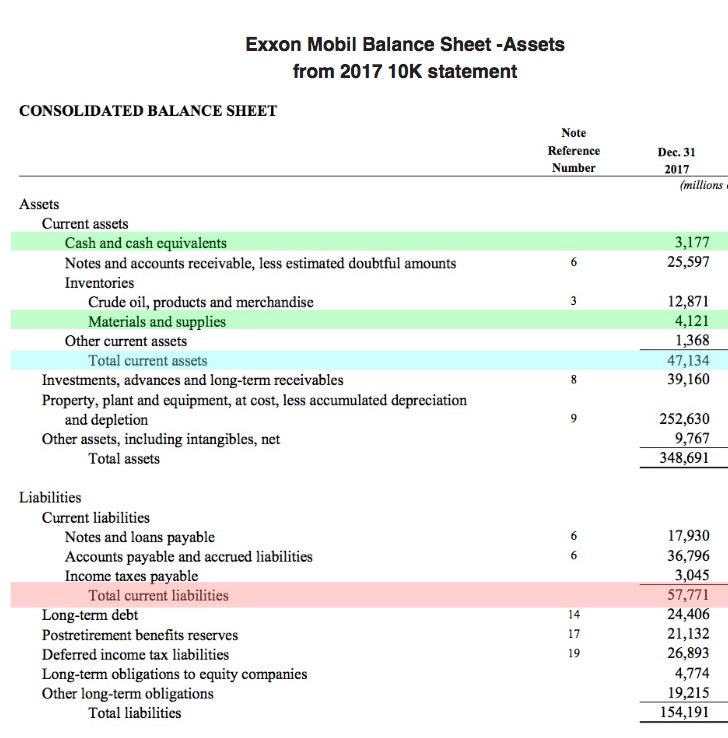

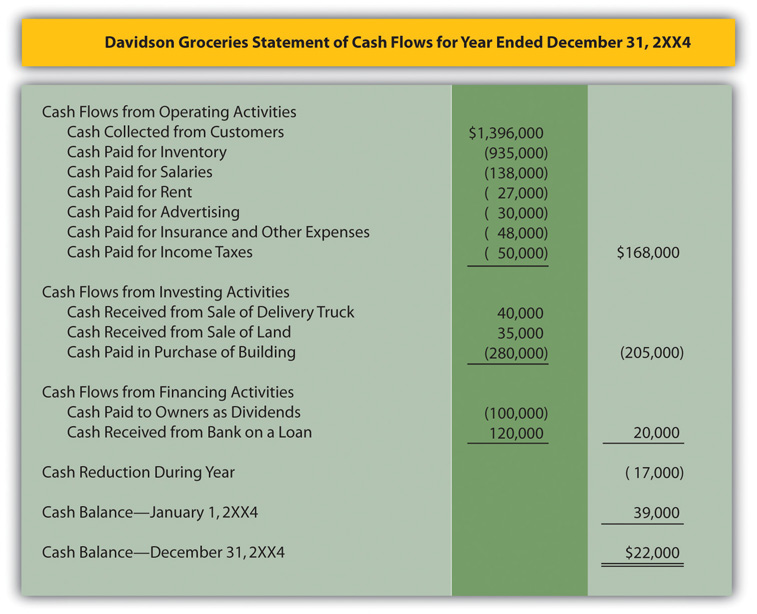

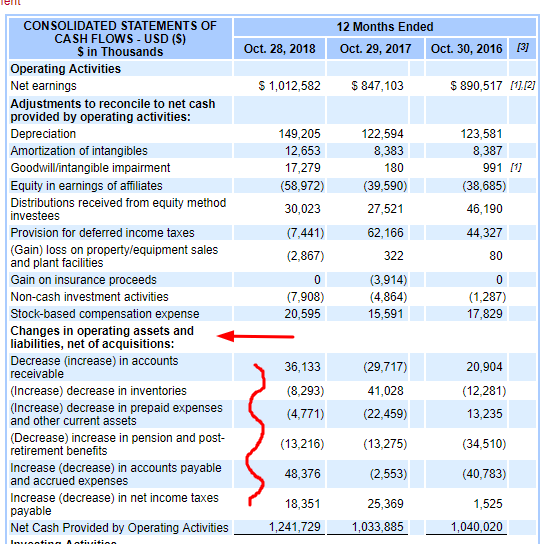

Capital in cash flow statement. The change in net working capital (nwc) section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period. The balancing figure is the cash spent to buy new ppe. Here are some examples of how cash and working capital can be impacted.

If a transaction increases current. The primary reason why capital reserves don’t impact the cash flow statement is that there is no cash involvement. The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business.

A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. Statement of cash flows, also known as cash flow statement, presents the movement in cash flows over the period as classified under operating, investing and financing activities. It provides insight toa company’s ability to generate cash and liquidity.

Cash flow statement (cfs) → the actual full cash outflow related to capex is captured in the cash from investing section of the cash flow statement. Investopedia / julie bang understanding. Working capital’s role businesses that manage their working capital stay healthy because proper management is essential to a company’s financial health and operational.

Solution here we can take the opening balance of ppe and reconcile it to the closing balance by adjusting it for the changes that have arisen in period that are not cash flows. Capital raising efforts, such as issuing debt or equity financing, are recorded in the cash flow from financing section. The cash flow statement (cfs) tracks how a company uses its cash to pay its debt obligations and fund its operating expenses and investments.

If the change in nwc is positive, the. Taking into account the profit and cash generation in 2023, as well. The cfs measures how well a.

Adjusted income statement, balance sheet and cash flow adjusted income statement (in euro million) fy 2022 fy 2023 % change. These reserves primarily include reclassifying funds from one account to another. Cash flow from operating activities (cfo):

The cash flow statement (cfs), which tracks the net change in cash during a specific period, is split into three sections:. Debt and equity issuances: Operating activities investing activities financing activities operating activities detail cash flow that’s generated once the company delivers its regular goods or services, and includes both revenue and expenses.

We remain committed to our capital allocation strategy by deploying our strong balance sheet towards organic investment, targeted m&a, share buybacks and 2023 dividend distribution at €2.20 per share.”. Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories generally. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

The deal lets employees cash out their shares in the company, rather. Even when companies set cash aside for. These activities also include paying cash dividends, adding or changing loans, or issuing and selling more stock.

![Working Capital Formula and Calculation Exercise [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2018/01/18162008/wc2.gif)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)