Formidable Info About A Cash Flow Budget Partnership Balance Sheet Format

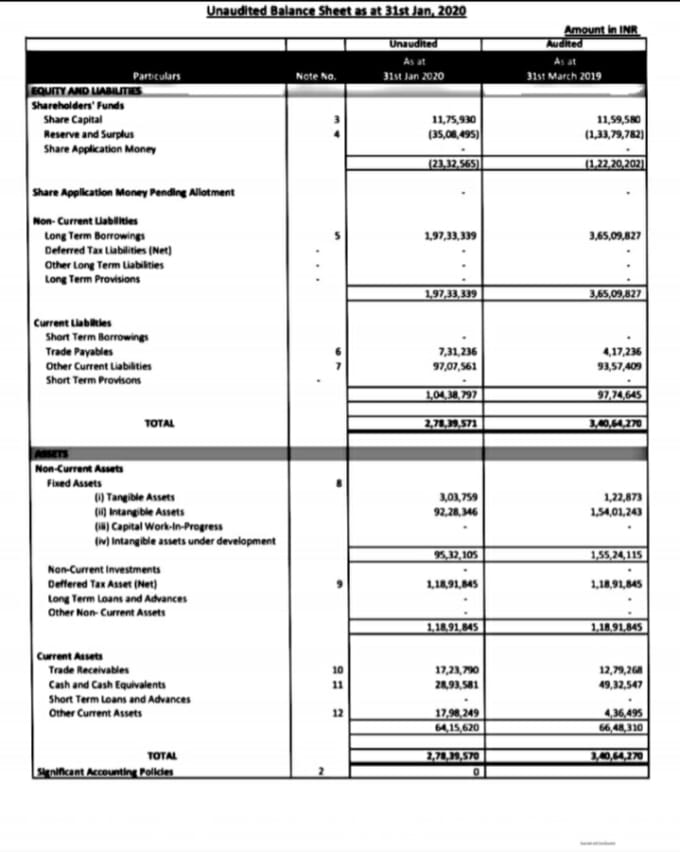

The format of the budgeted balance sheet is similar to the conventional balance sheet.

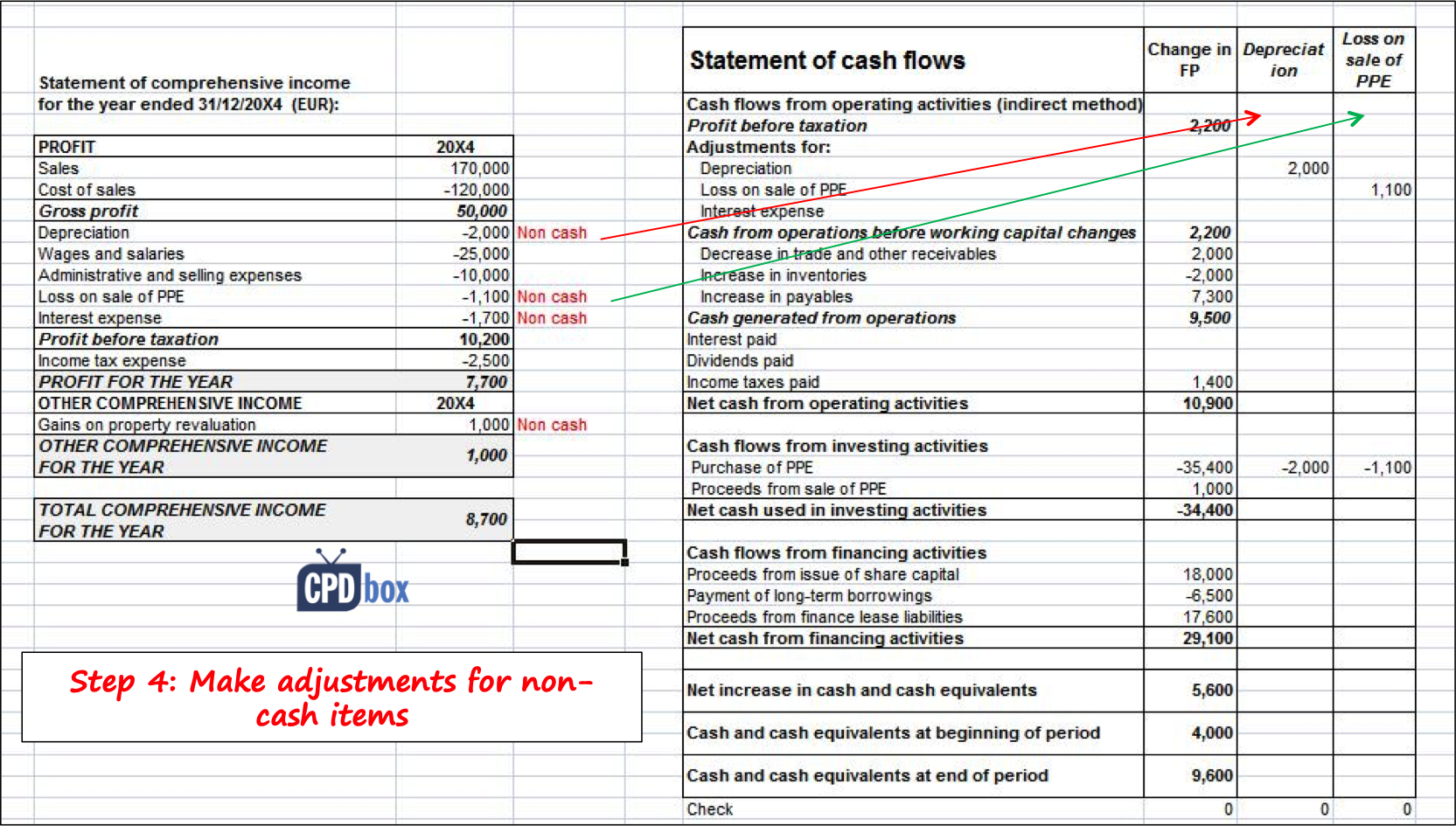

A cash flow budget partnership balance sheet format. It arranges items from the cash. While income statements are excellent for. By combining your cash flow statement with a balance sheet, income statement, and other forms, you can manage cash flow and get a comprehensive.

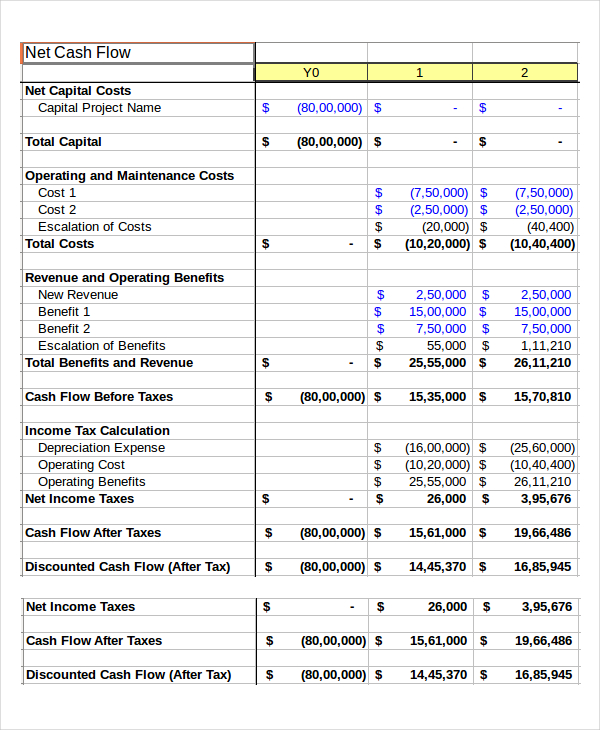

The balance sheet and cash flow statement are two of the three financial statements that companies issue to report their financial performance. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). Essentially, a budgeted cash flow statement is the same as the cash budget.

A partnership's balance sheet reflects assets, liabilities and partner equity. You don’t need to edit as it is a universal template for all companies looking for cash. The statement of cash flows acts as a bridge.

There are three major pro forma statements: Some of the reasons for cash flow budgeting are; However, it uses the standard format for the cash flow statement.

A cash budget is a budget based on actual inflows and outflows of cash, as opposed to being based on accounting principles such as revenue recognition, matching, and. Pro forma income statements pro forma balance sheets pro forma cash flow statements pro forma statements look like regular. Sample income statement, balance sheet and statement of changes in equity of partnership.

It is simple and ready to print. Consolidated statement of cash flows 11 notes to the ifrs example consolidated 12 financial statements 1 nature of operations 13 2 general information, statement of. Balance sheet each partner has to have a capital account and, probably, a current account in the balance sheet.

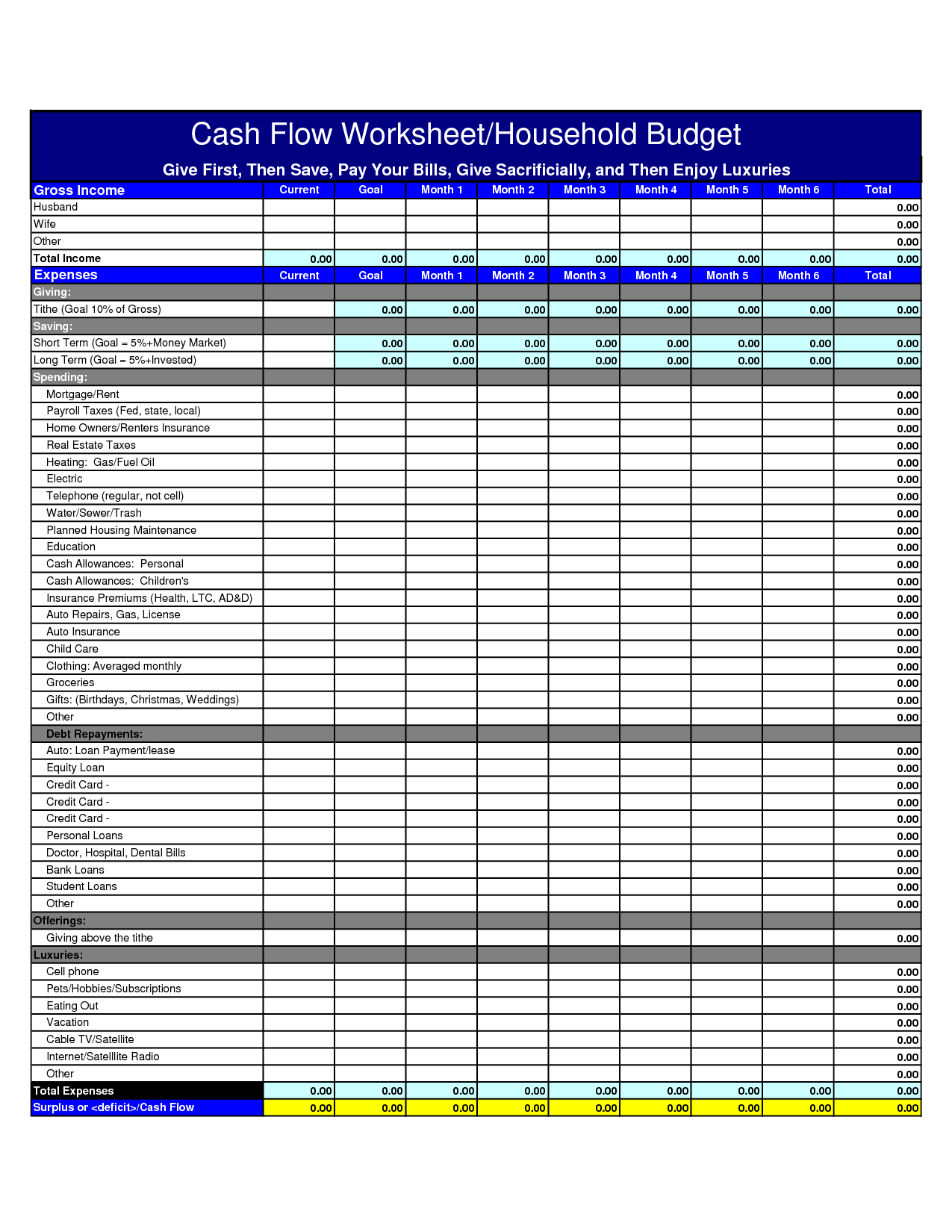

A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period. A cash flow forecast is an estimate of your future sales and expenses. Cash is paid to a partner only when it is withdrawn from the partnership.

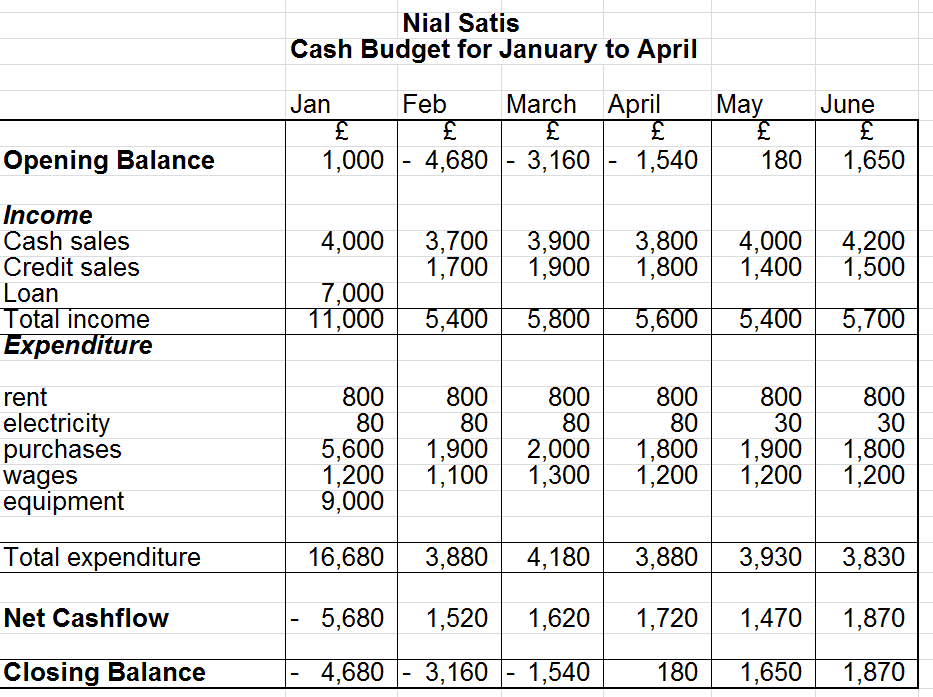

Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the. This monthly cash flow budget template is the one for you. Cash flow budgeting enables you to know the status of the cash position at a certain.

It is a useful tool to help you understand if you will have enough income to cover your. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. Remember that allocating net income does not mean the partners receive cash.

Assets include bank accounts, accounts receivable and any property. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from.

:max_bytes(150000):strip_icc()/AppleCFSInvesto2-6a84aed790a5476abbc3ef04b1718106.jpg)