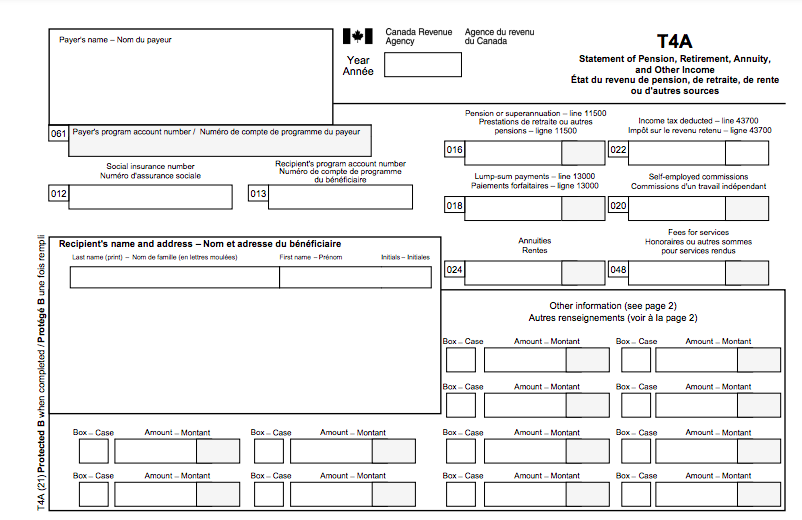

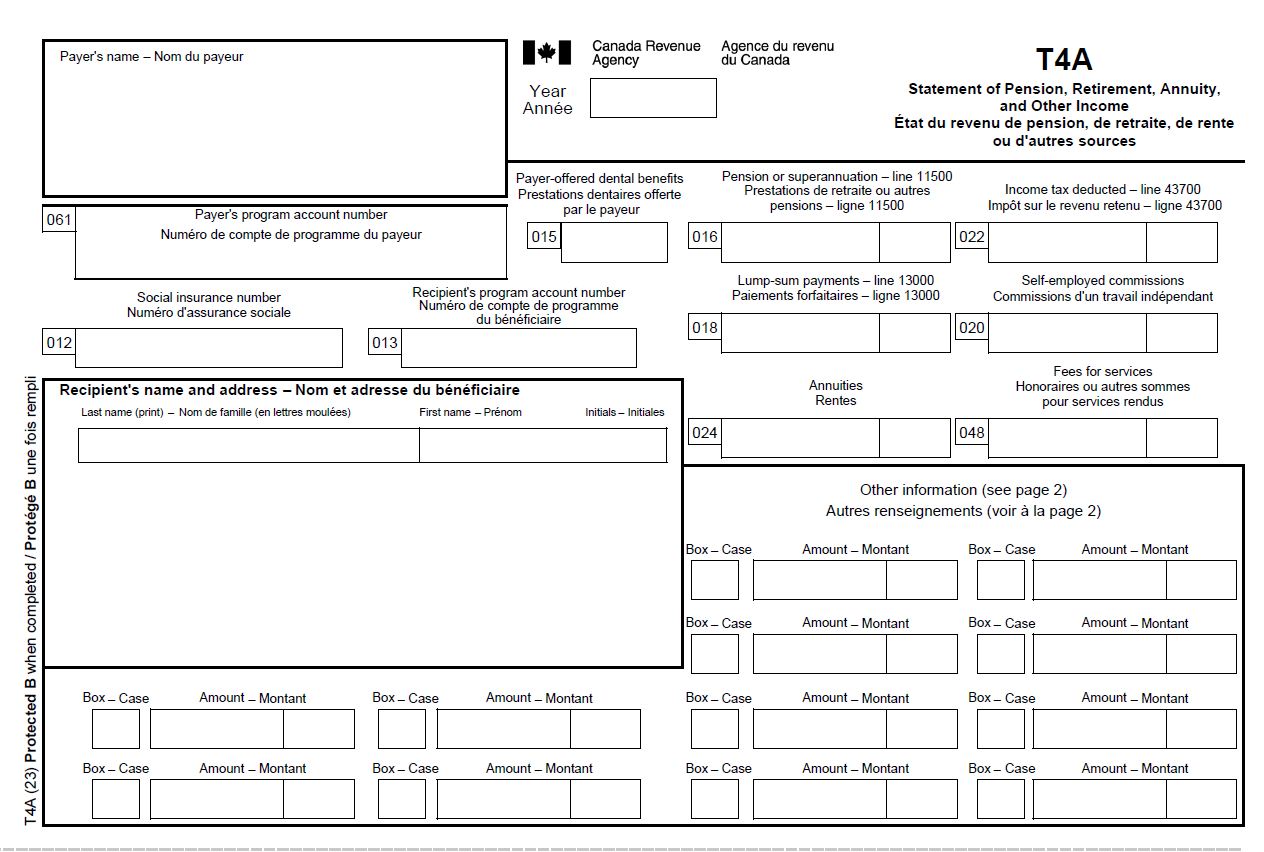

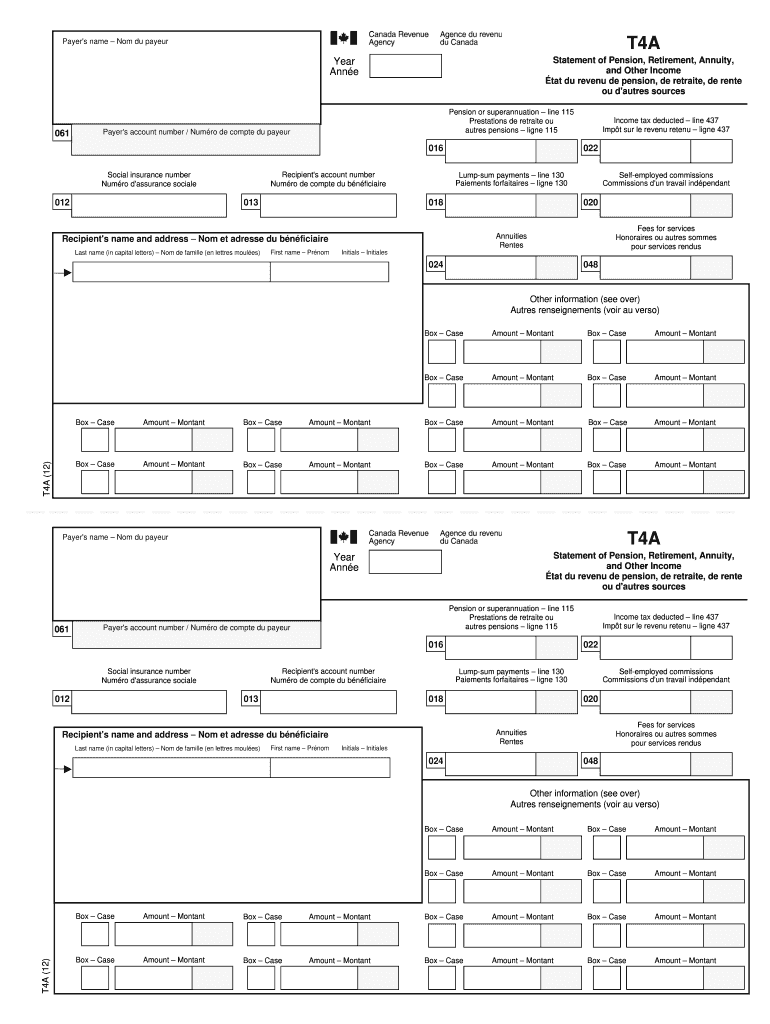

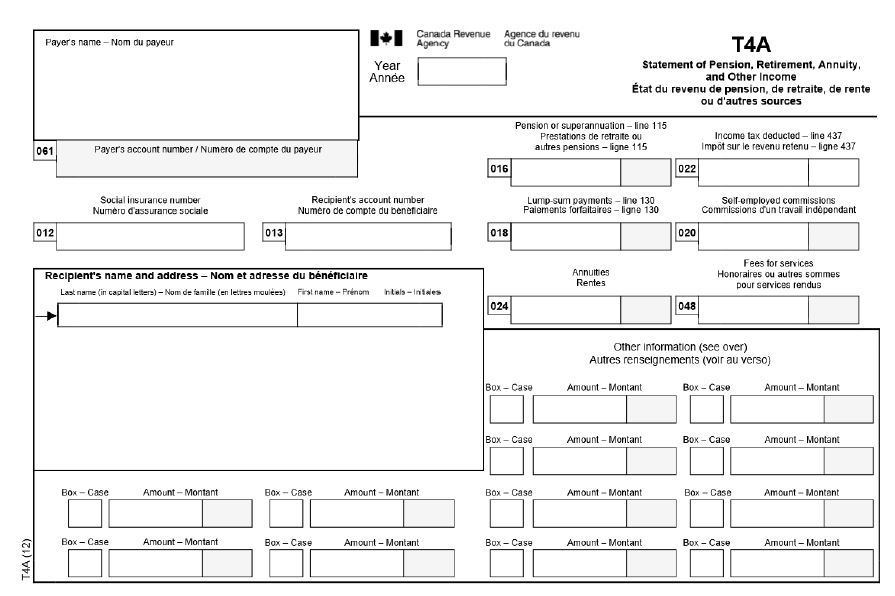

Neat Info About T4a Statement Of Pension Retirement Annuity And Other Income

A taxpayer qualifying for the eligible pension income amount of $2,000 can report all or a portion of the amount in box 024 as eligible pension income.

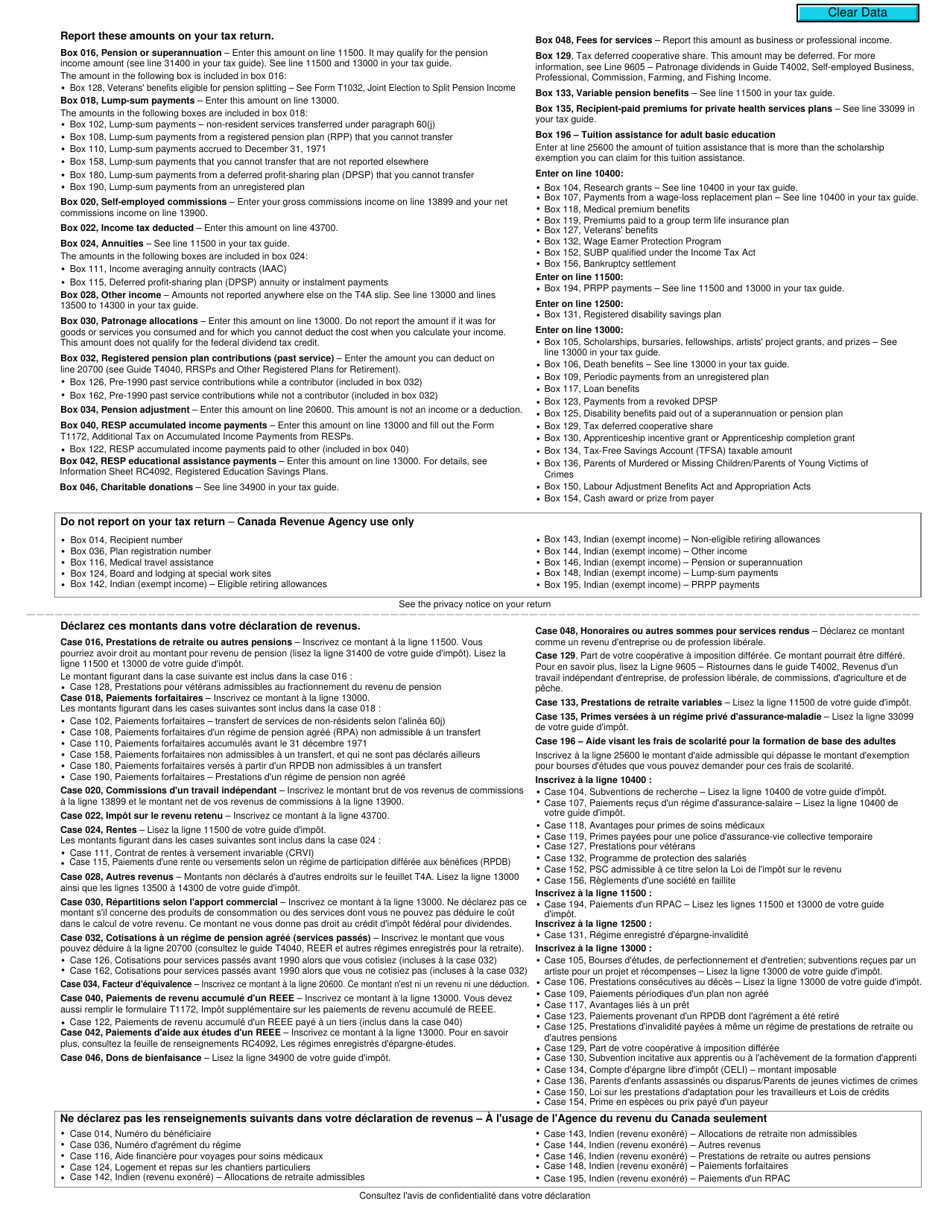

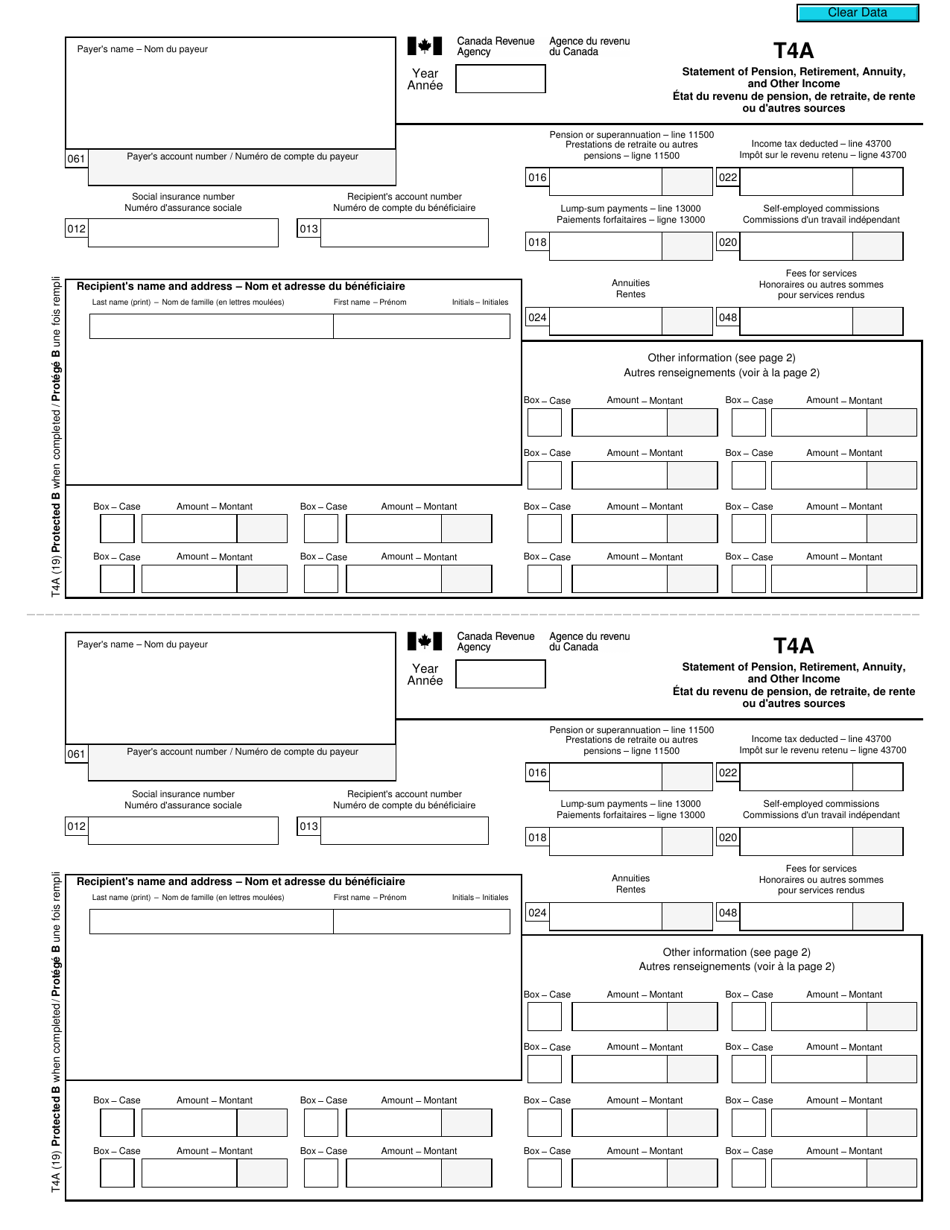

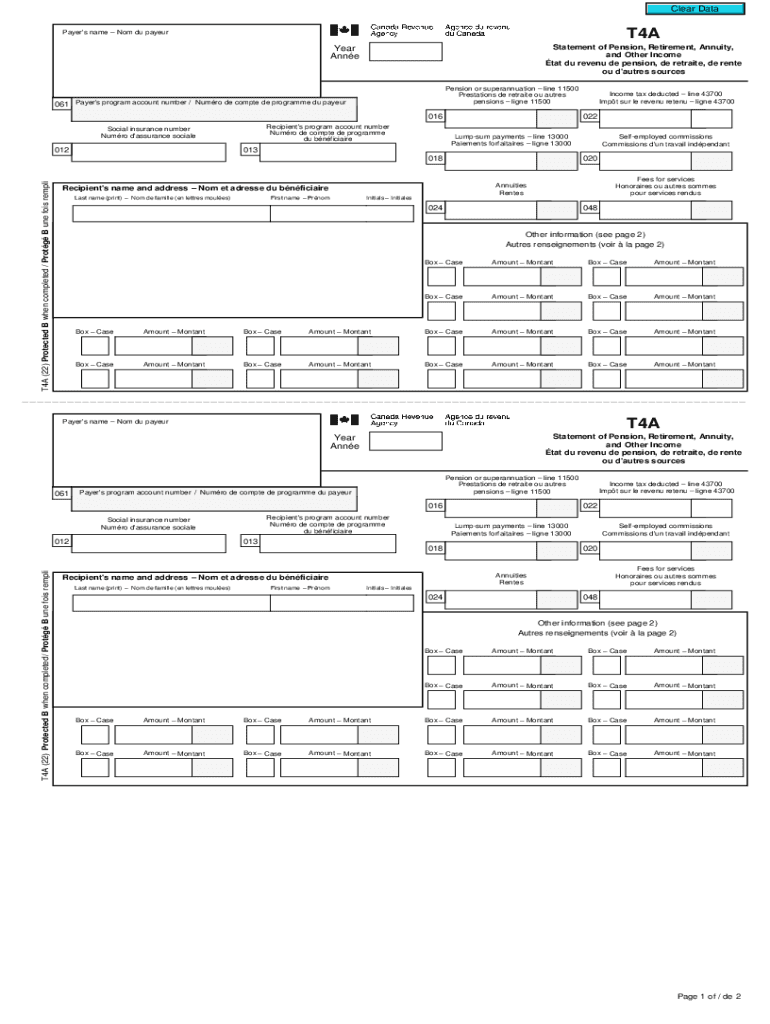

T4a statement of pension retirement annuity and other income. You’ll receive a t4a: See line 11500 if you received other pensions or superannuation and line 13000 if this amount is considered other income. Eligible pension may qualify for the pension income amount.

You have to fill out the t4a slip, statement of pension, retirement, annuity, and other income, if you made any of the payments listed above and one of the following applies:. Statement of pension, retirement, annuity, and other income slip for payments from any of the following income sources: They’re statements of income and both you and the cra receive copies.

Statement of pension, retirement, annuity, and other income slip for payments from any of the following income sources: Statement of pension, retirement, annuity, and other income slip for payments from any of the following income sources: You’ll receive a t4a:

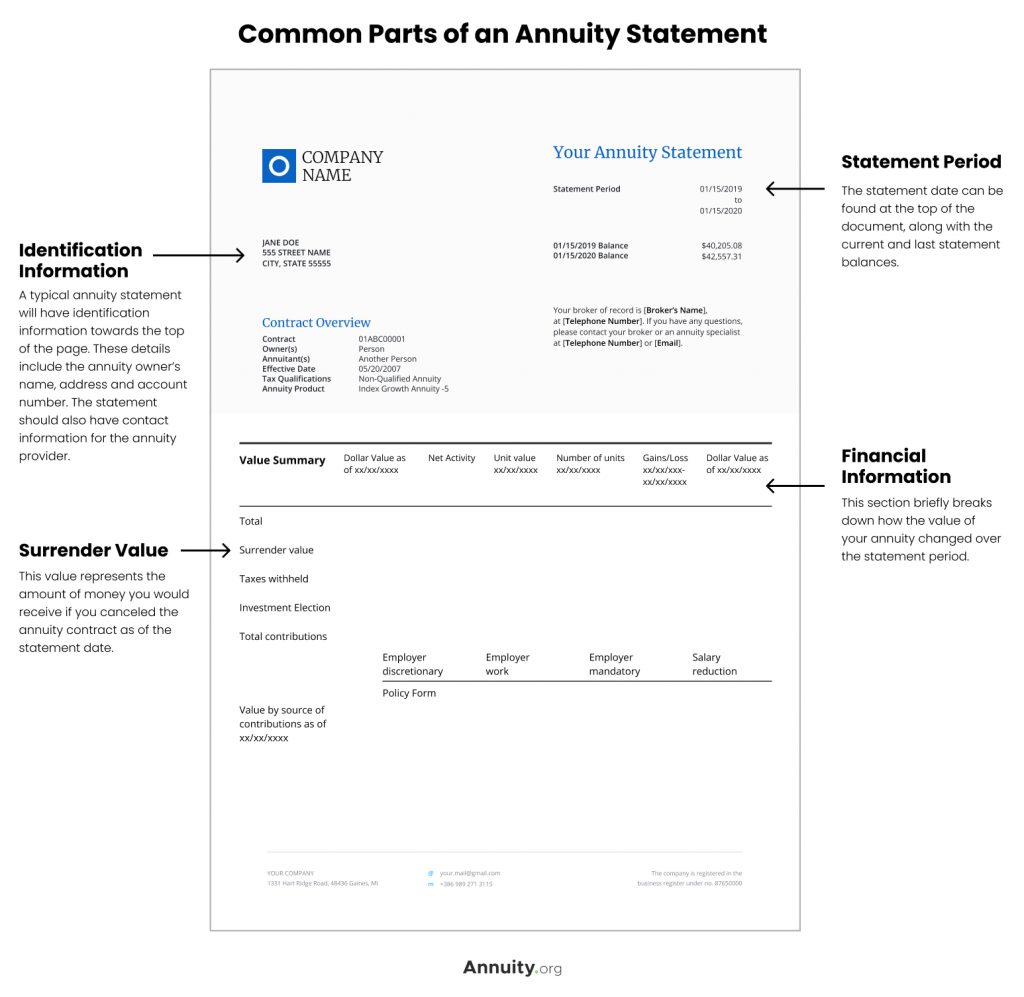

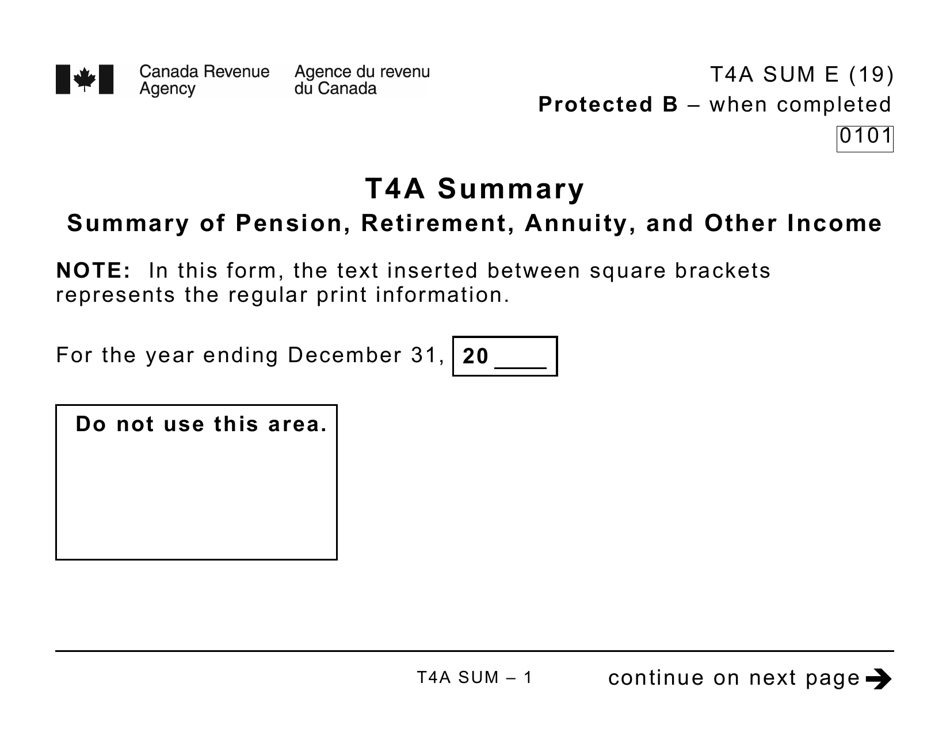

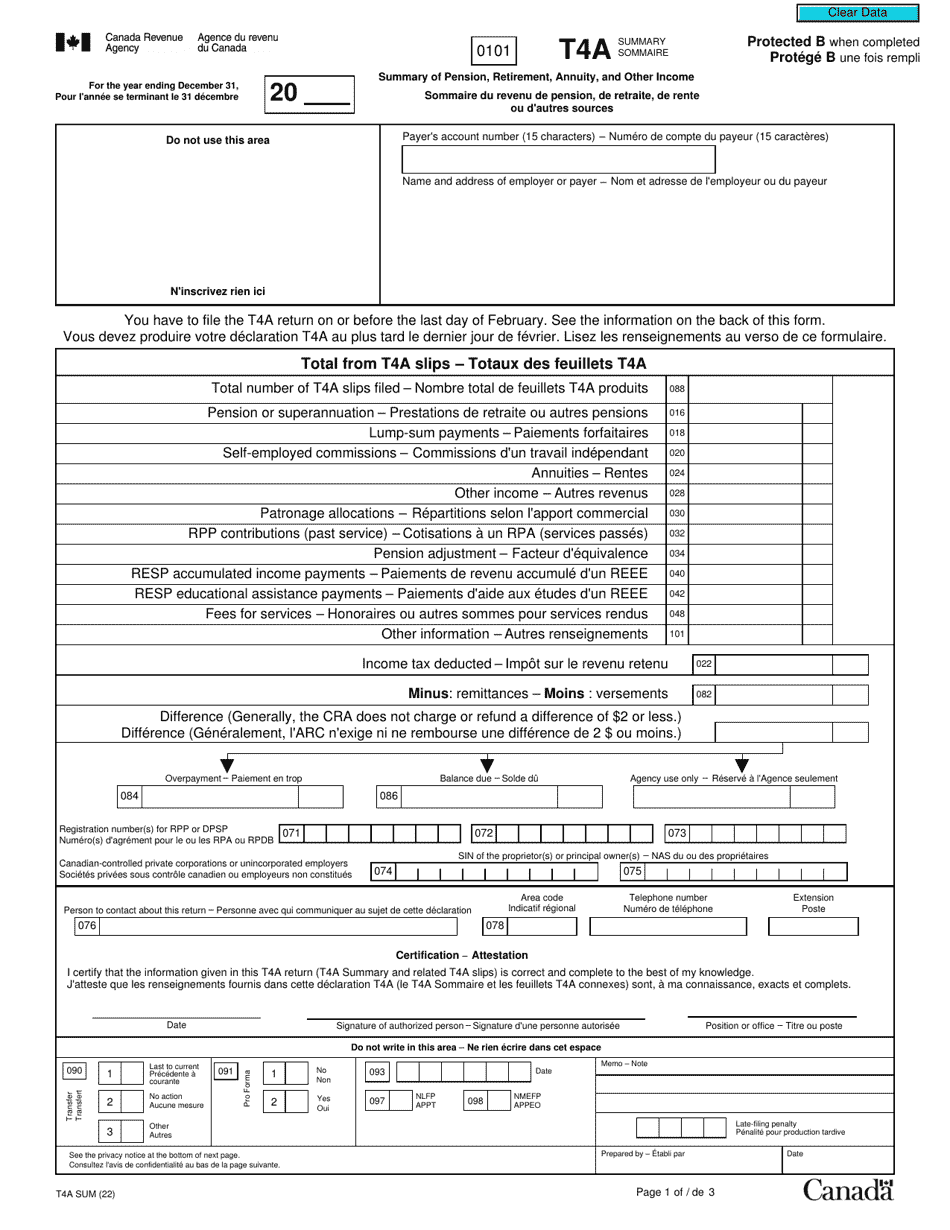

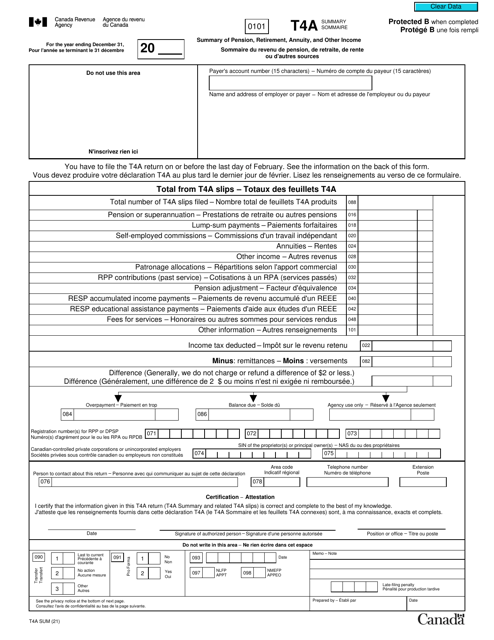

73 rows enter this amount on line 11500 of your return. The t4a summary (t4asum) represents the total of the information reported on all of. Statement of pension, retirement, annuity, and other income état du revenu de pension, de retraite, de rente ou d'autres sources.

You’ll receive a t4a: T4asum summary of pension, retirement, annuity, and other income. Statement of trust income allocations and designations.

Generating and filing statement of pension, retirement, annuity, and other income slips for contractors emily s. You’ll receive a t4a: Statement of pension, retirement, annuity, and other income.