Great Info About Accrued Interest Income In Balance Sheet Sample P&l And

However, they will not receive payment for the services.

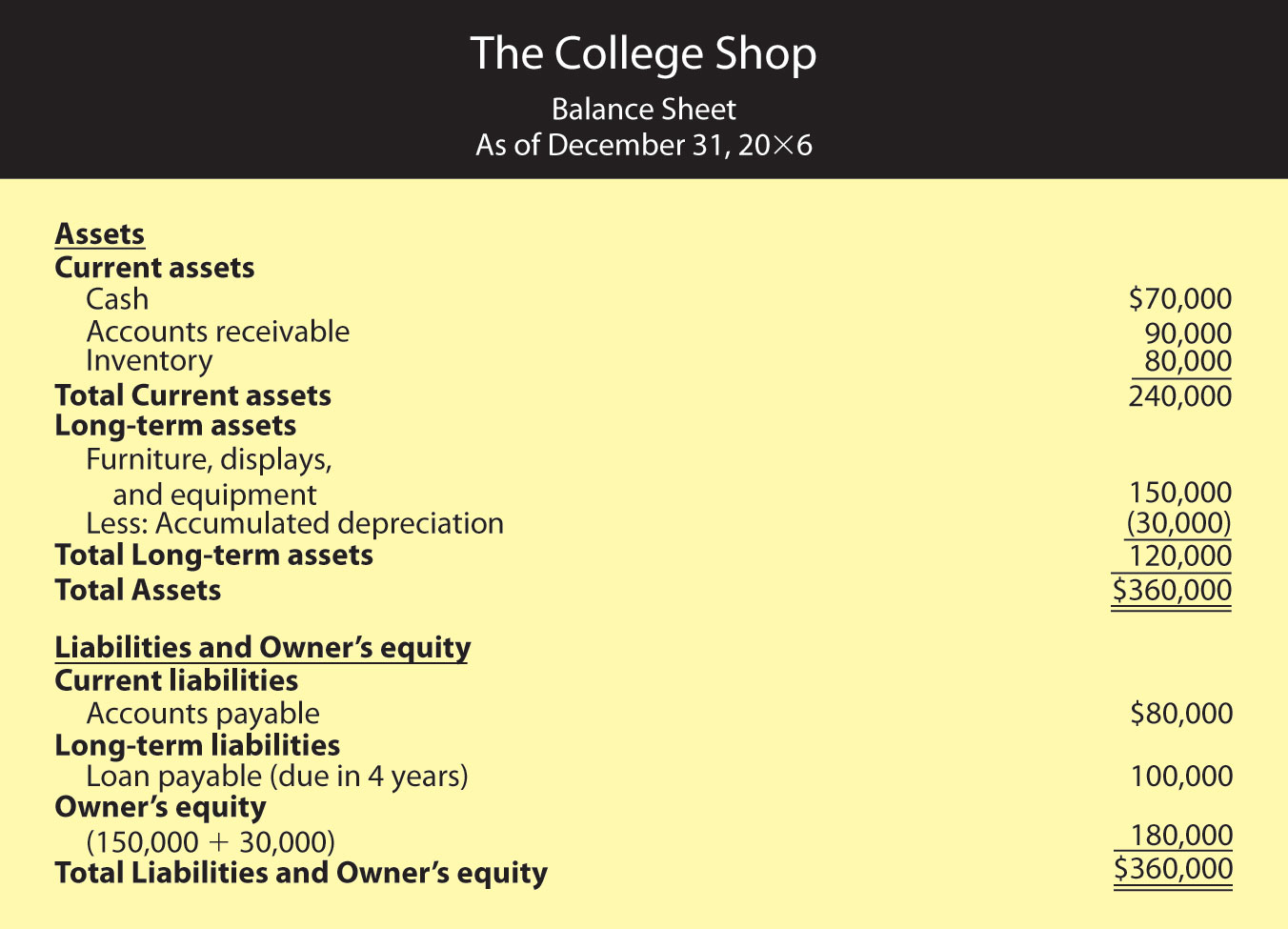

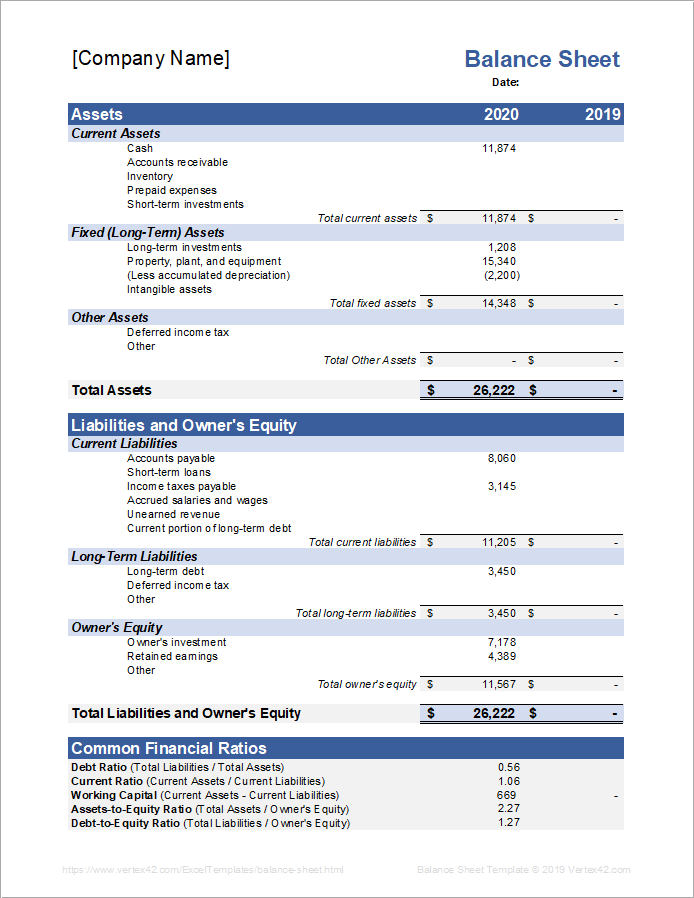

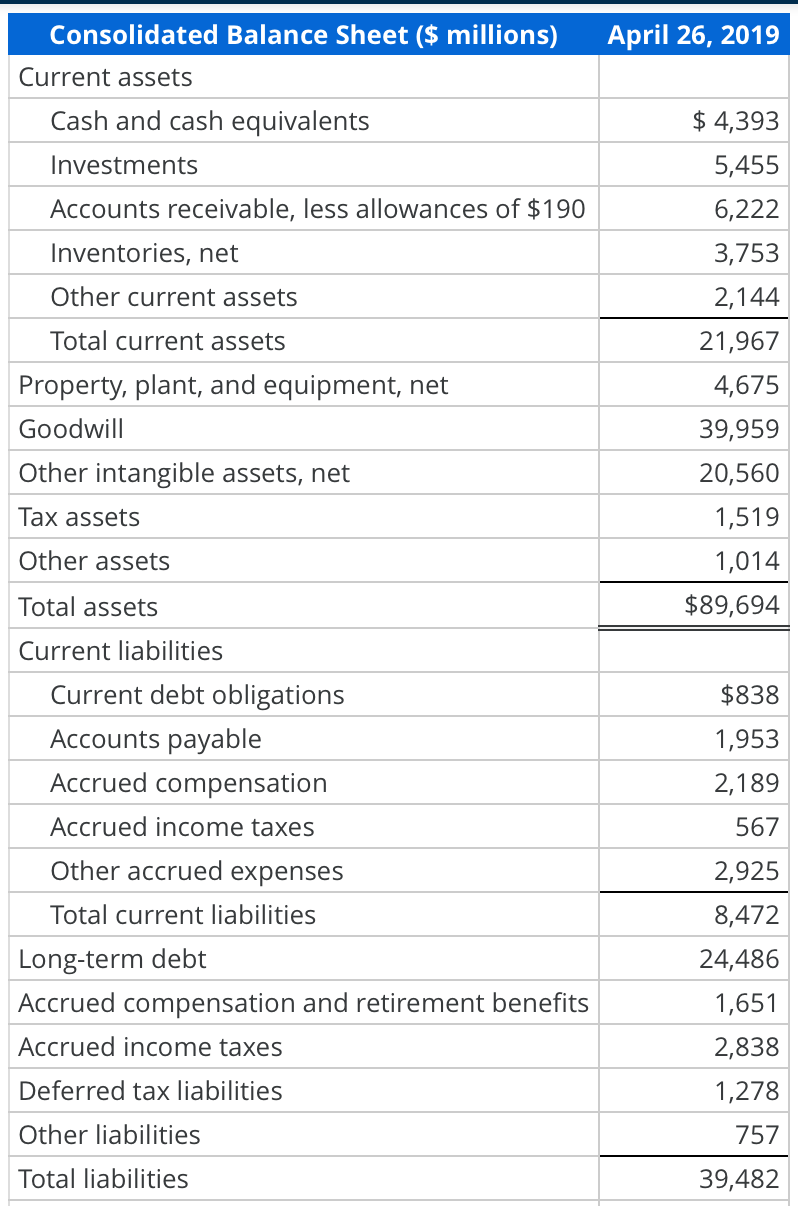

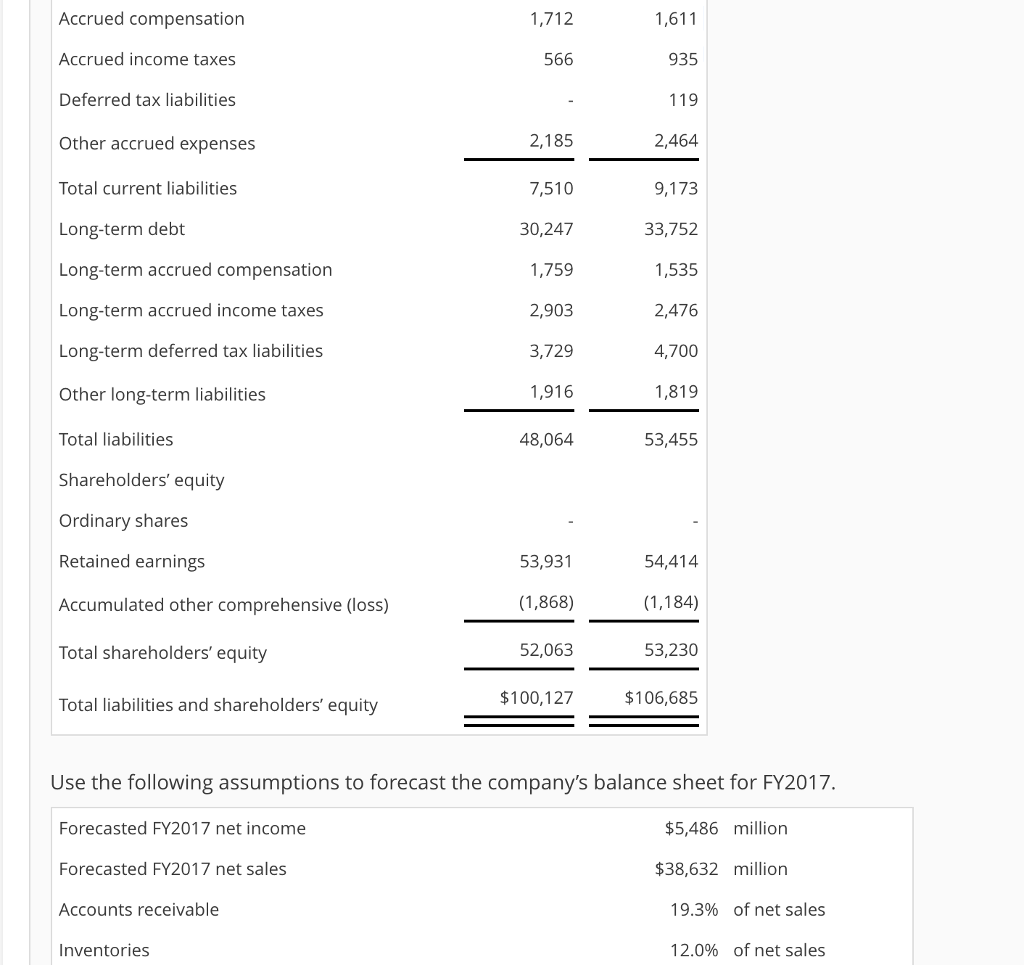

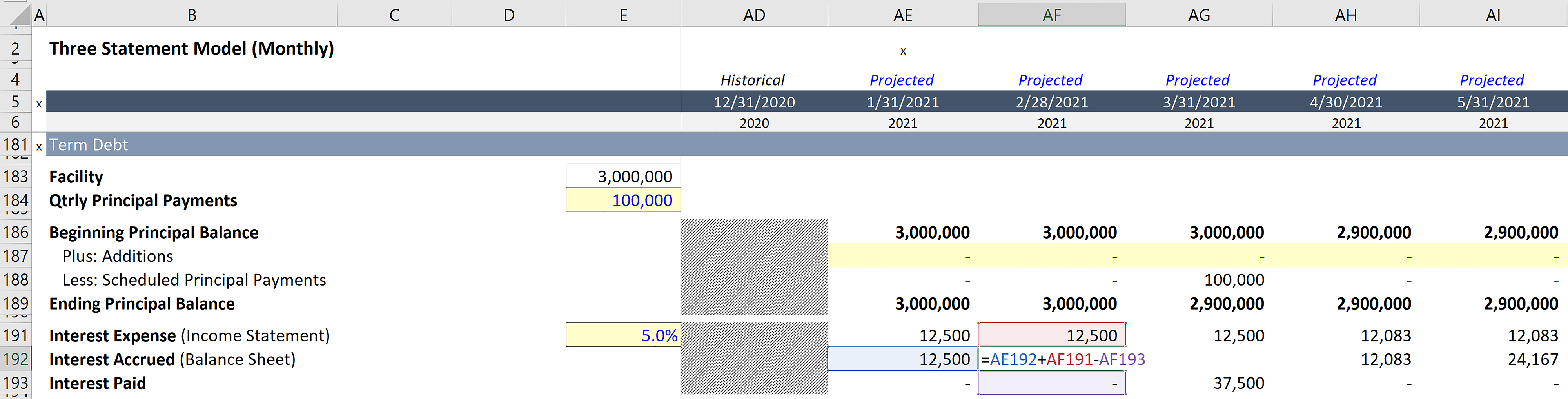

Accrued interest income in balance sheet sample p&l and balance sheet. When looking at your financial statements, there are three main types that you will issue on a regular basis: Us financial statement presentation guide 12.5. Accrued interest current practice 2.

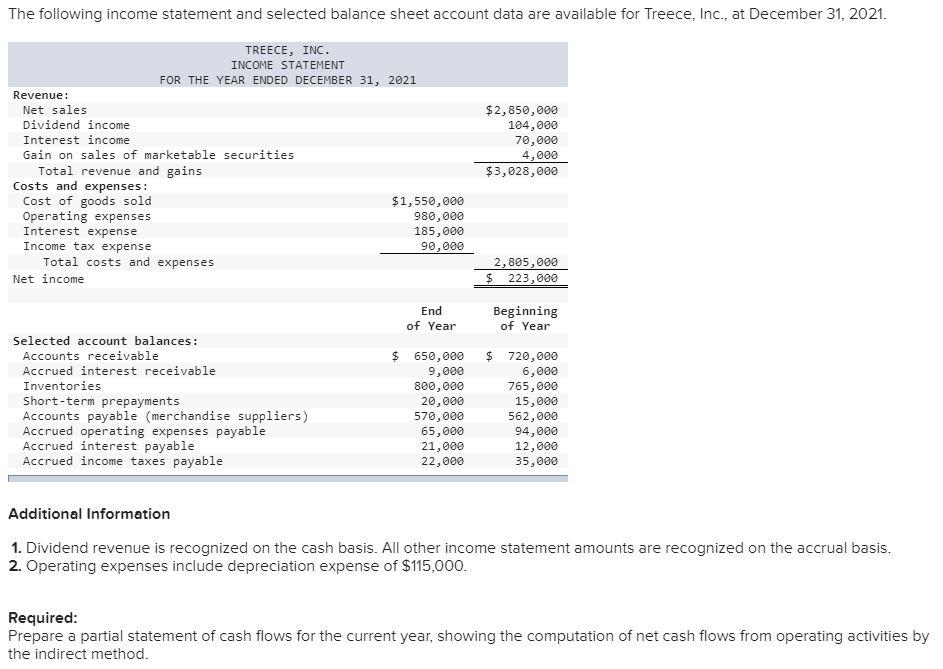

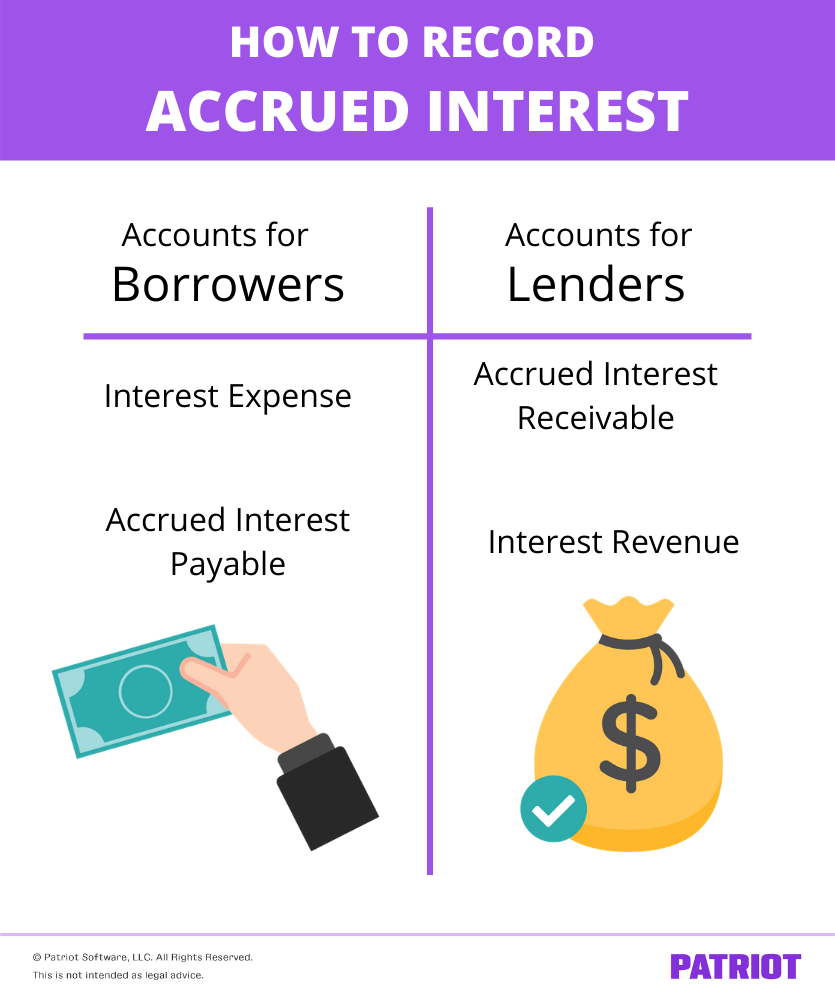

Interest income per month = $ 100,000 * 2% = $ 2,000 the journal entry is debiting accrued interest receivable $ 2,000 and interest. The interest income is calculated as follows: Examples of other expenses that usually need an accrual adjusting.

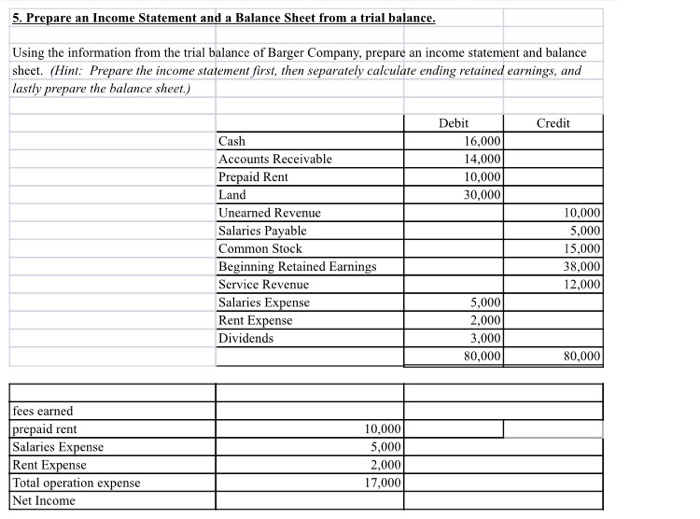

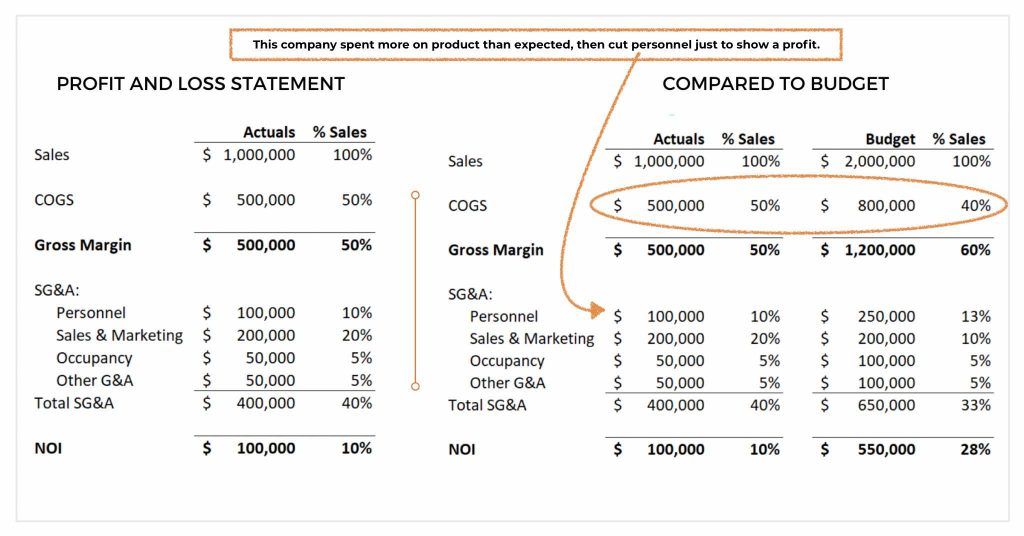

What is the impact of such an accrual on the. Given those assumptions, we can enter them into our p&l format, with the following line items. For example, a corporation may have its excess cash invested in an.

The accrued interest on investment is an asset that will be shown on the balance sheet under the heading current assets. When an accrual is created, it is typically with the intent of recording an expense on the income statement. A profit and loss statement (p&l) is an effective tool for managing your business.

Accrued interest refers to the interest that has been earned on an investment or a loan, but has not yet been paid. Home students study resources financial accounting (fa) adjustments to financial statements many candidates struggle with certain adjustments in the exam. Thus, accrued interest = 90 x (12% / 360).

Entities accumulate interest earned but not yet collected on financial assets as an accrued interest receivable. Example on march 31, 2017, corporate finance institute provided $75,000 worth of online resources to lasdo company. Where is accrued income reported in the balance sheet?

Interest expense = $5 million. Journal entry for accrued income recognizes the accounting rule of “debit the increase in assets” (modern rules of accounting). Accrued income refers to amounts that have been earned, but the amounts have not yet been received.

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and. The balance sheet, the profit and loss. It gives you a financial snapshot of how much money you’re making (or losing).

Sg&a = $20 million. Updated april 30, 2022 reviewed by gordon scott fact checked by pete rathburn the balance sheet and the profit and loss (p&l) statement are two of the three financial.