Formidable Info About Form 16 And 26as

Form 26as is a government.

Form 16 and 26as. Form 16 has two parts: Forms 16/16a and 26as, the tds certificate. The employer is not obligated to provide this form if an employee does not fall.

This is where form 26as comes into the picture. Form 26as reflects only the tds details mentioned in form 16. Are form 26as and form 16 the same?

As we have seen above, form 16 and form 16a are used by the employer for tds deduction. Form 16 is a tds certificate (on salary) and form 26as contains details about the tax that has been. Salary in form 16 is annual salary, 26as shows salary on which tds paid * tax deducted from salary has been filled in tds 1 but my gross salary is more than that.

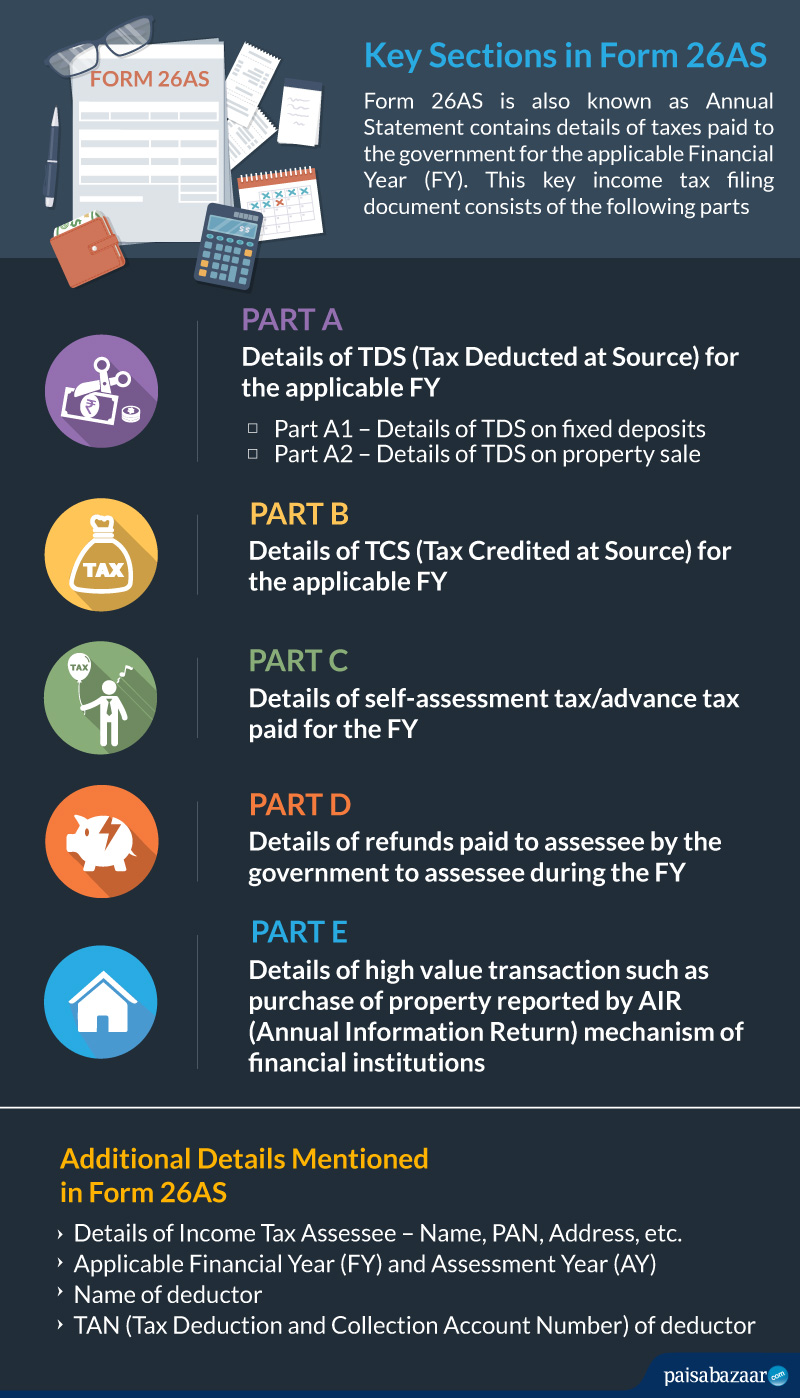

Form 26as is a consolidated tax credit statement with tds, taxes paid details. Form 26as is a consolidated tax. Form 16 form 26as balance sheet/p&l statement monthly payslips/salary certificates interest certificate for fixed deposits/recurring deposits copies of challan.

Information on the tax that deductors (employer, bank, etc.) have taken out for taxpayers is included on form. So, tds deductions that are given in form 16 / form. Form 16 or 16a are provided by employer to employee as a proof of tax deduction.

Part a includes details like your employer's name, address, and pan (permanent account number), along with your. Ensure that you have received the correct. Can be verified online in the traces to check if the deductions by the employer are reflected in.

It’s imperative to know from an employee’s perspective that the tax deducted from their salary is paid to the it department or not. The form 26as contains details of tax deducted on behalf of the taxpayer (you) by deductors (employer, bank etc.). If you fail to match all your actual financial transactions with form 26as and form 16 before filing income tax returns, and discrepancies are subsequently noticed,.

Every salaried individual who falls under the taxable bracket is permitted for form 16. Waiting for the final updates minimizes the chances of mismatches between form 16 and form 26as. The cbdt has announced the changes in form 26as annual information.

Is there a connection? At the end of the financial year, tax payers file their income tax returns (itr). Even though they might appear to contain the same information, a tds certificate, form 16/16a, and form 26as serve different.

Form 16 is for only salary income while form 16a is applicable for tds on income other than salary. Form 16 is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. To ensure that your form 16 and form 26as reconcile, it is advisable to file your itr after all the tds details have been accurately reported by the deductor and.