Out Of This World Tips About Retained Income Statement

This is the amount of retained earnings that is posted to the retained earnings account on the 2020 balance sheet.

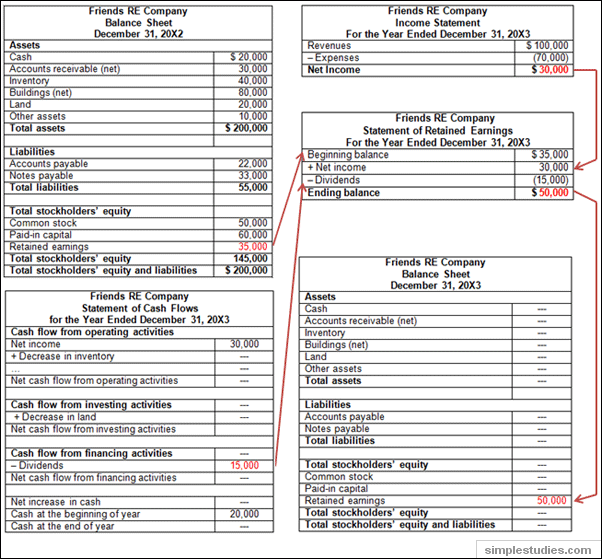

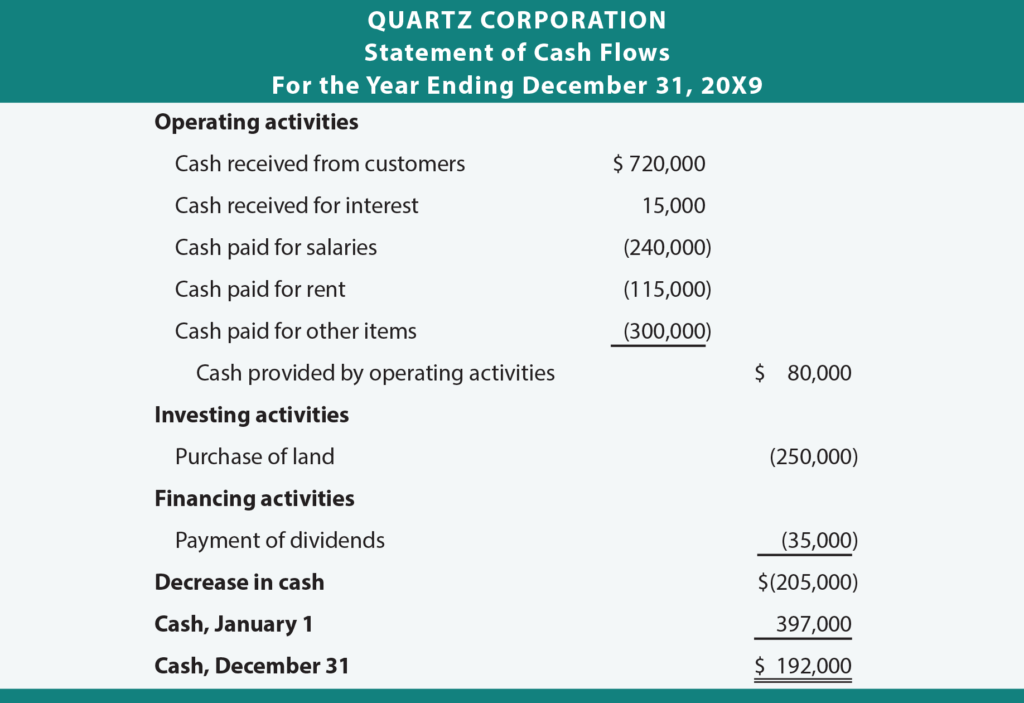

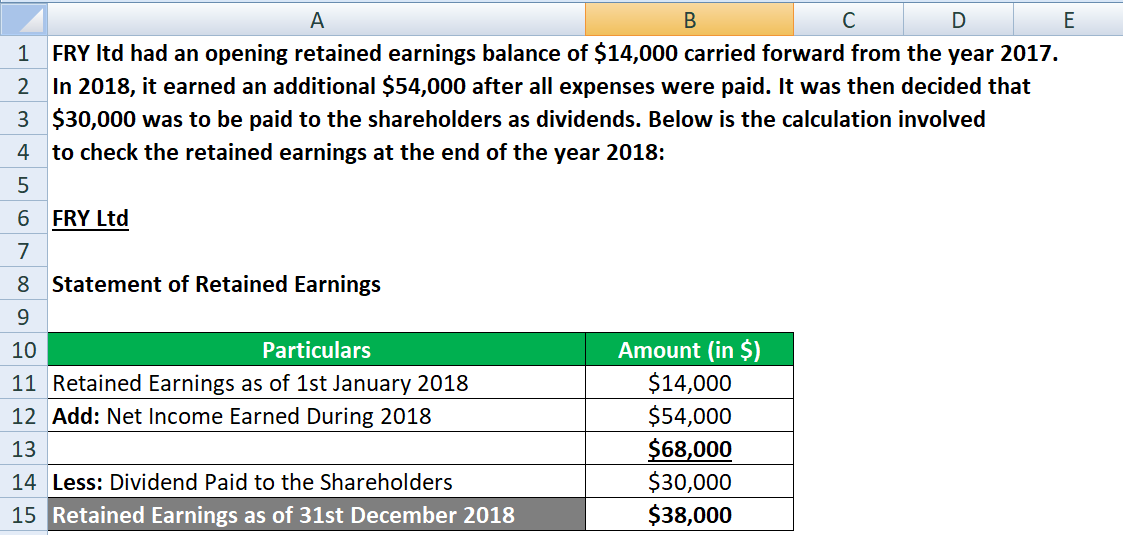

Retained income statement. A company can use retained earnings in many cases. In smaller companies, the retained earnings statement is very brief. Your accounting software will handle this calculation for you when it generates your company’s balance sheet, statement of retained earnings and other financial statements.

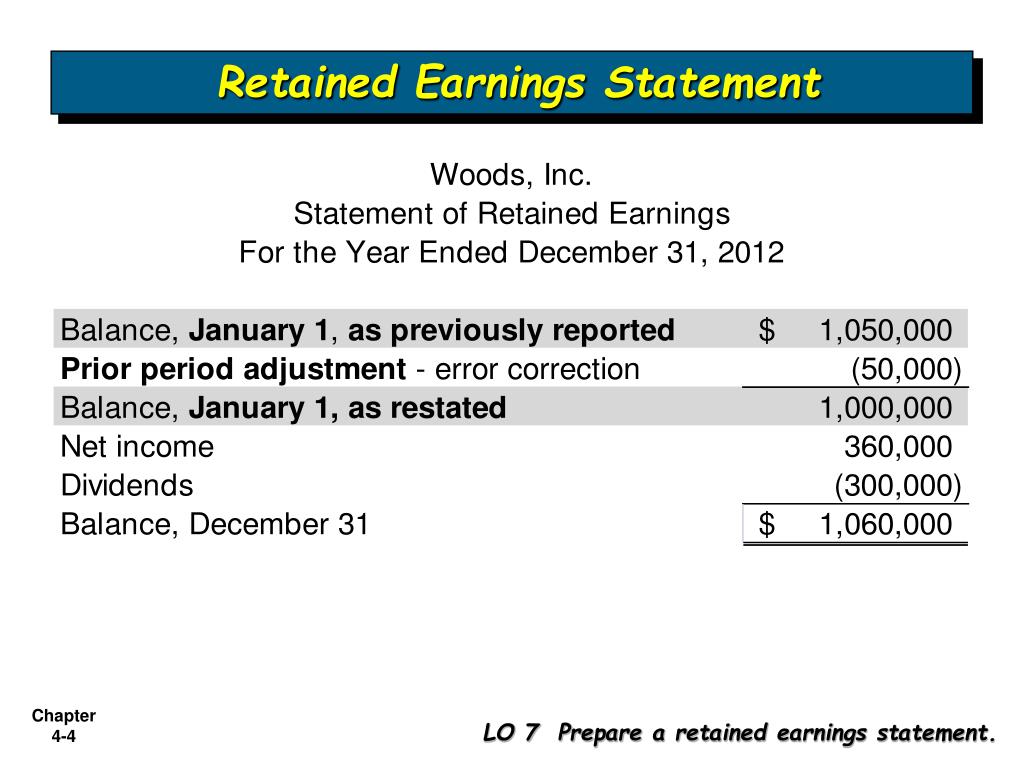

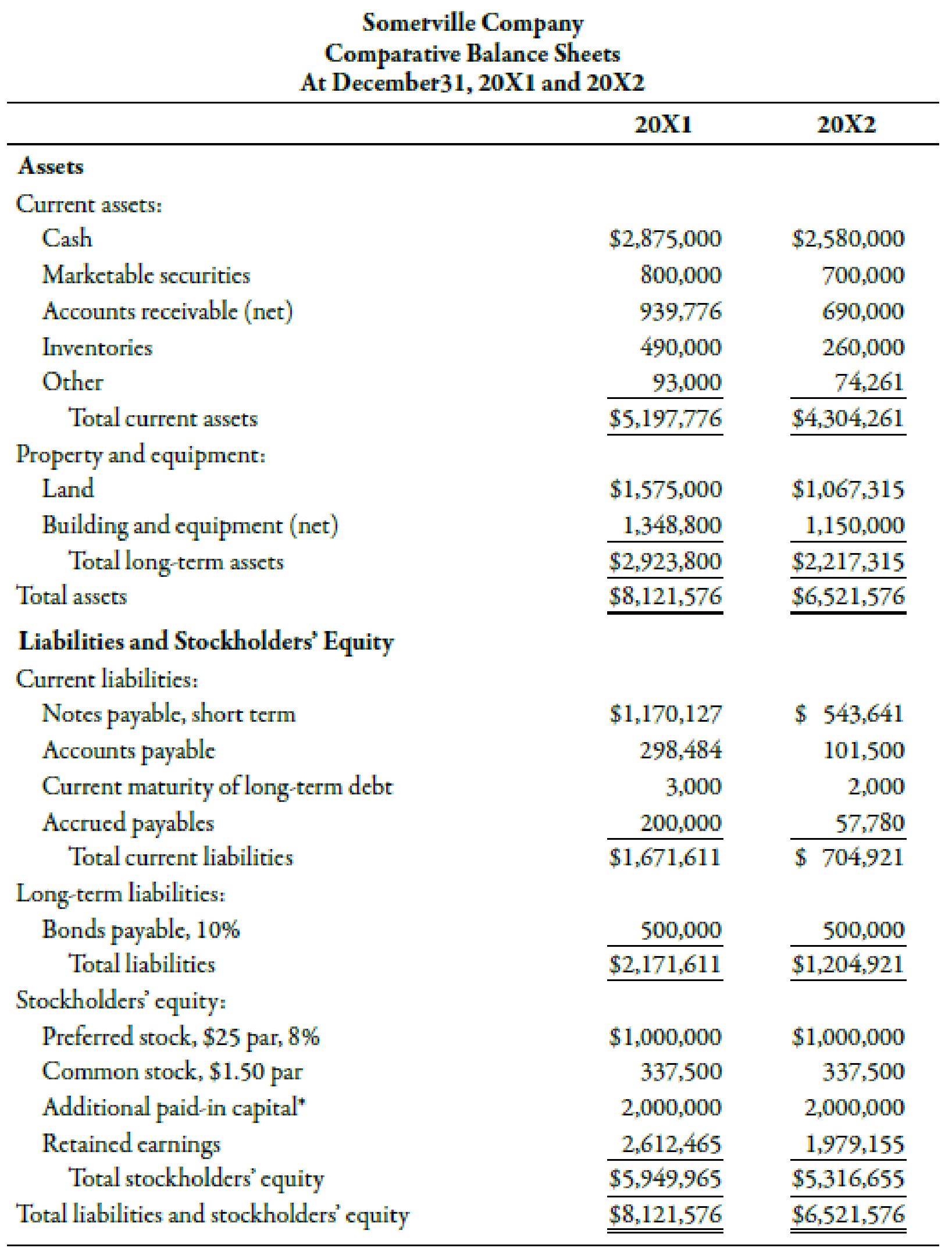

The balance sheet is going to include assets, contra assets, liabilities, and stockholder equity accounts, including ending retained earnings and common stock. Beginning retained earnings → the ending retained earnings balance from the prior period, which is recorded in the shareholders’ equity section of the balance sheet.; The purpose of retaining these earnings can be varied and includes buying new equipment and machines, spending on research and development, or other activities that.

The retained earnings formula is fairly straightforward: What is the statement of retained earnings? At the autumn statement on 22 november 2023, the government announced the national insurance changes starting to take effect from january 2024.

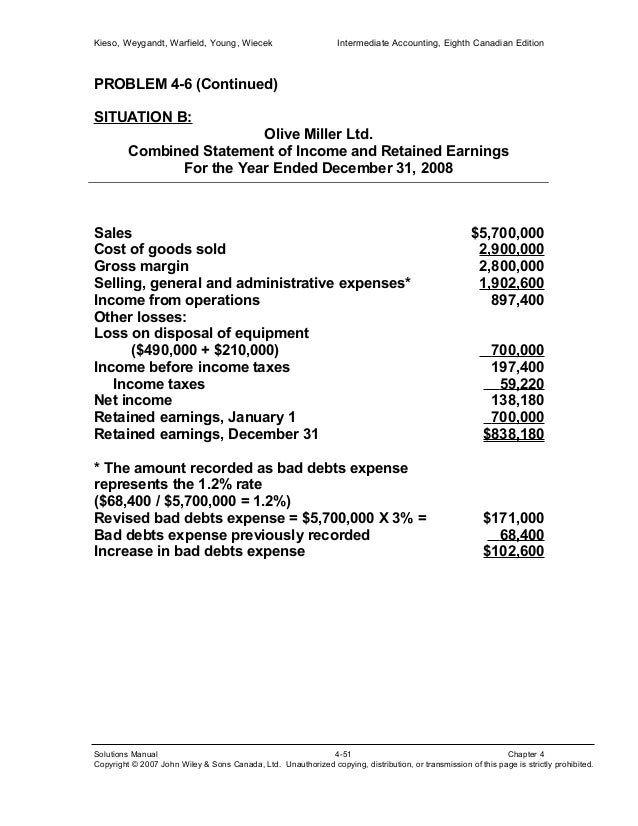

Revenue is a critical component of the income statement. Retained earnings refer to a company’s net profit after paying out dividends to shareholders. The statement of retained earnings is a financial statement that is prepared to reconcile the beginning and ending retained earnings balances.

In the upcoming quarters, net income that's left over after paying. Retained earnings refer to the residual net income or profit after tax which is not distributed as dividends to the shareholders but is reinvested in the business. Retained earnings are the profits or net income that a company chooses to keep rather than distribute it to the shareholders.

Retained earnings refer to the historical profits earned by a company, minus any dividends it paid in the past. Revenue and retained earnings provide insights into a company’s financial performance. In that case, the company may choose not to issue it as a separate form, but simply add it to the balance sheet.

The net income contributes to retained earnings but, as mentioned, retained earnings are cumulative across accounting periods. Typically, the net profit earned by your business entity is either distributed as dividends to shareholders or is retained in the business for its growth and expansion. Beginning period retained earnings = $200,000;

Simply put, retained earnings represent a company’s accumulated net income that has not been distributed as dividends to shareholders. This was featured in the december employer bulletin. To get a better understanding of what retained earnings can tell you, the.

Subtract the dividends, if paid, and then calculate a total for the statement of retained earnings. The formula for the company's retained earnings at the end of the accounting period would be:

Statement of retained earnings example A retained earnings income statement is the balance of a company's net profits on the income statement that it doesn't pay as dividends. The statement of retained earnings is a financial statement prepared by corporations that details changes in the volume of retained earnings over some period.