Ideal Info About Positive Balance Sheet

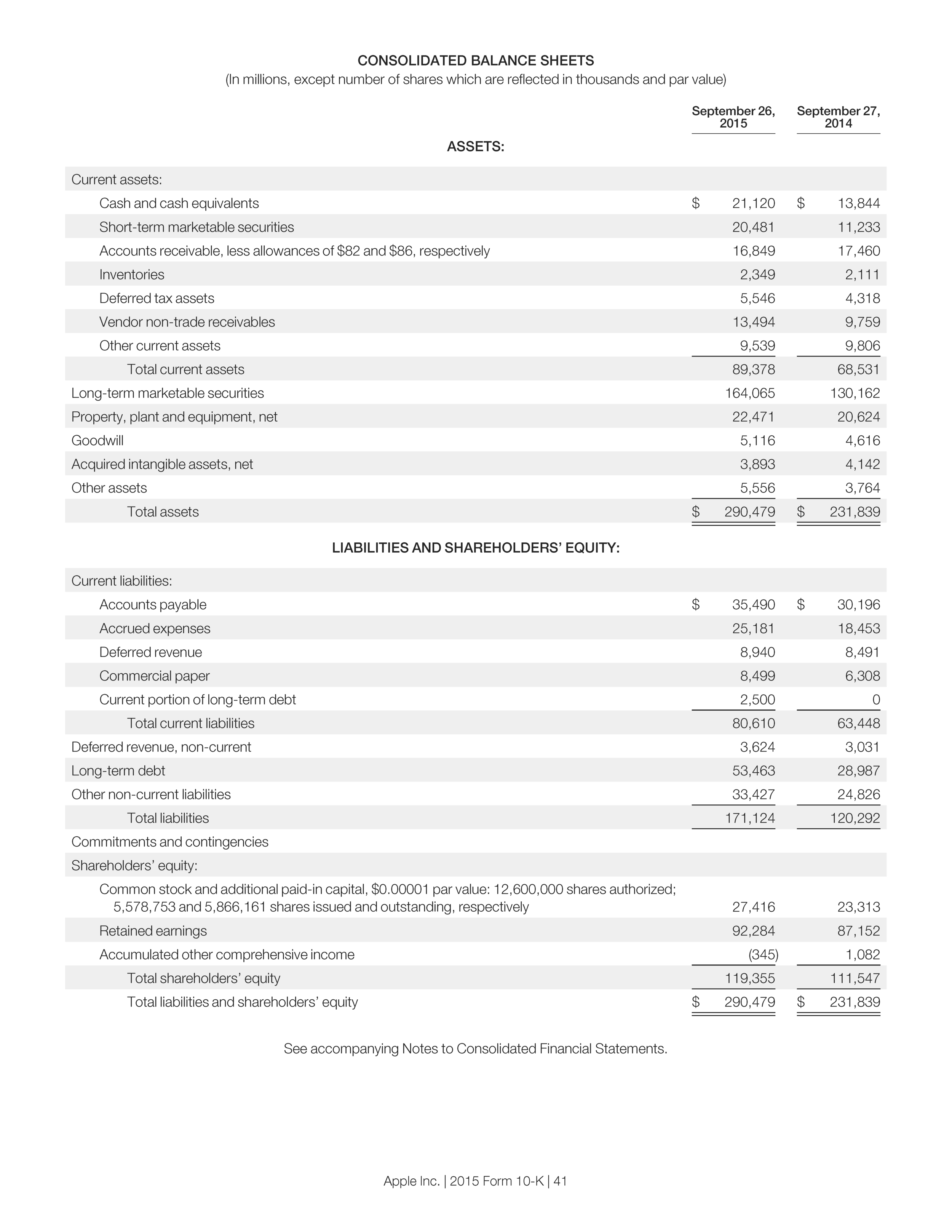

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

Positive balance sheet. More detail further down page. Intelligent working capital, positive cash flow, a balanced capital structure, and income generating assets. Net assets are the value of your assets after you pay your obligations.

The balance sheet is a key financial statement that provides a snapshot of a company's finances. It's one of the most effective tools for. Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a particular date.the main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date.

The forces of secular stagnation could mean that after a brief intermezzo in 2022 and part of 2023, the balance sheet will resume its rise, adding to wealth but also to. If you have plenty of assets after everything is paid off, your balance sheet is in a strong position. What can your company’s balance sheet tell you?

How does a balance sheet work? A balance sheet is simply a financial statement that summarizes an organization's assets, liabilities, and shareholders' equity. Cash flow is the net amount of cash and cash equivalents being transacted in and out of a company in a.

The net worth of your small business, how much money you have, and where it’s kept. Positive net assets. To read a balance sheet, you need to analyze your business’s assets, liabilities, and equity to get a clear picture of what your company owns and owes.

Let’s take a look at each feature in more detail. Every balance sheet is based on the following formula: It gives viewers a snapshot of what's owned and what's owed, and.

A balance sheet is one of the primary statements used to determine the net worth of a company and get a quick overview of its financial health. This highlights whether a business is profitable and whether these profits are being reinvested back into the business. So you definitely need to know your way around one.

The balance sheet provides an overview of the state of your business finances at a specific point in time, also known as the reporting date. It provides a snapshot of the company’s financial position, showcasing what it owns,. The bank has a right to draw any amount from an account with a positive balance to cover an account with a negative balance.

Strong balance sheets will possess most of the following attributes: Balance sheet is the statement that shows the balance of assets, liabilities, and equity of the entity at the end of accounting periods. That’s where this guide comes in.

A positive net asset position is a measure of how a business is performing. A balance sheet explanation is a financial statement that summarizes a company’s assets, liabilities, and equity at a specific moment. It can also be referred to as a statement of net worth or a statement of financial position.